Global UV Curable Resin Market Size, Share Analysis Report By Resin Type (Acrylated Epoxies, Acrylated Polysters, Acrylated Urethanes, Acrylated Silicones, Others), By Composition ( Monomers, Photoinitiators, Oligomers, Coinitiators, Others), By Application (Coating, Printing, Adhesives and Sealants, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153821

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

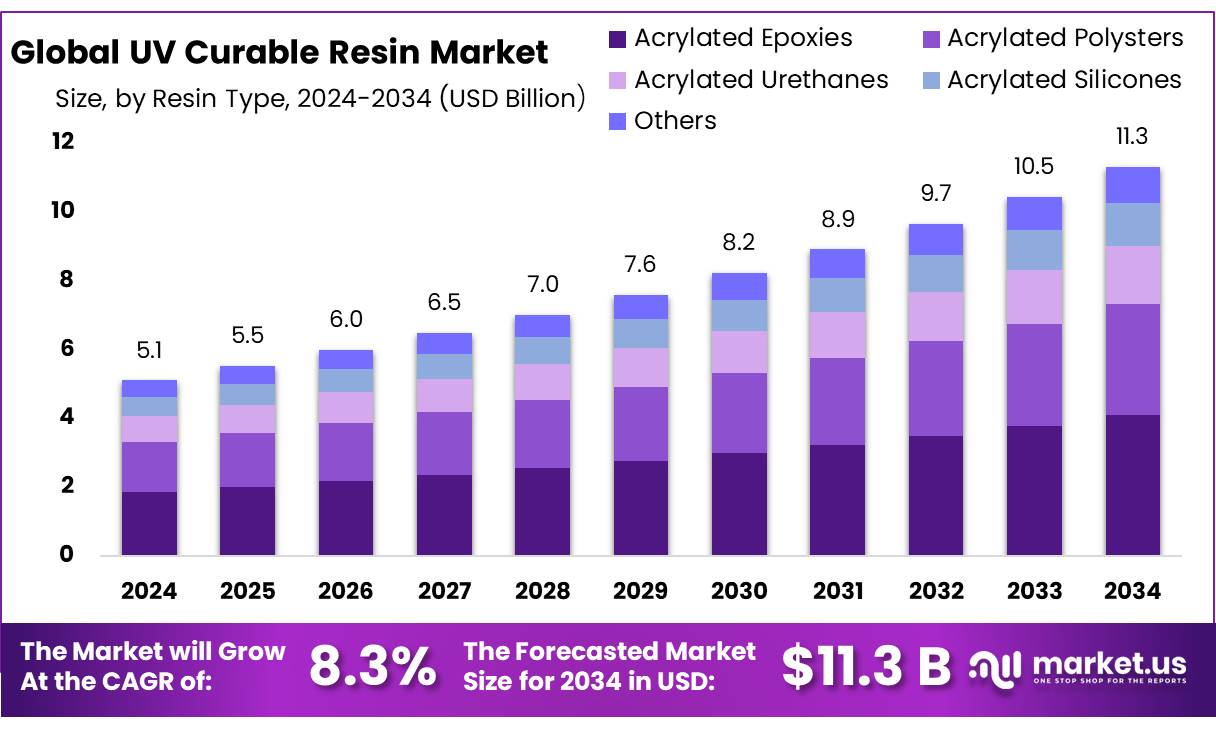

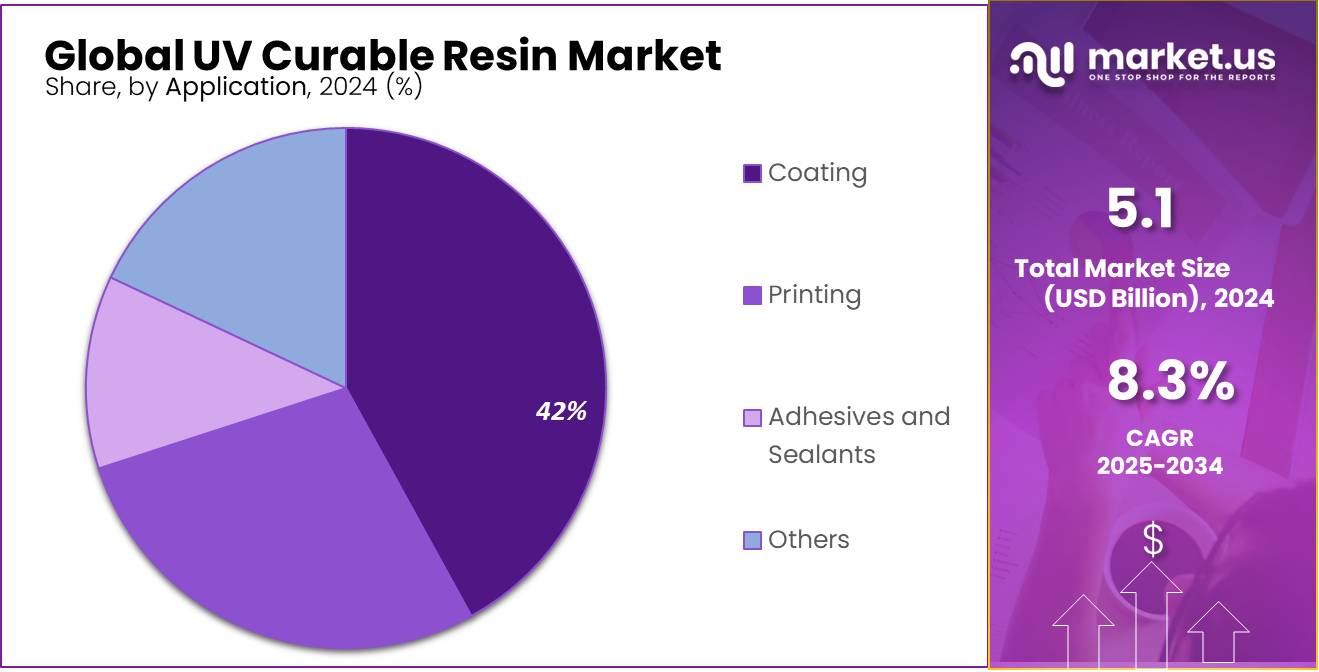

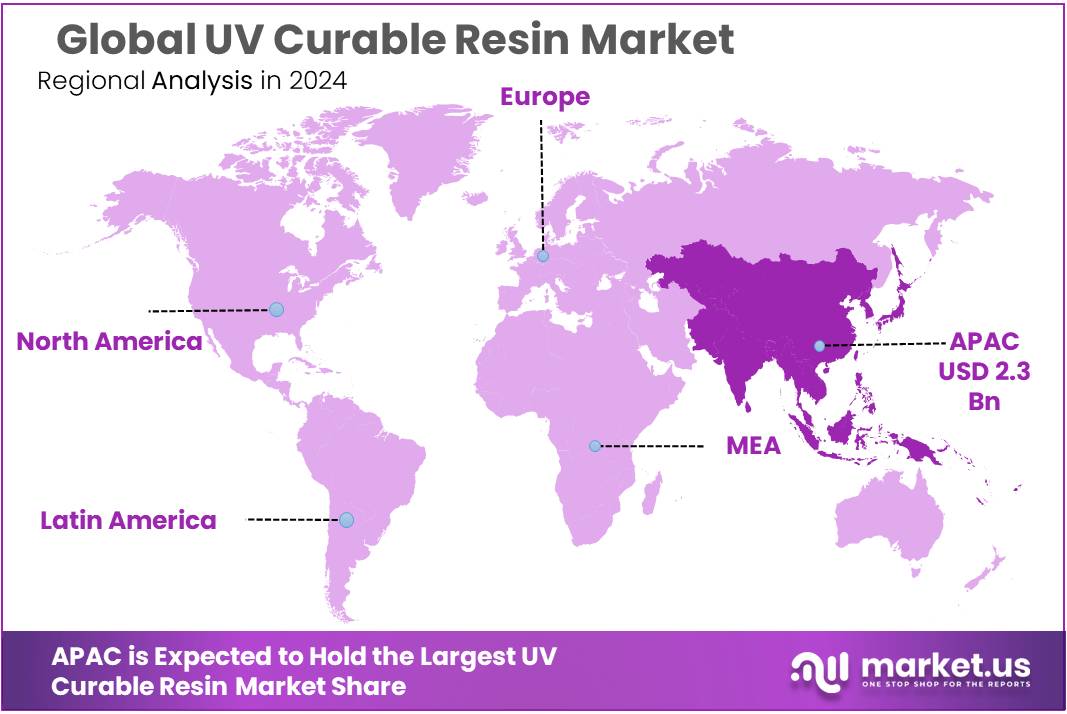

The Global UV Curable Resin Market size is expected to be worth around USD 11.3 Billion by 2034, from USD 5.1 Billion in 2024, growing at a CAGR of 8.3% during the forecast period from 2025 to 2034. In 2024, Asia Pacific (APAC) held a dominant market position, capturing more than a 45.9% share, holding USD 2.3 Billion revenue.

UV curable resin concentrates are formulations comprising pre‑polymers, monomers, photoinitiators and additives, which polymerise rapidly upon exposure to ultraviolet light. These systems are used extensively in coatings, adhesives, inks and 3D printing applications. The technology enables near‑100 % reactive solids, minimising volatile organic compound (VOC) emissions and energy consumption compared to solvent‑borne or thermal curing alternatives.

Several factors are propelling the demand for UV curable resin concentrates. Stringent environmental regulations are encouraging industries to adopt low volatile organic compound (VOC) emitting materials.

For instance, the U.S. Environmental Protection Agency (EPA) has implemented regulations that have led to a significant decrease in the usage of solvent-based resins in favor of UV-curable alternatives. Additionally, the growing consumer preference for eco-friendly products and the need for faster production times are further driving the adoption of UV curable resins.

At the national level, India’s chemical industry is a strategic priority: as of 2022 it contributed approximately 7% of GDP, with over 80,000 commercial chemicals produced and over five million employed. Under the Make in India and Aatmanirbhar Bharat programs, investment of around INR 8 lakh crore (~USD 100 billion) is targeted in the chemicals and petrochemicals sector by 2025. The Market Access Initiative was revised to support smaller chemical players in global export markets.

Key Takeaways

- UV Curable Resin Market size is expected to be worth around USD 11.3 Billion by 2034, from USD 5.1 Billion in 2024, growing at a CAGR of 8.3%.

- Acrylated Epoxies held a dominant market position in the UV curable resin market, capturing more than a 36.2% share.

- Monomers held a dominant market position in the UV curable resin market, capturing more than a 48.9% share.

- Coating held a dominant market position in the UV curable resin market, capturing more than a 42.6% share.

- Asia Pacific (APAC) region held a commanding position in the global UV curable resin market, capturing more than 45.9% of the total market share, equivalent to a market value of approximately USD 2.3 billion.

By Resin Type Analysis

Acrylated Epoxies lead with 36.2% share due to strong adhesion and excellent chemical resistance.

In 2024, Acrylated Epoxies held a dominant market position in the UV curable resin market, capturing more than a 36.2% share. This segment’s leadership is mainly driven by its high-performance characteristics such as strong adhesion, superior mechanical strength, and excellent chemical and heat resistance. These resins are widely used in coatings for electronics, wood, automotive, and industrial components where durability and precision are essential.

Acrylated epoxies cure rapidly under UV light, making them suitable for fast-paced production lines in advanced manufacturing facilities. Their ability to form tough, cross-linked films has made them the preferred choice in demanding end-use industries. The consistent demand from electrical and electronics manufacturing, especially for printed circuit boards and protective coatings, has further contributed to the segment’s strong hold in the market. The segment is expected to maintain its leading position through 2025, supported by expanding applications and compatibility with low-VOC environmental standards.

By Composition Analysis

Monomers dominate with 48.9% share due to their vital role in formulation flexibility and fast curing.

In 2024, Monomers held a dominant market position in the UV curable resin market, capturing more than a 48.9% share. Monomers serve as essential reactive diluents in UV formulations, allowing precise control over viscosity, cure speed, and mechanical performance. Their flexibility in tailoring end-product characteristics—such as hardness, adhesion, and surface finish—makes them a key component across coatings, inks, and adhesives. Monomers are particularly favored in applications requiring fast UV curing, including packaging, electronics, and automotive coatings, where production efficiency and surface quality are critical.

The segment’s high share also reflects rising demand for low-VOC materials and customized resin blends. With industries increasingly shifting to sustainable and energy-efficient processes, the role of monomers in supporting low-temperature curing and high throughput remains crucial. This strong demand is expected to continue in 2025, as formulators prioritize resin systems that offer both performance and environmental compliance.

By Application Analysis

Coating leads the way with 42.6% share owing to its widespread use in wood, automotive, and electronics finishes.

In 2024, Coating held a dominant market position in the UV curable resin market, capturing more than a 42.6% share. This strong presence is largely due to the increasing use of UV coatings in various end-use industries such as wood processing, automotive refinishing, electronics, and metal finishing. UV-curable coatings are preferred for their fast curing, durability, and eco-friendly properties, including low volatile organic compound (VOC) emissions. In the wood industry, they offer high gloss and wear resistance for flooring and furniture. In electronics, these coatings protect delicate components while enhancing performance.

Automotive applications benefit from UV coatings due to their resistance to scratching and chemicals. The ability to cure instantly under UV light significantly reduces processing time and energy usage, making it ideal for high-speed manufacturing. As sustainability becomes a global priority, industries are adopting UV coatings to meet stricter environmental standards without compromising quality. This trend is expected to hold steady through 2025, further reinforcing the coating segment’s leading role in the UV curable resin market.

Key Market Segments

By Resin Type

- Acrylated Epoxies

- Acrylated Polysters

- Acrylated Urethanes

- Acrylated Silicones

- Others

By Composition

- Monomers

- Photoinitiators

- Oligomers

- Coinitiators

- Others

By Application

- Coating

- Printing

- Adhesives and Sealants

- Others

Emerging Trends

Emergence of Bio-Based UV Curable Resins

A notable recent trend in the UV curable resin market is the development and adoption of bio-based formulations. These resins are derived from renewable resources, offering a sustainable alternative to traditional petroleum-based options. The shift towards bio-based resins is driven by increasing environmental concerns and stringent regulations aimed at reducing carbon footprints and volatile organic compound (VOC) emissions.

For instance, in November 2024, Arkema introduced bio-based UV resins and low-carbon polyamides as part of its sustainability initiatives. These innovations are designed to enhance material performance while reducing environmental impact. Such advancements reflect a broader industry trend towards eco-friendly solutions in resin technology.

The adoption of bio-based UV curable resins is particularly significant in industries like food packaging, where safety and environmental considerations are paramount. These resins offer improved performance characteristics such as enhanced durability, scratch resistance, and chemical resistance, making them suitable for various applications, including food packaging.

Government initiatives worldwide are also supporting this shift. For example, the European Union’s REACH regulation and the Clean Air Act in the United States are pushing industries towards adopting low-VOC or VOC-free coatings. These regulatory frameworks are expected to further accelerate the demand for bio-based UV curable resins.

Drivers

Growth in Demand for Eco-Friendly Coatings

The growing demand for sustainable and environmentally friendly products has significantly influenced the adoption of UV curable resins in various industries. UV curable resins are known for their low environmental impact because they cure quickly under UV light, reducing the need for solvents and other harmful chemicals. This shift aligns with increasing regulations aimed at minimizing environmental pollution and promoting sustainability.

A key factor driving this trend is the tightening of environmental regulations in several regions. For instance, the European Union’s “EU Green Deal” and the U.S. Environmental Protection Agency (EPA) have imposed stricter environmental standards, encouraging industries to adopt low-VOC (Volatile Organic Compounds) and solvent-free solutions. As of 2023, the EU’s directive on Volatile Organic Compounds, specifically for coatings and paints, mandates significant reductions in solvent usage. This has led to the adoption of more eco-friendly materials like UV curable resins, which release minimal pollutants compared to conventional solvent-based coatings.

The food packaging industry has also embraced these resins due to their ability to produce durable, non-toxic coatings that meet regulatory standards for food safety. For instance, UV-curable coatings are increasingly being used in food packaging materials, ensuring compliance with both sustainability goals and health regulations. According to the American Coatings Association, UV curing technology has grown by 10% annually over the past five years, highlighting its growing presence across sectors such as food packaging and printing.

Restraints

High Cost of Raw Materials

One of the major factors restraining the growth of the UV curable resin market is the high cost of raw materials used in their production. The primary ingredients for UV curable resins, including acrylates, methacrylates, and other specialty chemicals, are often more expensive compared to traditional solvent-based materials. This price difference creates a financial barrier for companies, particularly small and medium-sized businesses, that are hesitant to make the switch to more sustainable options due to the higher upfront costs.

The global supply chain disruptions, particularly during the COVID-19 pandemic, have exacerbated the situation. The cost of key chemicals used in the production of UV curable resins has seen substantial increases. For instance, in 2021, a shortage of raw materials like bisphenol A (BPA) led to a 30-40% price hike in epoxy resins and other essential components used in UV curable coatings. This resulted in higher production costs for manufacturers, which, in turn, affected the price of finished products, making them less competitive compared to cheaper alternatives.

In the food packaging industry, while UV curable coatings are gaining traction due to their eco-friendly properties, the initial cost barriers remain significant. Many food manufacturers, especially in developing economies, continue to rely on conventional coatings, which are more affordable but less sustainable. According to the Food and Agriculture Organization (FAO), over 60% of food packaging in emerging markets still uses traditional coatings due to cost concerns, even though regulatory pressure to adopt sustainable packaging is increasing. Governments are pushing for eco-friendly packaging, but the cost factor remains a critical challenge to rapid adoption.

Opportunity

Expansion in Food Packaging and Labeling

One significant growth opportunity for the UV curable resin market lies in the expanding demand for sustainable food packaging and labeling solutions. As global awareness of environmental concerns continues to rise, consumers are increasingly seeking products with eco-friendly packaging. In response to this demand, many food and beverage companies are shifting towards more sustainable packaging options, and UV curable resins are well-positioned to meet this need due to their low environmental impact.

UV curable resins are gaining popularity in food packaging because they offer a range of benefits, such as faster curing times, lower VOC emissions, and the ability to create durable, high-quality coatings. These resins are especially valued in the production of labels, printing, and coatings used in food packaging, as they are both effective and safe for food contact materials.

Governments around the world, such as the European Union and the United States, are also implementing stricter regulations on food packaging to reduce plastic waste and encourage recycling. For example, the EU’s “Circular Economy Action Plan” aims to make packaging more sustainable, and many regulations now require food packaging to meet higher sustainability standards. As a result, food manufacturers are increasingly adopting UV curable resins to comply with these regulations and meet consumer expectations for environmentally responsible products.

According to the Food and Agriculture Organization (FAO), the global market for sustainable food packaging is expected to grow by over 8% annually between 2024 and 2030, driven by both regulatory pressures and changing consumer preferences. This shift is encouraging more food manufacturers to explore UV curable resins as an alternative to traditional, less sustainable packaging materials. The cost of UV resins is also expected to decrease as production methods improve, making them more accessible to a broader range of companies.

Regional Insights

Asia Pacific dominates the UV curable resin market with 45.9% share, reaching USD 2.3 billion in 2024.

In 2024, the Asia Pacific (APAC) region held a commanding position in the global UV curable resin market, capturing more than 45.9% of the total market share, equivalent to a market value of approximately USD 2.3 billion. This dominant status can be attributed to the region’s robust industrial base, particularly in China, India, Japan, and South Korea, which are major manufacturing hubs for electronics, automotive components, furniture, and packaging materials. The widespread adoption of UV curable technologies in these industries is driven by the growing need for high-performance, environmentally friendly coatings, inks, and adhesives that offer faster curing times and reduced energy consumption.

China continues to lead the regional demand, supported by its expansive electronics and furniture manufacturing industries, while India is witnessing rapid growth due to increasing investments in infrastructure and automotive production. In Japan and South Korea, advanced technological integration in precision electronics and high-end packaging applications is fueling the demand for UV-curable systems. Additionally, strong government regulations aimed at reducing VOC emissions are encouraging the shift from solvent-based systems to UV-based alternatives, further accelerating market penetration across the region.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Alberdingk Boley GmbH is a leading supplier of water-based and UV-curable resins, serving industries such as coatings, adhesives, and inks. The company specializes in environmentally friendly resin technologies, including polyurethane dispersions and acrylates, with a focus on sustainability and performance. Its UV-curable product line supports low-VOC and high-durability applications across Europe and Asia. Continuous R&D efforts have positioned the company as a preferred partner in the transition toward greener and faster-curing industrial solutions.

IGM Resins, backed by private equity firm Astorg, specializes in developing and supplying UV-curable materials including photoinitiators, oligomers, and monomers. The company serves markets like coatings, adhesives, and 3D printing, with a focus on energy-curable technologies. IGM operates manufacturing and application labs in the U.S., Europe, and Asia to support global clients. Its innovation-driven approach emphasizes regulatory compliance and performance, strengthening its position in sustainable UV-curing systems for various industrial applications.

Arkema Group operates as a major chemicals and advanced materials company, offering UV-curable resins through its Sartomer brand. Its product range includes specialty acrylates and methacrylates used in high-performance coatings, electronics, 3D printing, and adhesives. Arkema invests heavily in R&D to promote sustainable chemistry and energy-efficient technologies. With manufacturing sites in Europe, the U.S., and Asia, the group supports global demand for innovative, fast-curing, and environmentally responsible resin formulations.

Top Key Players Outlook

- Alberdingk Boley GmbH

- Allnex Netherlands B.V.

- Arkema Group

- Astorg (IGM Resins)

- BASF SE

- Covestro AG

- DIC Corporation

- IGM Resins

- Jiangsu Litian Technology Co., Ltd.

- Mitsubishi Chemical Europe GmbH (Nippon-Gohsei)

- Miwon Specialty Chemical Co., Ltd.

- Resonac Holdings Corporation

- SOLTECH LTD

- TOAGOSEI CO., LTD.

- Wanhua Chemical Group Co., Ltd.

Recent Industry Developments

In 2024 IGM Resins (backed by Astorg), operated with around 821 employees across production and R&D sites in Italy, the U.S., and China, serving over 1,400 formulators in more than 25 countries.

Arkema Group stands as a major global force in the UV‑curable resin market through its Sartomer brand, which delivers specialty acrylates and methacrylates for high-performance coatings, adhesives, printing inks, electronics, and 3D‑printing applications. In 2024, the group reported revenue of €9.5 billion, supported by 21,150 employees and operations in 55 countries.

Report Scope

Report Features Description Market Value (2024) USD 5.1 Bn Forecast Revenue (2034) USD 11.3 Bn CAGR (2025-2034) 8.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Resin Type (Acrylated Epoxies, Acrylated Polysters, Acrylated Urethanes, Acrylated Silicones, Others), By Composition ( Monomers, Photoinitiators, Oligomers, Coinitiators, Others), By Application (Coating, Printing, Adhesives and Sealants, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alberdingk Boley GmbH, Allnex Netherlands B.V., Arkema Group, Astorg (IGM Resins), BASF SE, Covestro AG, DIC Corporation, IGM Resins, Jiangsu Litian Technology Co., Ltd., Mitsubishi Chemical Europe GmbH (Nippon-Gohsei), Miwon Specialty Chemical Co., Ltd., Resonac Holdings Corporation, SOLTECH LTD, TOAGOSEI CO., LTD., Wanhua Chemical Group Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alberdingk Boley GmbH

- Allnex Netherlands B.V.

- Arkema Group

- Astorg (IGM Resins)

- BASF SE

- Covestro AG

- DIC Corporation

- IGM Resins

- Jiangsu Litian Technology Co., Ltd.

- Mitsubishi Chemical Europe GmbH (Nippon-Gohsei)

- Miwon Specialty Chemical Co., Ltd.

- Resonac Holdings Corporation

- SOLTECH LTD

- TOAGOSEI CO., LTD.

- Wanhua Chemical Group Co., Ltd.