Global Wellhead System Market Size, Share, And Enhanced Productivity By Product (Hangers, Flanges, Master Valve, Casing Head, Casing Spools, XOthers), By Application (Onshore, Offshore), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170693

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

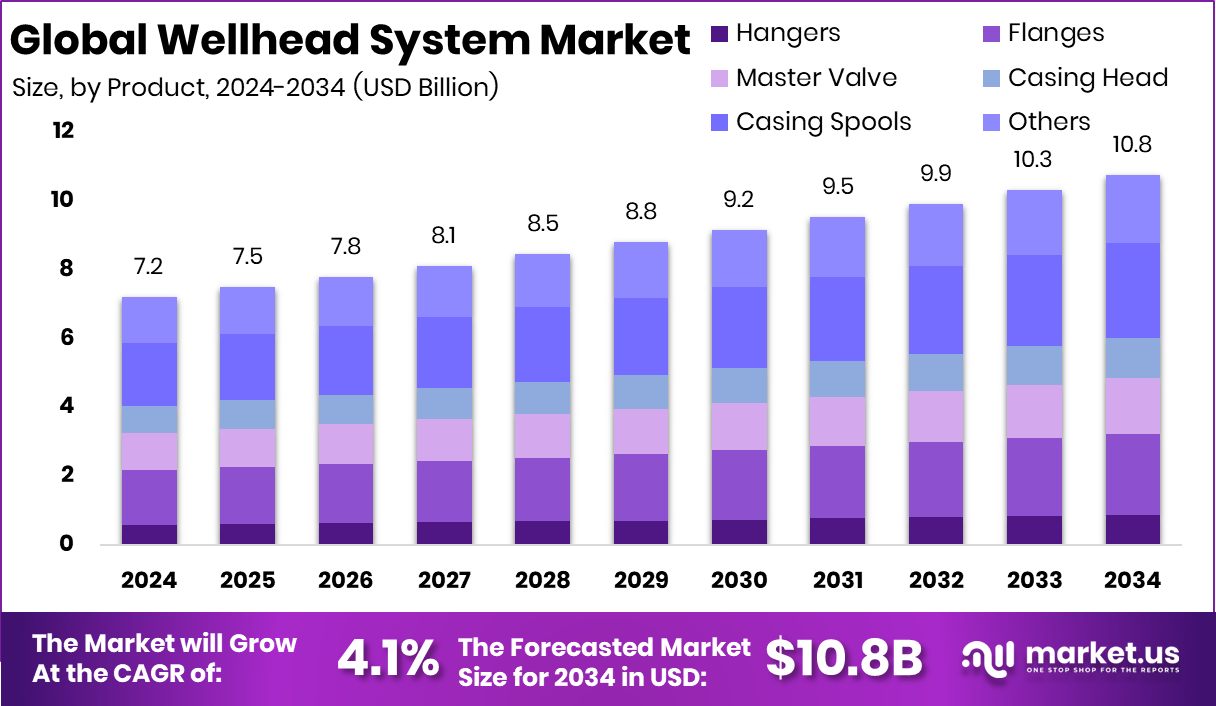

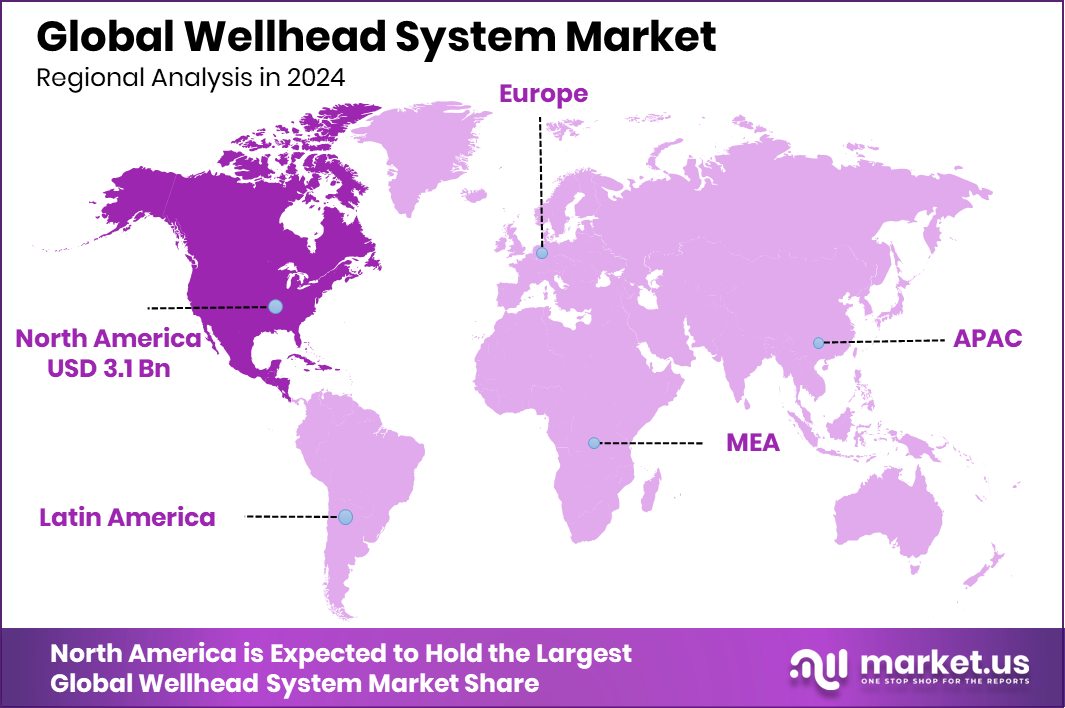

The Global Wellhead System Market is expected to be worth around USD 10.8 billion by 2034, up from USD 7.2 billion in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034. North America accounts for major wellhead system demand, capturing 43.90% share, totaling USD 3.1 Bn in the region.

A wellhead system is a set of surface equipment installed at the top of an oil or gas well. It controls pressure, supports casing strings, and provides safe access to drilling, completion, and production operations. The system plays a key role in maintaining well integrity, managing flow, and ensuring safety throughout a well’s lifecycle.

The Wellhead System Market refers to the global demand and supply of these systems across onshore and offshore oil and gas activities. The market grows as operators focus on safe pressure control, efficient well management, and longer production life. Wellhead systems are essential from drilling to production, making them a core part of upstream operations.

Growth factors include ongoing drilling activity, redevelopment of mature wells, and rising emphasis on operational safety. Financial support across the energy ecosystem reflects this momentum. For example, Plexus secured a £2 million loan as international activity picked up, while Singapore-based OMS Energy raised $43 million from its Nasdaq debut, supporting expansion and technology advancement linked to energy infrastructure.

Demand remains strong due to continuous well maintenance, upgrades, and the need for reliable surface control equipment. Public investment also supports related infrastructure, as Port Washington, Westbury, and Greenlawn water districts received $11.4 million to treat contamination, highlighting broader spending on pressure control and fluid management systems.

Opportunities are emerging from digital integration, efficiency improvements, and strategic consolidation within energy technologies.

- Pason’s planned $88.3 million acquisition of an Alberta-based energy technology firm highlights growing investment in advanced systems, supporting smarter drilling operations and improved well performance across upstream projects.

Key Takeaways

- The Global Wellhead System Market is expected to be worth around USD 10.8 billion by 2034, up from USD 7.2 billion in 2024, and is projected to grow at a CAGR of 4.1% from 2025 to 2034.

- In the wellhead system market, casing spools held a 25.7% share due to strong demand in drilling operations.

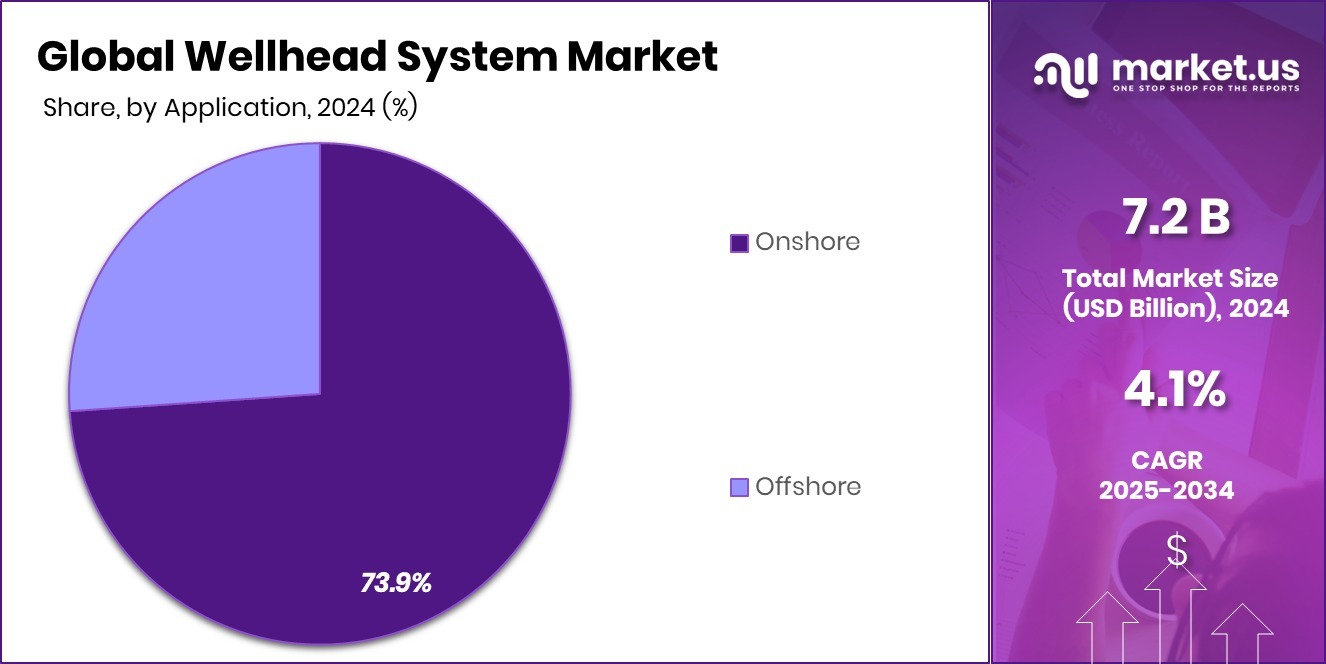

- Onshore applications dominated the wellhead system market with a 73.9% share, supported by extensive land-based oil exploration.

- North America leads the regional Wellhead System Market, holding a 43.90% share worth USD 3.1 billion in the region.

By Product Analysis

Casing spools held a 25.7% share, driven by strong demand in wellhead systems.

In 2024, casing spools held a dominant market position in the byproduct segment of the wellhead system market, with a 25.7% share, reflecting their critical role in supporting casing strings and maintaining pressure control during drilling and production activities. This strong share highlights how widely casing spools are used as a core structural component within wellhead assemblies, especially in projects where operational reliability and safety are essential.

The dominance of casing spools is closely linked to their ability to provide stable load support and enable effective sealing between casing strings. Their standardized design and proven field performance make them a preferred choice for operators seeking long-term well integrity. As a result, casing spools continue to remain a foundational product category within the wellhead system market.

By Application Analysis

Onshore applications dominated with 73.9%, supported by extensive drilling activities.

In 2024, Onshore held a dominant market position in the By Application segment of the Wellhead System Market, with a 73.9% share, underlining the continued importance of land-based oil and gas operations. This high share indicates that a majority of wellhead system demand is concentrated in onshore fields, where development activity remains extensive and operational access is comparatively easier.

Onshore applications benefit from lower installation complexity, faster project execution, and flexible maintenance practices, all of which support sustained demand for wellhead systems. The strong share also reflects the large number of active and mature onshore wells requiring reliable surface pressure control equipment. Consequently, onshore operations continue to anchor overall market volumes for wellhead systems.

Key Market Segments

By Product

- Hangers

- Flanges

- Master Valve

- Casing Head

- Casing Spools

- Others

By Application

- Onshore

- Offshore

Driving Factors

Infrastructure Expansion Driving Surface Control Equipment Demand

One major driving factor for the Wellhead System Market is the continuous expansion and upgrade of critical infrastructure that relies on safe pressure control and durable surface equipment. As governments and public bodies invest in large-scale infrastructure assets, the need for reliable mechanical systems, skilled installation practices, and long-life components increases. This broader push supports industries linked to energy, construction, and industrial facilities, where wellhead systems benefit from similar engineering standards focused on safety, load management, and long-term performance.

Recent public funding highlights this infrastructure momentum. Three Connecticut airports received nearly USD 1 million in federal grants for runway and hangar improvements, while Akron-Canton Airport secured state funding for a 12,000 square-foot hangar project, reinforcing demand for robust structural and mechanical systems. In parallel, the U.S. House approved USD 15 million for Blue Angels hangar repairs and the S. Navy Boulevard project, signaling sustained government spending on complex infrastructure that indirectly strengthens demand for engineered surface control solutions.

Restraining Factors

Capital Diversion Toward Non-Energy Infrastructure Spending

A key restraining factor for the Wellhead System Market is the diversion of public and institutional capital toward non-energy infrastructure projects. When large funding allocations are directed to aviation and civic assets, fewer resources remain available for upstream oil and gas investments, slowing new well development and surface equipment upgrades. This shift can delay procurement decisions and extend project timelines for wellhead installations, especially in regions where public spending strongly influences industrial activity.

Recent funding examples highlight this trend. Airport authorities requested USD 4.84 million in state funding for hangar construction, while Salisbury Airport secured USD 450k in state grants for facility improvements. Additionally, the Maine Air National Guard received USD 50 million to construct a new hangar in Bangor. Such large-scale commitments show how capital is prioritized toward aviation infrastructure, indirectly constraining near-term investment momentum in wellhead systems.

Growth Opportunity

Rising Investment Unlocks New Industrial Development Opportunities

A strong growth opportunity for the Wellhead System Market comes from rising public and private investment that supports new infrastructure and technology-led expansion. As funding flows into construction, manufacturing, and advanced engineering projects, demand increases for reliable surface systems that can handle pressure, safety, and long service life. These conditions favor wellhead systems, especially where new assets are being built or existing facilities are expanded with modern design standards.

Recent funding signals support this opportunity. The OWB board is planning to use USD 2.5 million in state funding to build 10 T-hangars for private pilots, showing continued investment in structural and mechanical development. At the same time, innovation-focused funding is growing, with CroíValve securing USD 16 million to support a new U.S. study, reflecting confidence in advanced engineering solutions that align with precision and reliability needs similar to wellhead systems.

Latest Trends

Carbon Transport Infrastructure Shaping Future Wellhead Designs

One major latest trend in the Wellhead System Market is the growing alignment of wellhead infrastructure with carbon management and transport systems. As energy projects expand beyond traditional extraction, wellhead systems are increasingly expected to support carbon dioxide handling, pressure containment, and long-term operational safety. This shift is pushing designs toward higher integrity, improved sealing, and compatibility with both onshore and offshore transport networks. Wellhead systems are becoming part of broader energy infrastructure planning rather than standalone oil and gas components.

Government-backed initiatives are reinforcing this trend. The U.S. Department of Energy invested USD 6 million to design an integrated onshore and offshore carbon dioxide transport system, highlighting the need for robust surface control equipment capable of managing pressurized CO₂ flows. Such developments signal a gradual transition where wellhead systems support both energy production and carbon transport use cases, opening new technical requirements and long-term deployment opportunities.

Regional Analysis

North America dominates the wellhead system market with a 43.90% share valued at USD 3.1 billion in the region.

North America dominates the Wellhead System Market, holding a 43.90% share and valued at USD 3.1 Bn, reflecting its strong concentration of upstream oil and gas activities and well-established production infrastructure. The region’s leadership is supported by sustained drilling operations, extensive replacement demand for aging wellheads, and a mature service ecosystem that emphasizes operational safety and efficiency.

Europe represents a stable market landscape, driven by ongoing field optimization and maintenance-focused activities, where wellhead systems are essential for extending the productive life of existing wells.

Asia Pacific shows steady progress as energy demand continues to rise, encouraging gradual development of onshore and selective offshore resources that rely on reliable wellhead installations.

The Middle East & Africa region remains structurally important due to its long-standing hydrocarbon base, where wellhead systems play a critical role in managing high-pressure reservoirs and ensuring production continuity. Latin America contributes through selective field developments and redevelopment projects, where efficient surface control equipment supports cost-focused operations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Forum Energy Technologies remains a strategically positioned player in the global Wellhead System Market due to its strong focus on engineered equipment and lifecycle solutions. The company’s wellhead portfolio is aligned with operator needs for durability, pressure control, and compatibility with complex drilling environments. Its integrated manufacturing and service capabilities allow it to support both new installations and aftermarket requirements, strengthening long-term customer relationships and repeat demand.

Shanghai Wellhead Equipment Manufacture continues to play an important role, particularly through its manufacturing-driven approach and cost-efficient production capabilities. The company is recognized for supplying standardized wellhead components that meet operational requirements across diverse field conditions. Its emphasis on production scalability and regional supply reliability supports steady adoption, especially in projects where cost control and timely delivery are key decision factors.

National Oilwell Varco holds a strong analytical position due to its deep technical expertise and broad oilfield equipment ecosystem. In wellhead systems, the company benefits from integrated design, manufacturing, and engineering know-how, enabling high-performance solutions for demanding operating conditions. Its ability to align wellhead systems with broader drilling and completion workflows enhances operational efficiency for operators, reinforcing its competitive standing within the global market.

Top Key Players in the Market

- Forum Energy Technologies

- Shanghai Wellhead Equipment Manufacture

- National Oilwell Varco

- GE Grid Solutions

- Delta Corporation

- Great Lakes Wellhead

- Integrated Equipment

- Jiangsu Sanyi Petroleum Equipment

- JMP Petroleum Technologies

Recent Developments

- In August 2024, GE Vernova’s Grid Solutions launched the FACTSFLEX GFMe product, combining STATCOM technology with supercapacitor energy storage to strengthen grid stability and support renewable integration.

- In April 2024, NOV Inc. (National Oilwell Varco) announced that its board approved a share buyback program of up to USD 1 billion and plans to increase its quarterly dividend by 50% starting in June 2024. This move reflects confidence in the company’s cash flow and supports shareholder returns amid ongoing energy equipment demand.

- In January 2024, Forum Energy Technologies completed its acquisition of Variperm Energy Services, a company that manufactures drilling and pressure-related equipment used in oil & gas operations. This move expanded FET’s manufacturing capabilities and product offerings in pressure control and drilling support systems, which align with wellhead system components.

Report Scope

Report Features Description Market Value (2024) USD 7.2 Billion Forecast Revenue (2034) USD 10.8 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Hangers, Flanges, Master Valve, Casing Head, Casing Spools, XOthers), By Application (Onshore, Offshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Forum Energy Technologies, Shanghai Wellhead Equipment Manufacture, National Oilwell Varco, GE Grid Solutions, Delta Corporation, Great Lakes Wellhead, Integrated Equipment, Jiangsu Sanyi Petroleum Equipment, JMP Petroleum Technologies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wellhead System MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Wellhead System MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Forum Energy Technologies

- Shanghai Wellhead Equipment Manufacture

- National Oilwell Varco

- GE Grid Solutions

- Delta Corporation

- Great Lakes Wellhead

- Integrated Equipment

- Jiangsu Sanyi Petroleum Equipment

- JMP Petroleum Technologies