Global Holography in Medical Imaging Market By Product Type (Holographic Displays, Holographic Prints, and Holography Microscopes), By Application (Medical Imaging, Biomedical Research, and Medical Education), By Imaging Modality (Computed Tomography (CT), X-ray, Ultrasound, and Magnetic Resonance Imaging (MRI)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158107

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

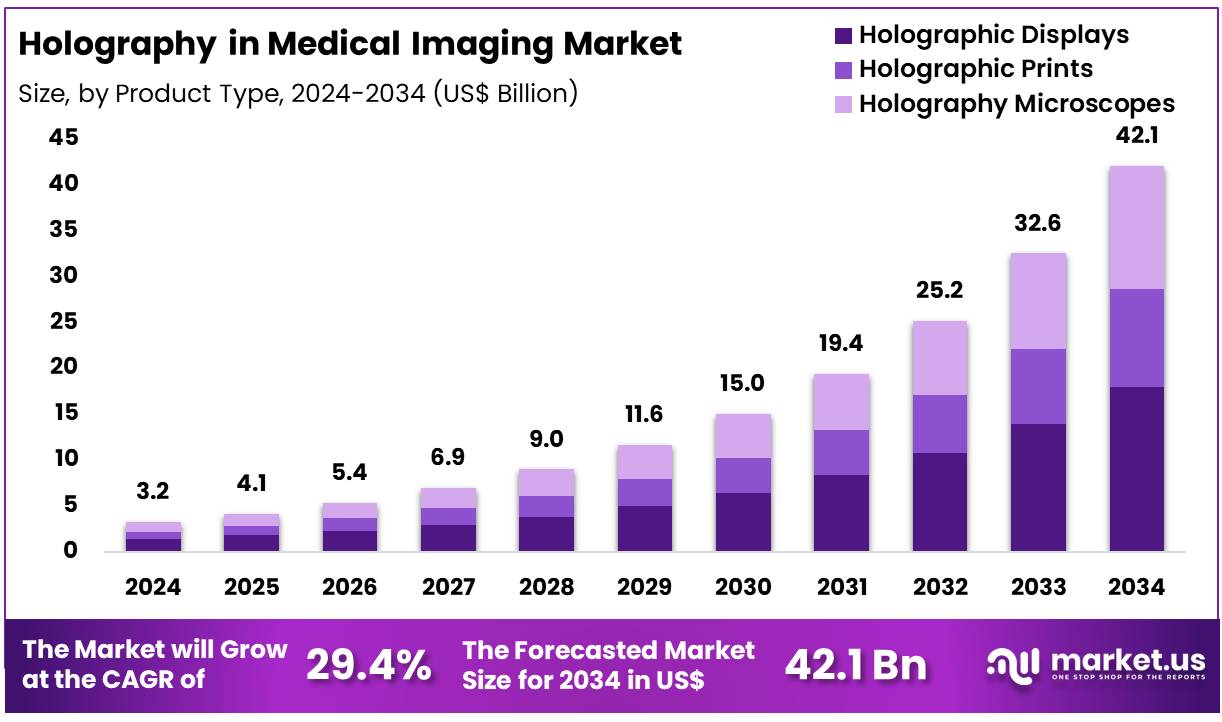

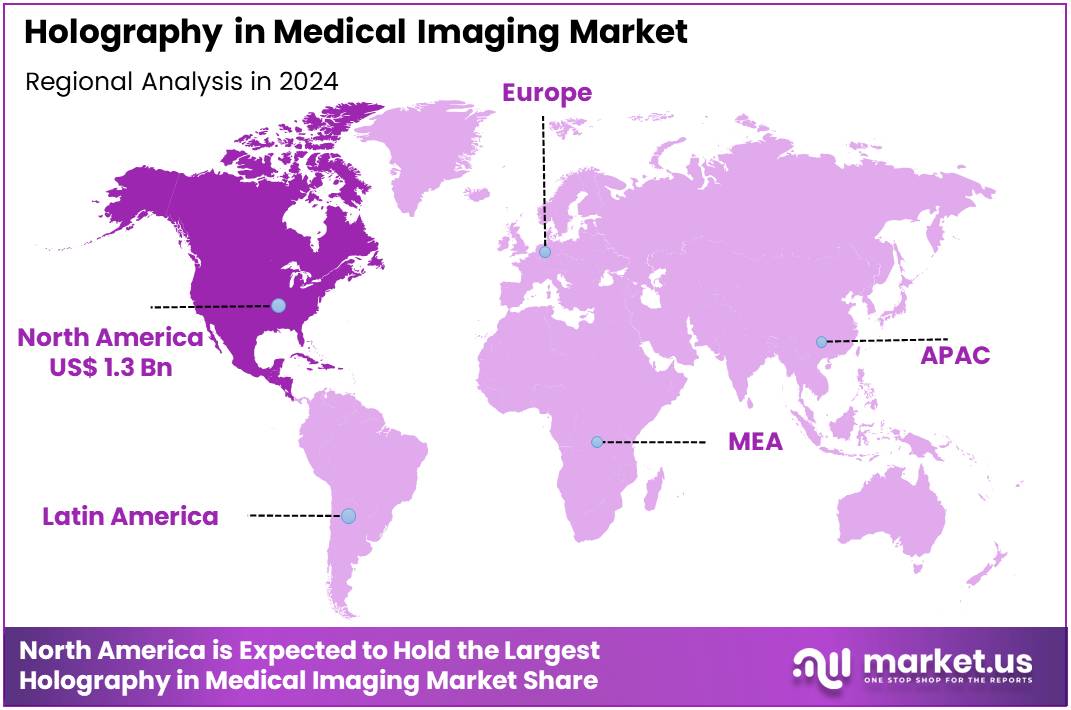

Global Holography in Medical Imaging Market size is expected to be worth around US$ 42.1 Billion by 2034 from US$ 3.2 Billion in 2024, growing at a CAGR of 29.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.5% share with a revenue of US$ 1.3 Billion.

Rising patient demand for advanced diagnostics and a growing preference for less invasive surgical procedures are primary drivers of the holography in medical imaging market. This technology creates real-time, interactive 3D images from traditional 2D scans like CT and MRI, providing a more intuitive and comprehensive view of a patient’s anatomy.

The global volume of diagnostic medical examinations is immense; according to the World Health Organization (WHO), approximately 3.6 billion diagnostic medical examinations are performed annually. This high volume of imaging data creates a robust need for sophisticated visualization tools that can improve diagnostic accuracy and surgical precision.

Growing technological integration and a focus on procedural efficiency are key trends shaping the market. Holography is increasingly used to enhance surgical planning and intraoperative guidance, moving beyond static 2D images to dynamic, interactive visualizations. A 2023 study by the National Institutes of Health (NIH) introduced a revolutionary system that enables surgeons to project and interact with 3D images in real-time during surgeries, enhancing decision-making and reducing reliance on traditional 2D images. This type of innovation is crucial for applications that require high precision, such as neurosurgery and cardiology, where understanding complex anatomical relationships is paramount.

Increasing collaboration and a drive for cost-effective solutions are creating significant opportunities for market expansion. The integration of holographic technology is not only improving clinical outcomes but also streamlining workflows and reducing costs. A 2021 NIH study highlighted the operational and clinical advantages of holography in surgical planning.

The study found that holography was not only faster and more cost-effective than using 3D printed models but also provided clear and accurate 3D representations of a patient’s anatomy, improving overall surgical precision. This focus on both clinical efficacy and economic viability is broadening the appeal of holography across various medical fields and driving its wider adoption.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.2 Billion, with a CAGR of 29.4%, and is expected to reach US$ 42.1 Billion by the year 2034.

- The product type segment is divided into holographic displays, holographic prints, and holography microscopes, with holographic displays taking the lead in 2023 with a market share of 42.8%.

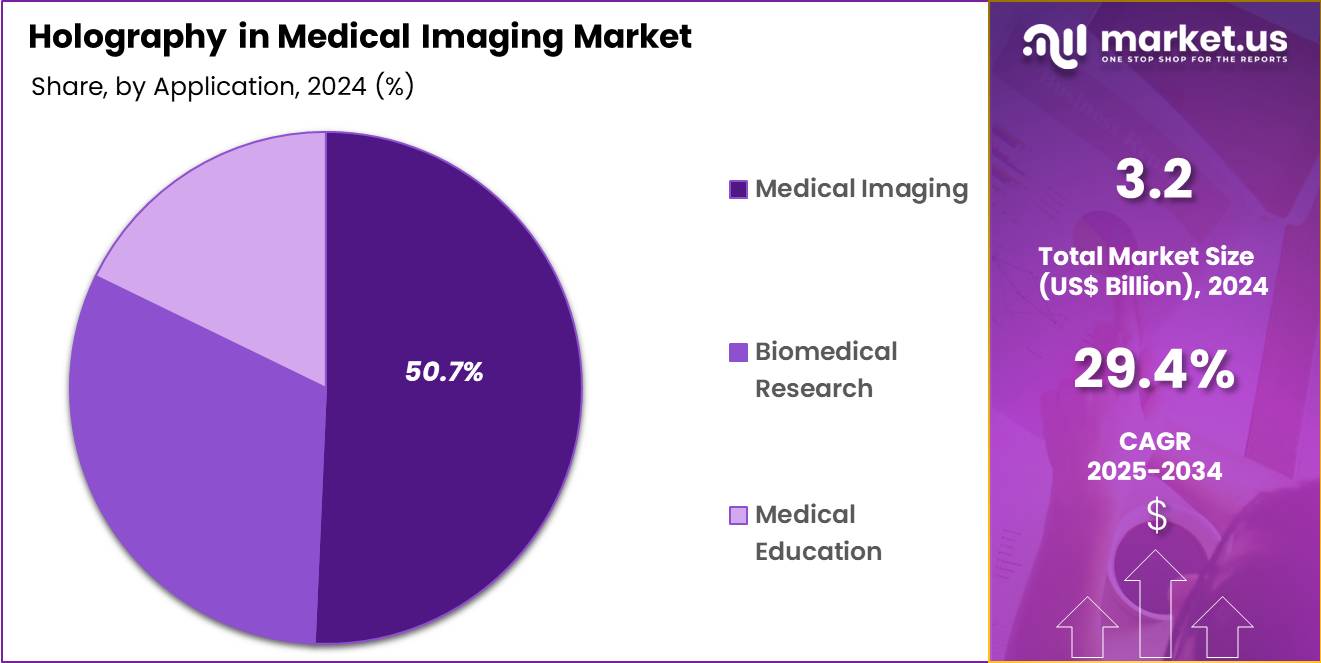

- Considering application, the market is divided into medical imaging, biomedical research, and medical education. Among these, medical imaging held a significant share of 50.7%.

- Furthermore, concerning the imaging modality segment, the market is segregated into computed tomography (CT), x-ray, ultrasound, and magnetic resonance imaging (MRI). The computed tomography (CT) sector stands out as the dominant player, holding the largest revenue share of 40.5% in the market.

- North America led the market by securing a market share of 41.5% in 2023.

Product Type Analysis

Holographic displays hold the largest share of 42.8% in the holography in medical imaging market. This growth is expected to continue as healthcare providers increasingly adopt advanced imaging technologies to enhance the visual representation of medical data. Holographic displays offer a three-dimensional view of medical images, which improves clinicians’ ability to diagnose and plan treatments accurately.

As healthcare institutions strive to integrate more advanced technologies for improved patient outcomes, the demand for holographic displays is anticipated to grow. Additionally, as the cost of holographic display technology decreases, it will become more accessible to a wider range of medical practices, driving further market expansion. The ability to visualize medical data in 3D is expected to be a game-changer in surgical planning, radiology, and patient education.

Application Analysis

Medical imaging holds 50.7% of the application segment in the holography in medical imaging market. This sector is expected to expand significantly due to the increasing demand for high-quality, precise imaging solutions in diagnostics and surgical planning. The integration of holography into medical imaging systems will improve the accuracy of scans, enabling healthcare professionals to better understand complex structures and conditions.

As the medical field continues to prioritize non-invasive imaging techniques, holography’s ability to enhance image clarity and depth perception is likely to drive its growth in this application. Moreover, holographic imaging can provide more interactive and detailed images, which are crucial for complex surgeries and diagnostics, making it a critical tool in modern medicine.

Imaging Modality Analysis

Computed tomography (CT) accounts for 40.5% of the imaging modality segment in the holography in medical imaging market. The application of holographic technology to CT scans is expected to revolutionize how physicians interpret and interact with medical images. Holography can provide 3D visualizations of CT images, allowing for a more thorough understanding of the anatomical structures being examined. This advancement is anticipated to enhance diagnostic accuracy, especially in complex cases such as cancer detection and cardiovascular conditions.

As the healthcare sector continues to adopt digital transformation and advanced imaging techniques, the integration of holography with CT scans will likely become more widespread. The demand for more precise and reliable imaging in clinical settings is projected to drive significant growth in this segment.

Key Market Segments

Product Type

- Holographic Displays

- Holographic Prints

- Holography Microscopes

Application

- Medical Imaging

- Biomedical Research

- Medical Education

Imaging Modality

- Computed Tomography (CT)

- X-ray

- Ultrasound

- Magnetic Resonance Imaging (MRI)

Drivers

The increasing demand for advanced 3D visualization in surgical planning is driving the market.

The holography in medical imaging market is being driven by the increasing demand for advanced three-dimensional (3D) visualization techniques in complex medical procedures, particularly surgical planning. Traditional 2D medical images, such as X-rays and CT scans, often require a high degree of mental reconstruction and can be prone to misinterpretation, especially in intricate surgical cases.

Holographic imaging provides a solution by creating interactive, life-size 3D representations of patient anatomy, which allows surgeons to visualize and manipulate organs, tumors, and blood vessels with unprecedented clarity and depth perception before they even make an incision. This technology enhances precision, minimizes risks, and shortens procedure times. A key indicator of this demand is the rising number of approvals for related technologies.

According to data from the US Food and Drug Administration (FDA) as of July 2025, there are now over 92 augmented reality (AR) and virtual reality (VR) medical devices with marketing authorization, a significant number of which are utilized for pre-operative surgical planning and visualization. This trend underscores a strong push by the medical community toward adopting immersive 3D technologies for more informed and effective surgical interventions.

Restraints

The high cost of hardware and complex integration are restraining the market.

A significant restraint on the holography in medical imaging market is the high cost of specialized holographic hardware and the complexity of integrating it into existing hospital infrastructure. The adoption of this technology requires a substantial upfront capital investment for the display units themselves, as well as for the necessary computational power to render complex medical data in real-time. This financial barrier is particularly challenging for smaller clinics and hospitals with limited budgets.

Additionally, integrating holographic technology with legacy medical imaging systems, like PACS (Picture Archiving and Communication System), can be a difficult and time-consuming process that requires specialized technical expertise. This leads to a longer adoption cycle and limits the technology’s widespread use.

For example, holographic display hardware is priced in a wide range, with units used for professional medical applications often costing tens of thousands of dollars, making it a capital-intensive investment for most healthcare facilities. This significant financial outlay, coupled with the technical integration hurdles, makes it difficult for many institutions to justify the expense, thereby slowing market growth.

Opportunities

The rising adoption of mixed reality is creating growth opportunities.

A significant growth opportunity for the holography in medical imaging market lies in the rising adoption of mixed reality (MR) and augmented reality (AR) technologies. These fields are creating a natural synergy with holographic imaging by allowing for the overlay of 3D medical data onto a patient’s body or within the clinical environment. This enables doctors to view internal organs and structures in their precise anatomical location without needing to look away from the patient, which can be invaluable during complex procedures.

The growing ecosystem of MR devices, such as headsets and smart glasses, is expanding the potential applications of holography from a static display to an interactive, real-time tool for diagnostics, training, and surgical guidance. The US Patent and Trademark Office (USPTO)’s patent application database shows a clear trend toward this integration. The USPTO has seen a steady increase in patents granted for medical devices that utilize augmented reality for anatomical overlay and visualization, with a notable number of filings between 2022 and 2024 specifically for this type of application, as companies work to secure intellectual property in this promising field.

Impact of Macroeconomic / Geopolitical Factors

The holography in medical imaging market is influenced by a combination of macroeconomic and geopolitical factors. The high cost of this technology and economic uncertainty, driven by high inflation, can lead to budget constraints in healthcare institutions, which may delay the adoption of new, expensive imaging systems. Geopolitically, the market’s global supply chain is vulnerable to disruptions due to its reliance on a few key manufacturing hubs for specialized components like high-resolution projectors and lasers.

The current US trade policy has introduced significant new duties on a range of imports. A universal baseline tariff of 10% now applies to most imported medical devices and components, while more substantial duties are levied on goods from specific countries. For example, semiconductors from China are subject to a 50% tariff, and certain medical consumables, such as syringes and gloves, now face a 20% duty. These tariffs raise the overall cost of manufacturing and acquiring holographic systems, compelling companies to either absorb the expenses or pass them on to healthcare providers, which can hinder market expansion and the widespread availability of this innovative medical technology.

Latest Trends

The development of portable and affordable holographic solutions is a recent trend.

A defining trend in the holography in medical imaging market in 2024 is the shift toward more portable and affordable holographic solutions, moving away from large, expensive, and stationary displays. This trend is driven by a focus on making the technology more accessible for a wider range of clinical settings, including smaller clinics, mobile medical units, and even for individual practitioners.

Innovations in light-field display technology and improvements in rendering software are enabling companies to produce smaller, more compact devices that do not sacrifice the clarity and depth of a true holographic image. This development lowers the barrier to entry and encourages broader adoption. This trend is demonstrated by the launch of new products.

For instance, Looking Glass Factory, a company specializing in light-field displays, introduced new, more portable display models in 2024 and 2025, which are being specifically marketed to the medical and educational sectors to enable professionals to view medical scans and models in true depth without the need for headsets, signaling a strategic focus on expanding market access through a more cost-effective and mobile design.

Regional Analysis

North America is leading the Holography in Medical Imaging Market

With a reported 41.5% share, North America has established itself as a dominant force in the global holography in medical imaging market. This substantial growth in 2024 is directly linked to the region’s advanced healthcare infrastructure, significant investments in research and development, and the swift adoption of innovative medical technologies. The integration of augmented reality (AR) and artificial intelligence (AI) with holographic systems is a key driver, enabling clinicians to interpret complex anatomical data with greater precision.

According to the Centers for Disease Control and Prevention (CDC), the United States saw a significant increase in new invasive cancer cases, with 1,777,566 cases reported in 2021 alone, and this rising disease burden necessitates advanced diagnostic tools. Furthermore, a 2022 study revealed that hospital spending on diagnostic imaging equipment service expenses in the US increased by 13.3% since 2020, demonstrating sustained investment in advanced imaging technologies.

The rising demand for minimally invasive procedures also plays a crucial role, as holographic imaging offers detailed, three-dimensional (3D) visualization for surgical planning and assistance. This technology allows surgeons to practice complex procedures in a virtual environment, which is particularly beneficial given the increasing prevalence of chronic diseases.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is expected to grow as the fastest-growing market for holography in medical imaging. The increasing investments in healthcare infrastructure and rising disposable incomes across countries like China and India are anticipated to drive this growth. Governments in the region are actively promoting the adoption of advanced medical technologies through various initiatives, which is likely to accelerate the market’s expansion.

The increasing number of hospitals and clinics in Asia Pacific provides a fertile ground for the wider integration of holographic technologies. The rising prevalence of chronic diseases and a rapidly aging population in the Asia Pacific are estimated to create a significant need for early and accurate diagnostic tools, which holographic imaging systems provide.

The World Bank’s data on public health expenditure shows a consistent upward trend in the region, with many countries increasing their health spending as a percentage of their GDP. For instance, according to the WHO’s Health at a Glance: Asia/Pacific 2022 report, public spending on health increased in a majority of the 27 countries and territories surveyed. The increasing focus on biomedical research and medical education is likely to boost the adoption of holography microscopes and other holographic solutions.

The increasing number of private hospitals and diagnostic centers in the region, driven by competition and the demand for high-quality care, are projected to invest heavily in cutting-edge imaging modalities, including those based on holography. Overall, the combination of technological advancements, supportive government policies, and a growing patient population is poised to make Asia Pacific a major hub for this market in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the holography in medical imaging market are driving growth through several key strategies. They are heavily investing in integrating advanced technologies like artificial intelligence and augmented reality to enhance real-time analysis and visualization. Companies are also pursuing strategic acquisitions and partnerships with hospitals and research institutions to expand their portfolios and gain access to new therapeutic areas. Furthermore, market leaders are actively developing portable and cost-effective holographic devices to make the technology more accessible in various clinical settings. This combination of innovation and strategic business development is crucial for maintaining a competitive edge.

C-RAD, a medical technology company, has established a significant position in the sector by specializing in surface-guided imaging solutions for radiation therapy. The company’s business model is centered on providing high-precision, non-invasive technology that enhances patient safety and treatment accuracy.

C-RAD’s strategy involves continuously investing in its research and development to improve its core products, such as the Catalyst+ system, while also forming strategic collaborations with major medical equipment manufacturers to integrate its solutions into a broader range of clinical workflows. The company’s focus on non-invasive imaging and its robust distribution network make it a key partner for many cancer treatment centers worldwide.

Top Key Players

- zSpace, Inc

- RealView Imaging Ltd

- Nanolive SA

- Mach7 Technologies Ltd

- Looking Glass Factory, Inc

- Leia Inc

- Holoxica Ltd

- Holografika Kft

- Eon Reality, Inc

- EchoPixel Inc

Recent Developments

- In April 2024, researchers at USST unveiled a split Lohmann lens-based holography technique that enables real-time, high-quality 3D visualization with reduced computational requirements. This innovation is set to transform medical imaging, virtual reality, and entertainment applications by improving efficiency and performance.

- In October 2024, Concordia University introduced Holographic Direct Sound Printing (HDSP), a groundbreaking 3D-printing technology that utilizes sound waves to rapidly fabricate complex biomedical structures. This method offers significant advantages, including lower energy consumption and the elimination of layering constraints.

Report Scope

Report Features Description Market Value (2024) US$ 3.2 Billion Forecast Revenue (2034) US$ 42.1 Billion CAGR (2025-2034) 29.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Holographic Displays, Holographic Prints, and Holography Microscopes), By Application (Medical Imaging, Biomedical Research, and Medical Education), By Imaging Modality (Computed Tomography (CT), X-ray, Ultrasound, and Magnetic Resonance Imaging (MRI)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape zSpace, Inc, RealView Imaging Ltd, Nanolive SA, Mach7 Technologies Ltd, Looking Glass Factory, Inc, Leia Inc, Holoxica Ltd, Holografika Kft, Eon Reality, Inc, EchoPixel Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Holography in Medical Imaging MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Holography in Medical Imaging MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- zSpace, Inc

- RealView Imaging Ltd

- Nanolive SA

- Mach7 Technologies Ltd

- Looking Glass Factory, Inc

- Leia Inc

- Holoxica Ltd

- Holografika Kft

- Eon Reality, Inc

- EchoPixel Inc