Global Ground Protection Mats Market By Thickness (Up to 1 inch, 1 to 2 inches, More than 2 inches), By Application (Residential, Commercial, Industrial, Agriculture), By Distribution Channel Analysis (Hypermarkets and Supermarkets, Specialty Stores, Retailers, Online Retail, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 32026

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Ground Protection Mats Market size is expected to be worth around USD 2.2 Billion by 2033 from USD 1.4 Billion in 2023, growing at a CAGR of 4.6% during the forecast period 2024 to 2033.

Ground protection mats are durable, heavy-duty mats designed to protect the ground surface from damage due to heavy machinery, equipment, and foot traffic during construction, landscaping, events, and other industrial activities. These mats help minimize soil compaction, prevent damage to sensitive terrains, and ensure stable, non-slip surfaces for vehicles and workers.

Made from materials like polyethylene, composite, or wood, they offer versatility and are often designed to be lightweight yet robust, ensuring ease of transportation and deployment.

The Ground Protection Mats Market encompasses the global production, distribution, and sales of these mats across various industries. This market includes a wide range of products differentiated by material, design, application, and load capacity, catering to sectors such as construction, oil & gas, utilities, military, and events management.

Market growth is driven by the increasing need for cost-effective and environmentally responsible solutions that safeguard terrains while supporting heavy-duty operations in diverse geographical regions.

The Ground Protection Mats Market is experiencing robust growth, driven by multiple factors. One significant driver is the rising emphasis on environmental protection regulations, which necessitates the use of protective mats to minimize ecological impact.

Additionally, growing construction and infrastructure development activities worldwide, particularly in emerging markets, are leading to a higher demand for ground protection solutions.

The rapid expansion of sectors like oil & gas, where heavy equipment is routinely used, further supports market expansion. Innovations in mat design, including the adoption of more durable and lightweight composite materials, are also contributing to market growth by improving efficiency and ease of use.

The demand for ground protection mats is predominantly fueled by the construction and industrial sectors, where their role is critical in ensuring safety, minimizing ground disturbance, and maintaining productivity.

Additionally, industries such as utilities, landscaping, and events are witnessing increasing demand as ground protection becomes a standard requirement in operations to enhance safety and operational efficiency.

The growth of these sectors, coupled with stricter adherence to safety regulations and sustainability initiatives, is driving steady demand for these products globally. The mats are not only a logistical necessity but also a strategic investment to reduce maintenance costs related to ground damage, making them indispensable in various operational scenarios.

There are several emerging opportunities in the Ground Protection Mats Market, primarily due to the increasing global focus on sustainable infrastructure development and eco-friendly solutions.

Technological advancements, such as the integration of Internet of things (IoT) and RFID tracking in ground protection mats, can provide additional value by enabling real-time monitoring and efficient asset management.

Furthermore, the rising trend of modular, portable, and reusable mats opens up avenues for innovative solutions tailored to niche applications, such as outdoor events, remote construction sites, and renewable energy projects.

Expanding adoption in developing regions, driven by the surge in construction activities and infrastructural upgrades, presents a substantial growth opportunity for manufacturers to expand their footprint and increase market penetration.

According to Greatmats, the most common thicknesses of ground protection mats range from 10 mm, suitable for lightweight protection, to 4 1/4 inches, designed for the heaviest machinery. Options include 3/8 inch mats for moderate foot traffic, 1/2 inch for light machinery, and up to 2 inches for heavy-duty industrial use. The 1 1/2 inch mats effectively support trucks and cranes, ensuring versatility across diverse applications.

According to buyjustrite.eu, the ground protection mats market demonstrates robust performance, with products like the TuffTrak range offering exceptional load capacities of over 200 tons, meeting the needs of the heaviest vehicles. Medium-duty variants support up to 120 tons, using rugged, 1/2” thick recycled polyethylene fully recyclable and sustainable.

Key Takeaways

- Global Ground Protection Mats Market is projected to exhibit a steady rise, expanding from an estimated USD 1.4 billion in 2023 to approximately USD 2.2 billion by 2033. This market is expected to achieve a compound annual growth rate (CAGR) of 4.6% over the forecast period from 2024 to 2033.

- Up to 1 Inch category leads with 40% market share, due to its versatility and cost-effectiveness.

- Industrial category holds the largest share at 33%, propelled by the demand for heavy-duty ground stabilization.

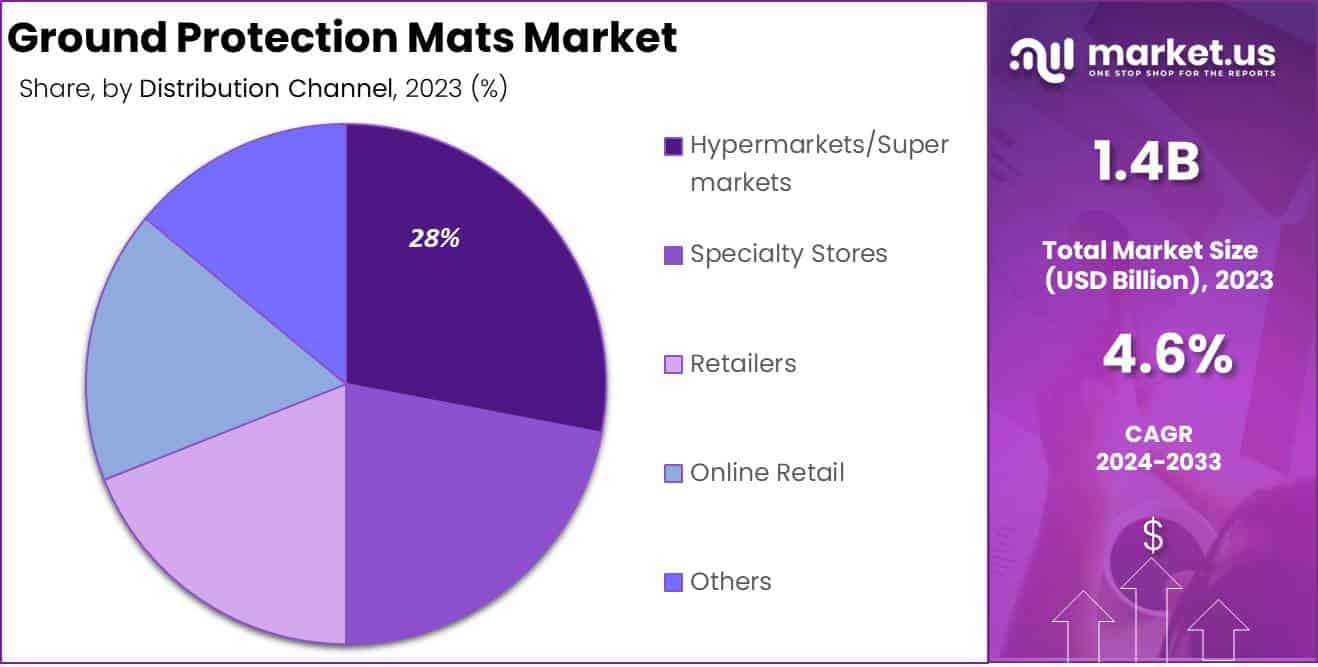

- Hypermarkets/Supermarkets dominate with a 28% share, attributed to their wide accessibility and consumer convenience.

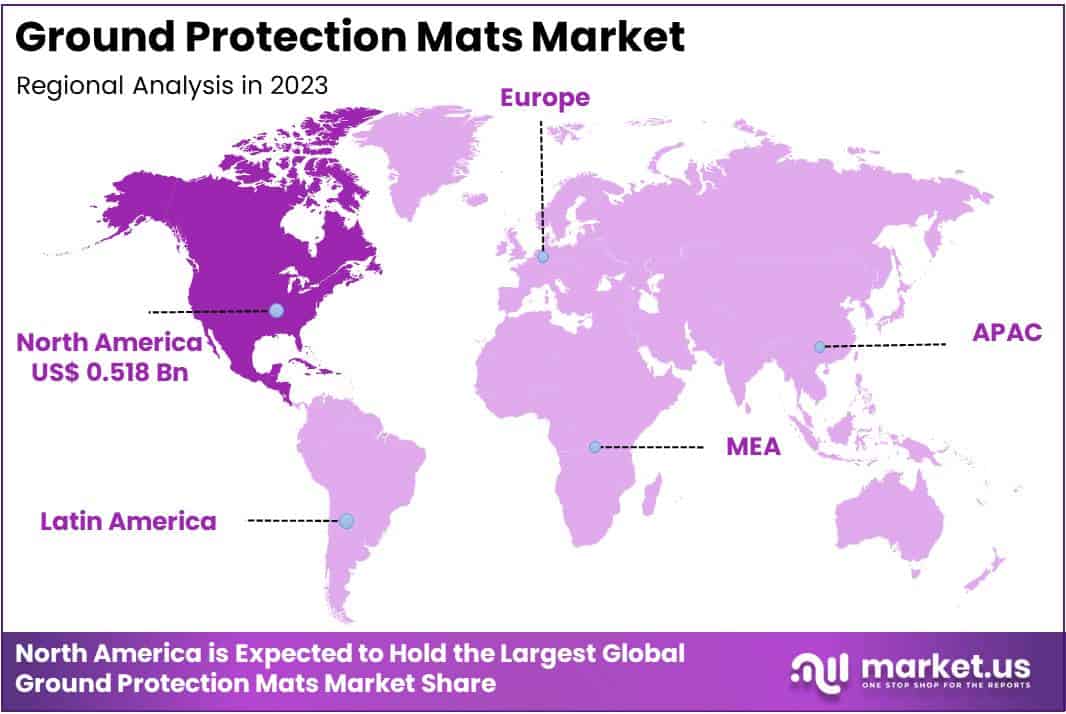

- North America leads with a 37% share, supported by robust construction and oil & gas industries.

By Thickness Analysis

Up to 1 Inch Dominating the Ground Protection Mats Market with 40% Market Share

In 2023, Up to 1 inch held a dominant position in the thickness analysis segment of the ground protection mats market, capturing over 40% of the market share. This segment’s leading status is largely attributed to its wide adoption across diverse industries, including construction, landscaping, and event management.

These mats are favored for their lightweight design, ease of handling, and cost-effectiveness, making them a go-to choice for projects that require quick deployment and short-term ground protection solutions.

The up to 1 inch segment’s growth is also driven by increased demand from small to medium-sized projects, where budget constraints and short-term usage needs align well with the lower cost of thinner mats.

In 2023, the 1 to 2 inches thickness segment accounted for approximately 35% of the ground protection mats market share, making it the second-largest segment by thickness. This category is witnessing strong growth, driven by its higher load-bearing capacity, making it suitable for more demanding applications.

Industries such as oil & gas, utilities, and large-scale construction projects frequently use mats within this thickness range due to their ability to withstand heavier loads, such as cranes, trucks, and other construction machinery.

These mats offer a balance between durability and cost, positioning them as a versatile option for projects that require both longevity and robust ground protection.

The 1 to 2 inches mats are also increasingly preferred for longer-term projects, where repeated use under challenging conditions is anticipated. Their enhanced strength provides better resistance to wear and tear, making them a cost-effective choice for medium to heavy-duty applications.

As infrastructure development continues to expand globally, the demand for these mats is expected to rise further, bolstering their market share in the ground protection mats industry.

The more than 2 inches thickness segment captured about 25% of the market share in 2023, carving out a niche in the ground protection mats market. This segment is primarily driven by heavy-duty applications, where maximum ground support is required, such as in mining, forestry, and oilfield operations.

Mats in this category are engineered to handle extreme loads, providing superior stability and protection for both equipment and ground surfaces. Their enhanced durability makes them ideal for long-term use in rugged environments, where ground integrity and worker safety are top priorities.

Despite representing a smaller share compared to thinner mats, the more than 2 inches segment is experiencing steady growth, fueled by its critical role in highly specialized industries.

The segment’s development is also supported by advancements in materials, which improve load distribution and increase the lifespan of the mats. As industries continue to prioritize safety and efficiency, the more than 2 inches segment is poised to grow, reflecting its importance in applications that demand the highest level of ground protection.

By Application Analysis

Industrial Segment Dominates Ground Protection Mats Market with 33% Share

In 2023, the Industrial segment held a dominant market position in the application segment of the Ground Protection Mats Market, capturing more than a 33% share.

This leading position can be attributed to the rising demand for ground protection solutions in sectors such as construction, oil & gas, and mining, where heavy machinery and equipment operations necessitate robust and durable ground stabilization measures.

Ground protection mats help in minimizing ground disturbance, ensuring worker safety, and reducing environmental impact, which are critical requirements across industrial projects.

The Residential segment accounted for approximately 22% of the market share in 2023. This segment is witnessing steady growth due to increased urbanization and the construction of new residential properties, where temporary ground protection is needed for landscaping, home construction, and renovation activities.

The adoption of ground protection mats in residential areas is driven by the need to maintain lawn integrity, reduce soil compaction, and offer non-slip surfaces in wet conditions.

The Commercial segment captured around 27% of the market share in 2023. The use of ground protection mats is widespread in commercial construction projects, including the development of office buildings, retail centers, and recreational facilities.

The growing emphasis on maintaining site cleanliness, reducing soil damage, and providing a stable ground surface in commercial zones fuels the demand in this segment. The sector benefits from increasing investments in infrastructure development, particularly in urban regions.

The Agriculture segment held approximately 18% of the market share in 2023. This segment’s growth is primarily driven by the need for ground protection solutions in agricultural fields to prevent soil erosion, manage muddy terrains, and facilitate machinery movement.

The adoption of ground protection mats in agriculture is essential for maintaining soil health and ensuring operational efficiency, particularly in large-scale farms and during the harvest season.

By Distribution Channel Analysis

Hypermarkets/Supermarkets Dominating the Ground Protection Mats Market with 28% Share

In 2023, Hypermarkets/Supermarkets held a dominant market position in the distribution channel segment of the Ground Protection Mats Market, capturing more than a 28% share.

This segment’s strong performance is driven by the convenience of in-person product evaluation, high consumer footfall, and wide accessibility, making it a key channel for both individual and commercial buyers seeking quality and immediate availability.

Specialty Stores accounted for approximately 22% of the distribution channel market share in 2023. These stores cater to niche customer requirements by offering tailored ground protection solutions, often supported by expert guidance. Their focused product range, specialized expertise, and customer service contribute to their strong foothold within the market.

Retailers contributed to about 19% of the market share in the Ground Protection Mats sector in 2023. They play a significant role in the distribution landscape by offering a mix of brand options and competitive pricing, appealing to a diverse customer base, including construction firms, event organizers, and other industries requiring ground protection solutions.

The Online Retail segment captured a 17% market share in 2023, reflecting the increasing preference for digital purchasing channels. E-commerce platforms offer a broader range of products, detailed product descriptions, and ease of comparison, making them an attractive option, especially for smaller businesses and individual buyers seeking cost efficiency and convenient delivery.

The Others segment, which includes direct sales, partnerships, and distribution networks outside traditional channels, accounted for 14% of the market share in 2023. While smaller in scale, this channel is critical for serving specialized projects, custom orders, and sectors with unique requirements for ground protection solutions.

Key Market Segments

By Thickness

- Up to 1 inch

- 1 to 2 inches

- More than 2 inches

By Application

- Residential

- Commercial

- Industrial

- Agriculture

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Retailers

- Online Retail

- Others

Driver

Rising Infrastructure Development Fueling Demand for Ground Protection Mats

The global surge in infrastructure projects is a primary driver of the ground protection mats market in 2024. The demand for durable and efficient temporary ground protection solutions is increasingly critical as governments and private entities invest heavily in expanding transportation networks, commercial complexes, and energy facilities.

Infrastructure projects often require machinery and heavy vehicles to traverse soft ground or sensitive environments, elevating the need for mats that provide safe, stable access. These mats not only prevent ground damage but also ensure worker safety, both of which are key concerns in construction, oil & gas, and utilities sectors.

Consequently, ground protection mats have become an essential component in the infrastructure sector, contributing to their growing adoption globally. For example, countries in Asia-Pacific and the Middle East are experiencing a construction boom, further boosting the demand for these mats.

Additionally, the adoption of ground protection mats aligns with stringent environmental regulations aimed at reducing site damage and soil contamination during construction. The mats are also increasingly favored for their reusability and cost-effectiveness, making them attractive for large-scale, long-term projects.

As infrastructure projects diversify, there is a greater emphasis on both urban and rural developments, where the protection of natural landscapes is equally important. The result is sustained market growth, as more project developers prioritize efficient site access solutions that meet both regulatory and operational requirements.

As global infrastructure spending continues to grow, the market for ground protection mats is poised to expand significantly, driven by increased awareness of their role in enhancing productivity and reducing environmental impact.

Restraint

High Initial Costs Limiting Adoption Among Small Enterprises

Despite the benefits, the high initial cost of ground protection mats is a notable restraint on market growth in 2024. These mats, especially those made from high-grade materials like composite and polyethylene, can be expensive to manufacture, leading to higher purchase prices.

For many small and medium-sized enterprises (SMEs), which often operate on limited budgets, these costs can be prohibitive.

This barrier is particularly evident in industries like agriculture, small-scale construction, and events, where budgets are tightly controlled, and immediate cost savings are prioritized over long-term investments. As a result, many potential buyers might opt for cheaper, less durable alternatives, even if they compromise on safety and ground protection standards.

Furthermore, the lack of rental options or flexible payment plans exacerbates this challenge for smaller companies. While larger corporations and government projects may have the financial bandwidth to invest in premium solutions, SMEs often struggle to justify the upfront expenditure.

This financial constraint can slow down the market’s penetration in emerging regions, where smaller enterprises play a crucial role in construction and development.

To address this restraint, market players need to focus on offering cost-effective solutions or financial models that can make these mats more accessible to smaller players. However, until this happens, the high initial cost will continue to act as a significant restraint on the broader adoption of ground protection mats, especially in price-sensitive markets.

Opportunity

Growing Emphasis on Environmental Sustainability

An increasing global emphasis on sustainability presents a major opportunity for the ground protection mats market in 2024. Environmental protection has become a key priority for governments, corporations, and consumers alike, and ground protection mats are uniquely positioned to contribute to this agenda.

These mats not only prevent soil erosion and land degradation but also help minimize the environmental footprint of construction activities.

With stricter regulations being implemented worldwide to reduce environmental damage during development projects, the adoption of eco-friendly and reusable ground mats is likely to surge.

In particular, industries like renewable energy, forestry, and utilities are seeking sustainable site access solutions that align with their green initiatives, providing significant market opportunities for manufacturers.

Additionally, innovations in materials science are paving the way for more environmentally friendly ground protection mats. Manufacturers are developing mats from recycled materials or bioplastics, which further align with sustainable practices.

Such products not only appeal to environmentally conscious buyers but also qualify for green certification and incentives, making them more attractive for government contracts and projects with sustainability mandates.

This trend towards sustainability also aligns with broader corporate social responsibility (CSR) goals, encouraging companies to adopt products that support their public commitment to environmental stewardship. Thus, the market is well-positioned to benefit from growing demand for green solutions, making sustainability one of the most promising avenues for growth in the coming years.

Trends

Technological Advancements in Material Durability and Performance

In 2024, one of the most significant trends in the ground protection mats market is the rapid advancement in material technology, which is driving improvements in durability and performance. Manufacturers are focusing on developing mats with enhanced strength-to-weight ratios, making them more resilient and easier to deploy across various terrains.

Advanced composite materials, for example, are being used to create mats that can withstand extreme loads while remaining lightweight, reducing transportation and installation costs.

These technological innovations are crucial as industries increasingly demand mats that can support heavy machinery, even in challenging environments like oilfields, mining sites, and remote construction areas.

The evolution of these materials ensures that ground mats can provide reliable access while maintaining structural integrity under heavy use. Another aspect of this trend is the development of mats with integrated safety features, such as anti-slip surfaces, reinforced edges, and superior load distribution.

These features not only enhance worker safety but also reduce the risk of accidents, which can be costly in terms of both human harm and project delays. The incorporation of sensors and monitoring technologies is also emerging, allowing for real-time analysis of load stress and ground conditions.

This trend reflects a broader movement towards smart construction solutions, where data-driven insights contribute to safer and more efficient operations. The ongoing advancements in material science and integration of smart features are expected to propel market growth, as industries prioritize safety, efficiency, and performance in their selection of ground protection mats.

Regional Analysis

North America Leading Region in the Ground Protection Mats Market with 37% Share

In 2023, North America emerged as the leading region in the Ground Protection Mats Market, holding a substantial 37% share, valued at approximately USD 0.518 billion. The region’s dominance is largely attributed to its robust construction sector, strong presence of oil and gas industries, and increased infrastructure development activities.

Additionally, growing awareness of safety standards, coupled with stringent regulations for worksite protection, has spurred demand for ground protection mats across the U.S. and Canada. Major players’ established supply chains and the presence of advanced manufacturing technologies also contribute to the region’s market strength.

Europe followed as the second-largest market, driven by infrastructure modernization and increasing investments in renewable energy projects, accounting for a significant portion of global demand. The region benefits from strong demand in countries like Germany, the U.K., and France, where industrial safety regulations are stringent, promoting the adoption of ground protection solutions.

The Asia Pacific region demonstrated rapid growth potential, attributed to its expanding construction sector, particularly in China, India, and Southeast Asia.

Increasing urbanization, infrastructural developments, and a booming construction industry drive this growth, making Asia Pacific a key focus area for market expansion. In 2023, it held a notable share of the market, backed by governmental efforts to boost infrastructure and industrial development.

Middle East & Africa showed a steady demand for ground protection mats, largely influenced by extensive construction activities, oil & gas exploration, and mining operations.

Countries like Saudi Arabia, the UAE, and South Africa are the major contributors, driven by the need for robust ground protection solutions in desert and rugged terrains.

In Latin America, the market is experiencing gradual growth, with Brazil, Mexico, and Argentina leading the demand. The region’s market dynamics are shaped by increased investments in infrastructure projects and the agriculture sector, where ground protection mats are used to minimize environmental impact and enhance operational safety.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global ground protection mats market in 2024 is witnessing dynamic participation from several key players, each contributing uniquely to market growth through innovation, product diversification, and strategic partnerships.

DuraDeck and Rhinomats remain at the forefront, leveraging their extensive product portfolios to cater to diverse applications such as construction, oil & gas, and event management. Their emphasis on lightweight yet durable materials continues to be a significant competitive advantage.

Signature Systems Group, LLC, a prominent player in this space, stands out for its modular ground protection solutions, making it a preferred choice in temporary infrastructure setups. Meanwhile, Bridgestone has expanded its reach with a focus on high-strength mats designed to withstand heavy-duty usage, tapping into sectors like logistics and military operations.

Newpark Resources, Inc. is capitalizing on its expertise in the energy sector, offering specialized mats that cater to demanding environments, thus addressing the growing need for sustainable and efficient site access solutions.

In Asia, Qingdao Ketian Materials Co., Ltd and Tangyin Sanyou Engineering Plastic Co., Ltd. are notable contenders, bringing cost-effective alternatives to the market. Groundtrax Systems Ltd. and Greatmats Corp.

focus on versatile applications, from landscaping to industrial use, emphasizing fast deployment and reusability. W.W. Grainger, Inc. and Quality Mat Company maintain a strong presence in distribution, ensuring prompt availability and extensive customer support.

Other key players are continuously innovating, striving to enhance durability, safety, and environmental compliance in their products, which collectively drives the market’s competitiveness and adoption across industries.

Top Key Players in the Market

- DuraDeck

- Rhinomats

- Signature Systems Group, LLC

- Bridgestone

- Newpark Resources, Inc.

- Qingdao Ketian Materials Co., Ltd

- Groundtrax Systems Ltd.

- W. W. Grainger, Inc.

- Greatmats Corp.

- Tangyin Sanyou Engineering Plastic Co., Ltd.

- Quality Mat Company

- Other Key Players

Recent Developments

- In 2024, Myers Industries, Inc. (NYSE: MYE), a prominent manufacturer and distributor of industrial products, successfully finalized its acquisition of Signature Systems, which had been initially announced on January 2, 2024. This strategic acquisition aims to enhance Myers’ portfolio and expand its market presence in the industrial solutions sector.

- In 2024, DICA introduced MaxiTrack®, a robust and innovative heavy-duty ground protection mat, specifically designed for the North American market. This launch represents DICA’s commitment to delivering advanced solutions for heavy-duty applications, catering to industries that require reliable ground support.

- In 2024, EZG Manufacturing expanded its product offerings by launching the Hogtrax Ground Protection Mats (GPM4x8) and a new range of Outrigger Pads (OP36, OP48, OP24-12, and OP24-24). These products are designed to provide enhanced stability and safety in construction and industrial operations, demonstrating EZG’s dedication to innovation in ground support solutions.

Report Scope

Report Features Description Market Value (2023) USD 1.4 Billion Forecast Revenue (2033) USD 2.2 Billion CAGR (2024-2033) 4.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Thickness (Up to 1 inch, 1 to 2 inches, More than 2 inches), By Application (Residential, Commercial, Industrial, Agriculture), By Distribution Channel Analysis (Hypermarkets/Supermarkets, Specialty Stores, Retailers, Online Retail, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape DuraDeck, Rhinomats, Signature Systems Group, LLC, Bridgestone, Newpark Resources, Inc., Qingdao Ketian Materials Co., Ltd, Groundtrax Systems Ltd., W. W. Grainger, Inc., Greatmats Corp., Tangyin Sanyou Engineering Plastic Co., Ltd., Quality Mat Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ground Protection Mats MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Ground Protection Mats MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- DuraDeck

- Rhinomats

- Signature Systems Group, LLC

- Bridgestone

- Newpark Resources, Inc.

- Qingdao Ketian Materials Co., Ltd

- Groundtrax Systems Ltd.

- W. W. Grainger, Inc.

- Greatmats Corp.

- Tangyin Sanyou Engineering Plastic Co., Ltd.

- Quality Mat Company

- Other Key Players