Global Glucose Monitoring Device Market By Device (Blood Glucose Meters, Flash Glucose Monitoring Systems, Continuous Glucose Monitoring Systems and Smartphone Apps & Wearables), By Patient Type (Type 2 Diabetes and Type 1 Diabetes), By End-User (Hospitals & Clinics, Home Care Settings and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174360

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

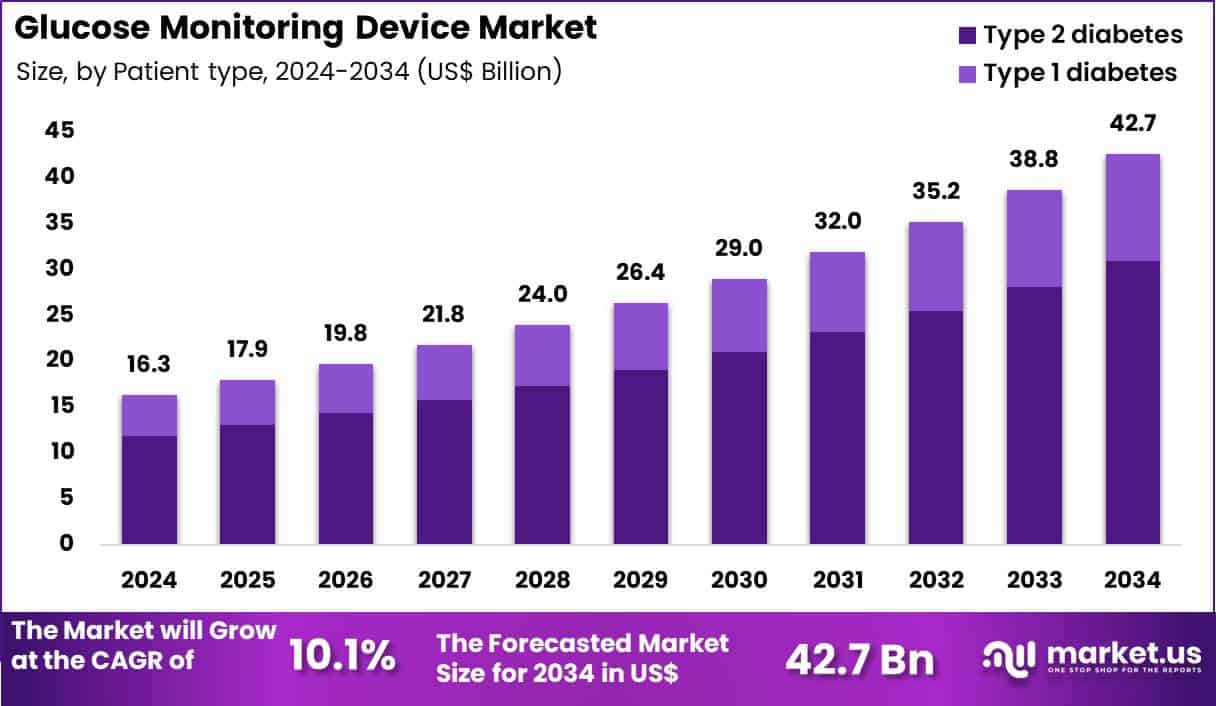

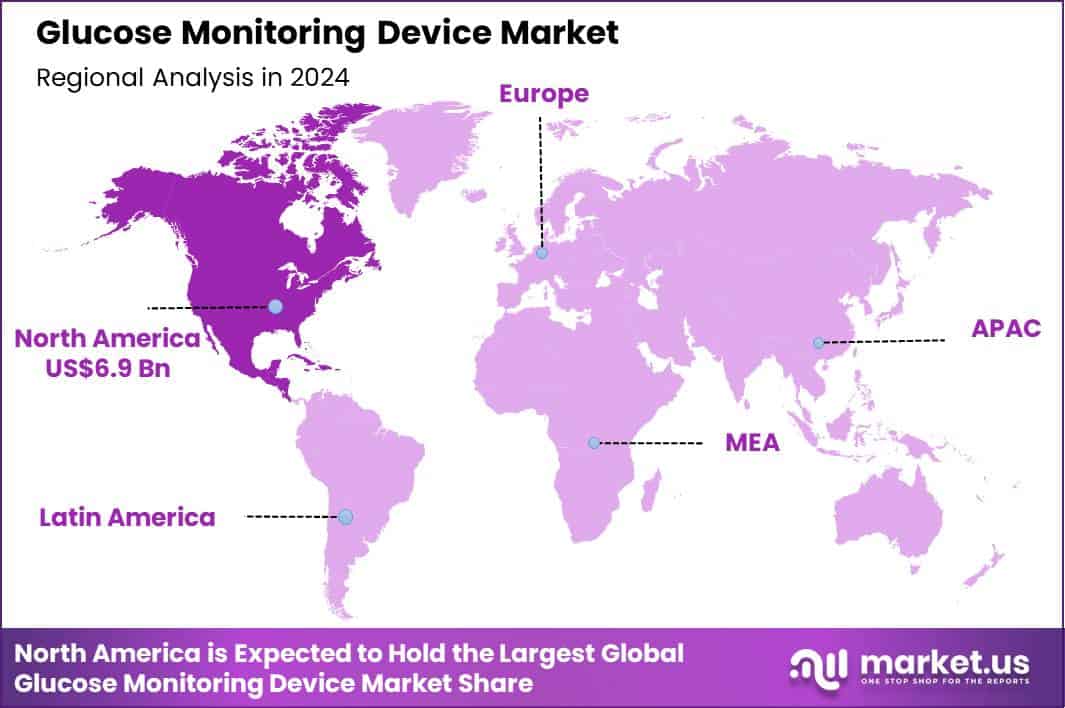

The Global Glucose Monitoring Device Market size is expected to be worth around US$ 42.7 Billion by 2034 from US$ 16.3 Billion in 2024, growing at a CAGR of 10.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.5% share with a revenue of US$ 6.9 Billion.

Rising prevalence of diabetes and prediabetes worldwide accelerates demand for glucose monitoring devices that enable accurate, real-time blood glucose tracking and informed therapeutic decisions. Patients with type 1 diabetes increasingly rely on continuous glucose monitors to detect glycemic excursions promptly, preventing hypoglycemia and hyperglycemia episodes through trend-based alerts.

Individuals managing type 2 diabetes utilize flash glucose monitoring systems to assess patterns without frequent fingerstick testing, supporting lifestyle adjustments and medication adherence. Healthcare providers apply these devices in gestational diabetes care, where pregnant women monitor postprandial glucose levels to safeguard fetal development and maternal health.

Clinicians employ professional continuous glucose monitoring in hospital settings to guide insulin therapy adjustments in critically ill patients with stress hyperglycemia. In July 2023, Aenova Group entered into a collaboration with Galvita centered on the development and manufacturing of oral dosage forms.

The partnership enhances the formulation development outsourcing landscape by broadening access to advanced oral formulation know-how. Pharmaceutical companies benefit from the ability to externalize formulation optimization, bioavailability enhancement, and scale-up activities to experienced partners, supporting more efficient product development timelines.

Manufacturers seize opportunities to integrate artificial intelligence algorithms into glucose monitoring platforms, enabling predictive analytics that forecast glucose trends and recommend insulin dosing adjustments. Developers advance hybrid closed-loop systems that combine continuous monitoring with automated insulin delivery, expanding applications for intensive diabetes management in children and adolescents.

These innovations facilitate remote monitoring capabilities that allow endocrinologists to review patient data in real time, optimizing therapy during virtual consultations. Opportunities emerge in non-invasive technologies that measure interstitial glucose through optical or sweat-based sensors, addressing barriers to adoption among patients averse to needle-based devices.

Companies pursue sensor miniaturization and extended wear designs that improve comfort and compliance in long-term use for prediabetes screening and type 2 diabetes prevention programs. Firms invest in data interoperability standards that enable seamless integration with electronic health records, enhancing clinical decision support across multidisciplinary diabetes care teams.

Key Takeaways

- In 2024, the market generated a revenue of US$ 16.3 Billion, with a CAGR of 10.1%, and is expected to reach US$ 42.7 Billion by the year 2034.

- The device segment is divided into blood glucose meters, flash glucose monitoring systems, continuous glucose monitoring systems and smartphone apps & wearables, with blood glucose meters taking the lead with a market share of 46.8%.

- Considering patient type, the market is divided into type 2 diabetes and type 1 diabetes. Among these, type 2 diabetes held a significant share of 72.5%.

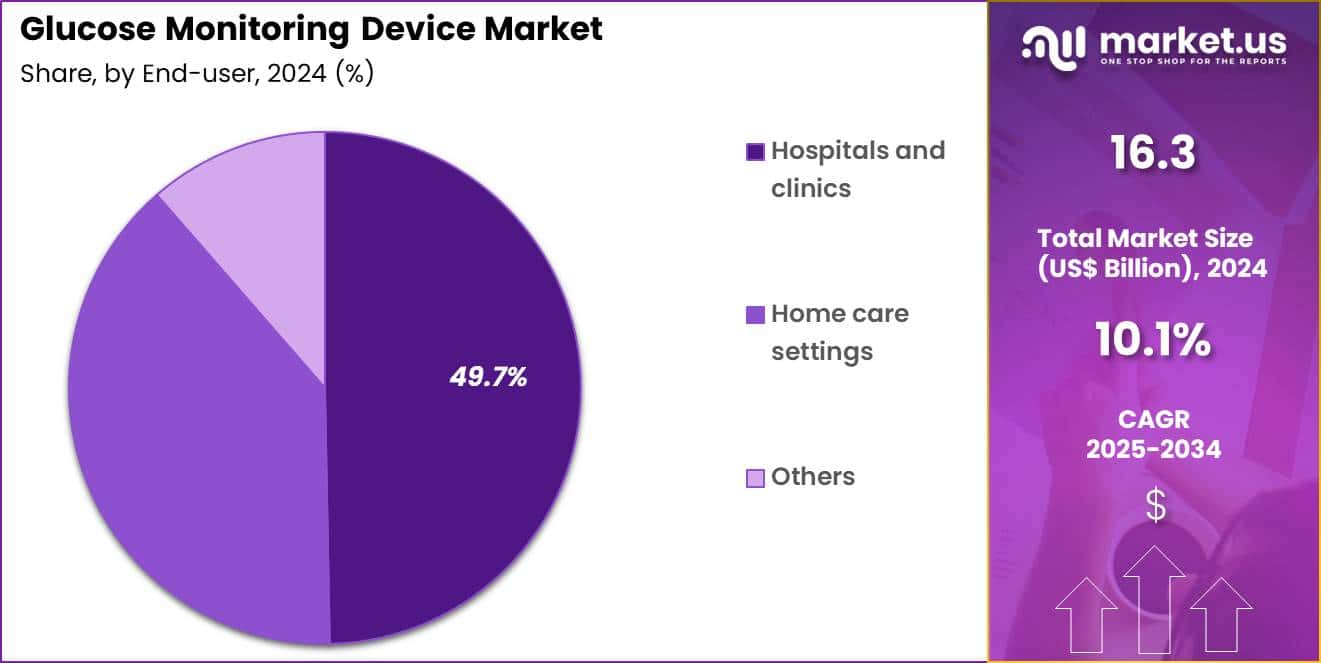

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, home care settings and others. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 49.7% in the market.

- North America led the market by securing a market share of 42.5%.

Device Analysis

Blood glucose meters accounted for 46.8% of growth within the device category and represent the most established solution in the Glucose Monitoring Device market. Widespread clinical familiarity supports continued use across care settings. Cost affordability improves accessibility in both developed and emerging markets. Simple operation supports frequent daily testing without specialized training. Hospitals rely on meters for rapid point-of-care glucose assessment.

Primary care settings favor meters for routine diabetes management. High prevalence of diabetes increases testing frequency. Reimbursement structures often favor strip-based monitoring solutions. Manufacturers continuously improve accuracy and ease of use. Compact designs support portability for patients and clinicians. Meter-based testing integrates well with clinical workflows.

Large installed base sustains replacement and consumable demand. Pharmacies and hospitals maintain steady inventory turnover. Educational programs emphasize self-monitoring using meters. Elderly patients prefer familiar testing methods. Emergency departments depend on fast glucose readings. Low maintenance requirements reduce operational burden.

Global diabetes screening initiatives support meter adoption. Product standardization improves reliability perception. The segment is projected to retain dominance due to affordability, accessibility, and clinical trust. Overall growth reflects high testing frequency and broad user base.

Patient type Analysis

Type 2 diabetes represented 72.5% of growth within the patient type category and stands as the primary demand driver of the Glucose Monitoring Device market. Rising global prevalence of type 2 diabetes expands the monitored population. Lifestyle-related risk factors increase diagnosis rates. Long-term disease management requires regular glucose monitoring. Clinicians recommend routine testing to prevent complications. Early-stage management emphasizes self-monitoring for glycemic control.

Aging populations contribute to higher type 2 diabetes incidence. Urbanization and dietary changes support disease growth trends. Hospitals and clinics prioritize monitoring in type 2 patients. Non-insulin-dependent patients still require frequent glucose checks. Treatment intensification increases monitoring frequency. Public health programs emphasize diabetes awareness and screening. Employers and insurers support monitoring to reduce long-term costs.

Education initiatives improve patient adherence to testing routines. Comorbidity management increases clinical monitoring demand. Oral antidiabetic therapy adjustments rely on glucose data. Telemedicine models integrate home glucose readings. Long disease duration increases cumulative device usage. Population-scale management programs support sustained demand. The segment is anticipated to remain dominant due to prevalence, chronic care needs, and continuous monitoring requirements.

End-User Analysis

Hospitals and clinics accounted for 49.7% of growth within the end-user category and dominate the Glucose Monitoring Device market. Initial diabetes diagnosis frequently occurs in hospital settings. Acute care environments require rapid glucose assessment. Inpatient monitoring supports glycemic control during illness and surgery. Hospitals manage patients with complex metabolic conditions. Clinical protocols mandate regular glucose testing. Outpatient clinics conduct routine diabetes follow-ups.

Emergency departments rely on immediate glucose readings. Hospitals maintain standardized device procurement policies. Trained staff ensure accurate testing and documentation. Point-of-care testing improves clinical decision-making speed. Integration with electronic health records supports data continuity. Hospitals manage high volumes of diabetic patients daily. Reimbursement systems favor hospital-based diagnostics.

Teaching hospitals promote standardized monitoring practices. Specialty clinics expand diabetes management services. Hospital pharmacies support consistent supply of testing consumables. Multidisciplinary care teams increase testing frequency. Referral networks concentrate diabetic care in hospitals. Infrastructure investment strengthens monitoring capacity. The segment is expected to retain dominance due to clinical centralization and high patient throughput.

Key Market Segments

By Device

- Blood glucose meters

- Flash glucose monitoring systems

- Continuous glucose monitoring systems

- Smartphone apps & wearables

By Patient Type

- Type 2 diabetes

- Type 1 diabetes

By End-User

- Hospitals & clinics

- Home care settings

- Others

Drivers

Rising prevalence of cardiovascular diseases is driving the market

The cardiovascular ultrasound market continues to expand primarily because of the growing number of individuals affected by heart-related conditions across the world, creating a strong need for non-invasive methods to detect and track these disorders. Clinicians depend on echocardiography and related imaging techniques to evaluate heart chambers, valve performance, and blood flow patterns with precision.

Health authorities worldwide advocate for broader use of ultrasound in routine cardiac evaluations to help lower the overall impact of these diseases on public health systems. Device manufacturers respond to this demand by developing equipment with superior resolution and portability suitable for various clinical environments.

Standard care pathways in hospitals and outpatient clinics now routinely include ultrasound as an initial assessment tool. International recommendations consistently endorse its application in managing hypertension, coronary issues, and structural abnormalities. Ongoing investigations reinforce its value in decreasing long-term mortality through reliable early findings.

Handheld and compact systems have extended access to ultrasound in settings with limited resources. The considerable societal and financial consequences of unrecognized cardiac problems reinforce the urgency of diagnostic advancement. Cardiovascular diseases remain among the principal causes of death worldwide, highlighting the essential function of ultrasound in contemporary clinical practice.

Restraints

High costs of advanced ultrasound systems are restraining the market

The cardiovascular ultrasound market encounters significant limitations due to the substantial expense of sophisticated equipment, especially systems equipped with advanced imaging capabilities and analytical software. Producers bear considerable costs related to research, regulatory approval, and quality verification, resulting in elevated prices for healthcare institutions.

Facilities with restricted budgets, particularly in smaller or rural locations, frequently find it difficult to justify acquiring top-tier systems. Ongoing requirements for calibration, software maintenance, and staff training generate persistent financial commitments. Reimbursement structures in numerous areas fall short of covering the full expense of premium ultrasound technology, creating additional disincentives.

Budgetary restrictions within public and private healthcare organizations often lead to preference for simpler, less expensive alternatives. Disparities in funding between wealthier and less affluent regions widen the divide in access to modern diagnostic tools.

Long-term economic assessments indicate that without meaningful price adjustments, expansion will remain limited in certain segments. Providers must balance the initial investment against potential improvements in diagnostic reliability and workflow. The combination of these financial obstacles continues to restrict the widespread implementation of cutting-edge cardiovascular ultrasound technology.

Opportunities

Advancements in AI-integrated ultrasound systems is creating growth opportunities

Considerable potential exists in the cardiovascular ultrasound market due to continuous progress in incorporating artificial intelligence, which improves diagnostic reliability and streamlines operational processes for various cardiac conditions. Equipment developers are able to embed automated functions that perform routine calculations, identify irregularities, and provide initial assessments, thereby lessening reliance on individual expertise.

Regulatory authorities have started to approve AI-enhanced equipment more readily when supported by solid performance evidence. Clinicians receive meaningful assistance in demanding environments, where AI aids in detailed evaluations such as ventricular function and strain measurements. Alliances between technology providers and medical institutions speed up the improvement of AI features for practical application.

Investigations examine the role of AI in remote evaluation and virtual cardiac consultations. Developing healthcare regions are gradually incorporating AI-capable equipment as digital systems become more widespread. Training programs are being updated to equip sonographers and cardiologists with skills for working alongside AI-generated insights.

Individuals gain from earlier and more dependable identification of heart abnormalities. The combination of greater diagnostic confidence and operational efficiency establishes AI-enhanced ultrasound as an important direction for future market development.

Impact of Macroeconomic / Geopolitical Factors

Global economic growth directs increased funding toward diabetes management solutions, stimulating the glucose monitoring device market as healthcare providers adopt continuous monitoring systems to address rising patient needs. Executives pursue opportunities in affluent regions where higher disposable incomes support premium device purchases, enhancing overall market revenues.

Nevertheless, economic instability from high inflation rates forces manufacturers to deal with elevated production and distribution expenses, limiting expansion in price-sensitive developing areas. Geopolitical conflicts in supply chain hotspots interrupt component deliveries from Asia, compelling companies to face extended lead times and heightened operational risks.

Business leaders respond by realigning partnerships toward more stable suppliers, which cultivates greater flexibility and reduces long-term vulnerabilities. Current US tariffs impose substantial duties on imported medical devices from China, often reaching 25% or more under Section 301, which raises costs for foreign-dependent firms and disrupts competitive pricing.

American enterprises take advantage of this shift by boosting domestic assembly operations, which generates employment and promotes technological self-reliance. Advanced integrations of AI-driven analytics in devices continually reinforce the market’s strength, facilitating broader adoption and promising profitable advancements for global stakeholders.

Latest Trends

Integration of artificial intelligence in cardiovascular ultrasound is a recent trend

The cardiovascular ultrasound market has displayed a noticeable shift in recent years toward extensive incorporation of artificial intelligence, which simplifies image evaluation and promotes more uniform diagnostic conclusions. Equipment producers are embedding AI functions that automatically recognize critical anatomical features and measure essential parameters during live examinations.

Cardiologists observe that AI shortens the duration of standard procedures while preserving high levels of precision. Regulatory authorities have released guidance that supports the verification and authorization of AI-supported ultrasound capabilities. Current clinical assessments are confirming the advantages of AI in recognizing subtle irregularities that might escape manual examination.

Training institutions are updating their programs to prepare future sonographers and physicians for effective collaboration with AI tools. International partnerships are working to establish consistent AI performance across different ultrasound systems and clinical contexts. Individuals experience the advantages of more dependable results and potentially shorter diagnostic timelines.

Ethical standards are being established to guarantee openness and fairness in AI-supported ultrasound reporting. The movement indicates a wider transition in medical imaging toward intelligent, data-supported approaches that complement clinical judgment.

Regional Analysis

North America is leading the Glucose Monitoring Device Market

North America accounted for 42.5% of the overall market in 2024, and the Glucose Monitoring Device market expanded strongly as diabetes management increasingly shifted toward continuous and connected monitoring solutions. Widespread adoption of continuous glucose monitoring systems improved real-time tracking and reduced dependence on frequent fingerstick testing.

Physicians encouraged broader use of digital monitoring to support tighter glycemic control and reduce complication risks. Insurance coverage expansion for CGM devices strengthened patient access across Type 1 and insulin-dependent Type 2 populations. Retail pharmacies and telehealth platforms supported easier onboarding and follow-up.

The Centers for Disease Control and Prevention reported that 38.4 million people in the United States were living with diabetes in 2022, creating sustained demand for monitoring technologies. Technological improvements in sensor accuracy and wear duration improved user adherence. These drivers collectively fueled market growth across North America in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to record robust growth during the forecast period as the Glucose Monitoring Device market benefits from rising diabetes prevalence and improving healthcare access. Urbanization and lifestyle changes increase demand for regular glucose tracking among newly diagnosed patients.

Governments expand national diabetes screening and management programs, encouraging device adoption in public healthcare systems. Smartphone integration and app-based analytics improve engagement among younger and working-age populations. Local manufacturing reduces device costs, supporting wider penetration across developing economies.

The International Diabetes Federation reported that Asia Pacific accounted for over 260 million adults living with diabetes in 2023, underscoring a vast and growing user base. Pharmacies and digital channels strengthen distribution reach beyond major cities. These factors position the region for sustained and accelerating market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Glucose Monitoring Device market drive growth by advancing continuous and minimally invasive sensing technologies that deliver real-time data and improve glycemic control for diabetic patients. Companies expand adoption by integrating mobile apps, cloud analytics, and clinician dashboards that support personalized treatment decisions and long-term adherence.

Commercial strategies emphasize reimbursement alignment, payer partnerships, and large-scale rollout through hospitals, pharmacies, and direct-to-consumer channels. Innovation priorities focus on sensor accuracy, longer wear duration, and factory calibration to reduce user burden and operating cost.

Market expansion targets emerging economies with rising diabetes prevalence and improving access to digital health infrastructure. Abbott operates as a leading participant through its FreeStyle portfolio, global manufacturing scale, and strong ecosystem of connected care solutions that support continuous monitoring across diverse patient populations.

Top Key Players

- Abbott Laboratories

- Roche Diabetes Care

- Medtronic plc

- Dexcom, Inc.

- Ascensia Diabetes Care

- Siemens Healthineers

- B. Braun Melsungen AG

- Nipro Corporation

- ARKRAY, Inc.

- AgaMatrix, Inc.

Recent Developments

- In May 2024, AGC Biologics partnered with BioConnection to jointly offer coordinated drug substance and drug product services. This alliance strengthens the formulation development outsourcing market by promoting integrated outsourcing models in which biopharmaceutical companies can work with a single provider across development stages. Such arrangements reduce operational complexity, minimize technology transfer risks, and accelerate formulation to fill finish progression, making external partners more attractive for end to end development support.

- In April 2024, CoreRx Inc. completed the acquisition of Societal CDMO Inc. in a transaction valued at USD 130 million. The deal expanded CoreRx’s capabilities in complex small molecule formulation, clinical manufacturing, and early stage development. This consolidation drives the formulation development outsourcing market by increasing the availability of specialized expertise and infrastructure, encouraging drug developers to outsource sophisticated formulation challenges rather than build in house capabilities.

Report Scope

Report Features Description Market Value (2024) US$ 16.3 Billion Forecast Revenue (2034) US$ 42.7 Billion CAGR (2025-2034) 10.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Device (Blood Glucose Meters, Flash Glucose Monitoring Systems, Continuous Glucose Monitoring Systems and Smartphone Apps & Wearables), By Patient Type (Type 2 Diabetes and Type 1 Diabetes), By End-User (Hospitals & Clinics, Home Care Settings and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, Roche Diabetes Care, Medtronic plc, Dexcom, Inc., Ascensia Diabetes Care, Siemens Healthineers, B. Braun Melsungen AG, Nipro Corporation, ARKRAY, Inc., AgaMatrix, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Glucose Monitoring Device MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Glucose Monitoring Device MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Roche Diabetes Care

- Medtronic plc

- Dexcom, Inc.

- Ascensia Diabetes Care

- Siemens Healthineers

- B. Braun Melsungen AG

- Nipro Corporation

- ARKRAY, Inc.

- AgaMatrix, Inc.