Global Yellow Pea Protein Market Size, Share, And Enhanced Productivity By Product Type (Isolate, Concentrate, Textured Pea Protein (TPP), Hydrolyzed Pea Protein), By Form (Dry, Wet), By Application (Meat and Poultry Analogues, Dairy and Frozen Dessert Alternatives, Sports Nutrition Powders and Bars, Bakery, Snacks and Cereals, Beverages (RTD and Concentrates), Clinical and Infant Nutrition, Pet Food), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170096

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

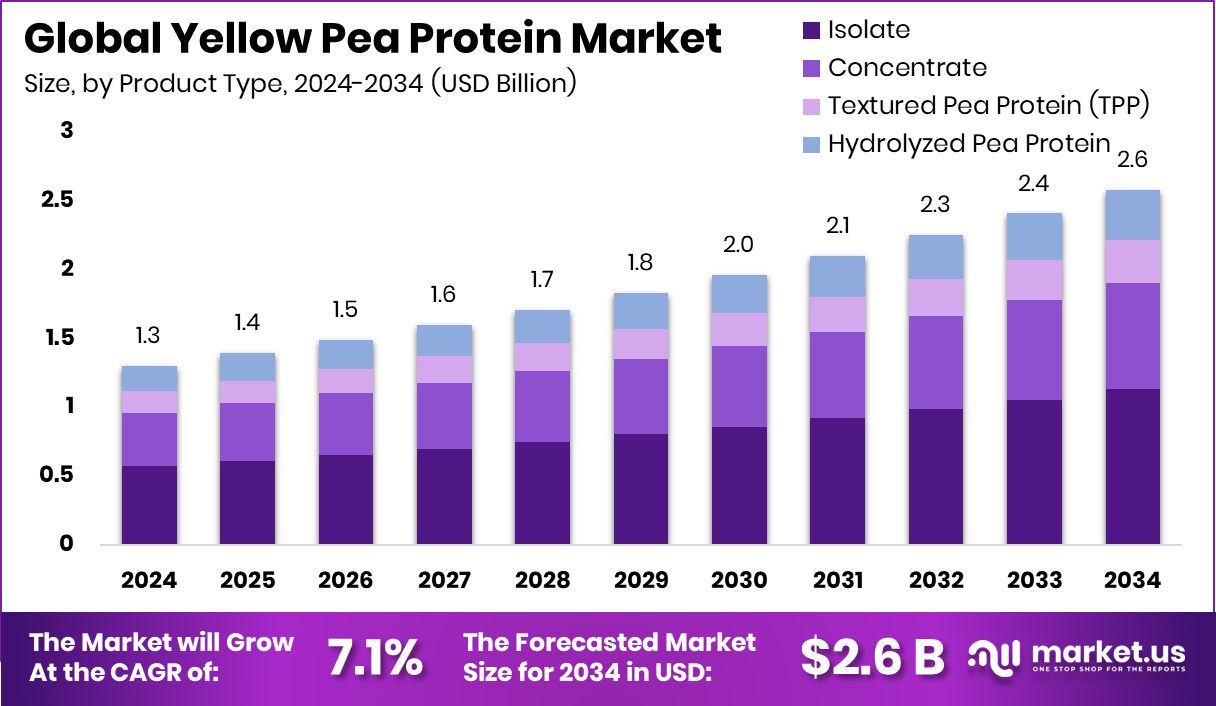

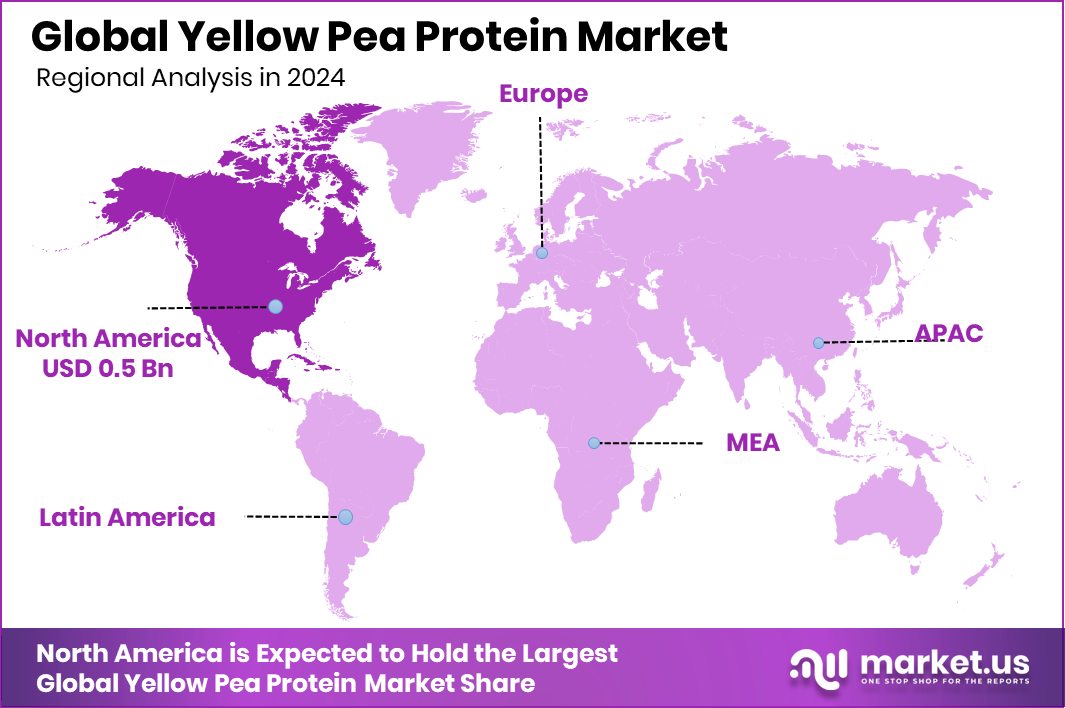

The Global Yellow Pea Protein Market is expected to be worth around USD 2.6 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 7.1% from 2025 to 2034. North America maintained growth momentum, sustaining a 41.2% share and a USD 0.5 Bn market size.

Yellow pea protein is a plant-based protein concentrate made from dried yellow peas through gentle milling and extraction. It is valued for its neutral taste, clean label profile, and high digestibility, making it suitable for dairy alternatives, protein drinks, and meat-free foods. The Yellow Pea Protein Market refers to the global ecosystem of producers, food manufacturers, and brands using pea protein to meet rising demand for healthy, allergen-free, and sustainable protein sources across nutrition, beverages, and plant-based foods.

Growth in this market is shaped by consumers shifting toward plant-based eating and fitness-driven protein intake. The surge in affordable fitness supplements, including the top 10 protein powders under ₹5000 and heavy discounts like up to 40% off protein powders during large online sales, expands awareness and boosts demand for pea-based options.

Opportunities continue to rise as governments and innovators invest in improving texture and quality. The German Government’s $780,000 investment to make vegan meat textures more realistic directly supports better use of yellow pea protein in next-generation meat alternatives.

- Ripple Foods raised $17 million to scale organic, high-protein pea milk, strengthening demand for versatile pea ingredients.

- Swiss startup secured $10M to convert a dairy plant into a facility producing protein from beer waste, highlighting growing interest in alternative protein innovation.

Wider plant-protein momentum also benefits the market, with multiple companies securing financing to expand plant-based foods—such as Daring Foods’ $65M Series C, its earlier $40M Series B, Next Gen Foods’ $100M expansion round, and InnovoPro’s $4.25M to accelerate chickpea-based proteins—all contributing to a broader ecosystem that elevates pea protein’s relevance and growth potential.

Key Takeaways

- The Global Yellow Pea Protein Market is expected to be worth around USD 2.6 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 7.1% from 2025 to 2034.

- In the Yellow Pea Protein Market, Isolate leads with a strong 43.8% share globally.

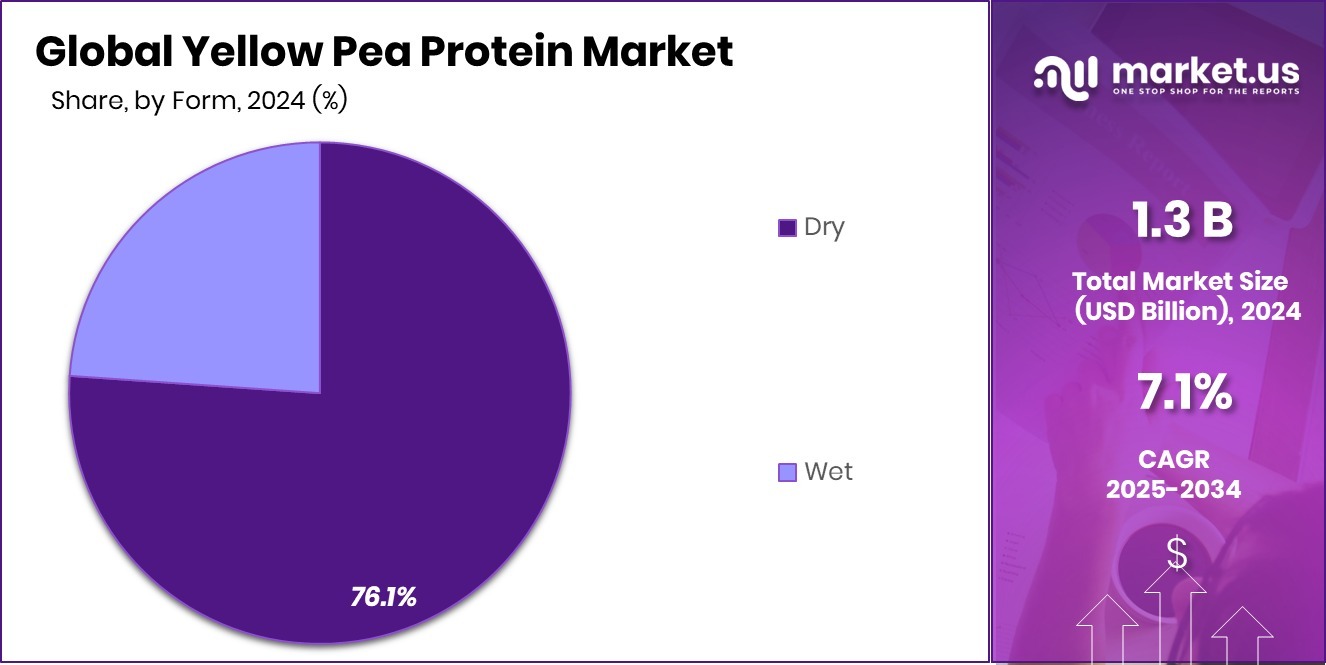

- The Yellow Pea Protein Market sees dry forms dominating production and sales with a 76.1% share.

- In the Yellow Pea Protein Market, Meat and Poultry Analogues account for a notable 34.7% demand share.

- North America’s strong demand strengthened its 41.2%, reaching nearly USD 0.5 Bn in 2024.

By Product Type Analysis

Yellow pea protein isolate holds 43.8% share, driven by growing clean-label demand.

In 2024, Isolate held a dominant market position in the By Product Type segment of the Yellow Pea Protein Market, with a 43.8% share. This leading position reflects its high purity level, neutral taste, and strong suitability for beverages, nutritional powders, and plant-based formulations. Manufacturers increasingly prefer isolate because it delivers higher protein concentration and better solubility, supporting clean-label and allergen-free product development in global nutrition categories.

Its dominance also comes from rising adoption in sports nutrition and fortified foods, where consistent texture and rapid absorption matter. As consumer demand shifts toward plant-based proteins with reliable performance, isolate continues to offer a balanced mix of functionality and processing efficiency. This steady reliance ensures its sustained leadership within the product type landscape.

By Form Analysis

Dry yellow pea protein leads with 76.1% share due to easier handling.

In 2024, Dry held a dominant market position in the By Form segment of the Yellow Pea Protein Market, with a 76.1% share. This strong lead reflects its wide suitability across nutrition powders, bakery mixes, meat alternatives, and ready-to-drink bases, where stable handling and longer shelf life are essential. Dry form also supports efficient transport and storage, making it the preferred choice for large-scale food manufacturers.

Its dominance further aligns with the growing demand for plant-based ingredients that integrate easily into existing processing lines. Because dry yellow pea protein maintains consistent functionality in texture, viscosity, and dispersion, it enables manufacturers to achieve predictable product quality. These operational advantages keep the dry form firmly ahead within the form category.

By Application Analysis

Meat and poultry analogues capture 34.7% share in yellow pea protein usage.

In 2024, Meat and Poultry Analogues held a dominant market position in the By Application segment of the Yellow Pea Protein Market, with a 34.7% share. This leadership stems from rising consumer demand for plant-based alternatives that mirror traditional meat textures while offering clean-label, allergen-friendly protein sources. Yellow pea protein supports this shift by delivering firm structure, moisture retention, and a neutral flavour profile suitable for burgers, nuggets, and mince-style products.

Its dominance also reflects strong adoption by manufacturers seeking reliable functional performance without soy or gluten. As product developers focus on improving bite, juiciness, and nutritional balance, yellow pea protein remains central to formulation strategies. These advantages reinforce its commanding role within the application landscape.

Key Market Segments

By Product Type

- Isolate

- Concentrate

- Textured Pea Protein (TPP)

- Hydrolyzed Pea Protein

By Form

- Dry

- Wet

By Application

- Meat and Poultry Analogues

- Dairy and Frozen Dessert Alternatives

- Sports Nutrition Powders and Bars

- Bakery, Snacks and Cereals

- Beverages (RTD and Concentrates)

- Clinical and Infant Nutrition

- Pet Food

Driving Factors

Growing Sports Nutrition Demand Boosts Pea Protein

The Yellow Pea Protein Market is strongly driven by rising interest in sports nutrition and daily wellness, where consumers look for clean, plant-based protein sources. This demand continues to grow as major nutrition brands expand their reach. Applied Nutrition’s move to set IPO pricing for a £400m market value shows how fast the sports nutrition space is scaling, creating more room for plant proteins like yellow pea protein. MuscleBlaze’s parent HealthKart also strengthened this trend by securing $153M, supporting wider access to high-protein products across fitness communities.

- Stephenson Harwood advising BD-Capital on an £82m takeover signals deeper investor confidence in performance nutrition.

The popularity of healthy lifestyle deals, such as the £10 Amazon Sports Nutrition bundle, is pushing more consumers toward affordable protein options, further accelerating demand.

Restraining Factors

High Production Costs Slow Market Expansion

One major restraint for the Yellow Pea Protein Market is the higher production cost compared to traditional protein sources. Processing pea protein requires careful extraction, filtration, and drying, which increases operational expenses for manufacturers. This becomes a bigger challenge when overall industry investments shift toward other food categories rather than plant proteins. Mars’ announcement of a €1bn investment in European manufacturing shows how large capital flows can lean toward broader food operations instead of supporting alternative proteins directly, creating competitive pressure.

- Little Debbie Snacks’ $500M expansion in Tennessee highlights rising investment in conventional snacks rather than plant-based options.

Tia Lupita Foods’ raising $2.6M seed funding reflects growing interest, but the overall scale remains smaller than traditional food investments. This imbalance slows market acceleration.

Growth Opportunity

Expanding RTD Beverages Unlock New Pea Protein Uses

A major growth opportunity for the Yellow Pea Protein Market comes from the rapid rise of ready-to-drink (RTD) beverages. These products need clean, stable, and allergen-free protein sources, making pea protein a strong fit. As more consumers prefer functional drinks for daily nutrition, brands look for ingredients that blend smoothly and offer natural protein without dairy. This shift creates space for pea protein to enter wellness drinks, alcohol-free refreshments, and protein-fortified RTDs.

- Hiyo securing nearly $20M shows rising investor confidence in RTD innovation.

The RTD momentum strengthens further as Pimentae raises £1.5m, and O’ Be Cocktails secures INR 3.5 crores for expansion. Even alcohol stock gains of 30% indicate expanding interest in beverages—opening new formulation opportunities for pea protein.

Latest Trends

RTD Innovations Inspire New Protein Applications

A leading trend in the Yellow Pea Protein Market is the rapid expansion of RTD beverages, which pushes manufacturers to explore plant proteins for smoother texture and clean-label nutrition. As consumers shift toward convenient, flavour-rich drinks, brands experiment with pea protein for added functional value. This trend gains momentum as multiple beverage innovators secure strong financial backing, signalling wider industry movement toward premium, ready-to-enjoy products.

- Canned cocktail brand Moth, securing £4.6m shows strong investor interest in RTD upgrades.

The trend widens further as Owl’s Brew raises $9M, Atomo secures $40M to scale molecular coffee RTDs, and Tuk Tuk Chai surpasses £150,000 in 24 hours. Long Drink’s $25M round and The Pathfinder’s $3.6M also reflect rising demand, opening fresh opportunities for protein integration.

Regional Analysis

North America led the Yellow Pea Protein Market with 41.2% and a USD 0.5 Bn value.

North America dominated the Yellow Pea Protein Market with a 41.2% share, valued at USD 0.5 Bn, supported by strong demand for plant-based foods and widespread use in meat and poultry analogues. The region’s established food processing ecosystem and rising consumer shift toward clean-label proteins further reinforce its leadership.

Europe follows with steady uptake as manufacturers expand pea-based applications in bakery, sports nutrition, and dietary supplements.

Asia Pacific continues to advance as its urbanising population embraces affordable plant proteins, strengthening long-term demand across convenience foods and health-focused categories. Meanwhile, the Middle East & Africa market shows gradual adoption driven by interest in alternative proteins compatible with regional dietary preferences.

Latin America is also progressing as local food industries incorporate pea protein into snacks and fortified foods. Across all regions, yellow pea protein benefits from rising preference for allergen-free and sustainable ingredients, with North America holding the clear lead.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Roquette Freres continues to strengthen its position through large-scale specialty protein capabilities and consistent advancements in pea-derived functional ingredients. Its emphasis on texture performance, solubility, and clean-label formulation keeps Roquette well aligned with the rapid expansion of plant-based foods, especially in meat analogues and nutritional beverages. The company’s technical expertise allows brands to create stable, high-protein formulations, reinforcing Roquette’s influence across global food manufacturing networks.

Puris remains a central innovator, driven by its commitment to allergen-free, non-GMO, and sustainably sourced pea protein solutions. Its close collaborations with major food and beverage brands support product development pipelines that rely on neutral-tasting, versatile protein ingredients. Puris’ focus on supply chain integration, from pea cultivation to final protein processing, helps ensure consistent quality and supports growing demand in North America’s dynamic plant-protein landscape.

Ingredion Incorporated leverages its broad ingredient portfolio to expand yellow pea protein into mainstream applications. With strong formulation capabilities, the company supports manufacturers seeking balanced functionality—whether enhancing viscosity, improving mouthfeel, or boosting protein content. Ingredion’s strategic positioning strengthens its engagement with clean-label and wellness-driven food categories, making it an influential player in 2024.

Top Key Players in the Market

- Roquette Freres

- Puris

- Ingredion Incorporated

- NutriPea

- COSUCRA Groupe Warcoing S.A.

- Axiom Foods, Inc.

- Burcon NutraScience Corporation

- AGT Food and Ingredients Inc.

- A&B Ingredients, Inc.

- Cargill, Incorporated

Recent Developments

- In June 2025, Roquette added new textured proteins to its NUTRALYS line, including a textured pea protein (NUTRALYS T PEA 700XC) with 70% protein content for hearty plant-based meals and sauces, helping food makers with simplified formulation and texture retention.

- In October 2024, at Supply Side West 2024, Puris unveiled four new plant-based protein products, including Pea Protein 2.0, HiLo, FlowX, and PURFava Function,+ to enhance texture, solubility, and taste for food and beverage makers.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.6 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Isolate, Concentrate, Textured Pea Protein (TPP), Hydrolyzed Pea Protein), By Form (Dry, Wet), By Application (Meat and Poultry Analogues, Dairy and Frozen Dessert Alternatives, Sports Nutrition Powders and Bars, Bakery, Snacks and Cereals, Beverages (RTD and Concentrates), Clinical and Infant Nutrition, Pet Food) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Roquette Freres, Puris, Ingredion Incorporated, NutriPea, COSUCRA Groupe Warcoing S.A., Axiom Foods, Inc., Burcon NutraScience Corporation, AGT Food and Ingredients Inc., A&B Ingredients, Inc., Cargill, Incorporated Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Yellow Pea Protein MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Yellow Pea Protein MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Roquette Freres

- Puris

- Ingredion Incorporated

- NutriPea

- COSUCRA Groupe Warcoing S.A.

- Axiom Foods, Inc.

- Burcon NutraScience Corporation

- AGT Food and Ingredients Inc.

- A&B Ingredients, Inc.

- Cargill, Incorporated