Global High Performance Tires Market Size, Share, Growth Analysis By Product (Tread Tire, Racing Slick, Others), By Tire Type (Summer, Winter, All-Season), By Application (Racing Cars, Off-the-Road Vehicles, Others), By Sales Channel (Aftermarket, OEM), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171662

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

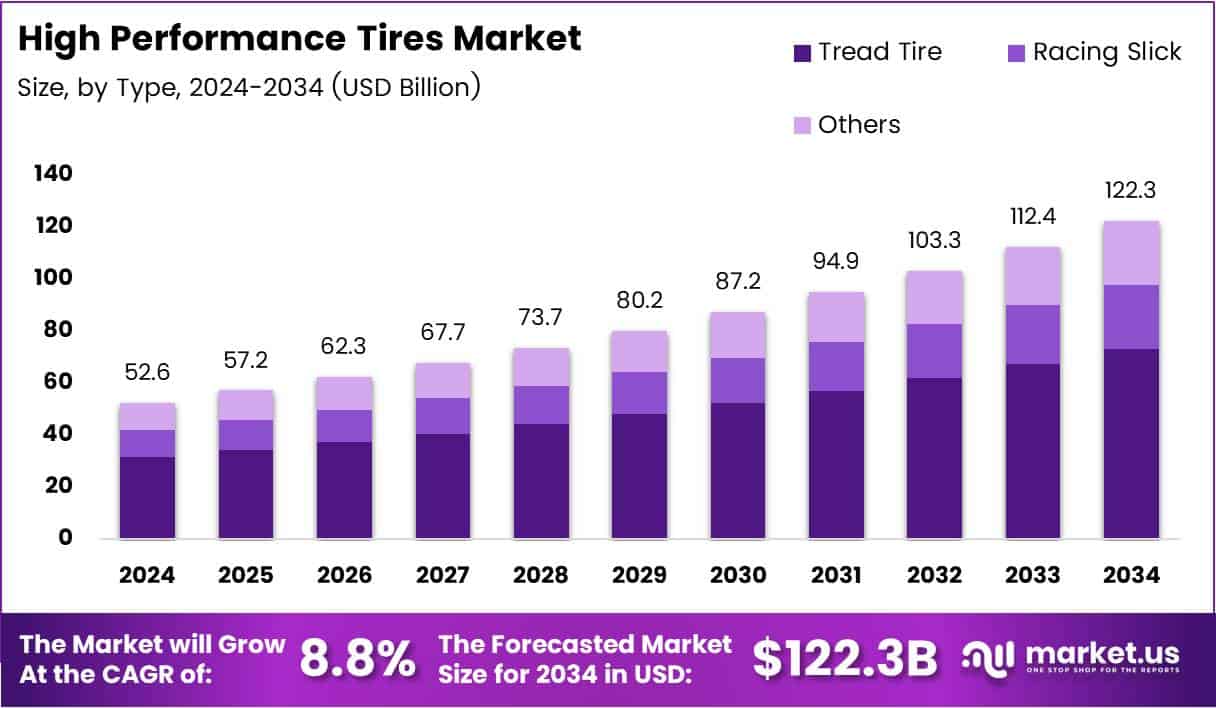

Global High Performance Tires Market size is expected to be worth around USD 122.3 Billion by 2034 from USD 52.6 Billion in 2024, growing at a CAGR of 8.8% during the forecast period 2025 to 2034.

High performance tires represent specialized automotive components engineered to deliver superior handling, enhanced traction, and optimal braking capabilities. These tires cater primarily to premium vehicles, sports cars, and performance-oriented automobiles. Unlike standard tires, they feature advanced rubber compounds, innovative tread patterns, and reinforced sidewalls designed for high-speed stability.

The High Performance Tires Market encompasses manufacturing, distribution, and sales of premium tire solutions globally. This sector serves diverse applications including racing vehicles, luxury automobiles, and performance-enhanced passenger cars. Market dynamics are shaped by technological innovation, consumer preferences, and automotive industry evolution.

Currently, the market experiences robust expansion driven by rising premium vehicle ownership worldwide. Consumer demand for superior driving experiences continues accelerating, particularly in developed economies. Additionally, growing motorsports participation fuels enthusiast demand for specialized tire solutions.

Market opportunities emerge from the electric vehicle revolution transforming automotive landscapes. Performance-oriented EV owners increasingly seek tires balancing efficiency with handling characteristics. Furthermore, aftermarket customization trends generate substantial replacement demand across vehicle segments.

Government regulations increasingly emphasize tire safety standards and performance certifications globally. Environmental initiatives promote sustainable manufacturing practices and eco-friendly material integration. These regulatory frameworks simultaneously challenge manufacturers while encouraging innovation in tire technology development.

Technological advancements in silica compounds enhance wet-weather performance and fuel efficiency characteristics. Manufacturers invest heavily in research facilities developing next-generation tire architectures. Smart tire integration with vehicle systems enables real-time performance monitoring and predictive maintenance capabilities.

According to Consumer Reports, 54% of surveyed tire buyers reported being completely satisfied with their purchase experience, indicating strong consumer confidence. Additionally, tire grip was valued by 54% of consumers, while handling performance proved important to 40% according to Cooper Teams research. These statistics underscore growing consumer prioritization of performance characteristics when selecting tire solutions.

Key Takeaways

- Global High Performance Tires Market valued at USD 52.6 Billion in 2024, projected to reach USD 122.3 Billion by 2034.

- Market growing at a CAGR of 8.8% during forecast period 2025-2034.

- Tread Tire segment dominates by type with 71.2% market share.

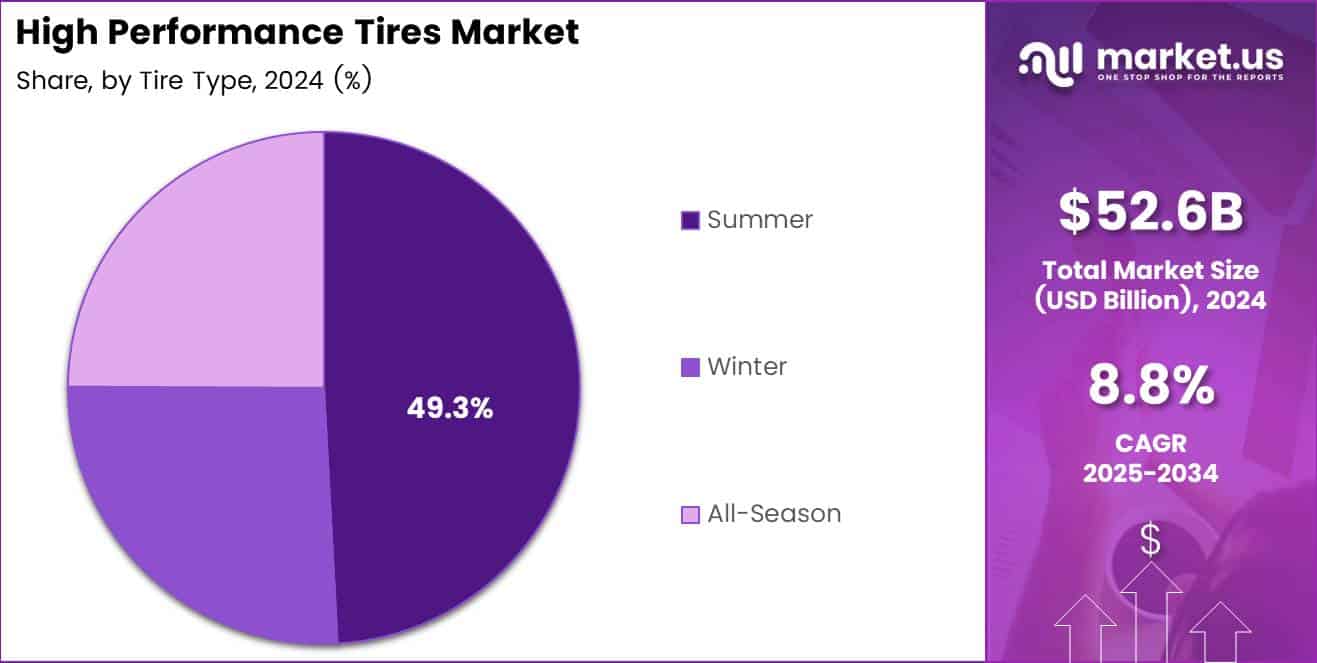

- Summer tires lead tire type segment with 49.3% market share.

- Racing Cars application holds largest share at 39.7%.

- Aftermarket sales channel commands 62.8% market share.

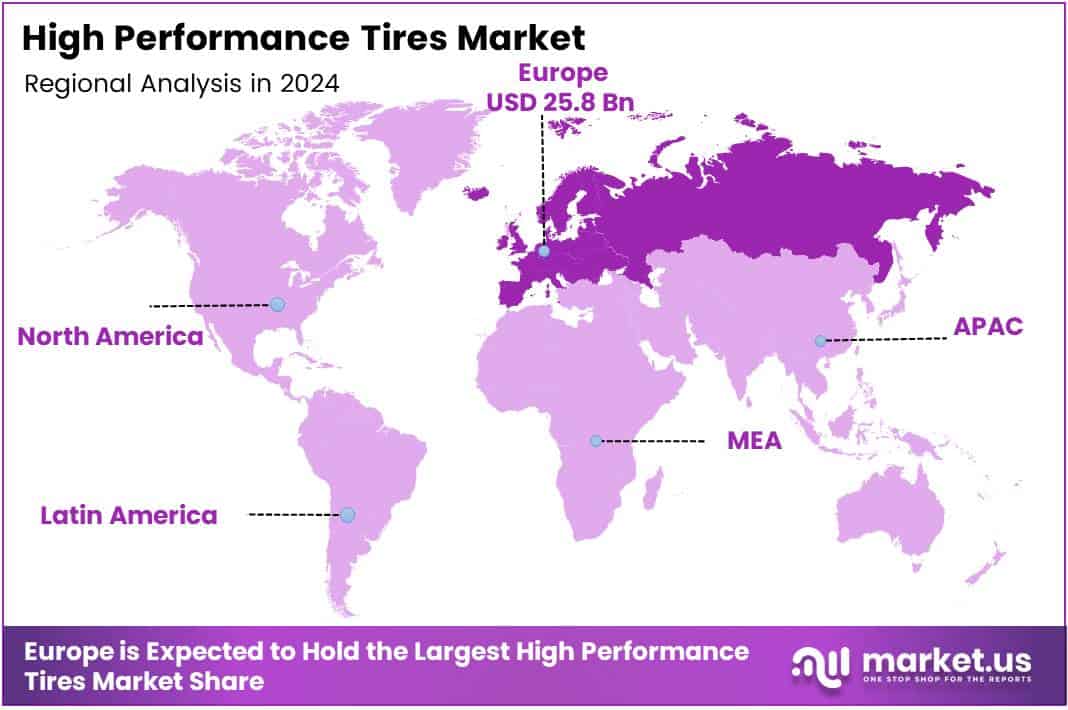

- Europe dominates regional market with 49.2% share, valued at USD 25.8 Billion.

By Type Analysis

Tread Tire dominates with 71.2% market share due to its versatile performance capabilities and widespread application suitability.

In 2024, Tread Tire held a dominant market position in the By Type segment of High Performance Tires Market, with a 71.2% share.

Tread Tire segment’s leadership stems from its balanced engineering approach combining performance with practicality. Tread tires feature sophisticated pattern designs optimizing water dispersion, cornering stability, and longitudinal grip simultaneously. Manufacturers continuously refine tread geometries using computational modeling and real-world testing protocols. These tires serve diverse vehicle categories from performance sedans to sport utility vehicles effectively.

Racing Slick tires occupy a specialized niche within professional motorsports applications exclusively. These tires eliminate tread patterns entirely, maximizing contact patch area for ultimate dry-surface grip. Professional racing teams rely on slicks for competitive advantage during track events. However, their limited application scope restricts broader market penetration compared to treaded alternatives.

Others category encompasses emerging tire technologies and specialized variants serving niche requirements. This segment includes experimental designs, prototype technologies, and application-specific solutions. Innovation-driven manufacturers continuously develop novel tire architectures addressing evolving performance demands and regulatory requirements.

By Tire Type Analysis

Summer tires lead with 49.3% market share due to optimal warm-weather performance and widespread consumer preference.

In 2024, Summer tires held a dominant market position in the By Tire Type segment of High Performance Tires Market, with a 49.3% share.

These tires utilize specialized rubber compounds maintaining flexibility across moderate temperature ranges. Summer tire treads feature shallower patterns optimized for dry and wet pavement conditions. Performance enthusiasts favor summer tires for superior cornering capabilities and responsive handling characteristics. Geographic regions with temperate climates drive substantial demand for seasonal summer tire installations.

Winter tires incorporate softer rubber compounds remaining pliable in freezing temperatures effectively. Deep tread patterns with aggressive siping enhance snow and ice traction significantly. Markets in northern latitudes mandate winter tire usage through regulatory requirements. However, seasonal application limitations constrain year-round market share compared to summer alternatives.

All-Season tires attempt balancing performance across diverse weather conditions throughout calendar years. These versatile options appeal to consumers seeking convenience over specialized seasonal performance. Compound formulations compromise between summer grip and winter traction capabilities. All-season variants continue gaining adoption in regions experiencing moderate seasonal variations.

By Application Analysis

Racing Cars dominate with 39.7% market share driven by extreme performance requirements and technological innovation demands.

In 2024, Racing Cars held a dominant market position in the By Application segment of High Performance Tires Market, with a 39.7% share.

Professional motorsports demand cutting-edge tire technology pushing performance boundaries continuously. Racing applications require tires withstanding extreme speeds, lateral forces, and temperature variations. Manufacturers leverage racing programs as proving grounds for technological innovations subsequently adapted for consumer markets. Competition tire development drives advances in compound chemistry, structural engineering, and thermal management systems.

Off-the-Road Vehicles represent growing application segment combining performance with rugged durability requirements. These vehicles demand tires capable of high-speed highway travel and challenging terrain navigation. Performance-oriented SUV and truck owners increasingly seek specialized tire solutions balancing on-road handling with off-road capability. Market growth reflects expanding crossover vehicle popularity across consumer segments.

Others application category encompasses diverse vehicle types including luxury sedans, performance coupes, and modified passenger cars. This broad segment reflects widespread performance tire adoption beyond traditional racing applications. Consumer enthusiasm for enhanced driving dynamics fuels aftermarket tire upgrades across various vehicle platforms consistently.

By Sales Channel Analysis

Aftermarket dominates with 62.8% market share reflecting strong replacement demand and customization trends.

In 2024, Aftermarket held a dominant market position in the By Sales Channel segment of High Performance Tires Market, with a 62.8% share.

Aftermarket channels serve vehicle owners seeking tire replacements, seasonal changes, and performance upgrades. Independent tire retailers, specialty shops, and online platforms facilitate diverse consumer purchasing preferences. Enthusiast communities drive substantial aftermarket demand through vehicle modification and performance enhancement activities. Additionally, tire wear necessitates periodic replacements generating consistent aftermarket revenue streams throughout vehicle lifecycles.

OEM channels supply tires directly integrated during vehicle manufacturing processes at assembly facilities. Automobile manufacturers collaborate with tire producers developing application-specific solutions optimized for particular vehicle models. Factory-fitted performance tires enhance new vehicle value propositions and brand differentiation strategies. However, OEM volume remains constrained by new vehicle production rates compared to expansive aftermarket replacement cycles.

Key Market Segments

By Type

- Tread Tire

- Racing Slick

- Others

By Tire Type

- Summer

- Winter

- All-Season

By Application

- Racing Cars

- Off-the-Road Vehicles

- Others

By Sales Channel

- Aftermarket

- OEM

Drivers

Rising Premium Vehicle Sales and Performance-Oriented Consumer Preferences Drive Market Expansion

Global sales of premium, luxury, and sports vehicles continue accelerating across developed and emerging markets. Affluent consumers increasingly prioritize driving performance and handling characteristics when selecting vehicles. This demographic shift fuels demand for factory-fitted high-performance tire specifications from automobile manufacturers.

Consumer expectations for superior handling, grip, and braking performance intensify with each vehicle generation. Performance enthusiasts seek tires delivering competitive advantages during spirited driving and track events. Additionally, growing motorsports participation worldwide cultivates performance-oriented driving culture among broader consumer populations.

Original Equipment Manufacturers increasingly specify high-performance tires as standard equipment on premium vehicle models. Automakers recognize tire performance directly influences vehicle reviews, safety ratings, and brand perception. This OEM focus creates substantial primary demand while establishing performance tire awareness among mainstream consumers effectively.

Restraints

Premium Pricing and Accelerated Wear Patterns Limit Market Penetration

High replacement and maintenance costs compared to standard tires create significant adoption barriers for price-sensitive consumers. Performance tire prices often exceed standard alternatives by substantial margins reflecting advanced materials and engineering. This cost differential restricts market penetration within budget-conscious consumer segments limiting overall addressable market size.

Reduced tread life under aggressive driving and high-speed conditions necessitates more frequent replacement cycles. Performance tire compounds prioritize grip over longevity creating inherent durability trade-offs. Enthusiasts accept shorter service intervals, however mainstream consumers often resist recurring expenses associated with premium tire ownership.

Economic downturns and discretionary spending reductions disproportionately impact premium automotive product categories. Performance tires represent optional upgrades for many vehicle owners who defer purchases during financial uncertainty. Market volatility creates cyclical demand patterns challenging manufacturers’ production planning and inventory management strategies consistently.

Growth Factors

Electric Vehicle Adoption and Technological Innovation Create Expansion Opportunities

Expanding adoption of high-performance tires in electric and hybrid vehicles opens substantial growth avenues. Electric vehicle acceleration capabilities demand tires capable of managing instant torque delivery and regenerative braking forces. Performance-oriented EV models require specialized tire solutions balancing efficiency with handling characteristics effectively.

Growing aftermarket demand driven by vehicle customization trends generates consistent replacement business throughout vehicle lifecycles. Enthusiast communities actively modify vehicles seeking enhanced performance, aesthetic differentiation, and competitive advantages. This customization culture sustains aftermarket channels while encouraging technological experimentation and niche product development.

Technological advancements in silica compounds and tread design methodologies enhance tire performance across multiple dimensions simultaneously. Manufacturers invest heavily in computational modeling, material science research, and testing infrastructure development. Additionally, increasing penetration in emerging markets with rising disposable incomes expands addressable consumer populations substantially across Asia-Pacific and Latin American regions.

Emerging Trends

Advanced Technologies and Sustainability Drive Industry Transformation

Industry shift toward ultra-high-performance and run-flat tire technologies reflects evolving consumer safety expectations and convenience preferences. UHP tires deliver exceptional handling characteristics approaching racing tire performance while maintaining street legality. Run-flat capabilities eliminate roadside tire changes enhancing driver confidence particularly in urban environments and remote locations.

Development of low-noise, low-rolling-resistance performance tires addresses conflicting consumer demands for performance and efficiency. Manufacturers engineer tire architectures minimizing cabin noise intrusion while reducing fuel consumption impacts. These dual-purpose designs appeal to environmentally conscious performance enthusiasts seeking reduced environmental footprints.

Integration of smart tire sensors for real-time performance monitoring enables predictive maintenance and safety optimization. Connected tire systems communicate pressure, temperature, and wear data to vehicle control units and smartphone applications. Rising use of sustainable and advanced composite materials in tire manufacturing reflects industry commitment toward environmental responsibility and circular economy principles.

Regional Analysis

Europe Dominates the High Performance Tires Market with a Market Share of 49.2%, Valued at USD 25.8 Billion

Europe maintains market leadership driven by strong automotive heritage, established motorsports culture, and premium vehicle concentration. The region hosts numerous performance vehicle manufacturers and tire producers with deep engineering expertise. European consumers demonstrate strong preferences for handling characteristics and driving dynamics.

Additionally, well-developed aftermarket infrastructure supports robust replacement tire demand. The market share of 49.2% represents a valuation of USD 25.8 Billion, reflecting the region’s mature automotive ecosystem and performance-oriented consumer base.

North America High Performance Tires Market Trends

North America exhibits substantial market presence supported by large sports car and performance vehicle populations. American muscle car culture and growing track day participation drive enthusiast tire demand. The region features extensive aftermarket distribution networks and competitive pricing dynamics. Additionally, increasing electric performance vehicle adoption creates emerging growth opportunities across premium segments.

Asia Pacific High Performance Tires Market Trends

Asia Pacific demonstrates fastest growth trajectory fueled by expanding middle-class populations and rising disposable incomes. Chinese luxury vehicle sales growth creates substantial OEM and aftermarket opportunities. Japanese and Korean manufacturers continue advancing tire technologies for domestic and export markets. Furthermore, developing motorsports infrastructure cultivates performance driving culture across younger demographics.

Middle East and Africa High Performance Tires Market Trends

Middle East markets exhibit strong luxury and sports vehicle ownership rates among affluent consumer segments. Extreme temperature conditions demand specialized tire formulations capable of maintaining performance in desert climates. African markets remain nascent but demonstrate potential as economic development progresses. Premium vehicle imports drive selective high-performance tire demand in key urban centers.

Latin America High Performance Tires Market Trends

Latin America shows moderate growth constrained by economic volatility and currency fluctuations affecting premium product affordability. Brazilian and Mexican markets lead regional demand supported by domestic automotive manufacturing presence. Growing motorsports interest and vehicle customization trends create niche opportunities. However, price sensitivity limits mass-market penetration compared to developed regions.

Key High Performance Tires Company Insights

The global High Performance Tires Market in 2024 features intense competition among established tire manufacturers leveraging technological innovation and brand heritage. Leading companies invest substantially in research facilities, motorsports programs, and distribution network expansion. Strategic partnerships with premium automobile manufacturers strengthen market positions while aftermarket channels remain crucial for sustained revenue generation.

Compagnie Générale des Établissements Michelin maintains industry leadership through continuous innovation in tire compounds and sustainable manufacturing practices. The company’s extensive motorsports involvement drives technological development subsequently commercialized across consumer product lines.

Bridgestone Corporation leverages global manufacturing scale and advanced research capabilities delivering comprehensive performance tire portfolios. Their strategic focus on premium segments and electric vehicle applications positions them advantageously for future market evolution.

The Goodyear Tire & Rubber Company combines American automotive heritage with global reach serving diverse performance vehicle segments. Their emphasis on connected tire technologies and smart mobility solutions reflects forward-thinking market strategy.

Continental AG integrates tire development with broader automotive systems expertise creating synergistic performance solutions. Their German engineering reputation and premium vehicle manufacturer relationships sustain competitive advantages in high-performance segments consistently.

Key Companies

- Compagnie Générale des Établissements Michelin

- Bridgestone Corporation

- The Goodyear Tire & Rubber Company

- Continental AG

- Pirelli & C. S.p.A.

- Hankook Tire & Technology Co., Ltd.

- Yokohama Rubber Co., Ltd.

- Sumitomo Rubber Industries, Ltd.

- Nokian Tyres plc

- Toyo Tire & Rubber Co., Ltd.

Recent Developments

- In November 2025, Gemspring Capital completed acquisition of The Goodyear Tire & Rubber Company’s Polymer Chemicals Business, strengthening capabilities in advanced material development. This strategic transaction enhances polymer compound innovation supporting next-generation tire performance characteristics and sustainable manufacturing initiatives.

- In June 2025, Bauer Built, Inc. acquired Meekhof Tire Sales & Service, Inc., significantly expanding Midwest footprint and aftermarket distribution capabilities. The acquisition strengthens regional market presence while enhancing customer service infrastructure across key geographic territories.

- In September 2025, Sailun Tire USA acquired Vogue Tyre, marking bold expansion into premium performance segment. This strategic move positions Sailun within luxury tire market while leveraging Vogue’s established brand heritage and specialized manufacturing expertise.

Report Scope

Report Features Description Market Value (2024) USD 52.6 Billion Forecast Revenue (2034) USD 122.3 Billion CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Tread Tire, Racing Slick, Others), By Tire Type (Summer, Winter, All-Season), By Application (Racing Cars, Off-the-Road Vehicles, Others), By Sales Channel (Aftermarket, OEM) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Compagnie Générale des Établissements Michelin, Bridgestone Corporation, The Goodyear Tire & Rubber Company, Continental AG, Pirelli & C. S.p.A., Hankook Tire & Technology Co., Ltd., Yokohama Rubber Co., Ltd., Sumitomo Rubber Industries, Ltd., Nokian Tyres plc, Toyo Tire & Rubber Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  High Performance Tires MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

High Performance Tires MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Compagnie Générale des Établissements Michelin

- Bridgestone Corporation

- The Goodyear Tire & Rubber Company

- Continental AG

- Pirelli & C. S.p.A.

- Hankook Tire & Technology Co., Ltd.

- Yokohama Rubber Co., Ltd.

- Sumitomo Rubber Industries, Ltd.

- Nokian Tyres plc

- Toyo Tire & Rubber Co., Ltd.