Global Wireline Services Market Size, Share Analysis Report By Service Type (Logging Services, Completion Services, Workover Services, Fishing Services), By Well Type (Vertical Wells, Horizontal Wells), By Type (Electric Line, Slick Line), By Hole Type (Open Hole, Cased Hole), By Location of Deployment (Onshore, Offshore) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153732

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

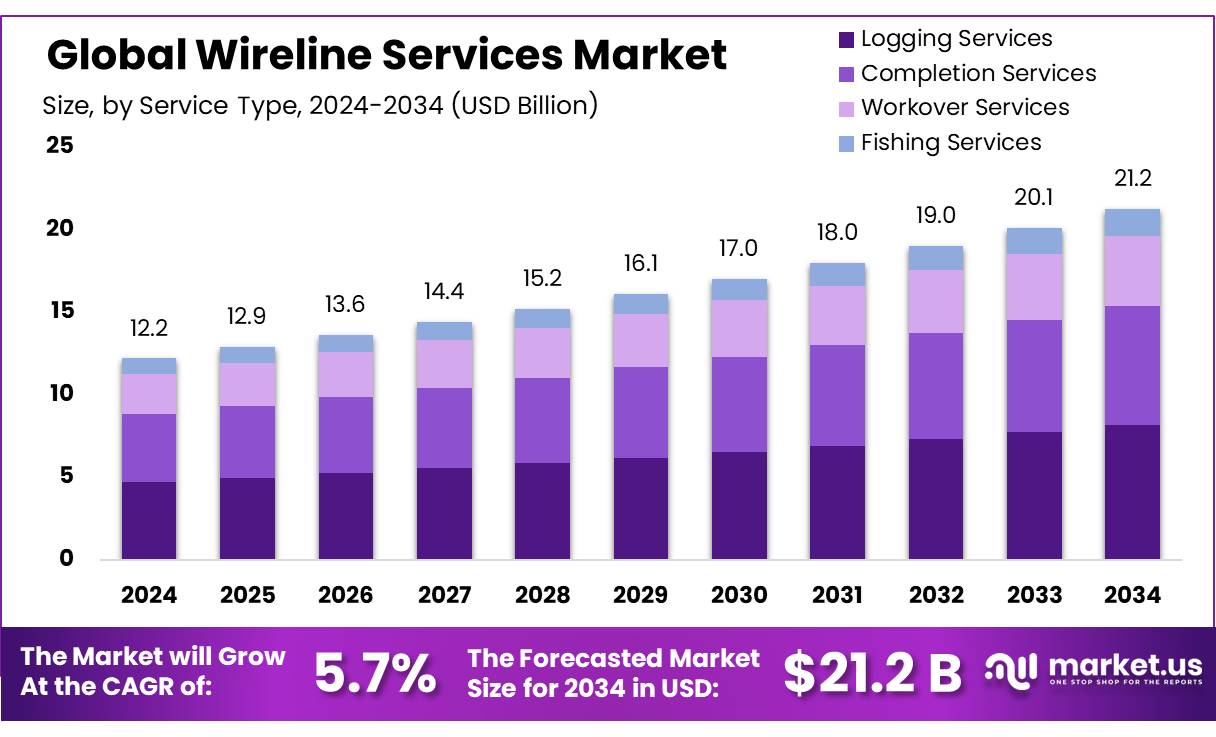

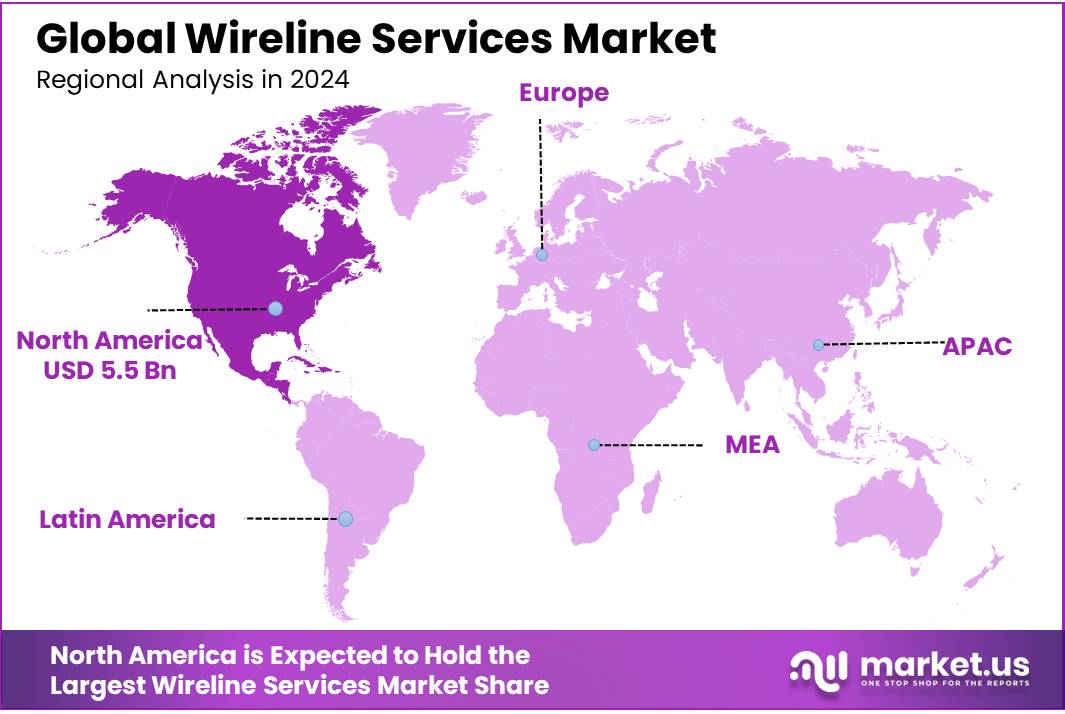

The Global Wireline Services Market size is expected to be worth around USD 21.2 Billion by 2034, from USD 12.2 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 45.2% share, holding USD 5.5 Billion revenue.

The global wireline services industry plays a pivotal role in the oil and gas sector, offering essential support throughout the well lifecycle—from exploration and drilling to completion and intervention. These services encompass activities such as well logging, pipe recovery, and reservoir evaluation, utilizing specialized equipment like electric and slick lines to perform downhole operations. The market’s expansion is closely tied to the increasing global demand for energy and the continuous need for enhanced oil recovery techniques.

The demand for wireline services is closely tied to the dynamics of the oil and gas sector. In North America, particularly in the United States, the market is driven by extensive shale oil and gas exploration, especially in regions like the Permian Basin. The U.S. Energy Information Administration (EIA) reports that the U.S. produced approximately 11.6 million barrels of crude oil per day in 2022, underscoring the scale of exploration activities. Similarly, in Europe, offshore oil and gas exploration, notably in the North Sea, has spurred investments in wireline services to maintain aging wells and ensure operational efficiency.

Government initiatives also play a significant role in shaping the wireline services market. In the United States, the Broadband Equity, Access, and Deployment (BEAD) Program, with an allocation of $42.5 billion, aims to expand high-speed internet access to underserved areas. While primarily focused on broadband, the program’s infrastructure developments indirectly support the wireline services sector by enhancing communication networks essential for remote monitoring and control of oil and gas operations .

Key Takeaways

- Wireline Services Market size is expected to be worth around USD 21.2 Billion by 2034, from USD 12.2 Billion in 2024, growing at a CAGR of 5.7%.

- Logging Services held a dominant market position, capturing more than a 38.4% share of the wireline services market.

- Horizontal Wells held a dominant market position, capturing more than a 67.2% share of the wireline services market.

- Electric Line held a dominant market position, capturing more than a 68.3% share of the wireline services market.

- Cased Hole held a dominant market position, capturing more than a 73.8% share of the wireline services market.

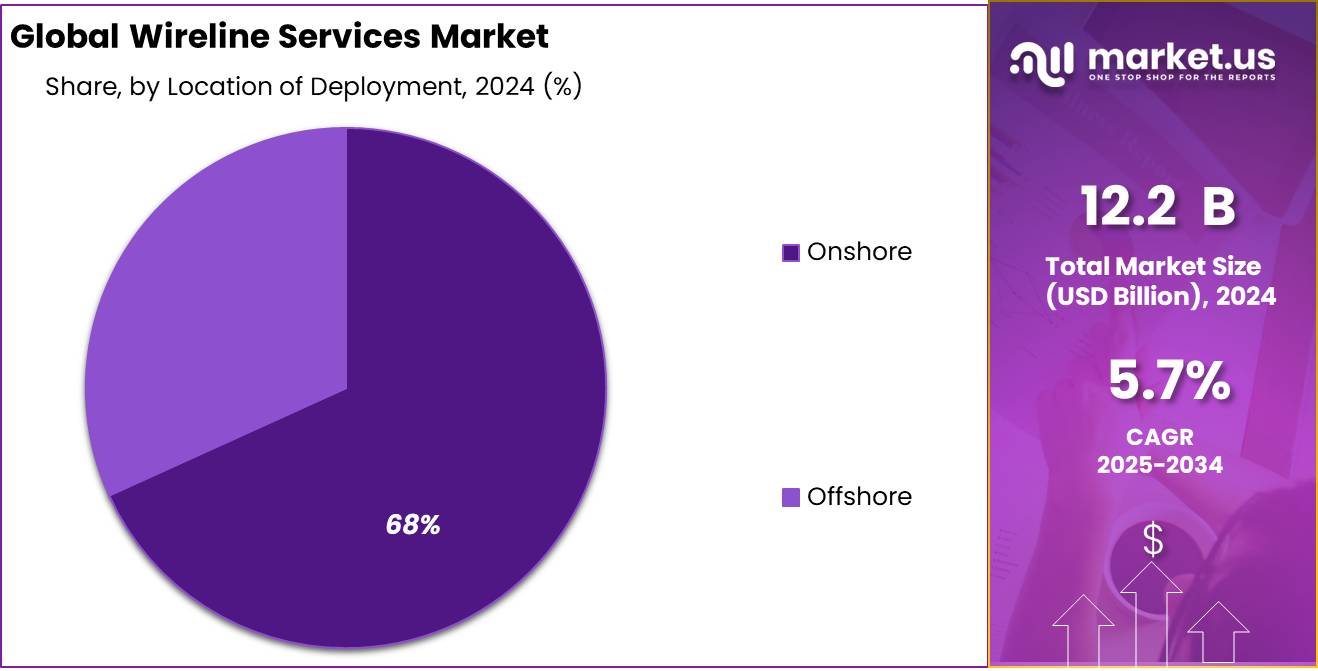

- Onshore held a dominant market position, capturing more than a 68.7% share of the wireline services market.

- North America held a dominant position in the global wireline services market, capturing more than 45.2% of the market share, valued at approximately USD 5.5 billion.

By Service Type Analysis

Logging Services Dominates Wireline Services Market with 38.4% Share in 2024

In 2024, Logging Services held a dominant market position, capturing more than a 38.4% share of the wireline services market. This sector’s prominence is attributed to its critical role in assessing well conditions, measuring formation properties, and providing valuable data for decision-making during oil and gas exploration. Logging services include a range of techniques such as electrical, nuclear, and acoustic logging, all of which are crucial for obtaining real-time information on well integrity and the reservoir’s potential.

The logging services market benefits from increasing demand for real-time data, as operators require accurate and continuous monitoring of well conditions. This demand has been driven by the complexity of modern wells, particularly in deepwater and unconventional oil and gas projects. As these exploration activities grow, the need for advanced logging technologies to support efficient and environmentally sustainable extraction processes also intensifies.

By Well Type Analysis

Horizontal Wells Lead the Wireline Services Market with 67.2% Share in 2024

In 2024, Horizontal Wells held a dominant market position, capturing more than a 67.2% share of the wireline services market. The widespread adoption of horizontal drilling techniques in the oil and gas industry has played a significant role in this dominance. Horizontal wells are increasingly favored for their ability to maximize reservoir exposure, improve production rates, and access harder-to-reach areas, such as shale formations and deepwater reserves.

The growing shift towards unconventional oil and gas extraction methods, particularly shale oil production, has significantly driven the demand for horizontal wells. This drilling method allows operators to extend well reach, improving resource recovery while reducing surface land use. As horizontal drilling technology continues to advance, the need for specialized wireline services, including logging, perforating, and well intervention, will increase in tandem.

By Type Analysis

Electric Line Dominates the Wireline Services Market with 68.3% Share in 2024

In 2024, Electric Line held a dominant market position, capturing more than a 68.3% share of the wireline services market. The electric line services, which utilize an electrically powered cable to deliver a variety of well services, have become the preferred choice for many operators. These services are critical for tasks such as well logging, perforating, and intervention activities, particularly in high-pressure and high-temperature wells.

The rise in electric line services is driven by their ability to provide real-time data, precision, and efficiency, making them an essential tool for modern oil and gas operations. Electric lines are particularly effective in deepwater and unconventional resource plays, where accuracy and reliability are vital. Their versatility in performing a wide range of services, from wellbore surveying to providing power for tools downhole, contributes significantly to their widespread use.

By Hole Type Analysis

Cased Hole Dominates the Wireline Services Market with 73.8% Share in 2024

In 2024, Cased Hole held a dominant market position, capturing more than a 73.8% share of the wireline services market. Cased hole operations, which involve the use of wireline tools to perform activities such as logging, perforation, and wellbore maintenance within a cased and cemented wellbore, are crucial for evaluating and enhancing well performance. These services are essential for maintaining well integrity, conducting reservoir analysis, and enabling efficient production.

The popularity of cased hole services can be attributed to their ability to handle a wide range of well conditions, including those found in mature or challenging wells. As the oil and gas industry focuses on maximizing the production potential of existing wells, cased hole services are increasingly critical for optimizing well interventions, ensuring the longevity of assets, and improving hydrocarbon recovery. Moreover, the growing demand for enhanced recovery techniques, such as acidizing and fracturing, has further fueled the adoption of cased hole services.

By Location of Deployment Analysis

Onshore Leads the Wireline Services Market with 68.7% Share in 2024

In 2024, Onshore held a dominant market position, capturing more than a 68.7% share of the wireline services market. Onshore oil and gas operations remain the primary driver of wireline service demand due to the vast number of wells located on land and the ongoing exploration and production activities in these areas. The demand for wireline services in onshore locations is primarily driven by the need for well logging, perforation, and well intervention activities to enhance production and ensure well integrity.

The onshore market’s dominance is supported by the extensive infrastructure already in place for these operations, along with cost-efficiency compared to offshore drilling. As many onshore fields are mature, operators are increasingly focused on maximizing output and extending the life of these wells, which in turn boosts the demand for wireline services to optimize recovery processes and manage well integrity.

Key Market Segments

By Service Type

- Logging Services

- Completion Services

- Workover Services

- Fishing Services

By Well Type

- Vertical Wells

- Horizontal Wells

By Type

- Electric Line

- Slick Line

By Hole Type

- Open Hole

- Cased Hole

By Location of Deployment

- Onshore

- Offshore

Emerging Trends

Integration of Fiber Optic Technology in Urban and Rural Infrastructure

A significant trend in the wireline services sector is the accelerated adoption of fiber optic technology, driven by both urban development and rural connectivity initiatives. This evolution is propelled by governmental policies and substantial investments aimed at enhancing broadband infrastructure across various regions.

In the United States, the expansion of fiber optic networks is a priority. For instance, AT&T has committed to investing approximately $3.5 billion in fiber network expansion, utilizing tax savings from recent reforms. The company aims to reach over 60 million fiber locations by 2030, reflecting a broader industry trend towards high-speed internet solutions.

Similarly, the Indian government has launched the National Broadband Mission 2.0, targeting the extension of optical fiber connectivity to 270,000 villages by 2030. This initiative seeks to increase the national average fixed broadband download speeds from 63.55 Mbps in 2024 to 100 Mbps by 2030, with a focus on enhancing digital infrastructure in underserved areas.

These developments underscore a global shift towards fiber optic technology as a cornerstone for future-proofing communication networks. Both urban centers and rural communities are benefiting from improved connectivity, which is essential for economic development, education, healthcare, and overall societal advancement.

Drivers

Increasing Demand for Efficient Communication and Data Transmission

One of the major driving factors for the Wireline Services market is the increasing demand for efficient and reliable communication and data transmission across industries, particularly in the oil and gas, telecommunications, and utilities sectors. In these sectors, the need for precise, real-time data has never been higher, as businesses strive to improve operational efficiency, reduce downtime, and ensure smoother operations.

For example, the oil and gas industry relies heavily on wireline services for well logging, formation evaluation, and intervention activities. The demand for wireline services is projected to grow as exploration and production activities intensify.

- According to the U.S. Energy Information Administration (EIA), global oil consumption reached 100.6 million barrels per day in 2024, and as exploration activities expand, there is a clear need for advanced wireline technologies to facilitate data-driven decision-making.

Additionally, the utility industry is also seeing an increase in wireline service adoption due to the expansion of smart grids and the increasing reliance on data for infrastructure maintenance and energy distribution. The U.S. Department of Energy’s Office of Electricity notes that over 70% of the U.S. electricity grid is aging and in need of modernization, which includes the incorporation of better monitoring and communication systems. Wireline services play a crucial role in enabling these upgrades by providing a reliable means of communication for critical infrastructure.

Moreover, the telecommunications sector is seeing a shift towards fiber optic connections, driving demand for advanced wireline services for both residential and commercial customers. The Federal Communications Commission (FCC) reports that more than 30 million Americans still lack access to high-speed internet, and efforts to expand broadband networks are accelerating. This shift towards better connectivity and faster internet is fueling the need for efficient wireline infrastructure to ensure that data transmission is both fast and reliable.

Restraints

High Capital Investment and Maintenance Costs

One of the significant restraining factors for the Wireline Services market is the high capital investment and ongoing maintenance costs associated with these technologies. The infrastructure required for wireline services, particularly in industries like oil and gas, telecommunications, and utilities, involves substantial upfront investments in equipment, installation, and training. Additionally, maintaining and upgrading these systems to keep up with technological advancements and changing regulatory standards also incurs high operational expenses.

In the oil and gas sector, the costs can be particularly prohibitive. The technology needed for well logging, formation evaluation, and other services requires specialized equipment that can be expensive to deploy and maintain. For instance, the cost of a single wireline unit can run into several million dollars, excluding the additional expenses of workforce training, maintenance, and repair. Furthermore, the physical wear and tear on equipment due to extreme environmental conditions, such as deep-sea drilling or harsh weather, means companies must allocate significant resources for upkeep, further increasing operational costs.

Telecommunication companies also face similar challenges when installing and maintaining wireline networks. While fiber optic cables are increasingly seen as essential for high-speed internet connectivity, the initial setup costs are very high. The U.S. Federal Communications Commission (FCC) estimates that expanding broadband access to underserved rural areas would require an investment of $40 billion. This considerable financial burden has led to slower adoption in some regions, as companies and governments must balance the demand for better connectivity with available funding.

Moreover, the utility sector is undergoing significant transformations with the introduction of smart grids, which are also dependent on wireline services for real-time data transmission. While the benefits of smart grids are substantial, such as more efficient energy distribution and fewer outages, the costs for upgrading traditional infrastructure are immense. The U.S. Department of Energy’s Office of Electricity reports that over 60% of the U.S. electricity grid is nearing the end of its useful life, requiring large investments to modernize. This financial strain is slowing down the pace at which wireline services can be fully integrated into the energy sector.

Opportunity

Expanding Broadband Infrastructure and Smart City Projects

A significant growth opportunity for the Wireline Services market lies in the ongoing expansion of broadband infrastructure and the development of smart city projects. As governments and private organizations continue to prioritize the improvement of digital infrastructure, the demand for reliable, high-speed wireline communication services is expected to rise significantly.

Broadband infrastructure is essential for connecting rural and underserved areas to high-speed internet, a critical factor in closing the digital divide. In the U.S., the Infrastructure Investment and Jobs Act allocated $65 billion to enhance broadband access across the country, particularly in rural regions. This initiative aims to provide reliable internet access to millions of Americans who are currently without high-speed connectivity. As more regions gain access to broadband, wireline services will be instrumental in ensuring the reliable and consistent delivery of high-speed internet.

For instance, the Federal Communications Commission (FCC) estimates that more than 30 million people in the U.S. lack access to high-speed internet. The expansion of wireline services, particularly fiber optic technology, is projected to be a key enabler in reaching these underserved areas. Fiber optic cables, which provide faster and more reliable internet speeds, will be crucial in meeting the rising demand for connectivity in both urban and rural areas.

In addition to broadband expansion, the rise of smart city projects presents another promising opportunity for wireline services. Smart cities use interconnected technologies to improve the efficiency of urban services, such as traffic management, waste disposal, and energy consumption.

- According to the U.S. Department of Energy, smart city technologies can save up to $160 billion annually in energy costs, a significant incentive for cities to adopt these technologies. Wireline services are essential for the seamless communication and data transmission required to support these projects.

Regional Insights

North America Dominates the Wireline Services Market with 45.2% Share, Valued at USD 5.5 Billion in 2024

In 2024, North America held a dominant position in the global wireline services market, capturing more than 45.2% of the market share, valued at approximately USD 5.5 billion. The region’s leadership is primarily driven by the substantial oil and gas production activities in the United States and Canada. North America’s abundant shale reserves, particularly in the Permian Basin and other unconventional plays, continue to fuel the demand for wireline services. The use of wireline technology is crucial for well logging, perforating, and well interventions, all of which are essential in maximizing production efficiency and ensuring well integrity in these complex formations.

The United States, in particular, has seen consistent growth in its oil and gas sector, with ongoing advancements in horizontal drilling and hydraulic fracturing techniques. These innovations have significantly increased the need for specialized wireline services to support the extraction of oil and natural gas from unconventional resources, such as shale and tight oil formations. Furthermore, the presence of large-scale oilfields and a favorable regulatory environment in North America continues to drive investments in exploration and production, resulting in sustained demand for wireline services.

In 2025, North America is expected to maintain its dominance in the wireline services market, supported by ongoing technological advancements and the region’s key role in global energy production. The continued development of unconventional resources and offshore projects, combined with the region’s extensive infrastructure, will ensure North America’s continued leadership, maintaining its substantial share of the market moving forward.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Schlumberger is a leading player in the wireline services market, offering advanced well logging, formation evaluation, and intervention services. With operations across over 120 countries, Schlumberger continues to drive innovation in wireline technology, enhancing the efficiency and accuracy of data collection for oil and gas exploration. The company’s extensive portfolio and technological advancements make it a significant contributor to the wireline services industry, with a focus on optimizing well performance and maximizing operational efficiency.

Halliburton is a prominent provider of wireline services, offering solutions in well logging, formation evaluation, and well intervention. The company operates in over 80 countries and serves various sectors, including oil and gas, power generation, and utilities. Halliburton’s wireline services enable energy companies to monitor and manage wells efficiently, contributing to better decision-making and cost-effective operations. Its focus on innovation, coupled with a wide range of services, makes it a critical player in the global wireline services market.

Neptune Energy is a leading energy company offering a range of wireline services, including well logging and intervention, primarily for offshore and onshore oil and gas fields. The company’s focus is on providing efficient, cost-effective services that support exploration and production activities. Neptune Energy’s expertise in reservoir management and drilling services allows it to play a significant role in optimizing wireline operations and enhancing the productivity of its clients’ energy assets across global markets.

Top Key Players Outlook

- Schlumberger

- Oceaneering International

- Halliburton

- Neptune Energy

- Baker Hughes

- National Oilwell Varco

- Superior Energy Services

- Cameron International

- Weatherford International

- Precision Drilling Corporation

- TechnipFMC

- Aker Solutions

Recent Industry Developments

In 2024 Schlumberger (NYSE: SLB), reported a total revenue of $36.29 billion, with a net income of $4.46 billion and earnings per share (EPS) of $3.11 .

Halliburton Company (NYSE: HAL) to the oil and gas industry. In 2024, Halliburton reported total revenue of $22.9 billion, with a net income of $615 million in Q4 2024.

Report Scope

Report Features Description Market Value (2024) USD 12.2 Bn Forecast Revenue (2034) USD 21.2 Bn CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Logging Services, Completion Services, Workover Services, Fishing Services), By Well Type (Vertical Wells, Horizontal Wells), By Type (Electric Line, Slick Line), By Hole Type (Open Hole, Cased Hole), By Location of Deployment (Onshore, Offshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Schlumberger, Oceaneering International, Halliburton, Neptune Energy, Baker Hughes, National Oilwell Varco, Superior Energy Services, Cameron International, Weatherford International, Precision Drilling Corporation, TechnipFMC, Aker Solutions Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Schlumberger

- Oceaneering International

- Halliburton

- Neptune Energy

- Baker Hughes

- National Oilwell Varco

- Superior Energy Services

- Cameron International

- Weatherford International

- Precision Drilling Corporation

- TechnipFMC

- Aker Solutions