Global Grow Light Market By Product(< 300 Watt, 300 Watt), By System(Hardware, Software), By Technology(High-Intensity Discharge (HID), LED, Fluorescent, Plasma), By Installation(New Installation, Retrofit), By Spectrum(Partial Spectrum, Full Spectrum), By Application(Indoor Farming, Vertical Farming, Commercial Greenhouse), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 46765

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

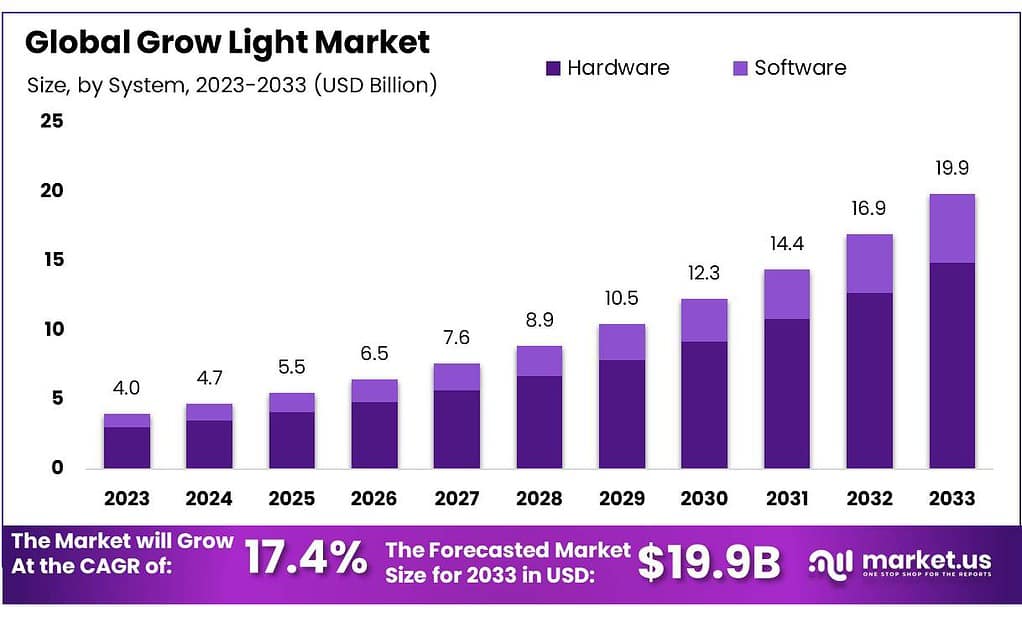

The Grow Light Market size is expected to be worth around USD 19.9 billion by 2033, from USD 4 billion in 2023, growing at a CAGR of 17.4% during the forecast period from 2023 to 2033.

The market is growing due to the increasing use of vertical farming, urban cultivation, and the adoption of environmentally friendly fruits and vegetables.

The urban agriculture sector has seen a surge in demand due to unprecedented global population growth. Vertical farming, which involves the production of food in vertically stacked layers such as a warehouse, skyscraper, or shipping container, is driving the market growth.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth Projection: The Grow Light Market is anticipated to surge to a staggering USD 19.9 billion by 2033, showing a remarkable CAGR of 17.4% from USD 4 billion in 2023.

- Drivers Behind Growth: Urban agriculture dynamics, propelled by a burgeoning global population, and the shift towards eco-friendly produce are driving the demand for grow lights.

- Product Differentiation: The 300-watt segment dominates revenue due to energy efficiency advancements and is expected to maintain its dominance.

- System Dynamics: LED lights, constituting over 75% of the market share, underline the significance of high-performance hardware in indoor cultivation setups.

- Technology Trends: LED technology’s rise is attributed to urban cultivation, despite initial higher costs. Plasma lights show promise due to durability and energy efficiency.

- Application Dynamics: Commercial greenhouses lead revenue share, but vertical farming is poised for rapid growth, addressing space constraints.

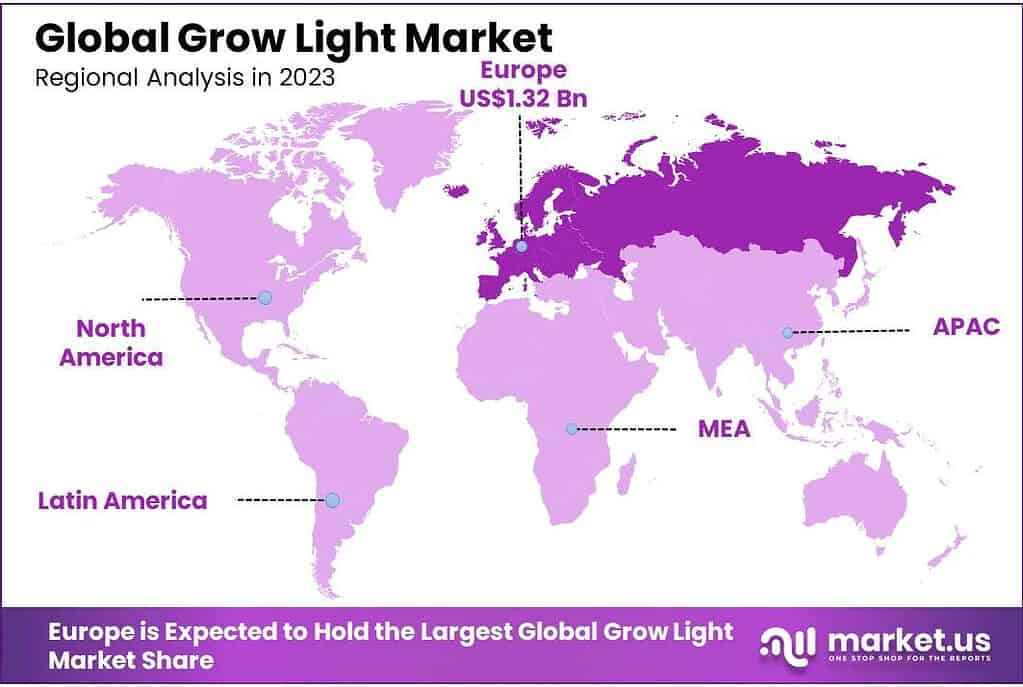

- Regional Market Dynamics: Europe leads in revenue share, propelled by alternative farming awareness and limited fertile land. Asia Pacific shows potential due to LED use in energy efficiency and crop technology adoption.

- Restrictions: LED grow lights’ upfront costs are a notable obstacle, demanding higher investments, and impacting newcomers entering indoor farming.

- Opportunities: The farm-to-table movement promotes sustainability, connecting agriculture and dining, emphasizing locally-grown produce.

- Challenges: Optimal placement of grow lights significantly impacts plant growth, demanding tailored setups for various plants and stages.

- Regional Analysis: Europe leads in revenue, followed by the Asia Pacific, Africa faces growth challenges due to limited resources.

- Key Companies: Market leaders employ strategies like partnerships and acquisitions for market expansion and growth.

Product Type Analysis

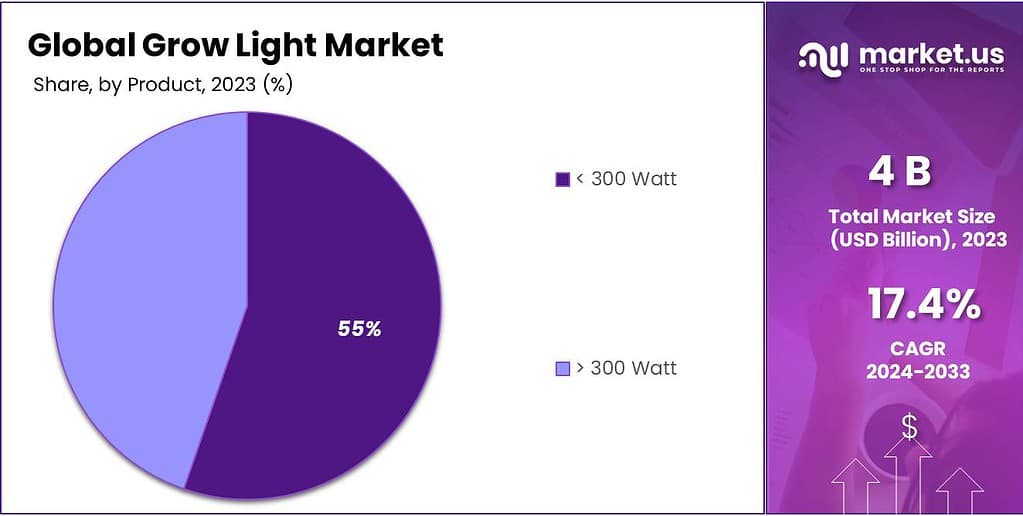

The industry can be divided into two groups based on its product: 300 watts. With a market share greater than 64%, the 300-watt segment was the most profitable in the industry in terms of revenue in 2023.

It is expected to continue its dominance over the forecast period. Technological advancements in energy efficiency and conservation are responsible for the industry’s growth.

The segment with a 300-watt is expected to see the greatest CAGR over the forecast period. Low-power growth lights (300 watts) are more efficient than high-power lights. Low-power grow lights produce less heat and can last for longer periods without causing damage to plants.

Higher wattage can cause plants to wilt, brown, or die.This is why the segment of >300 Watts will likely hold a smaller market share than other segments. Some growers make use of it to increase their yields by adding more nutrients to counteract the high wattage. Grow lights are more expensive but offer a quicker way to grow indoor plants.

These lights are used primarily in the horticulture industry to produce a faster harvest. Commercial greenhouses also use high-wattage grow lights. To maintain temperature, grow lights with a power rating of >300 watts may need to be cooled. This adds to energy costs.

Note: Actual Numbers Might Vary In The Final Report

System Analysis

The dominance of the ‘Hardware’ segment in the Grow Light Market highlights the pivotal role played by tangible elements like LED lights, fixtures, and associated equipment in indoor plant cultivation. This segment’s ascendancy to over 75% of the market share in 2023 mirrors the surge in demand for sophisticated and high-performing lighting systems sought after by indoor growers.

The software segment of the grow light market contains Controlled-Environment Agriculture (CEA) to control various environmental factors such as humidity, temperature, water, and light. Grow lights can be equipped with software solutions to enhance plant quality. Each plant has its requirements in terms of optimal lighting duration and intensity.

This can optimize the indoor plant’s production output. The best way to maximize the use of grow lights is to design specialized software that meets the needs of each plant. Many companies offer software services, such as the repair and maintenance of grow lights.

Technology Analysis

The technology classifications of the industry are High Intensity (HID), LED, and Fluorescent. HID is primarily used in commercial farming, such as vertical farms and commercial greenhouses. The LED segment will dominate the market over the forecast period.

The LED segment will be driven by increasing urban cultivation and government initiatives to use energy-efficient LEDs.

The most efficient LED lamps can be found at a higher cost point. LEDs produce the exact wavelength of light desired. It can simultaneously produce both red and blue spectrums. All growth stages can use LEDs. While LEDs can be more costly in the initial stages, they become less expensive over time.

The highest expected CAGR for the plasma segment will be seen during the forecast period. Plasma lights emit full-spectrum light that is similar to sunlight. These lights are more durable and produce less heat. Plasma lights consume less energy than other types of lighting technology, even though they produce light with similar intensity to HID and LED.

Although plasma lights are expensive initially, they become less expensive over time. Both vegetative growth and flowering can be made easier by plasma lights.

Spectrum Analysis

A partial spectrum grows lights in a particular spectrum, such as yellow, green, or blue. These light spectrums can be used at different stages of plant growth.

They are designed to target specific stages of plant development and can significantly reduce growth time and increase yields. For the vegetative stage, blue and red wavelengths are most favorable. However, for flowering, far-red and far-red wavelengths encourage a better indoor plant growth rate.

The full spectrum segment will dominate the forecast period. It is expected to grow at an even higher CAGR than the partial spectrum. Full-spectrum light is light that reaches all wavelengths from 400 nm up to 700 nm. This is called Photosynthetic Active Radiation, (PAR).

Full-spectrum light can be used for dual purposes. It can also provide lighting for plants and space. This light can be used to help growers reduce or eliminate additional sources of light from their growing spaces.

Application Analysis

The industry can be divided into three types based on the applications: indoor farming, vertical agriculture, commercial greenhouse, and others. The commercial greenhouse segment was the most profitable in terms of revenue. This is due to technological advances and increased use of grow lights. The fastest-growing segment of vertical farming is expected to be during the forecast period.

Over the forecast period, factors such as technological advances in grow lights and increased penetration of indoor and vertical farming will drive the application segment. Vertical farming is well-accepted in countries such as Japan, China, and the Netherlands.

Vertical farming allows for the production of herbs, medicine, and food in vertically stacked layers that are then integrated into a warehouse, skyscraper, or shipping container. Vertical farms can also use grow lights and metal reflectors to improve the sunlight.

Due to space constraints, multiple vertical farms have been established in major cities across Japan and China. Vertical farming is a growing sector in which big companies like Toshiba and Panasonic are investing heavily. This will be a major factor in the growth of the grow light market.

Кеу Маrkеt Ѕеgmеntѕ

By Product

- < 300 Watt

- 300 Watt

By System

- Hardware

- Software

By Technology

- High-Intensity Discharge (HID)

- LED

- Fluorescent

- Plasma

By Installation

- New Installation

- Retrofit

By Spectrum

- Partial Spectrum

- Full Spectrum

By Application

- Indoor Farming

- Vertical Farming

- Commercial Greenhouse

- Other applications

Drivers

More people are coming, so we’ll need loads more food. Experts say we’ll have to make double the food we did in 2014 by the time 2050 rolls around. The United Nations figures there’ll be around 9.6 billion people on the planet then.

This is a big deal for farmers—they’re going to feel a ton of pressure to grow more crops.Cities are growing larger, water resources have decreased significantly and climate conditions are altering in ways that make farming difficult – meaning each person has less space in which they can cultivate food – creating yet another challenge for agriculture.

As a result, farmers are exploring new methods of cultivating food. Some use smart greenhouses while others farm vertically in tall buildings – all while having to navigate reduced land availability for farming. It will take the collective intelligence of everyone involved to solve this complex challenge of feeding nearly 10 billion people by 2050!

Restraints

Indoor gardening, powered by grow lights, has long been popular for cultivating fresh produce and herbs, creating a refreshing ambiance at home. LED grow lights, gaining traction due to their numerous advantages over traditional lighting like HPS and fluorescent lights, offer enhanced solutions for indoor farming.

While these modern lights outperform older technologies by providing specific light spectrums tailored for plant growth, their initial setup costs pose a notable obstacle.

Unlike conventional lighting options, LED grow lights demand a higher upfront investment owing to their specialized design. Each unit incorporates arrays of LEDs optimized for horticultural purposes, varying in watts and wavelengths to cater to different plant needs.

High-powered LED grow lights enter the market at a starting price of $500, escalating to $2,000 or more for top-notch, full-spectrum options suitable for commercial indoor farming. This substantial cost differential compared to older lighting technologies like fluorescent and HID lamps poses a significant challenge, particularly for newcomers entering the realm of indoor farming, where high-quality lighting is essential for optimal plant growth.

Opportunities

The farm-to-table movement, championing locally sourced food in nearby eateries and food spots, is gaining significant traction. More folks are seeking out meals made from local ingredients, boosting the demand for these farm-fresh options. This trend isn’t just about health-conscious or trendy eaters anymore—it’s becoming a bigger deal for many.

This movement is pushing for a more sustainable way of growing food and eating, promoting a connection between agriculture and dining within communities. As it gains momentum, people are getting more aware and interested in eating food that’s grown nearby.

This growing preference for local ingredients isn’t limited to one type of eatery. It’s spreading into different parts of the hospitality industry. Horticulture lighting plays an essential role in farm-to-table restaurants by providing access to locally grown produce, and that is where Controlled Environment Agriculture (CEA) comes into play. CEA ensures restaurants receive enough food even as demand continues to increase – helping make farm-to-table an increasingly sustainable form of eating which reaches more and more people each year.

Challenges

The placement of grow lights plays a pivotal role in ensuring optimal plant growth. The quality of light a plant receives depends significantly on how these lights are positioned, considering both multilayering and horizontal arrangements. Achieving an even distribution of light is crucial, as the distance between fixtures can impact this balance.

When placed too closely, these lights can create hot spots due to overlapping, leading to certain areas receiving too much light and causing wilting in others that get insufficient light. On the contrary, hanging lights too far away may result in inadequate light energy, affecting plant development, such as smaller or fewer flowers, fruits, or leggier growth.

Grow lights are commonly suspended above plants, integrated into shelving units, or used in standalone lamps. The height distance between the plant and the LED light is a critical factor. If the lamp is too close, it risks burning or discoloring the leaves, while placing it too far may lead to insufficient light exposure, hindering growth, especially in plants with sparse leaves and slow development.

Striking the right balance in light placement is a significant challenge for the grow lights industry, as it directly impacts plant health and growth, demanding tailored setups for various plant types and growth stages.

Geopolitical and Recession Impact Analysis

Geopolitical Impact:

- Trade Import and Tariff Restrictions: Tensions between nations might trigger tariffs and restrictions on the import of grow lights. This could disrupt the supply chain, elevate production costs, and ultimately lead to increased prices for consumers.

- Supply Chain Disruptions: Conflicts or instability in key regions where grow lights are manufactured might disrupt the supply chain. Political instability in a major manufacturing country could cause delays in raw material shipments and interruptions in production.

- Market Access Challenges: Geopolitical tensions could hinder grow light companies from expanding into new markets. Restrictions or unfavorable trade policies might limit their growth potential in specific regions, impacting market expansion.

- Currency Exchange Rate Fluctuations: Geopolitical events often result in fluctuations in currency exchange rates. These fluctuations can impact the cost of raw materials and the competitiveness of grow light exports, affecting both domestic and international markets.

Recession Impact:

- Reduced Agricultural Expansion: Economic downturns often lead to a decrease in agricultural expansion, affecting the demand for grow lights used in indoor farming or greenhouse setups. Consumer

- Spending Constraints: Economic recessions typically result in reduced consumer spending. This could lead to delays or cutbacks in purchasing grow lights for personal gardening or indoor plant cultivation.

- Cost-Cutting Measures: Grow light manufacturers might implement cost-cutting measures during recessions, potentially affecting the availability of certain light models and influencing market competitiveness.

- Innovation and Product Development: Recessions may spur innovation in the grow light industry. Manufacturers may focus on developing more cost-effective and energy-efficient lighting solutions to align with changing consumer preferences and budget constraints.

Regional Analysis

The Europe region was the market leader in revenue in 2023, with a market share greater than 33%. It is expected to continue its dominance over the forecast period. The key factors expected to drive industry demand are growing awareness about the importance of alternative farming and the decreasing availability of fertile land.

The growing use of genetically modified crop technology is expected to drive significant growth in the Asia Pacific region market over the forecast period.

Many countries in the region are switching to energy-efficient LED lighting to lower their energy consumption. The replacement of traditional incandescent bulbs with LEDs could help reduce greenhouse gas emissions.

The African region’s demand is expected to grow due to growing urban populations and the commercialization of indoor agriculture.

The region’s growth will be impeded by limited financial resources and access to water and land. Vertically stacked wooden boxes and sack gardens are two examples of models that have been used in Africa to overcome these challenges.

Note: Actual Numbers Might Vary In The Final Report

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Companies

To increase their market share, the key market players use strategies like partnerships and new product development. To strengthen their market position, companies also acquire businesses of competitors.

Signify Holding B.V., for example, announced in December 2023 that it had reached an agreement to purchase Fluence, Osram’s agriculture lighting division, to increase its agricultural lighting business. This acquisition has also helped to strengthen the company’s position in North American horticulture lighting markets.

Кеу Маrkеt Рlауеrѕ

- AeroFarms

- EVERLIGHT ELECTRONICS CO. LTD.,

- GAVITA Holland bv

- Heliospectra AB

- Hortilux Schréder

- Illumitex

- LumiGrow Inc

- Osram Licht AG

- Other Key Players

Recent Developments

July 2022: AB Lighting announced the unveiling of the company’s new LED grow lights, AB330 and AB660. These are for commercial vegetable growers; the grow lights optimize power consumption for new greenhouse environments. These lights were designed to help vegetable growers reach higher yields by offering a lower wattage, a full spectrum designed explicitly for vegetables, and continuous run times that vegetables need.

June 2022: ams OSRAM announced that Taiwan-based Ledtech had chosen OSLON UV 3636 UV-C LEDs for a sanitization function in its newBioLED intelligent air purifier. The BioLED’s OSLON UV 3636 LEDs can inactivate up to 99.99% of viruses, including SARS-CoV-2, at a dosing rate of 3.6mJ/cm2.

Report Scope

Report Features Description Market Value (2023) USD 4.0 Bn Forecast Revenue (2032) USD 19.9 Bn CAGR (2023-2032) 17.4% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(< 300 Watt, 300 Watt), By System(Hardware, Software), By Technology(High-Intensity Discharge (HID), LED, Fluorescent, Plasma), By Installation(New Installation, Retrofit), By Spectrum(Partial Spectrum, Full Spectrum), By Application(Indoor Farming, Vertical Farming, Commercial Greenhouse, Other applications) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape AeroFarms, EVERLIGHT ELECTRONICS CO. LTD.,, GAVITA Holland bv, Heliospectra AB, Hortilux Schréder, Illumitex, LumiGrow Inc, Osram Licht AG, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are grow lights?Grow lights are artificial light sources designed to stimulate plant growth by emitting light similar to the sun's spectrum, aiding in photosynthesis.

Which plants benefit most from grow lights?Grow lights can benefit various plants, including indoor houseplants, vegetables, herbs, and even some fruit-bearing plants. They are particularly useful in areas with limited natural sunlight.

Are there specific light spectrums for different plant growth stages?Yes, plants have different light requirements during various growth stages. For instance, blue light is beneficial for vegetative growth, while red light aids flowering and fruiting.

-

-

- AeroFarms

- EVERLIGHT ELECTRONICS CO. LTD.,

- GAVITA Holland bv

- Heliospectra AB

- Hortilux Schréder

- Illumitex

- LumiGrow Inc

- Osram Licht AG

- Other Key Players