Global Traction Batteries Market Size, Share, And Enhanced Productivity By Product Type (Lead Acid, Nickel Based, Lithium-Ion, Others), By Capacity (Less than 100 Ah, 100-200 Ah, 200 Ah-300 Ah, 300-400 Ah), By Application (Electric Vehicle (EV), Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV), Forklift, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171685

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

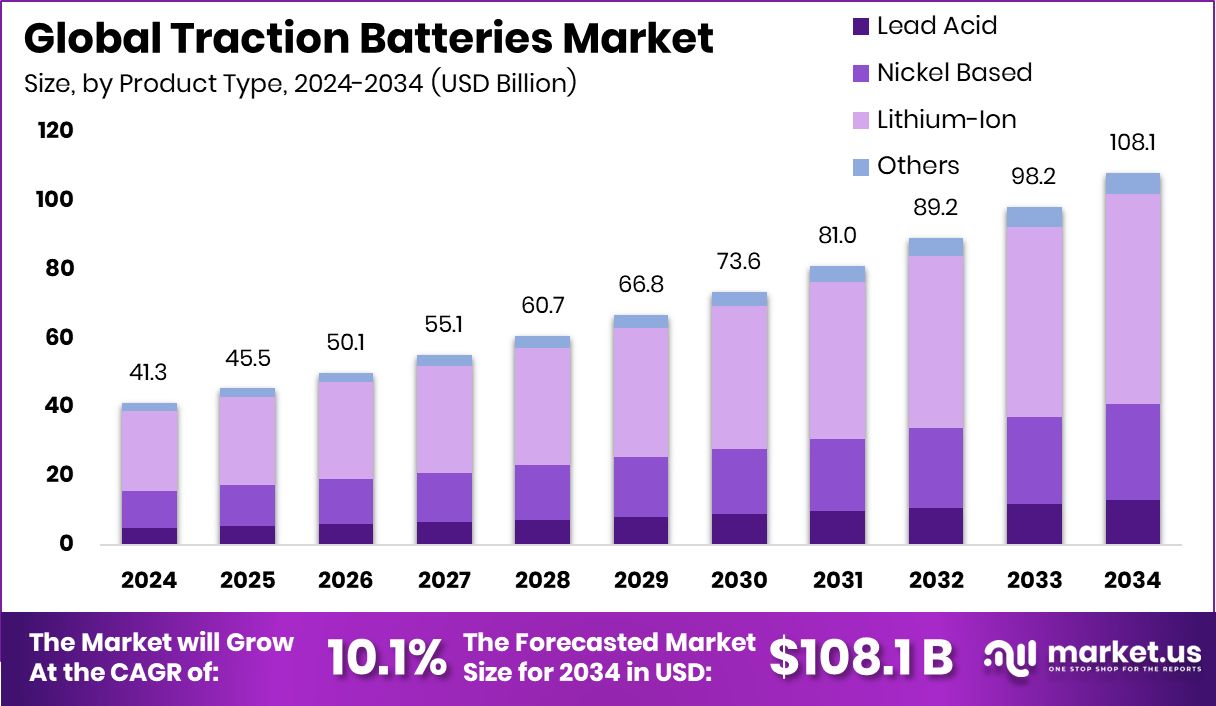

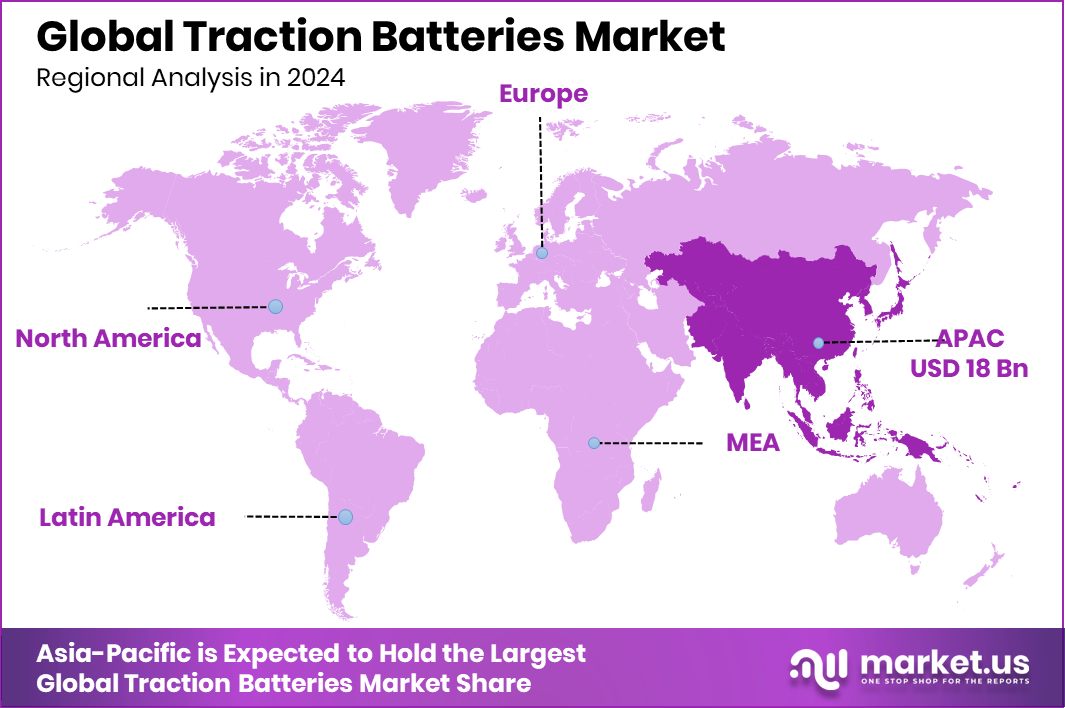

The Global Traction Batteries Market is expected to be worth around USD 108.1 billion by 2034, up from USD 41.3 billion in 2024, and is projected to grow at a CAGR of 10.1% from 2025 to 2034. In traction batteries, the Asia Pacific achieved 43.80% market control, totaling USD 18 Bn.

Traction batteries are deep-cycle power systems designed to deliver sustained energy for moving equipment such as electric vehicles, forklifts, industrial carts, and mobility platforms. Their design supports long discharge cycles, consistent torque, and reliable performance across continuous-duty operations. They act as the core power source in electric mobility, enabling smooth propulsion and stable output even under variable load conditions.

The traction batteries market represents the commercial ecosystem that designs, manufactures, and supplies these high-capacity energy units for mobility, industrial transport, warehouses, logistics, and heavy equipment. It continues to evolve as nations expand electric mobility support and industry transitions toward cleaner systems powered by long-life battery packs.

Growth factors strengthen as global electrification expands. Large financial movements influence this momentum, including Ample’s $330 million bankruptcy-linked collapse, which reshaped confidence in battery-swapping models. At the same time, India’s EV ecosystem is raising Rs 1,400 crore YTD, and an expected £1.3bn EV grant scheme in the UK highlights major shifts in investment-driven expansion.

Demand rises with stronger policy pushes, such as grants up to $50,000 for electric heavy vehicles, ARENA’s $21 million investment for Australia’s EV transition, and India’s EV start-ups crossing $2bn funding in FY25. These efforts keep traction battery adoption on a steady climb.

Opportunities grow as financing widens globally. Major boosts include Octopus EV securing £2bn, Cariqa raising €4m, Illinois launching a $20 million EV charging round, Kenya securing USD 169 million, NYSERDA offering $7 million, and Somerset’s £3.78m chargepoint funding, all opening new pathways for traction battery expansion across mobility and infrastructure.

Key Takeaways

- The Global Traction Batteries Market is expected to be worth around USD 108.1 billion by 2034, up from USD 41.3 billion in 2024, and is projected to grow at a CAGR of 10.1% from 2025 to 2034.

- The Traction Batteries Market shows strong momentum as lithium-ion dominates with 56.3% product share.

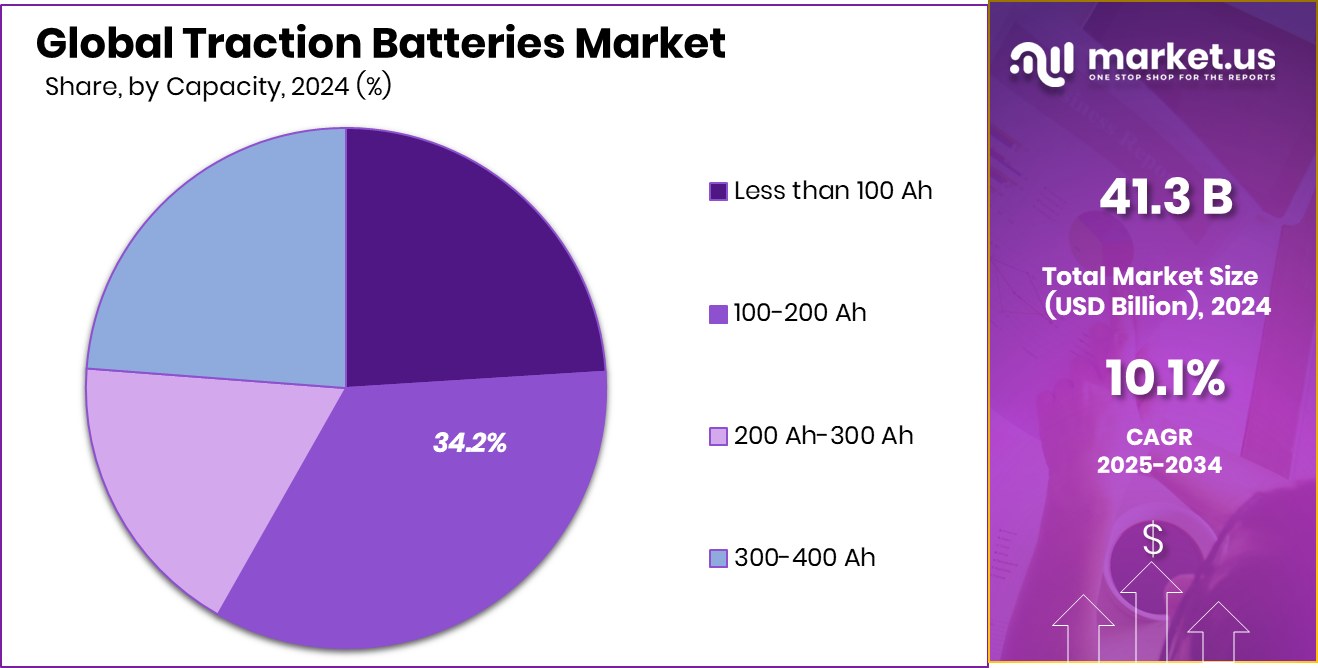

- Within the Traction Batteries Market, the 100–200 Ah capacity range leads usage with a 34.2% share.

- The Traction Batteries Market expands rapidly as electric vehicle applications account for 41.8% overall demand.

- The Asia Pacific region maintained dominance by securing 43.80%, worth nearly USD 18 Bn.

By Product Type Analysis

The Traction Batteries Market sees Lithium-Ion leading with a 56.3% share.

In 2024, Lithium-Ion held a dominant market position in the By Product Type segment of the Traction Batteries Market, with a 56.3% share. Its leadership reflects strong industry confidence in its high energy density and reliable charging behavior, making it suitable for continuous traction requirements. Manufacturers increasingly rely on this chemistry due to its balanced performance, long cycle life, and adaptability across modern traction equipment.

As industries focus on improved efficiency, lithium-ion remains the preferred choice because it supports faster charge cycles and stable discharge patterns. This dominance also signals a shift toward technologies that deliver low maintenance and consistent power output, ensuring a dependable operational profile for traction-driven systems across evolving mobility and industrial applications.

By Capacity Analysis

In capacity trends, 100–200 Ah dominates the Traction Batteries Market at 34.2%.

In 2024, 100–200 Ah held a dominant market position in the By Capacity segment of the Traction Batteries Market, with a 34.2% share. This capacity range appeals to applications requiring a balance between operational endurance and manageable battery size, making it a practical fit for traction systems operating under moderate load cycles.

Its dominance also highlights user preference for batteries that support longer operating hours without demanding excessive space or complex integration. This range continues to be adopted where consistent power delivery is essential, allowing equipment to function smoothly during extended duty. As traction-based operations expand, the 100–200 Ah segment remains a strong performer because it maintains an efficient midpoint between power availability and operating convenience.

By Application Analysis

The traction batteries market grows as electric vehicles drive a 41.8% application share.

In 2024, Electric Vehicles (EVs) held a dominant market position in the By Application segment of the Traction Batteries Market, with a 41.8% share. This leadership reflects the rapid shift toward cleaner mobility systems where traction batteries serve as the core power source for propulsion.

The EV segment benefits from rising adoption driven by performance stability and the suitability of traction batteries for repeated charge-discharge cycles. Their role in supporting smooth acceleration, sustained driving power, and efficient energy use reinforces EV reliance on traction-grade battery systems. With growing emphasis on dependable propulsion, the EV segment maintains its market lead due to the essential function that traction batteries play in delivering consistent and responsive vehicle performance.

Key Market Segments

By Product Type

- Lead Acid

- Nickel Based

- Lithium-Ion

- Others

By Capacity

- Less than 100 Ah

- 100-200 Ah

- 200 Ah-300 Ah

- 300-400 Ah

By Application

- Electric Vehicle (EV)

- Battery Electric Vehicle (BEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

- Forklift

- Others

Driving Factors

Rising Global Support for EV Charging Expansion

Growing investment in charging infrastructure has become a major driving factor for the Traction Batteries Market, as better charging access encourages more electric vehicles on the road. This momentum strengthens further with major funding activity, such as Evie securing $50 million to expand EV charging networks, which directly supports wider use of battery-powered mobility.

The push is also visible in the United States, where Wisconsin awarded $14 million in EV charging grants covering 26 statewide projects, helping create a stronger base for traction-battery-dependent vehicles.

Additionally, the UK Government’s £63 million commitment to improving charging at homes and businesses lowers operating barriers and accelerates EV adoption. Together, these funding efforts make traction batteries more essential and widely used across growing electric mobility segments.

Restraining Factors

High Recycling Gaps Slow Battery Expansion

One key restraining factor for the Traction Batteries Market is the gap between rising battery usage and the limited recycling and recovery capacity available in many regions. This challenge becomes clearer as new investments highlight the need for stronger end-of-life management.

For example, South Africa’s Maxwell+Spark receiving $15 million for lithium-ion systems shows how quickly battery deployment is growing, while recycling systems struggle to keep pace. In Nigeria, All On investing $1.5 million in Hinckley E-Waste Recycling reflects the need for better processing facilities to handle used traction batteries responsibly.

Even upstream material projects, such as FPX Nickel securing C$3.5 million for development studies, show that supply chains remain tight. These gaps slow market growth by increasing long-term environmental and operational concerns.

Growth Opportunity

Growing Investments Strengthen Battery Development Pathways

A major growth opportunity for the Traction Batteries Market comes from rising investments that support new technologies, better materials, and stronger recycling systems. This opportunity becomes clearer with fresh funding entering different parts of the battery value chain.

For example, EV smart battery maker Neuron Energy securing INR 200 million shows how manufacturers are expanding production and improving battery performance for mobility applications. At the same time, progress in recycling is supported by a lead-acid battery recycler receiving £1.5 million, helping create a more circular and sustainable battery ecosystem.

Material innovation also opens new possibilities, especially with Genomines raising $45 million to extract battery-grade nickel using enhanced plants, which strengthens raw material availability. Together, these investments create room for new products, better chemistry development, and stronger supply chains—making traction batteries more scalable and efficient for future mobility and industrial needs.

Latest Trends

Shift Toward Better Materials and Recycling Systems

A key trend in the Traction Batteries Market is the growing focus on improving battery materials and strengthening recycling systems. This shift becomes visible as funding flows into projects that secure long-term access to essential battery resources. For example, Lifezone securing a $60 million bridge loan for strategic Kabanga nickel transactions highlights the increasing push toward dependable nickel supply, which directly supports traction battery production.

Energy storage growth in Europe also reflects this trend, especially with Li-ion and mechanical storage leading €2.14bn ESS funding, showing how advanced storage technologies are shaping next-generation traction battery solutions. At the same time, recycling is becoming more important, supported by a UK consortium receiving £8.1 million to boost lithium battery recycling. Together, these developments show how the market is moving toward cleaner materials, stronger recovery systems, and improved long-term sustainability.

Regional Analysis

Asia Pacific led the traction batteries market with a strong 43.80% share, reaching USD 18 Bn.

In 2024, Asia Pacific emerged as the dominant region in the Traction Batteries Market, securing a strong 43.80% share valued at USD 18 Bn. This leadership reflects the region’s broad adoption of advanced traction systems across mobility and industrial platforms, supported by expanding use of high-capacity battery technologies. Asia Pacific’s scale advantage and consistent demand patterns position it as the central hub for traction-battery deployment.

North America follows with steady uptake driven by electrified equipment requirements and increasing use of traction-based solutions in mobility segments. Europe maintains a structured growth path as industries adapt traction batteries to efficiency-oriented applications, benefiting from technology-focused adoption behavior.

Meanwhile, the Middle East & Africa show gradual traction battery integration in emerging industrial activities, while Latin America continues progressing as operational sectors transition toward dependable battery-powered systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Unik Batteries Pvt. Ltd. continues to strengthen its presence by focusing on traction-oriented battery solutions designed for industrial mobility and consistent operational cycles. Its emphasis on stable discharge characteristics and product dependability positions it well in segments where equipment uptime is critical.

EXIDE INDUSTRIES LTD., known for its long-standing footprint in the battery ecosystem, maintains strategic relevance in traction applications through continuous product adaptation and diversified deployment across mobility and material-handling environments. Its established distribution network and manufacturing depth enable consistent market participation as demand for traction batteries expands into new operational formats.

Meanwhile, Bater contributes to the competitive landscape by supporting traction battery requirements across applications seeking robust power output and endurance. Its role aligns with the rising demand for solutions that balance cycle life with operational efficiency. Together, these companies contribute to a market environment defined by technology upgrades, evolving performance expectations, and a clear shift toward traction-specific battery designs that support productivity across global industrial and mobility sectors.

Top Key Players in the Market

- Unik Batteries Pvt. Ltd.

- EXIDE INDUSTRIES LTD.

- Bater

- Microtex Energy Private Limited

- Yuki Electric India Pvt Ltd.

- UBT Batteries Pvt. Ltd.

- akkuteam Energietechnik GmbH

- Rico

- Tianneng

Recent Developments

- In January 2024, Unik Batteries published a detailed article explaining traction batteries’ performance and use in industrial applications. This content effort highlights the company’s focus on educating customers about deep-cycle and traction power solutions, reinforcing their expertise in traction systems.

- In July 2025, Exide Industries outlined its dual focus on conventional lead-acid batteries and lithium-ion battery production, confirming that commercial production at its lithium-ion cell manufacturing facility is expected during the fiscal year 2025-26. This development signals the company’s intention to support traction and EV battery demand with localized advanced cell manufacturing.

Report Scope

Report Features Description Market Value (2024) USD 41.3 Billion Forecast Revenue (2034) USD 108.1 Billion CAGR (2025-2034) 10.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Lead Acid, Nickel Based, Lithium-Ion, Others), By Capacity (Less than 100 Ah, 100-200 Ah, 200 Ah-300 Ah, 300-400 Ah), By Application (Electric Vehicle (EV), Battery Electric Vehicle (BEV), Plug-In Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV), Forklift, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Unik Batteries Pvt. Ltd., EXIDE INDUSTRIES LTD., Bater, Microtex Energy Private Limited, Yuki Electric India Pvt Ltd., UBT Batteries Pvt. Ltd., Akkuteam Energietechnik GmbH, Rico, Tianneng Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Traction Batteries MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Traction Batteries MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Unik Batteries Pvt. Ltd.

- EXIDE INDUSTRIES LTD.

- Bater

- Microtex Energy Private Limited

- Yuki Electric India Pvt Ltd.

- UBT Batteries Pvt. Ltd.

- akkuteam Energietechnik GmbH

- Rico

- Tianneng