Global High Fiber Feed Market Size, Share, And Industry Analysis Report By Product Type (Ruminants, Poultry, Equines, Swine, Aquatic Animals, Pets), By Nature (Soybean, Wheat, Corn, Sugar Beet, Others), By Sales Channel (Direct Sales, Indirect Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175936

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

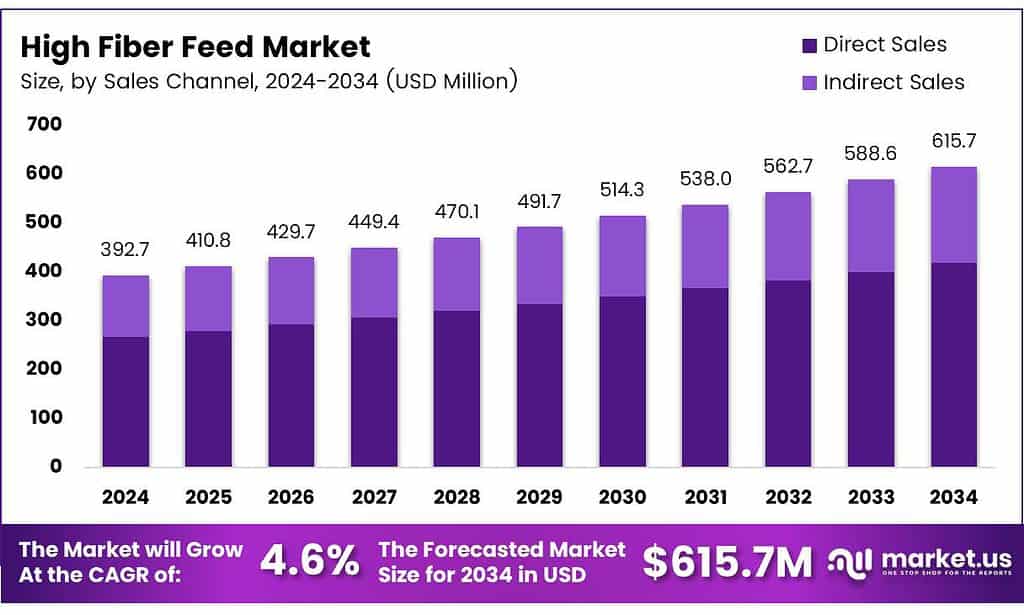

The Global High Fiber Feed Market size is expected to be worth around USD 615.7 million by 2034, from USD 392.7 million in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

The High Fiber Feed Market represents a fast-expanding segment of the global animal nutrition industry, driven by rising demand for gut-health-oriented feed solutions and sustainable ingredient sourcing. It includes feed products formulated with fiber-rich ingredients such as citrus pulp, beet pulp, soy hulls, and crop residues. These formulations aim to enhance digestive efficiency, improve rumen health, and support animal well-being across dairy, beef, poultry, and swine categories.

The market continues gaining traction as producers shift toward functional feed components that strengthen feed conversion ratios and promote long-term productivity. As sustainability becomes a core priority, manufacturers increasingly use agricultural by-products for high-fiber feed formulations. This approach reduces environmental waste while lowering feed production costs, creating a dual economic and ecological advantage.

- The FAO reports that nearly 1.3 billion tonnes of food are wasted annually, generating large volumes of fiber-rich by-products for feed use. A significant portion comes from fruit and vegetable residues, with citrus pulp containing 10–40% soluble fiber—mainly pectins. This rich nutrient profile boosts rumen activity, supports gut health, and provides slow-release energy, making citrus pulp a highly valuable ingredient in high-fiber livestock diets.

Moreover, rising concerns about gut disorders and metabolic stress in livestock further elevate the relevance of high-fiber feed solutions. Farmers increasingly adopt fiber-enhanced formulations to improve rumen fermentation, maintain stable energy release, and support milk yield consistency. These functional attributes align with broader trends toward animal health optimization and preventive nutrition.

Key Takeaways

- The Global High Fiber Feed Market is projected to reach USD 615.7 million by 2034, growing from USD 392.7 million in 2024, at a 4.6% CAGR between 2025 and 2034.

- Ruminants dominate the product type segment with a leading 47.1% share in 2025.

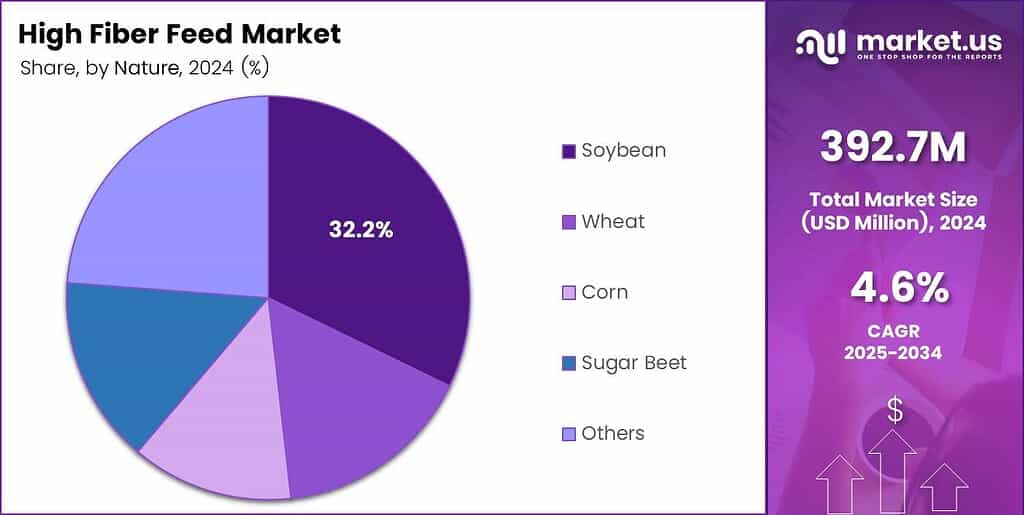

- Soybean leads the nature segment with a strong 32.2% market share.

- Indirect Sales represent the largest distribution channel, holding 68.6% share.

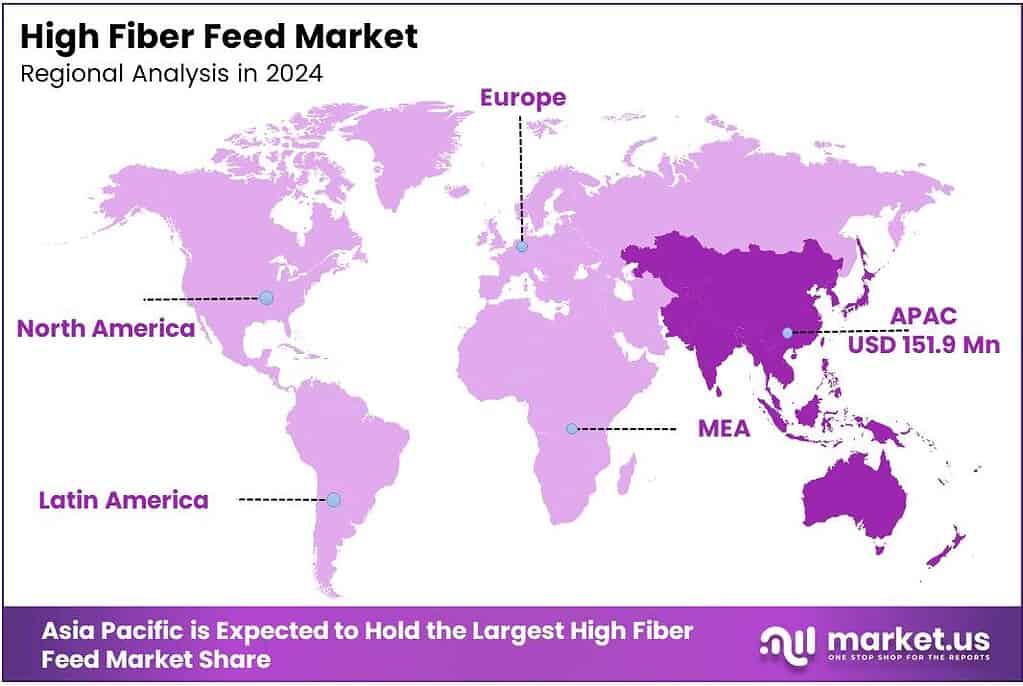

- Asia Pacific is the dominating region with a 38.7% market share, valued at USD 151.9 million.

By Product Type Analysis

Ruminants lead the High Fiber Feed Market with a dominant 47.1% share due to higher fiber requirements in cattle-based nutrition.

In 2025, Ruminants held a dominant market position in the By Product Type Analysis segment of the High Fiber Feed Market, with a 47.1% share. Their reliance on fiber-rich feed for digestion continues to boost demand. Rising dairy and beef production further increases the adoption of structured fiber sources.

Poultry showcased steady growth as producers incorporate fiber to support gut health and improve feed efficiency. Although poultry requires lower fiber than ruminants, the segment is witnessing higher acceptance due to improved bird performance. Expanding commercial farming and rising meat consumption support ongoing usage.

Equines continued adopting fiber-focused diets to maintain digestive balance and overall stamina. Horse owners prefer structured fiber-rich feed that supports metabolism and reduces digestive distress. Growth in recreational horse activities and equine sports sustains moderate market expansion across this segment.

Swine gradually increased fiber use as producers recognize benefits like improved gut performance and reduced digestive concerns. Controlled fiber integration enhances feed conversion and stability. The segment expands as modern swine diets shift toward balanced and efficient nutrition systems.

Aquatic Animals adopted fiber supplements to enhance gut functionality and water stability in feed pellets. Specialized formulations allow controlled fiber usage without affecting nutrient density. Growing aquaculture expansion continues to strengthen this niche category.

By Nature Analysis

Soybean dominates the High Fiber Feed Market with a strong 32.2% share due to its rich nutrient and fiber profile.

In 2025, Soybean held a dominant market position in the By Nature Analysis segment of the High Fiber Feed Market, with a 32.2% share. Its balanced protein and fiber content make it a preferred ingredient for multiple livestock categories. Expanding soybean cultivation further supports its consistent industry presence.

Wheat remained a widely used fiber ingredient as wheat bran offers efficient digestibility and balanced nutrition. Producers prefer wheat-derived fiber for cost efficiency and availability. Its use continues rising across poultry, swine, and pet feed applications due to adaptable nutritional performance.

Corn maintained stable demand with its fiber-rich by-products like corn gluten feed. Producers use corn-based fiber to enhance energy levels while supporting steady digestion. Its versatility in livestock diets supports continued market relevance across mixed feed formulations.

Sugar Beet contributed significantly to fiber-focused diets because beet pulp is easy to digest and ideal for ruminants and equines. Its high fermentability supports digestive balance, prompting consistent adoption. Growing acceptance of premium pet food also boosts segment traction.

By Sales Channel Analysis

Indirect Sales dominate the High Fiber Feed Market with a strong 68.6% share driven by large distribution networks.

In 2025, Indirect Sales held a dominant market position in the By Sales Channel Analysis segment of the High Fiber Feed Market, with a 68.6% share. Extensive dealer networks and retail availability make fiber feed easily accessible to both small and large livestock farms. This ensures stronger market penetration.

Direct Sales continued supporting bulk buyers seeking customized feed solutions. Producers often favor direct procurement for consistent supply and tailored formulations. The segment grows steadily as feed manufacturers strengthen relationships with commercial farms, improving transparency and price advantages.

Key Market Segments

By Product Type

- Ruminants

- Poultry

- Equines

- Swine

- Aquatic Animals

- Pets

By Nature

- Soybean

- Wheat

- Corn

- Sugar Beet

- Others

By Sales Channel

- Direct Sales

- Indirect Sales

Emerging Trends

Increasing Shift Toward Sustainable and Plant-Based Feed Trends

One of the most notable trends in the high fiber feed market is the rapid shift toward plant-based and sustainable feed ingredients. Feed manufacturers are replacing synthetic additives with natural fiber sources to meet rising consumer expectations for clean-label animal products. This trend is reshaping product innovation across global markets.

- In the U.S. alone, 14.7 million tons of distillers’ wet grains (high moisture), 4.54 million tons of distillers’ dried grain (DDG), and 3.16 million tons of wet mill corn gluten feed. Those are not small side streams anymore—they are industrial-scale feed ingredients that nutritionists can plan around.

The adoption of precision nutrition. Farmers now use data-driven tools to design diets tailored to species, age, and production goals. High fiber feed plays a vital role in maintaining gut health, making it a preferred component in scientifically balanced diets.

Drivers

Rising Focus on Animal Digestive Health Drives Market Growth

Growing awareness about livestock digestive health is one of the strongest drivers of the high fiber feed market. Farmers now understand that fiber-rich feed helps animals maintain a healthy gut and better absorption of nutrients, which improves overall performance and reduces veterinary costs. This shift is encouraging producers to include more natural fiber sources in feed formulations.

The increasing global pressure to improve feed sustainability. High-fiber feed often uses agricultural by-products like beet pulp and soy hulls, which reduces waste and supports circular agriculture. This makes fiber-based feed more attractive in markets seeking sustainable and low-cost nutrition strategies.

The rising demand for high-quality dairy and meat products also pushes farmers to adopt high-fiber feed. Good fiber levels promote stable rumen function in cattle and support consistent milk yield and growth rates. As livestock populations grow across developing economies, demand for such feed solutions is expanding steadily.

Restraints

Limited Availability of Quality Raw Materials Restrains Market Growth

One of the major restraints for the high fiber feed market is the inconsistent supply of high-quality raw materials. The availability of crops like alfalfa, oats, and beet pulp varies by season and region, making it difficult for feed manufacturers to maintain stable production levels. This creates supply fluctuations and affects pricing stability.

- Feed and residual use to 6.2 billion bushels. When feed use runs that high, it supports steady demand for complementary feed components—especially fiber sources that help maintain rumen function in dairy and beef systems, or improve satiety and gut comfort in other livestock segments.

Another challenge relates to the high transportation and processing costs. Fiber-rich ingredients require careful handling, drying, and storage to maintain nutritional quality. This increases production expenses, especially for small and medium feed producers, limiting wide-scale adoption in cost-sensitive regions.

Growth Factors

Expanding Use of By-Products in Feed Formulations Creates New Opportunities

A major growth opportunity lies in the increasing use of agricultural by-products as cost-effective fiber sources. Materials like rice bran, wheat bran, soybean hulls, and sugar beet pulp provide affordable fiber while supporting sustainability goals. This strengthens the market potential for high fiber feed among value-focused farmers.

Growing demand for natural and chemical-free feed ingredients also presents strong opportunities. Consumers are increasingly choosing meat and dairy from animals fed cleaner, plant-based diets. This pushes producers to adopt fiber-rich feed blends made from natural sources, fueling growth in premium livestock segments.

The rise of commercial livestock farming across the Asia-Pacific opens large-scale market opportunities. Countries like India, China, and Vietnam are expanding dairy and poultry operations, which increases demand for balanced high fiber feed to improve productivity and health outcomes.

Regional Analysis

Asia Pacific Dominates the High Fiber Feed Market with a Market Share of 38.7%, Valued at USD 151.9 Million

The Asia Pacific region leads the High Fiber Feed Market, holding a dominant share of 38.7%, equivalent to a valuation of USD 151.9 million. This leadership is driven by the region’s expanding livestock population, rising awareness of gut-health-focused feed, and government support for sustainable animal nutrition. Countries such as China, India, and Australia continue increasing the adoption of high-fiber feed formulations to enhance animal productivity and reduce dependency on antibiotic-based feed.

North America shows steady growth due to its strong focus on precision nutrition, advanced feed technology, and growing demand for natural dietary fiber in animal feed. The United States remains the primary contributor, driven by higher spending capacity, commercial dairy and poultry expansion, and stringent quality regulations. Increasing adoption of fiber-rich feed for digestive health optimization continues to strengthen regional demand.

Europe’s market performance is shaped by strict regulatory frameworks supporting sustainable and fiber-enhanced feed ingredients. The region’s mature livestock sector, especially in Western Europe, has seen rising use of plant-based fiber sources as part of welfare-driven feed programs. Growing consumer preference for clean-label animal products further encourages the use of nutritional fiber in feed formulations.

Asia Pacific remains a fast-growing market fueled by expanding livestock farming, higher feed production volumes, and increased awareness among small and mid-scale farmers. Improvements in feed manufacturing infrastructure and the gradual transition toward functional feed additives support long-term market acceleration across emerging economies.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, Cargill, Incorporated will remain a heavyweight in high-fiber feed because it can source fiber-rich raw materials at scale and keep formulations consistent across regions. Its broad animal nutrition footprint also helps it respond quickly to dairy and beef producers seeking better rumen health and cost control.

ADM is well-positioned as high-fiber rations become more common in value-focused feeding programs, especially where producers want stable energy release and improved digestion. With deep capabilities in grain processing and co-products, ADM can keep a strong pipeline of fiber ingredients suited to ruminant and some monogastric applications.

Bunge Limited benefits from its large oilseed and grain handling network, which supports the steady availability of fiber co-products used in feed. In 2025, its advantage is reliability—moving ingredients efficiently and supporting feed customers with a predictable supply during seasonal price swings.

Wilmar International Limited remains influential in Asia-led feed demand, where integrated agri-processing helps secure feed inputs and manage costs. Its scale and regional reach support wider adoption of high-fiber feed solutions in fast-growing livestock and dairy systems, particularly where producers need economical diets without compromising gut function.

Top Key Players in the Market

- Cargill, Incorporated

- ADM

- Bunge Limited

- Wilmar International Limited

- Nutreco N.V.

- Charoen Pokphand Foods PCL

- ForFarmers Group

- MBRF

- Alltech Inc.

- Gulshan Polyols Ltd

- De Heus Animal Nutrition

- Others

Recent Developments

- In 2025, Cargill Animal Nutrition & Health announced an increase in micronutrition production capacity to meet growing customer demand in the animal feed sector. Cargill conducted a voluntary recall of a single lot of Nutrena Country Feeds Cracked Corn due to elevated aflatoxin levels, affecting livestock feed for certain animal types.

- In 2025, Wilmar supported research on co-fermentation of peanut meal with Weizmannia coagulans and Bacillus subtilis to improve nutritional quality and aflatoxin detoxification for animal feed, funded through its Biotechnology R&D Center.

Report Scope

Report Features Description Market Value (2024) USD 392.7 Million Forecast Revenue (2034) USD 615.7 Million CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ruminants, Poultry, Equines, Swine, Aquatic Animals, Pets), By Nature (Soybean, Wheat, Corn, Sugar Beet, Others), By Sales Channel (Direct Sales, Indirect Sales) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Cargill, Incorporated, ADM, Bunge Limited, Wilmar International Limited, Nutreco N.V., Charoen Pokphand Foods PCL, ForFarmers Group, MBRF, Alltech Inc., Gulshan Polyols Ltd, De Heus Animal Nutrition, Others Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Cargill, Incorporated

- ADM

- Bunge Limited

- Wilmar International Limited

- Nutreco N.V.

- Charoen Pokphand Foods PCL

- ForFarmers Group

- MBRF

- Alltech Inc.

- Gulshan Polyols Ltd

- De Heus Animal Nutrition

- Others