Global Grain Fumigants Market by Product Type (Phosphine, Methyl Bromide, Sulfuryl Fluoride, and Others), By Form (Solid, Liquid, and Gas), By Application (Commercial Grain Elevators, On-farm Silos, Shipping Containers, and Barges, Warehouse and Transit Storage), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157181

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

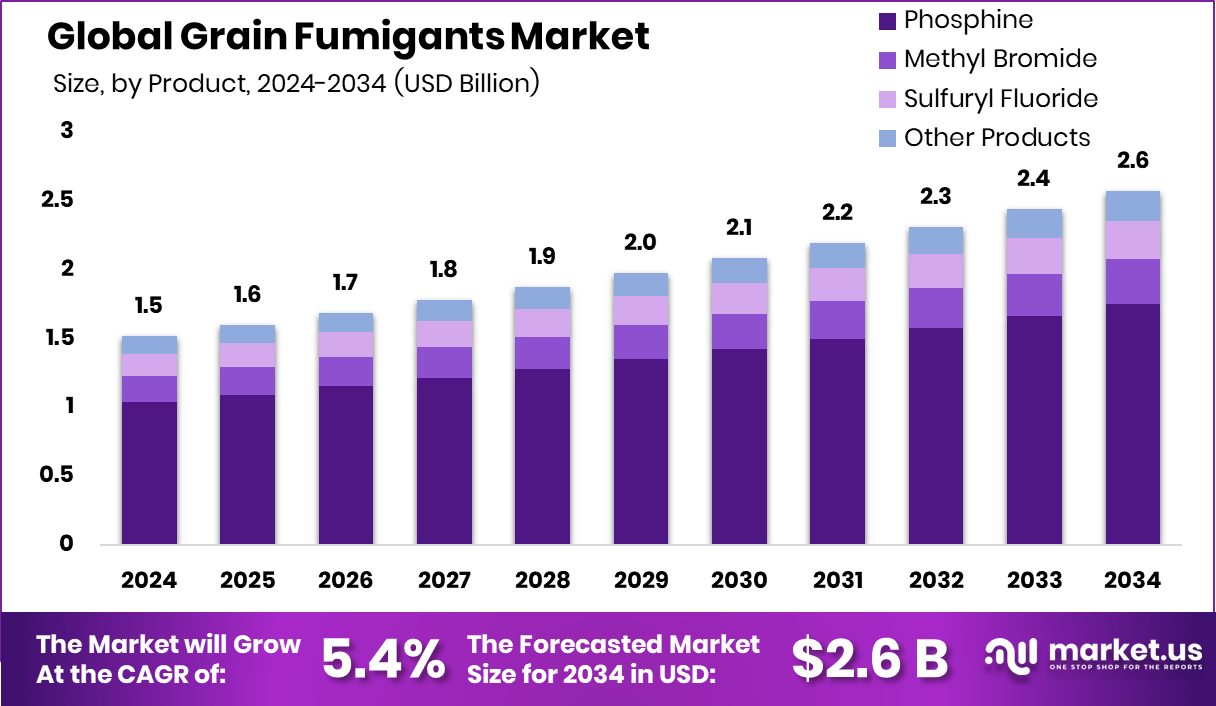

In 2024, the Global Grain Fumigants Market was valued at US$1.52 billion, and between 2025 and 2034, this market is estimated to register a CAGR of 5.4%, reaching about US$2.6 billion by 2034.

Grain fumigants are gaseous pesticides used to control insects and other pests in stored grains. They are designed to penetrate the grain mass and eliminate pests at all life stages. Fumigation is a crucial process in agriculture to maintain grain quality and prevent economic losses caused by pests.

Phosphine-based fumigants are the most commonly used in solid form in warehouse settings. The main driver of the grain fumigants market is the rising grain consumption in the world, which requires reducing grain losses during its transportation or storage. As the fumigants are hazardous in nature, they are highly regulated and highly invested in research and development activities.

These regulations and the evolving resistance of pests to the fumigants might restrain the growth of the market. In recent years, bio-based fumigants have gained popularity, and incorporating fumigants in the integrated pest management systems is a growing trend.

- An estimated 2.5 billion tons of food go uneaten around the world each year. A study in the United Kingdom revealed that as much as 1.3 billion tons of food is lost on farms globally during and after harvest, which is the equivalent of 15% of all food produced globally.

Key Takeaways

- The global grain fumigants market was valued at US$1.52 billion in 2024.

- The global grain fumigants market is projected to grow at a CAGR of 5.4% and is estimated to reach US$2.6 billion by 2034.

- In the product segment, phosphine-based grain fumigants dominate the market with around 68.2% of the total market share.

- Among the forms, solid grain fumigants held the majority of revenue share in 2024 at 38.4%.

- Based on applications, the grain fumigants market was led by warehouse fumigants with a substantial market share of 62.7% in 2024.

- In 2024, the Asia Pacific was the biggest market for grain fumigants, constituting around 41.1% of the total market share, valued at approximately US$624 million.

Product Type Analysis

Phosphine-based Fumigants Dominate the Market, Valued at US$ 954 Million.

The grain fumigants market is segmented based on product type as phosphine, methyl bromide, sulfuryl fluoride, and other products. In 2024, phosphine-based fumigants held a dominant market position, capturing more than a 68.2% share of the global market.

Phosphine is highly effective against a broad range of stored product pests, including insects, mites, and rodents. In addition, phosphine is relatively inexpensive compared to other fumigants. According to the National Institutes of Health (NIH), the application process is generally simpler and less equipment-intensive.

The chemical can be used in a variety of storage facilities and vehicles, including silos, bins, warehouses, railcars, ships, and containers. Furthermore, phosphine breaks down quickly in the environment, resulting in minimal residual contamination of harmless phosphorous oxides.

Form Analysis

Solid Grain Fumigants Dominated the Market Due to Efficiency and Easier Storage.

Based on forms, the grain fumigants market is divided into solid, liquid, and gas. In 2024, solid grain fumigants held a dominant market position, capturing a market share of 38.4%. While liquid and gaseous fumigants are also used, solid fumigants often present certain advantages, leading to their widespread use in specific applications.

Granular formulations of solid fumigants are easier to handle and apply with common equipment like spreaders, resulting in less drift compared to fine mists or dusts. This reduces the risk of applicator exposure and contamination of surrounding areas. Additionally, solid fumigants can be formulated to release the active gas slowly and consistently over a longer period.

Similarly, solid fumigant formulations can be less hazardous to handle than concentrated liquids or compressed gases. They are typically less prone to spillage or accidental release of high concentrations of the fumigant, further reducing applicator risk during preparation and application.

Application Analysis

Warehouse Applications Dominate the Grain Fumigants Market with around 62.7% of the Total Market Share.

Based on applications, the market can be segregated into soil and warehouse. In 2024, the warehouse storage applications in the category dominated the global grain fumigants market with a market share of 62.7%. Fumigants are widely used in storage and soil applications due to their ability to effectively penetrate and eliminate pests in various environments.

They are mostly used during the storage of grains and transportation. Fumigants can permeate stored products, including grains, fruits, and vegetables, reaching even hidden pests within the stored items. It can treat all stored items in a single application, saving time and labor compared to other methods.

Key Market Segments

By Product Type

- Phosphine

- Methyl Bromide

- Sulfuryl Fluoride

- Other Products

By Form

- Solid

- Liquid

- Gas

By Application

- Commercial Grain Elevators

- On-farm Silos

- Shipping Containers and Barges

- Warehouse and Transit Storage

Drivers

Rising Global Grain Consumption and Loss Reduction Initiatives Drive the Grain Fumigants Market.

The grain fumigants market is experiencing significant growth due to a confluence of factors, including rising global grain consumption, increasing post-harvest losses, and a growing emphasis on food safety and residue reduction. According to the Population Reference Bureau (PRB), the global population reached about 8.2 billion in 2024.

As the global population increases, the demand for staple grains such as wheat and rice continues to rise sharply. According to the Food and Agriculture Organization (FAO), they represent a significant portion of global consumption (about 45% of calories), making their availability critical to global food security. According to the International Grain Council (IGC), global grain production in the 2024/25 season reached around 2,315 million tons.

This massive volume of grain production must be preserved during storage and transportation, driving the need for effective fumigation solutions to control pests, molds, and insects that compromise food quality and safety. Additionally, the importance of grain fumigants grows stronger as the demand for the reduction of post-harvest losses increases.

In India, which produces over 300 million metric tons of food grains annually, government estimates suggest around 10% of the total production is lost post-harvest, mainly due to inadequate storage infrastructure and pest attacks.

- According to the FAO, up to 30% of global grain production is lost annually due to poor storage conditions, pest infestations, and microbial contamination. In sub-Saharan Africa, post-harvest grain losses can reach up to 40%, while in South and Southeast Asia, the range is typically between 10–25%.

Restraints

Regulations and Pest Resistance Might Pose a Challenge to the Grain Fumigants Market.

While fumigants play a vital role in preserving grain quality during storage and transportation, the growing complexity of environmental regulations and the biological adaptation of pests to commonly used fumigants are creating significant hurdles for industry stakeholders. One of the most prominent regulatory challenges stems from the phasing out of certain fumigants, particularly methyl bromide, a highly effective but ozone-depleting chemical.

Under the Montreal Protocol, more than 150 countries have agreed to limit or ban methyl bromide use due to its harmful effects on the ozone layer. Similarly, sulfuryl fluoride has been subject to tighter residue limits in the European Union due to concerns about its potential impact on human health.

The U.S. Environmental Protection Agency (EPA) has also evaluated its contribution to greenhouse gas emissions, as it has a global warming potential significantly higher than carbon dioxide. Furthermore, over time, insects exposed repeatedly to the same chemical agents develop resistance traits that are passed on to future generations, reducing the efficacy of fumigants and necessitating higher doses or combination treatments.

According to research published in journals such as Pest Management Science, major pests like the red flour beetle and lesser grain borer have demonstrated increasing resistance to phosphine, one of the most widely used grain fumigants globally.

Opportunity

Bio-based Fumigants and R&D in Controlled Release Technologies are Anticipated to Create More Opportunities in the Market.

The growing emphasis on environmental sustainability and food safety is driving significant interest in bio-based fumigants and controlled release technologies within the grain fumigants market. Traditional fumigants like methyl bromide, phosphine, and sulfuryl fluoride have long been effective in controlling storage pests, but rising concerns over toxicity, human exposure, residue limits, and environmental impact have spurred demand for greener, safer alternatives.

As regulatory agencies around the world tighten restrictions on chemical residues and ozone-depleting substances, bio-based fumigants and innovative R&D in controlled release systems are rapidly emerging as viable solutions, offering both ecological and operational benefits.

Trends

Integration of Integrated Pest Management and Grain Fumigants.

The integration of Integrated Pest Management (IPM) systems is an increasingly prominent trend in the grain fumigant market, driven by the need to balance effective pest control with sustainability, safety, and regulatory compliance. IPM is a comprehensive approach that combines biological, physical, and chemical control methods to manage pest populations in stored grain while minimizing environmental impact and pesticide resistance.

Traditionally, grain fumigation has relied heavily on chemical treatments such as phosphine and sulfuryl fluoride. However, over-reliance on these agents has led to issues like insect resistance, which has shown increasing phosphine resistance in countries like Australia and India. To address these concerns, IPM promotes the strategic and limited use of fumigants as a last resort, incorporating alternative pest control practices such as temperature management, aeration, sanitation, and biological controls.

Additionally, IPM supports better residue management and helps meet international trade standards, such as maximum residue limits (MRLs) set by importing countries. It allows grain exporters to minimize chemical residues, reduce costs, and extend the lifespan of fumigants by delaying resistance development.

Geopolitical Impact Analysis

Impact of Geopolitical Tensions

Geopolitical tensions have had a profound and multifaceted impact on the grain fumigants market, influencing everything from supply chains and production to regulatory standards and pricing. One of the most notable geopolitical events affecting this market has been the Russia–Ukraine conflict, which began in 2022.

According to the Food and Agriculture Organization of the United Nations, before the war, Russia and Ukraine together produced around 30% of the global wheat exports, but after the war started, there was approximately a 30% drop in Ukraine’s wheat exports. The war not only disrupted grain shipments but also heightened the urgency for preserving limited stocks through fumigation. Increased reliance on grain stored in temporary or emergency facilities has led to higher demand for fumigants.

Similarly, tensions between China and Western nations, especially the U.S., have also influenced the grain fumigants market. China is not only a top consumer of fumigants due to its massive grain production but also a significant manufacturer of chemical fumigants, including methyl bromide and aluminum phosphide. Escalating trade restrictions, tariffs, and stricter customs inspections have led to delays and cost surges in chemical exports from China, impacting global supply availability.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Grain Fumigants Market

In 2024, the Asia Pacific dominated the global grain fumigants market, holding about 41.1%, valued at approximately US$624 million. As the Asia Pacific comprises about half the global population, the demand for food security is highest in the region, accounting for most of the grain fumigants market. For instance, in 2024, China’s total grain production amounted to 706.50 million tons (1,413.0 billion jin), an increase of 11.09 million tons (22.2 billion jin) or 1.6% compared with that in 2023.

Similarly, according to India’s Ministry of Agriculture and Farmers Welfare, in 2024, India produced approximately 332.3 million metric tons of grain. Additionally, the tropical climate of the region is an ideal ground for pests and fungal outbreaks post-harvest. To mitigate these risks, grain fumigants are routinely used by farmers and storage operators to preserve crop quality during storage.

Furthermore, the region is experiencing an expansion of storage facilities and export volume of food grains. For instance, the Food Corporation of India (FCI), the main agency responsible for food grain procurement and distribution, initiated a public-private partnership model to construct 2.5 million tons of modern wheat storage facilities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Douglas Products, Arkema Group, AMVAC Chemical Corporation, LANXESS, Trinity Manufacturing, UPL, Detia-Degesch Group, National Fumigants, and Jining Shengcheng Chemical Experimental are the giants in the grain fumigants market. In a competitive market of grain fumigants, many players try to gain a competitive edge by engaging in strategic activities, such as product development, mergers, partnerships, and investments.

Douglas Products is a key player in the fumigation industry, specializing in grain fumigants for protecting stored commodities. They are known for their ProFume (sulfuryl fluoride) and PH3 (phosphine) fumigants, offering solutions for on-farm storage, grain terminals, export shipping, and food processing and manufacturing.

Arkema has developed Accolade and Paladin as fumigation solutions in various countries with a broad spectrum of effectiveness (nematicide, herbicide, fungicide). It is used for crop protection and the preparation of horticultural soils, making the company a leader in soil protection chemicals.

AMVAC Chemical Corporation, a subsidiary of American Vanguard Corporation, specializes in developing, manufacturing, and marketing products for global agriculture. The company prioritizes complying with environmental regulations and actively promotes stewardship programs to ensure the safe and proper use of its products.

Top Key Players in the Market

- Douglas Products

- Arkema Group

- AMVAC Chemical Corporation

- LANXESS

- Trinity Manufacturing, Inc.

- UPL Ltd.

- Detia-Degesch Group

- National Fumigants Pty Ltd.

- Jining Shengcheng Chemical Experimental Co., Ltd.

- Other Key Players

Recent Developments

- In June 2024, Douglas Products, the manufacturer behind leading brands Vikane and ProFume, announced its initiative to enhance fumigation tool technology while significantly reducing environmental impacts. As part of its commitment to sustainable pest management, DP pledged to cut global post-fumigation emissions from Sulfuryl Fluoride (SF) by 50% by 2035, ensuring the continued protection of people, food, and property without compromising environmental integrity.

- In January 2024, Degesch America, Inc., a leading innovator in fumigation and pest control solutions, introduced U-Phos(R) Phosphine Fumigant to the U.S. market with approval from the U.S. EPA.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 2.6 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Phosphine, Methyl Bromide, Sulfuryl Fluoride, Other Products), By Form (Solid, Liquid, Gas), By Application (Commercial Grain Elevators, On-farm Silos, Shipping Containers, and Barges, Warehouse and Transit Storage) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Douglas Products, Arkema Group, AMVAC Chemical Corporation, LANXESS, Trinity Manufacturing, Inc., UPL Ltd., Detia-Degesch Group, National Fumigants Pty Ltd., Jining Shengcheng Chemical Experimental Co., Ltd., Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Grain Fumigants MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Grain Fumigants MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Douglas Products

- Arkema Group

- AMVAC Chemical Corporation

- LANXESS

- Trinity Manufacturing, Inc.

- UPL Ltd.

- Detia-Degesch Group

- National Fumigants Pty Ltd.

- Jining Shengcheng Chemical Experimental Co., Ltd.

- Other Key Players