Global White Chocolate Market Size, Share, And Business Benefits By Product (White Chocolate Truffles, White Chocolate Bars, White Chocolate Bulk), By Form (Bars, Chips and Chunks, Spreads), By Application (Confectionery, Bakery, Dairy and Frozen Desserts, Beverages, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Non-Grocery Retailers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153176

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

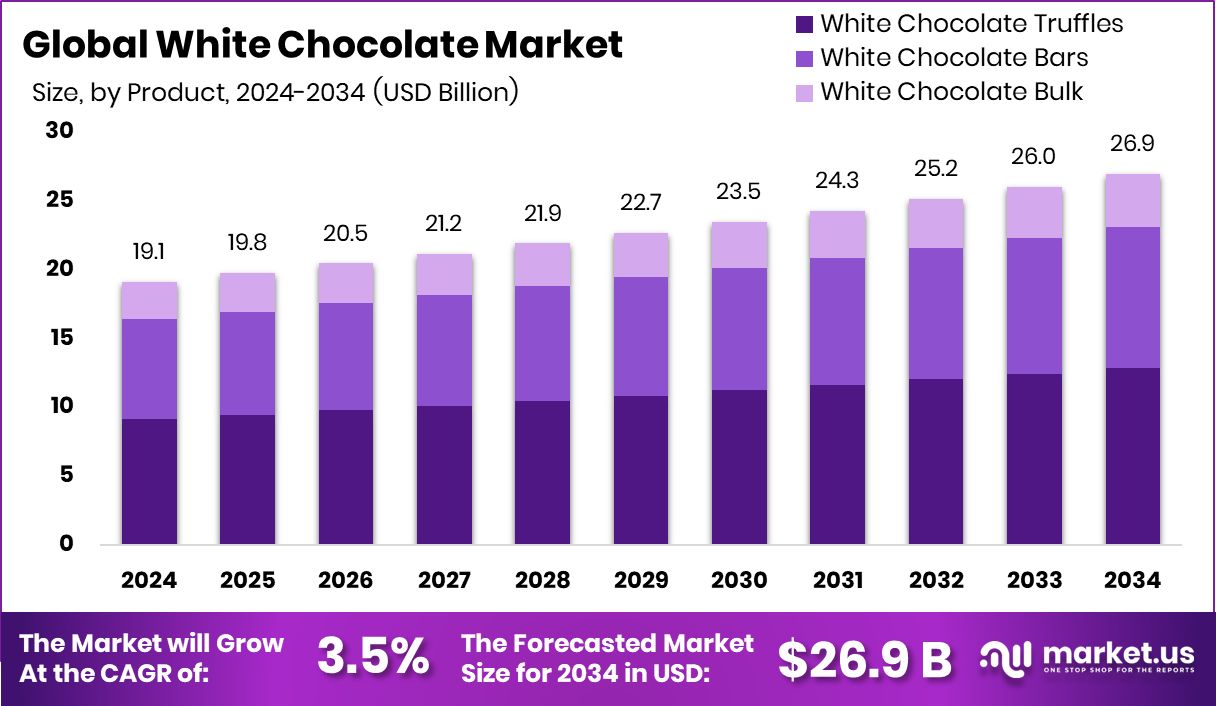

The global white chocolate market is expected to be worth around USD 26.9 billion by 2034, up from USD 19.1 billion in 2024, and is projected to grow at a CAGR of 3.5% from 2025 to 2034. Strong retail presence and premium demand boosted North America’s USD 7.2 billion market.

White chocolate is a type of confectionery made primarily from cocoa butter, sugar, and milk solids. Unlike milk or dark chocolate, it does not contain cocoa solids, which gives it a creamy color and a milder, sweeter taste. The presence of cocoa butter, a key fat extracted from cocoa beans, imparts a smooth texture and rich mouthfeel, making it popular in baking, desserts, and premium candy formulations.

The white chocolate market is growing steadily due to rising global interest in indulgent and gourmet confectionery. The increasing consumer preference for premium and artisanal sweets is driving demand, particularly in urban areas. Its unique taste profile and versatility in food applications have widened its appeal among younger populations and dessert-focused product innovations. This is evident in companies such as Awake Chocolate, which recently secured a fresh funding boost of $8 million to expand its product lines, including white chocolate energy-based bars that align with evolving snack trends.

A major growth factor for the market is the ongoing trend toward premiumization in confectionery. Consumers are actively seeking high-quality, differentiated chocolate experiences that stand out in both taste and presentation. This trend is encouraging food manufacturers and bakeries to incorporate white chocolate in limited-edition and seasonal offerings.

For instance, Italy’s Choruba & the Chocolate Factory drew in €3.4 million for its Foreverland line, which focuses on crafting cocoa-free chocolate treats, including white chocolate alternatives. Similarly, Planet A Foods picked up $15.4 million in Series A funding as it prepares to launch its cocoa-free chocolate in the UK, responding to sustainability and ingredient innovation trends.

Demand for white chocolate is also being fueled by its integration in modern bakery items, beverages, and frozen desserts. McVitie’s, a key player in the biscuit segment, recorded a sharp rise in profits to £131.3 million, largely driven by strong consumer demand for its white-chocolate digestives. Its compatibility with nuts, fruits, and spices makes white chocolate ideal for creating layered flavor profiles.

Additionally, health-conscious consumers are leaning toward white chocolate varieties with reduced sugar or plant-based ingredients, adding further momentum to innovation in the segment. Supporting this shift, Brain-health snack brand MOSH completed a Series A round, raising $3 million to expand its functional snack line, which includes white chocolate-based products targeting wellness-focused consumers.

Moreover, Voyage Foods closed a $52 million Series A+ round following its partnership with Cargill, highlighting the increasing investor interest in sustainable and alternative white chocolate solutions. This financial backing reflects growing confidence in product innovation that maintains the sensory appeal of white chocolate while addressing ethical sourcing and climate concerns.

Key Takeaways

- The global white chocolate market is expected to be worth around USD 26.9 billion by 2034, up from USD 19.1 billion in 2024, and is projected to grow at a CAGR of 3.5% from 2025 to 2034.

- In the White Chocolate Market, truffles accounted for 47.8% of the total product segment share.

- Bars dominated the white chocolate market by form, securing a 53.1% share due to high consumption.

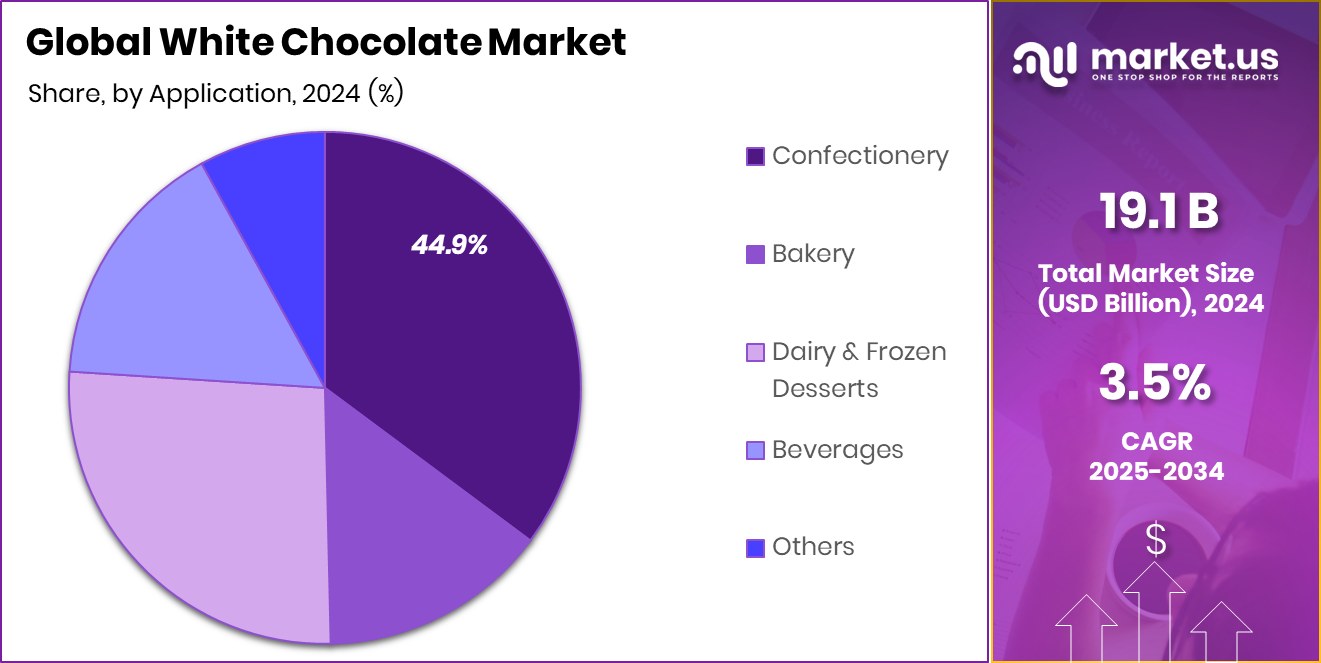

- Confectionery is led by application in the White Chocolate Market, contributing 44.9% to the overall segment value.

- Supermarkets and hypermarkets captured a 48.5% share in the White Chocolate Market’s distribution channel segment.

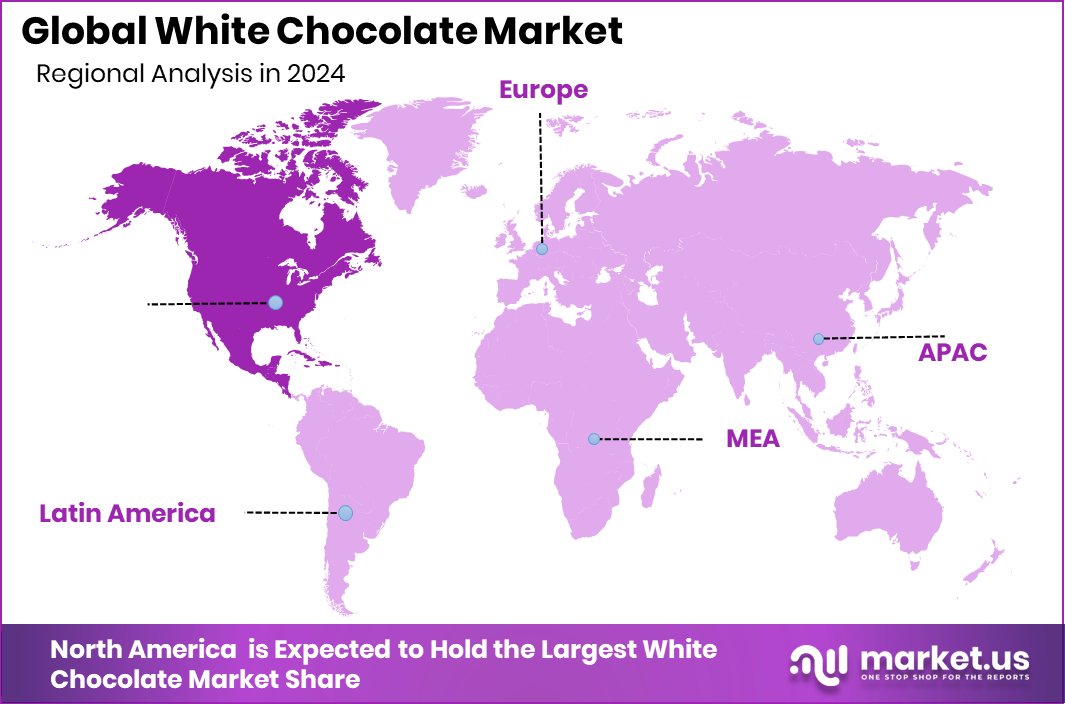

- North America held a dominant 37.8% share of global white chocolate sales.

By Product Analysis

White chocolate truffles hold a 47.8% share in the product segment.

In 2024, White Chocolate Truffles held a dominant market position in the By-Product segment of the White Chocolate Market, with a 47.8% share. This significant market presence can be attributed to the growing consumer preference for premium, indulgent confections that offer both rich taste and visual appeal. White chocolate truffles, known for their smooth texture and luxurious fillings, continue to resonate strongly with consumers seeking high-quality dessert experiences, particularly in urban and gift-oriented markets.

Their popularity is further enhanced by their association with special occasions, festive gifting, and seasonal promotions, where white chocolate truffles often serve as a symbol of elegance and indulgence. The versatility in flavor infusions—ranging from fruit-based centers to nutty blends—has expanded their appeal across diverse taste preferences.

Consumer trends favoring gourmet and handmade sweets are also contributing to sustained demand for white chocolate truffles. Their share in the market reflects not only strong retail performance but also growing uptake in online specialty stores and luxury confectionery chains.

By Form Analysis

Bars dominate the form category, capturing 53.1% of the market share globally.

In 2024, Bars held a dominant market position in the By Form segment of the White Chocolate Market, with a 53.1% share. This leadership can be primarily linked to the widespread consumer acceptance of white chocolate bars as a convenient, on-the-go indulgence. The bar format offers ease of packaging, portion control, and product innovation, making it a preferred choice among consumers across all age groups.

White chocolate bars are often positioned as premium or specialty products, attracting attention through unique ingredient combinations and limited-edition offerings. The form also allows for clear branding and visual appeal, both of which are critical in influencing purchase decisions at the point of sale.

The segment’s dominance reflects not just consistent demand but also strategic product placements in supermarkets, convenience stores, and e-commerce platforms. The versatility of bars in terms of flavor variety, packaging sizes, and targeted marketing continues to support their strong position within the white chocolate market landscape.

By Application Analysis

Confectionery applications account for 44.9% of market utilization.

In 2024, Confectionery held a dominant market position in the By Application segment of the White Chocolate Market, with a 44.9% share. This strong market presence is largely attributed to the rising global demand for indulgent sweets and the continued popularity of white chocolate in various confectionery formats.

The confectionery segment benefits from the visual appeal and versatility of white chocolate, which enhances both product design and flavor variety. Its adaptability allows confectioners to combine it with fruits, nuts, and spices, creating a wide range of offerings that cater to evolving consumer preferences.

Increased interest in artisanal and gourmet confections has further driven innovation within the white chocolate confectionery category. Brands often capitalize on the emotional and celebratory appeal of such products, which plays a significant role in maintaining their market share. With consistent demand from both retail and specialty channels, the confectionery application continues to be a key contributor to the overall performance of the white chocolate market.

By Distribution Channel Analysis

Supermarkets and hypermarkets lead with a 48.5% distribution channel share.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the White Chocolate Market, with a 48.5% share. This leading position is supported by the strong consumer preference for purchasing confectionery products through large-scale retail outlets that offer wide product visibility, promotional pricing, and in-store sampling experiences.

These retail formats also benefit from higher footfall, enabling brands to reach a diverse audience through both impulse and planned purchases. Seasonal promotions, bundled offers, and dedicated confectionery sections contribute to increased visibility and conversion rates for white chocolate products. Furthermore, the ability of supermarkets and hypermarkets to stock multiple product variants—ranging from everyday treats to premium white chocolate options—caters to different consumer segments within a single shopping environment.

The dominance of this channel also reflects the continued expansion of retail infrastructure, particularly in urban areas, where consumers prioritize convenience and variety. As a result, supermarkets and hypermarkets remain key contributors to volume sales and brand exposure, reinforcing their critical role in shaping the overall distribution strategy within the white chocolate market.

Key Market Segments

By Product

- White Chocolate Truffles

- White Chocolate Bars

- White Chocolate Bulk

By Form

- Bars

- Chips and Chunks

- Spreads

By Application

- Confectionery

- Bakery

- Dairy and Frozen Desserts

- Beverages

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Non-Grocery Retailers

- Others

Driving Factors

Rising Demand for Premium and Indulgent Treats

One of the key driving factors for the white chocolate market is the increasing consumer preference for premium and indulgent sweet products. White chocolate is often associated with richness, smooth texture, and visual appeal, making it a popular choice among those seeking luxurious or special-occasion treats.

As consumers become more willing to spend on high-quality desserts and snacks, white chocolate is being used more often in gourmet products, festive gifting, and artisanal confections.

Its creamy flavor pairs well with fruits, nuts, and spices, allowing for a variety of innovative combinations that attract a broad audience. This rising demand for indulgent experiences is supporting the growth of white chocolate across both retail and specialty food sectors globally.

Restraining Factors

High Production Cost Limits Mass Market Reach

A major restraining factor in the white chocolate market is its high production cost, which makes it less accessible for price-sensitive consumers. White chocolate requires a higher percentage of cocoa butter, which is more expensive than other ingredients used in regular chocolate.

Additionally, it needs milk solids and premium-quality processing to maintain its smooth texture and creamy flavor. These factors increase the overall cost of production and, in turn, the retail price.

As a result, many consumers prefer more affordable chocolate alternatives, especially in developing regions. This price barrier limits white chocolate’s reach in the mass market and can slow down its growth in areas where affordability plays a key role in purchasing decisions.

Growth Opportunity

Rising Demand for Healthier White Chocolate Alternatives

A significant growth opportunity in the white chocolate market lies in the development and promotion of healthier product variants. With increasing consumer focus on wellness, there is growing interest in white chocolate made with alternative ingredients like reduced sugar, plant-based milk, or functional additives such as fiber or protein.

These innovations allow white chocolate to appeal to health-conscious individuals seeking indulgence without guilt. By launching products that balance taste with better nutritional profiles, manufacturers can tap into a broader audience, including vegan, diabetic-friendly, and fitness-focused consumers.

This opportunity not only enables brand differentiation but also encourages repeat purchases from customers prioritizing both flavor and well-being. As lifestyle trends evolve, healthier white chocolate offers a promising path for market expansion.

Latest Trends

Creative Flavor Combinations in White Chocolate Products

A leading trend in the white chocolate market is the rise of creative flavor combinations that offer new taste experiences. Consumers are showing strong interest in unique blends such as white chocolate with matcha, raspberry, lemon zest, chili, sea salt, and exotic spices.

These bold and unexpected pairings are attracting attention, especially among younger buyers looking for something different from traditional sweets. Limited-edition and seasonal offerings based on such combinations are helping brands stand out on store shelves.

This trend is also encouraging home bakers, dessert makers, and chocolatiers to experiment with new recipes. By adding exciting flavors to the familiar smoothness of white chocolate, brands are able to refresh their offerings and maintain consumer excitement.

Regional Analysis

In North America, the white chocolate market reached USD 7.2 billion in 2024.

In 2024, North America emerged as the dominant region in the global white chocolate market, accounting for a leading 37.8% share with a market value of USD 7.2 billion. This strong regional performance is driven by high consumer spending on premium confectionery, well-established retail networks, and growing demand for indulgent dessert products.

North American consumers exhibit a strong preference for white chocolate in both traditional and innovative formats, including truffles, bars, and baked goods. The presence of organized supermarkets and specialty outlets further supports the segment’s reach and visibility.

Europe also holds a significant share in the market, supported by the region’s long-standing confectionery culture and demand for artisanal and seasonal chocolates. In Asia Pacific, rising disposable incomes and increasing westernization of diets are contributing to growing interest in white chocolate products, especially among younger demographics.

Although the Middle East & Africa and Latin America currently represent smaller portions of the global market, both regions are witnessing gradual growth driven by expanding urban populations and improving retail infrastructure.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Blommer Chocolate Company maintains a leadership role as a major bulk chocolate supplier, leveraging its vertically integrated operations from sourcing to processing. Its established relationships with cocoa growers and robust manufacturing capabilities enable cost-effective production of cocoa butter, a primary white chocolate component. This operational efficiency supports competitive pricing while maintaining quality.

Cargill, Incorporated, distinguishes itself through scale and global reach. With extensive agri-commodity networks spanning the Americas, Europe, and Asia, Cargill ensures stable access to high-grade cocoa butter. This advantage underpins its ability to support growing regional demand and respond to fluctuations in raw material markets. The company’s emphasis on traceability and sustainable sourcing practices aligns with consumer preferences, supporting brand reputation and driving demand within premium and ethically minded segments of white chocolate.

CEMOI Group, as a leading European chocolatier, anchors its strategy in innovation and product differentiation. The firm’s agile product development processes deliver limited-edition and regionally inspired white chocolate variants that appeal to emerging consumer segments. Its strength in artisanal and gourmet retail channels, coupled with established distribution networks across Europe, allows CEMOI to capitalize on the continent’s taste for premium and specialty confections.

Top Key Players in the Market

- Barry Callebaut AG

- Blommer Chocolate Company

- Cargill, Incorporated

- CEMOI Group

- Chocoladefabriken Lindt & Sprüngli AG

- Ferrero

- Fuji Oil Company Ltd.

- Ghirardelli Chocolate Co

- Guittard Chocolate Company

- Kerry Group

- Kraft Heinz Company

- Mars Incorporated

- Mondelez International, Inc

- Nestle S.A.

- The Hershey Company

- Unilever

Recent Developments

- In April 2025, Barry Callebaut introduced non‑cocoa alternatives in the UK and Benelux using precision‑fermented sunflower, offering “chocolaty experiences” alongside traditional white chocolate. This innovation addresses rising cocoa prices and broadens their product range.

- In July 2024, Guittard introduced its Guittard Couverture line, designed specifically for professional use. This launch included white chocolate variants such as 31 % cacao Crème Française White Chocolate and 35 % cacao Soie Blanche White Chocolate, offered in new 3 kg bags made with 30 % post-consumer recycled packaging.

Report Scope

Report Features Description Market Value (2024) USD 19.1 Billion Forecast Revenue (2034) USD 26.9 Billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (White Chocolate Truffles, White Chocolate Bars, White Chocolate Bulk), By Form (Bars, Chips and Chunks, Spreads), By Application (Confectionery, Bakery, Dairy and Frozen Desserts, Beverages, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Non-Grocery Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Barry Callebaut AG, Blommer Chocolate Company, Cargill, Incorporated, CEMOI Group, Chocoladefabriken Lindt & Sprüngli AG, Ferrero, Fuji Oil Company Ltd., Ghirardelli Chocolate Co, Guittard Chocolate Company, Kerry Group, Kraft Heinz Company, Mars Incorporated, Mondelez International, Inc, Nestle S.A., The Hershey Company, Unilever Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Barry Callebaut AG

- Blommer Chocolate Company

- Cargill, Incorporated

- CEMOI Group

- Chocoladefabriken Lindt & Sprüngli AG

- Ferrero

- Fuji Oil Company Ltd.

- Ghirardelli Chocolate Co

- Guittard Chocolate Company

- Kerry Group

- Kraft Heinz Company

- Mars Incorporated

- Mondelez International, Inc

- Nestle S.A.

- The Hershey Company

- Unilever