Halal Food Market By Product(Meat and Alternatives, Milk and Milk Products, Fruits and Vegetables, Grain Products, Others), By Distribution Channel( Supermarket/Hypermarket, Convenience Stores, Specialty Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 117117

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

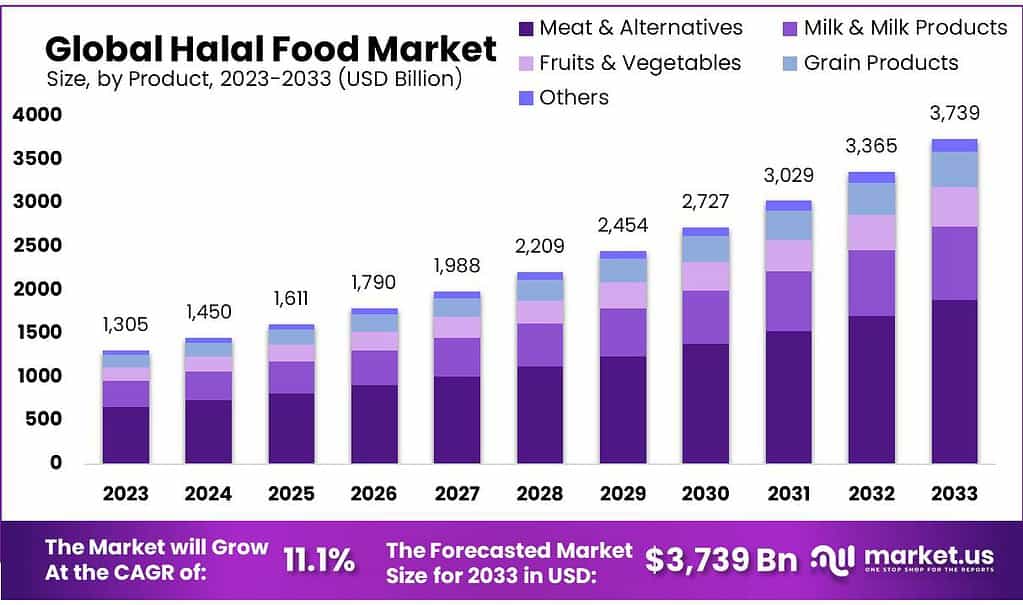

The global Halal Food Market size is expected to be worth around USD 3739 billion by 2033, from USD 1305 billion in 2023, growing at a CAGR of 11.1% during the forecast period from 2023 to 2033.

The Halal food market refers to the segment of the food industry that adheres to Islamic dietary laws, known as Halal. Halal food products are prepared and produced according to specific guidelines outlined in Islamic law, which governs not only the ingredients used but also the methods of preparation, processing, and handling.

Key principles of Halal food include the prohibition of certain ingredients such as pork and alcohol, as well as the requirement for animals to be slaughtered in a humane and specific manner by a Muslim who recites a blessing during the process. Additionally, Halal food should be free from contamination with non-Halal substances and should not come into contact with utensils or equipment used for non-Halal foods.

The Halal food market caters not only to Muslim consumers but also to individuals who seek products that meet certain ethical and dietary standards. As a result, the Halal food industry has experienced significant growth globally, with an increasing number of companies obtaining Halal certification for their products to tap into this expanding market segment.

Fresh produce and meat, the Halal food market encompasses a wide range of products, including processed foods, snacks, beverages, and even cosmetics and pharmaceuticals. Halal certification, issued by recognized Islamic authorities, serves as a mark of authenticity and compliance with Halal standards, assuring consumers about the purity and suitability of the products they purchase.

By Product

In 2023, Meat & Alternatives held a dominant market position, capturing more than a 50.6% share. This category includes various Halal-certified meats like beef, lamb, and poultry, as well as plant-based options such as tofu and tempeh. Consumers favor Meat & Alternatives for their protein content and cultural significance in many cuisines.

Following closely behind, Milk & Milk Products accounted for 28.3% of the market share in 2023. This segment comprises Halal-certified dairy products like milk, yogurt, cheese, and butter. Milk & Milk Products are popular for their nutritional value and versatility in cooking and baking.

Fruits & Vegetables held a significant share of the Halal food market, with 12.9% in 2023. This category includes a wide range of fresh and processed fruits and vegetables that meet Halal standards. Consumers value Fruits & Vegetables for their health benefits and natural flavors.

Grain Products made up 6.2% of the market share in 2023. This segment encompasses Halal-certified grains such as rice, wheat, oats, and barley, as well as processed grain products like bread, pasta, and cereals. Grain Products are essential staples in many diets, providing energy and essential nutrients.

The remaining 2% of the market was attributed to Other products, including snacks, beverages, condiments, and prepared meals. This diverse category caters to various consumer preferences and dietary needs, offering convenience and flavor in Halal-certified options.

The halal food market is comprised of several product categories, each catering to specific consumer preferences and dietary requirements. While Meat & Alternatives hold the largest market share, Milk & Milk Products, Fruits & Vegetables, Grain Products, and Other segments also play crucial roles in meeting the growing demand for Halal-certified food products.

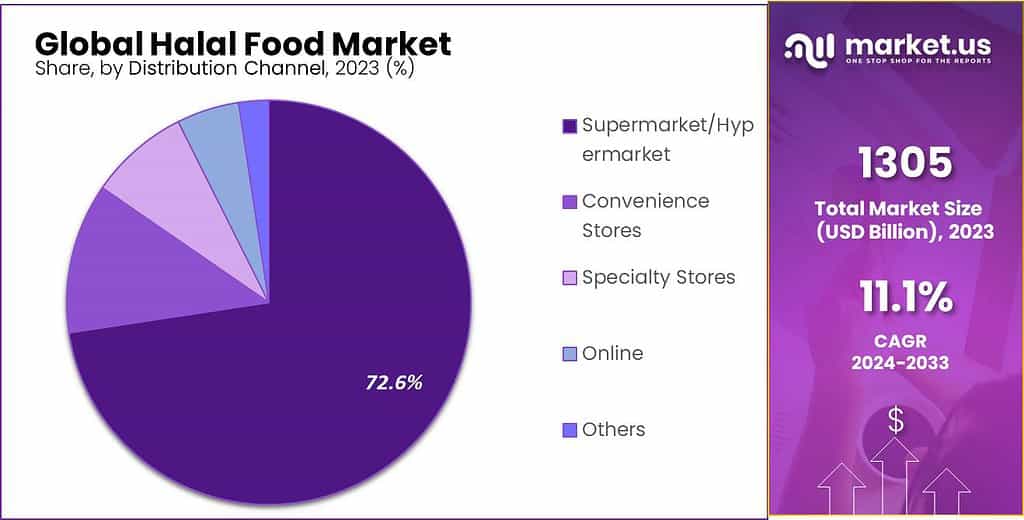

By Distribution Channel

In 2023, Supermarket/Hypermarket held a dominant market position, capturing more than a 72.6% share. These large retail outlets offer a wide range of Halal-certified products, providing convenience and variety to consumers looking for Halal food options.

Convenience Stores accounted for 14.5% of the market share in 2023. These smaller retail stores cater to consumers seeking quick and accessible Halal food choices, offering a selection of snacks, beverages, and ready-to-eat meals.

Specialty Stores held a significant share of the Halal food market, with 8.9% in 2023. These stores focus specifically on Halal products, providing a curated selection of high-quality items to consumers with specific dietary requirements and preferences.

Online platforms made up 3.8% of the market share in 2023. E-commerce platforms offer convenience and accessibility to consumers, allowing them to purchase Halal food products from the comfort of their homes and have them delivered to their doorstep.

The remaining 0.2% of the market was attributed to Other distribution channels, including food service providers, vending machines, and direct sales. These channels cater to niche markets and specific consumer needs, offering unique opportunities for accessing Halal food products.

Overall, the Halal food market encompasses various distribution channels, each serving different consumer segments and offering distinct advantages regarding convenience, accessibility, and product selection. While Supermarket/hypermarkets dominate the market, Convenience Stores, Specialty Stores, Online platforms, and Other channels also play essential roles in meeting the diverse needs of Halal food consumers.

Market Key Segments

By Product

- Meat & Alternatives

- Milk & Milk Products

- Fruits & Vegetables

- Grain Products

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Specialty Stores

- Online

- Others

Drivers

An increasing Muslim population worldwide is driving market expansion.

A rapidly increasing Muslim population worldwide is driving market expansion. A rising interest for halalcertified food among Muslims due to hygiene and safety guarantees has significantly contributed to market expansion, according to Pew Research Center report, an American think tank which estimated 2.19 billion Muslims by 2030 globally; therefore increasing Muslim numbers are expected to drive increased halal food market expansion rates.

Implementation of increasingly stringent regulations regarding halal foods

Many Islamic and non-islamic nations are adopting strict regulatory frameworks incorporating internationally accepted standards to attract new participants in the market. Indonesia recently instituted mandatory halal labeling and certification rules in 2019, leading to consumers preferring halal food products today. Manufacturers have responded by expanding their product lines with value-added items like sandwiches, cookies, hot dogs, soups, candies burgers creams and pizzas; so increasing implementation of tight rules regarding halal foods could spur market expansion.

Restraints

Halal food market presents numerous issues.

Government laws and regulations will present one of the major barriers to market growth of Halal Food Market. High costs related to R&D proficiencies will further slow its advancement; dearth of large scale Halal industries along with fluctuations in raw material costs could further inhibit this market expansion over the forecast period.

This report covers recent developments and regulation changes related to halal food markets such as trade regulations, import/export analysis, production analysis, value chain optimization and optimization strategies, market share impacts of domestic and localized players as well as opportunities in terms of emerging revenue pockets, changes to regulations as well as growth potential in terms of category market size growths, application niche dominance as well as product approvals launches geographic expansion and technological innovations in this market.

Opportunity

Technology advances are fuelling growth in Halal food products.

Technological developments in halal food products are rapidly increasing their prominence within the global halal market, prompting laboratories dedicated solely to food safety to expand and become involved with their implementation. These laboratories specialize in food analysis to maintain high standards for product quality while simultaneously searching for any sign of alcohol, blockchain, or porcine materials that might threaten market viability. Free PBC, an open semantic graph database company located in the US, recently joined forces with Sinisana Technologies from Malaysia for Web3 Blockchain Traceability to offer unrivaled halal food product sourcing and safety to Malaysia-based supply chain operations. Through their partnership, Fluree announced they could enable Sinisana Technologies’ supply chains in Malaysia to offer unparalleled end-to-end sourcing of their Halal food product range while simultaneously keeping their operations safe from audit.

With new product releases to expand our halal food product lines.

Marks & Spencer recently unveiled its own-brand halal ready meals including chicken and leek bake, hotpot, arrabbiata pasta with chicken jalfrezi, jalfrezi and tikka masala available across Dubai, U.K. and Singapore outlets operated by Al-Futtaim in November 2019. These will all provide opportunities for market expansion.

Trends

Consumers appreciate authentic and credible Halal certification, leading to greater demand for certified products. Nestle Malaysia earned Halal certification, becoming the first multinational corporation ever to meet stringent Halal standards.

Recent years have witnessed an upsurge in online Halal Food sales. Platforms such as Halalworlddepot.com and Crescentfoods.com offer consumers certified Halal food options delivered straight to their homes.

Demand for ethically sourced Halal food products continues to rise as consumers prioritize environmental impact and animal welfare in their decisions. Leading Halal food producer Al Islami Foods meets this need by adhering to sustainable production methods while upholding animal welfare in their production processes.

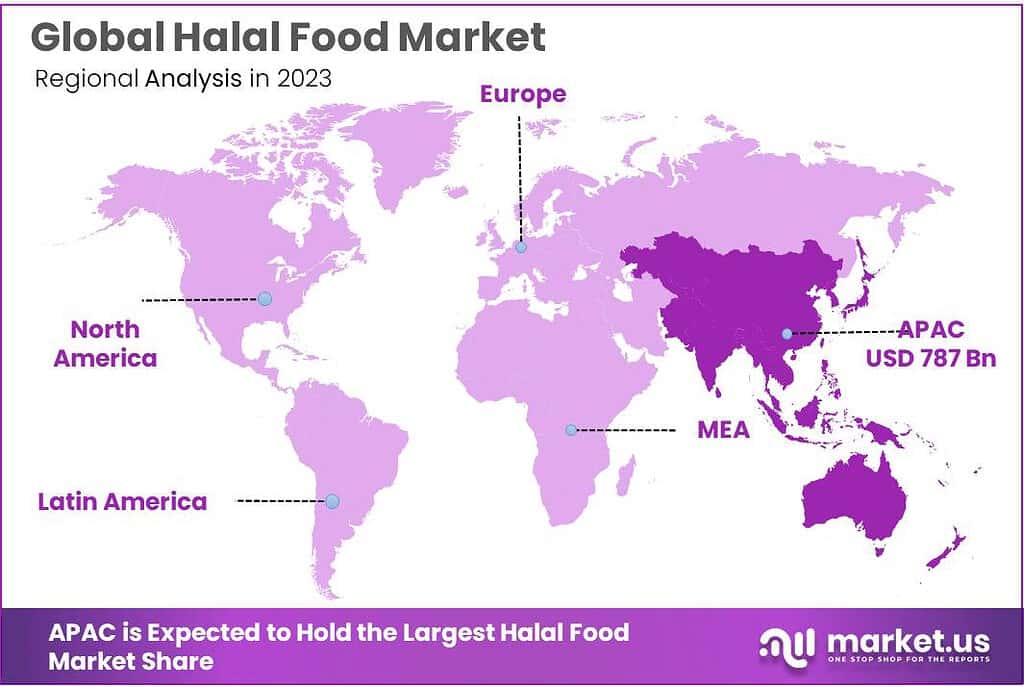

Regional Analysis

The Asia Pacific region dominates the global Halal food market, commanding a significant market share of 60.3%. The market is projected to reach a value of 786.91 billion during the forecast period. This dominance is attributed to increased consumption of Halal food across key sectors such as foodservice, retail, and hospitality.

The substantial growth in Halal food production in countries like Indonesia, Malaysia, Pakistan, and Bangladesh is expected to drive market expansion in the Asia Pacific region. These countries are witnessing rising demand for Halal-certified products, driven by a growing Muslim population and increasing awareness of Halal dietary requirements.

In North America, the Halal food market is experiencing steady growth, fueled by increasing demand from Muslim consumers and a growing preference for ethical and natural food products. The region’s diverse population and multicultural society contribute to the popularity of Halal food options.

Similarly, Europe is witnessing significant growth in the Halal food market, driven by increasing awareness of Halal certification among consumers and the growing availability of Halal products in retail outlets and foodservice establishments. The region’s multiculturalism and diverse consumer preferences further contribute to market expansion.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Halal food market, several key players play a significant role in shaping the industry landscape. Nestlé, a global food and beverage company, stands out as a major player offering a diverse range of Halal-certified products, including dairy, confectionery, and packaged foods. With a strong presence in Muslim-majority countries, Nestlé has established itself as a trusted provider of high-quality and safe Halal food options.

Another key player in the Halal food market is Al Islami Foods, based in the UAE. Specializing in Halal meat products such as chicken, beef, and processed meats, Al Islami Foods is renowned for its commitment to producing Halal products of exceptional quality. The company has expanded its reach across the Middle East and beyond, catering to the dietary needs of Muslim consumers worldwide.

Market Key Players

- Nestlé S.A

- Cargill, Incorporated

- Unilever

- American Halal Company, Inc.

- Al-Falah Halal Foods

- Prima Agri-Products

- One World Foods Inc.

- Midamar Corporation

- QL Foods

- Rosen’s Diversified Inc.

- Wellmune

- Kewpie Corporation

- YHS (Singapore) PTE Ltd.

Recent Developments

- In 2024, Cargill announced strategic partnerships with Halal certification bodies to ensure compliance with Halal standards across its global operations. The company also invested in research and development to innovate new Halal products for diverse consumer preferences.

- In 2024, the American Halal Company introduced innovative packaging solutions for its Halal food products to enhance convenience and freshness for consumers. The company also expanded its distribution network to reach new markets.

Report Scope

Report Features Description Market Value (2023) USD 1305 Bn Forecast Revenue (2033) USD 3739 Bn CAGR (2023-2033) 11.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Meat and Alternatives, Milk and Milk Products, Fruits and Vegetables, Grain Products, Others), By Distribution Channel( Supermarket/Hypermarket, Convenience Stores, Specialty Stores, Online, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Nestlé S.A, Cargill, Incorporated, Unilever, American Halal Company, Inc., Al-Falah Halal Foods, Prima Agri-Products, One World Foods Inc., Midamar Corporation, QL Foods, Rosen’s Diversified Inc., Wellmune, Kewpie Corporation, YHS (Singapore) PTE Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Who are the key players in the Halal Food Market?Nestlé S.A, Cargill, Incorporated, Unilever, American Halal Company, Inc., Al-Falah Halal Foods, Prima Agri-Products, One World Foods Inc., Midamar Corporation, QL Foods, Rosen's Diversified Inc., Wellmune, Kewpie Corporation, YHS (Singapore) PTE Ltd.

What is the size of Halal Food Market?Halal Food Market size is expected to be worth around USD 3739 billion by 2033, from USD 1305 billion in 2023

What is the CAGR for the Halal Food Market?The Halal Food Market expected to grow at a CAGR of 11.1% during 2023-2032.

-

-

- Nestlé S.A

- Cargill, Incorporated

- Unilever

- American Halal Company, Inc.

- Al-Falah Halal Foods

- Prima Agri-Products

- One World Foods Inc.

- Midamar Corporation

- QL Foods

- Rosen's Diversified Inc.

- Wellmune

- Kewpie Corporation

- YHS (Singapore) PTE Ltd.