Global Turbo Generator Market Size, Share, And Enhanced Productivity By Type (Gas Turbine Generator, Steam Turbine Generator, Water Turbine Generator), By Cooling System (Air Cooled, Water Cooled, Hydrogen Cooled), By End-Use (Coal Power, Plants Nuclear Power Plants, Gas Power Plants, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 168018

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

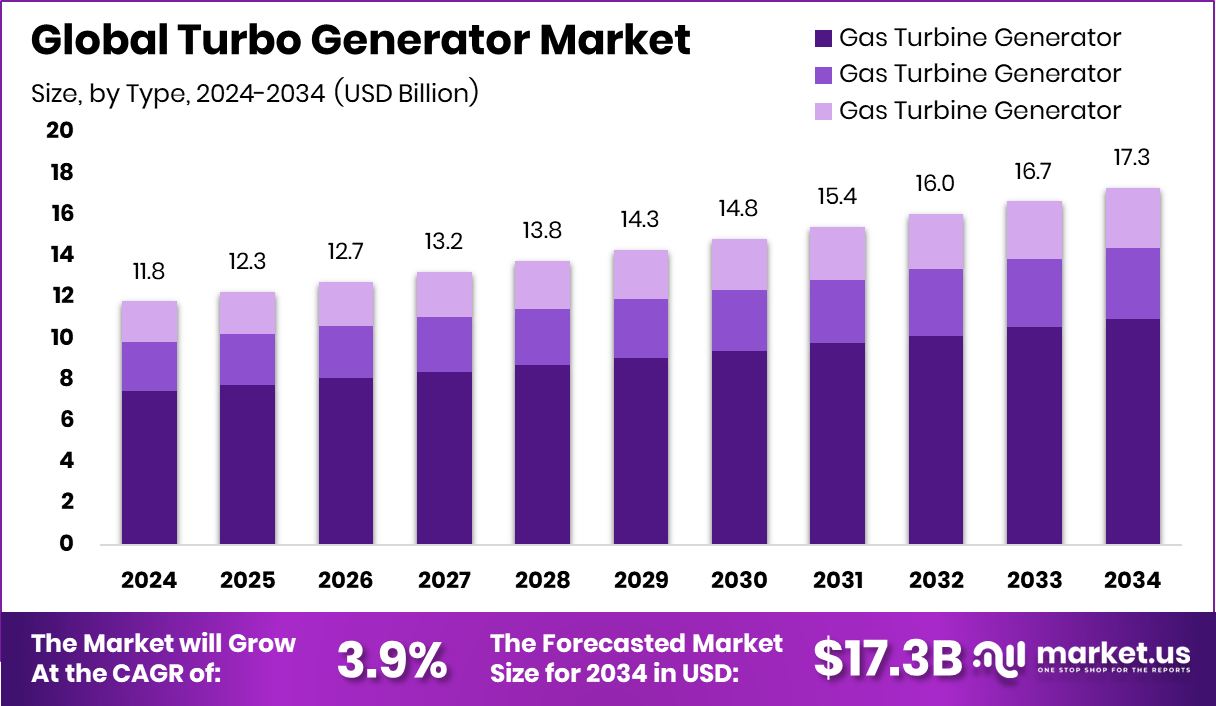

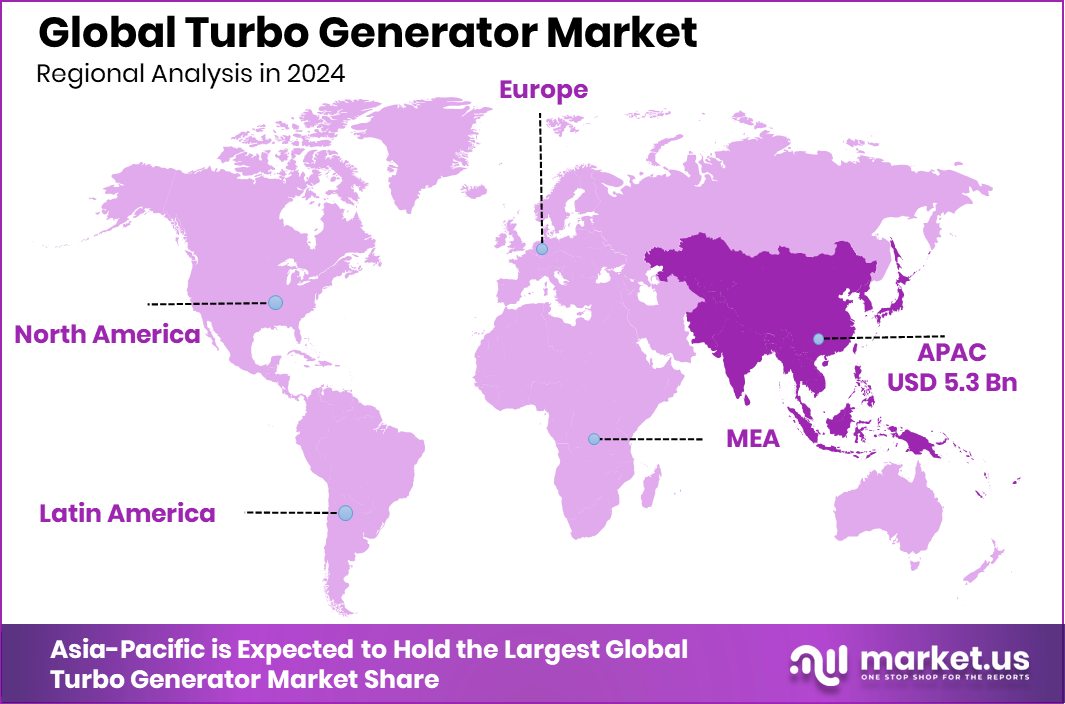

The Global Turbo Generator Market is expected to be worth around USD 17.3 billion by 2034, up from USD 11.8 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034. With a USD 5.3 Bn value, Asia-Pacific accounts for 45.1 of % Turbo Generator Market.

A turbo generator is an integrated system where a turbine—driven by steam, gas, water, or nuclear heat—rotates a generator to produce electricity. It is designed for continuous, high-speed operation, offering stable power output, high efficiency, and long service life in large power plants.

The Turbo Generator Market covers equipment, upgrades, and supporting systems used across thermal, nuclear, hydro, and emerging clean-energy facilities. It plays a central role in grid-scale electricity supply, balancing energy security, efficiency targets, and lower emissions across industrial and utility power generation.

Growth factors are supported by strong public and private funding. GE Gas Power received $4.2 million to improve gas turbine efficiency, while the U.S. Department of Energy announced $28 million for ultrahigh-temperature materials in gas turbines and $35 million for hydrokinetic turbine development.

Demand is rising as grids need flexible and reliable baseload power. First National Capital provided $148 million for natural gas turbine generators, and Texas approved projects under its $7.2 billion loan program aimed at strengthening gas-based power capacity.

Opportunities are expanding in nuclear and advanced hydro systems. GE Steam Power signed a $165 million nuclear turbine contract with BHEL, X-energy raised $700 million for nuclear energy expansion, and Natel Energy secured $20 million to deploy restoration hydro turbines.

Key Takeaways

- The Global Turbo Generator Market is expected to be worth around USD 17.3 billion by 2034, up from USD 11.8 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034.

- Gas turbine generators lead the Turbo Generator Market with 63.3%, driven by efficiency, fast startup, and cleaner power generation.

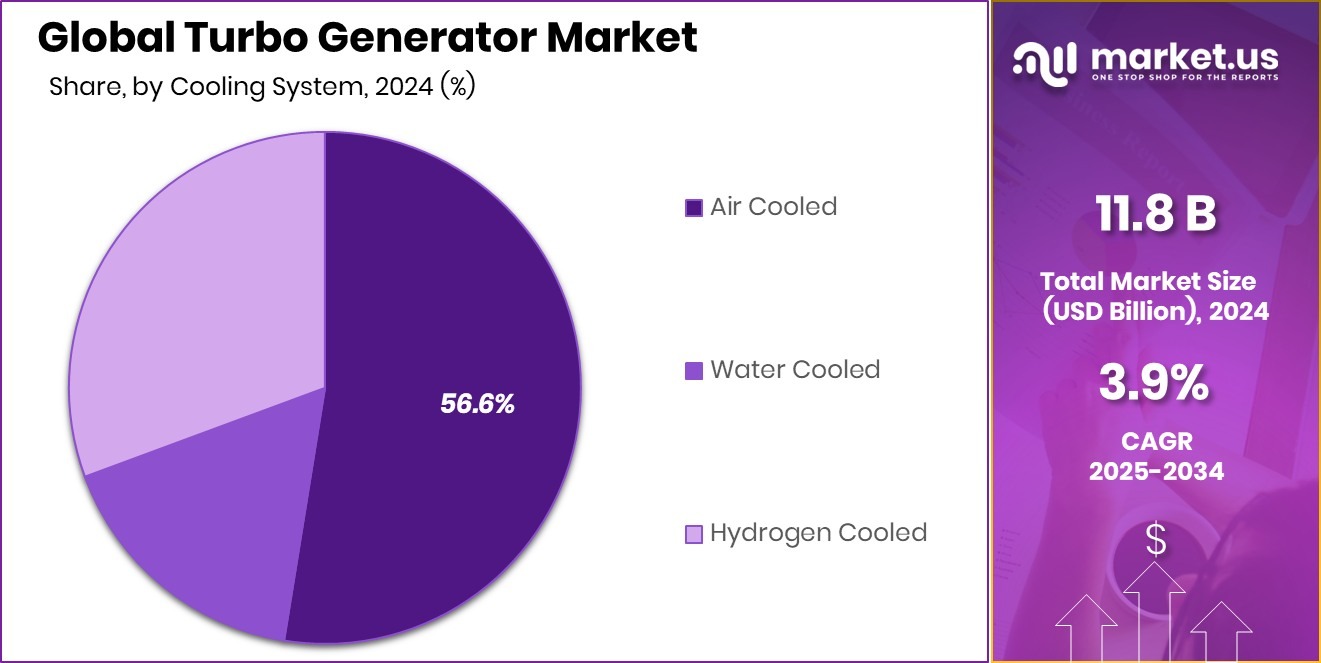

- Air cooled systems hold 56.6% share due to lower water use, simpler design, and reduced maintenance needs.

- Coal power accounts for 44.9%, supported by existing plants requiring reliable turbo generators for baseload electricity.

- Asia-Pacific records 45.1% market share as the Turbo Generator Market totals USD 5.3 Bn.

By Type Analysis

Gas turbine generators dominate the Turbo Generator Market with a 63.3% share globally.

In 2024, Gas Turbine Generator held a dominant market position in the By Type segment of the Turbo Generator Market, with a 63.3% share. This leadership reflects the growing preference for gas-based power generation due to its fast start-up capability and operational flexibility.

Utilities and industrial users increasingly rely on gas turbine generators to support peak-load management and balance variable renewable energy sources. Their ability to deliver high power output with a compact design makes them suitable for both large-scale grid installations and captive power plants.

In addition, gas turbine generators offer relatively lower installation time compared to other turbo generator technologies, supporting quicker capacity additions. Stable fuel supply infrastructure and ongoing efficiency improvements further strengthen their position across developed and emerging power markets, allowing gas turbine generators to play a critical role in meeting rising electricity demand and grid reliability requirements.

By Cooling System Analysis

Air cooled systems lead the Turbo Generator Market with a 56.6% adoption rate.

In 2024, Air Cooled held a dominant market position in the By Cooling System segment of the Turbo Generator Market, with a 56.6% share. This dominance is driven by the simpler design and lower maintenance requirements associated with air-cooled systems.

Power producers favor air-cooled turbo generators because they eliminate the need for complex water management infrastructure, making them suitable for regions with limited water availability. These systems also reduce installation time and overall project costs, supporting faster commissioning of power plants.

Improved ventilation design and thermal management have enhanced operational reliability, allowing air-cooled units to perform efficiently under continuous load conditions. As utilities focus on cost control and operational simplicity, air-cooled turbo generators continue to maintain strong adoption across diverse power generation applications.

By End-Use Analysis

Coal power applications account for 44.9% of the Turbo Generator Market usage.

In 2024, Coal Power held a dominant market position in the by-end-use segment of the turbo generator market, with a 44.9% share. This dominance reflects the continued reliance on coal-based power generation for stable and large-scale electricity supply, particularly in regions with established coal infrastructure.

Coal power plants operate as baseload units, requiring turbo generators that can deliver consistent output over long operating cycles. The long operational life of coal facilities supports sustained demand for turbo generators used in both new installations and refurbishment projects.

In addition, existing coal power assets continue to undergo efficiency upgrades and reliability improvements, reinforcing the need for durable turbo generator systems. As a result, coal power remains a significant end-use segment within the turbo generator landscape.

Key Market Segments

By Type

- Gas Turbine Generator

- Steam Turbine Generator

- Water Turbine Generator

By Cooling System

- Air Cooled

- Water Cooled

- Hydrogen Cooled

By End-Use

- Coal Power

- Plants Nuclear Power Plants

- Gas Power Plants

- Others

Driving Factors

Rising Need for Reliable Large-Scale Power Generation

One of the main driving factors of the Turbo Generator Market is the rising need for reliable and continuous electricity to support growing industries, cities, and energy-intensive facilities. Power grids require stable equipment that can operate for long hours without interruption, and turbo generators are well-suited for this role due to their high efficiency and durability.

As electricity demand increases from manufacturing, transport, and digital infrastructure, utilities focus on strengthening baseload and backup power capacity. Public support also reflects this trend.

The U.S. Department of Energy announced $40 million to develop more efficient cooling solutions for data centers, highlighting the rising power and thermal management demands of modern digital systems. Such investments push power producers to adopt advanced turbo generators that can deliver steady output while supporting efficiency and cooling improvements across the energy ecosystem.

Restraining Factors

High Capital Cost Limits New Turbo Generator Adoption

One major restraining factor in the Turbo Generator Market is the high upfront capital required for procurement, installation, and supporting infrastructure. Turbo generator projects often involve heavy civil work, advanced cooling systems, and long commissioning timelines, which increase overall project costs.

Smaller utilities and private power producers may delay investments due to funding pressure and long payback periods. Capital is increasingly flowing toward alternative infrastructure needs, such as digital facilities, which can divert investment attention.

For example, Colovore secured a $925 million debt facility from Blackstone to expand liquid-cooled data centers, highlighting how large capital pools are being allocated to power-intensive but non-generation assets. This shift can limit immediate spending on new turbo generator installations, slowing adoption despite rising electricity demand and grid reliability needs.

Growth Opportunity

Advanced Cooling Technologies Creating New Revenue Opportunities

A key growth opportunity in the Turbo Generator Market comes from the rising demand for advanced cooling technologies linked to high-power applications. As electricity loads increase from digital infrastructure and energy-intensive operations, power producers are seeking turbo generators that can run efficiently under higher thermal stress. This opens opportunities for integrating improved cooling systems that enhance performance and extend equipment life.

Recent investments reflect this shift toward better thermal management. LiquidStack secured $20 million in recent funding to expand liquid cooling solutions for AI data centers worldwide, highlighting how cooling innovation is becoming a priority across power ecosystems.

Such developments encourage utilities and industrial users to upgrade or install turbo generators optimized for advanced cooling, creating new revenue streams through modernization, efficiency improvements, and long-term service demand.

Latest Trends

Growing Shift Toward Hydrogen-Ready Power Generation

One of the latest trends in the Turbo Generator Market is the gradual shift toward hydrogen-ready and low-carbon power generation systems. Power producers are preparing for cleaner fuel options by adapting turbines and generators to operate with hydrogen or hydrogen blends. This trend supports long-term emission reduction goals while keeping existing power infrastructure valuable and flexible.

Investment activity shows strong momentum in this direction. Green hydrogen startup Hysata raised $111 million to scale its high-efficiency electrolysis technology, reflecting growing confidence in hydrogen as a future energy carrier.

As green hydrogen production expands, turbo generators designed to work alongside hydrogen-based power systems gain importance. This trend is encouraging innovation in materials, cooling, and system design to support safer, efficient, and cleaner electricity generation.

Regional Analysis

Asia-Pacific leads the Turbo Generator Market with 45.1% share, valued at USD 5.3 Bn.

The Turbo Generator Market shows clear regional variation in adoption patterns, driven by power demand growth, infrastructure maturity, and energy mix priorities. Asia-Pacific stands out as the dominating region, accounting for 45.1% of the global market and valued at USD 5.3 Bn. This leadership is supported by large-scale electricity consumption, expanding industrial activity, and continuous investment in thermal, hydro, and nuclear power generation capacity. Rapid urbanization and grid expansion across developing economies further reinforce the region’s strong requirement for high-capacity and reliable turbo generators.

In North America, the market is supported by steady replacement demand, plant upgrades, and efficiency-driven modernization of existing power infrastructure. The region focuses strongly on reliability, grid stability, and operational performance, which sustains demand for advanced turbo generator systems.

Europe reflects a stable but technologically driven market, where aging power plants undergo upgrades to improve efficiency and meet regulatory and operational standards. Demand here is closely tied to modernization rather than large-scale capacity additions.

The Middle East & Africa region shows selective demand, mainly linked to utility-scale power projects and industrial energy needs, supported by long-term power infrastructure development plans.

Latin America experiences gradual growth, driven by grid expansion and the continued role of conventional power generation in ensuring electricity availability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

EBARA CORPORATION plays an important role in the turbo generator landscape through its strong engineering capabilities and long-standing focus on rotating equipment. In 2024, the company continues to emphasize efficiency, reliability, and lifecycle performance in power generation solutions. Its technical depth supports applications where stable output and durable operation are critical, particularly in large industrial and utility environments. EBARA’s approach reflects steady demand for proven, precision-engineered turbo generator systems.

Siemens AG maintains a strong position in the Turbo Generator Market by leveraging integrated power engineering expertise and system-level design capabilities. In 2024, the company’s focus remains on high-efficiency generation, digital monitoring, and long-term operational stability. Siemens’ broad technological foundation allows it to serve complex power projects requiring advanced control, strong load-handling capability, and dependable performance across diverse operating conditions.

Bharat Heavy Electricals Limited holds a significant position driven by its deep involvement in large-scale power infrastructure development. In 2024, BHEL continues to support utility-grade turbo generator requirements through robust manufacturing experience and project execution strength. Its role is closely aligned with baseload power needs, refurbishment programs, and long operational lifecycles, reinforcing its importance in supporting grid-scale electricity generation.

Top Key Players in the Market

- EBARA CORPORATION

- Siemens AG

- Bharat Heavy Electricals Limited

- Suzlon Energy Limited

- ANSALDO ENERGIA

- GE Vernova

- TOSHIBA CORPORATION

- Mitsubishi Heavy Industries, Ltd.

- Andritz AG

- Beijing BEIZHONG Steam

Recent Developments

- In November 2025, Siemens Energy announced that its orders for the fiscal year reached €58.9 billion and revenue €39.1 billion — a significant boost over the prior year, driven largely by strength in turbines and grid infrastructure orders.

- In September 2024, Ebara revealed plans to set up a new commercial-scale testing and development centre for hydrogen infrastructure equipment. The facility, named E-HYETEC, will be used for performance testing of liquid hydrogen pumps using real liquid hydrogen. This step underlines Ebara’s push into hydrogen fuel infrastructure — a shift that could influence power generation and related equipment markets.

- In September 2024, BHEL secured a landmark order to demonstrate methanol firing in a gas turbine at the 350 MW NTPC-run Combined Cycle Power Plant in Kayamkulam, Kerala. This first-of-its-kind contract covers supply of equipment, auxiliaries, technology support, erection and commissioning — signifying BHEL’s push into alternative-fuel and flexible-firing gas turbine solutions.

Report Scope

Report Features Description Market Value (2024) USD 11.8 Billion Forecast Revenue (2034) USD 17.3 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Gas Turbine Generator, Steam Turbine Generator, Water Turbine Generator), By Cooling System (Air Cooled, Water Cooled, Hydrogen Cooled), By End-Use (Coal Power, Plants Nuclear Power Plants, Gas Power Plants, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape EBARA CORPORATION, Siemens AG, Bharat Heavy Electricals Limited, Suzlon Energy Limited, ANSALDO ENERGIA, GE Vernova, TOSHIBA CORPORATION, Mitsubishi Heavy Industries, Ltd., Andritz AG, Beijing BEIZHONG Steam Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Turbo Generator MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Turbo Generator MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- EBARA CORPORATION

- Siemens AG

- Bharat Heavy Electricals Limited

- Suzlon Energy Limited

- ANSALDO ENERGIA

- GE Vernova

- TOSHIBA CORPORATION

- Mitsubishi Heavy Industries, Ltd.

- Andritz AG

- Beijing BEIZHONG Steam