Global Tortilla Chips Market Size, Share, Growth Analysis By Product (Organic, Conventional), By Type (Baked, Fried), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158329

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

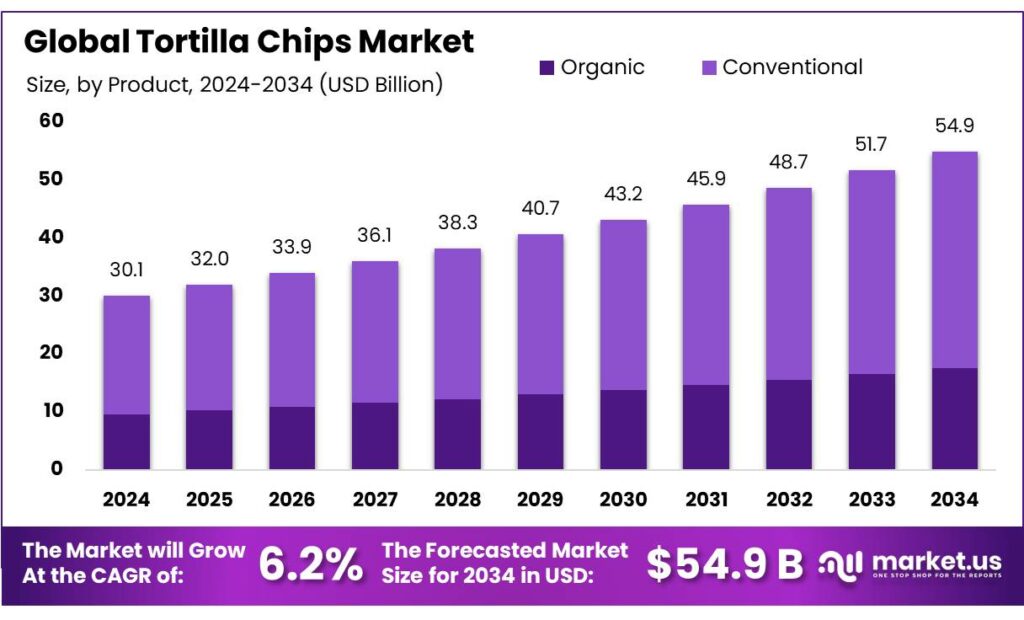

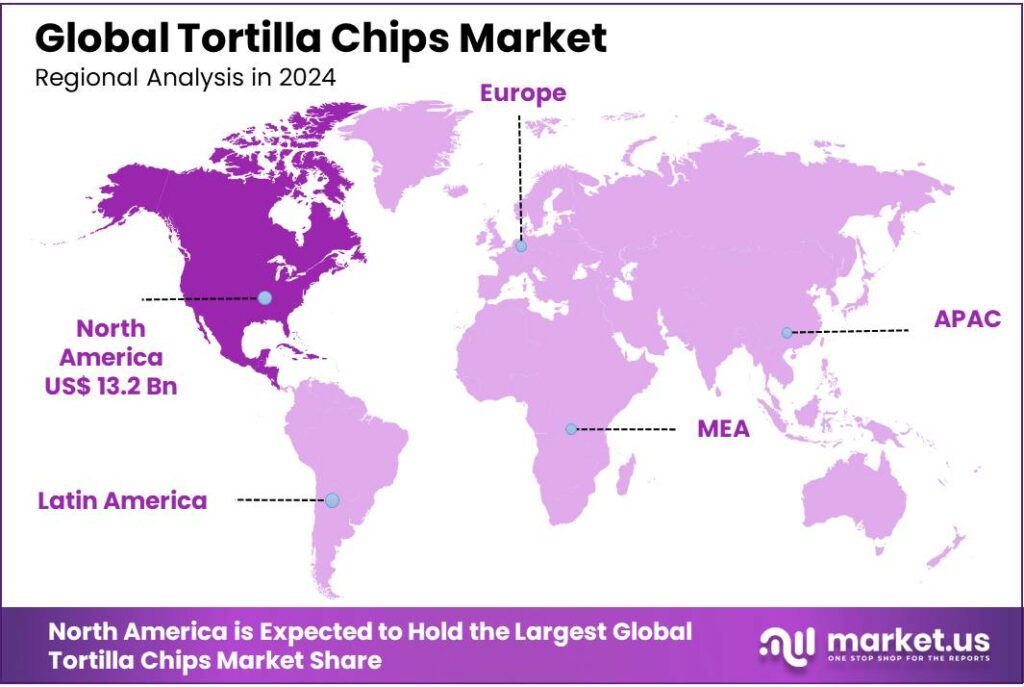

The Global Tortilla Chips Market size is expected to be worth around USD 54.9 Billion by 2034, from USD 30.1 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 43.9% share, holding USD 13.2 Billion in revenue.

Tortilla chips are a popular snack made from corn tortillas that are cut into triangular shapes and then fried or baked until crispy. The primary ingredient is typically corn, which is ground into masa (a dough made from treated corn), and then shaped into round tortillas. After the tortillas are cooked, they are cut into wedges and either fried in oil or baked to achieve a crispy texture.

Several factors contribute to this upward trajectory. The increasing demand for convenient, ready-to-eat snack options among the urban population, especially the younger demographic, is a primary driver. Additionally, the growing popularity of Western cuisines and the expansion of quick-service restaurant (QSR) chains in India have further fueled the consumption of tortilla-based products. Government policies, such as the Production Linked Incentive Scheme for Food Processing Industry (PLISFPI), with an outlay of Rs. 10,900 crore, aim to enhance manufacturing capabilities and promote exports in the food processing sector.

Government initiatives have played a role in supporting the tortilla chips industry. In Mexico, the federal government implemented the Tortilla Price Stabilization Pact in 2007, aiming to limit the volatility of tortilla prices. This agreement between the government and major tortilla-producing companies, including Grupo Maseca and Bimbo, set a price ceiling at MXN 8.50 per kilogram of tortilla, with penalties for companies found hoarding corn.

- The Ministry of Food Processing Industries (MoFPI) has implemented several schemes aimed at enhancing infrastructure, promoting value addition, and improving export capabilities. For instance, the Pradhan Mantri Kisan SAMPADA Yojana (PMKSY) has been allocated ₹4,600 crores, with an additional ₹920 crores recently allocated to sustain its objectives.

Furthermore, partnerships between major food corporations and regional producers have led to the expansion of product distribution networks, ensuring broader market reach. For instance, PepsiCo’s acquisition of Siete Foods for USD 1.2 billion in 2024 exemplifies strategic moves to diversify product portfolios and tap into the expanding demand for ethnic and health-oriented snack options.

This program has allocated ₹500 crores to promote farmer producers’ organizations (FPOs), agri-logistics, and processing facilities, thereby ensuring a steady supply of quality raw materials for snack manufacturers.

Key Takeaways

- Tortilla Chips Market size is expected to be worth around USD 54.9 Billion by 2034, from USD 30.1 Billion in 2024, growing at a CAGR of 6.2%.

- Conventional tortilla chips maintained a dominant position in the Indian market, capturing more than a 67.5% share.

- Fried tortilla chips held a dominant position in the Indian market, capturing more than a 63.8% share.

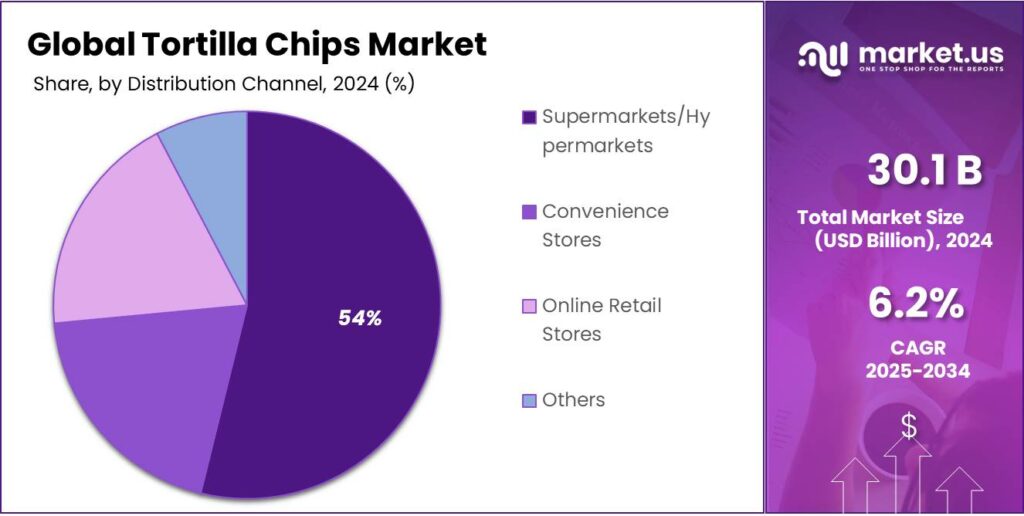

- Supermarkets and hypermarkets held a dominant position in the Indian tortilla chips market, capturing more than a 54.2% share.

- North America emerged as the dominant region in the global tortilla chips market, capturing a substantial 43.9% share, translating to approximately USD 13.2 billion.

By Product Analysis

Conventional Tortilla Chips Lead the Market with Over 67.5% Share in 2024

In 2024, conventional tortilla chips maintained a dominant position in the Indian market, capturing more than a 67.5% share. This segment’s popularity is attributed to its affordability, widespread availability, and the familiarity of traditional flavors among consumers. Manufacturing conventional tortilla chips is cost-effective due to the easy availability of raw materials, making them accessible to a broad consumer base. Additionally, the versatility of conventional chips allows for a wide range of flavor profiles and seasonings, catering to diverse taste preferences.

The growth of the conventional segment is further supported by the expansion of quick-service restaurants (QSRs) and the increasing trend of snacking. As urbanization accelerates and lifestyles become more fast-paced, the demand for convenient and ready-to-eat snacks has risen. Conventional tortilla chips, being easy to store and consume, fit well into this demand. Moreover, the affordability of these chips makes them a popular choice among price-sensitive consumers.

By Type Analysis

Fried Tortilla Chips Dominate with 63.8% Market Share in 2024

In 2024, fried tortilla chips held a dominant position in the Indian market, capturing more than a 63.8% share. This segment’s popularity is primarily driven by the traditional taste and texture that consumers associate with authentic tortilla chips. The deep-frying process imparts a crispy and flavorful profile, making them a preferred choice among snack enthusiasts.

The widespread availability of fried tortilla chips across various retail channels, including supermarkets, convenience stores, and online platforms, has further contributed to their market dominance. Their affordability and the familiarity of the product have made them accessible to a broad consumer base. Additionally, the versatility of fried tortilla chips allows for a wide range of flavor profiles and seasonings, catering to diverse taste preferences.

By Distribution Channel Analysis

Supermarkets and Hypermarkets Capture 54.2% of Tortilla Chips Market in 2024

In 2024, supermarkets and hypermarkets held a dominant position in the Indian tortilla chips market, capturing more than a 54.2% share. This segment’s prominence is primarily due to the widespread presence of these retail formats across urban and semi-urban areas, offering consumers a convenient one-stop shopping experience. The extensive shelf space dedicated to snack products, including tortilla chips, allows for a diverse range of brands and flavors, catering to varying consumer preferences.

The growth of this distribution channel is further supported by the increasing disposable incomes and changing lifestyles of Indian consumers, leading to a higher demand for ready-to-eat snack options. Promotional activities and discounts offered by supermarkets and hypermarkets also play a significant role in attracting consumers, thereby boosting sales of tortilla chips.

Key Market Segments

By Product

- Organic

- Conventional

By Type

- Baked

- Fried

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail Stores

- Others

Emerging Trends

Embracing Health-Conscious Snacking: The Rise of Veggie-Based Tortilla Chips

In recent years, the tortilla chips market has witnessed a significant shift towards health-conscious snacking options. Consumers are increasingly seeking snacks that align with their wellness goals, prompting manufacturers to innovate and offer healthier alternatives to traditional fried corn chips. This trend is particularly evident in the growing popularity of vegetable-based tortilla chips, which cater to the demand for nutritious, flavorful, and convenient snack options.

- For instance, Siete Foods, known for its grain-free tortilla chips, reported a 28.1% increase in sales over the previous year, highlighting the growing consumer interest in alternative snack options. This surge reflects a broader movement towards healthier snacking choices, with consumers actively seeking products that offer both taste and nutritional benefits.

In India, the government’s support for the food processing sector further bolsters this trend. Initiatives like the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) Scheme provide financial, technical, and business support to micro food processing units. Under this scheme, small enterprises can receive a 35% capital subsidy on projects up to ₹10 lakh, seed capital support of ₹40,000 per member for Self-Help Groups (SHGs), and 50% assistance for branding and marketing efforts. Such support encourages the development of innovative products, including healthier snack options like vegetable-based tortilla chips.

Vegetable-based tortilla chips are crafted using ingredients like sweet potatoes, beets, spinach, and kale, offering a vibrant color palette and a unique flavor profile compared to their corn counterparts. These chips are often baked rather than fried, reducing their fat content and making them a more appealing choice for health-conscious consumers. The incorporation of vegetables not only enhances the nutritional value—providing vitamins, minerals, and fiber—but also introduces a diverse range of flavors that appeal to a broad audience.

Drivers

Government Support and Infrastructure Development

A significant driving factor for the tortilla chips industry in India is the robust support from the Indian government, particularly through initiatives aimed at enhancing food processing infrastructure and promoting value-added products. The Indian government has recognized the importance of the food processing sector in boosting economic growth, creating employment opportunities, and reducing food wastage.

One of the key initiatives is the Production Linked Incentive Scheme for Food Processing Industry (PLISFPI), launched with an outlay of ₹10,900 crore. This scheme aims to support the establishment of global food manufacturing champions and promote Indian brands of food products in international markets. The PLISFPI provides financial incentives to companies engaged in the production of processed food products, including snacks like tortilla chips, thereby encouraging investment and expansion in the sector.

- For instance, Amul Dairy’s plans to set up a ₹100 crore processing plant in Assam are a testament to the expanding infrastructure supporting dairy product manufacturing. These government-backed initiatives not only boost production capacities but also ensure a steady supply of quality ingredients, which is essential for tortilla chips production.

Additionally, the government has been actively promoting the establishment of food processing units through various schemes and subsidies. These initiatives aim to improve the processing capacity, quality standards, and market reach of food products. By providing financial assistance and facilitating the creation of infrastructure for food processing, the government is enabling the growth of the tortilla chips industry and other value-added food sectors.

Restraints

Challenges in Cold Chain and Processing Infrastructure

A significant challenge hindering the growth of the tortilla chips industry in India is the inadequate cold chain and processing infrastructure. Despite being the world’s largest producer of milk and a major producer of various crops, India faces substantial gaps in its food processing and storage capabilities. These infrastructural deficiencies lead to high levels of food wastage, estimated at approximately 30% annually, due to spoilage and inadequate storage facilities.

The lack of advanced processing plants further exacerbates the situation. While some regions have made strides, many areas still rely on outdated equipment and methods, leading to inefficiencies and inconsistent product quality. For instance, the absence of modern processing units capable of producing value-added products like tortilla chips limits the industry’s ability to meet both domestic and international standards.

Recognizing these challenges, the Indian government has initiated several programs to bolster the food processing infrastructure. The Integrated Cold Chain and Value Addition Infrastructure Scheme, under the Pradhan Mantri Kisan Sampada Yojana (PMKSY), aims to reduce post-harvest losses by improving storage, transportation, and processing infrastructure. The scheme provides financial assistance for setting up integrated cold chain projects, including processing units, to ensure better linkages between producers and markets.

- As of June 2025, a total of ₹66,310 crore has been sanctioned for 1,13,419 projects under the AIF, including 2,454 cold storage projects. This initiative aims to enhance storage capacities, reduce wastage, and improve the overall efficiency of the food supply chain.

Opportunity

Government Support for Small-Scale Tortilla Chip Production

A significant growth opportunity for tortilla chips in India lies in leveraging government initiatives aimed at supporting small-scale food processing enterprises. These programs not only provide financial assistance but also foster innovation and market expansion, particularly for startups and micro, small, and medium enterprises (MSMEs) in the food sector.

The Indian government has introduced several schemes to bolster the food processing industry. The Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme, part of the Atmanirbhar Bharat Abhiyan, offers a 50% subsidy to small food processing units, encouraging the use of locally sourced ingredients and promoting self-employment.

- For instance, in Madikeri, Karnataka, the scheme has facilitated loans amounting to ₹15.2 crore for 89 entrepreneurs, with a focus on products like coffee, black pepper, and cardamom

Additionally, the Mega Food Park Scheme aims to create integrated infrastructure for food processing, including cold storage and testing labs, thereby reducing wastage and enhancing product quality. The government supports such projects with funding up to ₹50 crore per project, fostering a conducive environment for the growth of food processing units.

These initiatives present a promising avenue for small-scale tortilla chip producers to scale their operations, improve product quality, and expand market reach. By aligning with these government schemes, entrepreneurs can access financial support and infrastructure development, paving the way for sustainable growth in the tortilla chip segment.

Regional Insights

North America Leads Tortilla Chips Market with 43.9% Share in 2024

In 2024, North America emerged as the dominant region in the global tortilla chips market, capturing a substantial 43.9% share, translating to approximately USD 13.2 billion in market value. This leadership position is primarily driven by the strong presence of major snack manufacturers, robust retail infrastructure, and a deep-rooted consumer preference for Mexican cuisine.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Grupo Bimbo, headquartered in Mexico, is a global leader in the bakery industry and a significant player in the tortilla chips market. Through its subsidiary, Bimbo Bakeries USA, the company offers a variety of tortilla chips under the “Tostitos” brand. Known for their quality and taste, Tostitos tortilla chips are widely available across North America. Grupo Bimbo’s extensive distribution network and strong brand presence contribute to its leadership in the market.

Arca Continental is one of the largest bottlers and distributors of Coca-Cola products in Latin America and also produces a variety of snack foods, including tortilla chips. The company’s snack division offers products under various brand names, catering to regional tastes and preferences. Arca Continental’s strong presence in Latin American markets and its extensive distribution network contribute to its significant share in the tortilla chips market.

Hain Celestial is a leading natural and organic food company that offers a variety of snack products, including tortilla chips. Under its “Garden of Eatin'” brand, the company produces organic and non-GMO tortilla chips in various flavors. Hain Celestial’s focus on health-conscious consumers and sustainable sourcing practices has positioned it as a prominent player in the better-for-you snack category. Its products are widely available in natural food stores and mainstream supermarkets.

Top Key Players Outlook

- Grupo Bimbo

- PepsiCo

- Arca Continental S.A.B. de C.V.

- Fireworks Foods

- Hain Celestial

- Intersnack Group

- Kellanova

- GRUMA corporation

- La Tortilla Factory

- Tyson Foods Inc.

Recent Industry Developments

In 2024, Grupo Bimbo’s revenue was approximately $22 billion, with the U.S. and Canada accounting for nearly half of its sales.

In 2024 Hain Celestial Group, net sales declined by 10.2% to $1.56 billion, with its snacks segment experiencing a 19% drop in net sales.

Report Scope

Report Features Description Market Value (2024) USD 30.1 Bn Forecast Revenue (2034) USD 54.9 Bn CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Organic, Conventional), By Type (Baked, Fried), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Grupo Bimbo, PepsiCo, Arca Continental S.A.B. de C.V., Fireworks Foods, Hain Celestial, Intersnack Group, Kellanova, GRUMA corporation, La Tortilla Factory, Tyson Foods Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Grupo Bimbo

- PepsiCo

- Arca Continental S.A.B. de C.V.

- Fireworks Foods

- Hain Celestial

- Intersnack Group

- Kellanova

- GRUMA corporation

- La Tortilla Factory

- Tyson Foods Inc.