Global Uv Curable Coatings Market Size, Share, And Business Benefits By Composition (Oligomers, Monomers, Photoinitiators, PU Dispersions, Others),By Type (Wood Coatings, Plastic Coatings, Over Print Varnish Display Coatings, Conformal Coatings Paper Coatings, Others), By End use Industry (Industrial Coatings, Electronics, Graphic Arts, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 160793

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

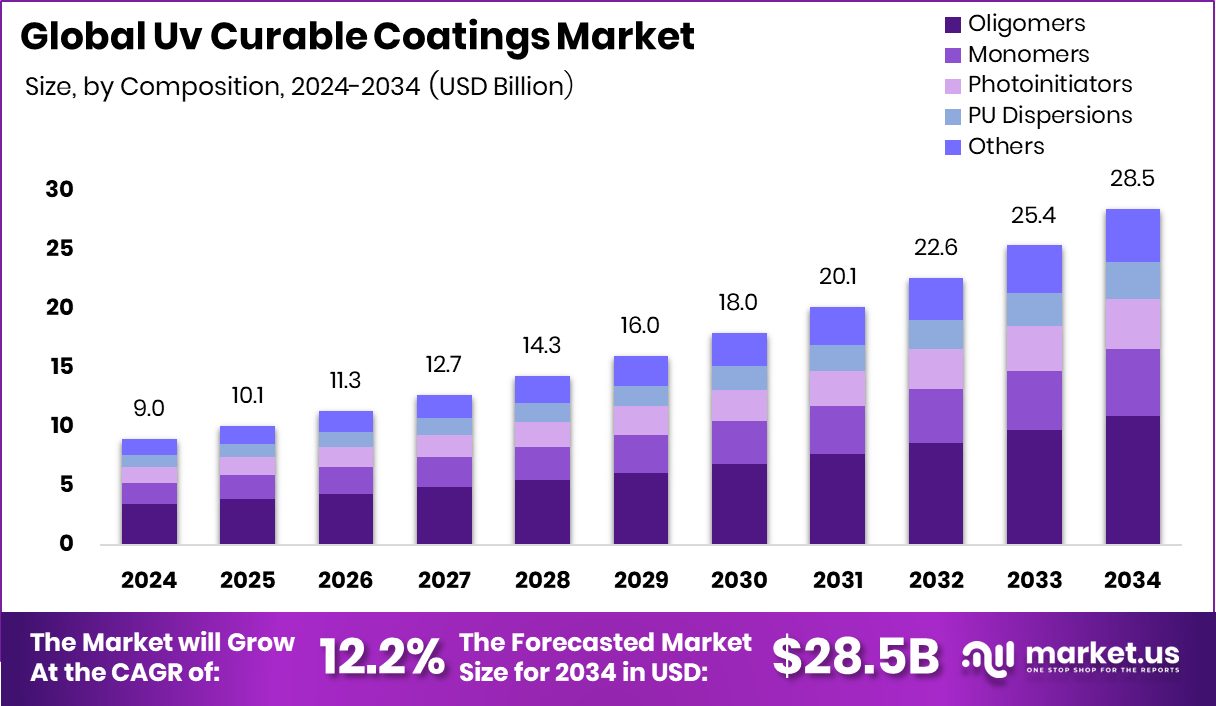

The Global Uv Curable Coatings Market is expected to be worth around USD 28.5 billion by 2034, up from USD 9.0 billion in 2024, and is projected to grow at a CAGR of 12.2% from 2025 to 2034. Asia Pacific 45.90% expanding automotive, electronics, and furniture sectors continue to boost UV curable coatings consumption regionally.

UV curable coatings are specialized surface finishes that harden or “cure” when exposed to ultraviolet light. Instead of relying on solvents evaporating, these coatings undergo a rapid photochemical reaction that forms cross-linked polymer chains. Because the process is fast, energy efficient, and low in volatile organic compounds (VOCs), UV curable coatings are increasingly used in applications such as wood finishes, automotive parts, electronics, graphic arts, and packaging.

The UV curable coatings market refers to the global industry ecosystem around producing, formulating, supplying, and using these UV-curing materials and systems. It includes manufacturers of resins, monomers, photoinitiators, coating formulators, UV equipment providers, and the end-user sectors (like automotive, furniture, electronics) that adopt these coatings. The market is expanding as demand rises for more efficient, environmentally friendly finishing solutions in many industries.

One key growth driver is the regulatory push for low-VOC and sustainable materials. Industries are tasked with reducing emissions and environmental footprint, and UV curable coatings help meet those goals. Technological progress in photoinitiators, resin chemistries, and UV LED curing systems has improved performance and lowered cost, making these coatings more attractive. Also, the shift toward automation and faster production cycles in manufacturing favors coatings that cure instantly, reducing downtime.

There is an opportunity in markets that remain underpenetrated, such as infrastructure, metal coatings, or emerging markets where traditional coatings dominate. Innovations in UV LED technology, new formulations that cure deeper or on difficult substrates, or hybrid systems combining UV cure with other chemistries can unlock new uses. Also, funding and capital investments in related industries may help expand uptake.

For instance, Indigo Paints plans to raise ₹1,000 crore, which could fuel advanced product development; Birla Opus is investing heavily (85 % of its capex) in a growth push in the paints sector; and an Alabama company securing a US$180,000 grant toward a planned US$115 million sawmill shows how regional industrial investment could broaden raw material or downstream demand ecosystems.

Key Takeaways

- The Global Uv Curable Coatings Market is expected to be worth around USD 28.5 billion by 2034, up from USD 9.0 billion in 2024, and is projected to grow at a CAGR of 12.2% from 2025 to 2034.

- In 2024, oligomers held a 38.2% share in the UV Curable Coatings Market, driving formulation efficiency.

- Wood coatings captured a 31.3% share in the UV Curable Coatings Market due to rising furniture demand.

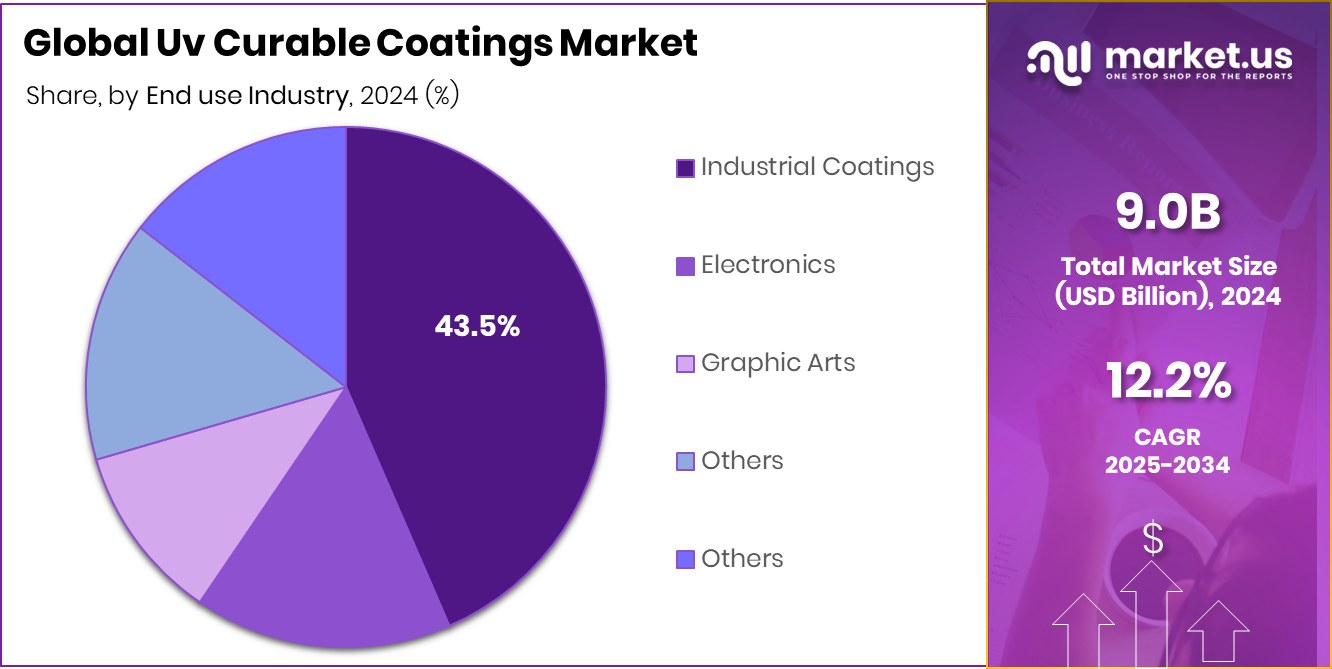

- Industrial coatings dominated with a 43.5% share in the UV Curable Coatings Market, driven by performance needs.

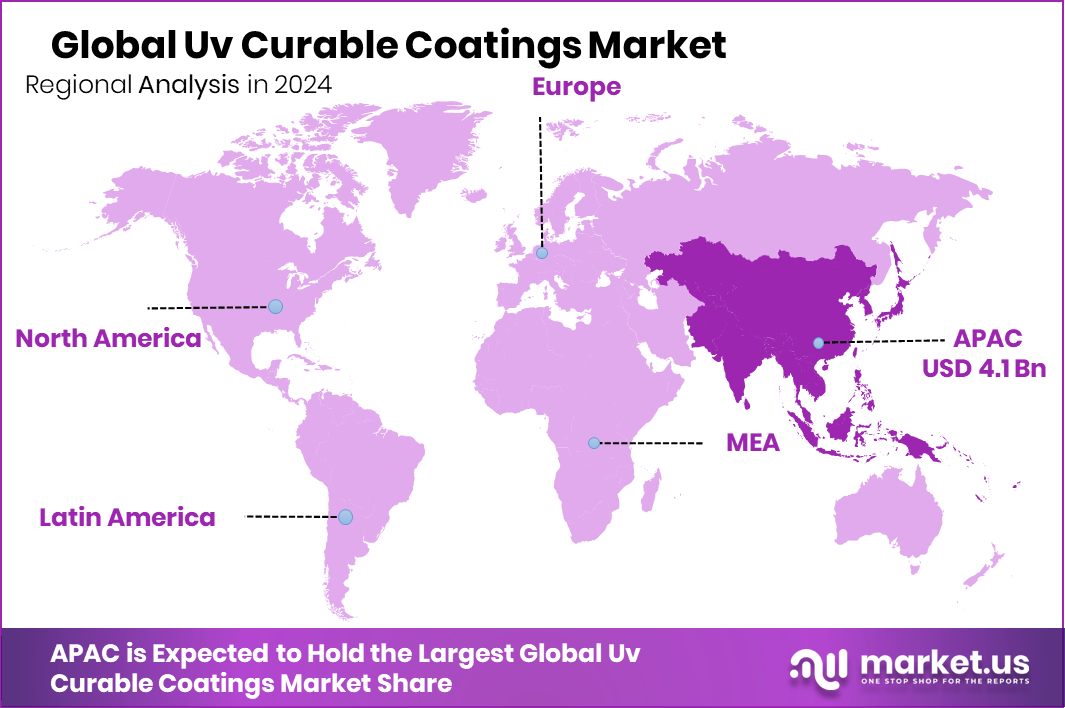

- The Asia Pacific’s 45.90% share dominance comes from rapid industrial growth and increasing eco-friendly coating demand.

By Composition Analysis

In 2024, oligomers dominated the UV Curable Coatings Market segment.

In 2024, Oligomers held a dominant market position in the By Composition segment of the UV Curable Coatings Market, with a 38.2% share. Oligomers serve as the primary building blocks that determine the mechanical strength, chemical resistance, and adhesion properties of UV coatings. Their ability to enhance flexibility, hardness, and durability makes them essential in achieving high-performance finishes across various substrates.

The strong adoption of oligomers is attributed to their rapid curing characteristics and compatibility with advanced UV curing technologies. Moreover, their balanced viscosity and excellent film-forming properties enable efficient application in industries such as wood coatings, automotive, and electronics, ensuring consistent surface quality and productivity in manufacturing operations.

By Type Analysis

Wood coatings held a 31.3% share in the UV Curable Coatings Market.

In 2024, Wood Coatings held a dominant market position in the By Type segment of the UV Curable Coatings Market, with a 31.3% share. The strong preference for UV-cured wood coatings stems from their quick-drying ability, superior surface hardness, and long-lasting finish. These coatings provide excellent resistance to scratches, stains, and chemicals, which makes them highly suitable for furniture, flooring, and cabinetry applications.

The rising focus on environmentally friendly and low-VOC solutions further supports their adoption, as UV curable systems emit minimal pollutants during production. Their instant curing under ultraviolet light enables faster processing and reduced energy use, making them an efficient choice for modern wood finishing operations seeking higher quality and productivity.

By End use Industry Analysis

Industrial coatings accounted for a 43.5% share in the UV Curable Coatings Market.

In 2024, Industrial Coatings held a dominant market position in the By End Use Industry segment of the UV Curable Coatings Market, with a 43.5% share. The dominance of this segment is driven by the growing use of UV-cured coatings in manufacturing environments where speed, durability, and quality are critical. These coatings offer superior adhesion, chemical resistance, and mechanical strength, making them ideal for metal, plastic, and composite surfaces used in industrial applications.

Their fast-curing capability helps reduce production time and energy consumption, improving overall efficiency. Additionally, the eco-friendly nature of UV curable coatings aligns with stricter environmental standards, supporting their widespread adoption in industrial finishing and protective coating processes.

Key Market Segments

By Composition

- Oligomers

- Monomers

- Photoinitiators

- PU Dispersions

- Others

By Type

- Wood Coatings

- Plastic Coatings

- Over Print Varnish Display Coatings

- Conformal Coatings Paper Coatings

- Others

By End use Industry

- Industrial Coatings

- Electronics

- Graphic Arts

- Others

Driving Factors

Growing Shift Toward Eco-Friendly and Fast-Curing Solutions

A major driving factor for the UV Curable Coatings Market is the growing shift toward eco-friendly, fast-curing coating technologies. Industries are increasingly adopting UV-curable coatings as they emit very low or no volatile organic compounds (VOCs), helping manufacturers meet global environmental regulations. The instant curing process under ultraviolet light also enhances productivity and reduces energy use, offering both economic and environmental benefits.

These coatings deliver durable finishes, improved surface resistance, and consistent quality, making them suitable for wood, metal, and plastic applications. Supporting this sustainability trend, Xampla raised $14 million to scale its plant-based alternatives to single-use plastics, reinforcing the global move toward greener materials and encouraging wider adoption of UV-curable solutions.

Restraining Factors

High Setup Cost and Limited Material Compatibility

One key restraining factor for the UV Curable Coatings Market is the high setup cost associated with UV curing systems and the limited compatibility of coatings with certain substrates. The requirement for specialized UV lamps, curing chambers, and controlled environments increases initial investment, particularly for small and medium-scale manufacturers. Additionally, not all materials, such as heat-sensitive plastics or thick coatings, can be efficiently cured using UV light, which restricts the application scope.

In some cases, coatings may require precise formulations or multiple curing steps to achieve the desired finish. These technical and financial challenges slow down adoption rates, especially in developing regions where capital constraints and technological awareness remain major barriers to market expansion.

Growth Opportunity

Expansion in 3D Printing and Additive Manufacturing Applications

A major growth opportunity for the UV Curable Coatings Market lies in their expanding use within 3D printing and additive manufacturing. UV-curable materials are increasingly preferred for creating precise, durable, and high-quality surface finishes on printed components. Their ability to cure instantly under UV light ensures smooth textures, enhanced strength, and minimal waste during production.

As industries such as automotive, healthcare, and electronics adopt 3D printing for customized parts and prototypes, the demand for UV-curable coatings continues to rise. These coatings also offer better design flexibility and compatibility with new printing technologies. The growing digital manufacturing trend worldwide provides a strong platform for UV-curable coatings to capture emerging industrial and creative applications.

Latest Trends

Rising Adoption of Bio-Based and Sustainable Coating Materials

One of the latest trends in the UV Curable Coatings Market is the growing adoption of bio-based and sustainable coating materials. Manufacturers are focusing on developing coatings derived from renewable and biodegradable sources to reduce dependence on petroleum-based resins. This shift supports global sustainability goals and helps meet stricter environmental regulations.

Bio-based UV curable coatings also offer strong adhesion, low emissions, and excellent curing efficiency, making them ideal for industries aiming to reduce their carbon footprint. Supporting this trend, a £10.2 million investment was made in green materials innovation company Xampla, which develops natural alternatives to traditional plastics. Such initiatives highlight the market’s move toward eco-friendly innovations and long-term sustainable growth.

Regional Analysis

In 2024, the Asia Pacific held a 45.90% share, valued at USD 4.1 billion.

In 2024, Asia Pacific dominated the global UV Curable Coatings Market, capturing a 45.90% share valued at USD 4.1 billion. The region’s leadership is driven by rapid industrialization, strong manufacturing growth, and expanding end-use sectors such as automotive, electronics, and furniture. Countries like China, Japan, South Korea, and India are leading adopters of UV-curable technologies due to their large production bases and increasing demand for sustainable, high-performance coatings.

North America follows with steady adoption supported by advanced manufacturing infrastructure and a growing shift toward low-VOC materials in coatings applications. Europe maintains a strong position backed by strict environmental regulations promoting eco-friendly coating technologies.

Meanwhile, the Middle East & Africa and Latin America show emerging potential, driven by industrial expansion and ongoing investment in infrastructure and manufacturing facilities. As the Asia Pacific continues to strengthen its industrial base and focus on sustainable technologies, it remains the most influential region in shaping the global UV Curable Coatings Market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Royal DSM N.V., traditionally recognized for its specialty materials and innovation focus, likely leveraged its expertise in advanced resin chemistries and sustainable formulations to maintain competitive standing. Its strength in high-performance materials and emphasis on R&D would help it stay relevant in a rapidly evolving UV coatings landscape.

PPG Industries Inc. remains a strong force through its broad coatings portfolio and industrial customer base. Its global reach and capacity to integrate UV curable formulations into existing coating lines give it an advantage. By capitalizing on demand for fast, low-VOC finishes across automotive, electronics, and industrial segments, PPG would have the flexibility to scale and adapt.

Akzo Nobel N.V. brings deep domain experience in coatings and decorative finishes, allowing it to tailor UV curable systems for diverse substrates and end-use needs. Its existing infrastructure and technological capabilities enable it to refine photoinitiator systems, coating additives, and curing processes to meet tighter environmental standards and performance demands.

Top Key Players in the Market

- Royal DSM N.V.

- PPG Industries Inc.

- Akzo Nobel N.V.

- BASF SE

- The Sherwin-Williams Company

- Axalta Coatings System

- Dymax Corporation

- Eternal Chemical Co. Ltd.

- DIC Corporation

- Dymax Corp.

Recent Developments

- In July 2024, PPG launched its DuraNEXT™ portfolio of energy-curable coatings for coiled metal, which includes UV and electron beam (EB) curable backers, primers, basecoats, and clearcoats. These coatings cure in seconds at ambient temperatures and are designed to improve energy efficiency and speed in metal coil coating processes.

- In May 2024, AkzoNobel introduced a new UV Putty for spot-size vehicle repairs. The product cures in under two minutes using a UV-A lamp and is engineered for quick and efficient patching of small dents, chips, or pinholes on substrates like steel, aluminium, plastics, and existing finishes.

Report Scope

Report Features Description Market Value (2024) USD 9.0 Billion Forecast Revenue (2034) USD 28.5 Billion CAGR (2025-2034) 12.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Composition (Oligomers, Monomers, Photoinitiators, PU Dispersions, Others), By Type (Wood Coatings, Plastic Coatings, Over Print Varnish Display Coatings, Conformal Coatings, Paper Coatings, Others), By End-use Industry (Industrial Coatings, Electronics, Graphic Arts, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Royal DSM N.V., PPG Industries Inc., Akzo Nobel N.V., BASF SE, The Sherwin-Williams Company, Axalta Coatings System, Dymax Corporation, Eternal Chemical Co. Ltd., DIC Corporation, Dymax Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Uv Curable Coatings MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Uv Curable Coatings MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Royal DSM N.V.

- PPG Industries Inc.

- Akzo Nobel N.V.

- BASF SE

- The Sherwin-Williams Company

- Axalta Coatings System

- Dymax Corporation

- Eternal Chemical Co. Ltd.

- DIC Corporation

- Dymax Corp.