Global Wall Insulation Market Size, Share, And Business Benefits Insulation Type (Fiberglass, Foam, Mineral Wool, Cellulose, Others), By Application (Residential, Commercial, Industrial, Others), By End-User (New Construction, Retrofit), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 160327

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

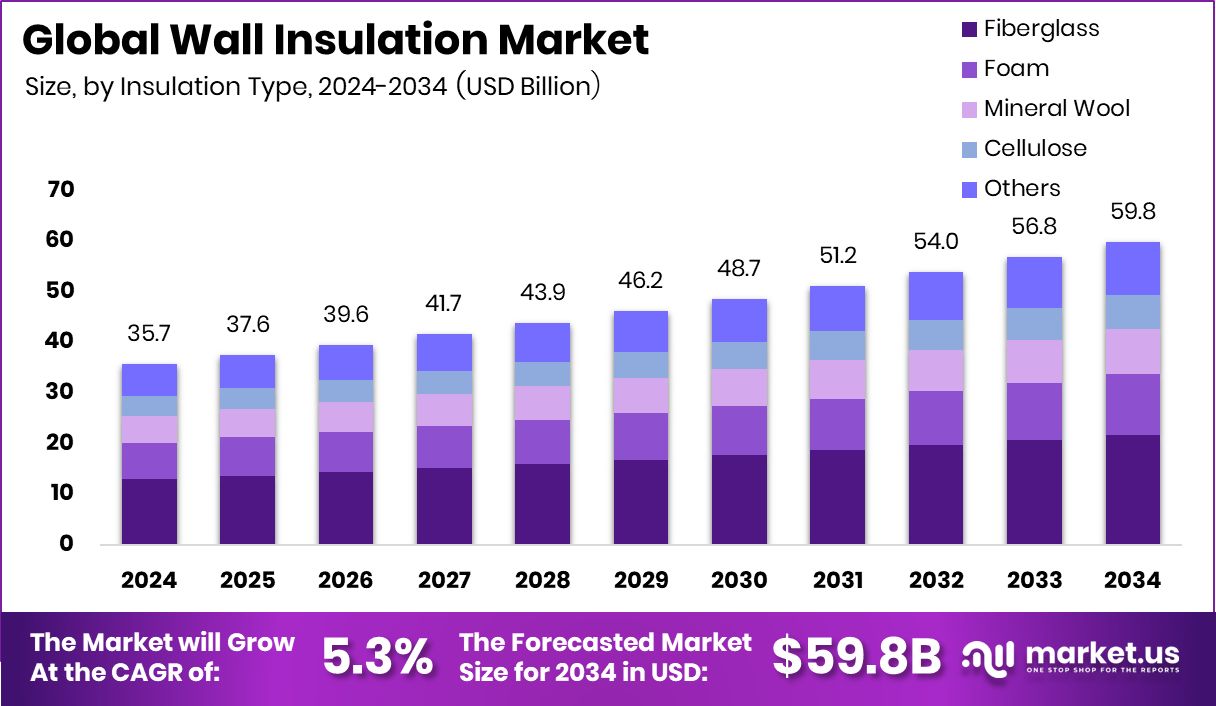

The Global Wall Insulation Market is expected to be worth around USD 59.8 billion by 2034, up from USD 35.7 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. North America’s 42.90% leadership reflects growing retrofitting projects and strict energy efficiency standards.

Wall insulation is the process of adding protective insulating materials within or around walls to reduce heat transfer, improve energy efficiency, and maintain indoor comfort. By keeping heat inside during winter and blocking excess heat in summer it helps lower energy bills and contributes to creating more sustainable buildings.

The wall insulation market continues to grow as governments and communities push for energy efficiency in both residential and commercial spaces. Over £10 million has been invested to make homes more energy efficient in Nottingham city, highlighting the role of local initiatives in upgrading existing housing stock and driving demand for insulation. Such investments show how policy support directly fuels adoption in this market.

One of the major growth factors is the rising need to modernize older buildings. With many structures still lacking proper insulation, the market benefits from retrofitting projects. In this direction, Schmelzer Industries announced an $850,000 investment at its Somerset facility, adding jobs and increasing capacity to meet growing insulation needs. These developments reflect how investments not only expand supply but also create regional economic benefits.

Opportunities in the market are also supported by infrastructure projects. For instance, Manchester-Boston Regional Airport received $2.8 million in federal infrastructure funding, showing that public buildings and transport hubs are also being upgraded with energy-saving solutions like wall insulation. As awareness of energy efficiency spreads, both private housing and large-scale facilities will continue to present opportunities for adoption and long-term growth.

Key Takeaways

- The Global Wall Insulation Market is expected to be worth around USD 59.8 billion by 2034, up from USD 35.7 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- In 2024, fiberglass led the wall insulation market with a 36.4% share dominance.

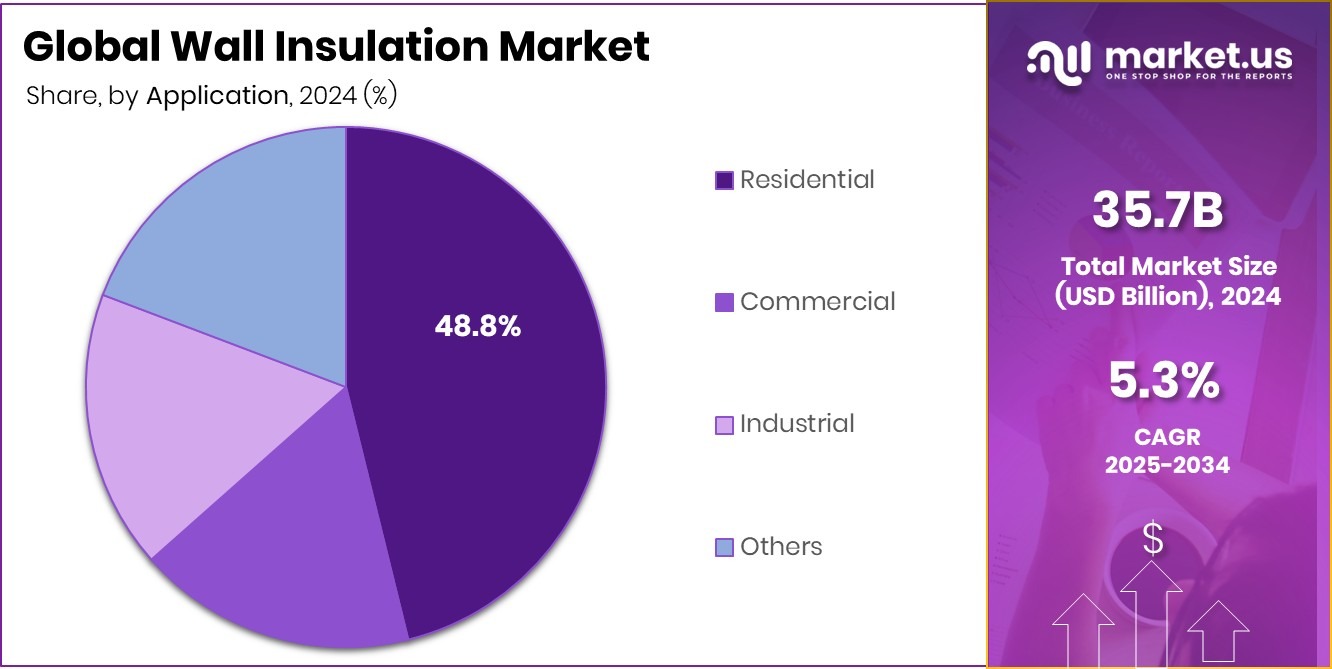

- The residential sector dominated the wall insulation market in 2024, holding a 48.8% market share.

- New construction accounted for 67.7% of the wall insulation market share in 2024.

- The North American market value reached USD 15.4 Bn, highlighting strong demand.

By Insulation Type Analysis

In 2024, fiberglass captured 36.4% of the wall insulation market.

In 2024, Fiberglass held a dominant market position in the By Insulation Type segment of the Wall Insulation Market, with a 36.4% share. This dominance reflects its widespread use as a reliable and cost-effective insulation material, offering strong thermal resistance and helping to maintain energy efficiency in buildings.

Fiberglass is widely favored due to its lightweight nature, ease of installation, and ability to fit different wall structures without compromising performance. Its adaptability in both small-scale and large-scale projects has further strengthened its share in the market. The significant presence of fiberglass in wall insulation highlights its role as a trusted solution, addressing growing demand for affordable and effective insulation systems across various construction needs.

By Application Analysis

Residential held a 48.8% share in the wall insulation market in 2024.

In 2024, Residential held a dominant market position in the By Application segment of the Wall Insulation Market, with a 48.8% share. This leadership reflects the strong demand from homeowners seeking energy-efficient solutions to lower heating and cooling costs while improving indoor comfort. The residential sector has been at the forefront of insulation adoption, particularly as governments and communities encourage energy-saving upgrades in housing.Retrofitting older homes and installing insulation in new residential projects have both contributed to this substantial share. The focus on reducing household energy consumption, cutting carbon emissions, and meeting stricter efficiency standards continues to drive residential dominance, highlighting its critical role in shaping the overall wall insulation market landscape.

By End-User Analysis

New construction accounted for 67.7% of the wall insulation market in 2024.

In 2024, New Construction held a dominant market position in the by-end-user segment of the wall insulation market, with a 67.7% share. This strong lead reflects the increasing integration of insulation during the initial phases of building projects, where energy efficiency standards and modern construction codes are easier to implement. Builders are prioritizing wall insulation in new residential and commercial structures to meet regulatory requirements and long-term energy savings goals.

The ability to incorporate advanced insulation materials during design and construction stages has further supported this dominance. With sustainability becoming central to urban development, the new construction sector continues to drive the largest share of demand in the wall insulation market.

Key Market Segments

By Insulation Type

- Fiberglass

- Foam

- Mineral Wool

- Cellulose

- Others

By Application

- Residential

- Commercial

- Industrial

- Others

By End-User

- New Construction

- Retrofit

Driving Factors

Growing Investments in Energy-Efficient and Modern Infrastructure

One of the strongest driving factors for the wall insulation market is the growing investment in upgrading infrastructure and housing with energy-efficient solutions. Governments and institutions are prioritizing the improvement of public buildings, schools, and residential complexes to cut energy costs and improve living standards. For example, £302 million has been allocated for further education colleges to fix dilapidated buildings, which will directly create demand for wall insulation as part of large-scale refurbishments.

Similarly, the New Eastern Placer Launchpad program has opened up $1 million in funding to build workforce housing, reflecting how new housing projects are incorporating insulation from the start. These combined efforts highlight the role of funding in accelerating adoption and ensuring sustainable market growth.

Restraining Factors

High Upfront Costs Slow Down Market Adoption

A key restraining factor for the wall insulation market is the high upfront cost of installation. While insulation delivers long-term savings on energy bills, the initial expenses for materials and skilled labor can be a significant barrier, especially for homeowners or small developers working with limited budgets. In many cases, the payback period feels too long for people to justify the investment immediately, even though the benefits are clear over time.

Additionally, retrofitting older buildings often requires more complex and expensive work, further discouraging adoption. These financial challenges limit market growth in certain regions, highlighting the need for stronger incentives or cost-effective solutions to make wall insulation more accessible and widely adopted.

Growth Opportunity

Expanding Construction Projects Creating Strong Market Opportunities

A major growth opportunity for the wall insulation market comes from the expansion of new construction and renovation projects across the public and private sectors. As communities prioritize sustainable building practices, insulation is becoming a standard requirement for energy efficiency and long-term cost savings. Governments are increasingly supporting this shift through targeted funding programs that encourage modern infrastructure development.

For instance, Governor Hochul has proposed an $110 million Child Care Construction Fund to build and renovate child care facilities, which will require high-quality wall insulation to ensure safe, energy-efficient, and comfortable spaces for children. Such funding-driven initiatives highlight how construction growth is opening new doors for insulation adoption, creating long-lasting opportunities for market expansion worldwide.

Latest Trends

Rising Focus on Sustainable Housing and Green Building Practices

One of the latest trends in the wall insulation market is the increasing focus on sustainable housing and green building practices. Governments and communities are placing stronger emphasis on reducing energy consumption, lowering emissions, and creating healthier living environments. Wall insulation plays a central role in this trend by helping buildings achieve higher energy performance standards while cutting operational costs.

For example, Ontario is investing $1.6 billion in the Municipal Housing Infrastructure Program, which will support large-scale housing developments that incorporate energy-efficient solutions like advanced wall insulation. This reflects how sustainability goals and public funding are working together, turning eco-friendly construction into a mainstream priority and driving new momentum for insulation adoption.

Regional Analysis

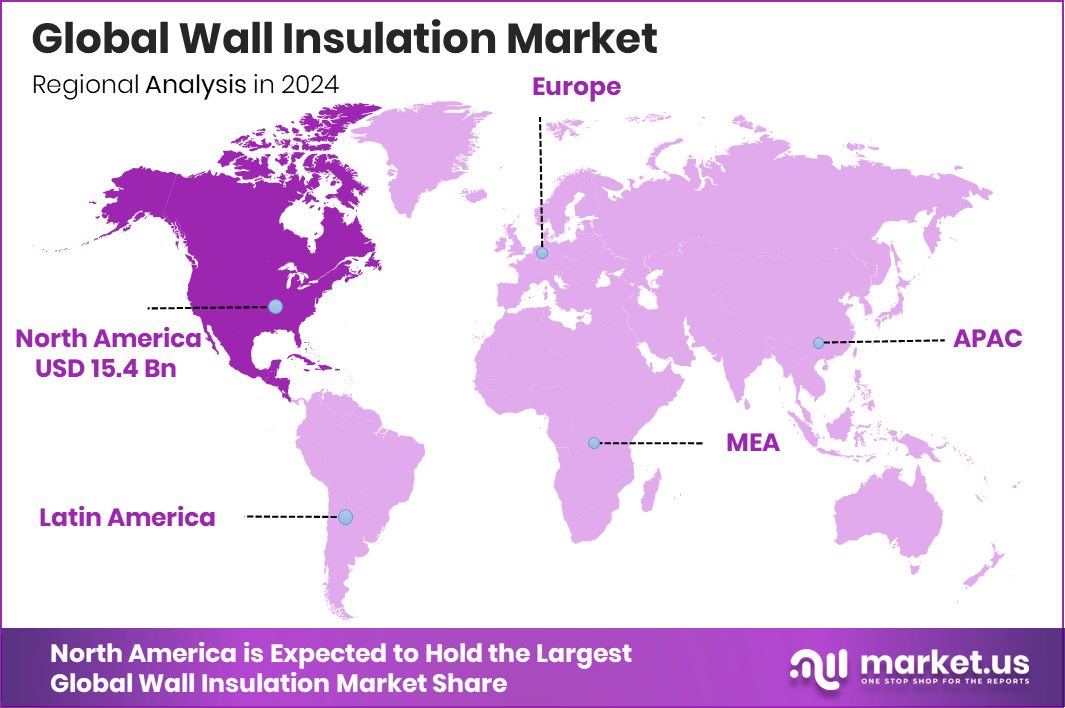

In 2024, North America held a 42.90% share of the Wall Insulation Market.

The Wall Insulation Market demonstrates varied performance across global regions, reflecting distinct energy priorities and construction activities. North America dominated in 2024, holding a 42.90% share valued at USD 15.4 billion, driven by strong retrofitting programs, strict building codes, and widespread adoption of energy-saving practices across residential and commercial sectors.

Europe also plays a significant role, supported by its focus on sustainable building regulations and renovation projects that encourage efficient insulation systems. The Asia Pacific region shows rising momentum, with urbanization and rapid construction fueling higher demand for wall insulation in new residential and infrastructure developments. In contrast, the Middle East & Africa region is gradually adopting insulation solutions to combat extreme climatic conditions, with a focus on modernizing urban centers.

Latin America contributes steadily, with residential upgrades and commercial construction driving usage, although at a smaller scale compared to dominant regions. Overall, while all regions support market growth, North America clearly stands out as the leading region, reflecting its advanced energy efficiency standards, retrofitting initiatives, and high market value. This leadership underlines the region’s strong role in shaping the direction of the global wall insulation market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Saint-Gobain S.A. remains a leader with its focus on sustainable construction materials. The company’s expertise in delivering high-performance insulation products supports the growing demand for energy-efficient building solutions. By aligning with global climate goals, Saint-Gobain continues to set benchmarks in material innovation and green building practices, making it a key player in wall insulation adoption across both residential and commercial projects.

Kingspan Group plc plays an equally important role, particularly in advancing insulation systems that combine high efficiency with modern design requirements. Its emphasis on developing lighter, durable, and performance-driven insulation materials has helped it stay competitive. Kingspan’s approach reflects a balance between meeting strict building codes and addressing customer needs for cost savings and sustainability in construction.

Rockwool International A/S stands out with its strong focus on stone wool insulation, which is valued for fire resistance, acoustic performance, and environmental durability. In 2024, the company’s products continue to be recognized as reliable solutions across varied climates, reinforcing its long-term positioning in the market.

Top Key Players in the Market

- Saint-Gobain S.A.

- Kingspan Group plc

- Rockwool International A/S

- Owens Corning

- Johns Manville Corporation

- Knauf Insulation

- BASF SE

- Huntsman Corporation

- Dow Inc.

Recent Developments

- In December 2024, Rockwool approved over USD 100 million investment for a new production line in Mississippi to produce industrial insulation products, incorporating their WR-Tech™ (water repellency) and CR-Tech™ (corrosion resistant) technologies

- In February 2024, Kingspan signed agreements to acquire the stone wool insulation business and assets of Karl Bachl Kunststoffverarbeitung GmbH & Co. KG (Bachl), expanding its insulation portfolio.

Report Scope

Report Features Description Market Value (2024) USD 35.7 Billion Forecast Revenue (2034) USD 59.8 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Insulation Type (Fiberglass, Foam, Mineral Wool, Cellulose, Others), By Application (Residential, Commercial, Industrial, Others), By End-User (New Construction, Retrofit) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Saint-Gobain S.A., Kingspan Group plc, Rockwool International A/S, Owens Corning, Johns Manville Corporation, Knauf Insulation, BASF SE, Huntsman Corporation, Dow Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Saint-Gobain S.A.

- Kingspan Group plc

- Rockwool International A/S

- Owens Corning

- Johns Manville Corporation

- Knauf Insulation

- BASF SE

- Huntsman Corporation

- Dow Inc.