Global Water Treatment Polymers Market Size, Share, And Business Benefit By Product Type (Organic Water Treatment Polymers, Inorganic Water Treatment Polymers), By Application (Fresh-Water Treatment, Waste-Water Treatment), By End-use (Residential Buildings, Commercial Buildings, Industrial Buildings), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166491

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

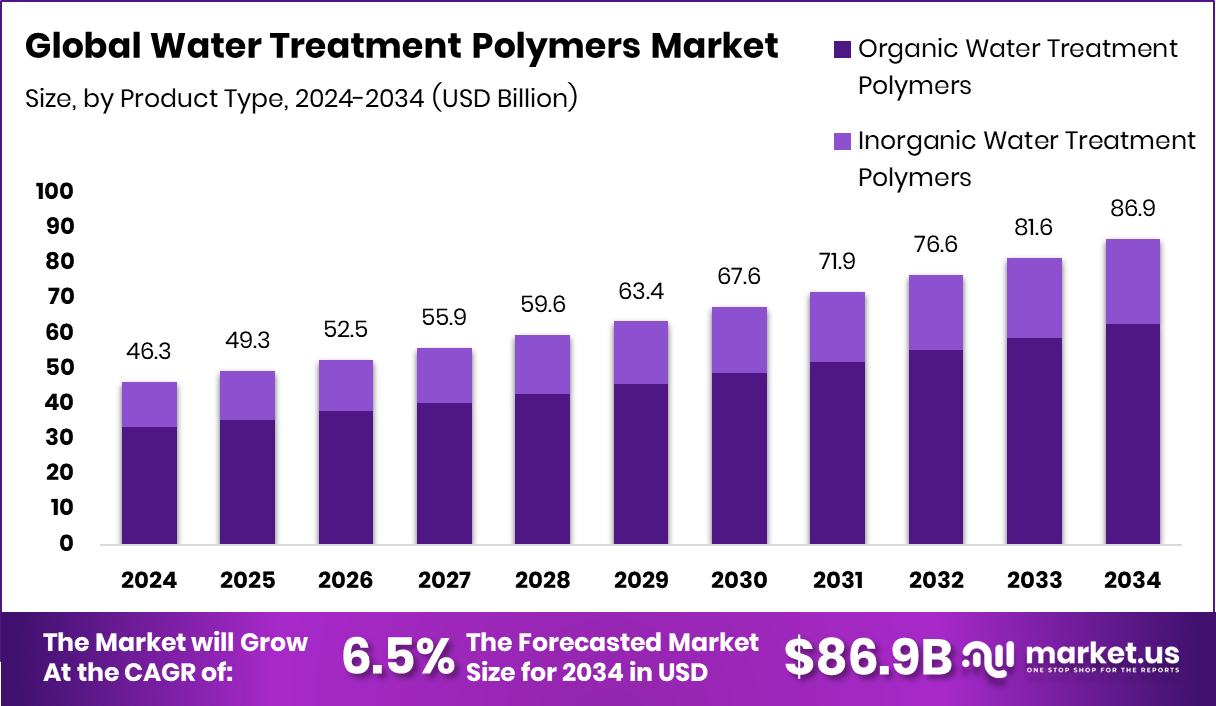

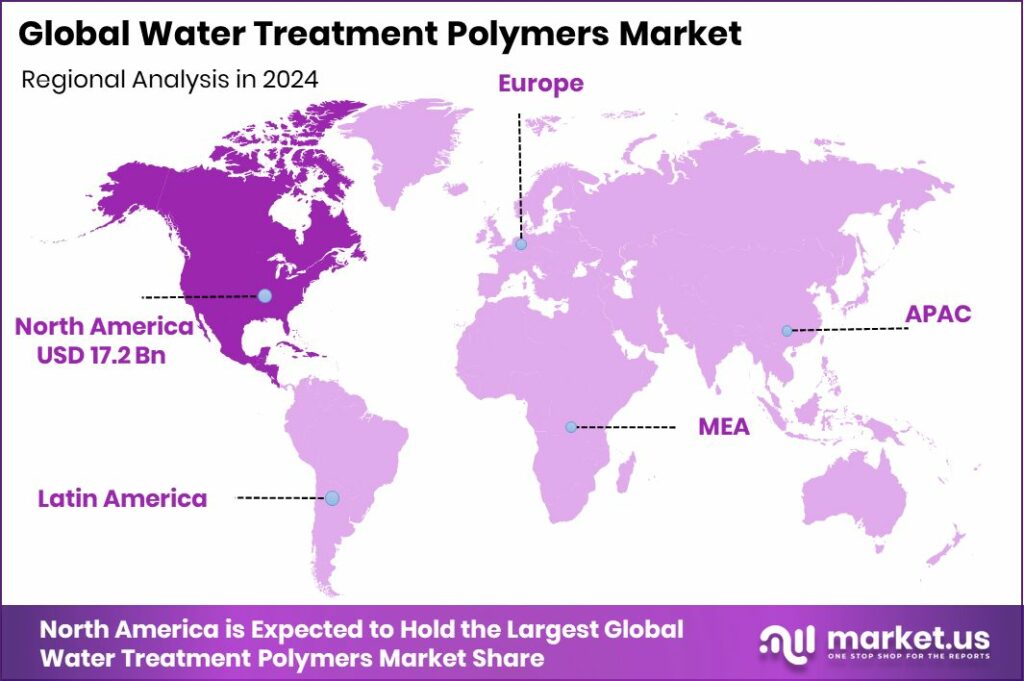

The Global Water Treatment Polymers Market is expected to be worth around USD 86.9 billion by 2034, up from USD 46.3 billion in 2024, and is projected to grow at a CAGR of 6.5% from 2025 to 2034. Strong infrastructure upgrades help North America maintain its 37.20%, USD 17.2 Bn lead.

Water treatment polymers are specialized chemicals that help remove impurities, stabilize contaminants, and improve the efficiency of clarification, filtration, and sludge management processes. These polymers play an essential role in municipal and industrial systems by enhancing water quality, reducing operational costs, and supporting compliance with rising environmental standards across countries.

The Water Treatment Polymers Market reflects the growing need to manage aging infrastructure, industrial wastewater, and urban water demand. The market is shaped by global investment momentum, including large state-driven upgrades and community-led revitalization plans. These polymers are now widely used to optimize coagulation, flocculation, and dewatering, making them central to modern treatment operations.

Growth is rising as governments expand funding for essential water systems. Major commitments, such as calls for $500 million in water infrastructure investments, demonstrate urgent national priorities. Local initiatives like the $1.95 million federal community project funding secured for wastewater treatment improvements further reinforce market expansion as municipalities upgrade outdated plants.

Demand continues to climb due to broader investment flows. A wastewater treatment firm receiving $50 million to scale membrane-based solutions shows how private capital accelerates polymer adoption across industrial users. International efforts, including €130 million allocated for sanitation projects in Iraq, highlight how emerging regions create strong long-term demand.

Opportunity strengthens with revitalization programs gaining momentum. Projects hitting “critical funding milestones,” such as the $19 million grant for wastewater treatment system upgrades, encourage new polymer technologies, better sludge handling, and improved water reuse systems. These initiatives open space for innovation and position water treatment polymers at the center of global infrastructure modernization.

Key Takeaways

- The Global Water Treatment Polymers Market is expected to be worth around USD 86.9 billion by 2034, up from USD 46.3 billion in 2024, and is projected to grow at a CAGR of 6.5% from 2025 to 2034.

- Organic polymers dominate the Water Treatment Polymers Market with a strong 72.1% share in 2024.

- Freshwater treatment leads the Water Treatment Polymers Market with a 62.4% contribution in 2024.

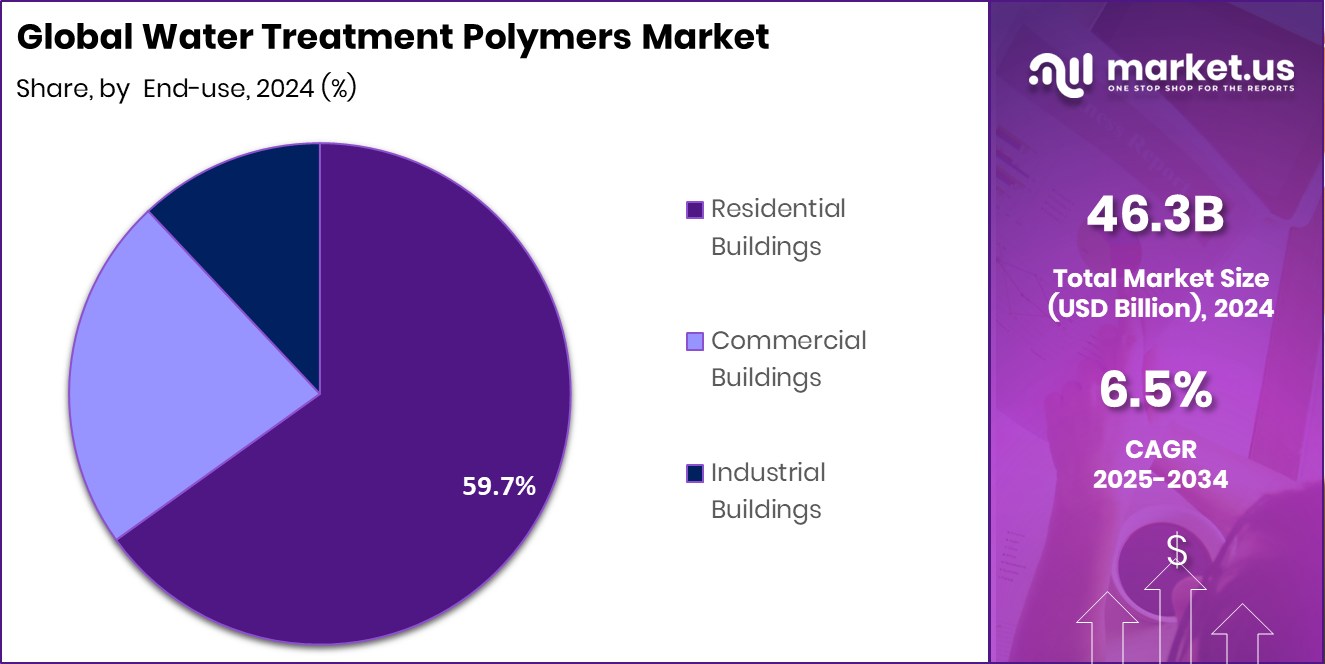

- Residential buildings account for 59.7% of the Water Treatment Polymers Market due to growing household needs

- North America reaches a market value of USD 17.2 Bn in 2024.

By Product Type Analysis

Organic polymers dominate the Water Treatment Polymers Market with a 72.1% share.

In 2024, Organic Water Treatment Polymers held a dominant market position in the By Product Type segment of the Water Treatment Polymers Market, with a 72.1% share. This strong lead reflects their wide acceptance in municipal and industrial treatment processes where safer, biodegradable, and highly efficient polymers are increasingly preferred.

Growing investment momentum in global water infrastructure further reinforces their usage, as facilities aim for better sludge handling, improved clarification efficiency, and reduced chemical load.

With governments and communities directing significant funds toward wastewater and sanitation upgrades, organic polymers continue gaining traction as the practical choice for plants modernizing their systems. Their performance consistency and compatibility with advanced treatment technologies help maintain this substantial market share.

By Application Analysis

Fresh-water treatment leads the Water Treatment Polymers Market at 62.4% share.

In 2024, Fresh-Water Treatment held a dominant market position in the By Application segment of the Water Treatment Polymers Market, with a 62.4% share. This leadership reflects the strong global focus on improving drinking water quality, upgrading municipal treatment networks, and addressing rising urban consumption. Growing government funding for water infrastructure upgrades continues to push polymer adoption in filtration, clarification, and sludge management steps within freshwater systems.

The segment benefits from the need to maintain consistent compliance with safety standards while supporting aging facilities that require higher-efficiency treatment solutions. As investment momentum accelerates across communities and public utilities, freshwater treatment remains the core driver sustaining this significant market share.

By End-use Analysis

Residential buildings contribute 59.7% to the global Water Treatment Polymers Market.

In 2024, Residential Buildings held a dominant market position in the by-end-use segment of the Water Treatment Polymers Market, with a 59.7% share. This leadership stems from the growing need for cleaner and safer water within households, especially as aging distribution networks and rising contamination concerns drive communities to adopt more reliable treatment solutions.

The segment benefits from continuous upgrades in local water systems, where polymers support efficient clarification, sediment removal, and overall water quality stability. Increasing funding directed toward municipal and community-level treatment enhancements further strengthens residential uptake, as improved infrastructure directly raises polymer consumption. With households prioritizing consistent water safety, this segment maintains its strong and influential market share.

Key Market Segments

By Product Type

- Organic Water Treatment Polymers

- Inorganic Water Treatment Polymers

By Application

- Fresh-Water Treatment

- Waste-Water Treatment

By End-use

- Residential Buildings

- Commercial Buildings

- Industrial Buildings

Driving Factors

Rising Global Investments Strengthen Polymer Market Demand

A major driving factor for the Water Treatment Polymers Market is the strong rise in global funding for wastewater and freshwater infrastructure upgrades. Cities and utilities are replacing old systems, creating higher demand for polymers that improve filtration, clarification, and sludge handling. Recent developments highlight this momentum. Winter Springs secured major funding to replace its decades-old wastewater plants, directly increasing the need for reliable polymer solutions during system modernization.

At the same time, a leading water-management company saw its stock jump 9% after announcing a $100 million investment in new water treatment projects. These upgrades boost polymer consumption because modern facilities require advanced chemicals to meet performance, efficiency, and water-quality standards.

Restraining Factors

High Infrastructure Costs Slow Polymer Adoption

A key restraining factor for the Water Treatment Polymers Market is the rising financial burden linked to large-scale water and sewer infrastructure upgrades. Many utilities face high installation and modernization costs, which can slow the pace of adopting advanced polymers. Even with strong investment activity, financial pressure remains visible.

California’s Hi-Desert Water District began work on a $103 million sewer expansion, highlighting how expensive essential upgrades have become. Similarly, the DANR announced over $5.8 million in additional ARPA grants for statewide water projects, showing that external support is often required to move projects forward. These heavy capital requirements can delay procurement cycles, slowing consistent demand for water treatment polymers.

Growth Opportunity

Rural System Upgrades Create Major Opportunity

A major growth opportunity for the Water Treatment Polymers Market comes from the rapid expansion and modernization of rural water and wastewater systems. Many smaller communities are replacing outdated plants and improving treatment quality, which increases the use of polymers for clarification, sludge control, and safer water delivery.

New funding is accelerating this shift. The EPA announced $30 million in grant support to strengthen rural water systems, opening space for advanced polymer adoption in underserved regions. Additionally, a $5 million funding boost to upgrade the Rutherglen sewage treatment plant highlights how rural and small-town projects are actively moving forward. As these upgrades expand, polymer demand grows steadily, creating a strong long-term opportunity.

Latest Trends

Large-Scale Funding Accelerates Technology Adoption

One of the latest trends in the Water Treatment Polymers Market is the rapid shift toward large-scale, long-term water infrastructure investments that push utilities to adopt more efficient and sustainable polymer technologies. Regions are moving beyond small upgrades and focusing on broad system transformation, which naturally increases polymer usage for filtration, sludge handling, and improved treatment performance.

Texas is set to make a $20 billion investment in water after voters approved Proposition 4, signaling a major wave of future treatment projects where polymers will play a core role. At the same time, the government’s decision to pull £277 million in funding for the Cambridge sewage works relocation reflects how funding decisions directly influence project timelines, technology choices, and polymer demand trends across the sector.

Regional Analysis

North America holds a 37.20% share in the Water Treatment Polymers Market.

In 2024, North America dominated the Water Treatment Polymers Market with a 37.20% share valued at USD 17.2 Bn, driven by strong federal and state investments supporting water infrastructure upgrades, wastewater modernization, and stricter compliance standards. The region’s continuous funding momentum and aging municipal systems reinforce polymer consumption across drinking water and wastewater networks.

Europe shows steady adoption as countries focus on meeting environmental rules, upgrading wastewater facilities, and improving sludge treatment efficiency. Demand grows as utilities move toward safer and more efficient treatment chemicals that enhance purification performance.

Asia Pacific expands rapidly due to rising urban populations, industrial growth, and increasing pressure to improve freshwater access. Countries continue upgrading local systems, supporting polymer usage in both municipal and industrial applications.

The Middle East & Africa maintain a growing need for polymers as water scarcity challenges encourage investments in treatment, reuse, and desalination-linked processes. Government-backed infrastructure projects support gradual adoption.

Latin America experiences consistent progress as countries improve community water networks and strengthen wastewater systems. Ongoing modernization efforts help expand polymer applications across residential and industrial treatment facilities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Kemira continued to strengthen its position in the Water Treatment Polymers Market by focusing on high-performance chemistries designed for municipal and industrial systems. The company’s long-standing emphasis on polymer efficiency, sludge reduction, and compliance-focused solutions keeps it well aligned with growing global investment in fresh water and wastewater networks. Kemira’s steady commitment to supporting utilities undergoing modernization enables it to benefit directly from large treatment-plant upgrades and infrastructure renewal cycles.

Ashland maintained a stable footprint by leveraging its expertise in specialty polymers used for water clarification and contaminant removal. The company’s focus on formulating polymers that improve treatment reliability positions it strongly as municipalities and industries seek better process performance. Ashland’s role in offering application-specific solutions allows it to meet the increasing demand for consistent water quality, especially in areas investing heavily in operational improvement and system optimization.

Arkema continued expanding its relevance in the market through its broad portfolio of functional additives and treatment-focused polymer technologies. The company’s emphasis on performance, durability, and integration with advanced water systems supports its growth as treatment operations evolve. Arkema’s steady engagement in sectors requiring enhanced purification performance helps reinforce its presence as global water infrastructure projects scale up, driving stronger adoption of efficient polymer-based solutions.

Top Key Players in the Market

- Kemira

- Ashland

- Arkema

- BASF SE

- DuPont

- Gantrade Corporation

- SNF Group

- Kuraray Co. Ltd

- Mitsubishi Chemical Corporation

- Nouryon

Recent Developments

- In September 2025, Kemira signed a purchase agreement to acquire Water Engineering, Inc. (Nebraska, USA), a specialist in industrial water-treatment services for boilers, cooling towers, and wastewater. The deal price is approximately USD 150 million in cash. This move expands Kemira’s industrial water treatment footprint and strengthens its service-based offerings.

- In April 2024, Arkema announced at the American Coatings Show the launch of a new polyurethane thickener, “Coapur™ XS 12”, specifically designed for water-based systems. This product helps improve film build and leveling in coatings, which is relevant to water-based treatment systems in infrastructure.

Report Scope

Report Features Description Market Value (2024) USD 46.3 Billion Forecast Revenue (2034) USD 86.9 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Organic Water Treatment Polymers, Inorganic Water Treatment Polymers), By Application (Fresh-Water Treatment, Waste-Water Treatment), By End-use (Residential Buildings, Commercial Buildings, Industrial Buildings) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kemira, Ashland, Arkema, BASF SE, DuPont, Gantrade Corporation, SNF Group, Kuraray Co. Ltd, Mitsubishi Chemical Corporation, Nouryon Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Water Treatment Polymers MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Water Treatment Polymers MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kemira

- Ashland

- Arkema

- BASF SE

- DuPont

- Gantrade Corporation

- SNF Group

- Kuraray Co. Ltd

- Mitsubishi Chemical Corporation

- Nouryon