Global Home Beer Brewing Machine Market By Type (Manual, Automatic), By Capacity (Less than 5 Liters, 5-10 Liters, Above 10 Liters), By Distribution Channel (Online Stores, Offline Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 64779

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

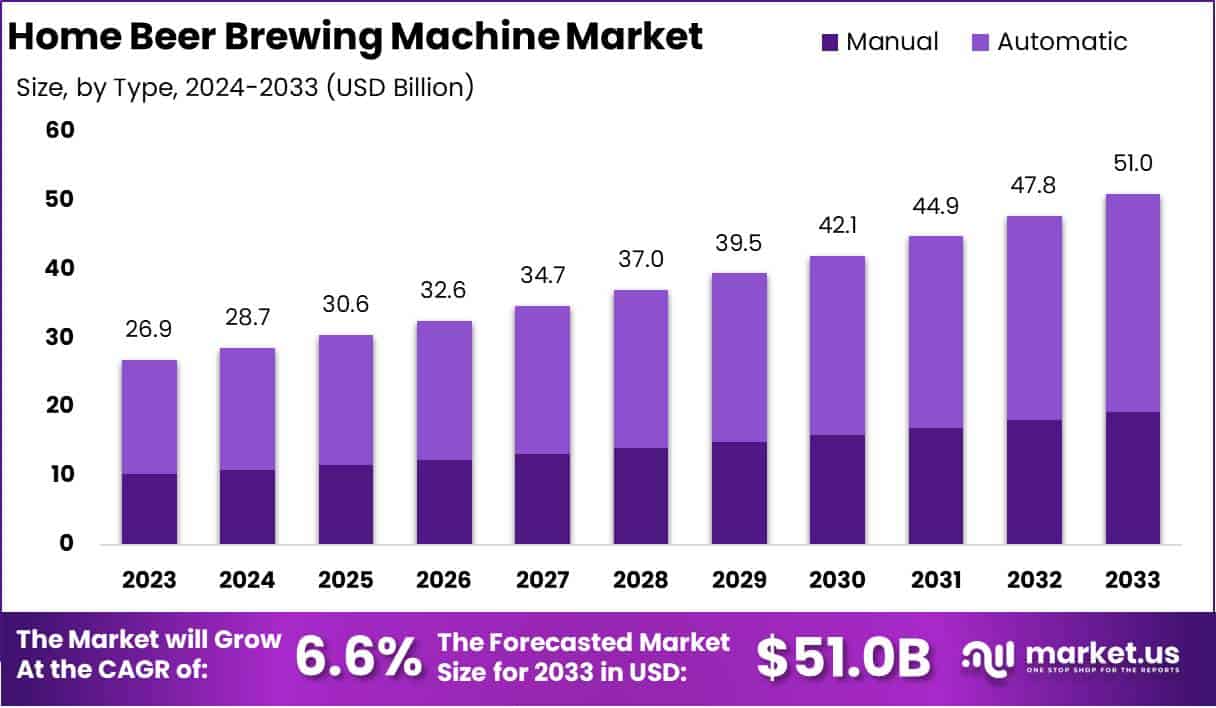

The Global Home Beer Brewing Machine Market size is expected to be worth around USD 51.0 Billion by 2033, from USD 26.9 Billion in 2023, growing at a CAGR of 6.6% during the forecast period from 2024 to 2033.

A home beer brewing machine is a compact, self-contained appliance designed for home use, enabling individuals to brew their own beer with minimal manual effort. These machines typically incorporate features such as automated brewing processes, customizable recipes, and simplified cleaning mechanisms, making them accessible to both beginners and experienced home brewers.

They allow for precise control over ingredients, flavors, and fermentation times, providing users with a highly customizable beer-brewing experience at home. The convenience and personalization potential of these machines make them an appealing choice for consumers looking to explore brewing as a hobby or to enjoy unique, homemade beer.

The home beer brewing machine market refers to the global industry surrounding the production, distribution, and sale of machines designed for domestic beer brewing. This market encompasses a range of machine types, from entry-level units for novices to advanced models targeting seasoned enthusiasts.

The market includes manufacturers, component suppliers, software providers (for recipe customization), and distribution channels such as specialty stores, online marketplaces, and home appliance retailers.

As consumer interest in artisanal and home-produced food and beverages has grown, so too has the scope and innovation within the home beer brewing machine market, reflecting broader trends in customization, experience-driven consumer spending, and at-home leisure activities.

Several key factors are driving growth in the home beer brewing machine market. Firstly, the trend toward DIY food and beverage preparation has seen steady growth, driven by consumers’ desire for greater personalization and control over their consumption habits. Secondly, rising interest in craft beer and local flavors encourages consumers to experiment with brewing at home.

Advances in technology, such as IoT-enabled brewing systems that allow remote monitoring and control, also make these machines more accessible and user-friendly. Additionally, as more consumers seek sustainable, at-home solutions for their hobbies, beer brewing machines meet the demand for reducing single-use packaging and supporting eco-friendly practices.

Demand for home beer brewing machines is steadily increasing, fueled by both millennial and Gen Z consumers who value experiential purchases, personalization, and novel leisure activities. These demographic groups are particularly drawn to hands-on hobbies that deliver both creative satisfaction and social capital, making home brewing an attractive option.

With the growing prevalence of remote work and the associated uptick in home-based activities, the demand for home brewing machines has seen renewed momentum, as consumers invest more in at-home entertainment and leisure solutions.

The home beer brewing machine market presents substantial opportunities for innovation and expansion. One promising area lies in integrating advanced technology such as app-based recipe guidance, remote control, and data analytics that can cater to both hobbyists and serious brewers alike.

There is also an opportunity for brands to appeal to sustainability-conscious consumers by developing machines with lower energy consumption or reusable packaging options. As consumer interest in unique, hands-on experiences continues to grow, companies that offer flexible, high-quality, and easy-to-use brewing solutions will likely capture a significant share of this expanding market.

According to a recent study, home beer brewing machines offer robust customization, averaging 15–20 recipe parameters, with 78% featuring pressure monitoring and 72% adopting remote capabilities. These machines retain a resale value of 45–55% after three years, with warranty claims under 3%, indicating high reliability and sustained value.

According to Truly Experiences, the U.S. saw a 40-50% rise in sales of beer-making equipment during the pandemic, indicating a growing trend in home brewing. Currently, there are 1.1 million home brewers in the U.S., with an average age of 42. The cost of a homebrew kit is approximately £40, yielding about 40 pints, or 75p per pint—a significant value for consumers.

Data from the American Home Brewers Association shows that 85% of home brewers are in relationships, 68% have a college degree, and nearly 68% earn above $75,000 annually, highlighting a high-income, educated demographic driving the market’s growth.

Geographically, home brewers are widely distributed: 31% are in the South, 26% in the Midwest, 24% in the Northeast, and 19% in the West. Most shop locally, with 94% visiting homebrew stores five times annually, and 75% also purchasing from online stores.

Internationally, while China leads in beer consumption due to population, the U.S. ranks 16th in per capita consumption at 72.8 liters per person, underscoring home brewing’s potential in this well-established beer market.

Key Takeaways

- The global home beer brewing machine market is anticipated to expand from USD 26.9 billion in 2023 to approximately USD 51.0 billion by 2033, achieving a CAGR of 6.6% driven by rising consumer interest in at-home, personalized brewing experiences.

- The Automatic segment dominates with a 62% market share in 2023, driven by a preference for user-friendly, automated brewing systems.

- The 5-10 liters capacity segment leads with 51% share in 2023, balancing affordability with adequate production capacity for most home brewers.

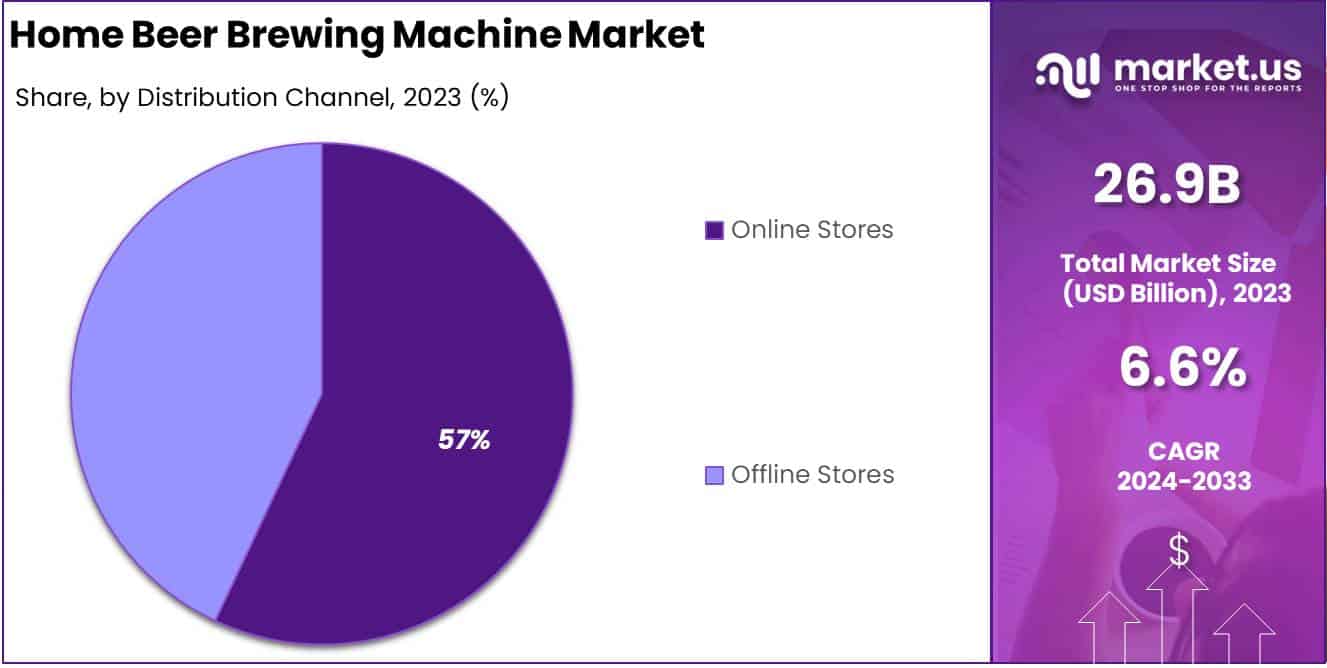

- Online stores capture the majority, holding a 57% market share in 2023, propelled by convenience and the shift towards digital purchasing.

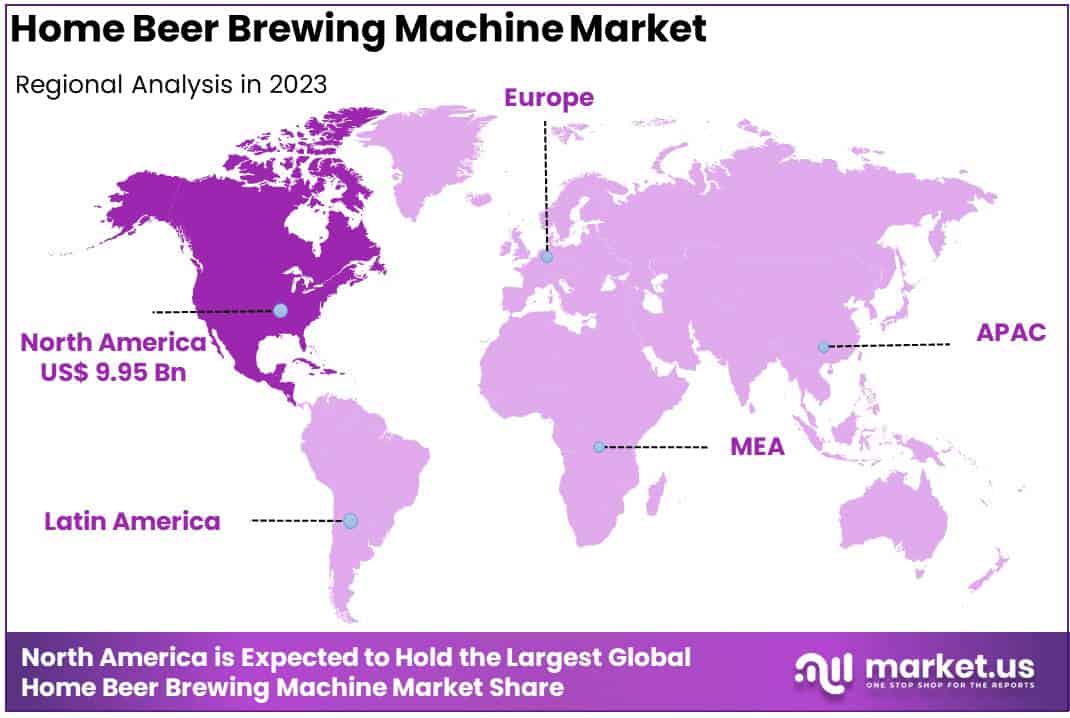

- North America leads globally with a 37% market share in 2023, supported by strong consumer interest in craft beer and well-developed e-commerce infrastructure.

By Type Analysis

Automatic Segment Dominates the Home Beer Brewing Machine Market with a 62% Market Share

In 2023, the Automatic segment held a dominant position in the Home Beer Brewing Machine Market by type, capturing more than 62% of the market share. This growth is driven by increasing consumer preference for user-friendly, automated brewing systems that simplify the complex brewing process.

The appeal of automation lies in its ability to provide consistent brewing quality and significantly reduce user involvement, which aligns with the convenience demanded by a broad range of consumers, from beginners to seasoned homebrewers.

While the Automatic segment continues to lead, the Manual segment holds a notable position, catering to traditionalists and craft beer enthusiasts.

Although smaller in market share compared to its automated counterpart, the manual segment benefits from a consistent demand, driven by consumers who value the hands-on experience and customization offered by manual brewing. This segment resonates particularly with hobbyists and enthusiasts who appreciate control over each step of the brewing process.

By Capacity Analysis

5-10 Liters Segment Dominates Home Beer Brewing Machine Market with a 51% Share

In 2023, the 5-10 liters segment held a dominant position in the home beer brewing machine market by capacity, capturing more than a 51% share. This segment’s strong market position can be attributed to its balance between affordability and production capacity, meeting the needs of both novice and enthusiast brewers.

The 5-10 liter machines are ideal for home brewers seeking a moderate volume that provides a satisfying yield without demanding significant space or resources, making this capacity highly popular.

The less than 5 liters segment is becoming increasingly attractive to casual brewers, thanks to its compact design and user-friendly features, which align well with beginners or those with limited space.

Although smaller in market share, this segment is growing steadily as consumers look for low-maintenance, affordable entry points into home brewing. This segment is projected to see incremental growth, supported by rising interest in personalized brewing experiences.

The above 10 liters segment, though smaller in share compared to the 5-10 liters category, appeals to seasoned brewers looking for higher volume production capabilities. This segment caters to a niche market that prioritizes quality over convenience, typically opting for larger machines that enable them to experiment with more complex brews.

By Distribution Channel Analysis

Online Stores Lead Home Beer Brewing Machine Market with 57% Share in 2023

In 2023, online stores held a dominant position in the distribution channel of the home beer brewing machine market, capturing more than a 57% share. The convenience, wider selection, and competitive pricing offered by e-commerce platforms have driven consumers to prefer online channels.

Additionally, the accessibility of product information, customer reviews, and home delivery options enhance the appeal of purchasing brewing equipment online. This segment’s strong performance aligns with the broader shift towards digital retail and is expected to maintain its lead as more consumers opt for the convenience and flexibility of online shopping.

Offline stores captured around 43% of the market share in 2023. Despite the rapid growth of online retail, brick-and-mortar stores remain vital for consumers who prefer in-person assistance, product demonstrations, and immediate purchase options.

Specialty brewing equipment retailers, as well as large-format retail stores, play a key role in serving consumers who value a tactile shopping experience. This segment continues to cater to a dedicated customer base, particularly in regions where consumers are more inclined to make significant purchases in-store.

Key Market Segments

By Type

- Manual

- Automatic

By Capacity

- Less than 5 Liters

- 5-10 Liters

- Above 10 Liters

By Distribution Channel

- Online Stores

- Offline Stores

Driver

Rising Consumer Demand for Personalized Brewing Experiences

The global home beer brewing machine market is significantly propelled by an increasing demand for personalized brewing experiences. Consumers, particularly in urban and suburban regions, are expressing a stronger desire for custom-crafted beverages tailored to individual preferences in flavor, style, and strength.

This shift is largely driven by the broader trend of personalization across consumer goods, where individuals seek control over the ingredients, brewing process, and final product. Home brewing machines cater to these expectations by providing flexible brewing options that accommodate a range of beer types and ingredient combinations, making it easier for users to experiment with various recipes.

This capability is particularly attractive to beer enthusiasts who want to recreate specific flavors, seasonal brews, or even design unique signature styles. The ability to customize each batch fosters a more interactive and rewarding experience, appealing to consumers looking to elevate their understanding and enjoyment of beer.

Moreover, as these machines become more user-friendly, integrating smartphone connectivity and advanced automation, even novice brewers can confidently craft high-quality beer at home. This ease of use, coupled with an emphasis on personalization, allows home brewers to bypass the complex and often costly commercial brewing process.

Additionally, the rise in disposable income, particularly among millennials and Gen Z, enables these demographics to invest in premium at-home brewing equipment. This market driver gains further strength as lifestyle shifts, such as remote work and stay-at-home entertainment, encourage people to seek new hobbies, including home brewing.

The increased desire for self-sufficiency and craft experiences in a controlled home environment has positioned personalized brewing as a central appeal. Consequently, the market sees sustained demand growth as manufacturers continually innovate to offer adaptable brewing solutions that cater to evolving consumer preferences, securing a robust growth trajectory in the coming years.

Restraint

High Initial Cost of Home Brewing Machines as a Key Market Restraint

Despite its potential, the global home beer brewing machine market faces a significant barrier in the form of high initial investment costs associated with premium brewing machines. While these machines offer advanced features, customization options, and convenience, the upfront expenditure required to purchase and maintain quality brewing equipment remains substantial.

This financial barrier can deter potential customers, particularly entry-level hobbyists and price-sensitive consumers who may find the cost prohibitive. Basic brewing kits often fail to deliver the same quality and customization as premium models, and this disparity reinforces the perception that quality home brewing is a costly hobby.

Such a notion limits the accessibility of home brewing to a niche segment, hindering broader market penetration. As a result, the potential customer base remains constrained to individuals willing to make this sizable investment.

Furthermore, the long-term costs associated with regular ingredient purchases and periodic maintenance add to the cumulative expense, potentially discouraging consistent usage among cost-conscious consumers. The need for replacement ingredients such as hops, grains, yeast, and other add-ons can lead to recurring costs that affect the perceived value of home brewing over time.

This financial barrier is particularly notable in regions where average disposable income does not align with the pricing of these advanced home brewing systems. Consequently, manufacturers in the market must address this restraint by offering cost-effective solutions or financing options that make entry into home brewing more accessible.

The development of budget-friendly models or installment payment schemes could mitigate this restraint, enabling a wider range of consumers to explore home brewing. However, until such solutions are mainstream, the high initial cost will continue to act as a restraint on market expansion, limiting the market’s reach and slowing the adoption rate of home beer brewing machines.

Opportunity

Expansion of E-Commerce Channels as a Major Market Opportunity

The expansion of e-commerce platforms presents a significant opportunity for the global home beer brewing machine market, as online channels enhance product accessibility and cater to a wider, more diverse customer base. With consumers increasingly opting to purchase products online, e-commerce channels provide manufacturers with a direct and cost-effective route to reach potential customers across geographic locations.

Online shopping allows customers to compare various models, prices, and features conveniently from their homes, which plays a crucial role in influencing purchasing decisions, especially for premium items like brewing machines.

Furthermore, the availability of customer reviews and feedback provides potential buyers with valuable insights into product performance and satisfaction levels, helping them make more informed choices. This transparency builds consumer confidence in purchasing brewing equipment online, overcoming some of the hesitation that might arise from investing in high-cost products.

E-commerce platforms also enable manufacturers and retailers to implement targeted digital marketing campaigns and promotional offers, boosting visibility and driving sales. Subscription-based delivery models for ingredients, accessories, and even repair services can further enhance the online shopping experience, providing consumers with a convenient, continuous supply chain to support their brewing activities.

Such value-added services increase customer retention and foster loyalty in a market that thrives on repeat purchases of consumables. With rising internet penetration and the shift towards digital transactions, especially in emerging markets, e-commerce channels allow brands to reach untapped demographics while reducing dependence on brick-and-mortar distribution.

The growing global reach of online marketplaces, coupled with advancements in digital logistics, positions e-commerce as a critical avenue for expansion. For manufacturers, leveraging this channel translates to higher visibility, increased sales, and long-term growth potential within the home beer brewing machine market.

Trends

Rising Trend of Technological Innovations in Home Brewing Machines

Technological advancements in home brewing machines are driving a transformative trend within the market, enhancing user experience, efficiency, and product appeal. Recent innovations in automation, Internet of things (IoT) integration, and AI-driven brewing algorithms have elevated the functionality of these machines, making them highly adaptable to individual brewing styles and preferences.

With smart connectivity features, users can monitor and control the brewing process remotely via mobile applications, receiving real-time notifications and quality assessments.

Such features not only simplify the brewing process but also improve precision, allowing users to produce consistent, high-quality brews without extensive manual intervention.

This trend is particularly appealing to tech-savvy consumers and busy professionals who appreciate the convenience of automation in home brewing. The user-friendly design of modern machines aligns with the demands of a wider consumer base, from novice brewers to seasoned enthusiasts.

Additionally, these innovations address common challenges in home brewing, such as temperature control and fermentation monitoring, which are crucial to producing quality beer. AI algorithms that adjust brewing conditions based on environmental factors or ingredient variations further enhance quality control, ensuring a more refined final product.

The incorporation of such technology has expanded the market’s appeal, making home brewing a more accessible and enjoyable hobby for a broader audience. As manufacturers continue to refine these technologies, the adoption of home brewing machines is expected to rise.

This trend represents a key market driver, as consumers increasingly view technologically advanced brewing machines as a viable means of achieving commercial-grade quality at home. The push for smarter, more efficient brewing systems signals a future where home brewing machines are seamlessly integrated into the modern connected home, further solidifying their place in the global market.

Regional Analysis

North America Leads Home Beer Brewing Machine Market with Largest Market Share of 37%

North America dominates the global home beer brewing machine market, capturing a substantial 37% market share as of 2023, valued at USD 9.95 billion. The region’s dominance can be attributed to a strong culture of craft beer consumption, coupled with a high disposable income level that supports the adoption of premium home brewing equipment.

In the U.S., a growing community of homebrewers and an increasing demand for craft beer have bolstered this market, leading to steady growth. Additionally, North America’s technological advancements have facilitated the development of sophisticated brewing machines, making them accessible and appealing to a broader demographic.

With a well-established e-commerce infrastructure, many North American consumers are turning to online platforms to explore and purchase these brewing systems.

This digital access, alongside active promotional campaigns, further fuels the market’s expansion. The presence of a mature distribution network and a high concentration of industry players is likely to sustain North America’s leading position in the coming years.

Europe represents a rapidly expanding market for home beer brewing machines, driven by its robust craft beer culture and a rising interest in home brewing among consumers.

The demand in key countries such as Germany, the U.K., and Belgium is driven by an appreciation for specialty beers and a tradition of innovative brewing methods, making the region a key market for premium and technologically advanced brewing systems.

European consumers are increasingly inclined toward artisanal products, which has extended to homemade beer varieties and customized brews. The region benefits from a supportive regulatory framework that encourages craft brewing, which further enhances market growth.

The European market is forecast to continue growing as more consumers seek DIY brewing solutions that allow them to experiment with traditional European styles, driving demand for user-friendly and versatile brewing equipment across the continent.

Asia Pacific is experiencing robust growth in the home beer brewing machine market, attributed to changing consumer lifestyles and the rising popularity of Western culture, including craft beer consumption, in countries such as China, Japan, and Australia.

As urbanization progresses and disposable income levels increase, particularly among younger demographics, there is a heightened interest in at-home hobbies like brewing.

Japan and South Korea exhibit notable demand due to a strong existing beer culture and increasing interest in personalization in food and beverage choices. Additionally, the e-commerce boom across Asia Pacific enables consumers to access a variety of home brewing machines, boosting sales in the region.

With rapid urbanization and an evolving consumer base that values convenience and customization, Asia Pacific is poised for significant growth, likely to emerge as a key market for affordable yet high-quality brewing equipment.

The Middle East and Africa region represents a niche but steadily expanding market for home beer brewing machines, primarily fueled by an increasing middle-class population and rising disposable incomes.

Although regional restrictions on alcohol consumption limit market growth in certain countries, markets such as South Africa, the UAE, and parts of North Africa show growing interest in home brewing.

These areas benefit from an expatriate population and a niche segment of consumers interested in adopting at-home brewing as a hobby. The region’s market growth is also supported by increasing online retailing, enabling a select customer base to access home brewing machines more readily.

While currently a smaller segment of the global market, Middle East & Africa presents potential for expansion as disposable incomes rise and market acceptance of home brewing grows among a specific demographic.

Latin America is an emerging market for home beer brewing machines, experiencing increasing demand driven by a strong tradition of beer consumption and a rising interest in personalized brewing options.

Countries like Brazil, Mexico, and Argentina exhibit growing interest in at-home brewing as consumers become more familiar with craft beer culture and show preference for artisanal products.

The region’s younger population, coupled with the trend of urbanization, is driving demand for DIY activities, with home brewing emerging as an appealing hobby. This trend is further supported by an expanding middle-class demographic with disposable income to invest in home-based leisure activities.

As e-commerce infrastructure continues to improve, Latin American consumers are gaining easier access to international brands and brewing equipment, promoting sustained growth within the region. Latin America’s market potential is expected to increase as local players introduce more affordable models, making home brewing accessible to a broader audience.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global home beer brewing machine market in 2024 is witnessing significant growth, supported by rising consumer interest in home-brewed beverages and expanding product ranges from key players.

Williams-Sonoma Inc., known for its premium kitchen and homeware, is positioned to capitalize on the upscale market, leveraging its strong brand and extensive retail network to offer high-quality brewing equipment to its dedicated customer base.

Inter IKEA Holding B.V., while traditionally focused on affordable home furnishings, could harness its global reach and adaptable, DIY-friendly approach to introduce accessible, budget-friendly brewing kits that appeal to the casual home brewer.

Specialty textile companies such as AB SIULAS, Prestige Linens, and Milliken & Company, primarily known for quality fabrics, add unique value through complementary accessories and innovative textiles tailored to brewing needs, like filtration and temperature control.

Frette and SFERRA, renowned for luxury linens, may cater to the niche high-end segment, enhancing the at-home brewing experience with exclusive branding and artisanal appeal, thereby elevating brewing kits to lifestyle products.

Additionally, Venus Group and Benson Mills, known for versatile home goods, could diversify into brewing accessories, enhancing their product portfolios with items suited for the beer brewing process.

Collectively, these players highlight a trend where adjacent industries are innovating within the home beer brewing market, catering to both casual and dedicated brewers.

As demand diversifies, these companies are strategically positioned to leverage their unique strengths, creating synergies between brewing machinery and lifestyle-oriented accessories to meet evolving consumer preferences in the home brewing space.

Top Key Players in the Market

- Brew Driver

- Craig Industries Inc.

- Keg King

- Kegco

- Micro Matic Inc.

- MiniBrew BV

- Perlick Corp.

- Speidel Tank und Behalterbau GmbH

- Spike Brewing

- The Middleby Corp.

- True Manufacturing Co. Inc.

- WilliamsWarn NZ Ltd.

- Other Key Players

Recent Developments

- In 2024, Gallo, a leading supplier of wine, spirits, and RTDs, expanded into the beer category through a strategic partnership with Montucky Cold Snacks. Montucky’s flagship “Cold Snack” is an American-style, sessionable lager with a 4.1% ABV, 102 calories, and 4.95 grams of carbohydrates per 12-ounce can. Known for its appeal to outdoor enthusiasts, Montucky adds a fresh dimension to Gallo’s Total Alcohol Beverage portfolio.

- In 2024, Prime Drink Group Corp. signed a binding letter of intent with 9296-0186 Québec Inc. (9296) to acquire Triani Canada Inc., a Québec-based producer of alcoholic and non-alcoholic beverages. Triani, founded in 2015, reported $28.4 million in annual net revenue and $4.4 million in adjusted EBITDA for the year ending November 30, 2023. Triani’s portfolio includes well-known brands such as Cantini, Ettaro, and Enjoy, as well as Octane, Mojo, Baron, Seagram, and Hickson.

- In 2024, Sunkey Beverage Holdings, based in Miami, finalized its acquisition of Silver Eagle Beverages, a major distributor in Texas covering San Antonio, Bexar County, and 12 other counties in the region. Silver Eagle will maintain its name, extending Sunkey’s distribution footprint and reinforcing its reach in the southwest Texas beverage market.

Report Scope

Report Features Description Market Value (2023) USD 26.9 Billion Forecast Revenue (2033) USD 51.0 Billion CAGR (2024-2033) 6.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Manual, Automatic), By Capacity (Less than 5 Liters, 5-10 Liters, Above 10 Liters), By Distribution Channel (Online Stores, Offline Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Brew Driver, Craig Industries Inc., Keg King, Kegco, Micro Matic Inc., MiniBrew BV, Perlick Corp., Speidel Tank und Behalterbau GmbH, Spike Brewing, The Middleby Corp., True Manufacturing Co. Inc., WilliamsWarn NZ Ltd., Other Key Players, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Home Beer Brewing Machine MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Home Beer Brewing Machine MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Brew Driver

- Craig Industries Inc.

- Keg King

- Kegco

- Micro Matic Inc.

- MiniBrew BV

- Perlick Corp.

- Speidel Tank und Behalterbau GmbH

- Spike Brewing

- The Middleby Corp.

- True Manufacturing Co. Inc.

- WilliamsWarn NZ Ltd.

- Other Key Players