Global Haptic Technology Market Size, Share, Growth Analysis By Component (Hardware, Software), By Feedback (Force, Tactile, Thermal), By Usage Type (Graspable, Touchable, Wearable), By Application (Consumer Electronics, Gaming, Automotive, Healthcare, Robotics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162933

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of AI

- AI Adoption

- Analysts’ Viewpoint

- Emerging trends

- US Market Size

- Investment and Business Benefit

- By Component

- By Feedback

- By Usage Type

- By Application

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Challenging Factors

- Competitive Analysis

- Major Developments

- Report Scope

Report Overview

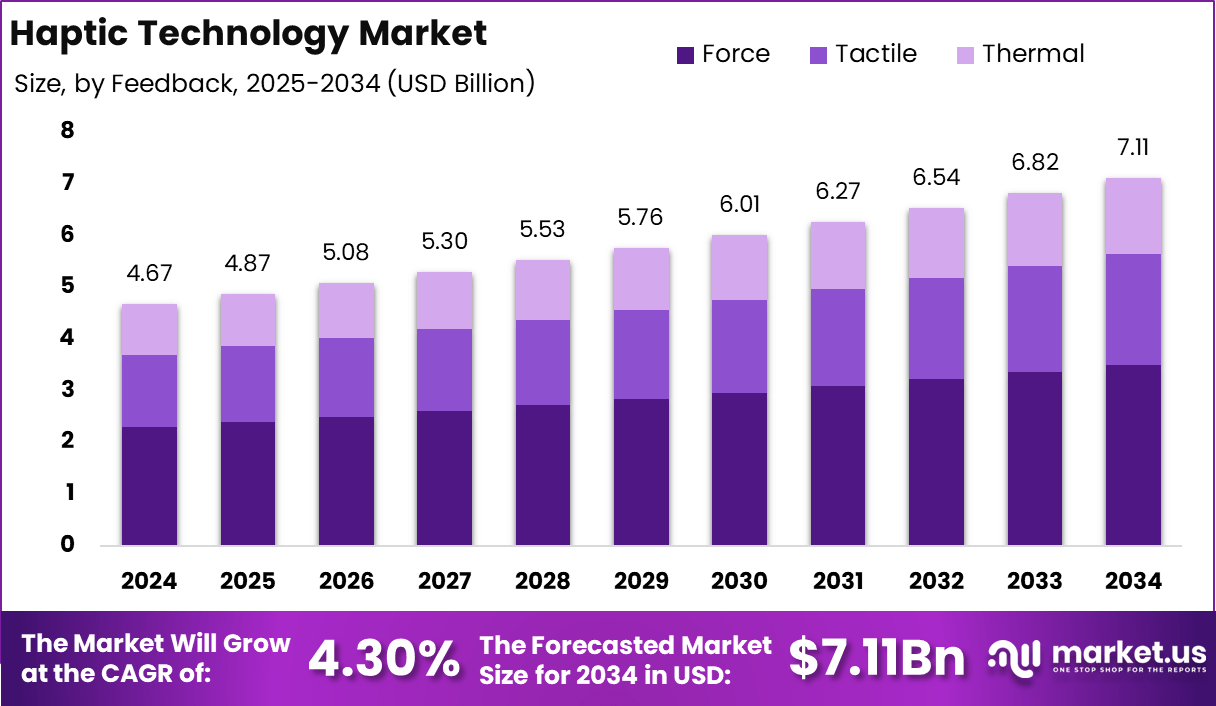

The global Haptic Technology Market was valued at USD 4.67 billion in 2024 and is projected to reach USD 7.11 billion by 2034, expanding at a CAGR of 4.3% during the forecast period. The market growth is driven by the increasing integration of tactile feedback systems in consumer electronics, automotive interfaces, and medical devices to enhance user interaction and realism. Continuous advancements in virtual reality (VR), augmented reality (AR), and gaming platforms are further fueling adoption, as manufacturers focus on immersive, multi-sensory user experiences.

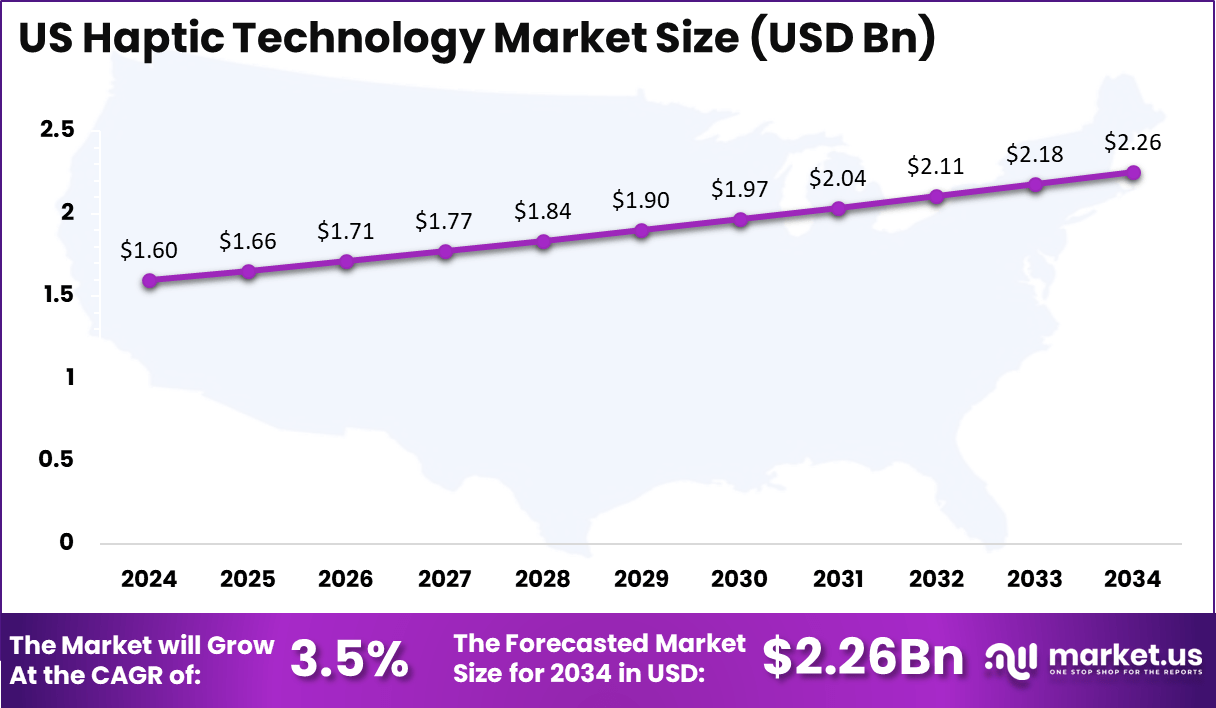

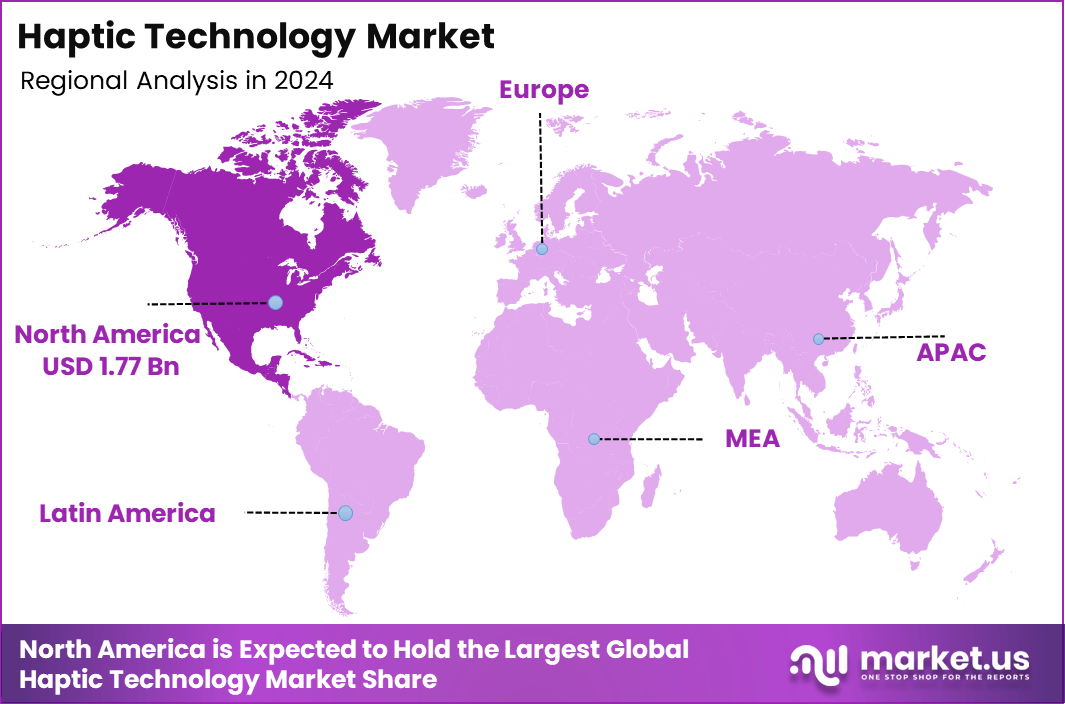

North America accounted for 38% of the global market share in 2024, amounting to USD 1.77 billion, supported by strong demand across the US technology and automotive sectors. The US market, valued at USD 1.6 billion in 2024, is anticipated to expand at a CAGR of 3.5% through 2034, driven by widespread adoption of advanced haptic feedback in smartphones, wearable devices, and simulation-based training applications across healthcare and defense sectors.

Haptic technology refers to the science of applying touch sensation and control to human–computer interaction, enabling users to experience tactile feedback through devices such as smartphones, wearables, gaming consoles, automotive controls, and medical simulators.

It bridges the gap between the physical and digital worlds by simulating the sense of touch through vibrations, forces, and motions, enhancing realism and user engagement across applications. The technology is increasingly integrated into next-generation consumer electronics, virtual reality, and augmented reality platforms to create more immersive and intuitive experiences.

In the automotive industry, haptic feedback improves driver safety and interface efficiency by allowing touch-based controls without visual distraction. In healthcare, it enables precise simulation-based training and robotic surgery with real-time tactile responses, enhancing accuracy and reducing errors. Similarly, in gaming and entertainment, haptics enrich user immersion through responsive feedback mechanisms.

The growing demand for immersive interfaces, coupled with advancements in sensors, actuators, and AI-driven touch control systems, continues to accelerate innovation. As industries move toward human-centric design and seamless user interaction, haptic technology is becoming a cornerstone of next-generation interface development, reshaping how people interact with digital environments and expanding its influence across industrial, consumer, and enterprise domains.

In February, Synaptics acquired a business unit from Broadcom for $198 million to strengthen edge-AI and wireless haptic solutions, while in January, Haptikos launched its hand exoskeleton for extended reality, and Synaptics introduced Resonate tech, reducing energy use by up to 80% in haptic-enabled displays. Northwestern University engineered a new wearable device, letting users feel more realistic touch feedback for VR shopping and assistive tech in March 2025.

AAC Technologies launched the RichTap Haptic Seat Solution for automotives in January 2025, showing how the automotive and transportation segments are becoming the fastest-growing, with high adoption of haptic feedback in driver-assistance and infotainment systems. Investment in startups remains robust, with funding focused on advancing actuator precision, XR applications, and consumer and healthcare interfaces.

Key challenges are high initial costs and technical complexity, but overall, the drive for immersive, realistic, and cost-effective haptic experiences is pushing the sector forward, particularly in gaming, VR/AR, wearables, and automotive safety systems.

Key Takeaways

- The Haptic Technology Market is projected to expand at a CAGR of 4.3% from 2024 to 2034, driven by the rising integration of tactile feedback systems in consumer electronics, automotive, and healthcare devices.

- North America accounted for 38% of the global market in 2024, led by the US, which continues to dominate adoption across smartphones, wearables, and advanced automotive controls.

- By Component, Hardware represented 67.3%, emerging as the dominant category due to widespread use of actuators, sensors, and drivers in device integration and feedback precision.

- By Feedback Type, Force feedback held 49.2%, supported by its extensive application in simulation, robotics, and AR/VR environments, where precise tactile resistance is crucial.

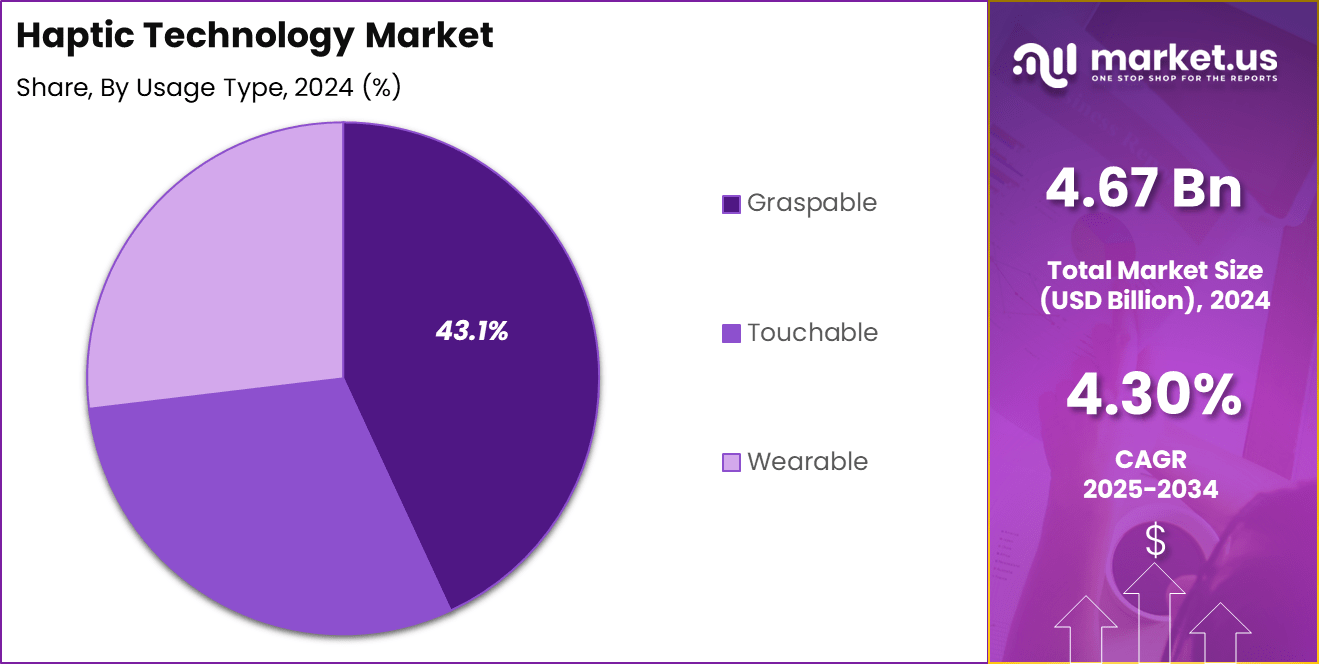

- By Usage Type, Graspable interfaces accounted for 43.1%, reflecting growing demand in VR gaming, medical training, and robotic control systems for realistic interaction experiences.

- By Application, Consumer Electronics led the market with 27.8%, fueled by smartphone innovation, touch-enabled displays, and wearable device enhancements focused on richer user engagement.

Role of AI

Artificial intelligence is playing a transformative role in advancing haptic technology by enabling smarter, adaptive, and more realistic tactile feedback experiences. Through AI-driven algorithms, haptic systems can now interpret user behavior, contextual cues, and environmental data to deliver precise and personalized sensations. In virtual and augmented reality environments, AI enhances realism by synchronizing tactile responses with visual and auditory stimuli, creating seamless multimodal experiences that closely mimic real-world interactions.

In consumer electronics, AI-powered haptics optimize vibration intensity and feedback timing based on user patterns, improving usability and accessibility for devices such as smartphones, wearables, and gaming consoles. In healthcare, AI-integrated haptic simulators assist in medical training and robotic surgery by replicating the feel of tissues or instruments, thus improving precision and learning outcomes. The automotive sector benefits from AI-enabled haptic controls that adapt to driver behavior, ensuring safety and reducing distraction.

As AI models continue to evolve, the combination of machine learning and haptics is expected to enable predictive and emotion-responsive feedback systems. This integration is not only redefining human–machine interaction but also laying the foundation for immersive, intelligent touch interfaces across entertainment, industrial automation, and telepresence applications.

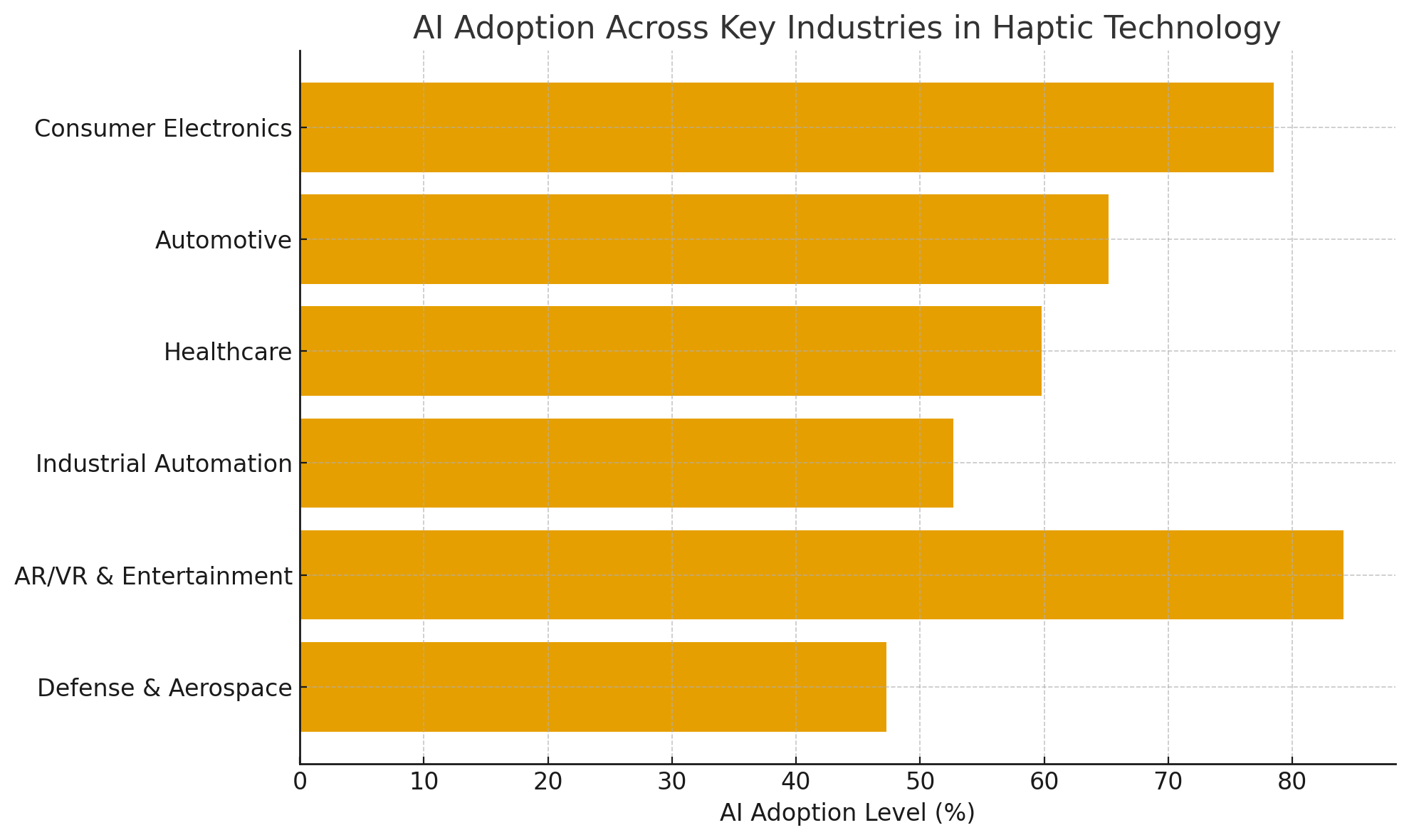

AI Adoption

AI adoption in the haptic technology landscape is accelerating as industries increasingly recognize its potential to enhance responsiveness, realism, and adaptability in touch-based systems. Artificial intelligence enables haptic devices to learn from user interactions, adjust feedback dynamically, and simulate realistic sensations with greater precision. This is driving adoption across sectors such as consumer electronics, automotive, healthcare, and immersive media, where tactile feedback is essential for user engagement and control accuracy.

In consumer electronics, AI-powered algorithms are being integrated into smartphones, gaming controllers, and wearables to deliver adaptive vibration patterns that respond intelligently to gestures, context, or user emotion. In healthcare, AI adoption supports advanced surgical robotics and rehabilitation systems, where machine learning models interpret real-time sensory data to provide accurate force feedback and improve patient safety. Automotive manufacturers are also embedding AI-driven haptics into infotainment and driver-assistance systems, offering context-aware touch controls that enhance both safety and comfort.

The growing convergence of AI with virtual and augmented reality platforms is further strengthening adoption trends, enabling more immersive and interactive experiences. As AI systems become more sophisticated, their integration into haptic interfaces is expected to become standard across industries, transforming human–machine communication into a more intuitive and emotionally responsive experience.

Analysts’ Viewpoint

Analysts view the Haptic Technology Market as poised for steady expansion driven by growing demand for immersive tactile experiences across key sectors. The consumer electronics segment is expected to maintain strong momentum as manufacturers integrate advanced haptic feedback into smartphones, wearables, and gaming controllers, thereby enhancing user engagement and differentiation. Automotive and healthcare applications are projected to gain traction as interfaces evolve toward more intuitive, safe, and responsive touch-based systems.

Despite the positive outlook, analysts caution that technical limitations—such as actuator miniaturisation, power consumption, and standardisation of haptic protocols—present meaningful hurdles. Cost pressures and integration complexities may constrain growth in some end-use applications. The regional landscape is also shifting: while North America remains a substantial contributor, rising adoption in the Asia Pacific is anticipated to drive incremental volume growth, reflecting expanding consumer electronics production and rising automotive innovation in that region.

From a strategic perspective, market participants are advised to focus on software-driven differentiation, ecosystem partnerships (particularly in AR/VR and automotive platforms), and leveraging AI to enable adaptive, context-aware feedback. Execution on these fronts is projected to determine which players capture a disproportionate share of the market’s value creation.

Emerging trends

The integration of haptic feedback into wearables and consumer electronics is accelerating as users demand richer, more intuitive interactions and manufacturers aim to differentiate their devices through touch-based interfaces. The growth of AR/VR platforms and immersive technologies is driving this trend forward as haptics become a core enabler of realistic digital-physical interaction.

AI and machine-learning-driven haptic systems are gaining traction, enabling adaptive and context-aware tactile responses that better mirror user actions, environmental conditions, and emotional cues. These smart haptic solutions are particularly relevant in automotive controls, gaming devices, and simulation platforms.

Flexible, mid-air, and surface haptics are emerging as novel modalities that extend touch feedback beyond traditional actuators. For instance, developments in pseudo-haptics allow users to feel tactile sensations via visual and inertial cues in virtual environments without physical contact.

Haptic technology is increasingly being adopted in training, simulation, and remote operations across healthcare, industrial automation, and telepresence. Realistic force-feedback and tactile simulation are enabling more effective skill development and remote control of machines and robots.

Sustainability and miniaturisation of haptic components (such as low-power actuators and compact drivers) are becoming important as device designers aim to integrate haptics into thinner, lighter form factors while maintaining performance and battery efficiency.

These trends collectively point toward a future where haptic feedback is deeply embedded across devices, platforms, and interfaces—shifting the role of touch from a novelty to a standard expectation in human–machine interaction.

US Market Size

The US market for haptic technology is projected to grow at a CAGR of about 3.5% through the forecast period, reflecting steady but moderate expansion. With a current market size of approximately USD 1.6 billion, the US market size is anticipated to reach around USD 2.26 billion by 2034. The growth is driven by the country’s mature consumer-electronics ecosystem, high adoption of immersive technologies such as AR/VR, and strong presence of component and system developers.

The relatively moderate growth rate, compared to emerging markets, suggests that incremental gains will come more from product enhancements—such as improved actuator efficiency, refined feedback algorithms, and integration with AI—rather than from rapid volume expansion. Key growth levers in the US include increasing penetration of haptic feedback in smartphones, wearables, gaming peripherals, and automotive interfaces, where improvements in safety, user experience, and intuitive interaction are focal areas.

Although technical integration challenges such as miniaturisation, power consumption, and standardisation persist, US suppliers and OEMs are leveraging ecosystem partnerships and software-centric differentiation to unlock value. As a result, the US market is expected to maintain its leadership in technology sophistication even as growth rates moderate.

Investment and Business Benefit

Investment in the haptic-technology space offers significant business benefits as industries increase demand for more immersive and tactile interactions. For investors, the appeal lies in the convergence of several drivers: the rising adoption of AR/VR, wearables, and advanced automotive human-machine interfaces, which expand the addressable market for haptic systems.

From a business-benefit perspective, companies incorporating haptics gain a competitive edge by enhancing user experience and differentiation. By converting touch into a strategic feature, firms create deeper user engagement, brand loyalty, and higher price points for devices with more advanced feedback.

Additionally, haptic-based innovations enable new revenue streams—such as software-driven haptic profiles, firmware updates, and ecosystem licenses—offering margin expansion beyond hardware commoditisation. Strategic investment into haptic modules and sensor-actuator subsystems also positions firms to capture value along the supply chain.

From a risk-mitigation standpoint, early investment helps firms establish intellectual-property leadership and ecosystem partnerships before the market matures. Given that technical challenges like actuator miniaturisation and standardisation still exist, companies making the required R&D and ecosystem plays now are projected to capture disproportionate value as the market scales.

By Component

Hardware accounted for around 67.3% of the total share in the haptic technology market, establishing itself as the dominant component due to its integral role in enabling physical touch feedback. The hardware segment primarily includes actuators, sensors, controllers, and drivers that generate vibrations, motions, or forces to simulate tactile sensations.

Continuous advancements in actuator technologies, such as linear resonant actuators (LRA), piezoelectric drivers, and electroactive polymers, have enhanced responsiveness, energy efficiency, and miniaturization, allowing seamless integration into compact devices like smartphones, wearables, and gaming controllers. The automotive and healthcare sectors are also fueling hardware adoption through force-feedback systems in driver-assist interfaces and surgical simulators.

The software segment, while smaller, is gaining strategic importance as it governs how hardware interprets inputs and delivers adaptive, context-aware responses. Software algorithms are increasingly utilizing artificial intelligence and machine learning to refine vibration patterns and personalize feedback based on user behavior or environment.

Companies are focusing on developing programmable haptic engines and open APIs that enable developers to create custom tactile experiences. As industries transition toward immersive environments such as AR, VR, and telepresence, the software component is expected to grow rapidly, transforming hardware-dependent systems into intelligent, experience-driven platforms.

By Feedback

Force feedback held approximately 49.2% share of the haptic technology market, making it the leading feedback type due to its extensive use in applications requiring realistic resistance and motion simulation. Force feedback systems generate physical forces through actuators, providing users with a sensation of pressure or weight, essential in automotive control interfaces, robotic surgery, industrial training, and advanced gaming systems.

These systems enhance precision and safety by allowing operators to “feel” mechanical interactions, improving accuracy in both virtual and real environments. Continuous innovations in electromechanical actuators and servo-based technologies are driving adoption across sectors where human–machine collaboration is critical.

The tactile feedback segment is gaining steady traction as it delivers localized vibrations or textures for surface-based interactions. It is widely used in smartphones, touchscreens, wearables, and infotainment systems to replicate the feel of pressing physical buttons or navigating digital surfaces.

Meanwhile, thermal feedback—though still emerging—aims to simulate temperature variations for heightened realism in virtual environments and medical simulations. As miniaturization and AI-driven control systems evolve, all three feedback types are expected to converge, creating more sophisticated, multi-sensory haptic experiences that enhance usability, realism, and emotional engagement across consumer and industrial interfaces.

By Usage Type

Graspable interfaces accounted for around 43.1% of the haptic technology market, emerging as the dominant usage type due to their wide applicability in virtual reality, robotics, and simulation-based environments. These devices, such as joysticks, controllers, and robotic arms, allow users to physically interact with and manipulate virtual or remote objects, providing a realistic sense of force and motion.

Their ability to reproduce precise feedback has made them indispensable in sectors such as healthcare for surgical training, industrial automation for remote handling, and defense for simulation-based learning. Continuous advancements in sensor precision and actuator control are further enhancing the accuracy and immersion of graspable systems.

Touchable interfaces represent another key usage type, primarily used in smartphones, automotive dashboards, and consumer electronics. They provide localized tactile feedback on flat or curved surfaces to simulate button presses and gestures, improving user interaction and accessibility.

Wearable haptic devices, including gloves, vests, and smartbands, are rapidly gaining traction as they enable full-body or targeted tactile experiences in AR/VR, gaming, and rehabilitation. The growing integration of AI and wireless connectivity in wearables is expanding their use in personalized feedback applications. Collectively, these usage types are shaping the future of intuitive, multi-sensory human–machine interaction.

By Application

Consumer electronics accounted for approximately 27.8% of the haptic technology market, emerging as the leading application segment due to the growing integration of tactile feedback in smartphones, tablets, wearables, and laptops. Haptic systems enhance user experience by delivering realistic touch sensations that replicate button presses, surface textures, or alert vibrations.

Continuous innovation from manufacturers such as Apple, Samsung, and Sony has accelerated adoption through pressure-sensitive touchscreens, adaptive vibration engines, and haptic touchpads. The rise of foldable devices, immersive mobile gaming, and advanced display technologies is further strengthening demand for refined haptic integration in everyday consumer devices.

The gaming sector follows closely, where immersive controllers and VR accessories use precise vibration and motion feedback to heighten realism and engagement. The automotive industry is increasingly adopting haptic systems for infotainment, steering, and safety controls, ensuring intuitive interaction without visual distraction.

In healthcare, haptics play a vital role in surgical robotics, medical training, and rehabilitation systems that rely on tactile precision. Robotics and industrial automation also leverage force-feedback systems for remote handling and teleoperation. Collectively, these applications highlight how haptic technology is transitioning from a convenience feature to a core human–machine interface element across diverse industries.

Key Market Segments

By Component

- Hardware

- Software

By Feedback

- Force

- Tactile

- Thermal

By Usage Type

- Graspable

- Touchable

- Wearable

By Application

- Consumer Electronics

- Gaming

- Automotive

- Healthcare

- Robotics

- Others

Regional Analysis

The North American region accounted for approximately 38% of the global haptic technology market in 2024, translating to a market size of about USD 1.77 billion. The region’s leading position is driven by a strong ecosystem of consumer electronics, high smartphone and wearable penetration, and significant investment in automotive and healthcare sectors, where haptic interfaces are increasingly integrated.

In the US, in particular, well-established OEMs and a culture of rapid technology adoption are fostering innovation in both hardware and software elements of haptic systems. Demand for immersive gaming, VR/AR environments, and advanced automotive controls continues to reinforce North America’s relevance in the market. Technical sophistication and early-stage adoption in sectors such as medical simulation and industrial automation further cement the region’s leadership.

That said, growth in North America is expected to be more moderate compared with emerging markets. The mature base of installed devices means incremental gains will rely on upgrades, higher-end integrations, and expansion into new usage types rather than pure volume expansion. Companies operating in this region are therefore advised to focus on differentiation—via software enhancement, ecosystem partnerships, and service-based models—to capture value from the existing installed base.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The share of the market is currently driven by strong integration of haptic technology into consumer electronics, with smartphones, wearables, and gaming devices increasingly embedding tactile feedback mechanisms to enhance user experience. The automotive industry’s adoption of haptics across steering wheels, dashboards, and infotainment systems is propelling growth as manufacturers seek safer, more intuitive interfaces.

Healthcare applications such as surgical simulators, rehabilitation devices, and tele-operation systems are contributing significantly to demand as tactile feedback becomes critical for realism and precision. The proliferation of immersive technologies (AR/VR) and the rise in remote operation and telepresence applications are creating new use cases for haptics. Technological advancements in actuator design, sensor miniaturisation, and software-driven feedback algorithms are improving performance and enabling broader deployment.

Restraint Factors

High implementation and component costs remain a key constraint, particularly for force-feedback systems and advanced actuators, limiting adoption in cost-sensitive segments. Energy consumption and power efficiency issues are restraining mobile and wearable deployments because haptic modules add to device battery burdens.

Technical integration challenges, including miniaturization in compact form factors, latency in feedback, and standardization across devices and interfaces, are slowing market traction. Lack of awareness and education around the benefits of haptics in certain industry verticals is limiting broader uptake.

Growth Opportunities

There is a substantial opportunity in the gaming and e-sports segments where immersive tactile experiences are becoming differentiators; haptic systems can bring new levels of realism and engagement to players. Industrial automation and robotics represent another growth frontier: as human-robot collaboration expands, haptic interfaces that provide tactile cues or force feedback can improve safety, ergonomics, and control.

Emerging form factors such as mid-air haptics, wearable haptic suits/gloves, and surface-haptic feedback open novel applications in training, healthcare, telepresence, and consumer entertainment. Regions with accelerating adoption of consumer electronics and automotive innovation (particularly Asia-Pacific) represent untapped growth zones.

Challenging Factors

The saturation of mature segments, especially in consumer electronics in developed regions, means incremental volume growth will be harder to achieve; value creation may increasingly depend on downstream services or software rather than hardware alone. The rapid evolution of technologies means companies face the risk of obsolescence and must invest continuously to keep pace.

Supply-chain constraints and reliance on specialised materials or components can impact scalability and cost dynamics. The ecosystem’s fragmentation—many different actuator standards, interface protocols, and vendor-specific ecosystems—raises integration complexity for OEMs and slows large-scale deployment.

Competitive Analysis

The haptic technology market is moderately consolidated, with a mix of established leaders and specialized innovators driving advancements across hardware, software, and integrated feedback systems. Immersion Corporation remains a key global player with a robust patent portfolio and expertise in haptic software, design tools, and licensing models that enable device manufacturers to embed rich tactile effects.

Imagis Co., Ltd. specializes in haptic driver ICs and sensor integration, positioning itself strongly in mobile and consumer electronics applications, particularly across the Asian market. Nidec Corporation has established leadership in actuator manufacturing for smartphones, tablets, and automotive systems, leveraging its large-scale production capabilities and supply chain reach.

Johnson Electric Holdings Limited contributes significantly through vibration motors and solenoid actuators, widely adopted in automotive and industrial systems. Microchip Technology Incorporated supports embedded haptic functionality through controller ICs, focusing on integration flexibility across electronic devices.

AAC Technologies and Aito BV are advancing innovation in miniature actuators and surface haptics for thinner, lighter consumer devices. Force Dimension and Geomagic, Inc. focus on precision force-feedback solutions in robotics, simulation, and healthcare, targeting high-value niche segments. Collectively, the competitive focus is shifting toward hybrid hardware–software ecosystems, where AI-based tactile algorithms and adaptive feedback capabilities will define the next phase of market differentiation.

Top Key Players in the Market

-

- Immersion Corporation

- Imagis Co., Ltd.

- Nidec Corporation

- Onsemi

- Johnson Electric Holdings Limited

- Microchip Technology Incorporated

- AAC Technologies

- Aito BV

- Force Dimension

- Geomagic, Inc.

- Others

Major Developments

- June 12, 2025: Immersion Corporation announced a new AI-powered haptic SDK designed to enhance tactile feedback realism in gaming, automotive, and AR/VR applications. The software enables developers to create adaptive haptic patterns that respond to user behavior and environmental context, improving immersion and responsiveness.

- May 3, 2025: Nidec Corporation unveiled its next-generation piezoelectric actuator series optimized for compact devices such as foldable smartphones and wearable gadgets. The new actuator line delivers higher energy efficiency and faster response rates, addressing OEM demands for miniaturized, low-power haptic components.

- April 8, 2025: AAC Technologies introduced a precision linear vibration motor for premium smartphones, offering ultra-fast tactile response and reduced latency. The innovation enhances user experience in mobile gaming and touchscreen feedback, aligning with the trend toward immersive interface design.

Report Scope

Report Features Description Market Value (2024) USD 4.67 Billion Forecast Revenue (2034) USD 7.11 Billion CAGR(2025-2034) 4.30% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Hardware, Software), By Feedback (Force, Tactile, Thermal), By Usage Type (Graspable, Touchable, Wearable), By Application (Consumer Electronics, Gaming, Automotive, Healthcare, Robotics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Immersion Corporation, Imagis Co., Ltd., Nidec Corporation, Onsemi, Johnson Electric Holdings Limited, Microchip Technology Incorporated, AAC Technologies, Aito BV, Force Dimension, Geomagic, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Immersion Corporation

- Imagis Co., Ltd.

- Nidec Corporation

- Onsemi

- Johnson Electric Holdings Limited

- Microchip Technology Incorporated

- AAC Technologies

- Aito BV

- Force Dimension

- Geomagic, Inc.

- Others