Global Green Tires Market Size, Share, Growth Analysis By Tire Size Type (15 Inch, 16 Inch, 17 Inch, 18 Inch), By Vehicle (Passenger Cars, Light Commercial Vehicle, Heavy Trucks, Buses & Coaches, Others), By Application (On Road, Off Road), By Sales Channel Type (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163418

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

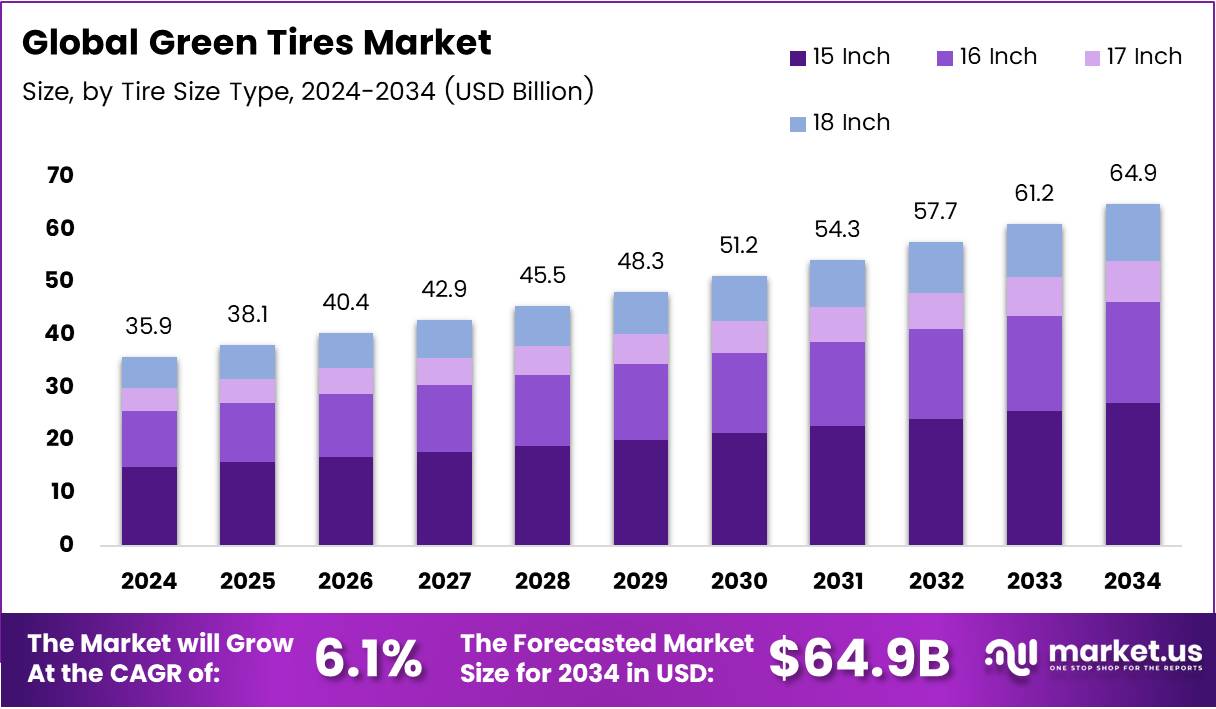

The Global Green Tires Market size is expected to be worth around USD 64.9 Billion by 2034, from USD 35.9 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

The Green Tires Market represents a vital shift in the global automotive industry toward sustainability and energy efficiency. Green tires are engineered using eco-friendly materials and advanced compounds that reduce rolling resistance and fuel consumption. This market is gaining strong traction as governments, consumers, and manufacturers emphasize carbon neutrality and clean mobility.

Furthermore, the market is propelled by the growing adoption of electric vehicles (EVs) and stringent emission standards. As automakers transition to electric and hybrid models, the need for lightweight, low-resistance, and high-durability tires becomes crucial. Consequently, green tire manufacturers are investing heavily in material innovation and smart tire technologies to enhance overall vehicle efficiency.

In addition, expanding government initiatives supporting green mobility continue to strengthen market dynamics. Various national policies promoting fuel efficiency and tire labeling programs are encouraging tire makers to prioritize sustainable production. This trend fosters innovation in renewable raw materials such as silica-based rubber compounds and bio-based polymers.

Moreover, the integration of circular economy principles has unlocked new growth opportunities. Companies are increasingly focusing on tire recycling, waste reduction, and sustainable supply chains. The development of advanced retreading solutions and eco-design processes further drives long-term profitability and environmental benefits in the global green tires industry.

According to an industry report, worldwide, more than 17 million electric cars were sold in 2024, and sales are projected to exceed 20 million in 2025, accounting for over 25% of all cars sold. China alone sold approximately 11 million EVs in 2024 and is expected to reach around 60% EV share in 2025, highlighting a massive opportunity for energy-efficient tire demand.

Additionally, according to an industry report, the rising U.S. tire recycling rate from 11% in 1990 to 79% in 2023 provides a robust foundation for adopting high-value, low-carbon recycling technologies. This shift aligns with global sustainability goals and reinforces the long-term growth outlook of the Green Tires Market, supported by continuous innovation, regulatory momentum, and rising eco-conscious consumer demand.

Key Takeaways

- The Global Green Tires Market was valued at USD 35.9 Billion in 2024 and is projected to reach USD 64.9 Billion by 2034, growing at a 6.1% CAGR.

- 16 Inch tire size led the market with a 29.6% share in 2024 due to its balance of performance and fuel efficiency.

- Passenger Cars dominated the market by vehicle type, accounting for a 48.7% share in 2024 driven by strong consumer demand.

- On Road applications held a commanding 85.2% share in 2024 owing to widespread use in everyday transportation.

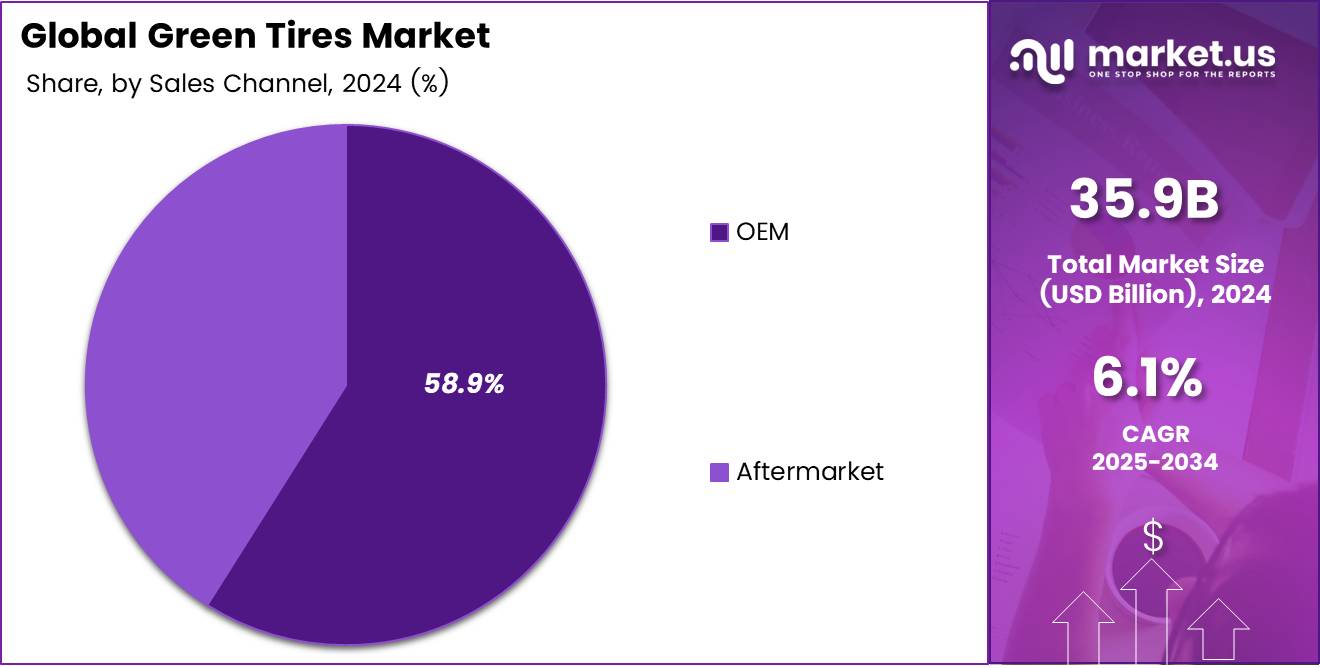

- OEM sales channel captured a 58.9% market share in 2024 due to automakers’ focus on factory-installed sustainable tires.

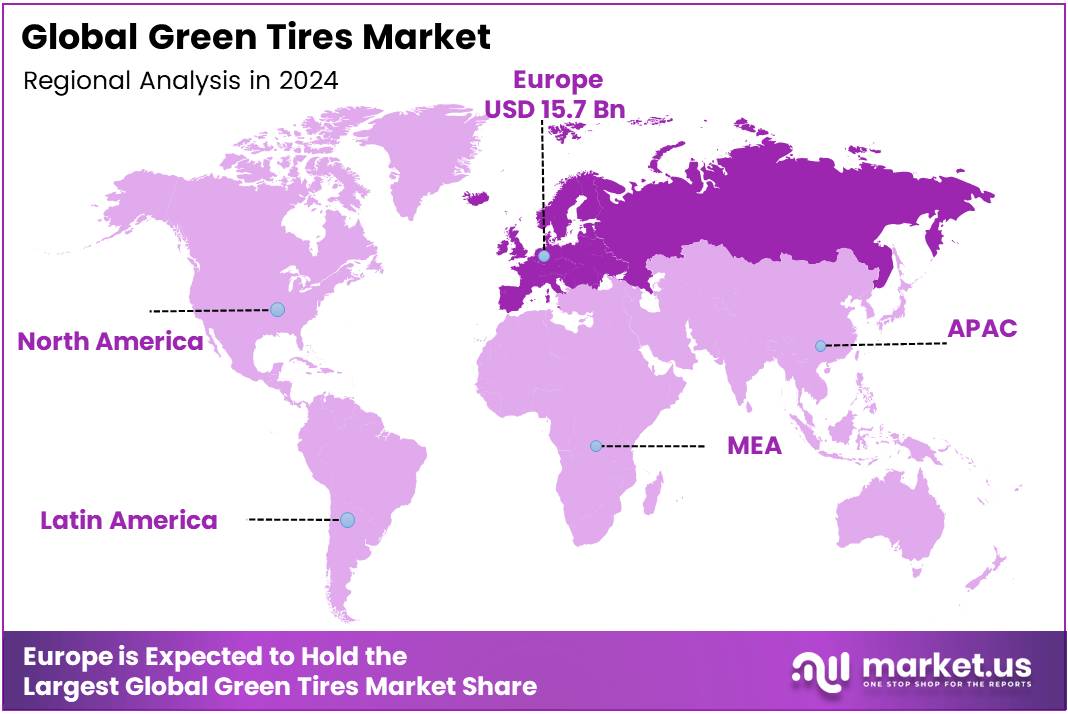

- Europe dominated regionally with a 43.8% share, valued at approximately USD 15.7 Billion in 2024, supported by strict environmental regulations.

By Tire Size Type Analysis

16 Inch dominates with 29.6% due to its optimal balance between performance and efficiency.

In 2024, 16 Inch held a dominant market position in the By Tire Size Type Analysis segment of the Green Tires Market, with a 29.6% share. Its balanced design, offering superior grip, reduced rolling resistance, and enhanced fuel economy, has made it a preferred choice across various passenger and commercial vehicles worldwide.

The 15 Inch tire segment continues to capture attention for compact and small cars, especially in urban settings where efficiency and affordability are key. The lower material usage and compatibility with lightweight vehicles make this size popular among cost-conscious consumers focusing on sustainability.

The 17 Inch tire category is gaining momentum, driven by rising demand from mid-size and premium vehicles that require better handling and comfort. Manufacturers are focusing on eco-friendly materials and innovative tread designs to meet environmental standards without compromising performance.

The 18 Inch segment appeals to high-performance and luxury vehicles, offering superior road contact and stability. While the cost is higher, consumers seeking performance and aesthetics are increasingly opting for this size, supported by growing hybrid and electric vehicle adoption.

By Vehicle Analysis

Passenger Cars dominate with 48.7% due to their massive production and consumer demand globally.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Analysis segment of the Green Tires Market, with a 48.7% share. Rising environmental awareness and stricter emission norms are driving automakers to adopt eco-friendly tire technologies for passenger vehicles worldwide.

The Light Commercial Vehicle segment is witnessing steady adoption of green tires owing to the need for enhanced fuel efficiency and lower maintenance costs. Businesses are investing in sustainable mobility options to reduce operational expenses and meet evolving environmental regulations.

The Heavy Trucks segment shows potential as logistics operators focus on reducing carbon emissions and improving long-term durability. Manufacturers are integrating recycled materials and advanced compounds to withstand heavy loads while improving energy efficiency.

The Buses & Coaches segment is benefitting from the shift toward electric and hybrid public transport. Green tires provide lower rolling resistance and improved longevity, making them suitable for continuous urban operations.

The Others category includes specialized vehicles adopting sustainable tires for niche uses, reflecting a gradual but steady trend toward green mobility solutions.

By Application Analysis

On Road dominates with 85.2% owing to the wide use of green tires in everyday transportation.

In 2024, On Road held a dominant market position in the By Application Analysis segment of the Green Tires Market, with a 85.2% share. The growth is attributed to the increasing number of passenger and commercial vehicles using eco-friendly tires to achieve better mileage, lower emissions, and improved safety on paved roads.

The Off Road segment, while smaller, is expanding as industries like agriculture, mining, and construction adopt sustainable tires. These tires are designed for durability, traction, and environmental compliance, offering performance benefits in harsh terrains and demanding operational conditions.

By Sales Channel Type Analysis

OEM dominates with 58.9% due to the preference for factory-installed sustainable tires.

In 2024, OEM held a dominant market position in the By Sales Channel Type Analysis segment of the Green Tires Market, with a 58.9% share. Automakers are partnering with tire manufacturers to integrate eco-friendly solutions from production, aligning with global sustainability goals and regulatory frameworks.

The Aftermarket segment is growing as consumers seek to replace worn-out conventional tires with green alternatives. Increased awareness of performance, safety, and fuel efficiency benefits is encouraging users to adopt sustainable tire options for long-term cost savings and environmental responsibility.

Key Market Segments

By Tire Size Type

- 15 Inch

- 16 Inch

- 17 Inch

- 18 Inch

By Vehicle

- Passenger Cars

- Light Commercial Vehicle

- Heavy Trucks

- Buses & Coaches

- Others

By Application

- On Road

- Off Road

By Sales Channel Type

- OEM

- Aftermarket

Drivers

Rising Adoption of Electric and Hybrid Vehicles Enhancing Demand for Low-Rolling-Resistance Tires

The growing popularity of electric and hybrid vehicles is significantly driving the demand for green tires. These vehicles require tires with low rolling resistance to improve energy efficiency and extend battery life. As automakers focus on enhancing vehicle performance, tire manufacturers are investing in advanced materials that reduce energy loss and support sustainable mobility.

Strict environmental regulations across major regions are also pushing tire manufacturers to adopt eco-friendly production methods. Governments are encouraging sustainable tire technologies to reduce carbon emissions, promoting the use of renewable materials and cleaner manufacturing processes.

Consumer awareness about environmental protection is rising, leading to a growing preference for fuel-efficient and eco-friendly automotive solutions. Green tires offer lower fuel consumption and improved vehicle performance, making them increasingly popular among environmentally conscious buyers.

Additionally, tire producers are increasing their investments in research and development (R&D) to design tires using bio-based materials such as natural rubber and plant-derived oils. These innovations not only lower dependence on petroleum-based compounds but also help in reducing the overall environmental footprint of tire manufacturing.

Restraints

Limited Availability of Raw Materials for Eco-Friendly Tire Production

One of the major restraints in the green tires market is the limited availability of sustainable raw materials. Producing eco-friendly tires requires renewable components like natural rubber, silica, and bio-oils, which are often in short supply. This scarcity leads to higher production costs and affects the scalability of green tire manufacturing.

Additionally, sourcing sustainable materials requires complex supply chain networks, making it difficult for small and mid-sized manufacturers to adopt green production processes. Dependence on agricultural products also exposes the industry to fluctuations in crop yields and weather conditions.

In emerging automotive markets, the lack of consumer awareness about the benefits of green tires remains a significant challenge. Many customers in developing regions prioritize affordability over sustainability, which limits the adoption rate of eco-friendly tires.

Furthermore, the higher upfront cost of green tires compared to conventional ones discourages price-sensitive consumers. This price gap, combined with limited marketing initiatives, slows down the widespread acceptance of sustainable tire technologies across developing economies.

Growth Factors

Expansion of Green Tire Manufacturing Facilities in Developing Economies

The green tires market presents significant growth opportunities through the expansion of manufacturing facilities in developing economies. Countries in Asia-Pacific, Latin America, and Africa are witnessing rapid industrialization, offering favorable conditions for cost-effective production and easy access to natural rubber resources.

Integrating smart tire technologies also creates new opportunities for energy optimization. Smart green tires equipped with sensors can monitor tire pressure, temperature, and wear, helping to enhance vehicle efficiency and safety while reducing energy waste.

Collaborations between automakers and tire manufacturers are further supporting the shift toward sustainable mobility. Joint initiatives focused on green innovation are helping both industries meet emission reduction goals and cater to environmentally conscious consumers.

In addition, the development of circular economy models for tire lifecycle management is opening new paths for sustainability. Recycling, retreading, and reusing materials from end-of-life tires not only reduce waste but also lower raw material costs, making the overall tire production process more resource-efficient.

Emerging Trends

Increasing Use of Recycled and Bio-Based Rubber in Tire Production

The green tires market is witnessing strong trends toward the use of recycled and bio-based rubber materials. Manufacturers are increasingly utilizing natural oils, plant-based polymers, and reclaimed rubber to minimize environmental impact and reduce reliance on petroleum-based compounds.

Another major trend is the adoption of nanotechnology to enhance tire durability and fuel efficiency. Nanomaterials improve tire strength, reduce wear, and help achieve better grip and performance while maintaining lightweight properties for lower rolling resistance.

Retreaded green tires are also becoming popular among commercial fleet operators. These tires extend the lifespan of existing casings and reduce waste generation, offering a cost-effective and sustainable option for logistics companies aiming to minimize their carbon footprint.

Furthermore, tire manufacturers are focusing on carbon-neutral production processes by investing in renewable energy and carbon offset initiatives. This shift toward sustainable manufacturing helps brands align with global climate goals and appeal to environmentally responsible consumers.

Regional Analysis

Europe Dominates the Green Tires Market with a Market Share of 43.8%, Valued at USD 15.7 Billion

Europe holds the leading position in the global green tires market, capturing a market share of 43.8% and valued at approximately USD 15.7 billion. The dominance of this region is attributed to stringent environmental regulations, strong adoption of sustainable mobility solutions, and the presence of advanced automotive manufacturing infrastructure. Increasing consumer awareness regarding eco-friendly transportation and the integration of green technologies in tire production continue to fuel market growth across European nations.

North America Green Tires Market Trends

The North American green tires market is experiencing steady growth, driven by the increasing penetration of electric vehicles and the growing demand for fuel-efficient tires. Government initiatives promoting sustainable transportation and advancements in tire technology are fostering market expansion. The U.S. remains a major contributor, with a strong focus on innovation and adoption of high-performance, low-rolling-resistance tires to reduce carbon emissions.

Asia Pacific Green Tires Market Trends

Asia Pacific represents one of the most promising regions for green tires, supported by rapid urbanization, rising disposable incomes, and growing automotive production. Countries such as China, Japan, and India are witnessing increased investments in eco-friendly mobility solutions. Moreover, the shift toward electric and hybrid vehicles, coupled with sustainability goals, is accelerating the adoption of green tires across the region.

Middle East and Africa Green Tires Market Trends

The Middle East and Africa green tires market is gradually expanding due to increasing awareness of environmental issues and the need to comply with emerging emission standards. The region is seeing a growing inclination toward sustainable automotive solutions, particularly in developed economies within the Gulf Cooperation Council (GCC). Additionally, government efforts to diversify economies and promote greener transport options are expected to support future market growth.

Latin America Green Tires Market Trends

In Latin America, the green tires market is gaining traction as consumers and manufacturers shift toward sustainable products. Economic recovery, infrastructure development, and the growth of the automotive aftermarket are contributing to this trend. Brazil and Mexico are key markets where increasing environmental regulations and rising fuel costs are encouraging the adoption of energy-efficient and eco-friendly tire alternatives.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Green Tires Company Insights

The global Green Tires Market in 2024 is witnessing accelerated momentum as tire manufacturers integrate sustainable materials and energy-efficient technologies into product design. Market leaders are focusing on advanced tread compounds, bio-based polymers, and low rolling resistance technologies to align with global carbon reduction goals and meet evolving OEM demands.

APOLLO TYRES LTD has strengthened its presence through the development of eco-friendly tires that use silica-based compounds and low-resistance materials. The company’s investments in sustainable R&D and expansion across Europe position it as a notable contributor to the green tire transition. Apollo’s focus on lifecycle carbon footprint reduction supports OEM partnerships emphasizing environmental compliance.

Bridgestone Corporation continues to lead innovation with its “ENLITEN” technology, enabling significant reductions in material use and rolling resistance. Its commitment to carbon neutrality and circular economy practices drives long-term competitiveness. Bridgestone’s collaborations with global automakers further reinforce its sustainability roadmap, particularly in electric vehicle tire development.

CANADIAN TIRE has strategically advanced in the eco-conscious tire retail space by promoting energy-efficient and low-emission tire lines. The company’s initiatives in recycling and sustainable logistics enhance its environmental responsibility within North America. Its private-label focus on green-certified tires strengthens brand equity among conscious consumers.

Continental AG remains at the forefront with its “Conti GreenConcept” and use of dandelion rubber, recycled PET, and bio-based materials. The firm’s holistic approach—from sourcing to end-of-life recycling—demonstrates leadership in sustainability-driven tire innovation. Its R&D in smart, lightweight tires supports fuel efficiency and lower CO₂ emissions, reinforcing its premium positioning.

Top Key Players in the Market

- APOLLO TYRES LTD

- Bridgestone Corporation

- CANADIAN TIRE

- Continental AG

- GRI Tires

- JK TYRE & INDUSTRIES LTD

- MICHELIN

- MRF Tyres

- Nokian Tyres plc.

- Pirelli & C. S.p.A.

Recent Developments

- In April 2025, Bridgestone launched its demonstration commercial tyre (M870) composed of 70% recycled and renewable materials, including circular rubber and carbon black, integrated with an innovative drive-over tread-monitoring system.

- In June 2024, ENSO, a UK-based tyre startup, announced plans to build a US $500 million manufacturing facility in the U.S., targeting production of 20 million tyres annually for EVs, while ensuring 100% recyclability of all tyres produced.

- In August 2024, Bridgestone Corporation, in collaboration with Grupo BB&G and Versalis, introduced a closed-loop recycling ecosystem for end-of-life tyres (ELTs) using pyrolysis to generate tyre-pyrolysis oil for new elastomer production.

- In December 2024, Bridgestone partnered with the Pacific Northwest National Laboratory (PNNL) to advance a catalytic process that converts ethanol derived from recycled tyres into butadiene, a key raw material for synthetic rubber production.

Report Scope

Report Features Description Market Value (2024) USD 35.9 Billion Forecast Revenue (2034) USD 64.9 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Tire Size Type (15 Inch, 16 Inch, 17 Inch, 18 Inch), By Vehicle (Passenger Cars, Light Commercial Vehicle, Heavy Trucks, Buses & Coaches, Others), By Application (On Road, Off Road), By Sales Channel Type (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape APOLLO TYRES LTD, Bridgestone Corporation, CANADIAN TIRE, Continental AG, GRI Tires, JK TYRE & INDUSTRIES LTD, MICHELIN, MRF Tyres, Nokian Tyres plc., Pirelli & C. S.p.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- APOLLO TYRES LTD

- Bridgestone Corporation

- CANADIAN TIRE

- Continental AG

- GRI Tires

- JK TYRE & INDUSTRIES LTD

- MICHELIN

- MRF Tyres

- Nokian Tyres plc.

- Pirelli & C. S.p.A.