Global GNSS Correction Service Market Size, Share Analysis Report By Service Type (Real-Time Kinematic (RTK), Differential GNSS (DGNSS), Precise Point Positioning (PPP), By Application (Agriculture, Construction, Mining, Transportation, Marine, Others), By End-User (Agriculture, Construction, Mining, Transportation, Marine, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152888

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

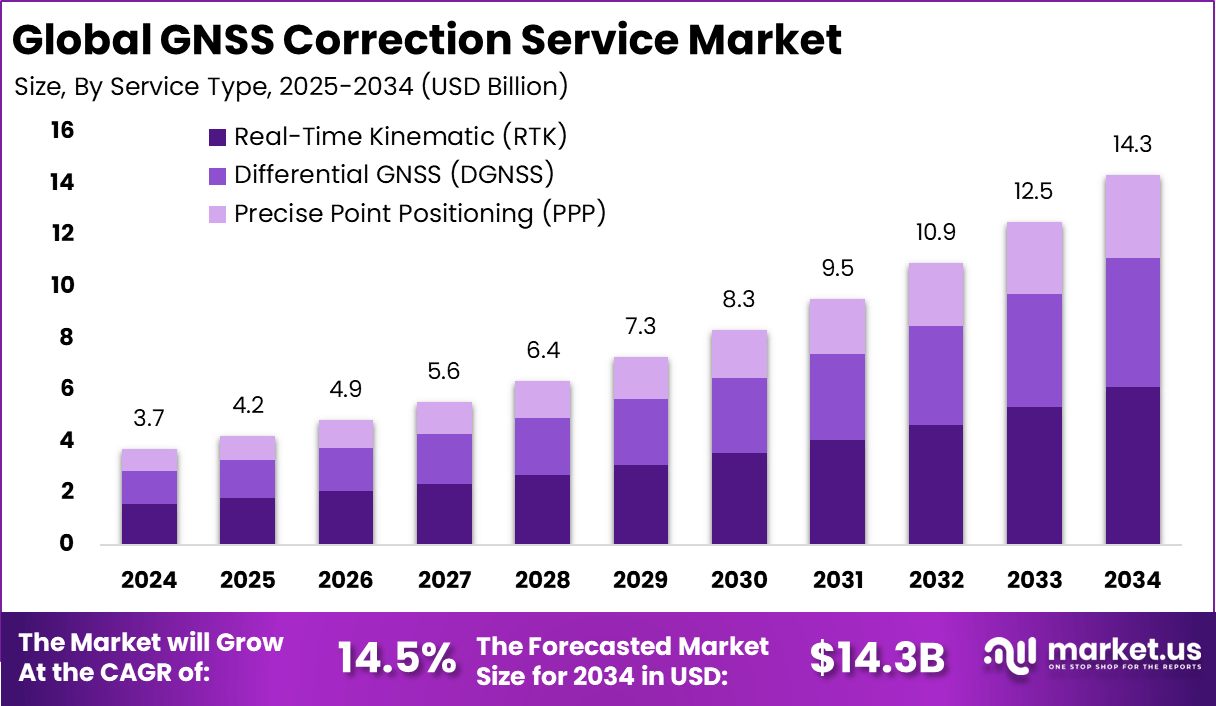

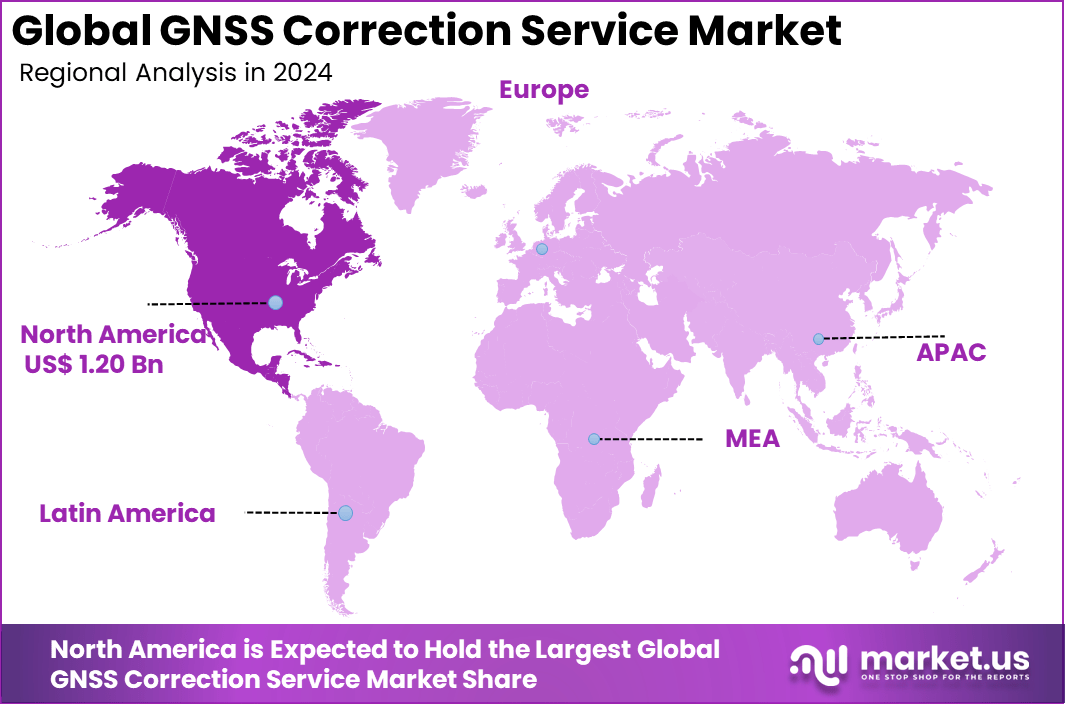

The Global GNSS Correction Service Market size is expected to be worth around USD 14.3 billion by 2034, from USD 3.7 billion in 2024, growing at a CAGR of 14.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32.6% share, holding USD 1.20 billion in revenue.

The market for GNSS correction services has grown rapidly as industries seek more precise positioning data to enable everything from autonomous vehicles and advanced surveying to innovative applications in agriculture and construction. GNSS correction services work by reducing errors in satellite signals, delivering much higher accuracy compared to standard GNSS.

High-accuracy positioning is at the core of growth for GNSS correction services. With expanding applications in fields like robotics, smart agriculture, logistics, and infrastructure development, the demand for precise geospatial data has never been greater. The push for automation and smarter cities also plays a significant role, with new transportation models and asset management solutions relying on corrected GNSS signals.

Demand for GNSS correction services is soaring as different sectors increase their reliance on digital technologies. The exponential growth in connected devices and the wider adoption of location-based services underpin steady upward movement. For instance, agriculture relies on GNSS correction for yield optimization, while construction and mapping depend on it for safety and efficiency.

Scope and Forecast

Report Features Description Market Value (2024) USD 3.7 Bn Forecast Revenue (2034) USD 14.3 Bn CAGR (2025-2034) 14.5% Largest market in 2024 North America [32.6% market share] For instance, in January 2025, Septentrio added GEODNET’s high-accuracy GNSS correction services to its portfolio, offering centimeter-level precision for applications like autonomous vehicles, precision agriculture, and industrial automation. This integration enhances Septentrio’s GNSS systems, improving reliability and performance to meet the growing demand for high-precision navigation across industries.

Key Takeaway

- The Global GNSS Correction Service market is projected to reach approximately USD 14.3 billion by 2034, growing at a healthy 14.5% CAGR between 2025 and 2034, supported by rising demand for precision navigation in critical sectors.

- In 2024, North America dominated the market with a 32.6% share, generating around USD 1.20 billion in revenue, driven by advanced infrastructure and widespread adoption of GNSS-based technologies.

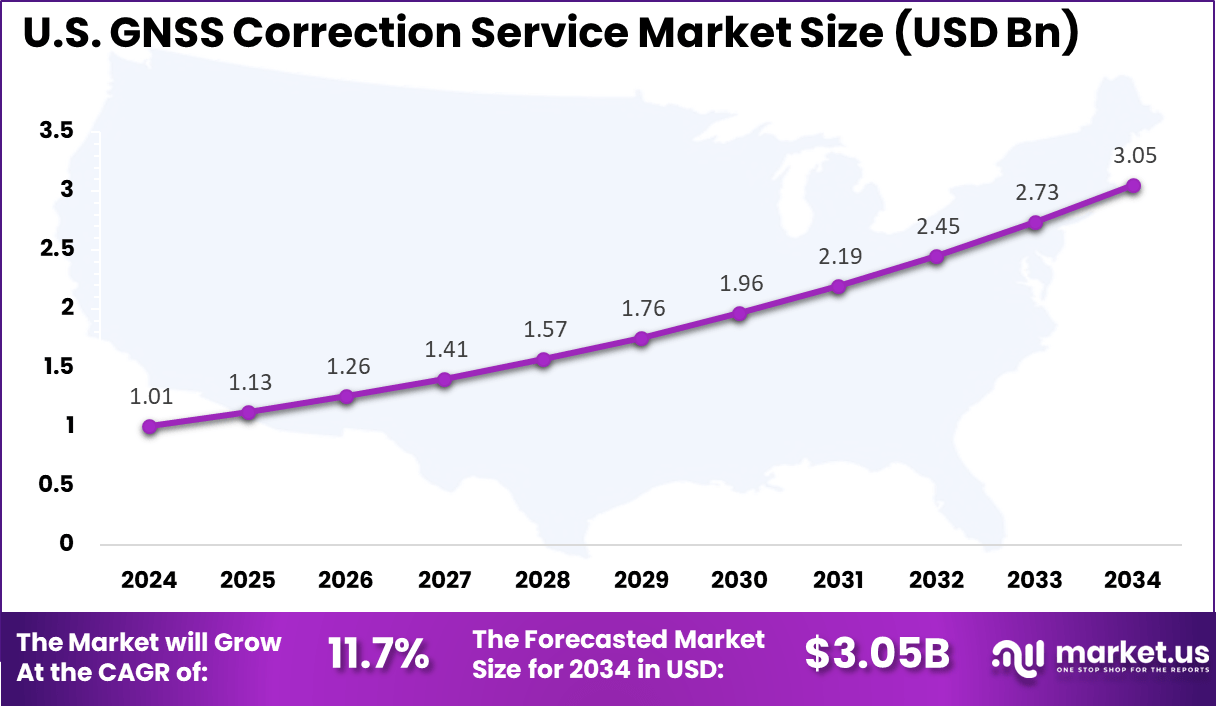

- The United States alone contributed nearly USD 1.01 billion in 2024 and is expected to grow at a steady 11.7% CAGR, reflecting strong investment in smart farming, construction, and autonomous systems.

- By service type, Real-Time Kinematic (RTK) services accounted for the largest share of 42.6%, due to their superior accuracy and reliability in real-time applications.

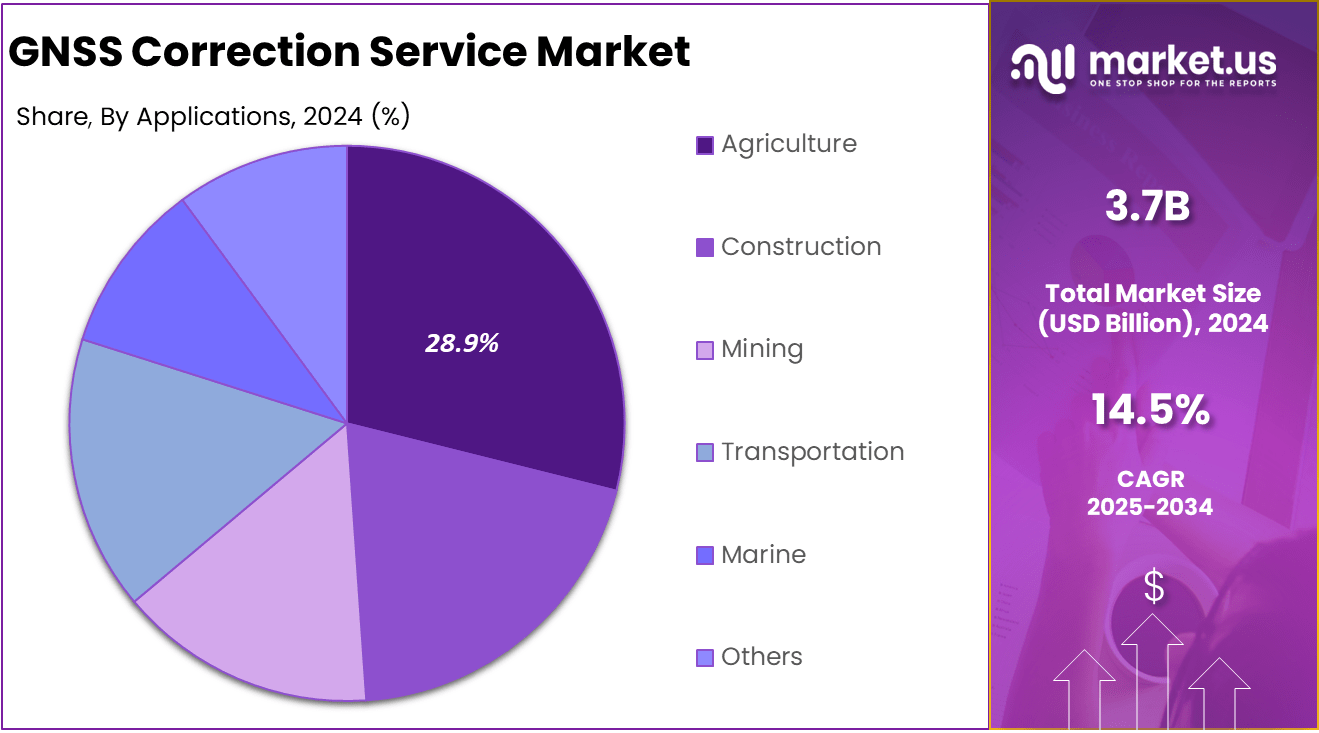

- By application, agriculture held a significant 28.9% share, as farmers increasingly rely on GNSS corrections to enhance crop yields and reduce input costs.

- By end-user, the agriculture sector remained the largest consumer, with a notable 32.7% share, underscoring its leadership in adopting precision guidance and monitoring solutions.

Analysts’ Viewpoint

GNSS correction services offer significant investment opportunities due to their interconnected applications across major sectors. With governments and private players making heavy investments in network infrastructure and the internet of things, the landscape is ripe for service and technology providers who can deliver innovative correction solutions.

Firms using GNSS correction services report improved accuracy, reduced errors, and higher operational efficiency. For sectors like logistics and surveying, these benefits reduce rework and downtime, directly impacting profitability.Precision agriculture sees better yields with optimized resource use, while safety advancements in aviation and transportation protect people and assets.

Regulatory requirements influence the roll-out and adoption of GNSS correction services. Governments are updating spectrum allocation policies and encouraging standardization to support both innovation and safety. However, compliance with international and regional licensing regimes can sometimes slow new entrants or cross-border expansion.

U.S. Market Size

The market for GNSS Correction Service within the U.S. is growing tremendously and is currently valued at USD 1.01 billion, the market has a projected CAGR of 11.7%. Due to the increasing demand for precise navigation and positioning in important sectors, this market is experiencing significant growth.

The fast-paced adoption of self-driving cars, drones, and modern agricultural technology is enhancing the demand for precise location data. Also, the development of 5G networks and IoT integration in infrastructure facilitates real-time GNSS corrections. By investing heavily in space technologies, both the government and private sectors contribute to enhancing the reliability and availability of GNSS correction services across various industries.

For instance, In January 2024, u-blox and Nordian launched the PointPerfect GNSS correction service in Brazil, extending its availability beyond the U.S. The service delivers high-accuracy positioning for applications like autonomous vehicles, agriculture, and surveying. This move highlights u-blox’s focus on expanding into emerging markets with reliable and precise GNSS solutions.

In 2024, North America held a dominant market position in the Global GNSS Correction Service Market, capturing more than a 32.6% share, holding USD 1.20 billion in revenue. This dominance is due to strong demand for high-precision positioning across sectors like agriculture, construction, GIS mapping, and marine navigation.

for instance, In May 2025, Quectel joined hands with GEODNET to deliver RTK correction services, enabling centimeter-level accuracy for mass-market use. This partnership reflects the increasing demand for precise positioning, especially in North America, where RTK services lead. The collaboration focuses on expanding access to scalable and cost-effective GNSS correction solutions, strengthening North America’s position in the real-time positioning market.

Service Type Analysis

In 2024, The Real-Time Kinematic (RTK) segment held a dominant market position, capturing a 42.6% share of the market. The dominance is due to its ability to deliver centimeter-level accuracy in real time, essential for sectors like construction, agriculture, and autonomous vehicles. RTK’s reliability, low latency, and ability to support dynamic, real-time operations make it the top choice for high-precision applications.

Advances in communication infrastructure, including cellular and satellite networks, ensure rapid and reliable data transmission, even in remote areas. Additionally, the growing affordability and ease of integrating RTK solutions have made them the preferred option for industries focused on precision and operational efficiency.

For Instance, In February 2023, GEODNET introduced an RTK GNSS correction service delivering centimeter-level precision for OEMs and system integrators in agricultural robotics. The service enables high-accuracy positioning for precision farming, allowing automated systems to perform more efficiently. By offering cost-effective, real-time corrections, GEODNET supports wider adoption of robotics in agriculture, boosting productivity and operational efficiency.

Application Analysis

In 2024, the Agriculture segment held a dominant market position, capturing a 28.9% share of the Global GNSS Correction Service Market. The demand in the sector has been primarily driven by the widespread use of precision farming technologies, including GPS-guided machinery, automated planting and harvesting systems, and drone-based crop monitoring.

These technologies depend on high-accuracy GNSS correction services to enhance field operations, reduce costs, and boost crop yields. Additionally, the growing need for sustainable farming practices in response to rising global food demand has further accelerated the adoption of GNSS correction services, helping farmers improve productivity and optimize resource management.

For instance, in May 2025, u-blox introduced its PointPerfect global GNSS correction service portfolio, designed to deliver high-accuracy positioning across a wide range of industries. The service offers real-time, centimeter-level corrections, enhancing applications such as autonomous vehicles, drones, and precision agriculture.

End-User Analysis

In 2024, Agriculture segment held a dominant market position, capturing a 32.7% share of the Global GNSS Correction Service Market. This dominance is due to the increasing reliance of farmers and agribusinesses on the precision agriculture solutions that require high-accuracy GNSS corrections for tasks like automated planting, variable rate application, and field mapping.

In agriculture, end-users benefit from improved crop yields, lower input costs, and better operational efficiency by utilizing GNSS-enabled systems and real-time data. As smart farming technologies continue to evolve and the focus on maximizing productivity while maintaining sustainability intensifies, GNSS correction services have become essential to modern agricultural practices.

For Instance, in January 2024, Sabanto and Trimble announced a collaboration to enhance GNSS positioning, surveying, and autonomy in agriculture. The partnership integrates Trimble’s high-accuracy GNSS technology with Sabanto’s autonomous farming solutions, enabling precise navigation and operation of agricultural machinery.

Key Market Segments

Service Type

- Real-Time Kinematic (RTK)

- Differential GNSS (DGNSS)

- Precise Point Positioning (PPP)

By Application

- Agriculture

- Construction

- Mining

- Transportation

- Marine

- Others

By End-User

- Agriculture

- Construction

- Mining

- Transportation

- Marine

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends Analysis

Smarter GNSS Correction with AI and Cloud Integration

A noticeable trend in GNSS correction services is the growing use of artificial intelligence (AI) and machine learning for cleaning up satellite data and making error corrections more precise, even in tricky conditions. Cloud-based services are becoming more popular as they let users access corrections anywhere with an internet connection, making the technology more flexible and scalable.

The use of multiple satellite systems is also improving reliability, especially in environments where buildings or thick forests used to cause problems. These innovations are pushing GNSS correction from niche applications into everyday use for a wider range of industries.

For instance, in April 2025, Rx Networks introduced TruePoint FOCUS, a cloud-based GNSS correction service that provides instantaneous centimeter-level accuracy. This innovative service is designed to make high-precision positioning accessible to a broader range of industries and applications, including autonomous vehicles, drones, and precision agriculture.

Driver Analysis

High Demand for Accurate Positioning in Modern Industries

The main driving force behind the adoption of GNSS correction services is the widespread demand for precise, real-time positioning across sectors like farming, construction, logistics, and emerging areas such as autonomous navigation.

Industries are eager to cut operating costs, boost efficiency, and ensure safety. Reliable location data helps modern workflows run smoother and supports everything from self-driving tractors to complex building projects. As industries automate and rely more on location data, this craving for proven accuracy continues to grow.

Restraint Analysis

High Costs Hinder Broader Adoption

Despite all the advantages, a significant roadblock is the high cost of rolling out GNSS correction services. Setting up and maintaining infrastructure, including ground stations, networks, and advanced receivers, can be daunting for small businesses or for users in developing regions.

Service costs and the price of keeping systems up to date make some cautious about taking the leap, creating an uneven playing field where only larger players can afford constant access to the highest-quality corrections.

Opportunity Analysis

Growth Potential in Emerging Markets and Smart Cities

There is a huge opportunity for GNSS correction providers in fast-growing markets such as Asia Pacific and in the expanding smart city sector. As more countries invest in digital infrastructure, and as urban areas become smarter and more automated, the demand for precise and reliable location data will rise sharply.

New applications in everything from agriculture to city transport planning create space for innovative services that can deliver corrections efficiently and affordably. This is a great chance for businesses to shape the future of connected communities and next-generation industries.

Challenge Analysis

Signal Interference and Security Threats

A big challenge facing the GNSS correction service market is the vulnerability of satellite signals to interference, both from natural obstacles like buildings and forests and from deliberate electronic jamming or spoofing.

On top of that, concerns about cybersecurity are growing as more industries rely on GNSS data for critical operations. Ensuring that correction data is both reliable and secure in the face of these risks is a tough technical hurdle, but overcoming it is essential for building trust and expanding adoption in vital sectors.

Key Players Analysis

Trimble, Hexagon, and Topcon dominate the GNSS correction service market with precise and reliable solutions for construction, agriculture, and geospatial industries. Septentrio and Leica Geosystems enhance competition with robust multi-constellation services, while Hemisphere GNSS and NavCom Technology target specialized sectors with scalable, high-accuracy offerings. Their strong focus on innovation and partnerships sustains leadership.

Veripos, Fugro, and Unicore Communications serve marine and industrial markets by delivering resilient correction networks for critical operations. Sokkia and Tallysman Wireless offer cost-effective solutions for niche and regional applications. Swift Navigation and ComNav Technology drive accessibility in emerging markets through affordable, reliable alternatives that expand adoption.

NovAtel, Racelogic, and Trimble RTX lead in real-time services supporting automation and connected systems. SBG Systems, CHC Navigation, and Harxon focus on OEM integration and custom hardware needs. Other regional players strengthen competition by addressing localized demands and sector-specific requirements, keeping the market dynamic and diverse.

Top Key Players in the Market

- Trimble Inc.

- Hexagon AB

- Topcon Corporation

- Septentrio N.V.

- Leica Geosystems AG

- Hemisphere GNSS

- NavCom Technology, Inc.

- Veripos (Hexagon Positioning Intelligence)

- Fugro N.V.

- Unicore Communications, Inc.

- Sokkia Co., Ltd.

- Tallysman Wireless Inc.

- Swift Navigation, Inc.

- ComNav Technology Ltd.

- NovAtel Inc.

- Racelogic Ltd.

- Trimble RTX

- SBG Systems

- CHC Navigation

- Harxon Corporation

- Others

Recent Developments

- In June 2025, Septentrio strengthened its Agnostic Corrections Partner Program by collaborating with Onocoy, a leader in providing high-accuracy GNSS correction services. This partnership expands the options available to customers by offering more choices for correction services, improving flexibility and performance across a range of industries.

- In November 2024, Topcon announced a major expansion of its Topnet Live GNSS correction service across the Western USA and Hawaii. This expansion adds 180 new geodetic reference stations, enhancing coverage and accuracy for users in these regions. The move aims to support industries such as construction and surveying by providing reliable, high-precision positioning services.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered Service Type (Real-Time Kinematic (RTK), Differential GNSS (DGNSS), Precise Point Positioning (PPP), By Application (Agriculture, Construction, Mining, Transportation, Marine, Others), By End-User (Agriculture, Construction, Mining, Transportation, Marine, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Trimble Inc., Hexagon AB, Topcon Corporation, Septentrio N.V., Leica Geosystems AG, Hemisphere GNSS, NavCom Technology, Inc., Veripos (Hexagon Positioning Intelligence), Fugro N.V., Unicore Communications, Inc., Sokkia Co., Ltd., Tallysman Wireless Inc., Swift Navigation, Inc., ComNav Technology Ltd., NovAtel Inc., Racelogic Ltd., Trimble RTX, SBG Systems, CHC Navigation, Harxon Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  GNSS Correction Service MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

GNSS Correction Service MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Trimble Inc.

- Hexagon AB

- Topcon Corporation

- Septentrio N.V.

- Leica Geosystems AG

- Hemisphere GNSS

- NavCom Technology, Inc.

- Veripos (Hexagon Positioning Intelligence)

- Fugro N.V.

- Unicore Communications, Inc.

- Sokkia Co., Ltd.

- Tallysman Wireless Inc.

- Swift Navigation, Inc.

- ComNav Technology Ltd.

- NovAtel Inc.

- Racelogic Ltd.

- Trimble RTX

- SBG Systems

- CHC Navigation

- Harxon Corporation

- Others