Global Water Soluble Fertilizer Market Size, Share, Analysis Report By Form (Dry, Powder, Granules, Liquid), By Product (Nitrogenous, Micronutrient, Phosphatic, Potassium, Others), By Mode of Application (Foliar, Fertigation, Hydroponics, Drip Irrigation, Others), By Crop Type (Cereals, Vegetables and Fruits, Turf and Ornamentals, Greenhouse Crops, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155957

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

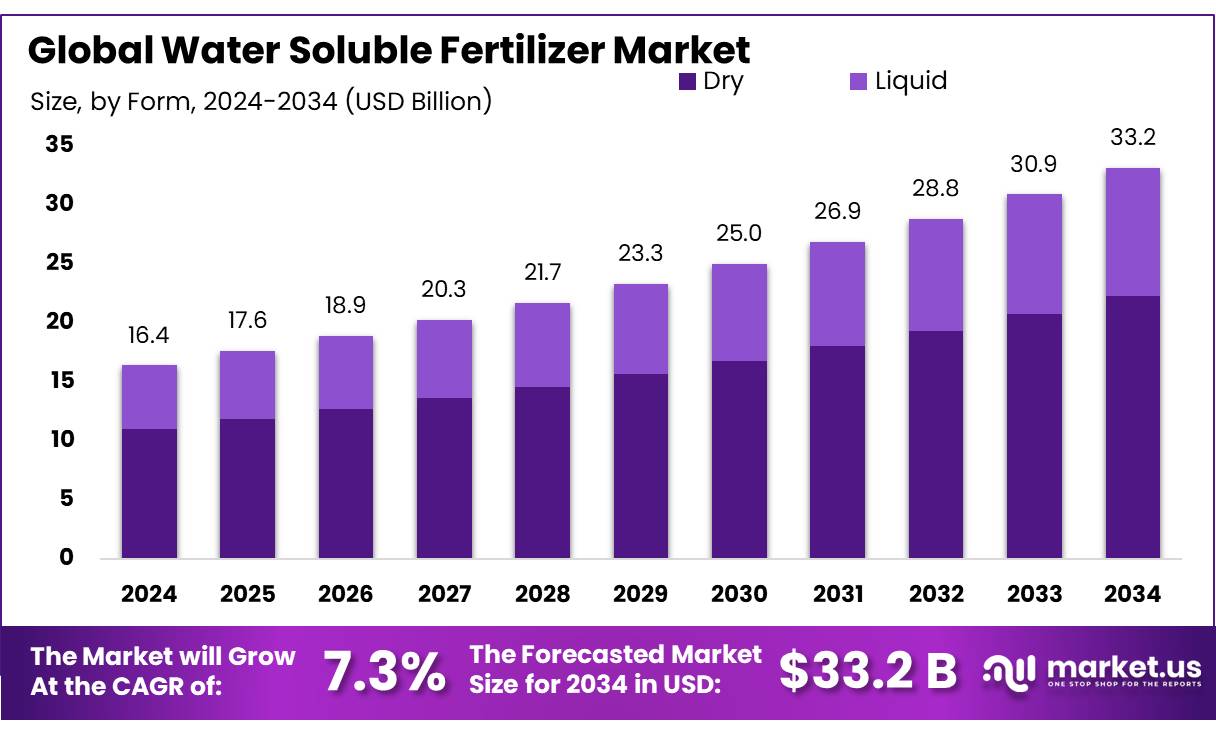

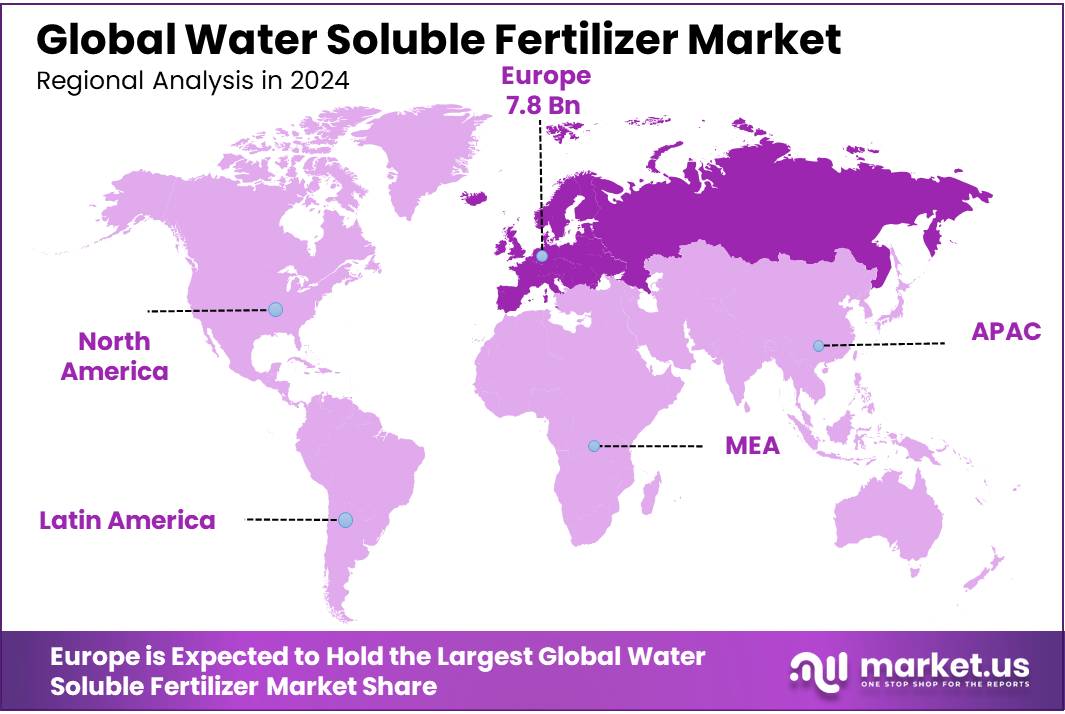

The Global Water Soluble Fertilizer Market size is expected to be worth around USD 33.2 Billion by 2034, from USD 16.4 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 47.9% share, holding USD 7.8 Billion revenue.

Water-soluble fertilizer (WSF) concentrates are high-purity N, P, K and micronutrient formulations designed to dissolve completely for fertigation and foliar feeding. They enable precise dosing through drip and sprinkler systems, which reduces losses and supports higher-value crops and protected cultivation. Context matters: global fertilizer use is expanding again, setting the base load for soluble grades. FAO’s latest release shows agricultural use of inorganic fertilizers rose from 142 Mt in 2002 to 190 Mt in 2023; nitrogen reached 112 Mt, phosphorus 41 Mt and potassium 38 Mt, with nutrient application per hectare also rising over the period.

Another government initiative worth noting: the Andhra Pradesh state government is actively promoting alternatives to conventional chemical fertilizers—including nano‑fertilizers such as Nano Urea and Nano DAP—aiming to reduce chemical fertilizer usage by 11% (equivalent to 400,000 MT) and replace portions with bio‑fertilizers and nano options, which may dovetail with broader WSF and advanced nutrient strategies.

Several systemic factors are propelling the adoption of water‑soluble fertilizers. Firstly, water scarcity, particularly in India where agriculture uses about 80 % of freshwater resources, has highlighted inefficiencies in traditional irrigation. Water‑soluble fertilizers applied via micro‑irrigation help reduce both water use and nutrient loss. Additionally, a special one‑time subsidy of ₹3,500 per tonne was provided for DAP (Di‑Ammonium Phosphate) from April 2024 to March 2025 to maintain its affordability.

While water‑soluble fertilizers are recognized, they currently fall outside subsidy coverage—these “100 % water‑soluble complex fertilizer” grades are not included in India’s NBS scheme. However, the government is encouraging local production of water‑soluble fertilizers to ease costs, reduce subsidy burdens, and reinforce farmer resilience. For instance, empirical data shows that in banana cultivation, WSF usage has reduced water consumption by 35 % and raised farmer profitability by up to ₹98,000 per hectare.

Key Takeaways

- Water Soluble Fertilizer Market size is expected to be worth around USD 33.2 Billion by 2034, from USD 16.4 Billion in 2024, growing at a CAGR of 7.3%.

- Dry held a dominant market position, capturing more than a 67.2% share in the Water Soluble Fertilizer market.

- Nitrogenous held a dominant market position, capturing more than a 49.3% share in the Water Soluble Fertilizer market.

- Foliar held a dominant market position, capturing more than a 37.4% share in the Water Soluble Fertilizer market.

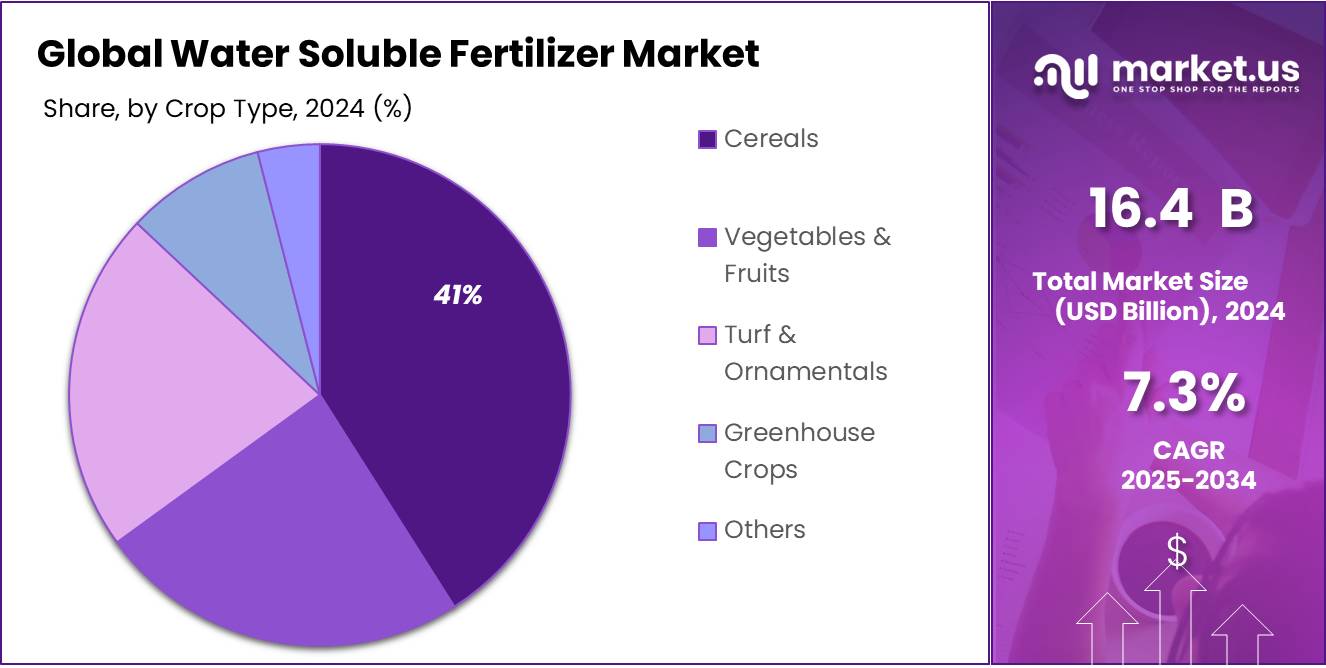

- Cereals held a dominant market position, capturing more than a 41.8% share in the Water Soluble Fertilizer market.

- Europe emerged as the dominant region in the Water Soluble Fertilizer market, accounting for a commanding 47.9% share, which translates to approximately USD 7.8 billion.

By Form Analysis

Dry Form Dominates with 67.2% in 2024 Due to Its Longer Shelf Life and Easy Handling

In 2024, Dry held a dominant market position, capturing more than a 67.2% share in the Water Soluble Fertilizer market by form. This strong preference for dry formulations is largely driven by their extended shelf life, ease of transportation, and cost-effectiveness in storage and distribution. Dry water-soluble fertilizers, including granules and powders, are particularly favored in large-scale farming operations due to their reduced risk of spillage and compatibility with fertigation systems after dilution. These fertilizers also allow for accurate nutrient concentration adjustments, which is crucial for high-value crops grown in controlled environments like greenhouses.

Dry formulations are often packaged in moisture-resistant materials, making them suitable for bulk use and export without significant quality loss. Their ability to be blended with other nutrient types before application adds another layer of flexibility, supporting farmers across different climatic zones and crop types. With growing demand for efficient, scalable, and precise fertilization methods, especially in countries such as India and China where fertigation acreage is expanding rapidly, the dry form is expected to maintain its market lead in 2025 as well. As agricultural modernization and precision farming continue to rise, dry water-soluble fertilizers are projected to remain a preferred option among growers worldwide.

By Product Analysis

Nitrogenous Fertilizers Lead with 49.3% Share in 2024 Owing to High Demand for Rapid Plant Growth

In 2024, Nitrogenous held a dominant market position, capturing more than a 49.3% share in the Water Soluble Fertilizer market by product. This dominance is mainly because nitrogen is an essential nutrient that supports fast vegetative growth, making it a crucial input for crops like cereals, leafy vegetables, and corn. Water-soluble nitrogenous fertilizers such as urea, ammonium nitrate, and calcium ammonium nitrate are widely used across both open-field and greenhouse farming, especially where immediate nutrient absorption is needed.

These fertilizers dissolve quickly in irrigation systems and provide an instant nutrient boost, which is important for high-yield farming under intensive cropping systems. In countries like India, where nitrogen-based fertilizers account for a major portion of overall consumption, the demand continues to rise due to government subsidies under schemes like the Nutrient Based Subsidy (NBS) and higher crop productivity goals. The widespread adoption of fertigation techniques and precision farming has also encouraged farmers to use nitrogenous products that deliver fast and visible results.

By Mode of Application Analysis

Foliar Application Tops with 37.4% Share in 2024 Due to Its Quick Nutrient Absorption and Crop Boosting Effect

In 2024, Foliar held a dominant market position, capturing more than a 37.4% share in the Water Soluble Fertilizer market by mode of application. This leading position is mainly because foliar spraying allows nutrients to be absorbed directly through plant leaves, offering faster results compared to soil-based applications. It is especially useful during critical growth stages or when root uptake is limited due to poor soil conditions, drought, or disease. Farmers prefer foliar application for its efficiency in correcting nutrient deficiencies quickly and enhancing the overall health and yield of crops.

Foliar feeding is widely used in horticulture, vineyards, and high-value crops such as fruits, vegetables, and ornamental plants. It enables targeted delivery of micronutrients like zinc, boron, and iron, which may not be effectively absorbed through soil. In countries such as China, Brazil, and India—where climatic variability often stresses crops—foliar nutrition helps maintain productivity. In 2025, the share of foliar application is expected to grow steadily, as more farmers adopt integrated nutrient management practices and precision agriculture techniques. The method also supports sustainable farming, as it reduces fertilizer wastage and environmental impact by minimizing leaching into the soil and water sources.

By Crop Type Analysis

Cereals Take the Lead with 41.8% Share in 2024 Owing to Rising Demand for Food Grains and Efficient Fertilization

In 2024, Cereals held a dominant market position, capturing more than a 41.8% share in the Water Soluble Fertilizer market by crop type. This leadership is mainly because cereals such as wheat, rice, maize, and barley require high volumes of nutrients to support rapid growth and large-scale production. Water-soluble fertilizers are widely used in cereal farming to ensure faster nutrient delivery, especially during key growth stages like tillering and grain filling. These fertilizers help in improving yield quality, reducing nutrient losses, and supporting timely crop development under varying climatic conditions.

Countries like India and China, which are among the top producers and consumers of cereals, are witnessing increased use of water-soluble fertilizers in irrigated cereal fields. This is further supported by government-backed fertilizer subsidy programs and the growing shift toward fertigation in large farms. In 2025, the demand from the cereals segment is likely to remain strong, as global food needs continue to rise and farmers focus on improving productivity per hectare. The compatibility of water-soluble fertilizers with mechanized farming and sustainable nutrient management practices also adds to their growing use in cereal cultivation.

Key Market Segments

By Form

- Dry

- Powder

- Granules

- Liquid

By Product

- Nitrogenous

- Micronutrient

- Phosphatic

- Potassium

- Others

By Mode of Application

- Foliar

- Fertigation

- Hydroponics

- Drip Irrigation

- Others

By Crop Type

- Cereals

- Vegetables & Fruits

- Turf & Ornamentals

- Greenhouse Crops

- Others

Emerging Trends

Government Support and Technological Integration Propel Water-Soluble Fertilizer Adoption

The Indian government’s initiatives to promote balanced and efficient fertilizer use present a significant growth opportunity for water-soluble fertilizers. These fertilizers are gaining attention due to their quick absorption and reduced environmental impact. The government’s focus on improving fertilizer efficiency and promoting sustainable agriculture aligns well with the benefits offered by water-soluble fertilizers.

The Indian government has been actively promoting balanced fertilizer use to enhance soil health and crop productivity. The Economic Survey 2018-19 highlights the declining fertilizer response ratio, indicating the need for balanced nutrient application. To address this, the government has been encouraging the use of water-soluble fertilizers, which provide nutrients in a readily available form to plants, leading to better uptake and reduced wastage.

Programs like the National Mission for Sustainable Agriculture (NMSA) aim to make agriculture more productive, sustainable, and climate-resilient. These programs promote the use of balanced fertilizers, including water-soluble types, to improve soil fertility and crop yields. By focusing on integrated farming systems and resource conservation, these initiatives create a conducive environment for the adoption of water-soluble fertilizers.

As farmers become more aware of the benefits of water-soluble fertilizers, their adoption is expected to rise. These fertilizers offer precise nutrient delivery, leading to improved crop quality and yield. The government’s support through subsidies and awareness programs further encourages farmers to switch to these efficient fertilizers. This shift not only enhances agricultural productivity but also contributes to environmental sustainability by minimizing nutrient runoff and soil degradation.

Drivers

Government Support and Schemes Driving the Adoption of Water-Soluble Fertilizers in India

One of the primary factors propelling the adoption of water-soluble fertilizers (WSFs) in India is the robust support from government initiatives aimed at enhancing agricultural productivity and sustainability. These schemes not only promote efficient water use but also encourage the adoption of modern farming practices, including the use of WSFs.

A cornerstone of these efforts is the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), launched in 2015 with the vision of “Har Khet Ko Pani” (Water to Every Field). The scheme focuses on expanding the cultivated area with assured irrigation and reducing water wastage through micro-irrigation techniques like drip and sprinkler systems. In the Union Budget for FY 2025-26, the government allocated ₹8,259.85 crore (approximately USD 964.71 million) to PMKSY, underscoring its commitment to improving irrigation infrastructure and water-use efficiency in agriculture.

The integration of micro-irrigation systems under PMKSY has created a conducive environment for the use of WSFs. These fertilizers are particularly effective when applied through fertigation systems, ensuring that nutrients are delivered directly to the plant roots, thereby enhancing uptake efficiency and reducing wastage. The synergy between micro-irrigation and WSFs has been recognized for its potential to improve crop yields and resource use efficiency.

- For instance, in FY 2020-21, the Department of Agriculture Cooperation and Farmers Welfare announced an allotment of ₹4,000 crore to state governments for implementing the ‘Per Drop More Crop’ component under PMKSY, which promotes water-use efficiency through micro-irrigation.

Restraints

High Initial Investment and Infrastructure Challenges

One of the significant barriers to the widespread adoption of water-soluble fertilizers (WSFs) in India is the high initial investment required for infrastructure setup and the technical knowledge needed for effective implementation. While WSFs offer efficient nutrient delivery, their benefits are maximized when integrated with advanced irrigation systems like drip and sprinkler setups. These systems necessitate substantial upfront costs for installation, which can be prohibitive for smallholder farmers who dominate India’s agricultural landscape.

According to the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), the government has recognized the need to enhance irrigation infrastructure to support modern farming practices. However, the scheme also highlights that the high costs associated with setting up efficient irrigation systems remain a significant challenge for many farmers. For instance, the installation of drip irrigation systems, which are essential for the effective use of WSFs, can cost between ₹40,000 to ₹60,000 per hectare, depending on the terrain and crop type. This financial burden is often beyond the reach of small-scale farmers.

Moreover, the lack of technical knowledge and training further exacerbates the situation. The PMKSY’s Task Force Report on Micro Irrigation emphasizes that a significant barrier to the adoption of fertigation practices is the insufficient awareness and technical information available to farmers. Many farmers are not adequately trained in the use of WSFs and fertigation systems, leading to suboptimal application and, in some cases, misuse of fertilizers. This not only affects crop yields but also poses environmental risks due to potential over-fertilization.

To address these challenges, the government has introduced various subsidy schemes under PMKSY to promote the adoption of micro-irrigation systems. For example, the scheme provides a subsidy of up to 55% for small and marginal farmers for the installation of drip and sprinkler irrigation systems. While these subsidies make the technology more accessible, the remaining cost still poses a financial challenge for many farmers. Additionally, the effectiveness of these subsidies is often hindered by bureaucratic delays and the farmers’ limited access to information regarding available support.

Opportunity

Government Support and Schemes Driving the Adoption of Water-Soluble Fertilizers in India

One of the primary factors propelling the adoption of water-soluble fertilizers (WSFs) in India is the robust support from government initiatives aimed at enhancing agricultural productivity and sustainability. These schemes not only promote efficient water use but also encourage the adoption of modern farming practices, including the use of WSFs.

A cornerstone of these efforts is the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), launched in 2015 with the vision of “Har Khet Ko Pani” (Water to Every Field). The scheme focuses on expanding the cultivated area with assured irrigation and reducing water wastage through micro-irrigation techniques like drip and sprinkler systems. In the Union Budget for FY 2025-26, the government allocated ₹8,259.85 crore (approximately USD 964.71 million) to PMKSY, underscoring its commitment to improving irrigation infrastructure and water-use efficiency in agriculture.

The integration of micro-irrigation systems under PMKSY has created a conducive environment for the use of WSFs. These fertilizers are particularly effective when applied through fertigation systems, ensuring that nutrients are delivered directly to the plant roots, thereby enhancing uptake efficiency and reducing wastage. The synergy between micro-irrigation and WSFs has been recognized for its potential to improve crop yields and resource use efficiency.

Furthermore, the government has incentivized the adoption of these technologies through subsidies and financial support. For instance, in FY 2020-21, the Department of Agriculture Cooperation and Farmers Welfare announced an allotment of ₹4,000 crore (approximately USD 533.76 million) to state governments for implementing the ‘Per Drop More Crop’ component under PMKSY, which promotes water-use efficiency through micro-irrigation.

Regional Insights

Europe Takes the Lead with 47.9% Share, Equivalent to USD 7.8 Bn in 2024

In 2024, Europe emerged as the dominant region in the Water Soluble Fertilizer market, accounting for a commanding 47.9% share, which translates to approximately USD 7.8 billion in revenue. This leadership stems from Europe’s strong commitment to sustainable agriculture, backed by stringent environmental regulations and a high level of awareness among farmers about efficient nutrient management.

European growers—especially in greenhouse-intensive sectors like horticulture and ornamental cultivation—have long favored water-soluble fertilizers due to their compatibility with precision delivery systems such as fertigation and foliar sprays. The ability to deliver nutrients accurately, while minimizing waste and environmental runoff, aligns perfectly with the region’s regulatory mandates and conservation goals. As a result, Europe continues to set the standard for sustainable, high-efficiency fertilizer use.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nutrien is a major global provider of water-soluble fertilizer components, supplying over 27 million tonnes of potash, nitrogen, and phosphate annually, and serving more than 600,000 customer accounts through its retail network in 2024. With a workforce of approximately 25,500 employees and operations spanning more than 50 countries, Nutrien combines scale with reach, offering both granular and soluble fertilizer solutions to diverse crop systems worldwide.

Haifa Group is globally recognized for its specialty water-soluble fertilizers—especially potassium nitrate—and controlled-release formulations. Founded in 1966, the company offers its products across more than 100 countries, focusing on balanced, stage-specific nutrition for growers and enhancing efficiency in drip, greenhouse, and foliar systems.

Coromandel International, based in India, supplies a suite of 100% water-soluble fertilizers tailored for crop-specific fertigation, such as Fitsol Solanaceae, Fitsol Banana, Acuspray Cereal, and Gromor Power 16‑8‑24 for flowers. The company operates 18 manufacturing facilities, supporting its innovation in customized, soluble nutrient solutions.

Top Key Players Outlook

- Nutrien

- Sociedad Química y Minera De Chile (SQM)

- K+S Aktiengesellschaft

- Yara International

- Haifa Chemicals Ltd

- Coromandel International Ltd

- The Mosaic Company

- Hebei Monband Water Soluble Fertilizers Co. Ltd

- EuroChem

- Agafert

Recent Industry Developments

In 2024, Yara International brought in about USD 13.9 billion in revenue and delivered around 22.9 million tonnes of fertilizers to farmers worldwide.

In 2024, EuroChem took a big step into water‑soluble fertilizers by investing 7.4 billion rubles (about USD 81 million) to build a new 70,000 ton per year production plant for potassium nitrate (NOP) at its Nevinnomysskiy Azot facility in Russia. This factory, expected to go online in the third quarter, significantly boosts the company’s capacity to meet growing demand for advanced fertigation solutions in Russia, Asia, and Latin America.

Report Scope

Report Features Description Market Value (2024) USD 16.4 Bn Forecast Revenue (2034) USD 33.2 Bn CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Dry, Powder, Granules, Liquid), By Product (Nitrogenous, Micronutrient, Phosphatic, Potassium, Others), By Mode of Application (Foliar, Fertigation, Hydroponics, Drip Irrigation, Others), By Crop Type (Cereals, Vegetables and Fruits, Turf and Ornamentals, Greenhouse Crops, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nutrien, Sociedad Química y Minera De Chile (SQM), K+S Aktiengesellschaft, Yara International, Haifa Chemicals Ltd, Coromandel International Ltd, The Mosaic Company, Hebei Monband Water Soluble Fertilizers Co. Ltd, EuroChem, Agafert Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Water Soluble Fertilizer MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Water Soluble Fertilizer MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nutrien

- Sociedad Química y Minera De Chile (SQM)

- K+S Aktiengesellschaft

- Yara International

- Haifa Chemicals Ltd

- Coromandel International Ltd

- The Mosaic Company

- Hebei Monband Water Soluble Fertilizers Co. Ltd

- EuroChem

- Agafert