Global Health Data Archiving Market By Type (Flash & Solid-State Storage, Magnetic Storage) By Storage System (Direct-Attached Storage, Storage Area Network, Network-Attached Storage) By Deployment (On-Premise, Hybrid, Cloud) By Architecture (Object Storage, File Storage, Block Storage) By End-User (Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, Diagnostic Laboratories, Other End-Users) and by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jun 2024

- Report ID: 83613

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

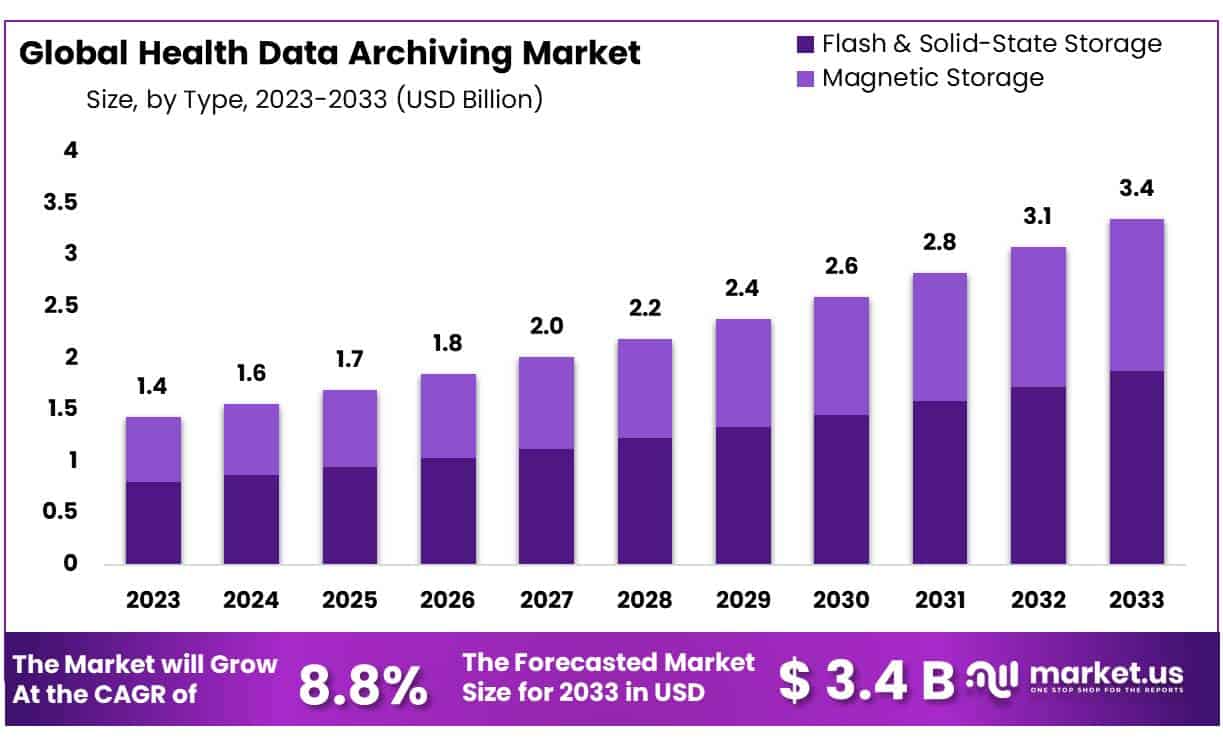

Global Health Data Archiving Market size is expected to be worth around USD 3.4 Billion by 2033 from USD 1.4 Billion in 2023, growing at a CAGR of 8.8% during the forecast period from 2024 to 2033.

Health Data Archiving is the process of collecting and storing data to be used for future research. Health data archiving can lead to new discoveries, as well as updated treatment options because it enables the study of historical data to compare and contrast with present and projected data.

Furthermore, these archives can be used as a way to inform healthcare providers about what happens after a patient leaves their care. Electronic ones are replacing physical records, so it’s important to take safety precautions to prevent data loss. Many hospitals have started implementing health data archiving programs, which include securing their servers and backing-up critical data. Though not all hospitals use these security measures, many are beginning to recognize the importance of protecting digital medical records.

In recent years, the healthcare industry has been undergoing a digital revolution. In order to maintain the preservation of patient records and manage current capacities, many organizations are switching to electronic systems for medical records storage. One of the biggest challenges with this transition is managing the volumes of data that will be created in the process.

Health Data Archiving, or HDA, is a solution that helps mitigate this dilemma by storing copies of data on offline media for a time when it may be needed. Health data archiving can be used to ensure public health, prevent legal issues, and research purposes as well. By storing medical records in a secure place, medical disasters, that could cause harm to individuals, are less likely to occur. These archives are also an invaluable resource should there be an outbreak of a disease.

Hospitals need to prepare for data archival. With the advent of newer technology and the continued expansion of internet access, it is becoming increasingly difficult to keep up with the pace of digital transformation. One aspect of this change that many hospitals are experiencing, is a rapid increase in data size. In response, hospitals have had to develop a strategy to effectively store these large amounts of data for the long term.

Data archiving is an important aspect of the healthcare industry. Any time that data is saved, it helps to ensure data integrity and accuracy. A benefit of healthcare data archival is the ability to store data indefinitely. Medical records are often stored electronically due to easier access and case organization, making it easier for medical professionals to retrieve specific information in the future.

Key Takeaways

- Market Size: Health Data Archiving Market size is expected to be worth around USD 3.4 Billion by 2033 from USD 1.4 Billion in 2023.

- Market Growth: The market growing at a CAGR of 8.8% during the forecast period from 2024 to 2033.

- Type Analysis: Flash & Solid-State Storage accounts for 56% of the market share.

- Storage System Analysis: Direct-Attached Storage (DAS) emerging as a dominant force, holding 34% of the market share in 2023.

- Deployment Analysis: The cloud deployment commanding a 36% market share in 2023.

- Architecture Analysis: In 2023, Object storage holds the largest market share at 38%.

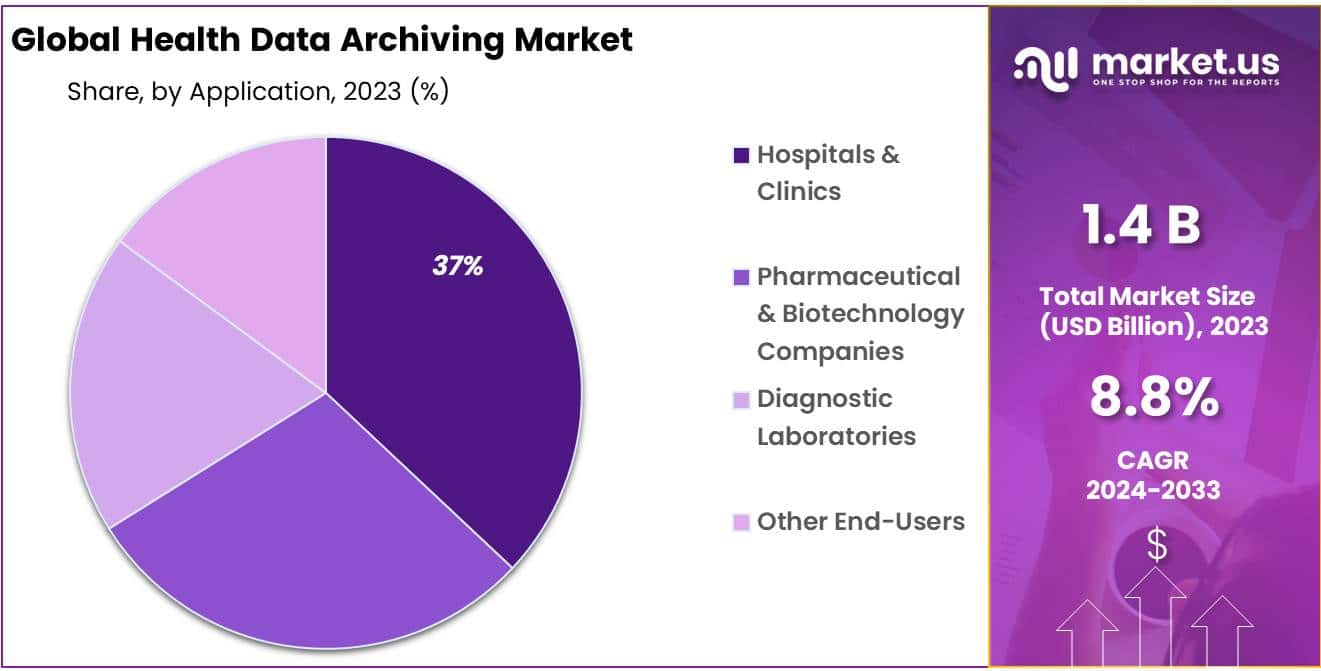

- End-Use Analysis: Hospitals and clinics account for 27% of the market share in 2023

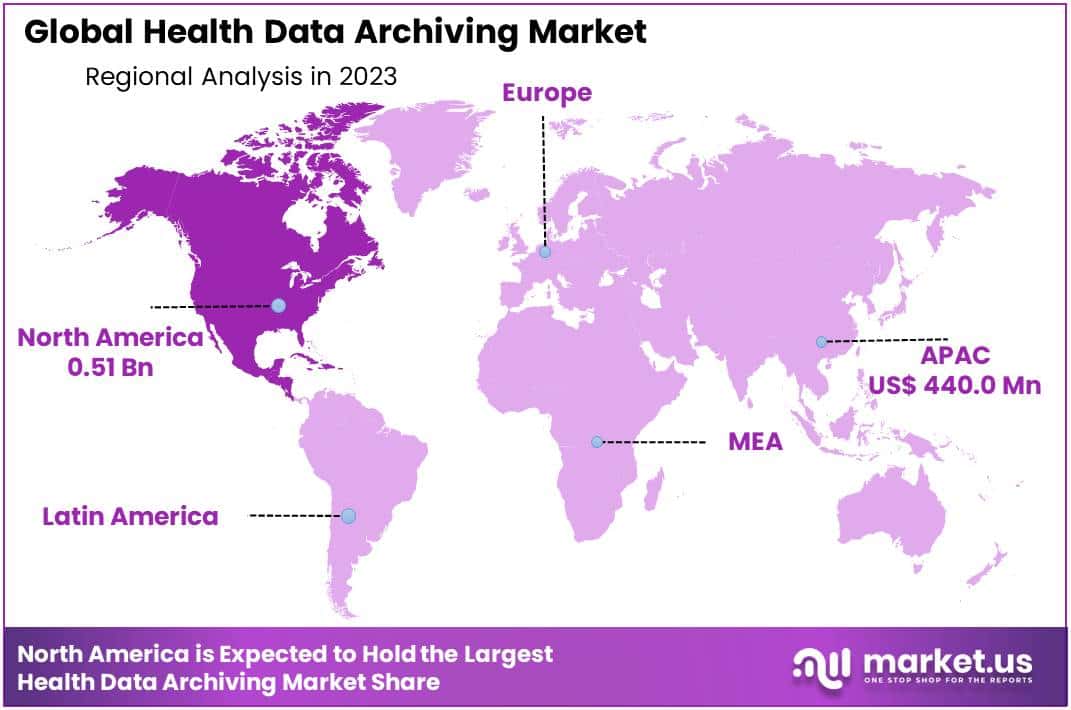

- Regional Analysis: In 2023, North America holds a dominant 36% market share in the health data archiving market

Type Analysis

The Health Data Archiving Market is experiencing significant growth, with the Flash & Solid-State Storage segment leading the way. Currently, Flash & Solid-State Storage accounts for 56% of the market share, reflecting its popularity due to its high speed, reliability, and efficiency. This segment is favored for its ability to handle large volumes of health data swiftly, ensuring quick access and retrieval, which is crucial in the healthcare sector.

In contrast, Magnetic Storage, while still relevant, is gradually losing ground to Flash & Solid-State Storage. Magnetic Storage systems are traditionally used for long-term data archiving due to their cost-effectiveness and large storage capacity. However, they are often slower and less efficient compared to their solid-state counterparts.

Storage System Analysis

The Health Data Archiving Market is evolving rapidly, with Direct-Attached Storage (DAS) emerging as a dominant force, holding 34% of the market share. DAS is favored in healthcare settings due to its simplicity, cost-effectiveness, and high performance for direct access to critical health data. This system is particularly popular in small to medium-sized healthcare facilities where budget constraints and the need for efficient data access are paramount.

Conversely, Storage Area Network (SAN) and Network-Attached Storage (NAS) systems are also significant players in the market, though they trail behind DAS in terms of market share. SANs offer high-speed, dedicated storage networks that provide robust data management and scalability, making them suitable for larger healthcare institutions with extensive data archiving needs. NAS systems, which provide centralized storage accessible over a network, are valued for their ease of use and ability to support multiple devices and users simultaneously.

Deployment Analysis

The Health Data Archiving Market is witnessing a significant shift towards cloud-based solutions, with cloud deployment commanding a 36% market share. This dominance is attributed to the cloud’s scalability, cost-effectiveness, and accessibility, making it an ideal choice for healthcare providers needing to manage vast amounts of health data efficiently. Cloud storage allows for seamless data access and collaboration across multiple locations, enhancing patient care and operational efficiency.

On-premise solutions, while still relevant, are less favored due to higher upfront costs and maintenance requirements. These systems offer better control and security over data, which is critical for organizations with stringent regulatory compliance needs or concerns over data privacy. However, their lack of flexibility and scalability compared to cloud solutions limits their appeal.

Hybrid deployments combine the best of both worlds, providing the flexibility of cloud storage with the control of on-premise systems. This approach is gaining traction as it allows healthcare providers to balance cost, security, and scalability, meeting diverse data archiving needs.

Architecture Analysis

The health data archiving market is witnessing substantial growth due to the increasing volume of digital medical records and regulatory requirements for data retention. Object storage holds the largest market share at 38%, attributed to its scalability and cost-efficiency for managing large datasets. This method is particularly favored for storing medical images, genomic data, and extensive patient records.

File storage systems, known for their simplicity and compatibility with traditional applications, are also widely used in the health sector. These systems are essential for managing structured data and unstructured data, offering a balance of performance and accessibility.

Block storage solutions, although less prevalent, play a critical role in applications requiring high-performance and low-latency data access. This type of storage is ideal for database-driven applications and virtualized environments where speed and reliability are paramount.

End-User Analysis

The health data archiving market is experiencing significant growth, driven by the need for secure and efficient management of extensive medical records. Hospitals and clinics account for 27% of the market share, utilizing advanced archiving solutions to manage patient records, medical imaging, and other critical health data. This segment’s demand is fueled by regulatory requirements and the necessity for quick, reliable access to patient information.

Pharmaceutical and biotechnology companies are also key contributors to the market. These organizations require robust archiving systems to store vast amounts of research data, clinical trial results, and regulatory submissions. The secure, long-term storage of this data is crucial for compliance and innovation.

Diagnostic laboratories, another vital end-user group, rely on health data archiving to manage diagnostic reports, test results, and laboratory information systems. Efficient data archiving enhances operational efficiency and ensures the availability of historical data for ongoing patient care.

Other end-users, including academic institutions and research organizations, also contribute to the market’s expansion. These entities require reliable archiving solutions to store and manage extensive research data and educational materials.

Key Market Segments

Type

- Flash & Solid-State Storage

- Magnetic Storage

Storage System

- Direct-Attached Storage

- Storage Area Network

- Network-Attached Storage

Deployment

- On-Premise

- Hybrid

- Cloud

Architecture

- Object Storage

- File Storage

- Block Storage

End-User

- Hospitals & Clinics

- Pharmaceutical & Biotechnology Companies

- Diagnostic Laboratories

- Other End-Users

Driver

The exponential growth of health data generated by healthcare facilities, coupled with the increasing adoption of electronic health records (EHRs), is a key driver in the health data archiving market. Healthcare providers are faced with the challenge of managing vast amounts of patient data while ensuring compliance with regulatory requirements. Health data archiving solutions offer secure storage, efficient retrieval, and long-term preservation of electronic health records, enabling healthcare organizations to optimize their data management processes and enhance patient care.

Trend

An emerging trend in the health data archiving market is the shift towards cloud-based archiving solutions. Cloud technology offers scalability, flexibility, and cost-effectiveness, allowing healthcare providers to securely store and access large volumes of health data from any location. Additionally, cloud-based archiving solutions facilitate seamless integration with other healthcare IT systems, enabling interoperability and data exchange across disparate platforms.

Opportunity

The increasing focus on data analytics and population health management presents significant opportunities for the health data archiving market. By leveraging advanced analytics tools and artificial intelligence, healthcare organizations can extract valuable insights from archived health data to improve clinical decision-making, optimize treatment outcomes, and enhance patient engagement.

Furthermore, the integration of health data archiving with population health management platforms enables healthcare providers to identify trends, patterns, and risk factors within patient populations, facilitating proactive intervention and preventive care strategies.

Restraint

One of the primary restraints in the health data archiving market is concerns regarding data security and privacy. Healthcare organizations must ensure compliance with stringent regulatory requirements, such as HIPAA, to protect sensitive patient information from unauthorized access, breaches, and cyber threats.

Additionally, the complexity of healthcare IT infrastructure and legacy systems poses challenges in implementing and maintaining robust data archiving solutions. Addressing these security and interoperability concerns is essential to fostering trust among healthcare providers and patients and promoting widespread adoption of health data archiving solutions.

Regional Analysis

In 2023, North America holds a dominant 36% market share in the health data archiving market, driven by advanced healthcare infrastructure and stringent regulatory requirements for data retention. The region’s significant investment in healthcare IT and widespread adoption of electronic health records (EHRs) contribute to its leadership position. Key players in the market, robust R&D activities, and the presence of major pharmaceutical and biotechnology firms further bolster North America’s dominance. Additionally, increasing awareness about data security and the need for efficient data management solutions are propelling the growth of the health data archiving market in this region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

Key players in the health data archiving market include IBM Corporation, Dell EMC, Pure Storage, Hitachi Limited. These companies offer advanced storage solutions that ensure data security, scalability, and compliance with healthcare regulations. IBM and Dell EMC are renowned for their robust on-premises and hybrid cloud solutions. this players provide cloud-based archiving services, providing flexibility and cost-efficiency. Their continuous innovation and strategic partnerships with healthcare providers enable them to address the evolving needs of the health data archiving market effectively.

Market Key Players

- IBM Corporation

- Dell

- Pure Storage

- NetApp Inc.

- Hitachi Limited

- Huawei Technologies Co. Ltd.

- Western Digital Corporation

- Hewlett Packard Enterprises

- Samsung Electronics Co. Ltd.

- Fujitsu Limited

Recent Developments

- Dell (April 2024): Launched its next-generation PowerStore X data storage appliance, specifically designed for high-performance healthcare environments. PowerStore X boasts faster data access and improved scalability for managing large medical datasets.

- Pure Storage (March 2024): Unveiled its new FlashArray//X all-flash storage system, targeting healthcare organizations with a focus on cost-effective and efficient health data archiving. This system offers increased density and reduced power consumption.

- Hitachi (January 2024): Introduced the Hitachi Virtual Storage Platform (VSP) E5900, a high-density storage solution optimized for healthcare institutions. VSP E5900 offers scalability and security features to address growing health data archiving needs.

Report Scope

Report Features Description Market Value (2023) USD 1.4 Billion Forecast Revenue (2033) USD 3.4 Billion CAGR (2024-2033) 8.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Flash & Solid-State Storage, Magnetic Storage) By Storage System (Direct-Attached Storage, Storage Area Network, Network-Attached Storage) By Deployment (On-Premise, Hybrid, Cloud) By Architecture (Object Storage, File Storage, Block Storage) By End-User (Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, Diagnostic Laboratories, Other End-Users) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape IBM Corporation, Dell, Pure Storage, NetApp Inc., Hitachi Limited, Huawei Technologies Co. Ltd., Western Digital Corporation, Hewlett Packard Enterprises, Samsung Electronics Co. Ltd., Fujitsu Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is health data archiving?Health data archiving involves the secure storage and management of electronic health records (EHRs), medical images, research data, and other critical healthcare information for long-term retention and compliance.

Why is health data archiving important?It ensures data integrity, regulatory compliance, secure access, and efficient management of large volumes of health information, aiding in improved patient care and operational efficiency.

How big is the Health Data Archiving Market?The global Health Data Archiving Market size was estimated at USD 1.4 Billion in 2023 and is expected to reach USD 3.4 Billion in 2033.

What is the Health Data Archiving Market growth?The global Health Data Archiving Market is expected to grow at a compound annual growth rate of 8.8%. From 2024 To 2033

Who are the key companies/players in the Health Data Archiving Market?Some of the key players in the Health Data Archiving Markets are IBM Corporation, Dell, Pure Storage, NetApp Inc., Hitachi Limited, Huawei Technologies Co. Ltd., Western Digital Corporation, Hewlett Packard Enterprises, Samsung Electronics Co. Ltd., Fujitsu Limited

What are the primary storage types used in health data archiving?The main storage types include object storage, file storage, and block storage, each offering different advantages in scalability, accessibility, and performance.

Who are the main end-users of health data archiving solutions?Key end-users include hospitals and clinics, pharmaceutical and biotechnology companies, diagnostic laboratories, and other healthcare-related organizations.

Which region dominates the health data archiving market?North America dominates the market with a 36% share, driven by advanced healthcare infrastructure and stringent data retention regulations.

Health Data Archiving MarketPublished date: Jun 2024add_shopping_cartBuy Now get_appDownload Sample

Health Data Archiving MarketPublished date: Jun 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Dell

- Pure Storage

- NetApp Inc.

- Hitachi Limited

- Huawei Technologies Co. Ltd.

- Western Digital Corporation

- Hewlett Packard Enterprises

- Samsung Electronics Co. Ltd.

- Fujitsu Limited