Global Hold Your Own Key Platform Market Size, Share Report By Component (Hardware, Software, Services), By Deployment Mode (On-Premises, Cloud), By Organization Size (Small and Medium Enterprises, Large Enterprises), By Application (Data Security, Compliance Management, Cloud Encryption, Access Control, Other Applications), By End-User (BFSI, Healthcare, Government, IT and Telecommunications, Retail, Other End-Users), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169427

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- US Market Size

- By Component

- By Deployment Mode

- By Organization Size

- By Application

- By End User

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

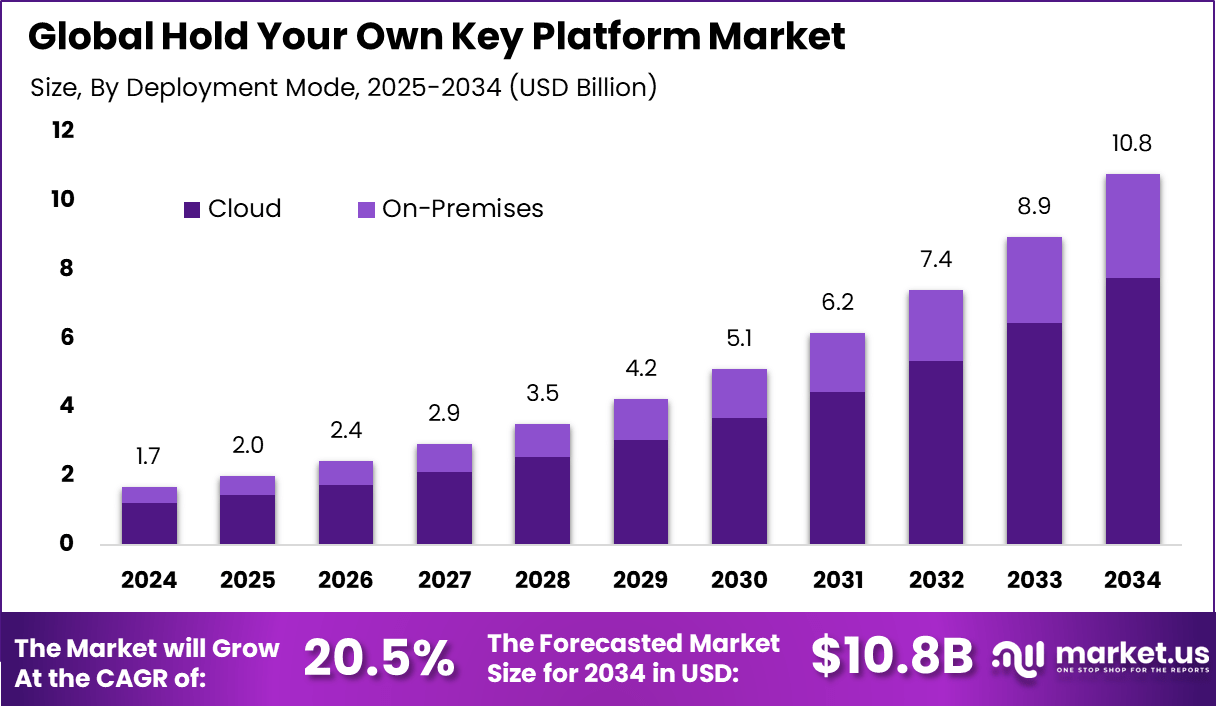

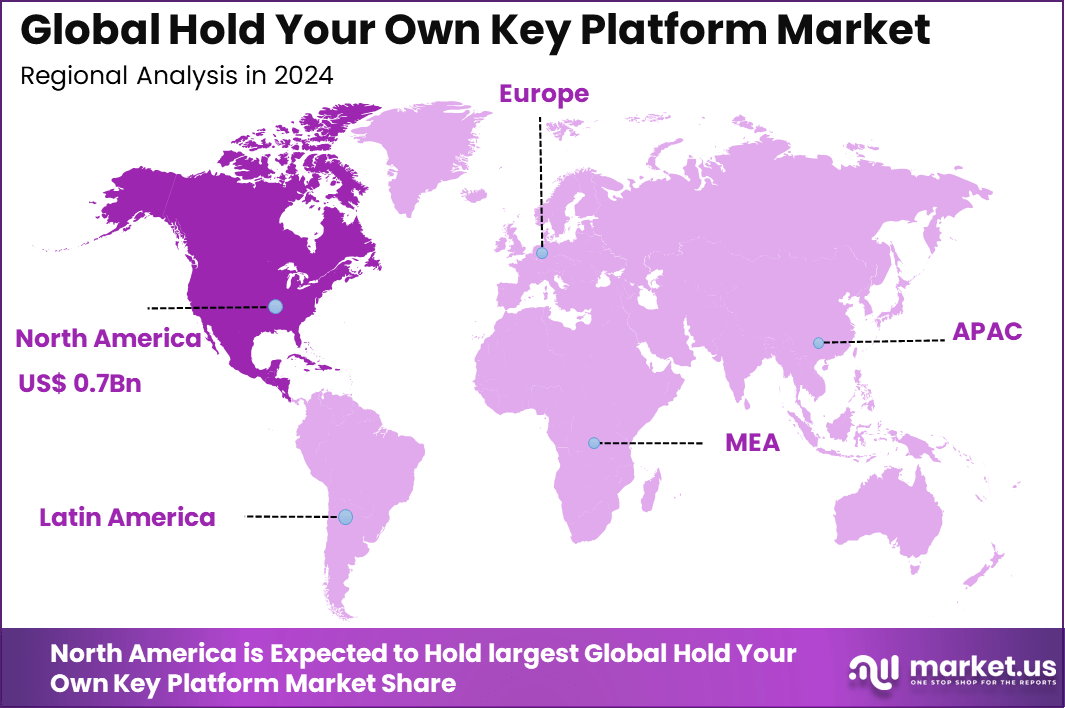

The Global Hold Your Own Key Platform Market generated USD 1.7 billion in 2024 and is predicted to register growth from USD 2.0 billion in 2025 to about USD 10.8 billion by 2034, recording a CAGR of 20.5% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 44.3 share, holding USD 1.0.7 Billion revenue.

The Hold Your Own Key (HYOK) platform market focuses on tools and services that let organizations generate, store, and control their own encryption keys instead of giving full key custody to cloud or SaaS providers. In a HYOK model, sensitive data can be encrypted before it leaves the organization, and cloud platforms only see ciphertext while keys stay in customer‑owned hardware security modules or key management systems.

The growth of the market can be attributed to increasing cybersecurity concerns, rising incidents of centralized platform failures and stronger regulatory focus on asset custody practices. Users are becoming more risk aware and prefer systems that remove counterparty exposure. Demand is also supported by growing digital asset adoption across payments, investment and enterprise use cases.

Demand is rising across retail investors, digital asset traders, institutional funds, fintech platforms and enterprises managing on chain assets. High net worth individuals and professional traders prefer self custody models to reduce exposure to custodial risk. Enterprises operating in tokenized assets, digital identity and blockchain based finance also rely on these platforms for secure internal asset control.

Top Market Takeaways

- Software led with 61.8%, showing that most organizations rely on digital platforms to manage asset control and compliance processes.

- Cloud deployment dominated with 72.1%, reflecting strong preference for scalable, remotely accessible infrastructure.

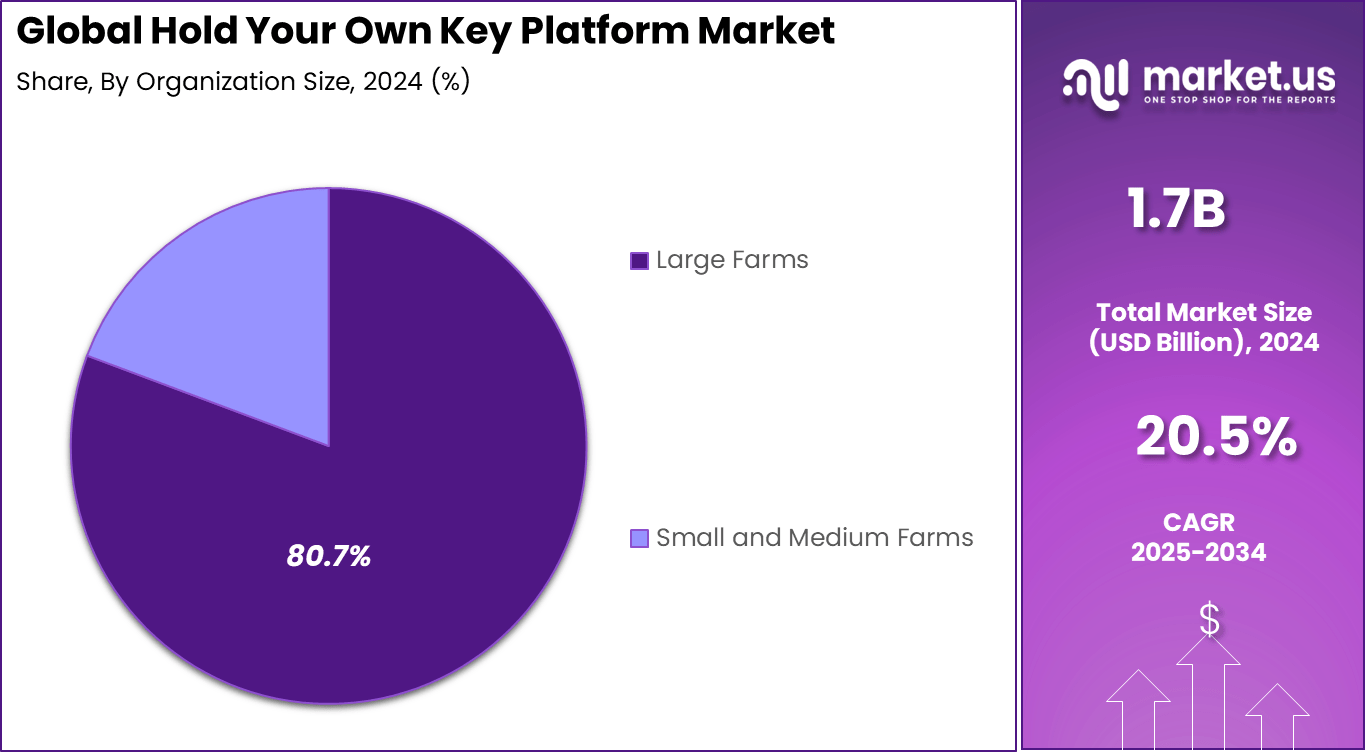

- Large enterprises accounted for 80.7%, confirming that complex regulatory and asset environments drive higher adoption among big organizations.

- Compliance management captured 34.5%, highlighting strong demand for automated monitoring, audit readiness, and risk reporting.

- The BFSI sector held 31.2%, driven by strict regulatory requirements and growing digital asset oversight needs.

- North America recorded 44.3%, supported by advanced regulatory frameworks and early enterprise adoption of secure control platforms.

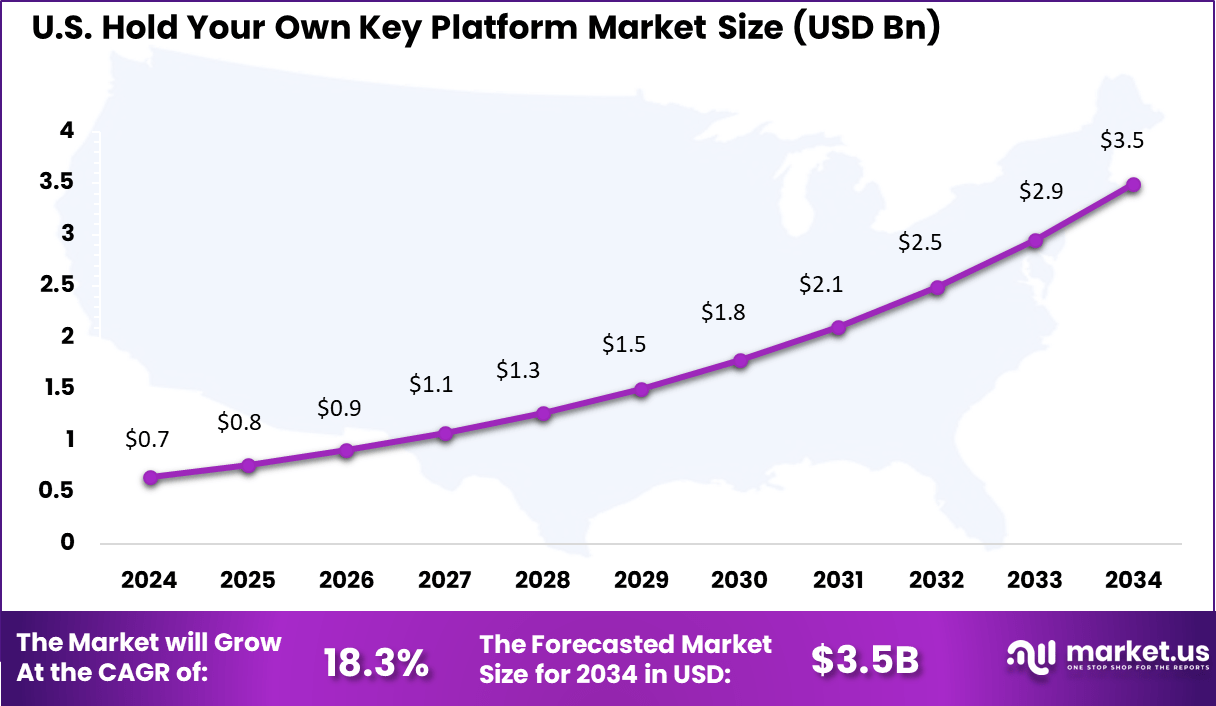

- The U.S. market reached USD 0.65 billion with a strong 18.3% CAGR, indicating fast-growing investment in compliance-driven asset governance platforms.

Quick Market Facts

Investment opportunities exist in secure key management infrastructure, institutional grade self custody platforms, recovery and inheritance solutions, hardware wallet integration, policy driven wallet systems and enterprise blockchain security frameworks. Strong potential is seen in tokenized finance, digital identity ecosystems, cross border digital payments and decentralized application infrastructure.

Businesses benefit from reduced counterparty risk, stronger asset governance and improved regulatory positioning. Self custody platforms eliminate trust dependency on external entities and provide direct control over transaction execution. Operational transparency improves, while security frameworks reduce exposure to unauthorized asset movements and internal misuse.

The market is shaped by digital asset custody regulations, data protection laws, anti money laundering guidelines and jurisdiction specific compliance rules. Technical impacting factors include key recovery methods, transaction signing security, hardware compatibility, audit trail reliability and resilience against key loss. Regulatory clarity around self custody continues to influence institutional participation.

US Market Size

The United States alone reached USD 0.65 Bn with a healthy CAGR of 18.3%, showing rising adoption across banking, healthcare, and digital service providers. Growth is linked to expanding use of cloud platforms for sensitive business operations.

North America leads with a 44.3% regional share, supported by strong cloud infrastructure, advanced cybersecurity adoption, and strict data protection standards. Enterprises across the region prioritize encryption ownership to reduce exposure from third-party risks.

High enterprise awareness around zero trust security models and increasing digital transaction volumes continue to support regional demand. Ongoing investments in secure cloud architecture and identity protection systems further strengthen market performance.

By Component

The software segment holds a leading share of 61.8%, showing that most hold your own key platforms are delivered through dedicated digital software solutions. These platforms allow organizations to manage encryption keys while maintaining full ownership and control over sensitive data access.

Strong demand for software-based platforms is driven by the need for centralized key control, audit management, and secure integration with cloud infrastructure. Software tools also allow easier upgrades, policy automation, and compatibility with existing enterprise security systems.

By Deployment Mode

Cloud-based deployment dominates with a 72.1% share, reflecting the rapid migration of enterprises toward cloud infrastructure for data storage and applications. Cloud deployment allows real-time access, easier key rotation, and secure remote access control across distributed environments.

The high adoption of cloud deployment is supported by growth in multi-cloud strategies and remote operations. Organizations prefer cloud platforms as they reduce infrastructure burden while maintaining full control over encryption keys and security permissions.

By Organization Size

Large enterprises account for a dominant 80.7% share, highlighting strong adoption among organizations handling high volumes of sensitive and regulated data. These enterprises operate across multiple regions and require advanced encryption key control to meet global data protection requirements.

Their strong presence in this segment is linked to complex IT systems, high cloud workloads, and strict compliance needs. Large organizations also possess the financial capacity to invest in advanced security platforms and dedicated key management infrastructures.

By Application

Compliance management represents 34.5% of application demand, making it the leading use case for hold your own key platforms. Enterprises use these platforms to meet strict regulatory requirements around data ownership, encryption, and audit readiness.

The growing reminder on regulatory reporting and digital risk controls continues to strengthen this segment. Key ownership gives organizations the ability to demonstrate data protection compliance across financial, healthcare, and government sectors.

By End User

The BFSI sector holds 31.2% of total end-user demand, making it the largest contributor to platform adoption. Financial institutions handle large volumes of transactional and identity data, which requires strong encryption and complete ownership of security controls.

Banks and financial service providers rely on hold your own key platforms to protect payment data, digital wallets, and cloud-based financial systems. Regulatory pressure and rising cyber threats continue to support steady adoption across this sector.

Emerging Trends

One key emerging trend is the integration of hold your own key platforms with identity and access management systems. This allows tighter user control over encrypted data, improving security monitoring and policy enforcement across cloud workloads.

Another visible trend is the rising use of hardware security module integration with cloud key ownership platforms. This improves physical and digital protection of encryption keys, especially in highly regulated environments such as banking and healthcare.

Growth Factors

Rising cloud adoption across enterprises remains the primary growth driver for hold your own key platforms. As more sensitive workloads move to the cloud, organizations seek direct control over encryption keys to reduce dependency on cloud service providers.

Increasing regulatory pressure related to data privacy, financial security, and cross-border data transfer is also supporting market growth. Businesses are required to demonstrate full data control, which directly strengthens demand for key ownership platforms.

Key Market Segments

By Component

- Hardware

- Hardware Security Modules

- Secure Key Storage Devices

- Network Encryption Appliances

- Dedicated Encryption Servers

- Cryptographic Processors

- Software

- Encryption Key Management Software

- Data Protection Software

- Cloud Security Software

- Access Control Software

- Identity Management Software

- Services

- Professional Services

- Managed Services

By Deployment Mode

- On-Premises

- Cloud

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By Application

- Data Security

- Compliance Management

- Cloud Encryption

- Access Control

- Other Applications

By End-User

- BFSI

- Healthcare

- Government

- IT and Telecommunications

- Retail

- Other End-Users

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A key driver in the Hold Your Own Key (HYOK) platform market is the rising need for stronger control over sensitive information. Many organizations store customer records, financial data, or regulated material in cloud systems. They prefer to keep their own encryption keys so that access to data cannot occur without their approval. HYOK platforms support this requirement by allowing full ownership of the key lifecycle. This level of control is important for sectors that must meet strict privacy rules or internal security guidelines.

Another driver comes from the growing focus on compliance. Many privacy laws require clear evidence that data is protected and that only authorized parties can view it. When organizations hold their own keys, they can show regulators that encryption is under their control. This reduces compliance risk and supports the use of cloud environments while meeting legal and policy requirements.

Restraint Analysis

A major restraint for this market is the difficulty of managing encryption keys internally. HYOK requires organizations to create, store, rotate, and safeguard keys without relying on a cloud provider. This work requires secure storage, trained staff, and careful processes. Some organizations, especially smaller ones, may find the workload heavy and may hesitate to adopt HYOK for this reason.

Another restraint is the risk that comes with full key ownership. If an organization misplaces a key or fails to back it up properly, access to encrypted data may be lost permanently. This possibility makes some users cautious. Organizations that lack clear key governance policies may prefer to avoid HYOK until they can manage this responsibility with confidence.

Opportunity Analysis

There is strong opportunity in the increased use of hybrid cloud and multi cloud systems. Many companies now operate across several environments at the same time. They need one method of controlling encryption keys across all of them. HYOK platforms that offer centralized oversight and consistent controls across different environments can meet this need and appeal to enterprises seeking better alignment in their security practices.

Another opportunity relates to sectors with high value or highly sensitive data. Industries such as healthcare, finance, and research often require strict protection of information. HYOK platforms can help these users keep data fully encrypted while limiting access to those who hold the keys. As more organizations adopt stricter security practices, interest in HYOK solutions increases.

Challenge Analysis

A significant challenge involves scaling key management across large organizations. Some enterprises use large numbers of keys and update them frequently. Managing storage, rotation, auditing, and access rights becomes complex as the number of keys grows. This can create operational pressure and may slow adoption among enterprises that lack dedicated security teams.

Another challenge is finding a balance between strong security and practical usability. HYOK gives users full control, but it may require additional steps for day to day operations. When data must be shared between departments or across locations, key distribution becomes more complex. If the system becomes difficult to manage, adoption may be limited even when security requirements are high.

Competitive Analysis

Amazon Web Services, Google, Microsoft, IBM, Oracle, SAP, and Salesforce lead the hold your own key platform market with enterprise-grade encryption, external key management, and cloud-native security controls. Their platforms allow organizations to retain full ownership of encryption keys while using public cloud services. These companies focus on data sovereignty, zero-trust security models, and regulatory compliance.

Thales, Rackspace, Box, Entrust, Netskope, Egnyte, and Protegrity strengthen the competitive landscape with customer-controlled encryption, tokenization, and cloud access security broker integration. Their solutions support secure collaboration, controlled data sharing, and continuous key lifecycle management. These providers emphasize granular access controls, audit visibility, and hybrid-cloud compatibility.

Fortanix, Utimaco, Futurex, HyTrust, Alibaba Cloud, Boxcryptor, and other participants broaden the market with hardware security modules, confidential computing, and client-side encryption platforms. Their offerings focus on key isolation, multi-cloud portability, and compliance with strict data residency laws. These companies prioritize tamper-resistant security and simple deployment models.

Top Key Players in the Market

- Amazon Web Services Inc.

- Google LLC

- Microsoft Corporation

- IBM Corporation

- Oracle Corporation

- SAP SE

- Salesforce Inc.

- Thales Group S.A.

- Rackspace Technology Inc.

- Box Inc.

- Entrust Corporation

- Netskope Inc.

- Egnyte Inc.

- Protegrity USA Inc.

- Fortanix Inc.

- Utimaco GmbH

- Futurex LP

- HyTrust Inc.

- Alibaba Cloud Computing Ltd.

- Boxcryptor GmbH

- Others

Recent Developments

- July 2025: HashiCorp rolled out Hold Your Own Key support for HCP Terraform. This lets customers encrypt state and plan files with their own keys from Vault, AWS KMS, Azure Key Vault, or Google Cloud KMS before upload. It helps firms meet strict compliance rules by keeping plaintext secrets off HashiCorp’s systems.

- June 2025: Thales CipherTrust added multi-user support for HYOK in Oracle Cloud Infrastructure through cross-region replication. The update ensures smooth failover for external key management, aiding data continuity in OCI setups.

- November 2025: Thales launched CipherTrust Data Security Platform as a Service integration with Oracle Cloud Infrastructure Vault’s External Key Management Service. Customers now manage HYOK keys fully without on-site hardware, boosting data sovereignty.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Bn Forecast Revenue (2034) USD 10.8 Bn CAGR(2025-2034) 20.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component(Hardware, Software, Services), By Deployment Mode (On-Premises, Cloud), By Organization Size (Small and Medium Enterprises, Large Enterprises), By Application (Data Security, Compliance Management, Cloud Encryption, Access Control, Other Applications), By End-User (BFSI, Healthcare, Government, IT and Telecommunications, Retail, Other End-Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Web Services Inc., Google LLC, Microsoft Corporation, IBM Corporation, Oracle Corporation, SAP SE, Salesforce Inc., Thales Group S.A., Rackspace Technology Inc., Box Inc., Entrust Corporation, Netskope Inc., Egnyte Inc., Protegrity USA Inc., Fortanix Inc., Utimaco GmbH, Futurex LP, HyTrust Inc., Alibaba Cloud Computing Ltd., Boxcryptor GmbH, Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Hold Your Own Key Platform MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Hold Your Own Key Platform MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Web Services Inc.

- Google LLC

- Microsoft Corporation

- IBM Corporation

- Oracle Corporation

- SAP SE

- Salesforce Inc.

- Thales Group S.A.

- Rackspace Technology Inc.

- Box Inc.

- Entrust Corporation

- Netskope Inc.

- Egnyte Inc.

- Protegrity USA Inc.

- Fortanix Inc.

- Utimaco GmbH

- Futurex LP

- HyTrust Inc.

- Alibaba Cloud Computing Ltd.

- Boxcryptor GmbH

- Others