Global Helicobacter Pylori Diagnostics Market By Product Type (Instruments, Services, and Reagents), By Application (Immunoassays, Molecular Diagnostics, and Point-of-Care (POC)), By End User (Hospitals, Diagnostic Laboratories, and Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 11895

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

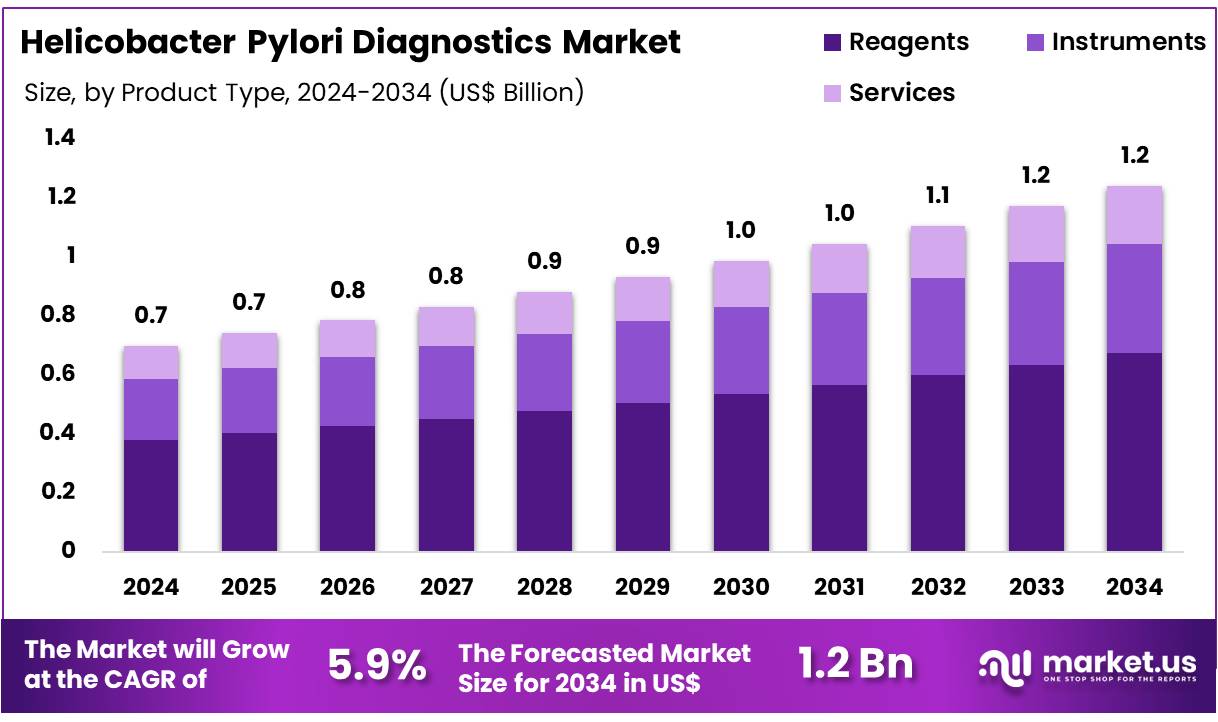

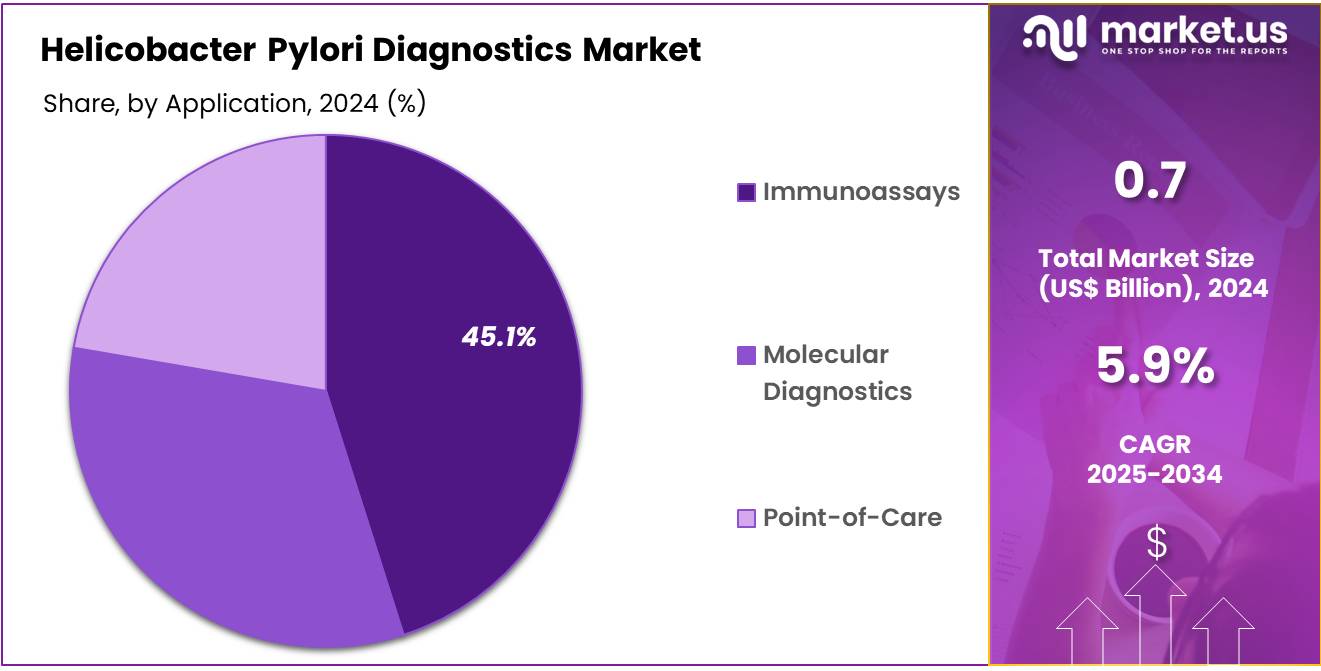

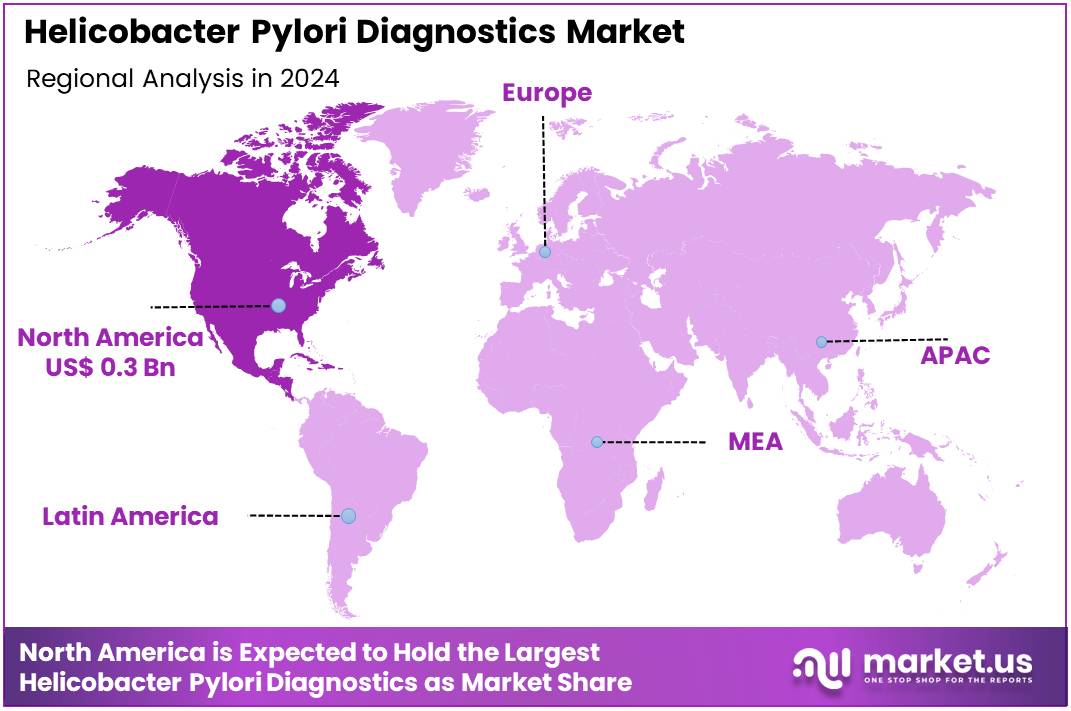

Global Helicobacter Pylori Diagnostics Market size is expected to be worth around US$ 1.2 Billion by 2034 from US$ 0.7 Billion in 2024, growing at a CAGR of 5.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 46.7% share with a revenue of US$ 0.3 Billion.

The increasing emphasis on identifying Helicobacter pylori (H. pylori) and its connection to various gastrointestinal conditions is fueling the expansion of the H. pylori diagnostics sector. H. pylori infections are associated with chronic gastritis, ulcers, and even gastric cancer, affecting a significant portion of the global population. As awareness grows about the importance of early detection, there is a rising demand for simple, efficient diagnostic solutions.

The market is benefiting from the need for accurate, quick, and cost-effective testing methods, especially non-invasive options such as breath tests, stool antigen tests, and serology. In May 2022, Biomerica, Inc. received CE Mark approval for its hp+detect diagnostic test for H. pylori, allowing the product to be marketed within the European Union and other regions, subject to local regulatory approvals. This marks a shift towards more streamlined and effective testing alternatives.

Moreover, the growing adoption of molecular diagnostics, such as PCR testing, is a significant trend in the industry, providing enhanced accuracy in H. pylori detection. Additionally, concerns about antibiotic resistance in H. pylori strains have led to a heightened demand for advanced diagnostic tools to optimize treatment strategies. With an ongoing focus on improving patient care, the H. pylori diagnostics market presents considerable potential for innovation and the development of new technologies and therapeutic approaches.

Key Takeaways

- In 2024, the market for helicobacter pylori diagnostics generated a revenue of US$ 0.7 Billion, with a CAGR of 5.9%, and is expected to reach US$ 1.2 billion by the year 2034.

- The product type segment is divided into instruments, services, and reagents, with reagents taking the lead in 2024 with a market share of 54.2%.

- Considering application, the market is divided into immunoassays, molecular diagnostics, and point-of-care. Among these, immunoassays held a significant share of 45.1%.

- Furthermore, concerning the end user segment, the market is segregated into hospitals, diagnostic laboratories, and clinics. The hospitals sector stands out as the dominant player, holding the largest revenue share of 58.9% in the helicobacter pylori diagnostics market.

- North America led the market by securing a market share of 46.7% in 2024.

Product Type Analysis

Reagents dominate the Helicobacter pylori diagnostics market, holding a significant 54.2% share. This growth is projected to persist as reagents play a critical role in the diagnostic process for detecting H. pylori infections. The increasing demand for accurate and rapid diagnostic solutions, particularly due to the rising prevalence of gastric disorders and ulcers associated with H. pylori, is driving the reagent market.

Continuous advancements in reagent technology, such as improved sensitivity and specificity, are expected to further boost their adoption across diagnostic settings. Additionally, the growing preference for non-invasive diagnostic methods, including stool antigen tests and urea breath tests both of which rely heavily on specialized reagents will continue to fuel market expansion. As the use of reagents expands in point-of-care and molecular diagnostics, the need for innovative and high-quality reagent products will remain strong.

Application Analysis

Immunoassays represent 45.1% of the market share in the H. pylori diagnostics segment, and this share is likely to grow further. Immunoassays, such as enzyme-linked immunosorbent assays (ELISA), are favored for their high sensitivity and specificity, making them an efficient and reliable method for detecting H. pylori infections. The increased focus on early diagnosis and treatment of gastric conditions linked to H. pylori, including ulcers and gastric cancer, is driving the demand for immunoassay-based tests.

Advancements in immunoassay technologies, including the development of faster and more user-friendly platforms, are anticipated to increase adoption in both hospital and outpatient settings. The cost-effectiveness, ease of use, and high throughput capabilities of immunoassays ensure their continued popularity in H. pylori diagnostics.

End-User Analysis

Hospitals account for the largest share of the H. pylori diagnostics market, with 58.9% of the market share. As the primary setting for diagnosing and treating complex H. pylori-related gastric diseases, hospitals are expected to continue seeing a rise in demand for diagnostic testing. The integration of technologies such as immunoassays, molecular diagnostics, and advanced imaging will enhance diagnostic accuracy and efficiency.

Furthermore, hospitals are increasingly focused on providing comprehensive patient care, which includes the use of reliable and accurate diagnostic tools for detecting infections like H. pylori. With growing healthcare expenditures and the expansion of hospital services, including specialized diagnostic tests for gastrointestinal diseases, hospitals will remain the dominant end-user segment in the H. pylori diagnostics market.

Key Market Segments

By Product Type

- Instruments

- Services

- Reagents

By Application

- Immunoassays

- Molecular Diagnostics

- Point-of-Care (POC)

By End User

- Hospitals

- Diagnostic Laboratories

- Clinics

Drivers

Rising Global Prevalence of H. pylori Infection Driving Market Demand

The increasing global prevalence of Helicobacter pylori (H. pylori) infection, a primary cause of chronic gastritis, peptic ulcers, and gastric cancer, is significantly driving the H. pylori diagnostics market. Early and accurate detection of this infection is crucial for effective treatment, preventing severe gastrointestinal complications, and reducing the long-term risk of gastric malignancies. As public health organizations and clinical guidelines emphasize the screening and eradication of H. pylori in high-risk populations, the demand for diagnostic tools remains strong.

A systematic review and meta-analysis published in November 2024 in the World Journal of Gastroenterology, which synthesized data from 152 studies, reported a combined H. pylori prevalence of 42.8% in China between 2014 and 2023. Globally, the infection affects around 4.4 billion individuals, with an estimated prevalence rate of 48.5%. Due to its classification as a Group 1 carcinogen by the World Health Organization, linked to gastric cancer, the persistent burden of this infection ensures sustained demand for effective diagnostic solutions to identify affected individuals and guide appropriate treatment.

Restraints

Challenges from Antibiotic Resistance and Market Constraints

The rising rates of antibiotic resistance in H. pylori strains represent a significant constraint on the market, as they lead to higher treatment failure rates and necessitate more complex diagnostic and re-testing protocols. When first-line eradication therapies fail, clinicians are often forced to use second- or third-line treatments, which are more expensive, have greater side effects, and typically require confirmation of successful eradication, complicating the diagnostic process.

A systematic review and meta-analysis published in BMC Medicine in January 2025 highlighted concerning primary resistance rates to key antibiotics among children with H. pylori infections globally. Specifically, metronidazole resistance was reported at 35.3%, clarithromycin at 32.6%, and levofloxacin at 13.2%. This growing resistance directly impacts the effectiveness of standard eradication therapies and increases the need for post-treatment diagnostics to confirm eradication, thereby raising re-testing costs and limiting market growth potential.

Opportunities

Growth Opportunities from Advancements in Non-Invasive and Molecular Diagnostics

Technological advancements in non-invasive and molecular diagnostic methods are creating significant growth opportunities within the market. Enhanced urea breath tests, refined stool antigen tests, and emerging nucleic acid amplification tests (NAATs) offer improved accuracy, faster results, and greater convenience compared to traditional invasive diagnostic methods, such as endoscopy with biopsy. These innovations not only reduce patient discomfort but also expand access to diagnosis, particularly in low-resource settings.

The FDA’s January 2024 approval of the PyloPlus UBT System for the qualitative detection of urease associated with H. pylori in human stomachs further demonstrates regulatory support for non-invasive diagnostic tools. Moreover, the development of molecular tests capable of detecting antibiotic resistance markers directly from clinical samples is poised to revolutionize treatment guidance, leading to more personalized and effective eradication strategies. These ongoing technological innovations expand the utility and accessibility of H. pylori detection, contributing to market growth.

Impact of Macroeconomic / Geopolitical Factors

Global economic conditions, such as inflation and the prioritization of public health investments, have a significant impact on the H. pylori diagnostics market. Inflation may increase manufacturing costs for diagnostic kits, reagents, and equipment, potentially making tests more expensive and limiting access in resource-constrained regions. However, governments and international public health organizations continue to recognize the critical importance of diagnosing and treating infectious diseases like H. pylori, leading to sustained investment in diagnostic tools.

The World Health Organization’s Global Spending on Health report for 2024 noted that while global health spending fell to US$9.8 trillion in 2022, the average health spending per capita remained above pre-pandemic levels. This indicates ongoing commitment to public health investments, despite economic fluctuations. Geopolitical stability also plays a crucial role in ensuring consistent supply chains for diagnostic components and reagents, which are often sourced internationally. As such, the critical need to manage and prevent H. pylori-related diseases ensures continued investment in advanced diagnostic solutions, supporting long-term market growth.

US trade policies, particularly tariffs on imported diagnostic components, are shaping the H. pylori diagnostics market by influencing manufacturing costs and reshaping supply chain strategies for key industry players. Manufacturers of H. pylori diagnostic tests often rely on intricate global supply chains for essential materials, such as enzymes and precision plasticware. Tariffs on these imports increase the costs for companies that manufacture in the US or import finished diagnostic kits for distribution.

The US Customs and Border Protection (CBP) reported collecting approximately US$77 billion in customs duties in fiscal year 2024, which highlights the broad impact of trade policies on the cost structure for businesses operating in the diagnostic sector. While these policies are intended to bolster domestic manufacturing, they primarily create more expensive and complex operational environments for companies. Nevertheless, the critical need for accurate H. pylori diagnosis encourages manufacturers to adapt their supply chain strategies and absorb some of these increased costs to ensure continued access to essential diagnostic tools in the US market.

Latest Trends

Emerging Trends in Point-of-Care Testing and Rapid Diagnostics

A significant trend shaping the H. pylori diagnostics market in 2024 and into 2025 is the increasing adoption of point-of-care testing (POCT) and rapid diagnostic solutions. Healthcare providers are increasingly seeking convenient, immediate testing options that offer quick results in various clinical settings, such as physician offices, urgent care centers, and community clinics. Point-of-care testing for H. pylori, including rapid urease tests on biopsy samples, rapid stool antigen tests, and breath tests, provides prompt diagnostic confirmation without the need for extensive laboratory processing.

While specific data on the number of H. pylori POCTs performed in 2024 is not readily available, trends from the broader diagnostics sector indicate growing demand for these decentralized testing solutions. For instance, Abbott Laboratories reported a global Diagnostics segment revenue of US$2.214 billion in Q1 2024, reflecting ongoing demand for accessible diagnostic tools, including those for H. pylori. This shift toward rapid and point-of-care testing enhances diagnostic turnaround times and facilitates immediate patient management.

Regional Analysis

North America is leading the Helicobacter Pylori Diagnostics Market

The Helicobacter pylori diagnostics market in North America, accounting for a substantial 46.7% market share, experienced significant growth in 2024. This surge can be attributed to the enduring prevalence of H. pylori infections, growing awareness of its association with various gastrointestinal disorders, and advancements in diagnostic technologies.

A meta-analysis conducted between 1980 and 2022 indicated a prevalence rate of 36.2% for H. pylori in North America, while more recent data from the Veterans Health Administration (1999–2018) showed that 25.8% of tested individuals were diagnosed with the infection, reflecting a significant patient population in need of diagnostic services. The continued emphasis on early detection and eradication to prevent severe conditions like peptic ulcers and gastric cancer has further fueled the demand for diagnostics.

Notably, stomach cancer remains a critical issue, with 10,976 deaths reported in the US in 2022, as per the World Cancer Research Fund. Leading diagnostic companies, such as Abbott, have shown strong financial performance in response to this demand. Abbott’s Diagnostics segment reported US sales of US$3.83 billion for the full year of 2024, reflecting steady growth and optimistic projections for continued expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

In the Asia Pacific region, the Helicobacter pylori diagnostics market is poised for considerable growth in the forecast period. This expansion is primarily driven by the high prevalence of H. pylori infections, the increasing burden of related gastrointestinal diseases, and improvements in healthcare infrastructure coupled with better access to diagnostic services. A systematic review and meta-analysis published in the World Journal of Gastroenterology in November 2024 reported a combined H. pylori prevalence of 42.8% in mainland China between 2014 and 2023, underscoring a substantial population in need of diagnostic solutions.

Furthermore, East Asia, particularly China, accounts for a significant share of the global gastric cancer burden, with China alone reporting approximately 358,700 new stomach cancer cases in 2022, as per data from the International Agency for Research on Cancer (IARC). Governments and health organizations across the region are focusing on strengthening noncommunicable disease prevention and control, including initiatives to improve gastric health.

Thermo Fisher Scientific, a key player in the diagnostics market, reported a total revenue of US$42.88 billion for the full year of 2024, with a strong operational presence in the Asia Pacific region. Abbott’s international diagnostics sales (excluding COVID-19 testing) also grew by 0.8% in 2024, further indicating continued activity and growth potential in key international markets. These factors highlight the significant and expanding market for H. pylori diagnostic solutions across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Helicobacter pylori diagnostics sector implement several strategic approaches to ensure growth. These include expanding their product portfolios, focusing on innovative diagnostic technologies, and fostering partnerships with research institutions to enhance the accuracy and efficiency of their offerings. Strategic mergers and acquisitions further enable them to enter new geographical markets and diversify their revenue streams.

Players also concentrate on strengthening their marketing efforts, driving awareness, and positioning their products as cost-effective solutions for widespread use. Additionally, companies invest significantly in research and development to keep pace with evolving diagnostic needs. These strategies help maintain competitive advantage and secure long-term market dominance.

One of the major players, Biohit Oyj, is a Finnish biotechnology company specializing in diagnostic solutions. The company focuses on providing high-quality diagnostic tools and tests for gastrointestinal diseases, including those related to Helicobacter pylori. Their commitment to research, along with their ability to adapt to market trends, enables them to offer precise and user-friendly diagnostic solutions, making them a key player in the healthcare diagnostics industry.

Top Key Players

- Thermo Fisher Scientific

- Quest Diagnostics Incorporated

- Meridian Bioscience

- Hoffmann-La Roche Ltd

- Epitope Diagnostics, Inc

- Coris BioConcept

- Certest Biotec

- Bio-Rad Laboratories

- Biohit Oyj

- Alpha Laboratories Ltd

Recent Developments

- In July 2023, Meridian Bioscience, Inc. received FDA approval for its Premier HpSA FLEX, a non-invasive immunoassay that detects H. pylori antigens in both preserved and unpreserved stool samples. This new tool enhances flexibility in diagnosing H. pylori infections, complementing the company’s portfolio, which includes BreathID, Curian HpSA, and ImmunoCard Stat! HpSA, all of which are used to identify conditions like gastritis and gastric cancer.

- In December 2023, Biomerica, Inc. obtained FDA 510(k) clearance for its HP Detect Stool Antigen ELISA test, designed to detect H. pylori infection. As H. pylori affects a significant portion of the US population, this test aids in identifying the infection, which is associated with gastric cancer, a leading cause of cancer-related deaths worldwide.

Report Scope

Report Features Description Market Value (2024) US$ 0.7 Billion Forecast Revenue (2034) US$ 1.2 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Instruments, Services, and Reagents), By Application (Immunoassays, Molecular Diagnostics, and Point-of-Care (POC)), By End User (Hospitals, Diagnostic Laboratories, and Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Quest Diagnostics Incorporated, Meridian Bioscience, F. Hoffmann-La Roche Ltd, Epitope Diagnostics, Inc, Coris BioConcept, Certest Biotec, Bio-Rad Laboratories, Biohit Oyj, Alpha Laboratories Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Helicobacter Pylori Diagnostics MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Helicobacter Pylori Diagnostics MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- Quest Diagnostics Incorporated

- Meridian Bioscience

- Hoffmann-La Roche Ltd

- Epitope Diagnostics, Inc

- Coris BioConcept

- Certest Biotec

- Bio-Rad Laboratories

- Biohit Oyj

- Alpha Laboratories Ltd