Global Hemp Protein Market Size, Share, Analysis Report By Source (Organic, Conventional), By Flavor (Unflavored/Regular, Flavored, Chocolate, Vanilla, Berry, Others), By Application (Food and Beverage, Bakery, Snacks, Confectionary, Beverages, Supplements, Sport/Performance Nutrition, Elderly Nutrition and Medical Nutrition, Personal Care and Cosmetics), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Health Stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156042

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

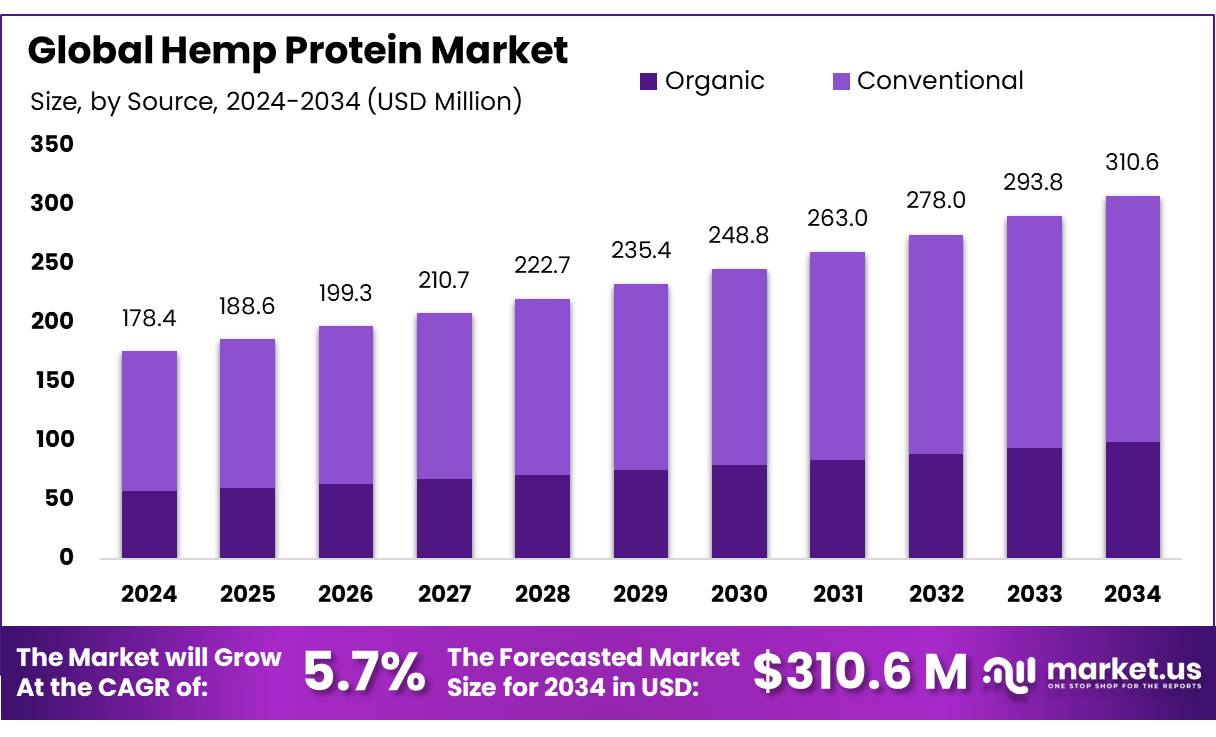

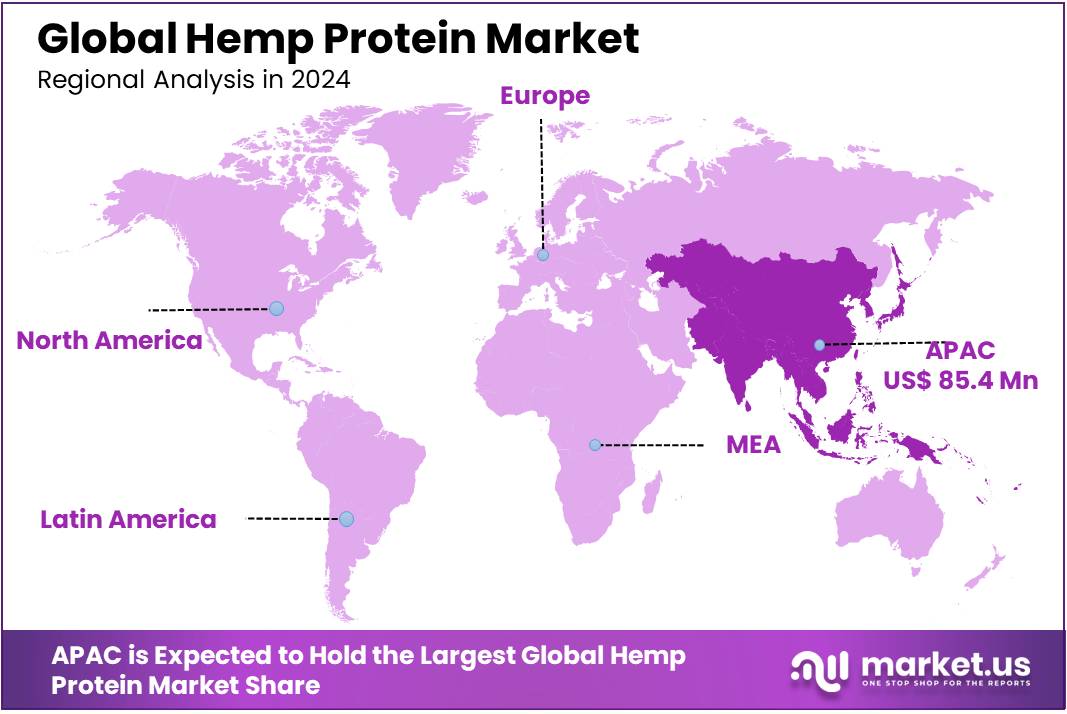

The Global Hemp Protein Market size is expected to be worth around USD 310.6 Million by 2034, from USD 178.4 Million in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 47.9% share, holding USD 85.4 Million revenue.

Hemp protein concentrate is emerging as a prominent component in the global plant-based protein sector, particularly within the Indian market. Derived from the seeds of the Cannabis sativa plant, hemp protein is recognized for its high nutritional value, boasting a complete amino acid profile, abundant dietary fiber, and essential fatty acids like omega-3 and omega-6. This positions it as a compelling alternative to traditional animal-based proteins, aligning with the growing consumer shift towards sustainable and health-conscious dietary choices.

The Indian government’s regulatory framework, particularly the Narcotic Drugs and Psychotropic Substances (NDPS) Act, 1985, permits the cultivation of cannabis plants for industrial purposes, including hemp. Under Section 14 of the NDPS Act, state governments have the authority to license the cultivation of cannabis for industrial purposes, provided the tetrahydrocannabinol (THC) content is below 0.3%. States like Uttarakhand and Uttar Pradesh have already initiated controlled cultivation of industrial hemp, paving the way for the development of local hemp industries.

Hemp protein concentrate is derived from hemp seeds, which contain 20–25% protein, and is known for its high digestibility and rich amino acid profile, including edestin and albumin proteins. This makes it an attractive option for consumers seeking plant-based protein sources. The concentrate is utilized in various applications, including dietary supplements, functional foods, and beverages, owing to its nutritional benefits and versatility.

Processing methods such as dehulling or oil extraction can increase the protein concentration in products like dehulled seed or hemp seed meal to over 50%. This high protein content, along with the presence of essential amino acids, fiber, and omega fatty acids, makes hemp protein concentrates a valuable addition to plant-based diets.

Key Takeaways

- Hemp Protein Market size is expected to be worth around USD 310.6 Million by 2034, from USD 178.4 Million in 2024, growing at a CAGR of 5.7%.

- Conventional held a dominant market position, capturing more than a 67.9% share in the hemp protein market.

- Unflavored/Regular held a dominant market position, capturing more than a 69.2% share in the hemp protein market.

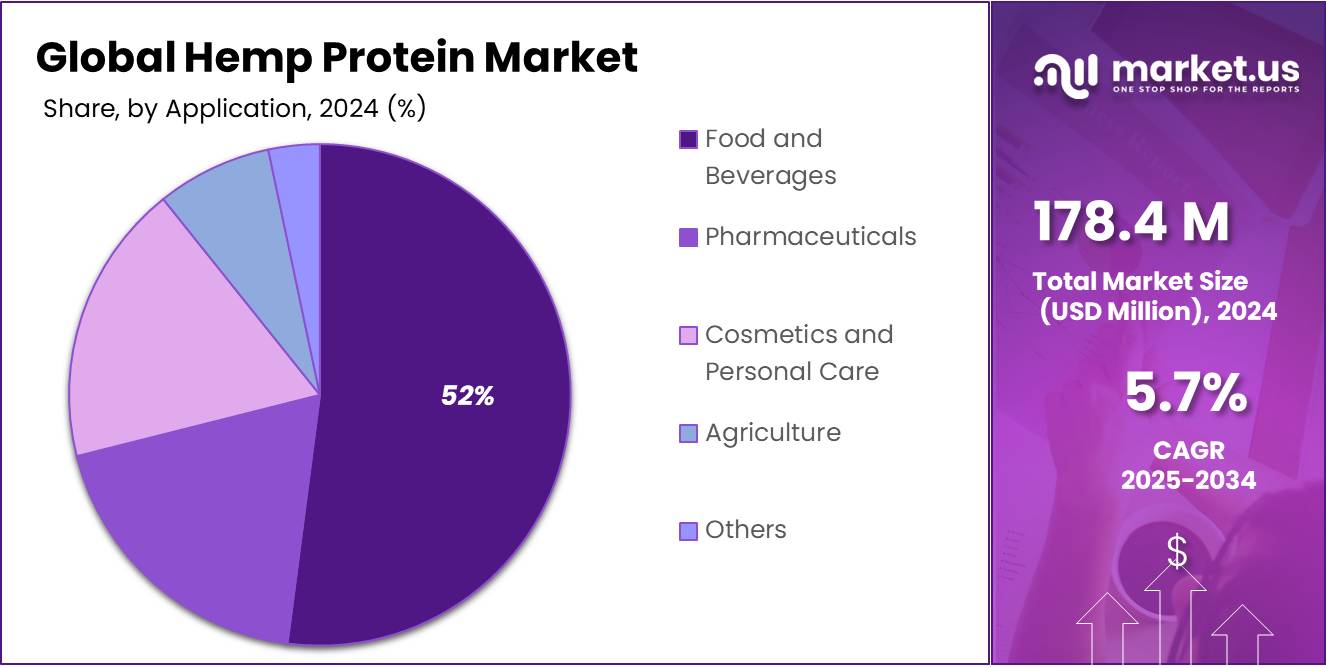

- Food and Beverage held a dominant market position, capturing more than a 59.1% share in the hemp protein market.

- Agriculture held a dominant market position, capturing more than a 62.5% share in the hemp protein market.

- Asia-Pacific (APAC) emerged as the leading region in the hemp protein market, securing more than 47.9% of the global share, equivalent to USD 85.4 million.

By Source Analysis

Conventional leads with 67.9% thanks to scale, steady supply, and sharp pricing.

In 2024, Conventional held a dominant market position, capturing more than a 67.9% share in the hemp protein market by source. This lead comes from simple realities on the ground: conventional hemp is grown at larger scale, processed in high-throughput mills, and priced to fit mainstream nutrition budgets. Formulators value its consistent specs—stable protein levels, predictable particle size, and reliable flavor—making it easier to use in powders, ready-to-drink shakes, bars, and bakery mixes without reformulation headaches. Retailers also favor conventional for wide distribution and private-label lines where affordability matters. Organic options are rising, but their higher farm-gate costs and tighter supply keep them niche compared with the broad availability of conventional material.

By Flavor Analysis

Unflavored/Regular dominates with 69.2% due to its versatility in product use.

In 2024, Unflavored/Regular held a dominant market position, capturing more than a 69.2% share in the hemp protein market by flavor. This strong lead is mainly because unflavored hemp protein can be easily added to a wide range of applications without altering the original taste. From smoothies and protein shakes to bakery mixes and functional snacks, its neutral profile makes it the preferred choice for both consumers and manufacturers. Health-conscious buyers also favor unflavored hemp protein as it provides a clean, natural source of protein without added sugars, artificial flavors, or masking agents.

By Application Analysis

Food and Beverage leads with 59.1% as hemp protein finds everyday nutrition appeal.

In 2024, Food and Beverage held a dominant market position, capturing more than a 59.1% share in the hemp protein market by application. This dominance is fueled by the rapid growth of plant-based diets and the use of hemp protein in everyday food items such as smoothies, energy bars, baked goods, cereals, and dairy alternatives. Its high digestibility, clean-label image, and natural amino acid profile make it an attractive choice for both health-conscious consumers and food brands. The segment also benefits from hemp protein’s ability to blend smoothly with other plant proteins like pea and rice, improving product texture and taste.

By Distribution Channel Analysis

Agriculture dominates with 62.5% as hemp protein strengthens feed and soil health use.

In 2024, Agriculture held a dominant market position, capturing more than a 62.5% share in the hemp protein market by end use. This lead is largely due to the growing use of hemp protein in animal feed formulations and soil enrichment practices. Farmers value it as a sustainable, protein-rich feed ingredient for livestock, poultry, and aquaculture, offering a natural alternative to conventional feed proteins like soy. Hemp protein also contributes amino acids, fiber, and essential fatty acids, making it a balanced choice that supports animal health and productivity. Beyond feed, byproducts of hemp protein processing are finding use in fertilizers and soil conditioners, helping to improve nutrient retention and organic matter in farming systems.

Key Market Segments

By Source

- Organic

- Conventional

By Flavor

- Unflavored/Regular

- Flavored

- Chocolate

- Vanilla

- Berry

- Others

By Application

- Food and Beverage

- Bakery

- Snacks

- Confectionary

- Beverages

- Supplements

- Sport/Performance Nutrition

- Elderly Nutrition and Medical Nutrition

- Personal Care and Cosmetics

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Health Stores

- Online

- Others

Emerging Trends

A Nutrient-Rich, Sustainable Alternative in India’s Plant-Based Protein Market

Hemp protein is emerging as a compelling option in India’s growing plant-based protein sector. With its rich nutritional profile and alignment with sustainable practices, hemp protein is gaining attention among health-conscious consumers and those seeking eco-friendly dietary choices.

The global shift towards plant-based diets is influencing consumer preferences in India. As awareness about the environmental impact of animal agriculture increases, many individuals are turning to plant-based alternatives. Hemp protein, derived from the seeds of the hemp plant, offers a complete protein source, containing all nine essential amino acids, making it an attractive option for vegetarians and vegans.

In India, the plant-based protein market is experiencing growth. The demand for plant-based proteins is driven by factors such as increasing health consciousness, dietary restrictions, and a desire for sustainable food options. While specific figures for hemp protein in India are limited, the overall trend indicates a positive outlook for plant-based proteins.

The Indian government has recognized the potential of hemp cultivation for industrial and nutritional purposes. The Narcotic Drugs and Psychotropic Substances (NDPS) Act of 1985 allows state governments to permit the cultivation of cannabis plants for medical, scientific, industrial, and horticultural purposes. States like Uttarakhand and Uttar Pradesh have granted licenses for industrial hemp cultivation, paving the way for the development of the hemp industry in India.

Additionally, the government’s focus on promoting sustainable agriculture and food security provides a supportive environment for the growth of hemp-based products. Initiatives aimed at enhancing food security and promoting nutritious food sources align with the benefits offered by hemp protein.

Hemp protein is a complete protein source, containing all nine essential amino acids. It is also rich in dietary fiber, omega-3 and omega-6 fatty acids, and essential minerals such as magnesium and iron. These attributes make it an attractive option for vegetarians, vegans, and individuals with dietary restrictions.

Drivers

Government Support and Legal Framework

One of the most significant driving factors for the hemp protein concentrate industry in India is the evolving legal and regulatory landscape that supports industrial hemp cultivation. The Indian government, through the Narcotic Drugs and Psychotropic Substances (NDPS) Act of 1985, permits the cultivation of cannabis plants for industrial purposes, provided the tetrahydrocannabinol (THC) content is below 0.3%. This legislation allows state governments to authorize the cultivation of cannabis for industrial, medical, scientific, and horticultural purposes, fostering a conducive environment for the hemp industry.

In line with this central policy, several Indian states have taken proactive steps to promote hemp cultivation. Uttarakhand became the first state to legalize industrial hemp cultivation in 2018, establishing a Hemp Cultivation Licensing Authority under the Excise Department. This move has facilitated the growth of a regulated hemp industry in the state. Similarly, Himachal Pradesh has approved pilot studies to explore the benefits of industrial hemp cultivation, aiming to boost local economies and reduce reliance on traditional crops. These state-level initiatives are instrumental in creating a robust framework for hemp protein concentrate production.

The government’s support extends beyond legislation. In Uttarakhand, partnerships with research institutions like the Council of Scientific and Industrial Research – Institute of Himalayan Bioresource Technology (CSIR-IHBT) have been established to advance research and development in hemp cultivation and processing. Such collaborations are crucial for developing sustainable and efficient methods for extracting hemp protein concentrates.

This favorable legal and regulatory environment has spurred interest among farmers and entrepreneurs in hemp cultivation. With the assurance of a legal framework and institutional support, stakeholders are more inclined to invest in hemp farming and processing, leading to an increase in the availability of hemp protein concentrates. As the industry grows, it is expected to contribute significantly to the agricultural economy, providing farmers with an alternative crop that is both economically viable and environmentally sustainable.

Restraints

Infrastructure and Processing Challenges

One of the primary obstacles hindering the growth of the hemp protein concentrate industry in India is the lack of adequate infrastructure and processing facilities. While the Indian government has initiated steps to promote hemp cultivation, such as legalizing industrial hemp in states like Uttarakhand and Uttar Pradesh, the absence of large-scale, specialized processing units remains a significant bottleneck. Hemp seeds require specific processing techniques to extract protein concentrates efficiently, and without the necessary infrastructure, the potential of hemp as a viable protein source remains underutilized.

The variability in seed composition across different hemp varieties further complicates the processing efforts. This inconsistency can lead to challenges in standardizing the quality of hemp protein concentrates, making it difficult for manufacturers to meet the stringent quality standards required for food-grade products. Additionally, the lack of standardized processing methods means that the nutritional profile of the final product can vary, affecting its appeal to health-conscious consumers.

Technological limitations also play a crucial role in this scenario. Advanced processing technologies, such as extrusion and fermentation, are essential for improving the quality and efficiency of plant-based protein production. However, these technologies are not yet widely adopted in India, primarily due to high capital investment requirements and a lack of technical expertise. As a result, the hemp protein concentrate industry struggles to scale up production and compete with more established protein sources like soy and pea protein.

Furthermore, the absence of a robust supply chain infrastructure exacerbates these challenges. Hemp cultivation is still in its nascent stages in India, and the lack of established networks for seed procurement, processing, and distribution makes it difficult for farmers and manufacturers to access the resources they need. This inefficiency leads to increased costs and delays, further discouraging investment in the hemp protein sector.

To address these challenges, the Indian government and industry stakeholders must collaborate to develop and implement comprehensive strategies. This includes investing in research and development to standardize processing techniques, building state-of-the-art processing facilities, and establishing a reliable supply chain infrastructure. Such initiatives would not only enhance the quality and quantity of hemp protein concentrates but also position India as a competitive player in the global plant-based protein market.

Opportunity

Put Hemp Protein Into Public Meal Programs

A single, practical growth path for hemp protein is to supply it to government-funded meal programs—school lunches, hospital and community kitchens—where the volumes are huge and the policy tailwinds favor plant protein. In the United States alone, the National School Lunch Program served about 4.86 billion lunches in fiscal year 2024. Even modest fortification (say, a few grams per serving) translates into very large annual tonnage for a reliable, multi-year buyer base.

The public-procurement opportunity is not limited to the U.S. Globally, school feeding now reaches 41% of primary-school children, and governments are rebuilding and expanding these programs after the pandemic. Where coverage is lower—especially in low-income countries—the direction of travel is still toward scale, which creates room for affordable, shelf-stable plant proteins that blend easily into staples. Hemp protein fits that brief.

Policy and regulation already clear the path in key markets. In the U.S., the Food and Drug Administration has recognized hemp seed protein powder (along with hulled hemp seed and hemp seed oil) as GRAS for use in conventional foods, a crucial green light for school and institutional formulators. That removes uncertainty for distributors who sell into public meal programs.

In the European Union, the Farm-to-Fork strategy explicitly pushes a shift toward EU-grown plant proteins, which supports public buyers and caterers that want to reduce reliance on imported soy and diversify protein sources—again aligning with hemp. In India, the Food Safety and Standards Authority of India (FSSAI) issued standards covering hemp seeds and seed products in its 2021 amendment—helpful for state tenders and large kitchens under schemes like PM-POSHAN.

Finally, sustainability expectations inside public menus favor plant proteins. FAO estimates livestock supply chains generate about 7.1 Gt CO₂-e (≈ 14.5%) of global anthropogenic greenhouse-gas emissions; many public buyers now include climate criteria in their food tenders. Offering hemp protein as a partial replacement or fortifier in meat-heavy recipes helps institutions meet those targets without rewriting entire menus, which lowers operational risk for caterers.

Regional Insights

APAC dominates with 47.9% valued at USD 85.4 million, driven by strong plant-based demand.

In 2024, Asia-Pacific (APAC) emerged as the leading region in the hemp protein market, securing more than 47.9% of the global share, equivalent to USD 85.4 million in market value. This dominance is primarily driven by the rapid adoption of plant-based nutrition in countries such as China, India, Japan, and Australia. Consumers in these markets are increasingly shifting toward vegan and vegetarian diets, supported by rising disposable incomes and a heightened awareness of the health benefits of plant proteins.

For instance, China’s plant-based food sector has seen double-digit growth in recent years, with hemp protein becoming a popular ingredient in smoothies, protein powders, and functional beverages. India, too, has witnessed growing demand, especially among urban consumers looking for high-protein alternatives to traditional dairy or meat sources.

Government support has further strengthened APAC’s leadership in this market. China and India have both encouraged the cultivation of industrial hemp for food and nutraceutical applications, helping boost raw material availability and reducing dependency on imports. Japan and South Korea, on the other hand, are expanding the use of hemp protein in functional foods and sports nutrition, tapping into their strong wellness industries.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ETChem specializes in producing hemp protein through mechanical milling of hulled hemp seed cake. They offer two specifications of hemp protein powder with 60% and 70% protein content, catering to the growing demand for plant-based protein ingredients in the food industry.

Established in 1998, Manitoba Harvest Hemp Foods is the world’s largest vertically integrated hemp food manufacturer. They produce a wide range of hemp-based products, including Hemp Hearts, Hemp Pro 70 protein concentrate, and Hemp Oil. The company is committed to sustainability, holding BRC certification and being Canada’s first CarbonZero certified food manufacturer.

Axiom Foods Inc., headquartered in California, is a leading innovator in plant-based protein solutions. They offer Cannatein® hemp protein, a high-concentration, allergen-free, and neutral-flavored ingredient derived from hemp hearts. Their products are certified organic, non-GMO, and FDA GRAS approved, catering to the food and beverage industry with a focus on sustainability and clean-label solutions.

Top Key Players Outlook

- Axiom Foods Inc.

- Manitoba Harvest Hemp Foods

- ETChem

- Tilray Brands Inc.

- North American Hemp & Grain Co. Ltd.

- Victory Hemp Foods

- Navitas LLC

- Canah International

- Hemp Oil Canada Inc.

- GFR Ingredients Ltd.

Recent Industry Developments

In 2024 Axiom Foods Inc, introduced Cannatein™, a hemp protein concentrate, expanding its portfolio alongside established products like Oryzatein® rice and VegOtein™ pea proteins.

In 2024, Manitoba Harvest introduced several innovative products to its hemp protein lineup. In March, the company launched Superseed Instant Oatmeal, available in three flavors, each providing 10 grams of plant-based protein per serving.

Report Scope

Report Features Description Market Value (2024) USD 178.4 Mn Forecast Revenue (2034) USD 310.6 Mn CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Organic, Conventional), By Flavor (Unflavored/Regular, Flavored, Chocolate, Vanilla, Berry, Others), By Application (Food and Beverage, Bakery, Snacks, Confectionary, Beverages, Supplements, Sport/Performance Nutrition, Elderly Nutrition and Medical Nutrition, Personal Care and Cosmetics), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Health Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Axiom Foods Inc., Manitoba Harvest Hemp Foods, ETChem, Tilray Brands Inc., North American Hemp & Grain Co. Ltd., Victory Hemp Foods, Navitas LLC, Canah International, Hemp Oil Canada Inc., GFR Ingredients Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Axiom Foods Inc.

- Manitoba Harvest Hemp Foods

- ETChem

- Tilray Brands Inc.

- North American Hemp & Grain Co. Ltd.

- Victory Hemp Foods

- Navitas LLC

- Canah International

- Hemp Oil Canada Inc.

- GFR Ingredients Ltd.