Global GMO Testing Market Size, Share, And Business Benefits By Technology (Polymerase Chain Reaction, ELISA Test, Strip Test), By Crop Type (Corn, Soy, Rapeseed and Canola, Potato, Others), By Trait (Stacked, Herbicide Tolerance, Insect Resistance, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165198

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

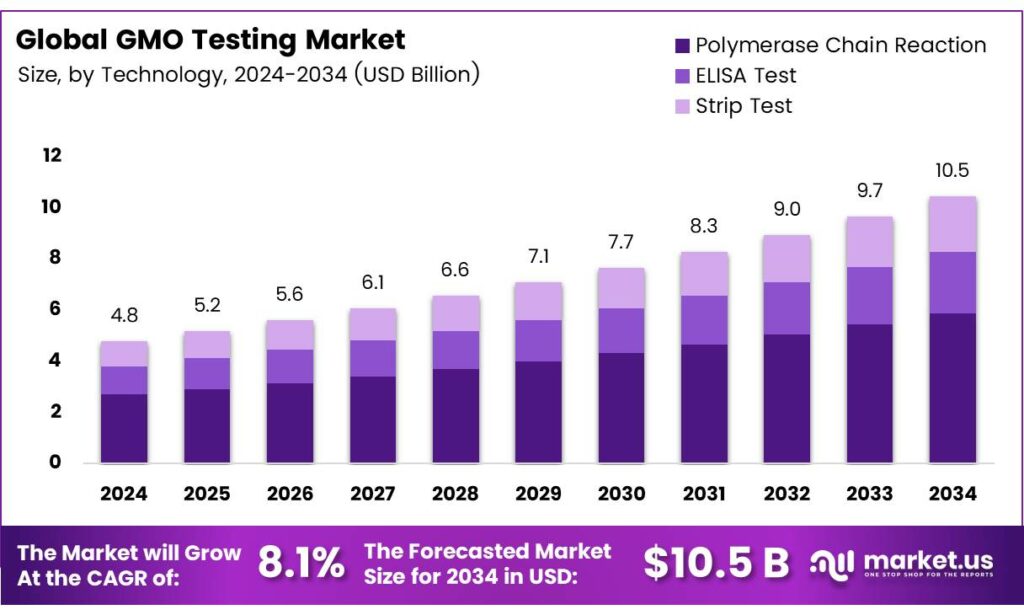

The Global GMO Testing Market size is expected to be worth around USD 10.5 Billion by 2034, from USD 4.8 Billion in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034.

Food products modified through biotechnological methods have been available on the market for decades. The polymerase chain reaction (PCR) test qualifies and quantifies genetically modified organisms (GMOs) in food or feed samples, providing the independent verification needed for confident trading. As part of the GMO screening process, state-of-the-art methods are utilized to offer a more cost-effective approach for identifying both authorized and unauthorized GMOs.

Food production has become more sophisticated and complex than ever before, leading to a continually evolving range and diversity of GMOs, which makes detection increasingly challenging. Routine GMO screening is essential because agricultural products containing GMOs can unintentionally mix with non-GMO foods and feeds. Consequently, GMO detection is required throughout the entire supply chain to prevent cross-contamination, where GM crops might inadvertently enter non-GM food and feed production.

- Rice feeds nearly 50% of the world’s population for calories. Genetic engineering boosts yield, herbicide tolerance, pest/disease resistance, nutrition, and stress resilience over traditional methods. GM crops covered 185.1 million hectares globally. Though soybean, maize, cotton, and canola dominate GM cultivation, few transgenic rice varieties exist, mostly in Asia, none commercially approved, yet unauthorized GM rice appears in many countries. China, the top rice producer, allocates 20% of its farmland to rice.

Two certified reference materials (CRMs) were obtained from the Institute of Reference Materials and Measurements in the EU. These references consisted of two available GM varieties: Bt 11 maize 5% and Roundup Ready soy 5%, both containing GM target sequences and thus used as positive controls in the study. Eighty-one rice seed samples, each 500 g, were randomly purchased from various local markets in Tehran. All samples were homogenized using an electric homogenizer and stored at −20°C before DNA extraction.

Key Takeaways

- The Global GMO Testing Market is expected to grow from USD 4.8 billion in 2024 to USD 10.5 billion by 2034 at 8.1% CAGR (2025-2034).

- Polymerase Chain Reaction led by the Technology segment in 2024 with 56.3% share due to accurate DNA amplification and sensitivity.

- Corn dominated the By Crop Type segment in 2024 with a 38.4% share driven by staple status, export compliance, and high testing volumes.

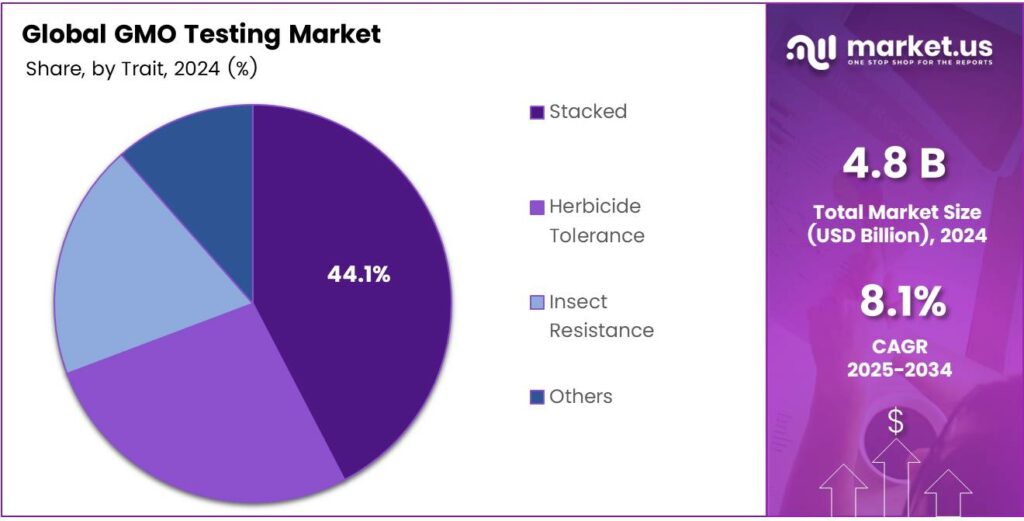

- Stacked traits held the top position in the By Trait segment in 2024 with a 44.1% share, owing to the combined benefits and complex assay needs.

- North America led the global market in 2024 with a 47.9% share of USD 2.2 billion, supported by strict regulations, biotech infrastructure, and an organized supply chain.

By Technology Analysis

Polymerase Chain Reaction dominates with 56.3% due to its precision and widespread adoption in GMO detection.

In 2024, Polymerase Chain Reaction held a dominant market position in the By Technology Analysis segment of the GMO Testing Market, with a 56.3% share. This method excels by amplifying DNA sequences accurately, enabling reliable GMO identification. Labs prefer it for sensitivity in complex samples. Consequently, it drives efficiency in regulatory compliance.

As demand grows, PCR integrates advanced tools, boosting throughput. Thus, it leads to innovation in food safety testing. ELISA Test follows as a key player in GMO Testing. It detects proteins from GMOs quickly via antibodies. This immunoassay suits field applications, offering cost savings. Moreover, it supports initial screenings effectively. However, it yields qualitative results, prompting further verification.

ELISA enhances accessibility for routine checks. Strip Test provides rapid, on-site GMO screening. Users dip strips into extracts for visual results. This lateral flow method simplifies detection without equipment. It aids farmers and processors in quick assessments. Yet, it is limited to specific traits. Still, Strip Test accelerates supply chain decisions efficiently.

By Crop Type Analysis

Corn dominates with 38.4% due to its extensive global cultivation and high GMO adoption.

In 2024, Corn held a dominant market position in the By Crop Type Analysis segment of the GMO Testing Market, with a 38.4% share. As a staple crop, corn faces rigorous testing for GM traits. This ensures export compliance amid vast acreage. Testing volumes surge with hybrid varieties. Hence, corn testing fuels market growth through advanced protocols.

Soy emerges as a vital segment in GMO Testing. Soybeans, heavily genetically modified, require frequent assays for traits. This crop’s global trade demands precise verification. Testing prevents contamination in feeds and oils. Additionally, soy drives demand for multiplex methods. Thus, it sustains steady market expansion.

Rapeseed and Canola contribute significantly to GMO screening. These oilseeds, often engineered for tolerance, undergo routine checks. Testing verifies purity in biodiesel and food uses. Regulations amplify their importance in Europe and Asia. Consequently, Rapeseed and Canola testing support sustainable farming practices effectively.

By Trait Analysis

Stacked dominates with 44.1% due to the rising complexity of multi-trait GM crops.

In 2024, Stacked held a dominant market position in the By Trait Analysis segment of the GMO Testing Market, with a 44.1% share. Stacked traits combine benefits like resistance in one plant. This complexity necessitates sophisticated assays. Developers prioritize testing for stacked events. As a result, it accelerates adoption in high-yield agriculture.

Herbicide Tolerance ranks prominently in GMO traits testing. Crops engineered for this withstand specific chemicals, reducing weeds. Testing confirms trait expression in seeds and harvests. Farmers rely on it for efficient weed management. Moreover, it aligns with precision farming trends globally.

Insect Resistance forms another core trait in GMO evaluation. It protects crops from pests, minimizing losses. Testing verifies Bt proteins accurately. This trait boosts yields in vulnerable regions. Hence, Insect Resistance testing ensures robust crop protection strategies.

Key Market Segments

By Technology

- Polymerase Chain Reaction

- ELISA Test

- Strip Test

By Crop Type

- Corn

- Soy

- Rapeseed and Canola

- Potato

- Others

By Trait

- Stacked

- Herbicide Tolerance

- Insect Resistance

- Others

Emerging Trends

Ultra-sensitive, multi-method GMO testing (dPCR and NGS) to meet tighter disclosure rules

A clear trend in GMO testing is the fast shift from single-target qPCR toward digital PCR (dPCR) and next-generation sequencing (NGS). Food manufacturers and labs are adopting these tools because regulators expect precise detection of tiny GMO traces in complex, highly processed products, and because stacked traits and new genomic techniques are harder to catch with one-off assays.

- Policy is pushing this upgrade. In the European Union, GMO labelling rules tolerate only adventitious or technically unavoidable presence below 0.9% per ingredient (and 0.5% in specific cases for not-yet-authorised material with a favourable risk assessment). That numeric threshold compels labs to validate methods that reliably detect and quantify down to low fractions—precisely where dPCR and NGS shine.

EFSA issued 2024 guidance on the quality of DNA sequencing and the use of whole-genome sequencing in GMO dossiers, signalling that sequencing outputs (read depth, assembly quality, variant calling) will increasingly underpin method development and event characterisation. As applicants align with these recommendations, NGS-based confirmatory testing becomes more routine in official control and industry QA programs.

Drivers

Stricter disclosure rules across major food markets

The biggest push behind GMO testing today is regulation. Food companies ship ingredients across borders every day, and each market has numeric thresholds and disclosure rules that must be proven with lab results. That number sets the bar for routine screening and quantification in oils, starches, and highly processed inputs.

The United States has also raised the operational stakes. USDA’s update to the National Bioengineered Food Disclosure Standard took effect. The update adds bioengineered sugarcane and amends squash on the official list, which means more ingredients fall within scope and more finished foods need evidence-based screening. This is pushing manufacturers to extend GMO panels and maintain auditable test records for imports and co-packed lines.

- The USDA reports 86% of U.S. corn acres and 90% of U.S. cotton acres used genetically engineered insect-resistant seeds, and stacked-trait seeds covered 83% of corn acres. With such widespread adoption in major exporting crops, traders and food processors rely on testing to segregate, certify, and label correctly as consignments move from farm to flour mill to packaged food.

Restraints

Technical and methodological limits in detecting emerging GM and genome-edited traits

One significant barrier to wider adoption of GMO testing is the technical difficulty of detecting new or complex genetic modifications in food and feed. The European Network of GMO Laboratories (ENGL) and the European Commission Joint Research Centre (JRC), methods validated for traditional GMOs may fail when faced with plants created by newer techniques such as genome editing.

- To ground this with numbers: for conventional GMO event detection in the EU, the method must satisfy a minimum performance requirement (MPR) of 0.1% (m/m) level for quantification (mass/mass) of authorised GM content. But when dealing with genome-edited plants that carry only single-base changes or small gene edits, even achieving that 0.1% detection becomes technically complex, especially since DNA fragments can degrade during food processing.

The human side is that producers may struggle to certify compliance, or incur high costs and still face uncertainty about trace-level findings. Until detection technology and validated reference materials catch up with breeding advances, this restraint will slow the responsiveness and confidence of GMO-testing regimes around the world.

Opportunity

Rising global biotech crop adoption is driving demand for GMO testing

One of the strongest forces boosting demand for GMO testing is the rapid worldwide adoption of biotech crops, which expands the number of supply-chain nodes and verification points that need reliable screening. The global area planted with biotech (genetically engineered) crops reached about 206.3 million hectares across 76 countries.

- Brazil, some 68 million hectares were planted with GE traits, and adoption rates in soybeans and cotton reached 99% and 95% respectively. These high numbers mean that feed, food‐processing, and exports all carry a significant GM‐derived ingredient load. As more countries approve events, traits, and crops, the number of “lots” needing testing grows.

In major producing countries like the United States, where GM soybean and maize dominate, testing capacity must scale up. This volume growth means that GMO testing labs are not just handling occasional shipments but have become integrated in routine quality assurance and regulatory compliance workflows, which supports stable demand for testing services, reagents, instrumentation, and reference materials.

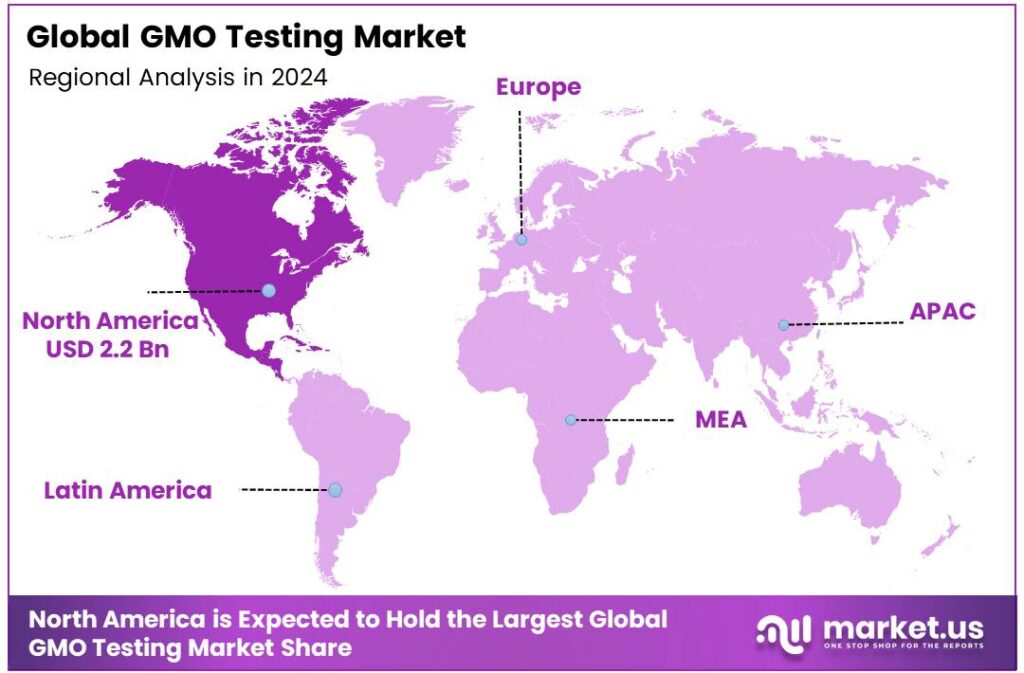

Regional Analysis

North America leads with a 47.9% share and a USD 2.2 Billion market value.

North America dominates the global GMO Testing Market, accounting for 47.9% share valued at USD 2.2 billion in 2024. The region’s leadership is supported by stringent regulatory frameworks, advanced biotechnology infrastructure, and a highly organized food supply chain.

The United States and Canada enforce rigorous GMO labeling and safety requirements under agencies such as the U.S. Department of Agriculture, Food and Drug Administration, and Canadian Food Inspection Agency. These authorities mandate continuous testing across processed foods, animal feed, and seed imports, strengthening regional demand for reliable GMO detection technologies.

Growing public concern regarding food transparency has further accelerated the adoption of advanced testing tools like PCR and immunoassay methods. Major laboratories and agritech companies in the region—such as Eurofins Scientific and Thermo Fisher Scientific are expanding service portfolios to cover multi-GMO detection and rapid assay kits.

North America’s focus on preventing cross-contamination and maintaining export compliance also drives sustained investment in testing facilities. With a strong policy framework, high consumer awareness, and advanced analytical capabilities, North America remains the benchmark region for GMO testing reliability and regulatory compliance globally.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Intertek Group plc provides comprehensive GMO testing across the entire food supply chain. Its strength lies in an extensive international network of accredited laboratories, offering one-stop solutions for compliance with complex global regulations. Intertek serves major food manufacturers and retailers, verifying label claims like Non-GMO and ensuring safety.

Bio-Rad Laboratories, Inc. is a foundational player in the GMO testing market, primarily through its innovative diagnostic instruments and reagents. The company is renowned for its Droplet Digital PCR (ddPCR) technology and a wide array of validated test kits for qualitative and quantitative GMO detection. By providing the essential tools and consumables used by other testing labs and food companies themselves.

LGC leverages its deep heritage in measurement science and standards to be a key partner in GMO testing. The company is distinguished by its production of certified reference materials (CRMs), which are crucial for test method validation and calibration. Through its SGS affiliate, it also offers extensive commercial testing services.

Top Key Players in the Market

- Intertek Group plc

- Bio-Rad Laboratories, Inc.

- LGC Limited

- EnviroLogix Inc.

- Microbac Laboratories, Inc.

- Institut Merieux

- SGS SA

- ALS Limited

- Koninklijke DSM N.V.

- TUV SUD AG

- Premier Foods plc

- R-Biopharm AG

- Eurofins Scientific

Recent Developments

- In 2024, Intertek enhanced its GMO testing services as part of broader food safety initiatives, including compliance with global labeling requirements for genetically modified ingredients. This aligns with the company’s full-year results, which reported strong growth in assurance, testing, inspection, and certification (ATIC) solutions for food and agriculture supply chains.

- In 2024, LGC Biosearch Technologies announced Amp-Seq One, a one-step amplicon sequencing workflow for GMO and genetic trait detection in agriculture. It targets breeders’ needs for faster GMO screening and will be commercially available in the first half. This innovation addresses challenges in detecting multiple GMO events simultaneously, enhancing efficiency in seed and crop testing.

Report Scope

Report Features Description Market Value (2024) USD 4.8 Billion Forecast Revenue (2034) USD 10.5 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Polymerase Chain Reaction, ELISA Test, Strip Test), By Crop Type (Corn, Soy, Rapeseed and Canola, Potato, Others), By Trait (Stacked, Herbicide Tolerance, Insect Resistance, Others Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Intertek Group plc, Bio-Rad Laboratories, Inc., LGC Limited, EnviroLogix Inc., Microbac Laboratories, Inc., Institut Merieux, SGS SA, ALS Limited, Koninklijke DSM N.V., TUV SUD AG, Premier Foods plc, R-Biopharm AG, Eurofins Scientific Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Intertek Group plc

- Bio-Rad Laboratories, Inc.

- LGC Limited

- EnviroLogix Inc.

- Microbac Laboratories, Inc.

- Institut Merieux

- SGS SA

- ALS Limited

- Koninklijke DSM N.V.

- TUV SUD AG

- Premier Foods plc

- R-Biopharm AG

- Eurofins Scientific