Global Heating Equipment Market By Product Type(Furnaces, Heat Pumps, Boilers, Unitary Heaters, Radiators, Others), By End-Use(Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: October 2024

- Report ID: 14761

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

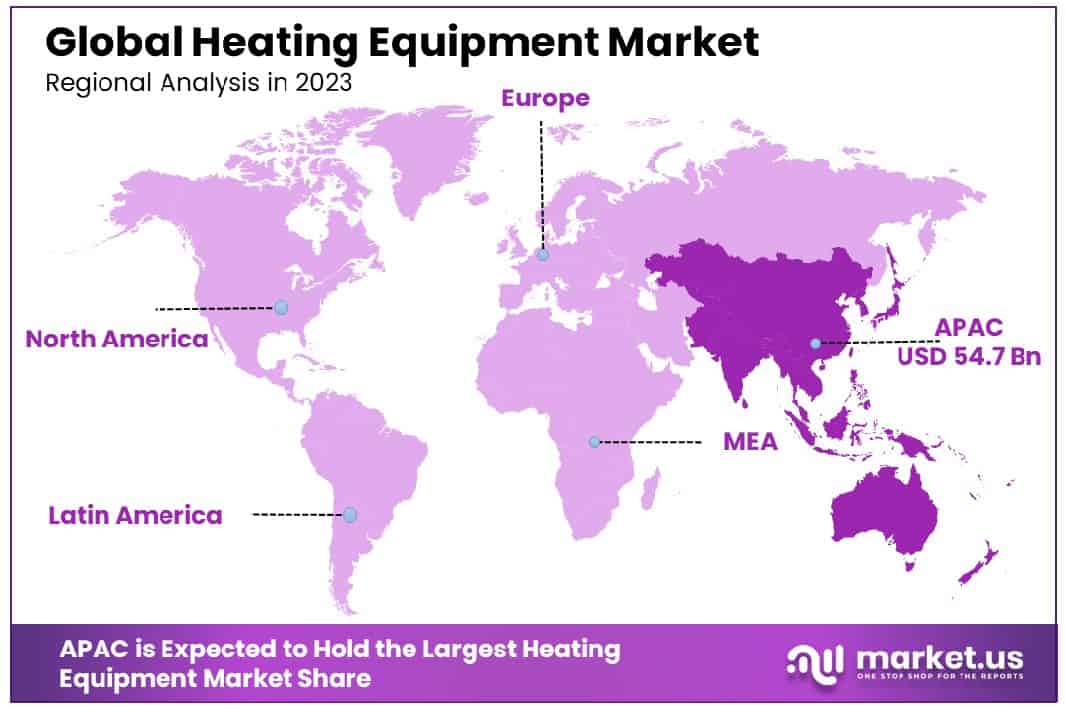

The Global Heating Equipment Market size is expected to be worth around USD 267.5 Billion by 2033, From USD 128.6 Billion by 2023, growing at a CAGR of 7.60 during the forecast period from 2024 to 2033. Asia Pacific dominated a 42.6% market share in 2023 and held USD 54.7 Billion in revenue from the Heating Equipment Market.

The Heating Equipment Market encompasses a comprehensive array of systems and devices designed for the generation and distribution of heat in residential, commercial, and industrial settings.

This market includes but is not limited to, central heating systems, heat pumps, furnaces, boilers, and radiators. Driven by increasing demands for energy efficiency and reduced carbon emissions, the sector is witnessing significant technological advancements and regulatory changes.

Market growth is further propelled by the construction industry’s expansion and the modernization of existing infrastructure. They are strategically positioned to capitalize on emerging opportunities through innovation in product development, market expansion strategies, and sustainability practices.

The Heating Equipment Market has been witnessing a significant transition in consumer preference and technological advancement, underscoring a shift towards more energy-efficient and environmentally friendly solutions.

This transition is emblematic of the broader industry trends that prioritize sustainability and energy efficiency, which are increasingly becoming key factors in consumer purchasing decisions. The market’s evolution can be attributed to several drivers, including regulatory changes, advancements in heating technology, and a growing awareness of environmental issues.

Notably, the sales dynamics within the United States provide a compelling illustration of these trends. In 2022, heat pump sales experienced a remarkable increase, reaching approximately 4.3 million units. This figure not only underscores the rising demand for energy-efficient heating solutions but also marks a pivotal shift, as it surpasses the sales of traditional gas furnaces, which totaled around 3.9 million units.

This data is indicative of a broader market preference for heating solutions that offer both efficiency and environmental benefits. Heat pumps, known for their ability to provide heating and cooling efficiently by transferring heat rather than generating it through combustion, are at the forefront of this shift.

This trend is reflective of a market that is increasingly aligning with sustainable practices and energy efficiency. As regulatory environments continue to evolve and consumer preferences shift towards more sustainable and energy-efficient products, the Heating Equipment Market is expected to continue to undergo significant transformation.

This evolution presents both challenges and opportunities for manufacturers, requiring them to innovate and adapt in a competitive and rapidly changing landscape.

Key Takeaways

- Global Heating Equipment Market size is expected to be worth around USD 267.5 Billion by 2033, From USD 128.6 Billion by 2023, growing at a CAGR of 7.60% during the forecast period from 2024 to 2033.

- In 2023, Heat Pumps held a dominant market position in the Product Type segment of the Heating Equipment Market, with a 55.4% share.

- In 2023, Residential held a dominant market position in the end-use segment of the Heating Equipment Market, with a 69.3% share.

- Asia Pacific dominated a 42.6% market share in 2023 and held USD 54.7 Billion in revenue from the Heating Equipment Market.

By Product Type Analysis

In 2023, the Heating Equipment Market was distinguished by its diverse product offerings, with Furnaces, Heat Pumps, Boilers, Unitary Heaters, Radiators, and Others as its main segments.

Among these, Heat Pumps held a dominant market position in the “By Product Type” segment, capturing more than a 55.4% share. This substantial market share can be attributed to their energy efficiency, environmental benefits, and technological advancements, which have significantly increased their adoption in both residential and commercial settings.

The preference for Heat Pumps underscores a growing trend towards sustainable heating solutions, as consumers and businesses alike seek to reduce their carbon footprint and energy costs. This shift is reflective of broader market dynamics, where efficiency and sustainability are becoming key drivers of consumer choice and market growth.

By End-Use Analysis

In 2023, the Heating Equipment Market was segmented into Residential, Commercial, and Industrial categories. Residential held a dominant market position in the By End-Use segment, capturing more than a 69.3% share.

This significant market share can be attributed to the increasing demand for energy-efficient heating solutions in smart homes, coupled with the rising awareness of sustainable living practices among consumers.

The Commercial and Industrial segments also showed notable activity, driven by advancements in heating technologies and the growing need for cost-effective and environmentally friendly heating solutions in various business sectors.

Key Market Segments

By Product Type

- Furnaces

- Heat Pumps

- Boilers

- Unitary Heaters

- Radiators

- Others

By End-Use

- Residential

- Commercial

- Industrial

Drivers

Market Growth Factors for Heating Equipment

In the heating equipment market, several key drivers are promoting growth and expansion. Primarily, the increase in construction activities, particularly in the residential and commercial sectors, is a significant factor. As new buildings rise, the demand for heating solutions to ensure comfort and meet regulatory standards for energy efficiency intensifies.

Furthermore, technological advancements are propelling the market forward. Innovations such as smart thermostats and systems that integrate with home automation technologies not only enhance user convenience but also improve energy management, leading to cost savings and environmental benefits.

The shift towards sustainable energy solutions is also influencing market dynamics, as there is a growing preference for eco-friendly heating systems that minimize carbon footprints.

Additionally, government incentives and regulations aimed at reducing energy consumption and greenhouse gas emissions encourage the adoption of more efficient heating technologies. These factors collectively contribute to the robust growth trajectory of the heating equipment market.

Restraint

Challenges Facing the Heating Equipment Market

The heating equipment market faces several notable challenges that could hinder its growth. One major restraint is the high initial cost associated with purchasing and installing advanced heating systems. This upfront expense can be prohibitive for both residential and commercial consumers, especially in regions with lower economic activity or in markets sensitive to price fluctuations.

Additionally, the complexity of installing modern, energy-efficient heating systems requires skilled technicians, which can add to the overall costs and delay implementation times. Regulatory compliance is another hurdle, as manufacturers must constantly adapt to evolving standards aimed at reducing environmental impact, which can necessitate costly redesigns and reengineering of existing products.

Moreover, the rise of alternative heating technologies, like heat pumps and solar heating, introduces competition that traditional heating equipment manufacturers must contend with. Together, these factors create a challenging environment for market players.

Opportunities

Emerging Opportunities in the Heating Market

The heating equipment market is ripe with opportunities that promise substantial growth potential. Notably, the increasing emphasis on energy efficiency presents a significant opportunity for the development and sales of next-generation heating solutions.

As global awareness and legislative mandates on energy conservation strengthen, there is a higher demand for systems that offer superior efficiency and lower operational costs.

This trend is particularly pronounced in regions with cold climates where heating is essential, driving the adoption of innovative technologies such as geothermal and hybrid systems. Additionally, the retrofitting of older buildings with modern heating equipment offers a vast market potential.

Urbanization in emerging economies also contributes to market expansion, as new urban centers and renovations of existing structures require updated heating solutions. These dynamics provide a fertile ground for market players to introduce advanced, eco-friendly heating technologies that meet the modern consumer’s needs and regulatory standards.

Challenges

Barriers in the Heating Equipment Market

The heating equipment market faces several challenges that could impede its growth trajectory. A primary challenge is the fluctuating raw material prices, which can significantly affect production costs and, consequently, pricing strategies. This variability can make it difficult for manufacturers to maintain consistent profit margins.

Additionally, the market is subject to stringent environmental regulations that require continual investment in research and development to ensure compliance. This can strain resources, especially for smaller players who may lack the financial capacity to adapt quickly.

The competitive nature of the market also poses a challenge, as companies must constantly innovate to differentiate their products from those of competitors, which can be both costly and resource-intensive.

Furthermore, the integration of new technologies poses technical and scale challenges that can hinder the adoption and widespread implementation of newer, more efficient systems. These challenges necessitate strategic planning and adaptation to sustain growth and remain competitive.

Growth Factors

Growth Drivers in the Heating Equipment Sector

The heating equipment market is experiencing significant growth, driven by several key factors. Increased construction activities, particularly in the residential and commercial sectors, have led to heightened demand for efficient heating systems.

This growth is further bolstered by advancements in technology, such as smart thermostats and energy-efficient systems, which offer consumers cost savings and enhanced control over their heating solutions.

There’s also a growing trend towards environmental sustainability, driving the adoption of eco-friendly heating technologies that minimize energy consumption and reduce carbon emissions. Government policies and incentives promoting energy efficiency in heating solutions provide additional momentum.

Moreover, the expansion into emerging markets where urbanization and improved living standards are on the rise creates new opportunities for market players. These factors collectively contribute to the robust expansion of the heating equipment market.

Emerging Trends

Trends Shaping Heating Equipment Market

Emerging trends in the heating equipment market are significantly influencing its evolution and growth. A notable trend is the increasing integration of smart technology in heating systems, such as IoT-enabled devices that allow for remote monitoring and control, enhancing user convenience and operational efficiency.

There’s also a shift towards the use of renewable energy sources in heating technologies, like solar-powered and geothermal systems, driven by a global push for sustainability and reduced reliance on fossil fuels. Additionally, the demand for hybrid heating systems is rising, combining traditional heating methods with renewable energy technologies to optimize energy use and reduce environmental impact.

Another significant trend is the development of ultra-efficient heat pumps, which offer both heating and cooling capabilities, making them attractive for year-round climate control. These trends reflect a market that is increasingly focused on energy efficiency, sustainability, and technological innovation.

Regional Analysis

The Asia Pacific region commands a substantial 42.6% share of the global heating equipment market, reflecting its significant influence and leadership in this sector.

The heating equipment market exhibits significant regional diversity, reflecting varying climate conditions, economic development levels, and industrialization across the globe.

In North America, the market is characterized by a high demand for energy-efficient heating solutions, driven by stringent regulatory standards and increasing awareness about carbon footprint reduction.

Europe shares a similar focus on energy efficiency, with additional emphasis on integrating renewable energy sources due to strong environmental policies and incentives.

Asia-Pacific emerges as the dominating region, accounting for approximately 42.6% of the global market with a share of USD 54.7 Billion. This dominance can be attributed to rapid urbanization, industrial growth, and the expanding construction sector in emerging economies such as China and India. The region’s vast population base and escalating demand for residential and commercial heating solutions further fuel market expansion.

In contrast, the Middle East & Africa region present a market driven by the need for cooling rather than heating solutions, although certain areas with cooler climates exhibit demand for heating technologies. Investment in infrastructure development and an increasing focus on energy-efficient buildings contribute to the market’s growth in these regions.

Latin America, though smaller in market size compared to Asia-Pacific, is witnessing growth in the heating equipment market due to urbanization and climate diversity across the region. Economic stability and growing investment in residential and commercial construction are key factors propelling market growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the global heating equipment market in 2023, several key players have significantly influenced trends, innovations, and market dynamics. Among these, companies like Trane, Panasonic Holdings Corporation, Emerson Electric Co., Fujitsu, and Haier have demonstrated robust performance and innovation.

General Electric and Hitachi, Ltd., alongside Midea Group and Mitsubishi Electric Corporation, have continued to leverage technological advancements to enhance product efficiency and sustainability.

Johnson Controls, Inc., Rheem Manufacturing Company, and Robert Bosch GmbH have focused on integrating smart technologies and IoT capabilities, catering to the growing demand for intelligent and energy-efficient heating solutions.

Daikin Industries, Ltd, LG Electronics, Inc., and Lennox International have been pivotal in driving the adoption of environmentally friendly refrigerants and heat pump technologies, reflecting the industry’s shift towards sustainability.

Samsung and Danfoss have made significant strides in customizing heating solutions for diverse climatic conditions and user needs, highlighting the importance of adaptability and user-centric design in the competitive landscape.

The growth of the market can be attributed to the increasing demand for energy-efficient heating solutions, spurred by rising energy costs and environmental concerns. The key players’ focus on R&D activities has facilitated the introduction of innovative products with enhanced performance and lower environmental impact.

Additionally, the expansion of smart home technologies has opened new avenues for the integration of heating systems into connected home ecosystems, offering convenience and improved energy management for consumers.

Top Key Players in the Market

- Trane

- Panasonic Holdings Corporation

- Emerson Electric Co.

- Fujitsu

- Haier

- General Electric

- Hitachi, Ltd.

- Midea Group

- Mitsubishi Electric Corporation

- Johnson Controls, Inc.

- Rheem Manufacturing Company

- Robert Bosch GmbH

- Daikin Industries, Ltd

- LG Electronics, Inc.

- Lennox International

- Samsung

- Danfoss

Recent Developments

- In February 2024, GN Feature highlights recent advancements in energy-efficient heating systems, emphasizing biomass pellets, electric fire starters, solar heating, geothermal heat pumps, and smart controls, promoting sustainability and comfort.

- In January 2024, Rheinmetall introduces a plug-and-play heat pump solution for hydrogen-powered trucks, enhancing efficiency and extending vehicle range. The innovation supports sustainable transport and expands Rheinmetall’s thermal management solutions into the H2 market.

- In January 2024, Nextac’s Ephoca wins AHR’s Product of the Year for reimagining PTAC units with 61 patent-pending innovations, focusing on energy efficiency and total comfort control, disrupting the PTAC market status quo.

- In January 2024, Cornwall leads in climate innovation with Mitchell and Webber’s trial of vegetable oil heating systems, reducing emissions by up to 90% in Kehelland.

Report Scope

Report Features Description Market Value (2023) USD 128.6 Billion Forecast Revenue (2033) USD 267.5 Billion CAGR (2024-2033) 7.60% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type(Furnaces, Heat Pumps, Boilers, Unitary Heaters, Radiators, Others), By End-Use(Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Trane, Panasonic Holdings Corporation, Emerson Electric Co., Fujitsu, Haier, General Electric, Hitachi, Ltd., Midea Group, Mitsubishi Electric Corporation, Johnson Controls, Inc., Rheem Manufacturing Company, Robert Bosch GmbH, Daikin Industries, Ltd, LG Electronics, Inc., Lennox International, Samsung, Danfoss Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Heating Equipment MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Heating Equipment MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Trane

- Panasonic Holdings Corporation

- Emerson Electric Co.

- Fujitsu

- Haier

- General Electric

- Hitachi, Ltd.

- Midea Group

- Mitsubishi Electric Corporation

- Johnson Controls, Inc.

- Rheem Manufacturing Company

- Robert Bosch GmbH

- Daikin Industries, Ltd

- LG Electronics, Inc.

- Lennox International

- Samsung

- Danfoss