Global Unsaturated Polyester Resin Market Size, Share, And Business Benefits By Form (Liquid Form, Powder Form), By Product (Orthopthalic, DCPD, Isophthalic, Others), By End-use (Building and Construction, Tanks and Pipes, Electrical, Marine, Transport, Artificial Stones, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 151921

- Number of Pages: 284

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

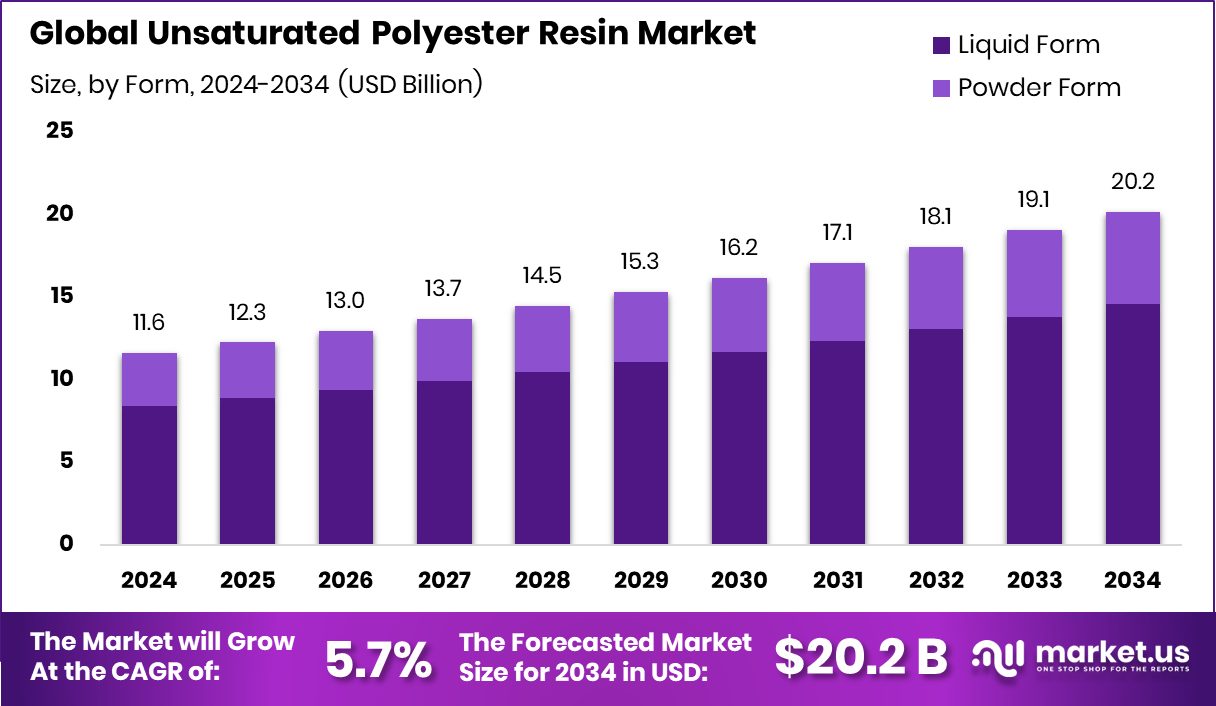

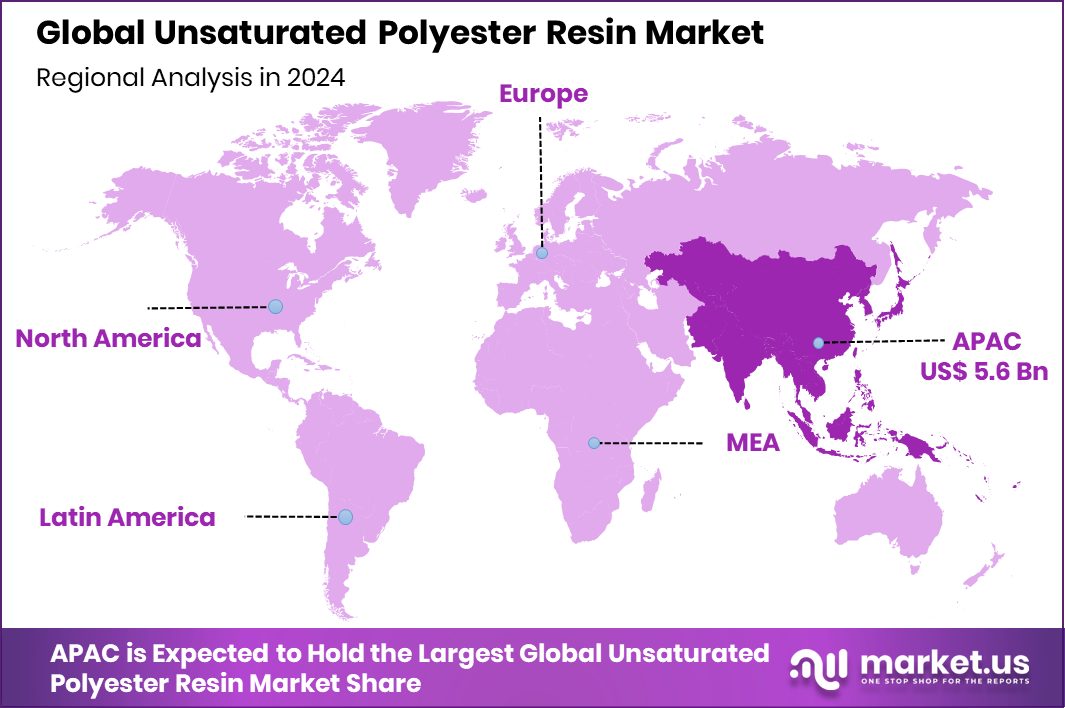

Global Unsaturated Polyester Resin Market is expected to be worth around USD 20.2 billion by 2034, up from USD 11.6 billion in 2024, and grow at a CAGR of 5.7% from 2025 to 2034. Asia-Pacific’s dominance reached 48.3%, valuing the unsaturated polyester resin market at USD 5.6 billion.

Unsaturated Polyester Resin (UPR) is a synthetic resin formed by the condensation of unsaturated acids and polyhydric alcohols. It is widely known for its versatility, durability, and ease of processing. UPR is often used in the production of fiberglass-reinforced plastics and castings due to its high mechanical strength and resistance to corrosion, water, and chemicals. The resin is typically cured through the addition of a catalyst, resulting in a hard, thermoset plastic.

The Unsaturated Polyester Resin market represents the global demand, production, and distribution of UPR products across multiple sectors. This market includes resins used in applications such as building panels, pipes, tanks, automotive parts, coatings, and electrical insulation. The growth of the UPR market is largely driven by increasing infrastructure development, lightweight material demand, and advancements in composite technology.

The demand for UPR is growing steadily due to its increasing use in the construction and transportation sectors. Rising infrastructure projects—such as bridges, commercial buildings, and water management systems—are creating a solid base for resin usage. Lightweight and durable properties of UPR make it a preferred choice over traditional metals or wood. MacroCycle Technologies, a developer of a novel polyethylene terephthalate (PET) and polyester textile scrap upcycling technology based in Cambridge, Massachusetts, has closed a $6.5 million seed financing round.

Strong demand from the automotive and marine industries is helping push UPR production levels. These sectors require corrosion-resistant and fuel-efficient materials, making UPR an ideal option. The resin’s adaptability for both reinforced and non-reinforced composites allows manufacturers to meet varied performance and design requirements, thus expanding its usage across multiple product categories.

Key Takeaways

- Global Unsaturated Polyester Resin Market is expected to be worth around USD 20.2 billion by 2034, up from USD 11.6 billion in 2024, and grow at a CAGR of 5.7% from 2025 to 2034.

- In the Unsaturated Polyester Resin Market, liquid form dominates, accounting for 72.4% of total usage.

- Orthophthalic resin holds a 41.9% share in the Unsaturated Polyester Resin Market due to its cost-efficiency.

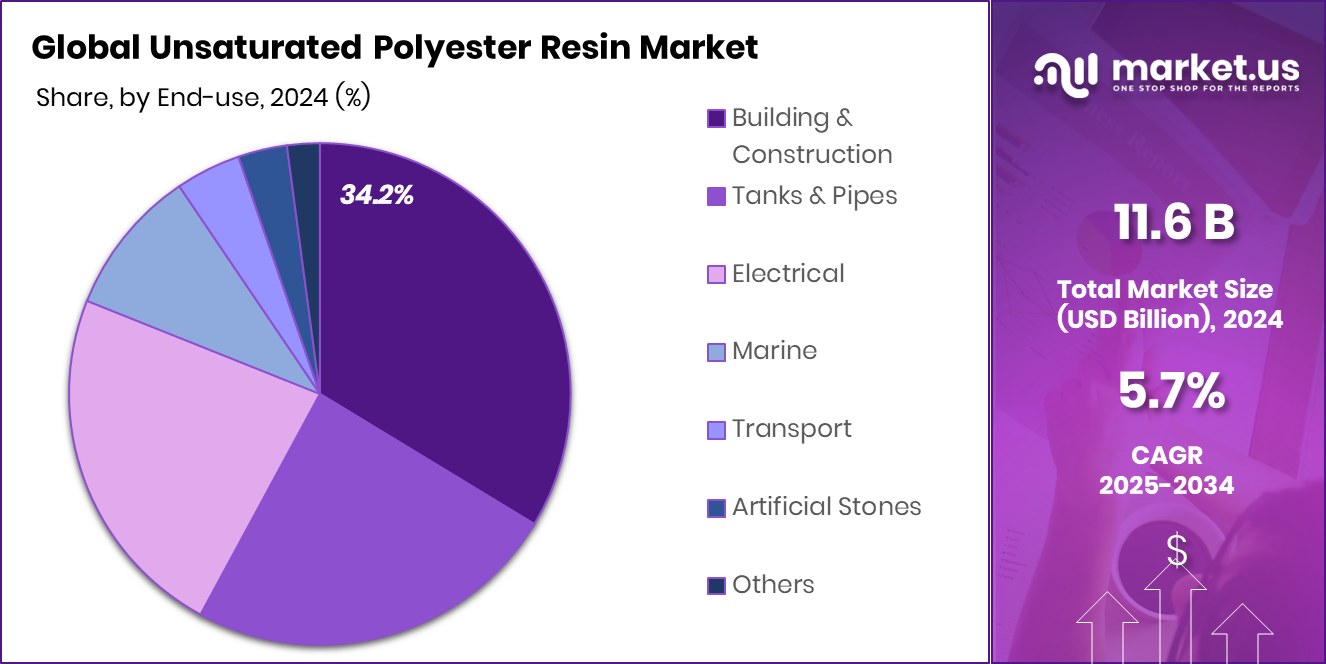

- The building and construction sector leads with a 34.2% market share in Unsaturated Polyester Resin applications.

- Strong industrial growth in Asia-Pacific supported its USD 5.6 billion resin market share.

By Form Analysis

Liquid form dominates the Unsaturated Polyester Resin Market with a 72.4% share globally.

In 2024, Liquid Form held a dominant market position in the By Form segment of the Unsaturated Polyester Resin Market, with a 72.4% share. This strong performance can be attributed to its ease of application, consistent viscosity, and superior adaptability across various end-use industries such as construction, marine, and automotive. Liquid UPR offers better handling and processing characteristics, making it suitable for complex moldings and large-scale composite structures.

Its ability to blend uniformly with reinforcing materials ensures enhanced mechanical strength and surface finish, which is essential for both structural and decorative components. Moreover, the liquid form allows for greater control over curing time and resin flow, which streamlines the manufacturing process and reduces material waste. Due to these benefits, manufacturers across sectors prefer liquid UPR for both reinforced and non-reinforced applications.

As a result, the dominance of liquid form is expected to remain steady, supported by rising demand from infrastructure and industrial fabrication activities in both developed and emerging markets. The widespread acceptance of liquid unsaturated polyester resin underlines its significance as a reliable and flexible material choice in modern composite manufacturing.

By Product Analysis

Orthophthalic resins lead the market, accounting for 41.9% of total usage.

In 2024, Orthophthalic held a dominant market position in the By Product segment of the Unsaturated Polyester Resin Market, with a 41.9% share. This dominance reflects the widespread preference for orthophthalic resins due to their cost-effectiveness, ease of processing, and balanced mechanical properties. Orthophthalic resins are commonly used in a broad range of general-purpose applications where moderate strength and chemical resistance are sufficient.

Their versatility allows them to be employed in products such as pipes, tanks, panels, and various molded components across construction and industrial sectors. The strong market share also indicates continued demand from manufacturers who seek reliable and affordable resin systems for both hand lay-up and spray-up fabrication techniques. These resins provide consistent performance, good adhesion with glass fiber, and predictable curing behavior, making them suitable for both small-scale and high-volume production environments.

Furthermore, their compatibility with fillers and pigments enhances design flexibility and surface finish, which are critical for end-user industries. The consistent 41.9% share held by orthophthalic resins highlights their role as the standard choice in many composite applications, particularly where a balance between performance and material cost is essential. This segment is expected to maintain its lead, driven by continued industrial use and infrastructure-related demand.

By End-use Analysis

Building and construction sector drives demand, contributing 34.2% to global resin consumption.

In 2024, Building and Construction held a dominant market position in the By End-use segment of the Unsaturated Polyester Resin Market, with a 34.2% share. This significant share highlights the increasing reliance on unsaturated polyester resin in infrastructure development and architectural applications. The material’s high durability, corrosion resistance, and lightweight nature make it well-suited for various construction elements such as wall panels, roofing sheets, cladding, and sanitary fixtures.

Additionally, UPR is extensively used in the production of pipes and tanks for water and wastewater systems due to its chemical resistance and structural strength. The growing number of commercial and residential construction projects, particularly in emerging urban areas, has contributed to the consistent demand for UPR in this sector. Its cost-efficiency and ease of molding into complex shapes further enhance its appeal in prefabricated structures and decorative components.

The ability of unsaturated polyester resin to perform in harsh environmental conditions while maintaining form and function supports its widespread use in building applications. The 34.2% market share underscores its critical role in modern construction practices, where material performance, longevity, and affordability are key considerations.

Key Market Segments

By Form

- Liquid Form

- Powder Form

By Product

- Orthopthalic

- DCPD

- Isophthalic

- Others

By End-use

- Building and Construction

- Tanks and Pipes

- Electrical

- Marine

- Transport

- Artificial Stones

- Others

Driving Factors

Growing Infrastructure Projects Fueling Resin Demand Worldwide

One of the main driving factors for the growth of the Unsaturated Polyester Resin (UPR) market is the rapid rise in global infrastructure development. Countries are investing heavily in building bridges, highways, pipelines, water tanks, and industrial structures, especially in emerging economies. UPR is widely used in construction materials because it is strong, lightweight, and resistant to corrosion and moisture.

These properties make it ideal for roofing sheets, panels, and water systems. As governments and private firms focus more on cost-effective and durable materials, the use of UPR continues to rise. This steady increase in construction activity, supported by urbanization and population growth, is creating strong and lasting demand for unsaturated polyester resin across many regions.

Restraining Factors

Environmental Concerns Related to Styrene Emissions Rise

A key restraining factor for the Unsaturated Polyester Resin (UPR) market is the environmental concern surrounding styrene emissions. Styrene, a major component used in UPR production, is classified as a volatile organic compound (VOC) and is known to release harmful fumes during manufacturing and curing. These emissions can affect air quality and pose health risks to workers if not properly managed.

Due to this, environmental agencies in several countries have imposed strict regulations on styrene handling and emissions. These rules can increase production costs and require additional safety systems, making it harder for small manufacturers to compete. As sustainability becomes a priority, the demand for low-emission or styrene-free alternatives may limit the growth of traditional UPR formulations.

Growth Opportunity

Eco-Friendly Bio-Based UPRs Unlock New Potential

The rise of bio-based and sustainable unsaturated polyester resins (UPRs) offers a strong growth opportunity for the market. Manufacturers are now able to replace traditional petroleum-derived components with natural or recycled materials—such as plant-based acids and alcohols—while maintaining performance. These greener formulations help lower carbon footprints and reduce reliance on finite resources, aligning with global sustainability goals.

As the construction, automotive, and marine sectors prioritize environmentally responsible materials, demand for bio-based UPRs is increasing. This shift not only opens new revenue streams for resin producers but also appeals to eco-conscious end users. Moreover, ongoing research is enhancing the mechanical and chemical resistance properties of these resins, enabling broader industrial adoption.

Latest Trends

Shift to Low‑Styrene Formulations for Better Safety

A prominent recent trend in the Unsaturated Polyester Resin (UPR) market is the adoption of low‑styrene formulations to improve workplace safety and meet tighter regulations. Conventional UPR contains styrene, which releases volatile organic compounds (VOCs) during curing and can harm both workers and the environment. In response, manufacturers have been developing resins that use reduced styrene levels or substitute it with other reactive diluents that emit less pollution.

These low‑styrene resins still offer strong binding and structural performance while minimizing harmful fumes. By lowering styrene content, production facilities can operate with simpler ventilation systems, making operations safer and more economical. The transition also caters to growing customer demand for safer and cleaner materials, helping UPR producers stay compliant with stricter environmental and health standards without sacrificing product quality.

Regional Analysis

In 2024, Asia-Pacific led the market with a 48.3% share, USD 5.6 billion.

In 2024, Asia-Pacific emerged as the leading region in the global Unsaturated Polyester Resin market, accounting for a dominant 48.3% share, which translates to a market value of USD 5.6 billion. This leadership position is supported by the region’s robust industrial base, large-scale infrastructure development, and strong presence of end-use sectors such as construction, automotive, and marine.

Countries across the region are witnessing a consistent rise in urbanization and manufacturing output, directly fueling the demand for lightweight and durable materials like unsaturated polyester resin. North America and Europe also represent significant markets, driven by advanced production technologies and increasing applications in corrosion-resistant products and composites. Meanwhile, the Middle East & Africa region is gradually expanding, supported by investments in industrial facilities and construction projects.

Latin America shows steady growth potential, particularly in developing economies where cost-effective and efficient materials are gaining traction in infrastructure development. However, Asia-Pacific maintains its dominance in both volume and value terms, due to its expansive manufacturing activities, competitive production costs, and increasing consumption across diverse industries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AOC, LLC demonstrates a consistent focus on operational efficiency and product quality. Through investments in advanced production systems and stringent quality controls, the company strengthens supply reliability and supports robust industrial usage. By streamlining logistics and optimizing production capacity, AOC aligns well with client demands, especially from large manufacturing and construction firms.

INEOS leverages its global reach and integration capabilities to maintain competitive pricing and broad product availability. With comprehensive distribution networks and diversified feedstock sourcing, INEOS delivers UPR solutions across multiple regions, ensuring swift delivery to major industrial markets. The company’s emphasis on economies of scale enhances cost competitiveness without diminishing overall product quality.

BASF SE continues to differentiate through research-driven innovation and specialty product offerings. By concentrating on functional enhancements—such as improved chemical resistance, flame retardancy, and low-styrene content—BASF sustains robust engagement with high-value end-use sectors. Its expertise in polymer science positions it as a leader in emerging formulations tailored for evolving market needs, including sustainable and high-performance applications.

Polynt employs a balanced strategy that combines capacity expansion with selective market focus. With production sites in key regions, Polynt effectively serves regional needs while maintaining agile coordination in its global supply chain. Emphasizing efficient plant operations and responsiveness to market trends, the company remains attuned to opportunities in construction, marine, and industrial applications.

Top Key Players in the Market

- AOC, LLC

- INEOS

- BASF SE

- Polynt

- LERG SA

- Koninklijke DSM N.V.

- U-PICA Company. Ltd.

- Eternal Materials Co., Ltd.

- Satyen Polymers Pvt. Ltd.

- Dow Inc.

- UPC Group

- Scott Bader Company Ltd.

- Deltech Corporation

- Qualipoly Chemical Corp.

Recent Developments

- In December 2024, INEOS Enterprises announced the sale of its INEOS Composites business—specializing in UPR, vinyl ester resins, and gelcoats—to KPS Capital Partners for approximately €1.7 billion. The agreement, expected to be completed in early 2025, reflects a strategic move to restructure INEOS’s composites operations.

- In October 2024, LERG S.A. highlighted enhancements to its ESTROMAL® UPR portfolio, including new orthophthalic, terephthalic, isophthalic, and DCPD-based resins. The updated line now also incorporates terephthalic resins derived from recycled PET bottles, offering improved chemical resistance and clarity comparable to orthophthalic types.

Report Scope

Report Features Description Market Value (2024) USD 11.6 Billion Forecast Revenue (2034) USD 20.2 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid Form, Powder Form), By Product (Orthopthalic, DCPD, Isophthalic, Others), By End-use (Building and Construction, Tanks and Pipes, Electrical, Marine, Transport, Artificial Stones, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AOC, LLC, INEOS, BASF SE, Polynt, LERG SA, Koninklijke DSM N.V., U-PICA Company. Ltd., Eternal Materials Co., Ltd., Satyen Polymers Pvt. Ltd., Dow Inc., UPC Group, Scott Bader Company Ltd., Deltech Corporation, Qualipoly Chemical Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Unsaturated Polyester Resin MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Unsaturated Polyester Resin MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AOC, LLC

- INEOS

- BASF SE

- Polynt

- LERG SA

- Koninklijke DSM N.V.

- U-PICA Company. Ltd.

- Eternal Materials Co., Ltd.

- Satyen Polymers Pvt. Ltd.

- Dow Inc.

- UPC Group

- Scott Bader Company Ltd.

- Deltech Corporation

- Qualipoly Chemical Corp.