Global Gluten-Free Bakery Premixes Market Size, Share, Growth Analysis By Product (Bread, Cake, Pizza Bases, Muffin, Hamburgers, Others), By Application (Bakeries and Confectionery, Restaurants and Cafes, Households) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157768

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

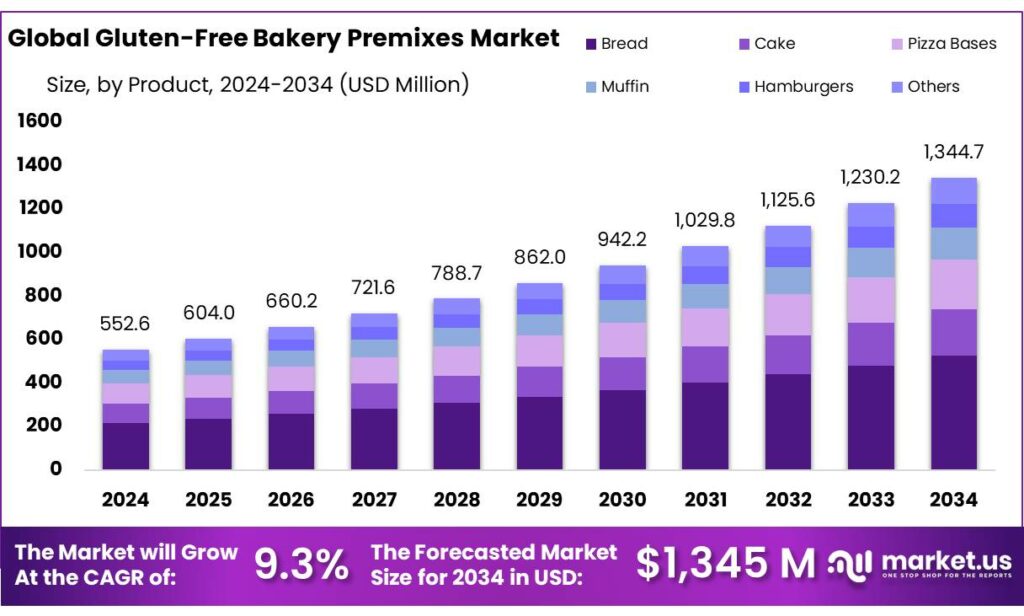

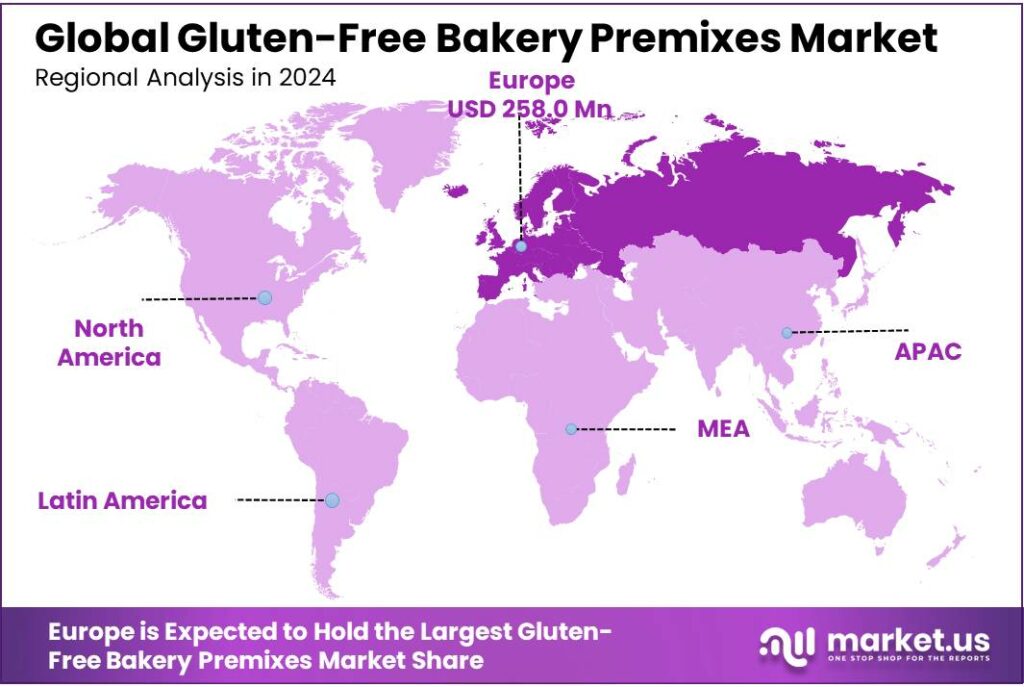

The Global Gluten-Free Bakery Premixes Market size is expected to be worth around USD 1344.7 Million by 2034, from USD 552.6 Million in 2024, growing at a CAGR of 9.3% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 46.7% share, holding USD 5.6 Billion in revenue.

The gluten-free bakery premixes industry in India is experiencing significant growth, driven by increasing health awareness, rising prevalence of gluten-related disorders, and supportive government initiatives. This sector encompasses ready-to-use blends designed for producing gluten-free bakery items such as bread, cakes, cookies, and pastries, catering to both consumers with medical conditions like celiac disease and those opting for gluten-free diets for health reasons.

The surge in demand for gluten-free bakery products is largely attributed to the growing prevalence of celiac disease and non-celiac gluten sensitivity. According to the U.S. National Institutes of Health (NIH), about 1% of the U.S. population is affected by celiac disease, with many others adopting gluten-free diets due to health concerns. This trend is not limited to North America; Europe and Asia-Pacific regions are also witnessing increased adoption, with Asia-Pacific projected to be the fastest-growing market, driven by urbanization and rising disposable incomes.

Government initiatives and regulations play a crucial role in supporting the growth of the gluten-free bakery premixes market. In the United States, the Food and Drug Administration (FDA) has established guidelines for gluten-free labeling, ensuring that products labeled as gluten-free contain less than 20 parts per million of gluten, thereby fostering consumer trust. Similarly, the European Commission’s Regulation (EU) No 828/2014 standardizes gluten-free labeling across member states, facilitating market access and consumer confidence.

The demand for gluten-free bakery premixes is primarily driven by the increasing prevalence of celiac disease and non-celiac gluten sensitivity. According to the U.S. Food and Drug Administration (FDA), approximately 1 in 133 Americans have celiac disease, and an estimated 18 million Americans have non-celiac gluten sensitivity. These conditions have led to a growing consumer base seeking gluten-free alternatives, including bakery products. In response, the FDA has established guidelines for gluten-free labeling, ensuring transparency and trust among consumers. Additionally, the FDA mandates that products labeled as “gluten-free” contain less than 20 parts per million of gluten, ensuring product integrity and consumer trust.

Key Takeaways

- Gluten-Free Bakery Premixes Market size is expected to be worth around USD 1344.7 Million by 2034, from USD 552.6 Million in 2024, growing at a CAGR of 9.3%.

- Bread premixes held a dominant position in the gluten-free bakery premixes market, capturing 48% of the market share.

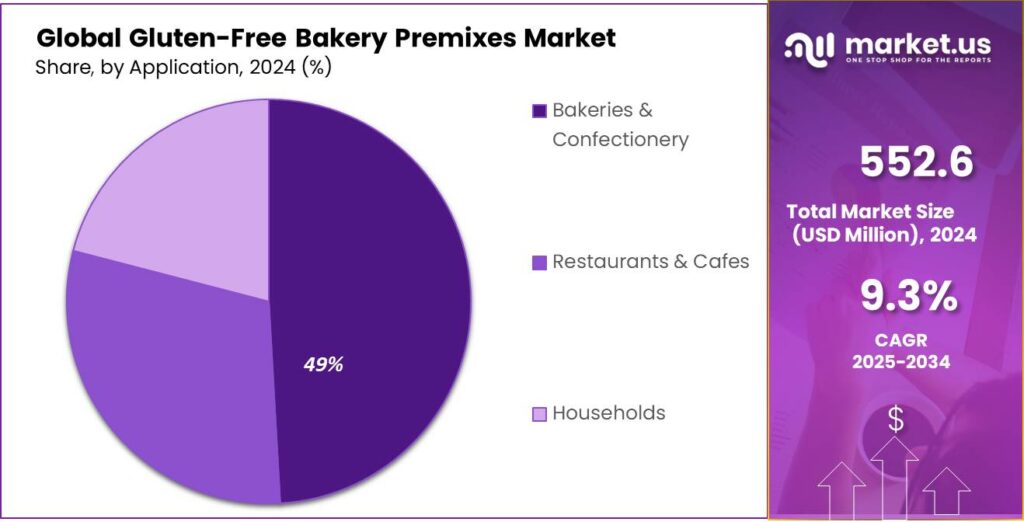

- Bakeries & Confectionery segment held a dominant position in the gluten-free bakery premixes market, capturing more than a 49.2% share.

- Europe held a dominant position in the global gluten-free bakery premixes market, capturing a substantial 46.7% share, equating to approximately USD 258 million.

By Product Analysis

Bread Premixes Lead the Gluten-Free Bakery Market with 48% Share in 2024

In 2024, bread premixes held a dominant position in the gluten-free bakery premixes market, capturing 48% of the market share. This significant share underscores the widespread consumer preference for gluten-free bread options, driven by health considerations and dietary restrictions. The demand for gluten-free bread has been bolstered by advancements in baking technology, which have improved the texture and taste of gluten-free products, making them more appealing to a broader audience.

The popularity of gluten-free bread premixes is also attributed to their convenience and ease of use. These premixes allow consumers to prepare gluten-free bread at home without the need for specialized ingredients or baking skills. This convenience factor has been particularly appealing to health-conscious individuals and those with gluten sensitivities, contributing to the segment’s robust growth.

By Application Analysis

Bakeries & Confectionery Lead the Gluten-Free Bakery Premixes Market with 49.2% Share in 2024

In 2024, the Bakeries & Confectionery segment held a dominant position in the gluten-free bakery premixes market, capturing more than a 49.2% share. This substantial market share underscores the significant role of commercial bakeries and confectioneries in driving the demand for gluten-free products.

The increasing prevalence of gluten-related disorders, such as celiac disease and gluten intolerance, has led to a surge in consumer demand for gluten-free bakery items. Bakeries and confectioneries, being primary producers of such goods, have adapted to this demand by incorporating gluten-free premixes into their production processes. These premixes offer a convenient solution, ensuring consistency and quality in the final products.

Key Market Segments

By Product

- Bread

- Cake

- Pizza Bases

- Muffin

- Hamburgers

- Others

By Application

- Bakeries & Confectionery

- Restaurants & Cafes

- Households

Emerging Trends

Rise of Clean-Label and Functional Ingredients in Gluten-Free Bakery Premixes

One of the most notable trends in the gluten-free bakery premixes market is the increasing consumer demand for clean-label products and the incorporation of functional ingredients. Consumers are becoming more health-conscious and are seeking products with simple, recognizable ingredients that align with their dietary preferences and health goals. This shift is prompting manufacturers to innovate and develop gluten-free premixes that not only cater to gluten-free diets but also offer additional health benefits.

The clean-label movement emphasizes transparency in food labeling, with consumers preferring products that have minimal processing and contain natural ingredients without artificial additives or preservatives. In response, gluten-free bakery premix manufacturers are focusing on using whole grains, ancient grains, and other natural ingredients to enhance the nutritional profile of their products. For instance, incorporating ingredients like quinoa, buckwheat, and teff flour not only caters to gluten-free needs but also adds fiber, protein, and essential minerals to the diet.

This trend is not only observed in developed markets but is also gaining traction in emerging economies. As consumers in countries like India and China become more aware of gluten-related health issues and the benefits of clean-label products, the demand for gluten-free bakery premixes is expected to rise. Manufacturers are responding by expanding their product offerings to include gluten-free premixes that cater to local tastes and dietary preferences, thereby tapping into new market opportunities.

Drivers

Rising Health Awareness and Demand for Gluten-Free Products

The growing prevalence of gluten-related disorders and increasing consumer health consciousness are pivotal drivers propelling the demand for gluten-free bakery premixes. In the United States, approximately 1 in 133 individuals are diagnosed with celiac disease, a condition that necessitates a strict gluten-free diet. Furthermore, an estimated 18 million Americans suffer from non-celiac gluten sensitivity, highlighting a significant portion of the population seeking gluten-free alternatives for health reasons

Beyond medical necessity, many consumers are adopting gluten-free diets as a lifestyle choice, aiming to improve overall health and well-being. This shift is particularly evident among millennials and health-conscious individuals who prioritize clean and natural ingredients in their food. A report by the National Institutes of Health (NIH) indicates that 70% of survey participants voluntarily try gluten-free diets without any medical diagnosis, reflecting a broader trend towards healthier eating habits

Government initiatives also play a crucial role in supporting the gluten-free bakery premixes market. In the United States, the Food and Drug Administration (FDA) has established guidelines for gluten-free labeling, ensuring transparency and trust among consumers. Similarly, the European Commission has implemented Regulation (EU) No 828/2014, which standardizes gluten-free labeling, contributing to the growth of gluten-free products in the region

Restraints

Higher Production Costs and Limited Consumer Accessibility

One of the significant challenges facing the gluten-free bakery premixes market is the higher production costs associated with gluten-free ingredients compared to traditional wheat-based counterparts. This price disparity often results in gluten-free products being more expensive for consumers, which can limit their accessibility, especially among price-sensitive segments.

For instance, gluten-free premixes frequently incorporate specialty flours such as rice, sorghum, or quinoa, which are not only more costly but also less widely available than conventional wheat flour. Additionally, the need for specialized manufacturing processes to prevent cross-contamination and to maintain the integrity of gluten-free products further escalates production expenses.

According to a study published in the National Center for Biotechnology Information (NCBI), the higher cost of gluten-free products is a recognized barrier to adherence to a gluten-free diet. This financial constraint can deter individuals from purchasing gluten-free bakery premixes, thereby impacting market growth. The study highlights that while the demand for gluten-free products is on the rise, the associated costs remain a significant hurdle for many consumers.

Moreover, the limited availability of quality gluten-free raw materials can further exacerbate the cost issue. The sourcing of high-quality, non-contaminated gluten-free ingredients often involves stringent quality control measures and certification processes, which can add to the overall cost of production. These factors collectively contribute to the premium pricing of gluten-free bakery premixes, making them less accessible to a broader consumer base.

Opportunity

Expansion of Specialty and Online Retail Channels

A significant growth opportunity for the gluten-free bakery premixes market lies in the expansion of specialty and online retail channels. The increasing consumer preference for gluten-free products has led to a surge in demand across these platforms. The convenience offered by online platforms, coupled with the availability of a wide range of specialty gluten-free bakery premixes, is further propelling market expansion.

In the United States, the Food and Drug Administration (FDA) has established guidelines for gluten-free labeling, ensuring transparency and boosting consumer confidence. These regulatory measures are encouraging manufacturers to innovate and cater to the growing demand for gluten-free bakery premixes.

The expansion of specialty and online retail channels is making gluten-free bakery premixes more accessible to consumers worldwide. E-commerce platforms, specialty stores, and supermarkets now offer a wide range of gluten-free products, making it easier for consumers to find and purchase them. The increased availability of gluten-free bakery premixes has contributed to their growing popularity and market penetration.

Regional Insights

Europe Leads the Gluten-Free Bakery Premixes Market with 46.7% Share in 2024

In 2024, Europe held a dominant position in the global gluten-free bakery premixes market, capturing a substantial 46.7% share, equating to approximately USD 258 million in market value. This significant share underscores Europe’s leadership in the sector, driven by several key factors.

The European market’s prominence is largely attributed to the region’s high awareness of gluten-related health issues, such as celiac disease and gluten intolerance. This awareness has spurred a growing demand for gluten-free products, including bakery premixes, among health-conscious consumers. Additionally, stringent food safety regulations and labeling standards in Europe have bolstered consumer confidence in gluten-free products, further fueling market growth.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADM is a global leader in food ingredient solutions, offering a diverse range of gluten-free bakery mixes, bases, and concentrates. Their products cater to various dietary needs, including keto, vegan, and reduced-sugar options, while maintaining great taste. With extensive agricultural processing capabilities, ADM develops customized premix formulations enriched with proteins, fibers, and other value-added components, driving innovation in specialty bread and functional dough products.

Bob’s Red Mill is a well-known brand offering a wide range of gluten-free baking mixes, flours, and grains. Their products are crafted to inspire joy with wholesome foods, providing consumers with high-quality and flavorful options for their baking needs. With a commitment to quality and sustainability, Bob’s Red Mill caters to the growing demand for gluten-free products in the market.

Canyon Bakehouse specializes in 100% whole grain gluten-free bakery products that do not compromise on taste and quality. All of their products are baked in a dedicated gluten-free facility and are free from soy, dairy, and nuts, ensuring that everyone can enjoy their offerings. Canyon Bakehouse’s commitment to quality and inclusivity has made them a trusted brand in the gluten-free bakery market.

Top Key Players Outlook

- Archer Daniels Midland Company

- Bakels Worldwide

- Baker Perkins

- Bob’s Red Mill

- Canyon Bakehouse

- Caremoli

- Choices Gluten-free

- Conagra Brands

- Doves Farm Foods

- Enjoy Life Foods

- Free2b Foods

Recent Industry Developments

In 2024 Canyon Bakehouse, continued to expand its product line, introducing new flavors and improving existing recipes to enhance taste and texture. Their offerings include various bread types such as Mountain White, 7-Grain, and Heritage Style Whole Grain, all made with 100% whole grains and free from gluten, dairy, soy, and nuts.

March 2024, Bob’s Red Mill launched its Signature Blends Baking Mixes, which include Fudgy Brownie Mix, Golden Cornbread Mix, Classic Yellow Cake Mix, and Decadent Chocolate Cake Mix. These mixes are crafted from a blend of premium flours, providing home bakers with high-quality, convenient gluten-free options.

Report Scope

Report Features Description Market Value (2024) USD 552.6 Mn Forecast Revenue (2034) USD 1344.7 Mn CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Bread, Cake, Pizza Bases, Muffin, Hamburgers, Others), By Application (Bakeries and Confectionery, Restaurants and Cafes, Households) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland Company, Bakels Worldwide, Baker Perkins, Bob’s Red Mill, Canyon Bakehouse, Caremoli, Choices Gluten-free, Conagra Brands, Doves Farm Foods, Enjoy Life Foods, Free2b Foods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Gluten-Free Bakery Premixes MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Gluten-Free Bakery Premixes MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Archer Daniels Midland Company

- Bakels Worldwide

- Baker Perkins

- Bob's Red Mill

- Canyon Bakehouse

- Caremoli

- Choices Gluten-free

- Conagra Brands

- Doves Farm Foods

- Enjoy Life Foods

- Free2b Foods