Global Home Appliances Rental Market Size, Share, Growth Analysis By Appliance Type (Washers & Dryers, Refrigerators & Freezers, Cooking Ranges, Cooktops & Ovens, Dishwashers, Air Conditioners, Others), By Duration (Long-term, Short-term), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 150814

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

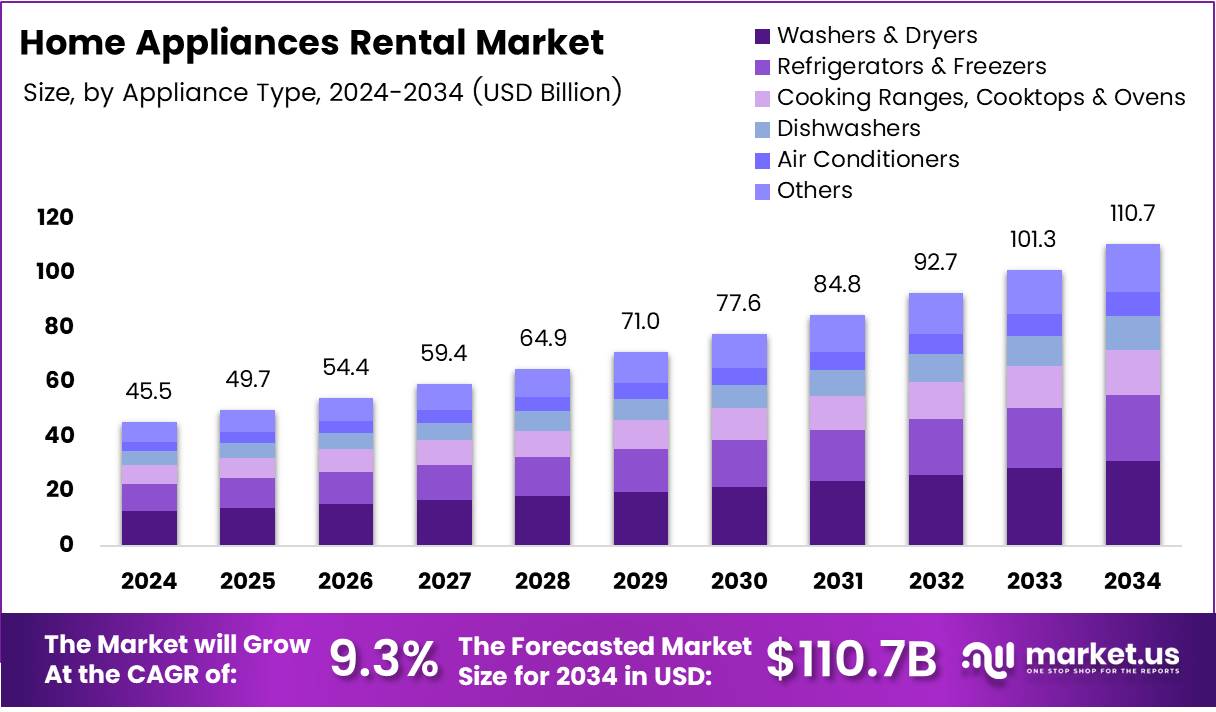

The Global Home Appliances Rental Market size is expected to be worth around USD 110.7 Billion by 2034, from USD 45.5 Billion in 2024, growing at a CAGR of 9.3% during the forecast period from 2025 to 2034.

The Home Appliances Rental Market has been growing as more people look for cost-effective and flexible solutions for appliances. Instead of buying items like washers, refrigerators, and air conditioners, consumers can rent them. This model is especially popular in urban areas with a high number of young professionals, students, and those in temporary housing.

The growth of this market is fueled by the affordability and convenience of renting. Rental prices range from $30 to $60 per month depending on the appliance and location, according to precision applianceleasing.

However, over time, the total amount paid in rentals can sometimes exceed the original purchase price of appliances like washers and dryers. This could impact both consumers and rental companies, as pricing structures need to be competitive yet profitable.

The market offers significant opportunities. As urbanization increases and incomes rise in emerging markets, the demand for renting home appliances is expected to grow. The rise of e-commerce and digital platforms makes it easier for consumers to access rental services. Companies can target specific niches like renting high-end appliances or offering value-added services such as installation and maintenance.

Government policies and investments are also essential for market growth. Supportive regulations can encourage businesses to offer rental services and sustainable products. Additionally, consumer protection laws can ensure rented appliances are safe and meet certain standards. These factors help shape the market and provide a stable environment for growth.

According to finmodelslab, home appliance rental owners typically earn between $50K and $150K annually, depending on factors like location, inventory size, and rental terms. This income range reflects different operating conditions across various regions. Though it requires significant capital investment, the rental business model offers promising growth opportunities.

Key Takeaways

- The Global Home Appliances Rental Market is projected to reach USD 110.7 Billion by 2034, up from USD 45.5 Billion in 2024.

- The market is expected to grow at a CAGR of 9.3% from 2025 to 2034.

- Washers & Dryers led the appliance type segment in 2024 with a 32.5% share, driven by their essential household utility.

- Long-term rentals (more than 6 months) dominated the rental duration segment in 2024 with a 62.1% share, due to consumer preference for cost-effective extended use.

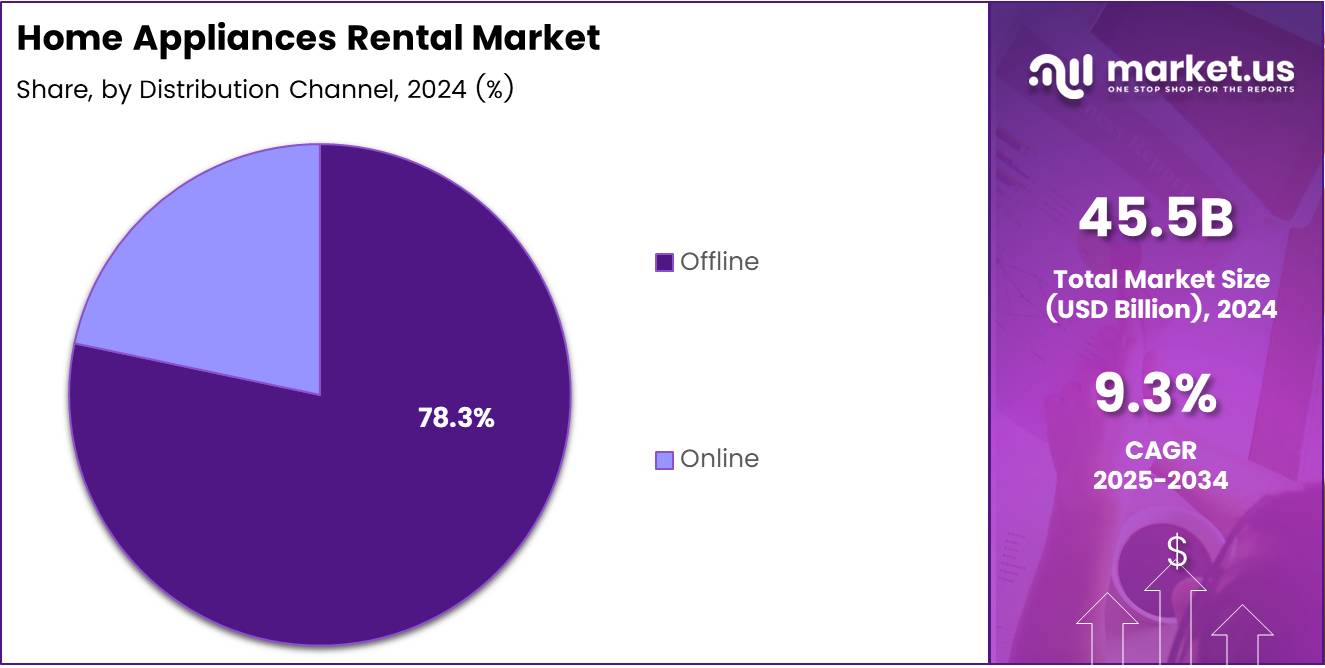

- The Offline distribution channel held a 78.3% share in 2024, favored for allowing customers to inspect appliances physically before renting.

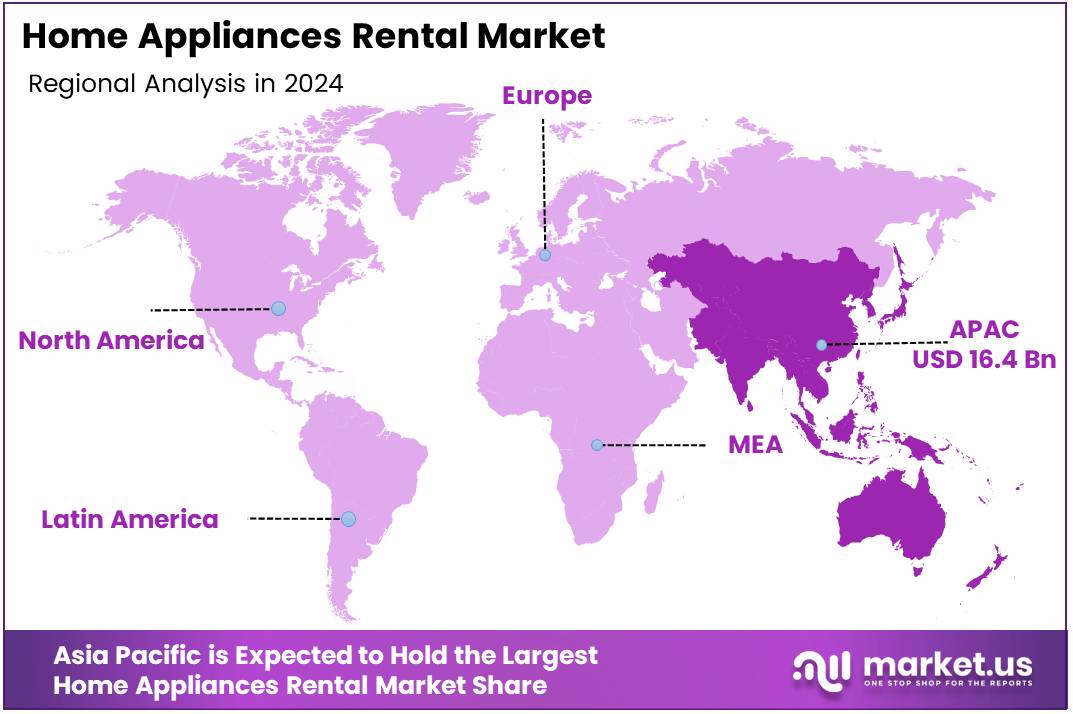

- Asia Pacific led the regional market in 2024 with a 35.6% share and a valuation of USD 16.4 Billion, fueled by urbanization and a growing middle class.

Appliance Type Analysis

In 2024, Washers & Dryers held a dominant market position in the By Appliance Type Analysis segment of the Home Appliances Rental Market, with a 32.5% share. This category’s widespread use and essential nature in households make it a preferred choice for rental services. Its high demand stems from its functionality and the growing trend of renting over purchasing for short-term use.

Refrigerators & Freezers followed closely, with increasing demand due to the necessity of cold storage in homes and offices. Consumers are opting for rental models to avoid large upfront costs and to upgrade more frequently.

Cooking Ranges, Cooktops & Ovens showed steady demand, driven by the need for kitchen appliances in rental properties. Similarly, Dishwashers and Air Conditioners also gained significant traction, attributed to a rise in demand for convenience and comfort.

Lastly, the Others category, while smaller, still plays a crucial role in catering to specialized needs for certain customers, contributing to the overall market dynamics.

Duration Analysis

In 2024, Long-term (more than 6 months) held a dominant market position in the By Duration Analysis segment of the Home Appliances Rental Market, with a 62.1% share. This preference for long-term rentals is driven by consumers’ desire for cost savings on essential appliances over extended periods.

Short-term (1 to 6 months) rentals represented the remaining share, appealing to consumers who need appliances for brief periods, such as during travel, temporary living situations, or seasonal use. Despite being a smaller segment, short-term rentals are growing as more people seek flexible rental agreements tailored to their transient lifestyles.

Distribution Channel Analysis

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Home Appliances Rental Market, with a 78.3% share. The offline segment remains preferred for its tangible experience, where customers can directly inspect appliances before renting.

Online channels, although growing, are still a secondary choice. However, with increasing digital penetration, online rental services are anticipated to gain traction as consumers become more comfortable with remote transactions. Despite this, offline channels continue to dominate the market due to trust and convenience factors.

Key Market Segments

By Appliance Type

- Washers & Dryers

- Refrigerators & Freezers

- Cooking Ranges, Cooktops & Ovens

- Dishwashers

- Air Conditioners

- Others

By Duration

- Long-term (more than 6 months)

- Short-term (1 to 6 months)

By Distribution Channel

- Offline

- Online

Drivers

Increasing Consumer Preference for Rental Models Over Ownership Drives Market Growth

Consumers are shifting from owning appliances to renting them. This change is due to the flexibility and lower upfront cost that rentals offer, especially for short-term needs or frequent movers. It allows users to access modern appliances without long-term commitment.

Online rental platforms are making it easier to rent home appliances. With a few clicks, customers can compare prices, choose products, and schedule deliveries, boosting the market growth through digital convenience and wider reach.

Urban areas are seeing a rise in disposable income, and many people prefer renting high-end appliances without buying them. This trend is popular among young professionals who want comfort and quality without spending too much upfront.

Restraints

High Maintenance and Repair Costs for Rental Appliances Limit Market Expansion

One major restraint in the home appliance rental market is the high cost of maintaining and repairing rented items. This reduces the profit margins for rental companies and can make the service more expensive for consumers over time.

Another challenge is the limited availability of premium or latest appliance models for rent. Many rental providers focus on standard products, which may not appeal to consumers who want advanced features or modern designs, limiting market reach and customer satisfaction.

Growth Factors

Subscription-Based Rental Models Gaining Popularity Boost Growth Potential

Subscription-based rentals are becoming popular as they offer fixed monthly payments, including service and maintenance. This predictable pricing model attracts budget-conscious consumers and helps retain long-term users.

Expanding rental services in emerging markets is a key growth opportunity. Rising urbanization and digital access in these regions can increase demand for affordable appliance access without large upfront costs.

The integration of smart home appliances into rental offerings adds value for tech-savvy users. Features like remote control and energy efficiency make rentals more attractive and modern, encouraging market expansion.

Emerging Trends

Adoption of Rental Models by Millennials and Gen Z Influences Market Trends

Millennials and Gen Z prefer flexibility over ownership, which makes appliance rentals appealing. They value convenience, cost-efficiency, and short-term commitments, aligning well with rental services.

Environmentally conscious consumers are choosing to rent rather than buy to reduce waste and overconsumption. This sustainable approach is driving growth in eco-friendly rental services.

Technology is also changing the market. Smart tracking and automated maintenance systems help rental providers monitor usage and keep appliances in good condition, improving customer experience and trust.

Regional Analysis

Asia Pacific Dominates the Home Appliances Rental Market with a Market Share of 35.6%, Valued at USD 16.4 Billion

Asia Pacific holds the leading position in the home appliances rental market, driven by the region’s rapidly urbanizing population, expanding middle-class segment, and rising preference for cost-effective living solutions.

The market share stands at 35.6%, with a valuation of USD 16.4 Billion, reflecting strong consumer adoption, particularly in densely populated countries. Increasing migration to metropolitan cities for employment and education continues to drive demand for short-term and flexible rental solutions across the region.

North America Home Appliances Rental Market Trends

North America represents a mature but steadily growing segment in the home appliances rental market. Rising consumer awareness around sustainability and cost-saving benefits of renting over buying is fueling market traction. The prevalence of digitally integrated rental platforms and high adoption among millennial consumers also contributes to market expansion across key urban centers.

Europe Home Appliances Rental Market Trends

Europe showcases a robust market outlook, supported by growing environmental consciousness and increased demand for sustainable consumption models. Consumer behavior is shifting towards access-based usage, especially in countries with high housing mobility. Flexible rental terms and subscription-based models are gaining traction, particularly among younger, urbanized populations.

Middle East and Africa Home Appliances Rental Market Trends

The Middle East and Africa region is witnessing gradual growth in the home appliances rental sector, spurred by increasing expatriate populations and a rise in temporary housing setups. Emerging economies within the region are beginning to embrace rental models due to affordability and convenience, though overall market penetration remains in its early stages.

Latin America Home Appliances Rental Market Trends

In Latin America, the home appliances rental market is developing steadily, driven by economic factors and an evolving perception of ownership. Urbanization and the demand for cost-effective home solutions are prompting consumers to consider rental alternatives. While still in a nascent phase, the market shows potential for growth with increasing digital access and changing lifestyle patterns.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Home Appliances Rental Company Insights

The global Home Appliances Rental Market in 2024 continues to see dynamic growth, driven by rising urban migration, shifting consumer preferences, and the increasing need for flexible lifestyle solutions. Among the prominent players, Aaron’s Inc. maintains a strong foothold in the North American market, leveraging its vast network and in-house financing options to attract budget-conscious consumers seeking ownership alternatives.

Edunetwork Pvt. Ltd. (RentoMojo) has reinforced its presence in India through a tech-first approach, targeting young professionals in urban areas with flexible rental plans and a focus on convenience and affordability.

AVA Lifestyle Products & Services Pvt. Ltd. (Rentickle) continues to differentiate itself with a diversified product portfolio and customer-centric services, making it a preferred option for both short-term users and families looking for cost-effective home solutions.

Rent-A-Center, Inc. remains a dominant force in the U.S. market, using strategic partnerships and e-commerce investments to strengthen its omni-channel presence and improve customer acquisition.

These key players are driving innovation and competition by embracing technology, enhancing customer service, and offering flexible rental models, which are crucial in a market increasingly defined by convenience and adaptability. As the industry evolves, these companies are well-positioned to capitalize on growing consumer demand, especially in urban centers and among digitally savvy populations.

Top Key Players in the Market

- Aaron’s Inc.

- Edunetwork Pvt. Ltd. (RentoMojo)

- AVA Lifestyle Products & Services Pvt. Ltd. (Rentickle)

- Rent-A-Center, Inc.

- House of Kieraya Limited (Furlenco)

- CITYFURNISH INDIA PRIVATE LIMITED

- CORT Business Services Corporation

- Mr Rental

- Buddy’s Home Furnishings

- FlexShopper, LLC.

Recent Developments

- In October 2024, IQVentures completed the acquisition of The Aaron’s Company, a leading provider of rent-to-own and retail services, expanding its market share and service offerings. The acquisition aims to enhance IQVentures’ national presence in the rent-to-own space and leverage The Aaron’s Company’s established customer base.

- In March 2024, Rent-A-Center announced the launch of its new national rent-to-own program, RAC Exchange™, designed to simplify the rental process for customers by offering more flexible payment options. The program targets enhancing accessibility and providing customers with a broader selection of products and services.

Report Scope

Report Features Description Market Value (2024) USD 45.5 Billion Forecast Revenue (2034) USD 110.7 Billion CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Appliance Type (Washers & Dryers, Refrigerators & Freezers, Cooking Ranges, Cooktops & Ovens, Dishwashers, Air Conditioners, Others), By Duration (Long-term, Short-term), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Aaron’s Inc., Edunetwork Pvt. Ltd. (RentoMojo), AVA Lifestyle Products & Services Pvt. Ltd. (Rentickle), Rent-A-Center, Inc., House of Kieraya Limited (Furlenco), CITYFURNISH INDIA PRIVATE LIMITED, CORT Business Services Corporation, Mr Rental, Buddy’s Home Furnishings, FlexShopper, LLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Home Appliances Rental MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample

Home Appliances Rental MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aaron’s Inc.

- Edunetwork Pvt. Ltd. (RentoMojo)

- AVA Lifestyle Products & Services Pvt. Ltd. (Rentickle)

- Rent-A-Center, Inc.

- House of Kieraya Limited (Furlenco)

- CITYFURNISH INDIA PRIVATE LIMITED

- CORT Business Services Corporation

- Mr Rental

- Buddy's Home Furnishings

- FlexShopper, LLC.