Global Ulexite Market Size, Share, And Business Benefit By Type (White, Transparent), By Application (Agriculture, Glass and Fiberglass, Oilfield, Ceramics, Pulp and Paper, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161889

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

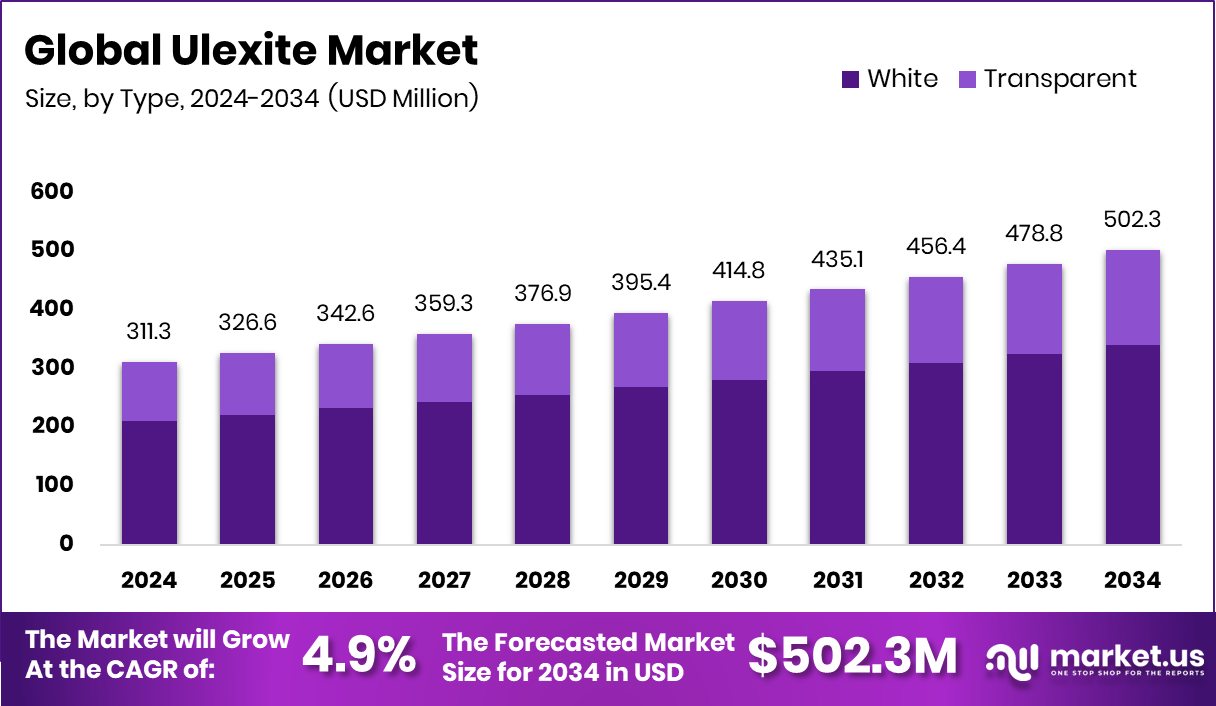

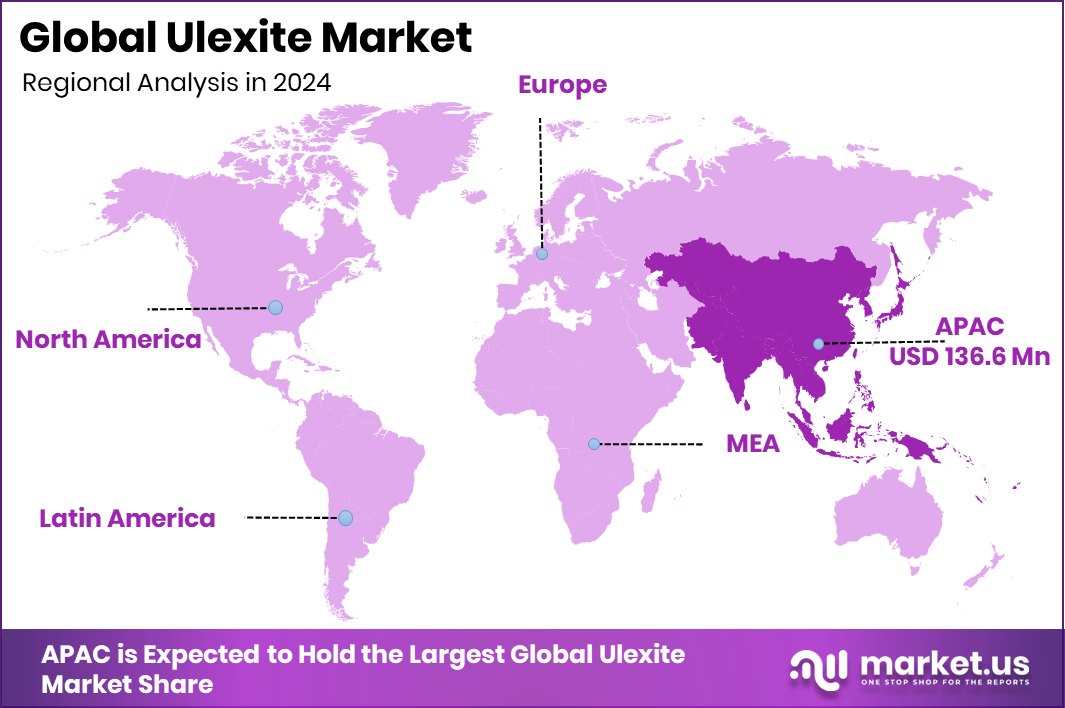

The Global Ulexite Market is expected to be worth around USD 502.3 million by 2034, up from USD 311.3 million in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034. In 2024, Asia-Pacific dominated the Ulexite Market with a 43.9% regional share.

Ulexite is a hydrated sodium-calcium borate mineral with the chemical formula NaCaB₅O₆(OH)₆·5H₂O. It is typically found in fibrous or acicular aggregates and is sometimes called “TV rock” because polished slices will transmit images from one face to the other along the fiber axes.

The ulexite market refers to the trade and industrial use of ulexite as a source of boron compounds in ceramics, glass, agriculture (as micronutrient fertilizers), and specialty chemical applications. Demand comes from sectors requiring borates, optical materials, and specialty fillers.

One growth driver is the increasing demand for boron-based products in the glass and ceramics industries, where borates improve thermal resistance and strength. Another factor is the rising agricultural use of boron fertilizers to support crop yields in boron-deficient soils. Also, innovation in specialty chemicals and optical materials can expand niche uses of ulexite.

Demand for ulexite is fueled by growth in construction, electronics, and renewable energy sectors, which require high-performance glass and ceramics. In agriculture, a rising focus on micronutrient management and soil health increases demand for boron inputs. Additionally, demand from research and advanced materials drives niche applications.

There’s an opportunity in developing low-impurity, high-grade ulexite for optical or electronic uses, as well as engineered derivatives for specialty chemicals. Also, integrating ulexite supply with downstream boron processing adds value.

Funding and investment in related sectors helps: for instance, Alpen received $18 million for thin-glass IGU production, O-I got nearly $3 million to boost cullet use, Philippine agriculture is pushing for a ₱8 billion boost in crop insurance, Michigan agriculture received $2 million for sustainability research, and the USDA opened an $18 million Farm to School grant program.

Key Takeaways

- The Global Ulexite Market is expected to be worth around USD 502.3 million by 2034, up from USD 311.3 million in 2024, and is projected to grow at a CAGR of 4.9% from 2025 to 2034.

- In 2024, White Ulexite dominated the Ulexite Market, capturing around 67.9% share.

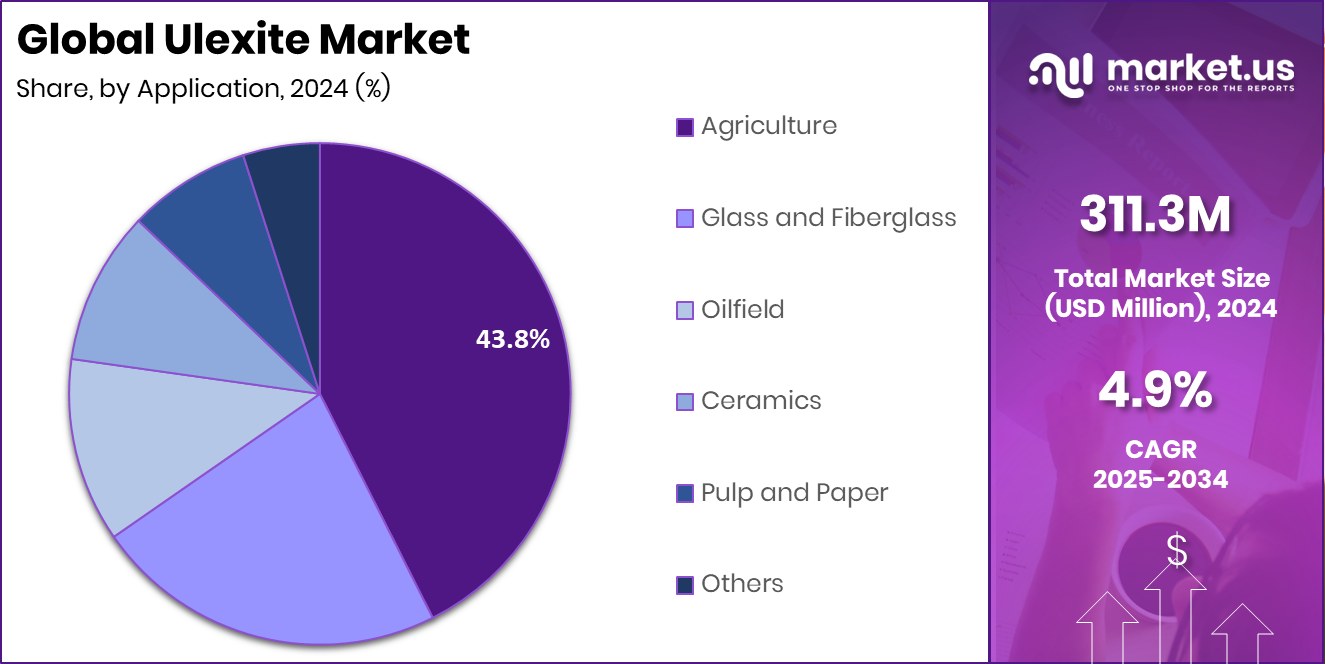

- In 2024, the Agriculture segment led the Ulexite Market, accounting for about 43.8% share.

- The Asia-Pacific market value reached approximately USD 136.6 million, reflecting strong agricultural and industrial demand.

By Type Analysis

In 2024, the Ulexite Market saw white-grade dominance due to high purity demand.

In 2024, White held a dominant market position in the By Type segment of the Ulexite Market, capturing more than a 67.9% share. This dominance is linked to its high purity, superior boron concentration, and suitability for industrial and agricultural applications. The white variety is preferred in boron-rich glass and ceramic manufacturing due to its low impurity levels and consistent composition, which enhance clarity and durability in finished products.

Additionally, its use in fertilizers and chemical formulations supports steady demand, particularly in regions focused on improving soil micronutrient levels. The stable supply chain and broader applicability across glass, ceramics, and agriculture reinforced its leading position throughout 2024.

By Application Analysis

In 2024, the Ulexite Market achieved strong growth through agricultural boron applications.

In 2024, Agriculture held a dominant market position in the *By Application* segment of the Ulexite Market, accounting for more than a 43.8% share. This leadership reflects the rising use of ulexite as a natural source of boron, an essential micronutrient for healthy crop growth and soil fertility. Its slow-release properties make it ideal for improving boron-deficient soils, ensuring steady nutrient availability to plants over time.

The product’s contribution to enhanced yield and crop quality has strengthened its adoption among farmers and fertilizer producers. Growing emphasis on sustainable farming practices and balanced nutrient management further boosted demand, solidifying the agriculture segment’s commanding role in the global ulexite market during 2024.

Key Market Segments

By Type

- White

- Transparent

By Application

- Agriculture

- Glass and Fiberglass

- Oilfield

- Ceramics

- Pulp and Paper

- Others

Driving Factors

Rising Agricultural Use of Boron-Rich Fertilizers

One of the strongest drivers in the ulexite market is the growing use of boron-rich fertilizers to support crop health. Ulexite, being a natural and slow-release source of boron, helps plants through critical growth phases, especially in soils deficient in this micronutrient. Farmers and agribusinesses are increasingly turning to ulexite-based products to improve yields, reduce crop stress, and maintain soil fertility.

The consistent demand from agriculture ensures stable market growth. Interestingly, in unrelated market news, a fund bought 12.5 lakh shares of Kajaria Ceramics for Rs 147 crore —this investment points to strong confidence in building material sectors, indirectly reflecting broader investor appetite in related minerals and industrial inputs.

Restraining Factors

Limited Availability and High Extraction Costs

One key restraining factor for the Ulexite Market is its limited availability and costly extraction process. Ulexite is found mainly in specific arid regions, making its mining geographically restricted and logistically challenging. Extracting and refining high-purity ulexite requires advanced processing facilities, which increases overall production costs. Additionally, environmental regulations surrounding boron mining often delay or limit operations, reducing supply consistency.

Transportation costs also rise because deposits are often located far from major industrial zones. These challenges affect pricing stability and discourage small producers from entering the market. As a result, limited raw material accessibility and high operational expenses continue to slow the broader expansion of the ulexite market across various end-use industries.

Growth Opportunity

Expanding Specialty & High-Purity Ulexite Applications

A major growth opportunity for the ulexite market lies in the development of specialty and high-purity ulexite applications. By refining ulexite to very low impurity levels, it can serve in electronics, optical components, and advanced ceramics—areas demanding ultra-pure materials. This shift would open up new high-margin markets beyond traditional uses.

The push for innovation and higher quality standards aligns with recent investment trends: CeraTattva Innotech secured ₹1.31 crores in funding from Campus Angels Network and Forge Innovation & Ventures, pointing to interest in tech-driven material ventures. As more capital flows into material science and specialty minerals, developing premium ulexite derivatives represents a promising path forward.

Latest Trends

Rise of 3D-Printed Ceramics Using Ulexite

A notable trend in the ulexite market is its growing integration into 3D-printed high-performance ceramics. Researchers and manufacturers are exploring ways to convert ulexite into advanced ceramic powders suitable for additive manufacturing, enabling complex geometries with strong thermal and mechanical properties. This approach taps into the booming 3D printing sector and allows novel product designs in aerospace, electronics, and biomedical parts.

Supporting this shift, a $4.5 million grant has been awarded to a project focused on 3D-printed high-performance ceramics, underlining increasing interest in next-generation materials. As this trend gathers momentum, demand for specialized ulexite derivatives for 3D printing could become a key growth axis in the industry.

Regional Analysis

This dominance highlights Asia-Pacific’s 43.9% expanding fertilizer consumption and steady boron-based material production growth.

In 2024, Asia-Pacific emerged as the dominant region in the Ulexite Market, accounting for 43.9% of the total share, valued at around USD 136.6 million. The region’s strong position is supported by its expanding agricultural base, growing demand for boron-based fertilizers, and rapid industrial development across countries such as China, India, and Indonesia. Ulexite’s role as a key boron source aligns with the region’s rising need for micronutrient enrichment in soils, especially in high-yield crop regions.

Meanwhile, North America shows steady growth, supported by technological applications and research in boron compounds. Europe continues to focus on environmental and material efficiency regulations, promoting controlled ulexite use.

The Middle East & Africa and Latin America regions are gradually adopting boron-based fertilizers to boost agricultural productivity, with emerging opportunities in mining and export activities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Eti Maden continued to leverage its strong position in the borate sector by focusing on producing ground ulexite as part of a broader boron product portfolio. The company processes ulexite alongside other borate minerals into refined forms meeting industrial standards, supplying consistent quality for glass, ceramics, and agricultural sectors.

American Borate Company sustains its role as a key supplier by offering both standard and specialty ground ulexite products, tailoring particle size and packaging to customer needs. This flexibility helps it serve diverse markets, from agriculture to industrial inputs.

Minera Santa Rita (MSR) distinguishes itself through strong upstream control: it owns and exploits ulexite and other borate reserves in Argentina’s salt lake basins. Its processing infrastructure in Campo Quijano already yields tens of thousands of tons of derivative boron products, with plans to scale further.

Top Key Players in the Market

- ETI MADEN

- American Borate Company

- Minera Santa Rita

- Quiborax

- BISLEY

- Others

Recent Developments

- In September 2025, the Kırka Boron Works (one of Eti Maden’s major complexes) is reported to be active in mining, chemistry, metallurgy, and logistics, reinforcing its integrated operations in boron—including ulexite downstream processes.

- In July 2024, local reports noted that the borate projects under Santa Rita Bórax (associated with Minera Santa Rita) continued operations in Salta province, emphasizing ongoing mining activity rather than expansion or structural change.

Report Scope

Report Features Description Market Value (2024) USD 311.3 Million Forecast Revenue (2034) USD 502.3 Million CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (White, Transparent), By Application (Agriculture, Glass and Fiberglass, Oilfield, Ceramics, Pulp and Paper, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ETI MADEN, American Borate Company, Minera Santa Rita, Quiborax, BISLEY, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ETI MADEN

- American Borate Company

- Minera Santa Rita

- Quiborax

- BISLEY

- Others