Global Hacksaw Blades Market Size, Share, Growth Analysis By Material (High Carbon Steel (HCS), Bi-Metal, High-Speed Steel (HSS), Carbide-Tipped), By Blade Type (Regular Hacksaw Blade, Raker Hacksaw Blade, Wavy Hacksaw Blade), By Teeth Per Inch (14 TPI, 18 TPI, 24 TPI, 32 TPI), By End-User Industry (Construction, Automotive, Aerospace, Manufacturing, Oil and Gas, Metalworking, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140590

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

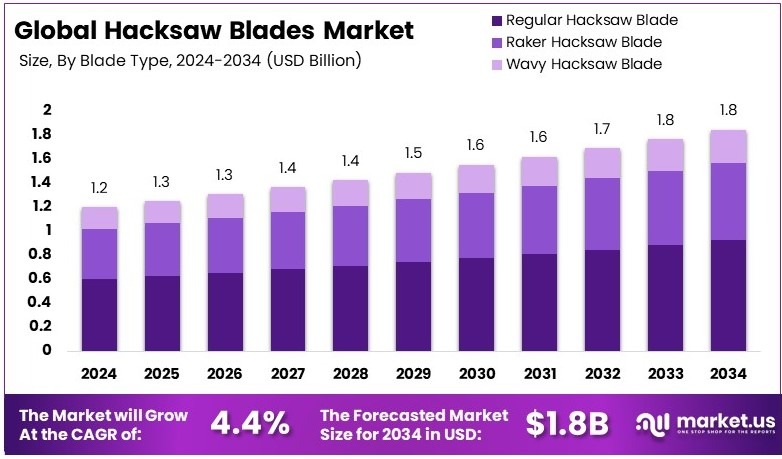

The Global Hacksaw Blades Market size is expected to be worth around USD 1.8 Billion by 2034, from USD 1.2 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

Hacksaw blades are thin, toothed metal strips used in hand saws for cutting metal and plastic. They are made from high-quality steel and designed for durability. The blades come in various tooth configurations and lengths to suit different cutting applications. They ensure clean cuts in diverse industrial and construction tasks.

Hacksaw blades market refers to the industry involved in manufacturing and distributing blades. It includes suppliers, manufacturers, and retailers. The market covers various segments based on blade type, size, and application. It serves construction, metalworking, and manufacturing sectors while focusing on quality, precision, and safety standards in production and distribution.

The hacksaw blades market is experiencing robust growth, significantly driven by the rising trend in do-it-yourself (DIY) furniture and home improvement activities. According to recent data, in 2024, approximately 62% of American homeowners indicated plans to undertake renovation projects, an increase from 48% the previous year.

Remarkably, 43% of these individuals preferred to complete these projects themselves, surpassing the 29% who chose professional help. This shift highlights a substantial increase in demand for DIY tools like hacksaw blades, which are crucial for cutting and shaping materials during renovations.

Moreover, the increasing popularity of home improvement projects has led to heightened market competition among hacksaw blade manufacturers.

Companies are now striving to innovate and enhance the durability and effectiveness of their products to capture this growing segment of self-reliant consumers. Additionally, the market faces saturation challenges; however, the continuous introduction of new technologies and materials in blade manufacturing is creating new opportunities for growth.

On a broader scale, the expansion of the hacksaw blades market has significant economic implications. Locally, it stimulates demand for a wide range of related goods and services, contributing to economic activity in hardware and home improvement sectors.

Furthermore, government involvement through regulations focusing on safety and environmental standards ensures the production of high-quality tools, supporting sustainable industry practices. Collectively, these dynamics are fostering a competitive and vibrant market environment, aligning with consumer preferences and regulatory frameworks to propel the future growth of the hacksaw blades industry.

Key Takeaways

- The Hacksaw Blades Market was valued at USD 1.2 billion in 2024 and is expected to reach USD 1.8 billion by 2034, with a CAGR of 4.4%.

- In 2024, High Carbon Steel dominated the material segment with 45%, driven by its affordability and durability in metal cutting.

- In 2024, Regular Hacksaw Blades led the blade type segment with 50%, owing to their versatility in cutting various materials.

- In 2024, 24 TPI blades accounted for 42%, as they offer fine cuts suitable for precision metalworking applications.

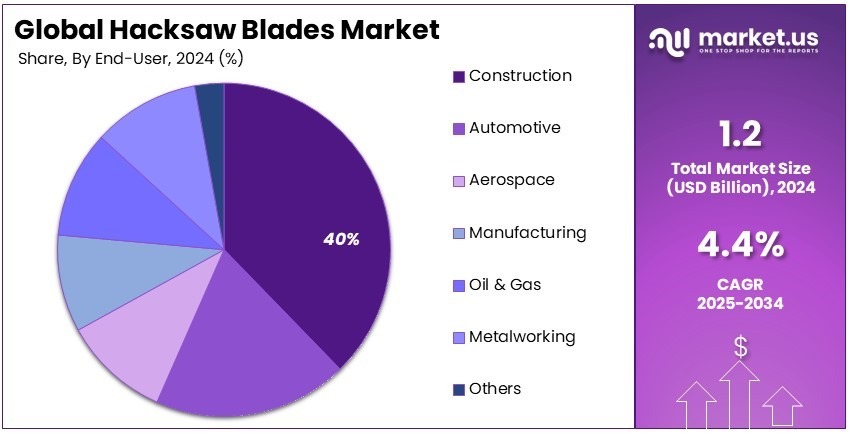

- In 2024, the Construction sector held 40%, attributed to rising infrastructure projects requiring durable cutting tools.

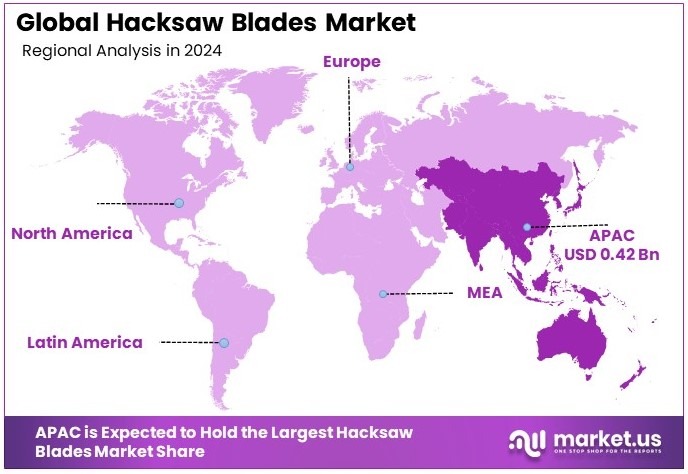

- In 2024, APAC dominated the market with 34.7% and a value of USD 0.42 billion, driven by rapid industrialization and construction growth.

Material Analysis

High Carbon Steel (HCS) dominates with 45.0% due to its affordability and versatility.

High carbon steel is the most widely used material in hacksaw blades due to its cost-effectiveness and strength. HCS blades offer excellent cutting performance for general-purpose tasks, making them a preferred choice across various industries. They are commonly used for cutting metals, plastic pipes, and other materials in applications such as construction, manufacturing, and automotive sectors.

The high carbon content in these blades contributes to their durability and ability to maintain sharpness over time. For example, in construction projects, HCS hacksaw blades are frequently used to cut pipes, rods, and structural components, benefiting from their low cost while providing reliable performance. This makes HCS blades the dominant material in the market, as they strike an optimal balance between price and performance.

Bi-Metal blades are another important segment, offering a longer lifespan compared to HCS blades. These blades are made by welding a high-speed steel (HSS) edge to a flexible steel body, combining durability and flexibility. Bi-metal blades are commonly used for tougher applications like metal cutting.

High-Speed Steel (HSS) blades are known for their resistance to wear and heat, providing a longer cutting life but at a higher cost. These blades are especially used in the aerospace and automotive industries, where precision and durability are paramount. Carbide-Tipped blades offer superior cutting performance, especially for hard materials like stainless steel or metal alloys, but they are more expensive, limiting their use to specialized industries.

Blade Type Analysis

Regular Hacksaw Blades dominate with 50.0% due to their versatility and broad application.

Regular hacksaw blades are the most common type used in many industries because they are effective for a wide range of materials and applications. These blades are typically used for general-purpose cutting in industries like construction, automotive, and manufacturing.

Their simple design and ability to cut through both metals and plastics efficiently make them a go-to choice for users. For example, in manufacturing plants, regular hacksaw blades are used for cutting rods, pipes, and other basic materials. This widespread use has solidified regular blades as the dominant type in the market.

Raker hacksaw blades are designed with teeth that are set alternately to the left and right. These blades are more suitable for cutting through thick materials and are often used in more specialized applications where higher cutting efficiency is required.

Wavy hacksaw blades, while less common, are used for cutting softer metals and plastics. These blades have a wavy tooth design, which reduces friction during cutting and allows for faster work, though they are used less frequently compared to regular and raker blades. Despite their smaller share in the market, these blade types play an essential role in industries requiring specific cutting capabilities.

Teeth Per Inch Analysis

24 TPI blades dominate with 42.0% due to their balance between speed and precision.

Blades with 24 teeth per inch (TPI) strike an optimal balance between cutting speed and precision, making them the most widely used in general-purpose applications. This TPI range is ideal for cutting through a variety of materials like mild steel, plastic, and other metals without sacrificing speed or accuracy.

In industries like manufacturing and automotive, 24 TPI blades are commonly used to achieve clean cuts with reasonable efficiency. The versatility of 24 TPI blades ensures their continued dominance in the market as they offer a wide range of cutting capabilities suitable for most tasks.

18 TPI blades are often used for cutting through thicker materials, providing slightly slower but more aggressive cutting. These blades are favored in industries where fast and rough cuts are required, like metalworking and construction.

14 TPI blades are used for heavier cuts, making them ideal for cutting through thick pipes or large metal components. These blades prioritize cutting power over precision, which makes them suitable for industrial and construction applications. 32 TPI blades, on the other hand, offer higher precision for fine cutting, but they are generally used in more specialized tasks like precision manufacturing or fine metalworking, giving them a smaller market share.

End-User Industry Analysis

Construction industry dominates with 40.0% due to high demand for cutting materials in large projects.

The construction industry holds the largest share in the hacksaw blade market. Hacksaw blades are essential tools for cutting through various materials such as steel pipes, rebar, and plastic components. The ongoing growth in the construction of residential, commercial, and infrastructure projects further drives the demand for these tools.

As the construction sector continues to expand, particularly in emerging economies, hacksaw blades remain in high demand for general-purpose cutting tasks on job sites. For example, in large building projects, hacksaw blades are indispensable for trimming and adjusting materials to fit structural specifications.

The automotive sector follows, utilizing hacksaw blades for cutting through metal components and automotive parts during manufacturing and repairs. Aerospace uses specialized hacksaw blades for cutting through metal alloys in aircraft manufacturing, where high precision is essential.

Oil & Gas and metalworking industries each rely on hacksaw blades for cutting pipes and other heavy-duty tasks. Lastly, others (like agriculture and small machinery industries) contribute to the overall growth but represent a smaller segment in the hacksaw blade market.

Key Market Segments

By Material

- High Carbon Steel (HCS)

- Bi-Metal

- High-Speed Steel (HSS)

- Carbide-Tipped

By Blade Type

- Regular Hacksaw Blade

- Raker Hacksaw Blade

- Wavy Hacksaw Blade

By Teeth Per Inch

- 14 TPI

- 18 TPI

- 24 TPI

- 32 TPI

By End-User Industry

- Construction

- Automotive

- Aerospace

- Manufacturing

- Oil & Gas

- Metalworking

- Others

Driving Factors

Rising Demand for Precision Cutting Drives Market Growth

The growing demand for precision cutting in metalworking and construction industries is a major driver of the hacksaw blades market. These sectors require high-quality blades to achieve accurate, clean cuts in various materials. The ability to make precise cuts is crucial in manufacturing, fabrication, and construction, and hacksaw blades are seen as effective tools for these purposes.

Additionally, the increasing use of hacksaw blades in DIY and home improvement projects contributes significantly to market growth. As more individuals engage in home renovation, repairs, and custom woodworking, the need for efficient and reliable cutting tools has expanded.

Furthermore, rising industrial automation enhances blade performance and durability. As industries adopt more automated processes, the demand for blades capable of withstanding higher operational speeds and providing greater longevity increases. This trend is driving innovation in hacksaw blade design, making them more reliable and efficient.

Advancements in blade materials are another factor driving market growth. New materials and coatings improve the lifespan and efficiency of hacksaw blades. These innovations enable blades to cut through tougher materials with ease, offering better performance and reducing the frequency of blade replacement, ultimately boosting market demand.

Restraining Factors

Competition from Alternatives and Safety Concerns Restrain Market Growth

Despite the growth potential, the hacksaw blades market faces several challenges. One key restraint is competition from alternative cutting tools such as band saws and power saws. These alternatives often provide faster, more efficient cutting, especially in large-scale industrial operations, which limits the demand for hacksaw blades.

Fluctuating raw material costs also impact blade pricing. Variations in the prices of steel and other materials used to manufacture hacksaw blades can increase production costs, which in turn affects retail pricing and consumer affordability.

Moreover, hacksaw blades have limitations in cutting capacity for specific materials. For instance, thicker or harder materials may require alternative tools, restricting the overall application range of hacksaw blades.

Safety concerns also pose a challenge, as improper handling or misuse of hacksaw blades can lead to accidents. Ensuring safety standards and user education is critical to preventing injuries, which could affect market growth if mishaps become more common.

Growth Opportunities

Expansion into New Sectors and Innovations Provide Market Opportunities

The hacksaw blade market has significant growth opportunities. One of the most promising prospects is the expansion of hacksaw blade applications in the automotive and aerospace industries. These sectors require high-precision cutting of complex materials, and the demand for high-performance blades is increasing.

Additionally, emerging markets are witnessing rapid industrial growth, which is driving demand for efficient cutting tools. As these markets continue to develop, hacksaw blades will play a crucial role in meeting the increasing need for industrial production and infrastructure projects.

The development of advanced coatings for enhanced durability and corrosion resistance is another key opportunity. As these coatings improve blade performance, they offer longer-lasting products and higher efficiency, meeting the demands of industries that require reliable tools for tough jobs.

Furthermore, the rising adoption of ergonomic designs for user comfort and efficiency provides an additional avenue for growth. Blades designed with ergonomics in mind will attract users who seek improved comfort and reduced physical strain during long cutting sessions, contributing to market expansion.

Emerging Trends

High-Performance and Sustainability Trends Shape Market Future

Several trends are shaping the hacksaw blades market. A shift towards high-performance and bi-metal blades is increasingly apparent. These blades, known for their strength and versatility, are being used in a wide variety of industries, offering longer lifespan and better performance in demanding applications.

There is also growing interest in sustainable and eco-friendly material sourcing for blades. As industries and consumers become more conscious of environmental impacts, the demand for blades made from recycled or eco-friendly materials is rising.

Moreover, there is an increasing demand for precision blades in industrial cutting applications. As industries focus on achieving higher levels of precision in production, specialized blades are required to meet these standards.

Finally, the popularity of multi-purpose hacksaw blades for versatile uses in various industries is on the rise. These blades are designed to handle different materials and applications, making them an attractive option for businesses that require flexibility in their cutting operations. Together, these trends are contributing to the evolution of the hacksaw blades market.

Regional Analysis

Asia Pacific Dominates with 34.7% Market Share

Asia Pacific (APAC) leads the Hacksaw Blades Market with a 34.7% share, valued at USD 0.42 billion. This dominance is driven by the rapid industrial growth, rising construction activities, and the expanding manufacturing sector in countries like China, India, and Japan. Additionally, the demand for hacksaw blades in the automotive, aerospace, and metalworking industries further strengthens the region’s position.

APAC benefits from its large, diverse manufacturing base and low production costs. Countries such as China and India are major contributors to the global demand for tools and machinery, including hacksaw blades, which are critical for various cutting applications. The region’s fast-paced urbanization and infrastructure development also support the need for tools in construction and industrial sectors.

The market is influenced by regional dynamics such as the availability of raw materials, low labor costs, and favorable government policies aimed at promoting industrialization. APAC’s manufacturing capabilities and export-driven economy provide a steady demand for hacksaw blades, which are essential tools across multiple industries. Additionally, the increasing focus on industrial automation and precision engineering will drive further demand for high-quality blades.

Regional Mentions:

- North America: North America holds a strong position in the Hacksaw Blades Market, driven by advanced manufacturing technologies and high demand in industries such as automotive and construction. The presence of leading manufacturers in the U.S. and Canada continues to support steady market growth in the region.

- Europe: Europe’s market is characterized by high demand for precision tools in sectors like aerospace and automotive. The region’s focus on high-quality, durable products and its technological innovation contribute to its stable growth, especially in countries like Germany and the UK.

- Middle East & Africa: The Middle East & Africa are gradually increasing their market share, driven by large-scale infrastructure projects and industrialization. Countries like Saudi Arabia are seeing a rise in construction and manufacturing activities, which supports the need for cutting tools like hacksaw blades.

- Latin America: Latin America is experiencing moderate growth in the Hacksaw Blades Market, with Brazil and Mexico leading demand. Increasing industrialization and the focus on modernizing the construction and manufacturing sectors in the region contribute to this market’s expansion.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Hacksaw Blades Market, the key players Stanley Black & Decker, Bosch Limited, Irwin Industrial Tools, and Bahco (SNA Europe) dominate the market due to their extensive product offerings, innovation, and global distribution.

Stanley Black & Decker, Inc. is a leading player in the hacksaw blades market, offering a wide range of durable and high-performance blades. The company’s long-standing reputation for quality and reliability, along with its strong distribution network, ensures its dominance in the global market. Stanley Black & Decker’s continuous focus on product development and customer satisfaction has helped it maintain a competitive edge.

Bosch Limited is a prominent competitor, known for producing precision-engineered hacksaw blades. Bosch’s commitment to high-quality manufacturing and advanced technology has made it a preferred choice among professionals in industries like construction and automotive. The company’s strong global presence and innovative approach to tool design ensure its continued leadership in the market.

Irwin Industrial Tools, part of Newell Brands, specializes in offering premium-quality hacksaw blades designed for demanding applications. Irwin’s tools are known for their cutting-edge technology and performance, making them a popular choice in various industries. The brand’s focus on product innovation and ergonomic design helps it maintain a leading position in the market.

Bahco (SNA Europe) has established itself as a key player in the hacksaw blades market by offering products known for their durability and superior performance. The company’s focus on quality, coupled with its strong brand reputation in Europe and expanding presence in global markets, positions Bahco as a top competitor.

These companies dominate the hacksaw blades market through innovation, high-quality product offerings, and strong global distribution networks, ensuring their continued leadership in the industry.

Major Companies in the Market

- Stanley Black & Decker, Inc.

- Bosch Limited

- Irwin Industrial Tools

- Bahco (SNA Europe)

- Lenox Tools (Apex Tool Group)

- Makita Corporation

- H.K. Porter Company, Inc.

- Starrett Company

- M. K. Morse

- TTI (Techtronic Industries)

- Essentra Components

- DMT (Diamond Machine Technology)

- Fiskars Group

Recent Developments

Stanley Black & Decker: Over the years, Stanley Black & Decker has expanded its brand portfolio to include names such as DeWalt, Black+Decker, Bostitch, Craftsman, Irwin, Lenox, and Porter-Cable. This move has strengthened its position in the global tools market.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Billion Forecast Revenue (2034) USD 1.8 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (High Carbon Steel (HCS), Bi-Metal, High-Speed Steel (HSS), Carbide-Tipped), By Blade Type (Regular Hacksaw Blade, Raker Hacksaw Blade, Wavy Hacksaw Blade), By Teeth Per Inch (14 TPI, 18 TPI, 24 TPI, 32 TPI), By End-User Industry (Construction, Automotive, Aerospace, Manufacturing, Oil and Gas, Metalworking, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Stanley Black & Decker, Inc., Bosch Limited, Irwin Industrial Tools, Bahco (SNA Europe), Lenox Tools (Apex Tool Group), Makita Corporation, H.K. Porter Company, Inc., Starrett Company, M. K. Morse, TTI (Techtronic Industries), Essentra Components, DMT (Diamond Machine Technology), Fiskars Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Stanley Black & Decker, Inc.

- Bosch Limited

- Irwin Industrial Tools

- Bahco (SNA Europe)

- Lenox Tools (Apex Tool Group)

- Makita Corporation

- H.K. Porter Company, Inc.

- Starrett Company

- M. K. Morse

- TTI (Techtronic Industries)

- Essentra Components

- DMT (Diamond Machine Technology)

- Fiskars Group