Global Zirconium Oxide Flap Disc Market Size, Share Analysis Report By Types (Medium Abrasive, Coarse and Extra Coarse Abrasive, Fine and Ultra Fine Abrasive), By Application (Steel Processing, Iron Processing, Others), By End-use (Automotive, Aerospace, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160525

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

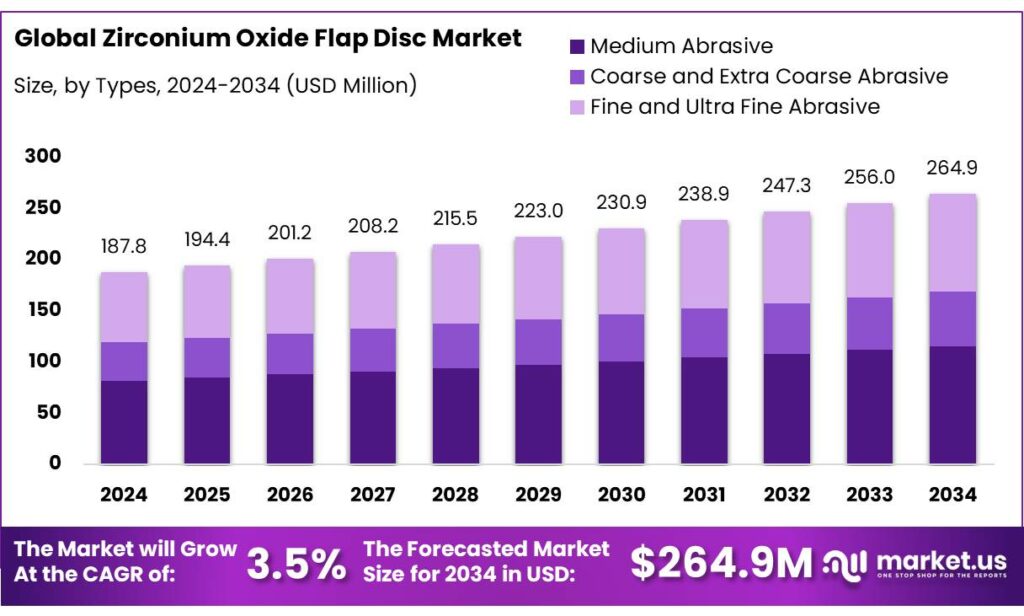

The Global Zirconium Oxide Flap Disc Market size is expected to be worth around USD 264.9 Million by 2034, from USD 187.8 Million in 2024, growing at a CAGR of 3.5% during the forecast period from 2025 to 2034.

Zirconium oxide flap discs are advanced abrasive tools widely used in industries requiring high-performance grinding, polishing, and finishing operations. These discs are composed of overlapping flaps made from zirconium oxide, a synthetic abrasive known for its exceptional hardness, thermal stability, and wear resistance. They are particularly effective on hard metals, composites, and ceramics, making them indispensable in sectors such as metal fabrication, automotive, aerospace, and construction.

The industrial scenario is characterized by demand linkages to heavy industries and vehicle manufacturing. Global crude steel output and fabrication activity are direct demand drivers for zirconia flap discs because steel finishing and weld dressing are routine end-uses; worldsteel reported world crude steel production of 144.5 million tonnes in December 2024, underscoring the scale of metalworking activity that supports abrasive consumption. Concurrently, growth in electrified vehicle manufacturing is increasing precision metalworking and battery pack fabrication needs; electric car sales approached 14 million units in 2023, which has required expanded fabrication and assembly capacity in battery and vehicle plants.

Key driving factors can be attributed to three principal forces. First, infrastructure and industrial investment has been stimulated by large public funding programs—most notably the U.S. Infrastructure Investment and Jobs Act which authorized approximately USD 1.2 trillion in transportation and infrastructure spending, including allocations that support manufacturing, energy and heavy industry modernization—measures that indirectly raise demand for metal-working consumables including zirconia flap discs.

Key Takeaways

- Zirconium Oxide Flap Disc Market size is expected to be worth around USD 264.9 Million by 2034, from USD 187.8 Million in 2024, growing at a CAGR of 3.5%.

- Medium Abrasive held a dominant market position, capturing more than a 43.8% share.

- Steel Processing held a dominant market position, capturing more than a 54.3% share.

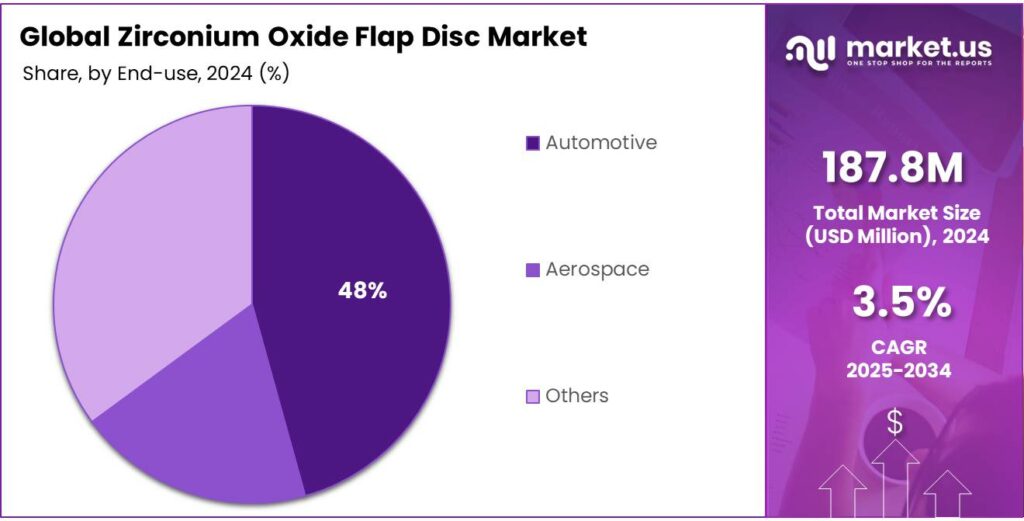

- Automotive held a dominant market position, capturing more than a 48.2% share.

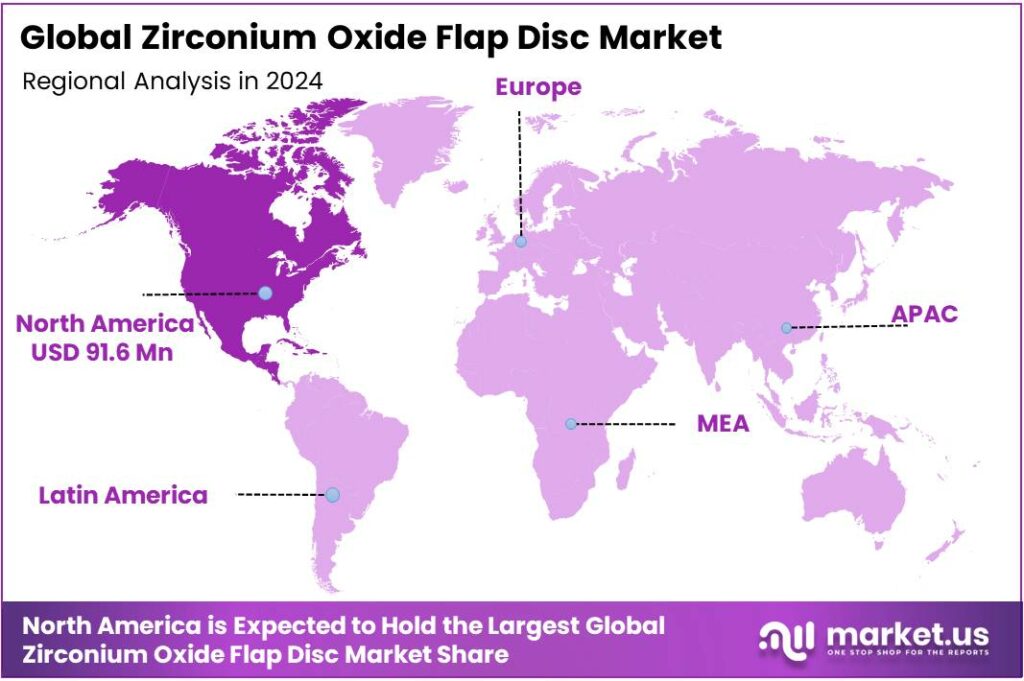

- North American region was observed to dominate the zirconium oxide flap disc market, accounting for 48.80% of regional share and equivalent to 91.6 million.

By Types Analysis

Medium Abrasive leads the market with 43.8% share in 2024 owing to its balanced performance and versatility.

In 2024, Medium Abrasive held a dominant market position, capturing more than a 43.8% share of the global zirconium oxide flap disc market. The segment’s leadership can be attributed to its optimal balance between cutting efficiency and surface smoothness, making it suitable for a wide range of metal fabrication applications. Medium-grade abrasives are widely preferred in industries such as automotive, shipbuilding, and general metalworking, where moderate material removal and fine finishing are required simultaneously.

During 2024, the adoption of medium abrasive zirconium oxide flap discs increased notably across manufacturing hubs in Asia-Pacific and Europe, driven by higher production of fabricated metal components and growing adoption of automated grinding systems. The discs are particularly valued for their longer service life and lower replacement frequency compared to coarse or fine variants, resulting in reduced operational downtime.

By Application Analysis

Steel Processing dominates with 54.3% share in 2024, driven by strong demand from fabrication and construction industries.

In 2024, Steel Processing held a dominant market position, capturing more than a 54.3% share of the global zirconium oxide flap disc market. The dominance of this segment is primarily due to the extensive use of zirconium oxide flap discs in grinding, deburring, and finishing of steel components used across manufacturing, infrastructure, and heavy engineering industries. Steel remains the backbone material for machinery, vehicles, pipelines, and construction structures, and the need for high-quality surface finishing continues to sustain strong demand for these flap discs. Their superior heat resistance, longer lifespan, and ability to maintain a consistent cut rate make them the preferred choice for large-scale steel fabrication processes.

In 2024, increased steel production—reaching over 1.88 billion tonnes globally as reported by the World Steel Association—supported steady consumption of abrasive tools across fabrication facilities and workshops. The rising focus on improving weld quality and surface precision in the production of stainless and structural steels also strengthened the use of zirconium oxide-based abrasives. Industrial workshops and automated metal-processing plants relied heavily on these discs for both rough and intermediate finishing tasks, enhancing efficiency while reducing rework costs.

By End-use Analysis

Automotive dominates with 48.2% share in 2024, supported by rising vehicle production and advanced surface finishing needs.

In 2024, Automotive held a dominant market position, capturing more than a 48.2% share of the global zirconium oxide flap disc market. This strong presence is largely driven by the growing demand for efficient metal finishing and precision grinding in vehicle manufacturing and component assembly. Zirconium oxide flap discs are extensively used in automotive production lines for surface preparation, weld removal, and edge blending of steel and aluminum parts.

During 2024, the global automotive sector experienced a rebound in production volumes, with the International Organization of Motor Vehicle Manufacturers (OICA) reporting over 93 million vehicles produced worldwide. The growing shift toward electric vehicle (EV) manufacturing has further increased the need for precision grinding tools to ensure the smooth finishing of lightweight metals and battery casings.

Key Market Segments

By Types

- Medium Abrasive

- Coarse and Extra Coarse Abrasive

- Fine and Ultra Fine Abrasive

By Application

- Steel Processing

- Iron Processing

- Others

By End-use

- Automotive

- Aerospace

- Others

Emerging Trends

Adoption of Eco-friendly Manufacturing Practices

A notable trend in the zirconium oxide flap disc market is the increasing adoption of eco-friendly manufacturing practices. This shift is driven by both regulatory pressures and a growing emphasis on sustainability within the industrial sector.

Governments worldwide are implementing stricter environmental regulations, compelling manufacturers to adopt cleaner production methods. For instance, the European Union’s Green Deal aims to make Europe the first climate-neutral continent by 2050, influencing industries to reduce their carbon footprints. Similarly, India’s “Make in India” initiative encourages sustainable manufacturing practices to enhance global competitiveness.

In response, companies are investing in research and development to create zirconium oxide flap discs that are not only high-performing but also environmentally friendly. This includes using recyclable materials for disc backings and reducing hazardous emissions during production. Such innovations not only comply with regulations but also appeal to environmentally conscious consumers and businesses.

Drivers

Government Initiatives and Industrial Growth Driving the Zirconium Oxide Flap Disc Market

The global demand for zirconium oxide flap discs is experiencing a significant uptick, primarily fueled by robust industrial growth and supportive government initiatives. These advanced abrasive tools, known for their durability and efficiency in metalworking applications, are becoming indispensable in sectors such as construction, automotive, and infrastructure development.

In the United States, the construction industry has been a major catalyst for the increased utilization of zirconium oxide flap discs. This growth is further supported by government initiatives aimed at stimulating economic growth through infrastructure development. For instance, the U.S. government’s investment in infrastructure projects is expected to boost the demand for angle grinder wheels, including zirconium oxide flap discs, in the construction industry.

Similarly, in India, the government’s focus on “Make in India” and “Atmanirbhar Bharat” initiatives has spurred growth in the manufacturing sector, leading to an increased demand for high-performance abrasives like zirconium oxide flap discs. These initiatives aim to promote domestic manufacturing and reduce reliance on imports, thereby fostering the growth of industries that require advanced abrasive tools for metalworking and finishing applications.

The automotive industry, particularly in emerging economies, is also contributing to the growing demand for zirconium oxide flap discs. As manufacturers strive for higher efficiency and better quality in metal fabrication, zirconia flap discs have emerged as a preferred choice due to their superior abrasive properties and longer lifespan. Government policies promoting industrial growth and technological advancements in manufacturing processes are further driving this trend.

Restraints

High Production Costs and Raw Material Volatility

A significant challenge facing the zirconium oxide flap disc market is the high production costs associated with these specialized abrasives. Zirconium oxide, the primary material used in these discs, is more expensive compared to alternatives like aluminum oxide. This price disparity can deter small and medium-sized enterprises (SMEs) from adopting zirconium oxide flap discs, especially in cost-sensitive markets.

Additionally, the volatility in raw material prices further exacerbates this issue. Fluctuations in the cost of zirconium oxide can lead to unpredictable production expenses, making it challenging for manufacturers to maintain consistent pricing strategies. This unpredictability can strain the budgets of businesses that rely on these abrasives for their operations.

To address these challenges, some manufacturers are investing in research and development to find cost-effective alternatives or to enhance the efficiency of zirconium oxide usage. However, such innovations require significant investment and time, posing a barrier for many companies in the industry.

Opportunity

Government Support for Sustainable Manufacturing Practices

he global push towards sustainability has led governments to introduce policies that encourage the adoption of eco-friendly manufacturing practices. These initiatives often include incentives for industries to reduce waste, lower emissions, and invest in energy-efficient technologies. For instance, in the United States, the Environmental Protection Agency (EPA) offers grants and tax credits to companies that implement green technologies and processes. Similarly, the European Union has set ambitious targets for reducing industrial emissions and has established funding programs to support businesses in achieving these goals.

In Asia, countries like Japan and South Korea have implemented strict environmental regulations that require industries to adopt cleaner technologies. These regulations often come with financial incentives, such as subsidies for purchasing energy-efficient equipment and penalties for exceeding emission limits. Such government support not only helps industries transition towards more sustainable practices but also creates a favorable market environment for products like zirconium oxide flap discs, which are integral to modern, efficient manufacturing processes.

These government initiatives are crucial in driving the adoption of advanced materials and technologies that contribute to sustainable industrial growth. By aligning economic incentives with environmental goals, governments play a pivotal role in shaping the future of manufacturing industries worldwide.

Regional Insights

North America leads regionally with 48.80% share, representing 91.6 million units/value in the zirconium oxide flap disc market.

In 2024, the North American region was observed to dominate the zirconium oxide flap disc market, accounting for 48.80% of regional share and equivalent to 91.6 million (units/value), reflecting concentrated demand from automotive, heavy fabrication and industrial maintenance segments.

The North American market is poised for continued growth, with projections indicating a steady increase in demand for high-performance abrasives. This growth is expected to be driven by ongoing industrialization, infrastructure development, and the need for efficient surface preparation and finishing solutions across various industries. As such, North America is anticipated to maintain its leading position in the global zirconium oxide flap disc market in the coming years.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Saint-Gobain, through its Norton brand, offers zirconia-alumina flap discs characterized by high cut rates, durable backing plates (fiberglass, resin, plastic), and grit options like 60 for medium/coarse and finishing work. Its products include Type 27 flat and Type 29 conical discs. For example, the Norton® 66623399138 is a 4-½-inch, 60-grit, medium-grade, zirconia-alumina flap disc with quick-trim plastic backing and rated to ~13,300 RPM. These discs are used in stock removal, weld blending, edge chamfering, and other steel processing tasks. Their designs aim to balance aggressiveness and operator comfort via backing and abrasive composition.

Klingspor’s zirconia flap disc products, such as the SMT “Supra” series, use alumina zirconia grains and are built for demanding metal grinding tasks. An example is the SMT624 Supra, 60 grit, angled backing plate, which is designed to aggressively remove welds and work on curved or difficult surfaces. Also, the SMT636 version includes a lubricant to reduce heat and clogging, improving performance on stainless steel and high alloy metals.

Weiler’s portfolio includes flap discs such as the “Tiger” series that use zirconia alumina grain for fast grinding and long life, especially in aggressive metal removal tasks. The 4-½-inch “Tiger Angled (Radial) Zirc” flap disc (40-grit) is made for steel and stainless steel welding, offering strong performance on fillet welds. Weiler has also expanded its offerings (Tiger X, Tiger Paw, Wolverine lines) with various sizes, densities, backing styles and grits (40, 60, 80) to cover from heavy stock removal to finishing work.

Top Key Players Outlook

- Saint-Gobain

- 3M

- Tyrolit

- Klingspor

- Weiler

- CGW

- METABO

- Stanley Black & Decker, Inc.

Recent Industry Developments

In 2024 Tyrolit, introduced its upgraded 2in1 flap discs, featuring a zirconia alumina coating that offers 30% better performance compared to previous models.

In 2024, Klingspor Abrasives reported a peak revenue of $69 million. The company employs approximately 424 individuals, with a revenue per employee ratio of $162,736.

Report Scope

Report Features Description Market Value (2024) USD 187.8 Mn Forecast Revenue (2034) USD 264.9 Mn CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Types (Medium Abrasive, Coarse and Extra Coarse Abrasive, Fine and Ultra Fine Abrasive), By Application (Steel Processing, Iron Processing, Others), By End-use (Automotive, Aerospace, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Saint-Gobain, 3M, Tyrolit, Klingspor, Weiler, CGW, METABO, Stanley Black & Decker, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Zirconium Oxide Flap Disc MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Zirconium Oxide Flap Disc MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Saint-Gobain

- 3M

- Tyrolit

- Klingspor

- Weiler

- CGW

- METABO

- Stanley Black & Decker, Inc.