Global Healthcare Reimbursement Market By Claim Payment Type (Underpaid Claims and Fully Paid Claims), By Reimbursement Model (Fee-For-Service, Capitation, Global Reimbursement, Bundled / Episode-Based and Cost-based), By Provider (Hospitals, Physician Offices/Clinics, Diagnostic Laboratories and Specialty Centers), By Payer (Public Payer and Private Payer), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178599

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

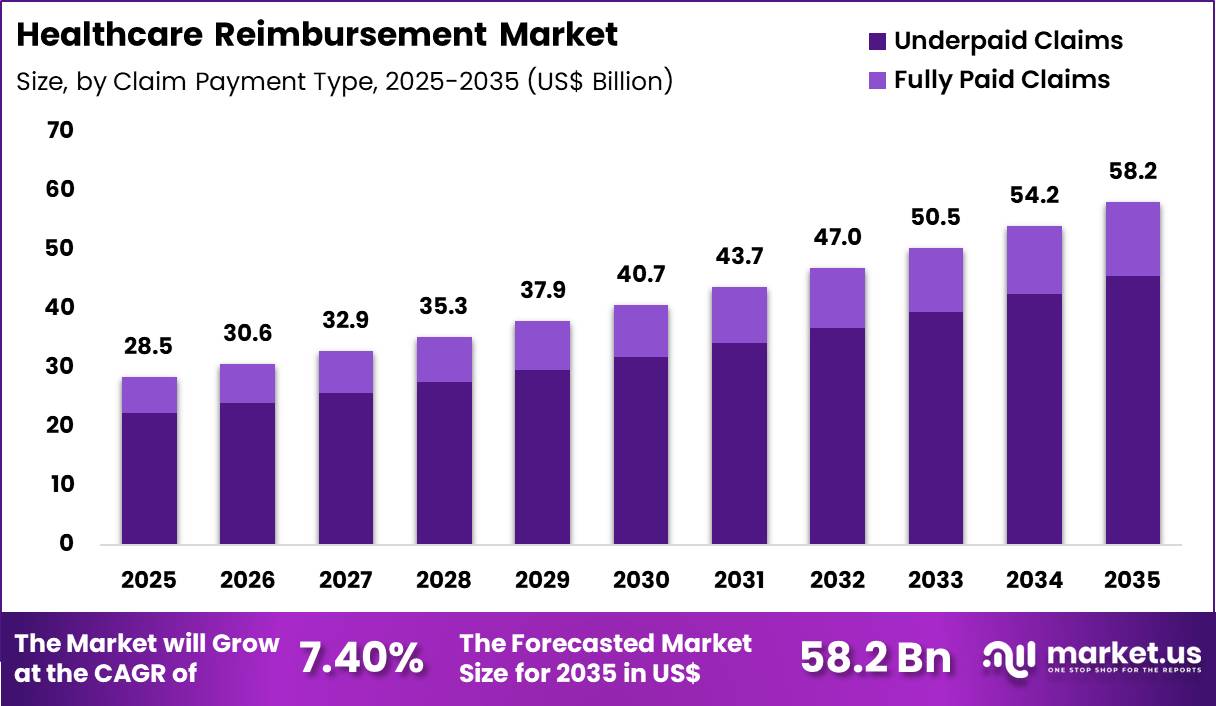

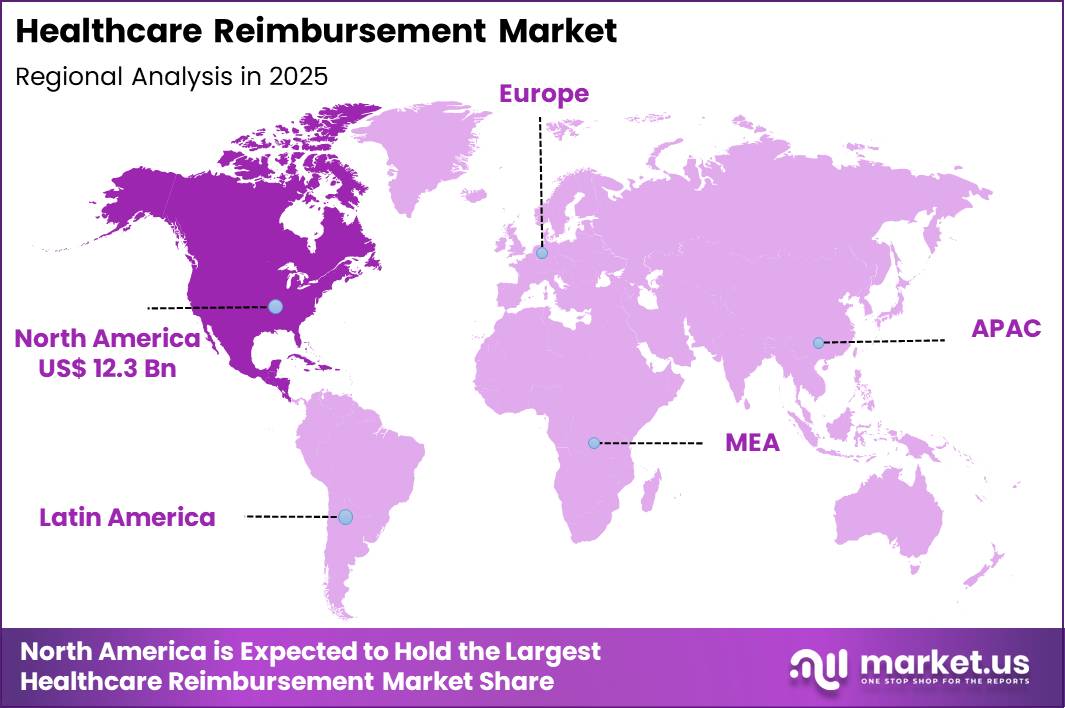

The Global Healthcare Reimbursement Market size is expected to be worth around US$ 58.2 Billion by 2035 from US$ 28.5 Billion in 2025, growing at a CAGR of 7.40% during the forecast period 2026-2035. In 2025, North America led the market, achieving over 43.1% share with a revenue of US$ 12.3 Billion.

Rising healthcare costs and the shift toward value-based care models drive the healthcare reimbursement market as payers and providers seek mechanisms that align payments with quality outcomes and cost efficiency.

Insurance companies increasingly implement bundled payment systems for episodes of care such as joint replacements and cardiac procedures, incentivizing coordinated delivery across hospitals, physicians, and post-acute providers to reduce readmissions and complications.

These arrangements support accountable care organizations that share financial risk, rewarding providers for improving chronic disease management in diabetes, heart failure, and chronic kidney disease through preventive services and care coordination.

Government programs expand alternative payment models that tie reimbursement to performance metrics, including reductions in hospital-acquired conditions and improvements in patient satisfaction scores. Private payers apply risk-adjusted capitation for primary care and specialty networks, encouraging population health strategies that lower utilization of high-cost interventions.

Employers adopt reference-based pricing and direct contracting with high-performing facilities for elective surgeries, promoting transparency and cost control in musculoskeletal and cardiovascular care.

Payers and providers pursue opportunities to integrate advanced analytics and digital platforms that enhance reimbursement accuracy, expanding applications in real-time claims adjudication and fraud detection for complex procedures and high-cost biologics.

Developers advance value-based contracting models that incorporate social determinants of health data, broadening utility in underserved populations with multiple chronic conditions. These innovations facilitate outcome-based agreements for specialty pharmaceuticals, where reimbursement adjusts based on clinical response in oncology, rare diseases, and autoimmune disorders.

Opportunities emerge in collaborative care networks that share data to optimize resource allocation and demonstrate cost savings. Companies invest in automated prior authorization tools and predictive modeling that streamline approvals for durable medical equipment and home health services.

Recent trends emphasize transparency in pricing and bundled payments for maternity care and behavioral health, positioning the healthcare reimbursement market as a key driver of sustainable, quality-focused delivery systems.

Key Takeaways

- In 2025, the market generated a revenue of US$ 28.5 Billion, with a CAGR of 7.40%, and is expected to reach US$ 58.2 Billion by the year 2035.

- The claim payment type segment is divided into underpaid claims and fully paid claims, with underpaid claims taking the lead with a market share of 78.4%.

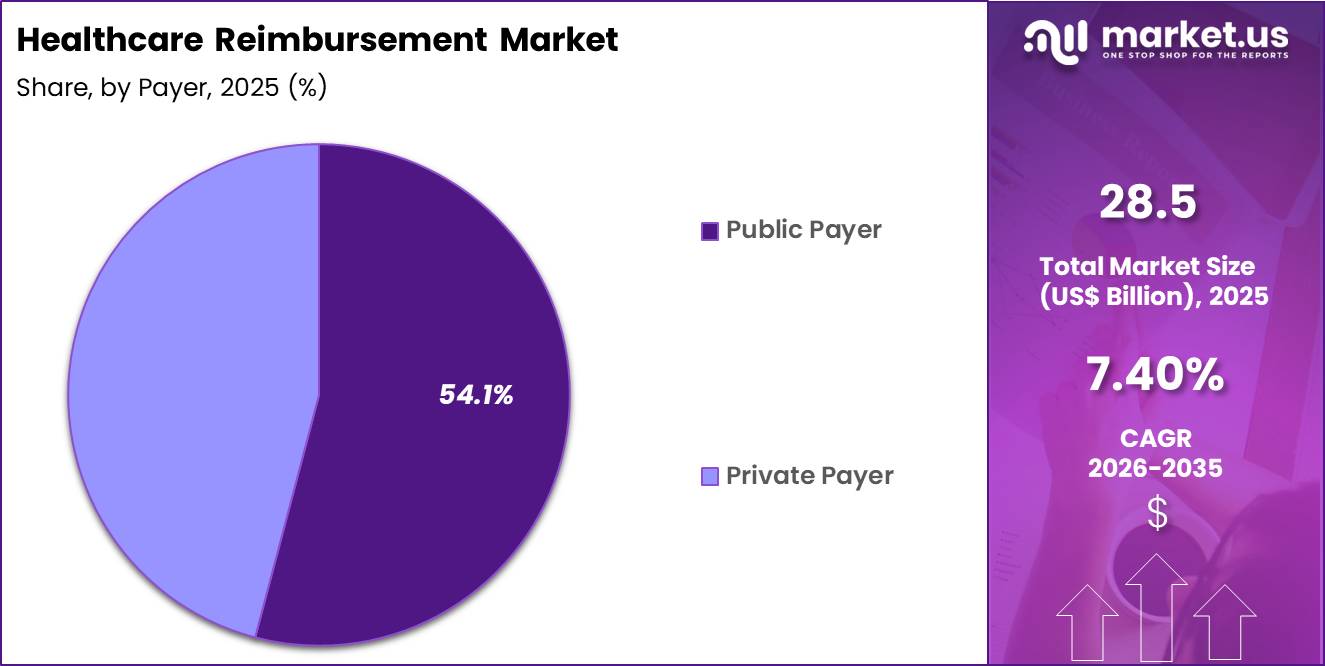

- Considering reimbursement model, the market is divided into fee-for-service, capitation, global reimbursement, bundled / episode-based and cost-based. Among these, public payer held a significant share of 54.1%.

- Furthermore, concerning the provider segment, the market is segregated into hospitals, physician offices/clinics, diagnostic laboratories and specialty centers. The fee-for-service sector stands out as the dominant player, holding the largest revenue share of 46.3% in the market.

- The payer segment is segregated into public payer and private payer, with the hospitals segment leading the market, holding a revenue share of 47.0%.

- North America led the market by securing a market share of 43.1%.

Claim Payment Type Analysis

Underpaid claims accounted for 78.4% of growth within claim payment type and dominated the healthcare reimbursement market due to rising billing complexity and frequent coding discrepancies. Providers increasingly identify payment gaps through audit and analytics systems, which expands focus on recovery management.

Regulatory updates and shifting payer policies create interpretation differences that contribute to underpayment disputes. Hospitals and clinics invest in revenue cycle optimization to address recurring shortfalls.

Growth strengthens as providers deploy advanced claim review software and denial management teams. Expansion of value-based metrics introduces additional adjustment variables that influence final payments. Increased scrutiny of documentation requirements further elevates underpayment detection.

Outsourced revenue cycle services also amplify recovery efforts. The segment is expected to remain dominant as financial sustainability pressures drive providers to actively pursue reimbursement corrections.

Reimbursement Model Analysis

Public payers contributed 54.1% of growth within payer and led the healthcare reimbursement market due to broad coverage populations and standardized payment structures. Government-funded programs manage large beneficiary volumes, which generate substantial claim flow across hospitals and outpatient facilities. Policy reforms and reimbursement updates directly influence provider revenue streams. Expansion of publicly funded insurance programs increases administrative and payment activity.

Growth continues as aging populations expand enrollment in public healthcare schemes. Public payers implement new reporting and compliance requirements that increase processing volumes. Digital claim submission systems enhance transparency and tracking.

Providers closely monitor public reimbursement rates to maintain financial stability. The segment is anticipated to maintain leadership as public healthcare financing continues to anchor national health systems.

Provider Analysis

Fee-for-service generated 46.3% of growth within reimbursement model and emerged as the leading segment due to its longstanding role in compensating providers per service rendered. Healthcare systems rely on fee-based structures for procedural clarity and straightforward billing alignment.

Providers favor this model for predictable service-level compensation tied directly to patient encounters. High procedural volumes across hospitals reinforce transaction frequency under this framework.

Growth accelerates as specialty procedures and diagnostic testing increase. Billing systems remain heavily configured around fee-based coding standards, which sustains operational continuity. Incremental adjustments in service pricing further stimulate claim volume.

Transition toward hybrid models still retains a strong fee-for-service foundation. The segment is projected to remain dominant as traditional reimbursement mechanisms continue to underpin healthcare payment flows.

Payer Analysis

Hospitals accounted for 47.0% of growth within provider and dominated the healthcare reimbursement market due to their concentration of high-cost, high-complexity services. Inpatient admissions, surgical interventions, and emergency care generate substantial claim value per episode.

Hospitals manage extensive billing operations to process diverse service categories. Regulatory reporting and compliance standards further increase reimbursement activity within institutional settings.

Growth strengthens as hospitals expand specialty services and integrate advanced diagnostics. Increasing patient acuity elevates claim complexity and reimbursement scrutiny. Investment in revenue cycle management technologies improves claim submission accuracy.

Public and private payer interactions further intensify administrative processes. The segment is expected to remain dominant as hospitals continue to represent the largest share of healthcare expenditure and reimbursement transactions.

Key Market Segments

By Claim Payment Type

- Underpaid Claims

- Fully Paid Claims

By Payer

- Public Payer

- Private Payer

By Reimbursement Model

- Fee-For-Service

- Capitation

- Global Reimbursement

- Bundled / Episode-Based

- Cost-based

By Provider

- Hospitals

- Physician Offices/Clinics

- Diagnostic Laboratories

- Specialty Centers

Drivers

Rising healthcare expenditure is driving the market.

The continuous increase in total healthcare spending worldwide has significantly expanded the scope and complexity of reimbursement systems. Governments and private payers face mounting pressure to manage costs while maintaining access to care. This growth necessitates more sophisticated reimbursement mechanisms to control utilization and ensure appropriate payments.

Healthcare providers require predictable revenue streams to sustain operations amid rising operational expenses. The correlation between higher spending and greater demand for insured services amplifies the role of reimbursement frameworks.

Public health insurance programs are expanding coverage to address unmet needs, further increasing reimbursement volumes. National budgets allocate larger portions to health, supporting broader reimbursement policies. Payers are implementing more granular payment models to align incentives with value-based outcomes.

Key stakeholders are investing in data infrastructure to support accurate claims processing. According to the Centers for Medicare & Medicaid Services, U.S. national health expenditure reached $4.9 trillion in 2023, representing 17.6% of gross domestic product.

Restraints

Persistent budget deficits in public payers are restraining the market.

Ongoing fiscal constraints within government-funded health programs limit the ability to expand reimbursement rates or cover emerging therapies. Many public payers operate under fixed or slowly growing budgets while facing rising enrollment and utilization. This mismatch creates downward pressure on provider payments and coverage decisions.

Regulatory bodies frequently impose cost-containment measures such as prior authorization and utilization management. These policies reduce provider revenue and slow adoption of innovative treatments. In regions with high public insurance reliance, reimbursement delays and denials become more frequent.

Payers prioritize essential services, restricting funding for elective or high-cost procedures. This restraint affects provider financial stability and willingness to accept certain insured patients. Industry efforts to negotiate higher rates face strong resistance from budget-limited entities. Despite increasing demand, fiscal limitations continue to constrain reimbursement growth.

Opportunities

Expansion of value-based payment models is creating growth opportunities.

The shift toward value-based reimbursement arrangements presents substantial potential for more sophisticated payment systems that reward quality and outcomes. Payers are increasingly tying compensation to measurable performance metrics rather than volume alone. This transition encourages development of advanced analytics and reporting capabilities.

Providers can capture additional revenue through shared savings and quality incentives. Government programs are expanding mandatory participation in value-based models. The large population covered by public insurance amplifies the scale of these opportunities.

Policy reforms continue to support alternative payment models in both commercial and government sectors. Organizations that excel in care coordination and outcome measurement gain competitive advantages. This opportunity aligns with broader efforts to improve efficiency and patient experience. In 2024, Medicare Advantage plans enrolled 33.8 million beneficiaries, representing more than half of all Medicare beneficiaries.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the healthcare reimbursement market through government budgets, employer sponsored insurance costs, and overall healthcare expenditure trends. Inflation and higher interest rates increase fiscal pressure on public payers and private insurers, which leads to tighter coverage criteria and slower claim approvals.

Geopolitical tensions disrupt pharmaceutical and medical device supply chains, raising treatment costs that feed directly into reimbursement negotiations. Current US tariffs on imported drugs, components, and medical equipment elevate provider expenses, which intensifies pricing discussions between payers and healthcare systems.

These pressures can strain margins for hospitals and create delays in updating reimbursement schedules. On the positive side, cost pressures drive stronger value based care models and encourage outcome focused payment frameworks.

Policymakers and insurers continue to invest in digital claims processing and fraud control to improve efficiency. With disciplined cost management and data driven reimbursement strategies, the market remains positioned for sustainable and structured growth.

Latest Trends

Implementation of AI-driven claims processing is a recent trend in the market.

In 2024, payers and third-party administrators rapidly deployed artificial intelligence tools to automate claims adjudication and reduce administrative burden. These systems analyze complex medical records and policy rules to determine coverage with greater speed and consistency. Leading organizations reported significant reductions in manual review requirements after implementation.

The trend focuses on improving first-pass accuracy and decreasing payment cycle times. UnitedHealth Group stated in its 2024 annual report that AI-powered tools now process a substantial portion of claims with minimal human intervention. This advancement addresses longstanding inefficiencies in traditional claims workflows.

Regulatory agencies have begun providing guidance on responsible use of AI in payment determinations. Industry collaborations continue to refine algorithms for complex specialty services. These developments aim to lower administrative costs while maintaining payment accuracy. AI integration positions the reimbursement ecosystem for greater efficiency in 2025 and beyond.

Regional Analysis

North America is leading the Healthcare Reimbursement Market

North America accounted for a 43.1% share of the Healthcare Reimbursement market in 2024, supported by expanding insurance coverage and rising healthcare utilization. Public and private payers strengthened digital claims processing systems to improve transparency, reduce fraud, and accelerate payment cycles.

Growth in chronic disease management, specialty drugs, and outpatient procedures increased overall claims volumes across Medicare, Medicaid, and commercial insurers. Value based care contracts encouraged providers to optimize documentation and coding accuracy, which expanded demand for advanced reimbursement management platforms.

Telehealth and remote patient monitoring services also entered mainstream coverage, widening the scope of payable services. Regulatory updates reinforced compliance standards and reporting requirements across payers and providers.

A clear supporting indicator comes from the Centers for Medicare and Medicaid Services, which reported that US national health expenditures reached USD 4.5 trillion in 2022, reflecting the substantial claims flow that sustains reimbursement infrastructure growth.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Healthcare Reimbursement market in Asia Pacific is expected to grow steadily during the forecast period as governments expand universal health coverage and digitize payment systems. Policymakers introduce insurance reforms to increase affordability and standardize billing frameworks.

Rapid hospital network expansion and rising private insurance enrollment increase claim volumes across emerging economies. Digital health records and electronic billing platforms strengthen administrative efficiency and reduce processing delays. Governments promote bundled payment models to improve cost control and service quality.

Growing middle class populations seek broader insurance coverage, which raises reimbursement activity across public and private sectors. A verifiable indicator appears in 2023 data from China’s National Healthcare Security Administration, which oversees medical insurance coverage for more than 1.3 billion people, underscoring the scale of payment systems that support continued regional expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the healthcare reimbursement market grow by developing advanced claims processing platforms, predictive analytics, and workflow automation that help payers and providers reduce administrative burden and improve payment accuracy.

They also expand service offerings with value-based care modules, real-time eligibility checks, and denials management tools that strengthen engagement with large health systems and insurers. Firms pursue strategic alliances with electronic health record vendors, clearinghouses, and specialty care networks to embed solutions deeper into clinical and administrative workflows that drive long-term contracts.

Geographic expansion into North America, Europe, and select emerging markets diversifies revenue streams and captures rising demand for cost-effective payment solutions amid regulatory complexity.

Optum, Inc. exemplifies a diversified healthcare services organization with a robust reimbursement and revenue cycle management portfolio, extensive data analytics capabilities, and deep integration with clinical operations that support efficient care delivery and financial performance.

The company advances performance through disciplined investment in technology innovation, coordinated partnerships, and a customer-centric approach that aligns solution development with payer and provider priorities.

Top Key Players

- United HealthCare Services, Inc.

- Cigna Healthcare

- CVS Health (Aetna)

- Blue Cross Blue Shield Association

- Waystar (Acquired Iodine Software)

- R1 RCM

- Optum (UnitedHealth Group)

- Allianz Care

- Aviva

- Waystar

- FinThrive

- Experian Health

- HealthEdge

- Waystar

Recent Developments

- In March 2025, Cigna Healthcare’s Global Health Benefits division introduced a new program in collaboration with Carrot Fertility. The offering is designed to provide integrated support for fertility care, family-building services, and hormonal health, specifically tailored for internationally mobile members and their partners.

- In November 2024, KindlyMD entered into a partnership with UnitedHealthcare to broaden insurance coverage across hospitals in Utah. The agreement expands patient access to KindlyMD’s services while strengthening its presence within the state’s healthcare network.

Report Scope

Report Features Description Market Value (2025) US$ 28.5 Billion Forecast Revenue (2035) US$ 58.2 Billion CAGR (2026-2035) 7.40% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Claim Payment Type (Underpaid Claims and Fully Paid Claims), By Reimbursement Model (Fee-For-Service, Capitation, Global Reimbursement, Bundled / Episode-Based and Cost-based), By Provider (Hospitals, Physician Offices/Clinics, Diagnostic Laboratories and Specialty Centers), By Payer (Public Payer and Private Payer) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape United HealthCare, Cigna Healthcare, CVS Health, Aviva, Agile Health, Wellcare, Allianz Care, BCBS, Waystar, FinThrive, Experian Health, HealthEdge, BNPP Paribas Cardif, Reliance Nippon. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Reimbursement MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Healthcare Reimbursement MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- United HealthCare Services, Inc.

- Cigna Healthcare

- CVS Health (Aetna)

- Blue Cross Blue Shield Association

- Waystar (Acquired Iodine Software)

- R1 RCM

- Optum (UnitedHealth Group)

- Allianz Care

- Aviva

- Waystar

- FinThrive

- Experian Health

- HealthEdge

- Waystar