Global Glycerol Market By Type (Crude and Refined), By Source (Biodiesel, Fatty Alcohols, Fatty Acids, and Soaps), By End-use (Food and Beverage, Pharmaceutical Nutraceutical, Other End-uses), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 53419

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

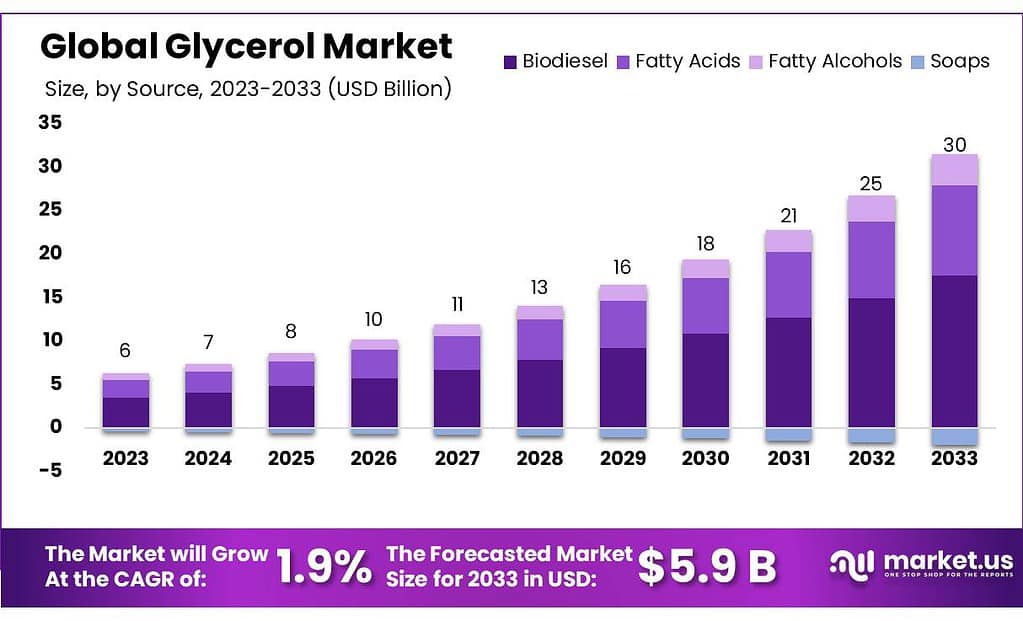

The global glycerol market size is expected to be worth around USD 5.9 billion by 2033, from USD 4.9 billion in 2023, growing at a CAGR of 1.9% during the forecast period from 2023 to 2033.

This is due to the increasing demand from the food, nutraceutical, and pharmaceutical sectors. It is used in many food products, including condensed milk & processed meats.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth Projection: The global glycerol market is expected to reach approximately USD 5.9 billion by 2033, growing from USD 4.9 billion in 2023, with a CAGR of 1.9% during the forecast period.

- Type Analysis: Refined Segment Dominance: Refined glycerol accounted for 78.0% of total revenue in 2023. Its versatile properties make it a sought-after ingredient in personal and home-care products. Crude Segment Growth: The crude glycerol segment is projected to experience a 6.2% CAGR due to increased demand in personal care and nutraceuticals despite its impurities.

- Source Analysis: Biodiesel Leading Source: Biodiesel held a 59.5% market share in 2023, driven by the rising demand for renewable energy sources globally.

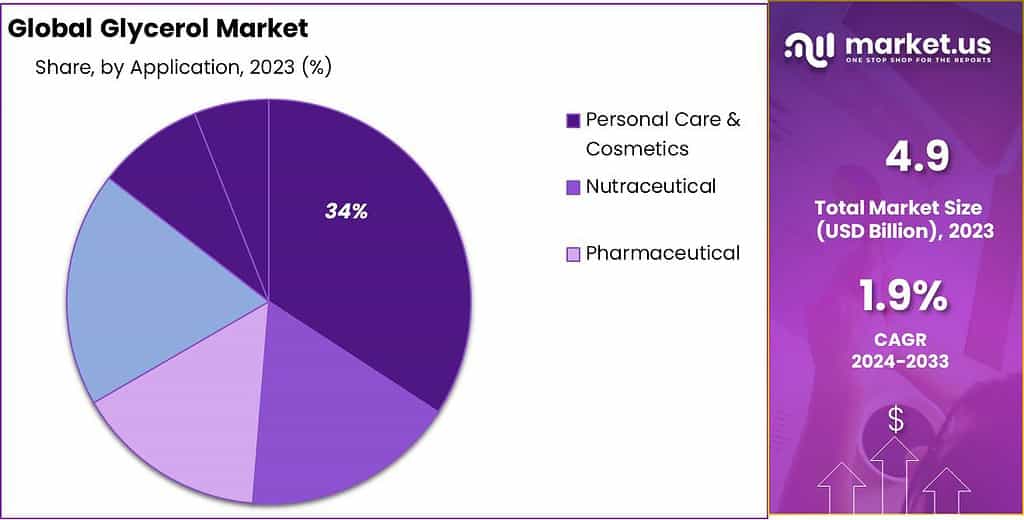

- End-Use Analysis: Personal Care Domination: The personal care and cosmetics sector captured over 34% of the market in 2023 due to glycerol’s moisturizing properties.

- Market Drivers: Biodiesel Demand: Increasing demand for biodiesel, driven by environmental regulations and consumer preference for cleaner fuels, contributes significantly to glycerol demand. Personal Care Industry Growth: Versatility in personal care and cosmetic products propels glycerol market expansion.

- Challenges: Supply-Demand Fluctuations: Market swings due to oversupply or scarcity impact prices and producer profits. Environmental Concerns: Despite being renewable, environmental worries could affect glycerol usage.

- Opportunities: Pharmaceutical Applications: Glycerol’s role in the pharmaceutical industry for extracting components and preventing substance precipitation presents growth avenues. Specialized Food Industry: Utilization of glycerol as a sweetener in diabetic-friendly foods aligns with increasing demand in this sector.

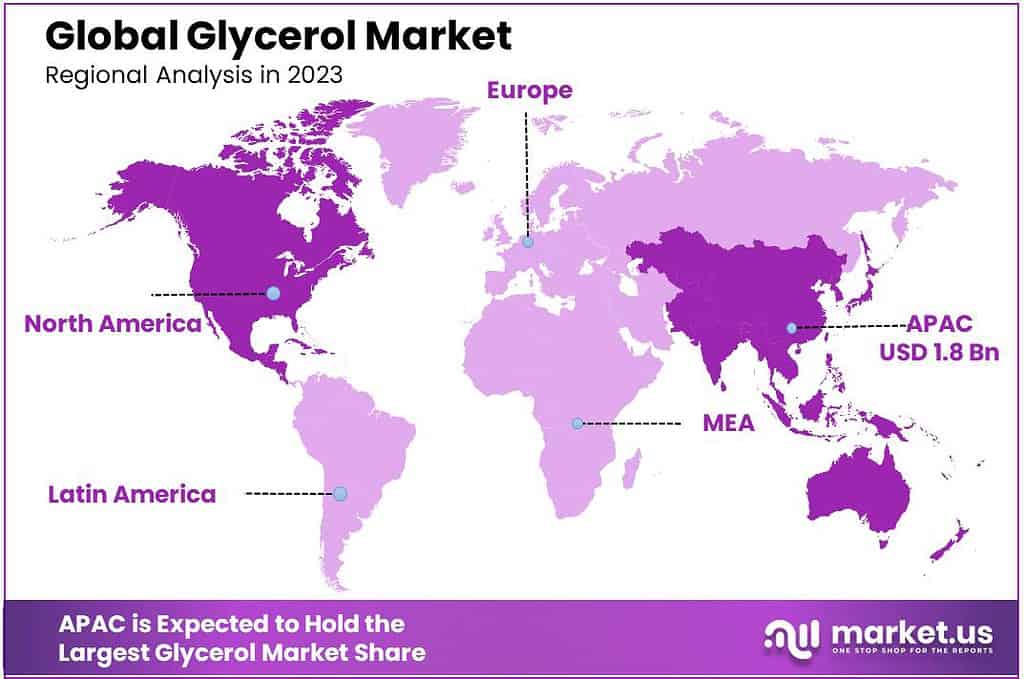

- Regional Analysis: Asia Pacific Dominance: The Asia Pacific region accounted for the largest revenue share in 2021 and is expected to grow at a 6.5% CAGR due to changing lifestyles and increased consumption.

- Key Players: Market dominance is held by major companies like Procter & Gamble, BASF SE, Cargill, Incorporated, Dow, and Oleon NV, among others, investing in R&D and expanding their global presence.

Type Analysis

Glycerol’s most profitable segment, the refined segment, earned 78.0% of total revenue for 2023.

Refined Glycerin can be described as a colorless, odorless liquid with a high boiling point. It is a useful addition to many personal and home-care formulas due to its moisturizing and emulsifying qualities. These attributes will contribute to the increased demand for this product in the future.

In the next five decades, the crude segment will witness a 6.2% compound annual growth rate. Because of its impurities and lack of fatty acids, crude glycerol will be less popular. Due to the growing demand for crude glycerol, which is used in personal care products and nutraceuticals.

Source Analysis

In 2023, Biodiesel held a dominant market position, capturing more than a 59.5% share. This was primarily due to the growing demand for renewable energy sources and the expansion of biodiesel production worldwide.

This segment is expected to grow at 6.5% annually in the next few years. It is used as a byproduct in the production of biodiesel fuels using chemical & enzymatic processes & the production of bioethanol. Because of its low price and biodegradable, renewable & non-toxic characteristics, biodiesel is a preferred source of glycerol.

The segment of fatty alcohols is expected to see the greatest CAGR over the estimated period. It is widely used in the manufacture of detergents and surfactants. They are also used in industrial solvents, as well as constituents in the food, beverage, and cosmetic industries. Glycerol market growth is expected to be accelerated by the increasing demand for fatty alcohol from these industries over the estimated period.

End-Use Analysis

In 2023, personal care and cosmetics held a dominant market position, capturing more than a 34% share. This was due to the widespread use of glycerol in skincare, haircare, and cosmetic products, leveraging its moisturizing and emollient properties.

This can be attributed to a rise in personal care & pharmaceutical products due to a better lifestyle and growing health awareness in emerging economies in Latin America and the Asia Pacific.

Glycerol can be used to improve smoothness, lubrication, or as a humectant. Glycerol is used in products such as hair products, skincare, shaving cream, and personal lubricants that are water-based. In the estimated period, the pharmaceutical segment will see the highest CAGR. Because of its healing and nutritional properties, the product is often used in pharmaceuticals. It is also found in toothpaste, expectorants, and mouthwashes. Glycerol is expected to see a significant increase in demand in the future for its various uses in pharmaceutical applications.

The product can also be used in food preservatives, as well as the making of explosives and perfumes. It helps other ingredients dissolve faster when it is added to water or alcohol in perfumes. Glycerol can be converted to nitroglycerin through a reaction with sulfuric acid. It can also be used in anti-freeze and lubrication as well as printing inks.

Note: Actual Numbers Might Vary In the Final Report

Key Market Segments

By Type

- Refined

- Crude

By Source

- Biodiesel

- Fatty Acids

- Fatty Alcohols

- Soaps

By End-use

- Food & Beverage

- Nutraceutical

- Pharmaceutical

- Industrial

- Personal Care & Cosmetics

- Other End-uses

Drivers

One major driver is the increasing demand for biodiesel. As more consumers and the transportation industry seek cleaner, renewable fuel sources, glycerol’s role in biodiesel production becomes pivotal. This demand is further bolstered by stringent environmental regulations targeting carbon emissions, driving the need for biodiesel derived from glycerol.

Additionally, the personal care segment is contributing substantially to the market’s growth. Glycerol’s versatility in personal care and cosmetics, used in products like moisturizers, shampoos, toothpaste, and more, is driving its demand. Its ability to moisturize and smoothen skin surfaces, along with its inclusion in products like shaving creams and eye drops, is fueling the market’s expansion.

Both these factors—increasing biodiesel demand and the surge in glycerol usage in personal care—stand as primary drivers propelling the global glycerol market forward.

Restraints

Fluctuating Supply and Demand: Sometimes, there’s too much glycerol available, which can lower prices and affect profits for producers.

Costs of Raw Materials: The prices of things like vegetable oils, used to make glycerol, can change a lot. When they go up, it can make glycerol more expensive to produce.

Competition from Other Options: There are other things that work like glycerol, and sometimes those things might be cheaper or easier to use. That makes it harder for glycerol to keep its place in the market.

Rules and Regulations: Different places have different rules about how glycerol should be made and labeled. Keeping up with these rules can be tricky and might slow down market growth.

Environmental Worries: Even though glycerol is renewable, some people worry about its environmental impact. This concern might affect how much people want to use it.

Limited Use in Some Industries: While glycerol has many uses, there might be limitations in getting it used in all kinds of products or industries, which can hold back its growth in those areas.

Opportunity

There are promising opportunities emerging in various sectors for the global glycerol market.

In the pharmaceutical industry, glycerol’s increasing utilization presents new growth avenues. Its role in preventing substances from precipitating and its use in extracting components are gaining traction. Additionally, the pharmaceutical sector’s inclination toward eco-friendly products, coupled with supportive government policies, is further boosting glycerol’s demand in this industry, leading to market expansion.

Glycerol is widely used to produce foods tailored for people living with diabetes. As more individuals develop the condition, they require food that will support their wellbeing. Glycerol helps make these foods, so it’s becoming really important in this special kind of food industry.

Glycerol’s use as a sweetener in these products aligns with this demand, offering a viable solution. Furthermore, the increased production of biofuels contributes to the market’s growth by providing more avenues for glycerol utilization.

These opportunities—driven by glycerol’s pharmaceutical applications and its role as a sweetener in specialized food products—are expected to propel the market forward in the coming years.

Challenges

Supply-Demand Swings: Sometimes, there’s too much glycerol or not enough, which messes with prices and how much money companies make.

Costs Changing: The stuff used to make glycerol, like vegetable oils, can get more expensive or hard to find. This affects how much it costs to make glycerol.

Other Options: There are things like glycerol that people can use instead, and sometimes those things are cheaper or easier. That makes it tough for glycerol to stay popular.

Rules Everywhere: Different places have different rules about making and selling glycerol. Keeping up with these rules can be tough and might slow down how much glycerol gets used.

Nature Worries: Even though glycerol is made from natural stuff, some people worry it might still harm the environment. This worry can make people not want to use it as much.

Not for Everything: While glycerol can do a lot of things, there are some places or things where it can’t be used much. This stops it from growing in those areas.

Regional Analysis

The Asia Pacific was the dominant market for glycerol and had the largest revenue share at 39.4% in 2021. In the next few years, the region will experience a 6.5% CAGR. This can be attributed to the changing lifestyles, increasing consumption of convenience food, and an increasing number of women working in the region.

Glycerol prices in the Asia Pacific rose multifold in the first half of 2021 due to increased demand from the end-use industries, constrained production, and a shortage in key feedstock chemicals.

Because of the limited availability of feedstock, Indonesia saw a decrease in glycerin production. Europe was the second largest regional market in 2020, accounting for 26.0% of revenue.

This can be attributed to large investments made by major cosmetics companies, rising consumer spending, and the introduction of innovative products in personal care. The top producers of this product in Europe are France, Germany, Italy, France, and the Netherlands.

There is a potential market for biofuels in Europe. The market will benefit from increased biodiesel production in the future.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Due to the large number of multinationals involved in continuous research and development, the market is extremely competitive. With a wide range of products and a global presence, companies such as Procter & Gamble SE, and Dow, dominate the market. To maximize profit and minimize investment, the majority of these companies have integrated all their business operations throughout the value chain.

Global companies are also looking to expand their capacity and sign partnerships with distributors. BASF SE, for example, has opened a new center in Johannesburg, South Africa, to support its focus on glycerol development with higher service quality and value-added customizations. The following are some of the most prominent players in the global glycerol market:

Market Key Players

- BASF SE

- Cargill, Incorporated

- Procter & Gamble

- Oleon NV

- KLK OLEO

- Dow

- ADM

- Wilmar International Ltd.

- Kao Corporation

- Emery Oleochemicals

- COCOCHEM

- Godrej Industries Limited

- Monarch Chemicals Ltd

- Aemetis, Inc.

- CREMER OLEO GmbH & Co. KG

- Sakamoto Yakuhin Kogyo Co.Ltd.

- Fine Chemicals & Scientific Co.

Recent developments

In July 2023, Louis Dreyfus Company announced its expansion of refining capacity in Indonesia. This plan includes the addition of a new glycerine refining capacity in the country.

In May 2023, BASF SE announced 1-year completion of converting glycerol to renewable propylene glycol (BioPG) by ORLEN Poludine, a biofuels company in Poland. ORLEN Poludine uses BASF’s technology for this conversion of glycerol to BioPG.

In December 2022, Argent Energy announced its plan to construct a new glycerine refinery. The 50,000 tons production capacity refinery is planned to be established in the port of Amsterdam.

Report Scope

Report Features Description Market Value (2023) USD 4.9 Billion Forecast Revenue (2033) USD 5.9 Billion CAGR (2023-2032) 1.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Refined, Crude), By Source (Biodiesel, Fatty Acids, Fatty Alcohols, Soaps), By End-use (Food & Beverage, Nutraceutical, Pharmaceutical, Industrial, Personal Care & Cosmetics, Other End-uses) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Daikin, Sinochem, Dongyue Group, Solvay, Koura Global, Lanxess, Yingpeng Chemical, Stella Chemifa Corp., Honeywell International Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is glycerol?Glycerol, also known as glycerin, is a colorless, odorless, viscous liquid that is sweet-tasting and non-toxic. It is a trihydroxy sugar alcohol and can be derived from natural sources such as fats and oils or synthesized from propylene.

What are the primary uses of glycerol?Glycerol has a wide range of applications. It is used in pharmaceuticals, food and beverages, personal care products (such as soaps, lotions, and toothpaste), as a solvent in various industries, and in the production of polyols for plastics and as a component in explosives and antifreeze.

How is glycerol produced?Glycerol can be obtained through various methods, primarily as a byproduct of biodiesel production from vegetable oils or animal fats through a process called transesterification. It can also be synthesized through the hydrolysis of fats or as a byproduct of soap manufacturing.

How important is sustainability in the glycerol industry?Sustainability is increasingly important, driving innovations in glycerol production processes to utilize renewable feedstocks and reduce waste generation. The focus is on developing eco-friendly processes and finding new applications for glycerol byproducts.

-

-

- BASF SE

- Cargill, Incorporated

- Procter & Gamble

- Oleon NV

- KLK OLEO

- Dow

- ADM

- Wilmar International Ltd.

- Kao Corporation

- Emery Oleochemicals

- COCOCHEM

- Godrej Industries Limited

- Monarch Chemicals Ltd

- Aemetis, Inc.

- CREMER OLEO GmbH & Co. KG

- Sakamoto Yakuhin Kogyo Co.Ltd.

- Fine Chemicals & Scientific Co.