Global Health Food Ingredient Market By Source (Plant, Animal, Microbial), By Form (Dry, Liquid), By Product Type (Protein, Vitamin, Mineral, Biotics), By Application (Food And Beverage, Pharmaceutical, Diet Supplement, Feeds, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 177509

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

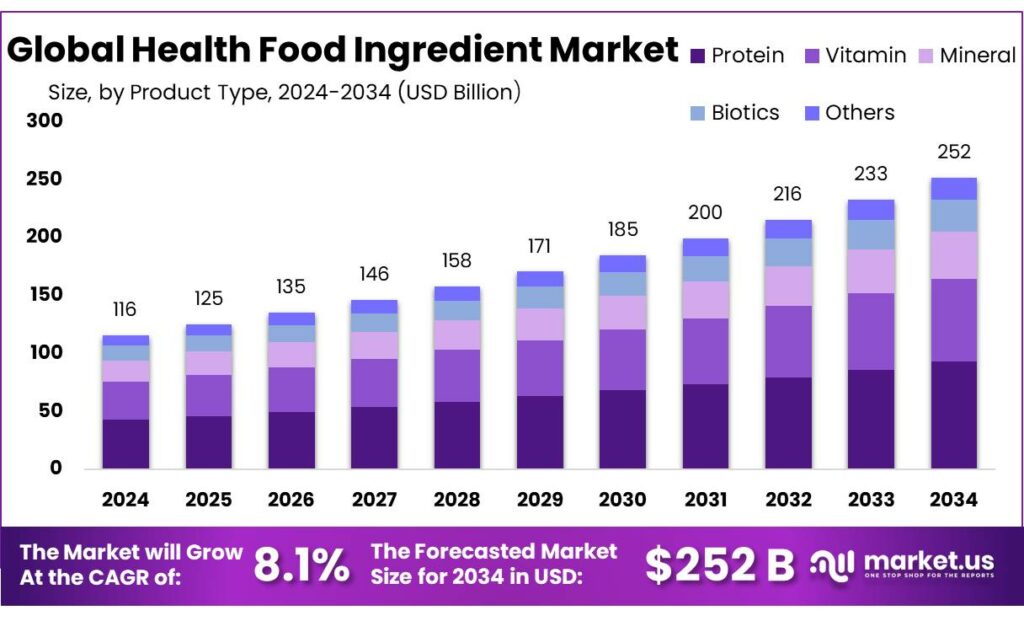

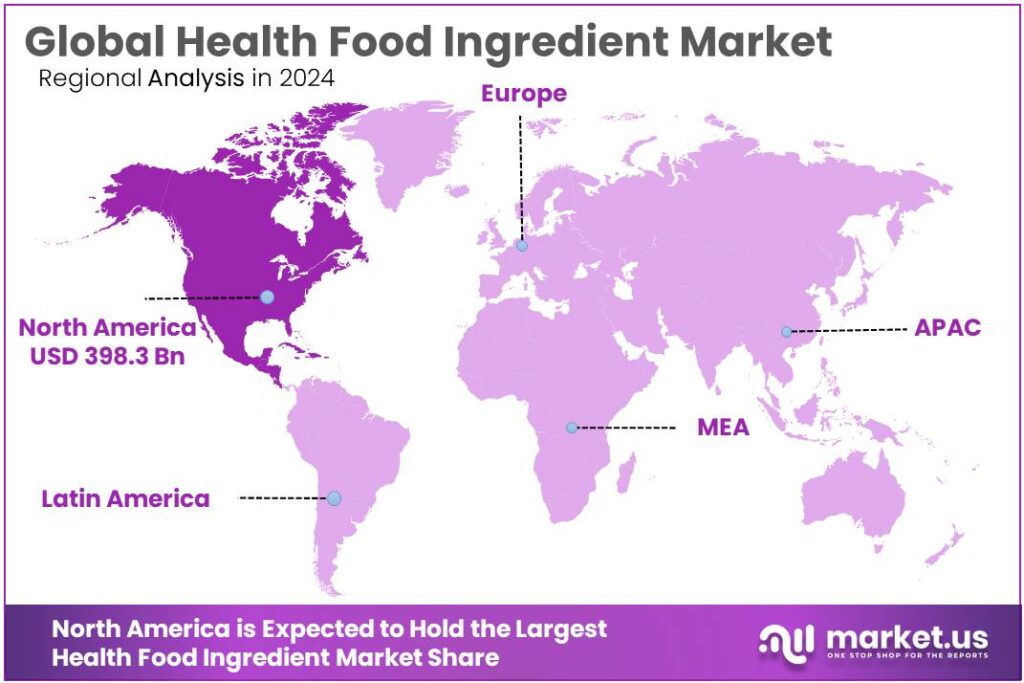

The Global Health Food Ingredient Market is expected to be worth around USD 252 Billion by 2034, up from USD 116 Billion in 2024, and is projected to grow at a CAGR of 8.1% from 2025 to 2034. The North America segment maintained 35.7%, supporting a Shore Power value of USD 398.3 Bn.

The health food ingredient industry sits at the intersection of nutrition science, consumer packaged goods, and preventive healthcare. It covers ingredients such as plant proteins, soluble fibers, omega oils, probiotics, vitamin–mineral premixes, botanical extracts, natural sweeteners, and functional carbohydrates that help brands formulate foods positioned for digestion, immunity, heart health, energy, weight management, or “clean label” nutrition.

Industry conditions are shaped by a fast-moving formulation race and tighter scrutiny of claims. Ingredient suppliers are investing in traceable sourcing, standardized actives, and food-grade clinical substantiation so that finished-product brands can defend on-pack statements and meet retailer compliance requirements. At the same time, the category’s commercial runway is supported by the continued growth of “better-for-you” segments such as organic and functional foods.

In the U.S., certified organic product sales reached $69.7 billion in 2023, signaling durable consumer willingness to pay for perceived health and integrity attributes. In Europe, the share of EU agricultural land under organic farming rose to 10.8% in 2023, showing that upstream conversion is expanding the ingredient base for health-positioned foods.

Key drivers are anchored in public health realities and behavior shifts. Globally, noncommunicable diseases caused at least 43 million deaths in 2021, equivalent to 75% of non-pandemic-related deaths, intensifying policy and consumer focus on diet quality. In the U.S., 57.6% of adults reported using at least one dietary supplement in the prior 30 days, reinforcing demand for foundational nutrients that often translate into fortified-food and functional-beverage innovation.

Consumer preference is also moving toward “food-first” functional benefits: the International Food Information Council reports that more than 9 in 10 consumers who try to consume protein and fiber get them from food, which encourages ingredient-led reformulation in everyday foods rather than niche pills.

Governments are actively shaping the space: Food Safety and Standards Authority of India launched the Eat Right India movement in July 2018 to promote safer and healthier food ecosystems, supporting a long-term pipeline for reformulation, fortification, and better ingredient standards in a high-growth consumption market.

In the U.S., U.S. Food and Drug Administration sought $7.2 billion in its FY2025 proposed budget to strengthen food safety and nutrition capacity—an enabling signal for compliant innovation and stronger oversight of claims and quality systems. In the EU, policy momentum remains clear: the Farm-to-Fork direction targets 25% of agricultural land under organic farming by 2030, supporting a larger, more standardized supply of health-positioned raw materials.

Key Takeaways

- Health Food Ingredient Market is expected to be worth around USD 252 Billion by 2034, up from USD 116 Billion in 2024, and is projected to grow at a CAGR of 8.1%.

- Plant held a dominant market position, capturing more than a 49.6% share of the global health food ingredient market.

- Dry held a dominant market position, capturing more than a 76.3% share of the overall health food ingredient market.

- Protein held a dominant market position, capturing more than a 37.9% share of the global health food ingredient market.

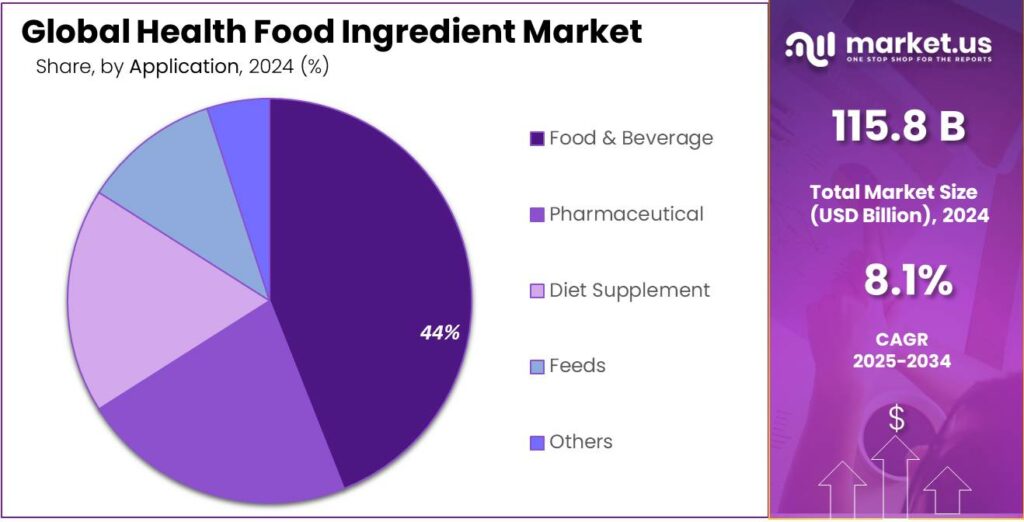

- Food & Beverage held a dominant market position, capturing more than a 44.8% share of the global health food ingredient market.

- North America dominates with 35.7% share 398.3 Bn.

By Source Analysis

Plant-Based Health Food Ingredients Lead with 49.6% Market Share in 2024

In 2024, Plant held a dominant market position, capturing more than a 49.6% share of the global health food ingredient market. This leadership reflects the steady shift toward natural, clean-label, and minimally processed nutrition. Consumers have become more selective about what goes into their everyday foods, and plant-sourced ingredients offer a balance of functionality, safety, and sustainability that aligns with this global movement.

Ingredient manufacturers report that plant proteins, botanical extracts, fibers, and natural antioxidants remain the fastest-adopted categories in functional snacks, fortified beverages, dairy alternatives, and wellness-oriented packaged foods. The momentum of plant-based diets also strengthened this segment in 2024, driven by rising awareness about heart health, digestive balance, and the environmental footprint of food production.

By Form Analysis

Dry Form Leads the Market with a Strong 76.3% Share in 2024

In 2024, Dry held a dominant market position, capturing more than a 76.3% share of the overall health food ingredient market. This clear leadership comes from the wide use of powdered, granulated, and dehydrated ingredients across functional foods, nutritional supplements, instant mixes, fortified beverages, and bakery applications.

Dry formats offer longer shelf life, better stability, and easier transportation, making them the preferred choice for both large-scale manufacturers and smaller clean-label brands. Consumers also tend to trust dry ingredients because they allow simple formulation and clear declaration on product labels. In 2024, ingredient suppliers expanded their portfolios of dry plant proteins, probiotic powders, vitamin–mineral blends, natural sweeteners, and botanical extracts, reflecting the industry’s push for more versatile and concentrated nutrition sources.

By Product Type Analysis

Protein Leads the Category with a Strong 37.9% Share in 2024

In 2024, Protein held a dominant market position, capturing more than a 37.9% share of the global health food ingredient market. This leadership reflects the growing consumer shift toward high-protein diets, muscle-supportive foods, and clean nutritional profiles across everyday eating. Protein ingredients—ranging from plant proteins like pea, soy, and rice to whey, collagen, and specialty blends—have become foundational in sports nutrition, functional snacks, fortified beverages, and meal-replacement categories.

In 2024, many brands reformulated their products with protein-rich inputs to meet rising demand for satiety, energy support, and better metabolic balance. The versatility of protein powders and isolates, along with their ability to improve texture and nutrient density, greatly strengthened the segment’s presence across mainstream food shelves.

By Application Analysis

Food & Beverage Leads the Market with a 44.8% Share in 2024

In 2024, Food & Beverage held a dominant market position, capturing more than a 44.8% share of the global health food ingredient market. This strong lead is driven by the rapid integration of functional ingredients into everyday food products, from fortified juices and high-protein snacks to clean-label bakery items and immunity-boosting beverages.

Consumers in 2024 increasingly preferred foods that offered both taste and targeted health benefits, such as digestive support, energy balance, or enhanced nutritional density. As a result, manufacturers expanded their use of plant proteins, dietary fibers, probiotics, natural sweeteners, botanical extracts, and vitamin-mineral blends. The broad acceptance of functional foods in supermarkets and convenience stores further strengthened the segment’s influence during the year.

Key Market Segments

By Source

- Plant

- Animal

- Microbial

By Form

- Dry

- Liquid

By Product Type

- Protein

- Vitamin

- Mineral

- Biotics

By Application

- Food & Beverage

- Pharmaceutical

- Diet Supplement

- Feeds

- Others

Emerging Trends

Digestive-health positioning is reshaping ingredients, from “probiotics” to smarter fiber systems

In 2024–2025, one of the clearest latest trends in health food ingredients is the mainstreaming of digestive-health benefits across everyday foods, not just supplements. Brands are increasingly building products around “gut-friendly” cues—fiber enrichment, fermented bases, and biotic-style ingredients—because digestion is an easy benefit for consumers to understand and feel. In the International Food Information Council 2024 survey, digestive health appears among the top benefits consumers seek from food, beverages, and nutrients, alongside energy and healthy aging.

This trend is also becoming more measurable at the consumer level. In IFIC’s gut health and probiotics survey, 24% of adults said digestive health is the most important aspect of their overall health, while another 48% said it is important but not the top priority. That split explains why manufacturers are targeting the “middle”: products that feel like normal food but quietly add digestive benefits. The same survey shows familiarity is already strong for traditional “biotic” ingredients—51% reported being familiar with probiotics—while newer terms like postbiotics and synbiotics lag behind, creating a runway for education-led products.

The product mix is shifting with this trend. Fermented and cultured formats are gaining attention because they naturally fit the digestion story. For example, U.S. cultured dairy has shown renewed momentum: one industry overview reported yogurt dollar sales up +6.5% and volume up +5.4%. Even when consumers do not read scientific definitions, fermented products signal “good for the gut,” which encourages manufacturers to invest in cultures, fermentation-derived flavors, and supportive ingredients that improve stability and taste.

Policy direction is reinforcing this trend by pushing clearer nutrition signals and reformulation—often increasing the need for fibers and functional ingredients that support both health goals and product quality. In the U.S., the U.S. Food and Drug Administration proposed a front-of-package “Nutrition Info box” approach in January 2025 to give at-a-glance information on saturated fat, sodium, and added sugars, which encourages brands to adjust formulas.

Drivers

Everyday food-first nutrition demand is pushing health ingredients into the mainstream

One major driving factor for health food ingredients is the clear shift toward food-first nutrition, where consumers prefer to get functional benefits from everyday foods rather than only from pills or niche products. In practice, this is translating into stronger demand for protein, fiber, probiotics, vitamin–mineral blends, and botanical actives that can be added to common formats like drinks, snacks, breakfast items, and dairy alternatives. The International Food Information Council’s 2024 Food & Health Survey found that more than 9 in 10 people who try to consume protein and fiber say they get them from food.

This demand is also tied to long-term health pressures that are hard for households and governments to ignore. The World Health Organization reports that noncommunicable diseases killed at least 43 million people in 2021, equal to 75% of non-pandemic-related deaths, and that 18 million people died from NCDs before age 70.

These numbers matter for the ingredient industry because they shape public attention around diet quality, sugar reduction, better fats, higher fiber intake, and higher protein intake. As a result, manufacturers increasingly treat functional ingredients as “must-have tools” to improve nutrition without changing consumer habits too dramatically—meaning the same snacks and beverages, but reformulated.

At the same time, the supplement market is not disappearing; it is simply reinforcing the broader wellness mindset that spills over into food and beverage innovation. In the United States, 57.6% of adults reported using at least one dietary supplement in the prior 30 days. When more than half of adults are already comfortable paying for health benefits, food brands have a strong reason to compete for that same consumer spending by offering functional benefits in convenient, familiar formats—ready-to-drink beverages, fortified staples, and better-for-you snacks.

Government initiatives also keep this driver active by pushing safer, healthier food environments that encourage reformulation and better ingredient practices. In India, FSSAI launched “The Eat Right Movement” on 10 July 2018 to improve public health and fight negative nutrition trends. More recently, a Government of India Press Information Bureau document (dated 8 July 2025) highlights scale milestones under Eat Right-linked programs, including 25 lakh food handlers trained under FoSTaC and certifications such as 284 Eat Right Stations and 249 Clean Street Food Hubs (status as of 6 July 2025).

Restraints

Limited ingredient transparency and safety concerns continue to slow wider adoption

One major restraining factor for the health food ingredient market is the growing concern around ingredient transparency, safety, and accuracy of labeling, which makes many consumers cautious about functional and fortified foods. Even though the demand for healthier options is rising, people increasingly question where ingredients come from, how they are processed, and whether labels truly reflect what is inside the product. These concerns make brands more hesitant to adopt advanced or novel ingredients unless they can guarantee clean documentation, consistent quality, and regulatory compliance.

A clear example of this restraint comes from global food safety monitoring. The World Health Organization (WHO) estimates that 600 million people fall sick every year from contaminated food, and 420,000 die annually, showing how sensitive consumers have become to food integrity. Although this number spans all food risks—not only health ingredients—it highlights a wider trust issue. When consumers are already concerned about food safety, any ingredient that sounds unfamiliar, overly processed, or insufficiently explained is met with hesitation.

Label compliance is another major barrier. The U.S. Food and Drug Administration (FDA) conducted nationwide inspections and issued over 400 warning letters in 2023 relating to food misbranding, improper ingredient declarations, or misleading health claims. These enforcement actions highlight how difficult it is for companies to meet standards when producing or importing ingredients—particularly natural extracts, probiotics, or novel sweeteners that need precise specification. Many small and mid-sized manufacturers simply avoid complex ingredients because meeting documentation requirements is too resource-heavy.

Governments are trying to address these concerns, but stronger oversight also increases compliance burdens for manufacturers. For instance, in India, the Food Safety and Standards Authority of India (FSSAI) intensified its enforcement activities under the “Eat Right India” movement. According to a 2025 Press Information Bureau document, FSSAI conducted over 3 lakh food safety surveillance inspections in the previous program cycle, along with rigorous checks on labeling and ingredient authenticity. While these actions protect consumers, they also increase operational challenges for ingredient suppliers, who must align with tighter rules for purity, documentation, and permissible claims.

Opportunity

Fortification-led public nutrition programs are opening a large, stable demand channel

One major growth opportunity for health food ingredients is the expansion of food fortification through public nutrition systems, because it creates repeat, high-volume demand for premixes and functional nutrients (iron, folic acid, vitamin B12, vitamin A, iodine, zinc, and related carriers). Unlike premium wellness launches that depend on marketing cycles, fortification programs are built into everyday consumption—staples and institutional meals—so ingredient volumes can scale quickly once specifications are standardized and procurement stabilizes.

The scale of the underlying nutrition need supports this opportunity. World Health Organization positions micronutrient deficiencies and diet-related risk as a long-term public health priority; for example, the agency highlights the ongoing global burden of anemia in women and children and tracks prevalence across countries and years. When governments respond to these gaps, they typically do so by strengthening staples because those foods reach the broadest population—meaning ingredient suppliers that can deliver stable, food-grade fortification blends have a clear runway.

Salt iodization shows how large the addressable base can become once a fortification approach is normalized. UNICEF reports that 89% of people worldwide consume iodized salt, indicating that a single fortified staple can achieve near-universal penetration in many markets. This matters for health food ingredients because it proves two things: mass fortification is operationally feasible at scale, and consumers generally accept fortified staples when taste and cooking performance are unchanged.

In India, the opportunity is becoming more concrete through fortified rice expansion. Press Information Bureau stated on 11 October 2024 that the Cabinet extended the universal supply of fortified rice under government welfare schemes from July 2024 to December 2028. A similar channel exists in the United States through national nutrition support programs that influence what millions of households buy every month. USDA Economic Research Service reported that WIC participation averaged 6.70 million people per month in FY 2024, and that WIC served an estimated 41% of all infants in the U.S.

Regional Insights

North America dominates with 35.7% share (398.3 Bn), backed by reformulation, premium wellness buying, and strong institutional nutrition channels.

North America is the dominating region in the Health Food Ingredient Market, led by the U.S. and supported by a mature ecosystem of ingredient innovators, large packaged-food manufacturers, and retailers that routinely scale functional claims across mainstream products. North America holds 35.7% and reaches 398.3 Bn, reflecting high penetration of better-for-you foods in categories such as ready-to-drink beverages, snacks, dairy alternatives, and fortified staples.

A key regional support signal is the size of wellness participation. In the United States, 57.6% of adults reported using at least one dietary supplement in the past 30 days, showing a broad habit of buying nutrition solutions that often transfers into functional foods and beverages. Demand is also reinforced by premium purchasing in natural and organic categories: the Organic Trade Association reported U.S. certified organic sales of $69.7 billion in 2023, helping pull more organic-compliant and clean-label ingredients through supply chains.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

DSM-Firmenich, formed through a 2023 merger, operates in 60+ countries and employs over 30,000 people, making it one of the largest global nutrition-ingredient providers. Its nutrition segment contributes more than EUR 7 billion annually, supporting vitamins, omega-3s, probiotics, and precision-fermentation innovations. Strong R&D spending—about 5% of revenue—positions the company at the forefront of science-based health ingredients.

Archer Daniels Midland operates with more than 270 plants and 420 crop procurement facilities, supporting a global supply of proteins, fibers, and natural extracts used in health food ingredients. In 2023, ADM generated USD 101.6 billion in revenue, enabling strong investment in clean-label systems, plant-based proteins, and functional nutrition solutions across North America and Europe.

BASF SE works in 90+ countries and runs 239 production sites globally, supplying vitamins, carotenoids, omega-3s, and scientific nutrition solutions. In 2023, BASF recorded EUR 68.9 billion in revenue. Its Nutrition & Care segment generated about EUR 6.5 billion, supporting consistent innovation in active ingredients for immune health, energy metabolism, and fortified foods.

Top Key Players Outlook

- Archer Daniels Midland Company

- DSM-Firmenich

- Kerry Group plc

- BASF SE

- Ingredion Incorporated

- Tate & Lyle plc

- Glanbia plc

- Arla Foods Ingredients

- Corbion NV

- International Flavors & Fragrances

Recent Industry Developments

In 2024, ADM reported net income of about USD 1.8 billion, assets of USD 53.3 billion, and employed 44,043 people, reflecting its scale and investment capacity for ingredient innovation.

In 2025, ADM continued this trend with net earnings of USD 1.1 billion and adjusted net earnings of USD 1.7 billion, reflecting steady demand for its health-oriented formulations that help consumer brands meet trends toward protein enrichment and better nutrition delivery.

Report Scope

Report Features Description Market Value (2024) USD 116 Bn Forecast Revenue (2034) USD 252 Bn CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plant, Animal, Microbial), By Form (Dry, Liquid), By Product Type (Protein, Vitamin, Mineral, Biotics), By Application (Food And Beverage, Pharmaceutical, Diet Supplement, Feeds, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland Company, DSM-Firmenich, Kerry Group plc, BASF SE, Ingredion Incorporated, Tate & Lyle plc, Glanbia plc, Arla Foods Ingredients, Corbion NV, International Flavors & Fragrances Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Health Food Ingredient MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Health Food Ingredient MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Archer Daniels Midland Company

- DSM-Firmenich

- Kerry Group plc

- BASF SE

- Ingredion Incorporated

- Tate & Lyle plc

- Glanbia plc

- Arla Foods Ingredients

- Corbion NV

- International Flavors & Fragrances