Global HLA Typing Market By Product Type (Reagents, Kits and Instruments), By Technology (PCR-Based, Microarray-Based and NGS-Based), By Application (Organ Transplantation, Bone Marrow Transplantation, Disease Diagnosis and Others), By End-User (Hospitals and Clinics, Diagnostic Laboratories, and Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 104182

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

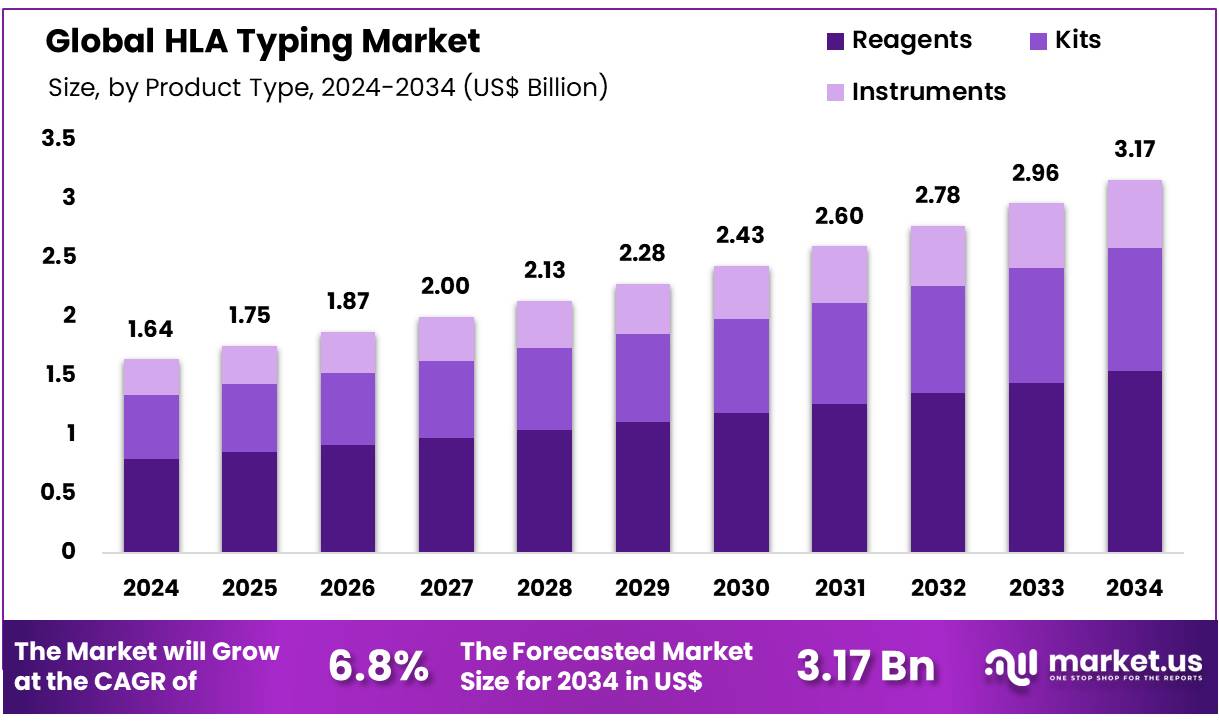

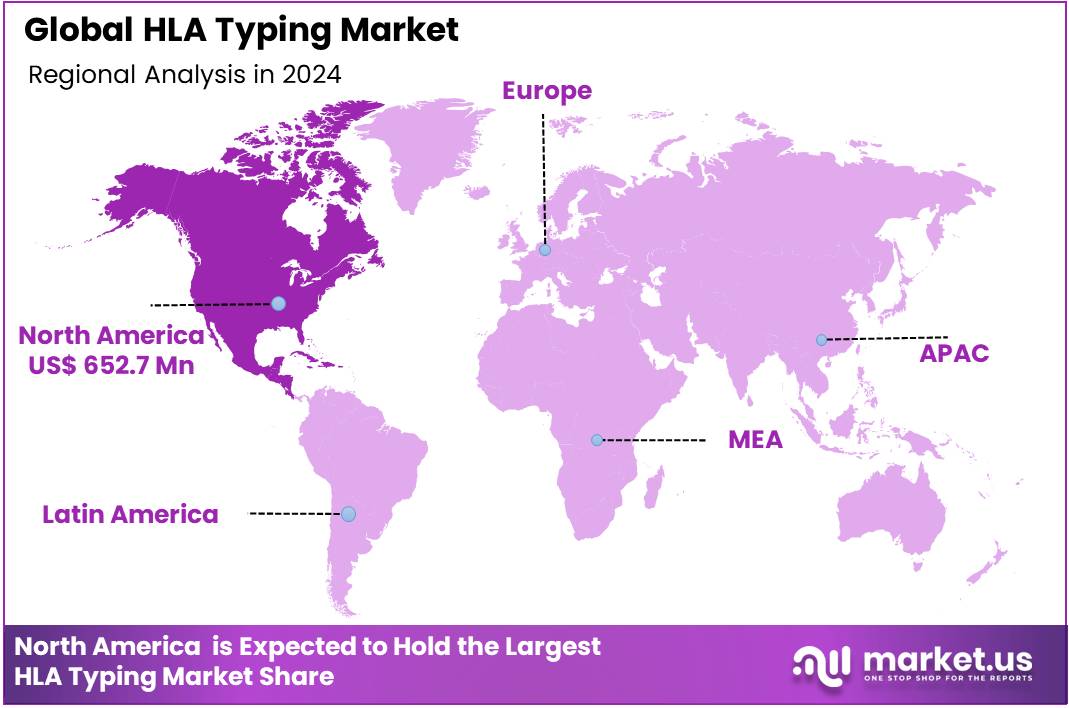

Global HLA Typing Market size is expected to be worth around US$ 3.17 Billion by 2034 from US$ 1.64 Billion in 2024, growing at a CAGR of 6.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.8% share with a revenue of US$ 652.7 Million.

The HLA Typing Market is essential for determining the compatibility of organ transplants, diagnosing various diseases, and managing immunotherapies. It focuses on identifying genetic markers in the Human Leukocyte Antigen (HLA) system, which plays a pivotal role in immune system functioning.

The market has experienced significant growth driven by the increasing demand for organ transplantation and the rising prevalence of chronic diseases that often lead to the need for transplant procedures. HLA typing ensures a match between donors and recipients, reducing transplant rejection and improving patient outcomes.

Technological advancements, particularly in Next-Generation Sequencing (NGS) and PCR-based methods, have significantly improved the accuracy and speed of HLA typing. The adoption of high-throughput and automated systems has further enhanced the efficiency of HLA typing, especially in large-volume laboratories. These innovations are particularly valuable in bone marrow transplantation and personalized medicine, where precise immune matching is crucial.

For instance, in October 2024, the Transplant Company, a prominent precision medicine firm dedicated to developing and delivering clinically advanced and high-impact healthcare solutions for transplant recipients and their caregivers, has unveiled new data and product updates. These developments are being showcased at the 50th Annual Meeting of the American Society for Histocompatibility and Immunogenetics (ASHI), held in Anaheim, California.

Geographically, the market is expanding rapidly in both developed and developing regions. In developed regions such as North America and Europe, the advanced healthcare infrastructure and rising transplant rates are driving the market. Meanwhile, emerging economies in Asia-Pacific are increasingly adopting advanced HLA typing technologies due to growing healthcare investments and awareness.

However, the market faces challenges, such as the high costs of testing and the complexity of the procedures. Despite these challenges, opportunities for growth exist in the ongoing technological advancements, particularly in NGS, and expanding the use of HLA typing in disease diagnostics and personalized healthcare. The market is expected to continue evolving with innovations aimed at improving affordability and accessibility.

Key Takeaways

- In 2024, the market for HLA Typing generated a revenue of US$ 1.64 billion, with a CAGR of 6.8%, and is expected to reach US$ 3.17 billion by the year 2034.

- The product type segment is divided into Reagents, Kits and Instruments with Reagents taking the lead in 2024 with a market share of 48.7%.

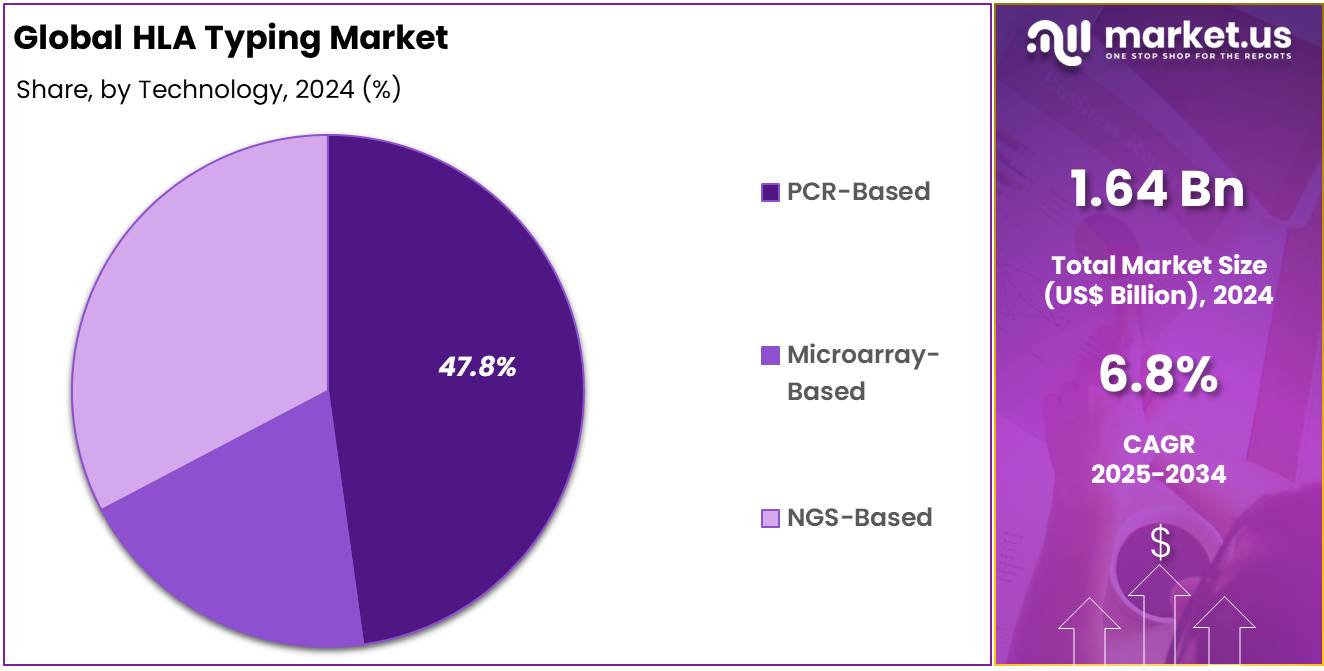

- By Technology, the market is bifurcated into PCR-Based, Microarray-Based, and NGS-Based, with PCR-Based leading the market with 47.8% of market share.

- Furthermore, concerning the Application segment, the market is segregated into Organ Transplantation, Bone Marrow Transplantation, Disease Diagnosis, and Others. The Organ Transplantation stands out as the dominant segment, holding the largest revenue share of 51.8% in the HLA Typing market.

- By End-User, the market is segmented into Hospitals and Clinics, Diagnostic Laboratories, and Research Institutes with Diagnostic Laboratories taking the dominating position in the market with 42.5% market share in 2024.

- North America led the market by securing a market share of 39.8% in 2024.

Product Type Analysis

Reagents hold the largest market share of 48.7% in the HLA typing market due to their recurrent use in every testing cycle, making them consumables with high turnover. Reagents are essential for various testing technologies, including PCR and NGS, as they facilitate DNA amplification, labeling, and sequencing. As organ transplantation and disease screening become more routine, the demand for high-sensitivity and specificity reagents rises.

Additionally, advancements in reagent formulations that enhance workflow efficiency and reduce error margins have encouraged their continued preference across laboratories. The broad compatibility of modern reagents with automated platforms also increases their utility, making them indispensable in both clinical and research settings. This recurring requirement and innovation-led enhancement make reagents the most dominant product type in the market.

Technology Analysis

PCR-based technology is the leading segment in the HLA typing market with a 47.8% market share due to its widespread adoption, cost-effectiveness, and high accuracy for low to moderate throughput needs. PCR allows for amplification and detection of specific HLA alleles, which is essential in organ matching, disease association studies, and donor registries.

Its established presence in clinical labs, supported by standardized protocols and FDA-approved kits, has made it the default method in many diagnostic applications. Compared to next-gen sequencing, PCR is quicker and more accessible in resource-constrained settings, offering reliable results at a lower cost. This ease of use and scalability in diverse laboratory environments ensures its dominance in the market.

For instance, in August 2024, Thermo Fisher Scientific Inc. has announced that the FDA has granted 510(k) clearance for the SeCore™ CDx HLA-A Sequencing System. The device will serve as a companion diagnostic for afamitresgene autoleucel (also known as afami-cel or Tecelra) in patients with previously treated advanced synovial sarcoma.

Application Analysis

Organ transplantation remains the dominant application segment with 51.8% market share in the HLA typing market, driven by the critical role of HLA compatibility in graft survival and transplant success rates. Accurate HLA matching is essential to prevent organ rejection and minimize post-transplant complications. The rising volume of organ transplants globally both kidney and liver along with the expansion of transplant registries and cross-border transplant programs, has significantly increased the demand for HLA typing tests.

Moreover, government initiatives and healthcare reforms supporting organ donation programs have boosted routine HLA screening, further cementing this segment’s lead. The clinical urgency and life-critical importance of precise donor-recipient matching make organ transplantation the largest and most impactful application in this market.

End-User Analysis

Diagnostic laboratories represent the dominant end-user segment with a 42.5% market share in the HLA typing market due to their high-volume testing capabilities, specialized infrastructure, and access to trained molecular professionals. These labs cater to both public and private healthcare institutions, handling transplant-related diagnostics, disease association studies, and population-level screening.

As outsourcing of complex tests becomes more common, hospitals and smaller clinics increasingly rely on centralized diagnostic labs to perform HLA typing using PCR and NGS-based platforms. Additionally, labs are often equipped with advanced automation and reporting systems, which streamline workflow and reduce turnaround times. Their role in offering reliable, scalable, and high-throughput testing solutions positions diagnostic laboratories as the largest revenue-generating end-user in the HLA typing market.

Key Market Segments

By Product Type

- Reagents

- Kits

- Instruments

By Technology

- PCR-Based

- Microarray-Based

- NGS-Based

By Application

- Organ Transplantation

- Bone Marrow Transplantation

- Disease Diagnosis

- Others

By End-User

- Hospitals and Clinics

- Diagnostic Laboratories

- Research Institutes

Drivers

Rising Demand for Organ Transplantation

Increased demand for organ transplantation is one of the primary drivers of the HLA Typing Market. As the global population ages, there is a growing need for organ transplants, particularly for organs such as kidneys, livers, and hearts. As per the data by organdonor.gov, currently there are 103,223 number of men, women, and children on the national transplant waiting list.

Human Leukocyte Antigen (HLA) typing plays a crucial role in determining compatibility between organ donors and recipients, thereby reducing the risk of transplant rejection. This need for accurate and timely HLA typing has amplified, with hospitals and healthcare centers prioritizing the use of advanced HLA typing methods to ensure better transplant success rates.

Additionally, the increasing prevalence of chronic diseases like kidney failure, liver cirrhosis, and heart disease, along with the rising number of individuals waiting for organ transplants, is driving the growth of this market. Governments and healthcare organizations worldwide are also investing heavily in transplant programs, creating further demand for HLA typing technologies.

The integration of automation and high-throughput technologies in HLA typing processes is also enhancing the overall efficiency of the process, making it more accessible and precise for healthcare providers.

Restraints

High Cost of HLA Typing

A significant restraint in the HLA Typing Market is the high cost of testing and associated equipment. HLA typing, especially when using advanced technologies such as Next-Generation Sequencing (NGS) and microarray-based methods, involves considerable upfront costs for equipment, reagents, and training. This makes it less affordable, particularly in low-resource settings and smaller diagnostic centers.

The cost of running and maintaining these systems can be prohibitive, limiting their accessibility and adoption in regions with budget constraints. For example, in the U.S., the cost of single antigen HLA typing ranges from $34 to $203 per test for individuals paying out-of-pocket or with high-deductible insurance plans, comprehensive HLA typing (multiple loci, such as HLA-A, B, and DR) using next-generation sequencing (NGS) platforms, the cost can be about $208 per sample (for 11 HLA genes in a batch of 24 samples) and deceased donor HLA typing: The average cost is $1,140 per donor, with an additional STAT (urgent) fee of $320 if rapid processing is required.

Furthermore, the reimbursement policies for HLA typing tests are not always favorable, which can lead to financial challenges for healthcare facilities. This barrier to widespread adoption, particularly in developing countries, has the potential to slow the market’s growth. Additionally, the long turnaround time and complex data interpretation processes in advanced HLA typing techniques can add to the overall costs, further reducing their attractiveness for routine clinical use. Efforts to reduce the costs of testing technologies, as well as improving reimbursement structures, could help mitigate this restraint.

Opportunities

Advances in NGS Technology

The increasing adoption of Next-Generation Sequencing (NGS) technology in HLA typing presents a significant opportunity for growth in the market. NGS offers advantages over traditional PCR-based methods, such as higher throughput, greater accuracy, and the ability to detect rare genetic variations. This technology enables the sequencing of multiple genes involved in immune responses with much greater precision, which is essential for more complex transplantations, like those requiring bone marrow transplants or stem cell therapies.

NGS can also provide a more comprehensive view of an individual’s immune profile, improving both the prediction of transplant rejection and the personalization of treatment protocols. The ability to sequence the entire exonic region of HLA genes without requiring labor-intensive steps opens up opportunities for faster, more cost-effective HLA typing.

In February 2025, Roche introduced its proprietary “sequencing by expansion” (SBX) platform marking a transformative step forward in next-generation sequencing technology. By pairing its novel SBX chemistry with a cutting-edge sensor module, the system delivers ultra-fast, high-throughput genomic readouts and is designed to be both flexible and scalable across a wide spectrum of research and clinical applications.

Moreover, in October 2024, Illumina, Inc., a global leader in DNA sequencing and array-based solutions, has introduced the MiSeq™ i100 Series sequencing systems. These new benchtop platforms offer exceptional speed and ease of use, aiming to accelerate the adoption and efficiency of next-generation sequencing (NGS) in laboratory settings.

As NGS technology becomes more affordable and accessible, it will likely drive market expansion by making these advanced capabilities available to a broader range of healthcare providers. Moreover, as the technology continues to evolve, it is expected to further improve the efficiency and accuracy of HLA typing, enhancing its use in diagnostics, transplant medicine, and immunotherapy.

Impact of Macroeconomic / Geopolitical Factors

The HLA typing market is sensitive to several macroeconomic and geopolitical variables that shape healthcare priorities, funding allocations, and global supply chain dynamics. One of the primary macroeconomic influences is public healthcare spending. In high-income nations, increased investments in organ transplantation infrastructure and diagnostic advancements have expanded access to HLA typing.

Conversely, in low- and middle-income countries, budget constraints often limit the adoption of advanced HLA technologies such as next-generation sequencing (NGS), restricting market penetration. Currency fluctuations and inflationary pressures also affect the cost of imported diagnostic instruments, reagents, and test kits, particularly in emerging economies.

This impacts procurement decisions for hospitals and diagnostic laboratories, potentially delaying the adoption of new technologies. Furthermore, healthcare reimbursement policies especially in countries with centralized healthcare systems play a crucial role in determining the affordability and utilization of HLA typing services.

Geopolitical tensions and trade restrictions significantly disrupt supply chains, delaying the availability of critical testing components such as reagents and PCR kits. The COVID-19 pandemic and the Russia-Ukraine conflict exposed vulnerabilities in global logistics, resulting in delayed transplant procedures and deferred diagnostic testing. Sanctions and cross-border regulatory differences also impact international collaborations and access to donor registries, which are vital for HLA-matched organ transplants.

Migration crises and refugee influxes caused by conflicts can create unanticipated regional demands for transplantation and disease screening, increasing the burden on local healthcare systems. As geopolitical uncertainties grow, HLA typing providers must build resilient supply chains and adaptive regulatory strategies to sustain global service delivery.

Latest Trends

Automation and High-Throughput Testing

The trend toward automation and high-throughput testing in the HLA Typing Market is revolutionizing the way HLA testing is performed. Automation in HLA typing reduces the potential for human error, enhances the speed of testing, and allows for more consistent and reliable results. High-throughput systems allow laboratories to perform large numbers of tests simultaneously, which is crucial as the demand for HLA typing continues to grow with the increasing number of organ transplants.

Automation also streamlines workflow processes, improving laboratory efficiency and reducing the manual labor required for testing. This trend is being driven by the need for faster and more accurate results, especially in urgent transplant scenarios. As a result, companies are investing in automated platforms and next-generation technology that can deliver faster results at lower costs.

For instance, in February 2024, Mass.-SCIEX, a global leader in analytical technologies for life sciences, introduced the Echo® MS+ system at SLAS 2024. This advanced platform integrates Acoustic Ejection Mass Spectrometry with Open Port Interface (OPI) sampling and can be paired with either the SCIEX ZenoTOF 7600 or the Triple Quad 6500+ system. The result is a high-performance solution offering both qualitative and quantitative precision, optimized for expanded, high-throughput screening workflows.

Additionally, advancements in software and data analysis capabilities are improving the interpretation of complex HLA typing results, which can guide better clinical decision-making. This trend is making HLA typing more accessible and affordable for healthcare providers, particularly in large hospitals and specialized transplant centers. As the technology continues to improve, it is expected to further drive market growth and adoption.

Regional Analysis

North America is leading the HLA Typing Market

North America dominates the HLA typing market accounting for 39.8% market share, driven by advanced healthcare infrastructure, high organ transplant rates, and widespread adoption of molecular diagnostics. The U.S., in particular, benefits from strong government support through agencies like the Health Resources and Services Administration (HRSA), which funds national transplant programs and donor registries. Robust reimbursement frameworks and the presence of leading diagnostic companies further strengthen market growth in this region.

Europe holds the second-largest share, with countries like Germany, the UK, and France actively supporting transplantation through centralized healthcare systems and regulated donor matching frameworks. The European Union’s harmonized organ-sharing networks, such as Eurotransplant, boost cross-border HLA testing demand.

Eurotransplant, a non-profit organization dedicated to the cross-border allocation of deceased donor organs across several European nations, recently shared its preliminary data for 2024. The organization reported the allocation of 7,150 organs from 2,181 deceased donors, with 22.5% of these organs exchanged between countries, highlighting its continued role in fostering international collaboration in transplant medicine.

Asia-Pacific is the fastest-growing region due to increasing organ donation awareness, rising chronic disease prevalence, and government initiatives to expand transplant programs. Countries like India, China, and Japan are investing in molecular diagnostic capabilities and modernizing hospital infrastructure, which is accelerating HLA testing adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the HLA Typing market includes Thermo Fisher Scientific Inc., Illumina, Inc., Abbott Laboratories, Bio-Rad Laboratories, Inc., Grifols S.A., Oxford Immunotec Global PLC, Qiagen N.V., PerkinElmer Inc., Luminex Corporation, F. Hoffmann-La Roche Ltd, Beckman Coulter, Inc., Becton, Dickinson and Company, Stanford Genetics, Transplant Genomics, Inc., CareDx, Inc., and Other Key Players.

Thermo Fisher Scientific is a major player in the HLA typing market, offering a comprehensive portfolio of reagents, PCR-based assays, and next-generation sequencing (NGS) solutions. The company’s Ion Torrent™ platform enables high-resolution HLA typing with fast turnaround times, making it suitable for both clinical and research applications.

Illumina is a front-runner in providing NGS-based HLA typing technologies, especially in high-throughput genomic applications. Known for its sequencing-by-synthesis (SBS) technology, Illumina’s platforms such as the MiSeq and NextSeq are extensively used for high-resolution typing of HLA Class I and II alleles.

Abbott Laboratories plays a significant role in molecular diagnostics, including HLA typing through its real-time PCR systems. The company’s m2000 platform and associated molecular assays enable detection and typing of key HLA alleles for clinical transplantation and disease association studies.

Top Key Players

- Thermo Fisher Scientific Inc.

- Illumina, Inc.

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- Grifols S.A.

- Oxford Immunotec Global PLC

- Qiagen N.V.

- PerkinElmer Inc.

- Luminex Corporation

- Hoffmann-La Roche Ltd

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- Stanford Genetics

- Transplant Genomics, Inc.

- CareDx, Inc.

- Other Key Players

Recent Developments

- In April 2023, Metropolis Healthcare Limited introduced the ‘NextGen HLA’ High Resolution Typing Test, a cutting-edge molecular diagnostic tool designed for both Hematopoietic Stem Cell Transplantation (HSCT) and solid organ transplants. This advanced test enhances donor compatibility assessment by analyzing the Human Leukocyte Antigen (HLA) genes inherited from an individual’s parents, thereby supporting the identification of suitable matches for bone marrow, cord blood, or organ transplantation.

- In December 2022, Thermo Fisher Scientific announced that the FDA granted de novo classification to the SeCore CDx HLA Sequencing System for use as a companion diagnostic with Kimmtrak for metastatic or unresectable uveal melanoma.

- In March 2021, Caris Life Sciences, a leader in molecular science and AI-driven precision medicine, has launched its new Human Leukocyte Antigen (HLA) Genotype reporting service. This addition expands the company’s comprehensive molecular profiling portfolio. HLA genes, which are increasingly recognized as important biomarkers in cancer treatment, play a critical role in T-cell activation and immune response, potentially influencing a patient’s responsiveness to immunotherapy.

Report Scope

Report Features Description Market Value (2024) US$ 1.64 Billion Forecast Revenue (2034) US$ 3.17 Billion CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reagents, Kits and Instruments), By Technology (PCR-Based, Microarray-Based and NGS-Based), By Application (Organ Transplantation, Bone Marrow Transplantation, Disease Diagnosis and Others), By End-User (Hospitals and Clinics, Diagnostic Laboratories, and Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., Illumina, Inc., Abbott Laboratories, Bio-Rad Laboratories, Inc., Grifols S.A., Oxford Immunotec Global PLC, Qiagen N.V., PerkinElmer Inc., Luminex Corporation, F. Hoffmann-La Roche Ltd, Beckman Coulter, Inc., Becton, Dickinson and Company, Stanford Genetics, Transplant Genomics, Inc., CareDx, Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific Inc.

- Illumina, Inc.

- Abbott Laboratories

- Bio-Rad Laboratories, Inc.

- Grifols S.A.

- Oxford Immunotec Global PLC

- Qiagen N.V.

- PerkinElmer Inc.

- Luminex Corporation

- Hoffmann-La Roche Ltd

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- Stanford Genetics

- Transplant Genomics, Inc.

- CareDx, Inc.

- Other Key Players