HIV/HBV/HCV Test Kits Market By Product Type (Rapid and Assay-based), By Sample (Blood, Urine, and Saliva), By End-user (Hospitals & Clinics, Diagnostic Laboratories, Government Organizations and NGOs, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165965

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

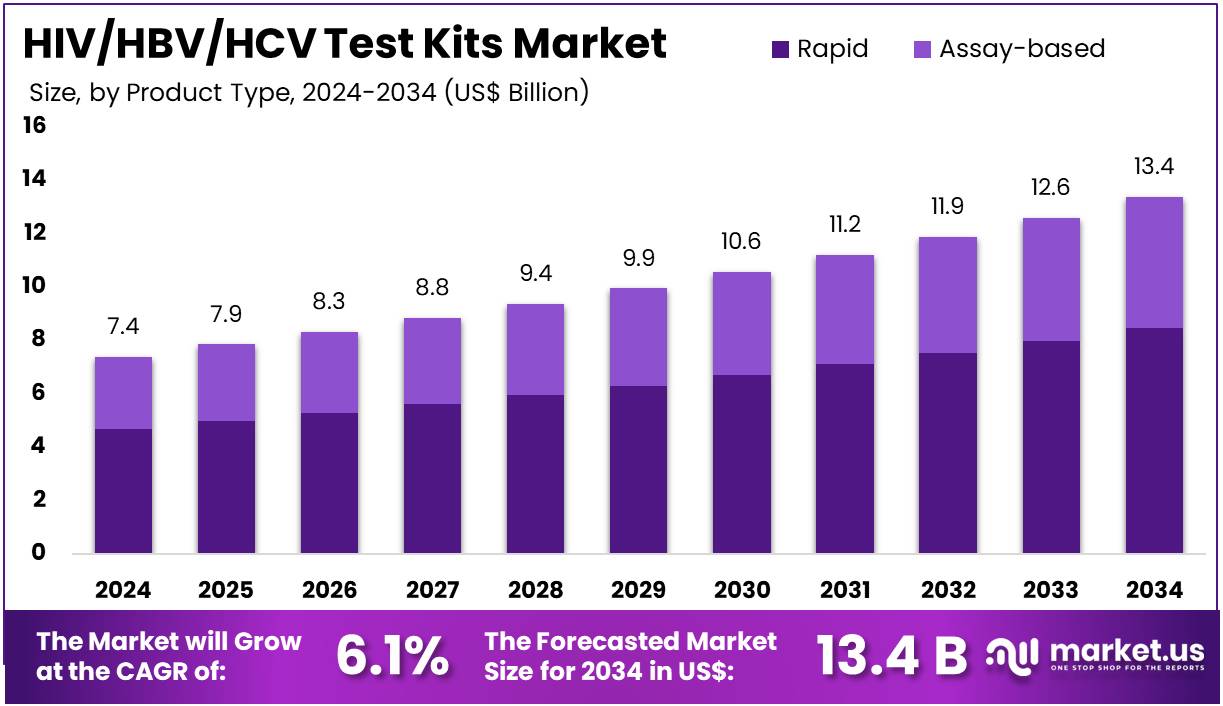

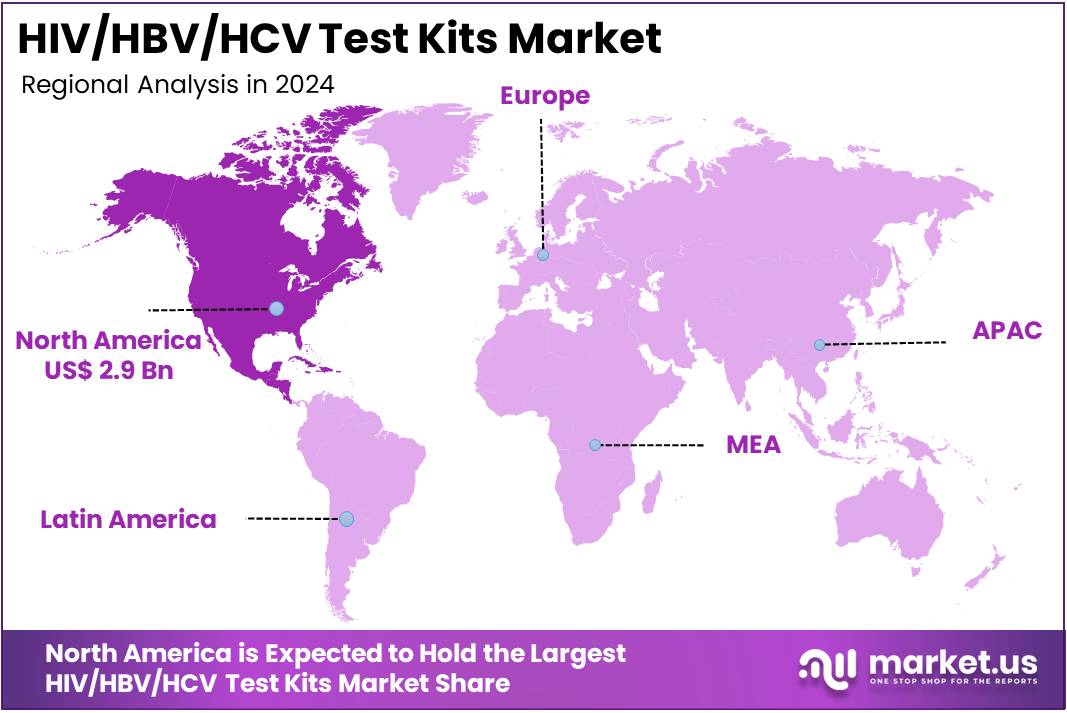

The HIV/HBV/HCV Test Kits Market Size is expected to be worth around US$ 13.4 billion by 2034 from US$ 7.4 billion in 2024, growing at a CAGR of 6.1% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.8% share and holds US$ 2.9 Billion market value for the year.

Increasing emphasis on integrated viral diagnostics propels the HIV/HBV/HCV Test Kits market, as laboratories consolidate workflows to detect multiple pathogens simultaneously from single specimens. Manufacturers engineer multiplex panels that combine antigen, antibody, and nucleic acid targets for comprehensive infection profiling. These kits support initial screening in blood donation centers, confirmatory testing in clinical laboratories, therapeutic monitoring during antiviral regimens, and resistance genotyping for personalized treatment adjustments.

Automation enhancements create opportunities to minimize hands-on time and elevate result reproducibility across high-volume settings. Abbott Molecular advanced this efficiency In July 2022 by securing FDA approval for its Alinity m HIV-1 assay kits, including AMP, CTRL, CAL, and Application Specification File, which streamline RT-PCR-based detection and quantification on a unified platform. This development markedly improves laboratory throughput and diagnostic precision.

Growing demand for point-of-care confirmatory solutions accelerates the HIV/HBV/HCV Test Kits market, as healthcare providers seek rapid, specimen-flexible assays that enable immediate clinical decisions. Diagnostic firms develop immunochromatographic devices compatible with diverse sample types to facilitate decentralized testing. Applications encompass supplemental antibody differentiation post-initial reactive screens, dual HIV-1/HIV-2 identification in outpatient clinics, hepatitis co-infection exclusion in at-risk populations, and pre-exposure prophylaxis eligibility assessments.

Versatile single-use formats open avenues for expanded access in resource-limited environments without compromising specificity. Bio-Rad Laboratories addressed this need on August 26, 2025, with FDA approval of the Geenius HIV 1/2 Supplemental Assay, delivering fast, accurate antibody confirmation from fingerstick, venous blood, serum, or plasma. This innovation significantly broadens reliable diagnostic reach across varied care delivery models.

Rising adoption of scalable molecular platforms invigorates the HIV/HBV/HCV Test Kits market, as virology labs prioritize systems that handle fluctuating testing volumes with consistent sensitivity. Companies optimize quantitative nucleic acid tests for seamless integration into automated analyzers supporting small to large workloads. These assays enable precise viral load tracking in chronic hepatitis management, early infant diagnosis of perinatal transmissions, occult infection detection in organ donors, and endpoint evaluation in cure-focused clinical trials.

High-throughput clearances facilitate standardized protocols and data interoperability across networks. Roche reinforced this capability on July 1, 2025, through FDA clearance of the cobas HIV-1 Quantitative Nucleic Acid Test for use on cobas 5800/6800/8800 systems, providing robust quantitation essential for monitoring therapeutic efficacy. This advancement solidifies leadership in molecular HIV diagnostics and propels market-wide efficiency gains.

Key Takeaways

- In 2024, the market generated a revenue of US$ 7.4 billion, with a CAGR of 6.1%, and is expected to reach US$ 13.4 billion by the year 2034.

- The product type segment is divided into rapid and assay-based, with rapid taking the lead in 2023 with a market share of 63.4%.

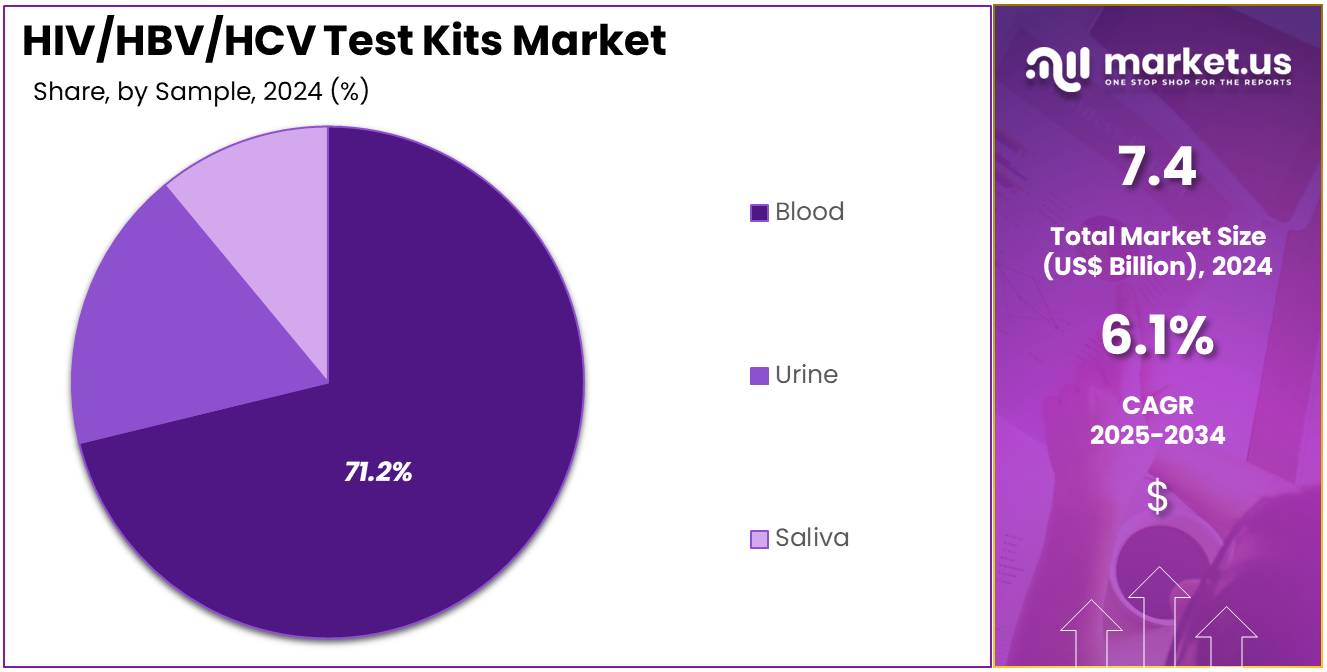

- Considering sample, the market is divided into blood, urine, and saliva. Among these, blood held a significant share of 71.2%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, diagnostic laboratories, government organizations and NGOs, and others. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 48.7% in the market.

- North America led the market by securing a market share of 38.8% in 2023.

Product Type Analysis

Rapid test kits account for 63.4% of the HIV/HBV/HCV Test Kits market and are anticipated to maintain dominance due to their speed, ease of use, and applicability in diverse clinical and field settings. The growing need for early diagnosis and mass screening in low-resource environments is driving widespread adoption. Rapid tests enable detection of viral infections within minutes, facilitating timely intervention and reducing transmission risk. Their affordability and portability make them suitable for community-based and emergency testing programs.

Governments and health agencies are increasingly deploying rapid testing kits for large-scale public health campaigns, especially in Africa, Asia, and Latin America. Technological advancements have improved accuracy and sensitivity, ensuring results comparable to laboratory-based assays. Rising awareness regarding point-of-care testing and home-use kits further strengthens demand. As global initiatives for infection control expand, rapid test kits are expected to remain the backbone of viral screening strategies, ensuring timely diagnosis and accessible healthcare delivery worldwide.

Sample Analysis

Blood samples dominate the sample segment with 71.2% of the HIV/HBV/HCV Test Kits market and are projected to retain this lead due to their superior diagnostic accuracy and wide acceptance in clinical and screening programs. Blood-based testing ensures high sensitivity in detecting antibodies and antigens, crucial for early-stage infection identification.

Hospitals and laboratories prefer blood tests for confirmatory analysis due to their reliability and compatibility with advanced immunoassay and molecular testing platforms. The increasing prevalence of co-infections and chronic hepatitis cases underscores the need for precise serological evaluation. Enhanced automation and miniaturization of blood-testing equipment are improving throughput and reducing turnaround times.

The integration of blood-based diagnostics into national screening programs and transfusion safety initiatives further accelerates adoption. Additionally, new plasma and serum-based testing kits with enhanced specificity for HBV DNA and HCV RNA detection are entering the market. With its proven clinical utility and consistent accuracy, blood testing is expected to remain the dominant sample choice in infection diagnostics.

End-User Analysis

Hospitals and clinics account for 48.7% of the HIV/HBV/HCV Test Kits market and are expected to sustain their dominance due to their central role in diagnosis, treatment, and patient management. These facilities conduct high volumes of testing for preoperative screening, antenatal care, and routine health checks, ensuring continuous test-kit utilization.

The integration of rapid diagnostic testing within emergency and outpatient departments enhances immediate decision-making. Hospitals are also expanding in-house laboratories equipped with advanced immunoassay analyzers to support large-scale screening and confirmatory diagnostics. Partnerships between hospitals and test-kit manufacturers are improving test accessibility and supply chain reliability.

Government-funded testing programs increasingly collaborate with hospital networks to expand coverage for high-risk populations. The adoption of automated platforms for HIV viral load monitoring and HBV/HCV genotyping strengthens diagnostic accuracy. As healthcare infrastructure modernizes and clinical awareness of viral infections grows, hospitals and clinics are anticipated to remain the primary end-users driving consistent demand in this market.

Key Market Segments

By Product Type

- Rapid

- Assay-based

By Sample

- Blood

- Urine

- Saliva

By End-user

- Hospitals & Clinics

- Diagnostic Laboratories

- Government Organizations and NGOs

- Others

Drivers

Increasing Global Prevalence of Viral Hepatitis is Driving the Market

The sustained high prevalence of chronic hepatitis B and C infections worldwide has emerged as a fundamental driver for the HIV/HBV/HCV test kits market, necessitating expanded screening to curb transmission and enable early intervention. This epidemiological reality compels public health systems to integrate routine testing into vaccination and surveillance programs, particularly in high-burden regions.

Diagnostic manufacturers respond by scaling production of multiplex assays capable of detecting multiple viral markers simultaneously, streamlining laboratory workflows. International organizations advocate for universal screening guidelines, embedding test kits within primary care protocols to reach at-risk populations. The economic rationale is clear, as timely diagnosis averts costly complications like cirrhosis and hepatocellular carcinoma.

Collaborative funding mechanisms support procurement in low-income settings, broadening market reach. Technological refinements in rapid diagnostic tests further align with this driver, offering field-deployable solutions for remote communities. Awareness campaigns by health ministries amplify demand, encouraging voluntary testing among key demographics. This prevalence-driven momentum fosters innovation in sensitivity-enhanced reagents, ensuring reliable detection across diverse sample types.

The World Health Organization estimates that 254 million people were living with chronic hepatitis B infection and 50 million with chronic hepatitis C in 2022. Such figures underscore the imperative for robust testing infrastructures to manage ongoing epidemics effectively. Consequently, this driver solidifies the market’s centrality in global elimination strategies.

Restraints

Limited Diagnosis Coverage in High-Burden Regions is Restraining the Market

Inadequate diagnosis rates for hepatitis B and C in resource-limited areas continue to hinder the full potential of the HIV/HBV/HCV test kits market, as undiagnosed cases evade linkage to care and perpetuate silent transmission chains. Logistical barriers, including supply chain disruptions and insufficient trained personnel, exacerbate this issue in rural districts. Cultural sensitivities and misconceptions about testing deter uptake, confining utilization to urban facilities.

Reimbursement inconsistencies across payers further discourage provider investment in kit stockpiles. This restraint manifests in stalled progress toward elimination targets, with many infections remaining undetected until advanced stages. Global health initiatives aim to address these gaps through capacity-building, yet funding shortfalls persist. Manufacturers face challenges in adapting kits for low-literacy environments, delaying localized validations.

The resultant underutilization not only curtails revenue but also undermines public trust in diagnostic reliability. Policy reforms for subsidized testing could alleviate pressures, but implementation varies widely. Globally, only 13.4% of people living with chronic hepatitis B were diagnosed between 2015 and 2022. These disparities highlight the urgent need for equitable distribution models to overcome entrenched barriers.

Opportunities

Targeted Interventions in WHO Focus Countries are Creating Growth Opportunities

Strategic focus on high-burden nations through tailored testing programs is unlocking substantial growth pathways for the HIV/HBV/HCV test kits market, leveraging concentrated epidemics for scalable interventions. These initiatives prioritize integration of affordable kits into national elimination roadmaps, enhancing detection in underserved cohorts. Partnerships between donors and local governments facilitate bulk acquisitions, optimizing cost efficiencies for volume-based pricing.

Point-of-care innovations tailored for these settings enable decentralized screening, reducing dependency on centralized labs. Capacity enhancement grants support workforce training, embedding test kits within community health outreach. This targeted approach not only boosts immediate uptake but also generates data for surveillance enhancements. Export-oriented production aligns with international tenders, diversifying supplier bases.

Demographic vulnerabilities in these regions amplify the case for multiplex formats, addressing co-infection risks. Long-term, successful pilots pave the way for regional expansions, fostering market resilience. The World Health Organization identifies 38 focus countries that account for almost 80% of global hepatitis infections and deaths as of 2022. Such prioritization heralds a era of focused, impactful market penetration.

Impact of Macroeconomic / Geopolitical Factors

Recessionary pressures and shrinking public health allocations squeeze procurement budgets for HIV/HBV/HCV test kits, causing distributors to ration supplies in low-income districts. Heightened corporate wellness programs and donor-funded screening drives, however, amplify orders as organizations target high-prevalence communities for proactive interventions. Intensifying geopolitical standoffs in the Asia-Pacific region choke off shipments of key antigens from Southeast Asian hubs, prolonging lead times and inflating raw material prices for kit assemblers.

These same frictions motivate regional biotech clusters to ramp up self-sufficiency, streamlining customs and fortifying against future bottlenecks. U.S. Section 301 tariffs levy 25% duties on Chinese-sourced diagnostic reagents under HTS 3822, escalating landed costs for American clinics and straining reimbursement negotiations with insurers. Vendors adapt by rerouting through Mexico and Vietnam under USMCA pacts, which preserves affordability and broadens supplier options amid trade flux. Collectively, these elements test resilience but ignite strategic pivots toward efficiency.

Latest Trends

Expansion of Self-Testing Approvals for Adolescents is a Recent Trend

The extension of self-testing authorizations to younger demographics has marked a significant trend in the HIV/HBV/HCV test kits market during late 2024, promoting discreet access amid rising youth infections. Regulatory bodies are prioritizing user-friendly formats with clear instructional aids to empower informed decision-making without clinical oversight. This development integrates digital result verification apps, bridging gaps to confirmatory services via telehealth linkages.

Educational integrations in school health curricula amplify visibility, normalizing early screening behaviors. Manufacturers are reformulating kits for enhanced stability in home environments, ensuring accuracy across storage conditions. The trend aligns with broader destigmatization efforts, encouraging peer-led distribution networks. Global endorsements facilitate harmonized labeling, easing cross-border availability.

Privacy safeguards in result reporting bolster adoption, mitigating disclosure fears. This youth-centric shift redefines prevention paradigms, emphasizing autonomy in high-risk groups. On December 20, 2024, the U.S. Food and Drug Administration approved a premarket approval application supplement for the OraQuick HIV Self-Test, expanding its use to individuals aged 14-17 years. Such advancements signal a proactive evolution in accessible diagnostics.

Regional Analysis

North America is leading the HIV/HBV/HCV Test Kits Market

The HIV/HBV/HCV Test Kits market in North America captured 38.8% of the global share in 2024, bolstered by federal mandates requiring expanded screening protocols in correctional facilities and syringe exchange programs to interrupt transmission cycles among vulnerable groups. Diagnostic innovators like OraSure Technologies and Bio-Rad Laboratories rolled out self-sampling kits with integrated barcode tracking, allowing anonymous submission and rapid turnaround for multiplex viral detection in high-volume settings.

The Health Resources and Services Administration augmented funding for Ending the HIV Epidemic initiatives, embedding routine co-infection assays into federally qualified health centers serving migrant and homeless populations. Policy updates from the Department of Health and Human Services prioritized integration of dried blood spot technologies, facilitating at-home collection for remote indigenous communities and reducing clinic overcrowding.

Supply chain enhancements post-supply disruptions introduced lyophilized reagents stable at ambient temperatures, extending shelf life and enabling stockpiling for emergency responses. Collaborations with electronic health record vendors automated result notifications, improving linkage to care rates and minimizing diagnostic delays in urban emergency departments.

Equity-driven grants supported culturally competent outreach in Latino and African American enclaves, incorporating multilingual instructions to foster trust and participation. Surveillance integrations with wastewater monitoring provided early warning for localized outbreaks, guiding targeted kit deployments. Academic partnerships refined algorithmic pathways for reflex testing, distinguishing acute from chronic phases to optimize antiviral initiations.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the multiplex viral diagnostics sector in Asia Pacific to surge during the forecast period, as authorities embed comprehensive screening into national immunization calendars to address endemic burdens. China deploys centralized procurement under the National Healthcare Security Administration, outfitting township hospitals with benchtop analyzers for integrated HBV-HCV panels amid urbanization-driven exposures.

Japan refines its National Center for Global Health protocols, incorporating saliva-based innovations for elderly cohorts in long-term care facilities to preempt hepatocellular carcinoma risks. India activates the National Viral Hepatitis Control Program expansions, training Accredited Social Health Activists to administer finger-prick kits in tribal hamlets for prenatal co-infection vigilance. South Korea channels Korea Centers for Disease Control investments into microfluidic devices, targeting injection drug users in port cities with streamlined result portals for immediate counseling.

Regulators in Thailand expedite Bureau of Laboratory Quality approvals for digital-linked cassettes, aligning with ASEAN pharmacopeia for cross-border validations. Innovation ecosystems in Malaysia foster public-private labs synthesizing affordable antigens, curbing reliance on imported components while scaling production. Regional forums under the Asia-Pacific Alliance for the Elimination of Viral Hepatitis standardize data platforms, enabling pooled analyses for outbreak forecasting. Pharmaceutical networks localize assembly lines in Indonesia, incorporating solar-powered readers for archipelago deployments during flood seasons.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Prominent leaders in the viral pathogen screening domain accelerate dominance by cultivating alliances with multilateral agencies like WHO and GAVI to deploy affordable, multiplexed point-of-care platforms in high-burden regions, thereby fortifying distribution networks and enhancing epidemiological surveillance. They channel resources into pioneering nucleic acid-based innovations that deliver simultaneous detection with sub-picogram sensitivity, streamlining workflows for community health workers and curtailing diagnostic delays in outbreak scenarios.

Decision-makers orchestrate targeted expansions via joint ventures with regional biotechs, customizing self-sampling devices for discreet, at-home use to penetrate underserved demographics in Southeast Asia and Latin America. Firms aggressively integrate AI-driven analytics into their assay ecosystems, enabling predictive risk modeling and automated result interpretation to command premium placements in national screening programs.

Executives champion eco-sustainable formulations and blockchain-tracked supply chains, differentiating offerings amid stringent environmental mandates while appealing to donor-funded initiatives. These interconnected tactics not only amplify adoption rates but also synchronize with the global push toward viral elimination milestones.

Abbott Laboratories, a Chicago-based healthcare titan founded in 1888, orchestrates a formidable infectious disease diagnostics arm that pioneers integrated platforms for HIV, HBV, and HCV identification, blending high-throughput automation with portable, user-centric tools to empower clinicians worldwide. The company deploys its Alinity ecosystem to facilitate seamless lab-to-lab interoperability, while i-STAT cartridges furnish rapid, bedside insights that inform immediate therapeutic decisions in emergency settings.

Abbott fortifies its market stature through strategic R&D collaborations with academic consortia, yielding next-wave assays that incorporate digital traceability for enhanced compliance and data sovereignty. Leadership under Robert B. Ford emphasizes agile pivots toward multiplexed, saliva-based modalities, positioning the firm at the forefront of decentralized testing revolutions.

Abbott extends its influence via dedicated access programs that subsidize kits for low-income cohorts, embedding its solutions deeply within public health infrastructures across emerging economies. This holistic approach underscores Abbott’s role as a catalyst for equitable diagnostic equity in the fight against persistent viral threats.

Top Key Players in the HIV/HBV/HCV Test Kits Market

- Siemens Healthineers AG

- QIAGEN N.V.

- OraSure Technologies, Inc.

- Meridian Bioscience Inc.

- Hologic Inc.

- Hoffmann‑La Roche Ltd

- DiaSorin S.p.A.

- Bio‑Rad Laboratories Inc.

- bioMérieux SA

- Abbott Laboratories

Recent Developments

- On June 19, 2025: The FDA’s pending Priority Review for Gilead’s lenacapavir, a long-acting injectable HIV-1 capsid inhibitor for pre-exposure prophylaxis (PrEP), underscored the expanding role of diagnostics in preventive therapy. As long-acting PrEP options emerge, the need for frequent and precise viral testing before and after administration intensifies. This development indirectly fuels growth in the HIV/HBV/HCV Test Kits Market by linking diagnostic demand to new preventive treatment regimens.

- On January 10, 2025: The EU’s In Vitro Diagnostic Regulation (IVDR) 2024/1860 came into effect, requiring manufacturers to notify authorities of potential shortages or discontinuations of critical diagnostic devices such as HIV and hepatitis tests. This regulatory step strengthened supply chain reliability and transparency, supporting uninterrupted access to essential diagnostic tools and bolstering long-term confidence in the HIV/HBV/HCV Test Kits Market across Europe.

Report Scope

Report Features Description Market Value (2024) US$ 7.4 billion Forecast Revenue (2034) US$ 13.4 billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Rapid and Assay-based), By Sample (Blood, Urine, and Saliva), By End-user (Hospitals & Clinics, Diagnostic Laboratories, Government Organizations and NGOs, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthineers AG, QIAGEN N.V., OraSure Technologies, Inc., Meridian Bioscience Inc., Hologic Inc., F. Hoffmann‑La Roche Ltd, DiaSorin S.p.A., Bio‑Rad Laboratories Inc., bioMérieux SA, Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  HIV/HBV/HCV Test Kits MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

HIV/HBV/HCV Test Kits MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens Healthineers AG

- QIAGEN N.V.

- OraSure Technologies, Inc.

- Meridian Bioscience Inc.

- Hologic Inc.

- Hoffmann‑La Roche Ltd

- DiaSorin S.p.A.

- Bio‑Rad Laboratories Inc.

- bioMérieux SA

- Abbott Laboratories