Global Tonic Water Market Size, Share, And Business Benefits By Type (Flavored, Non-flavored), By Category (Low/No Sugar, Regular), By Packaging Type (Bottles, Cans), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150802

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

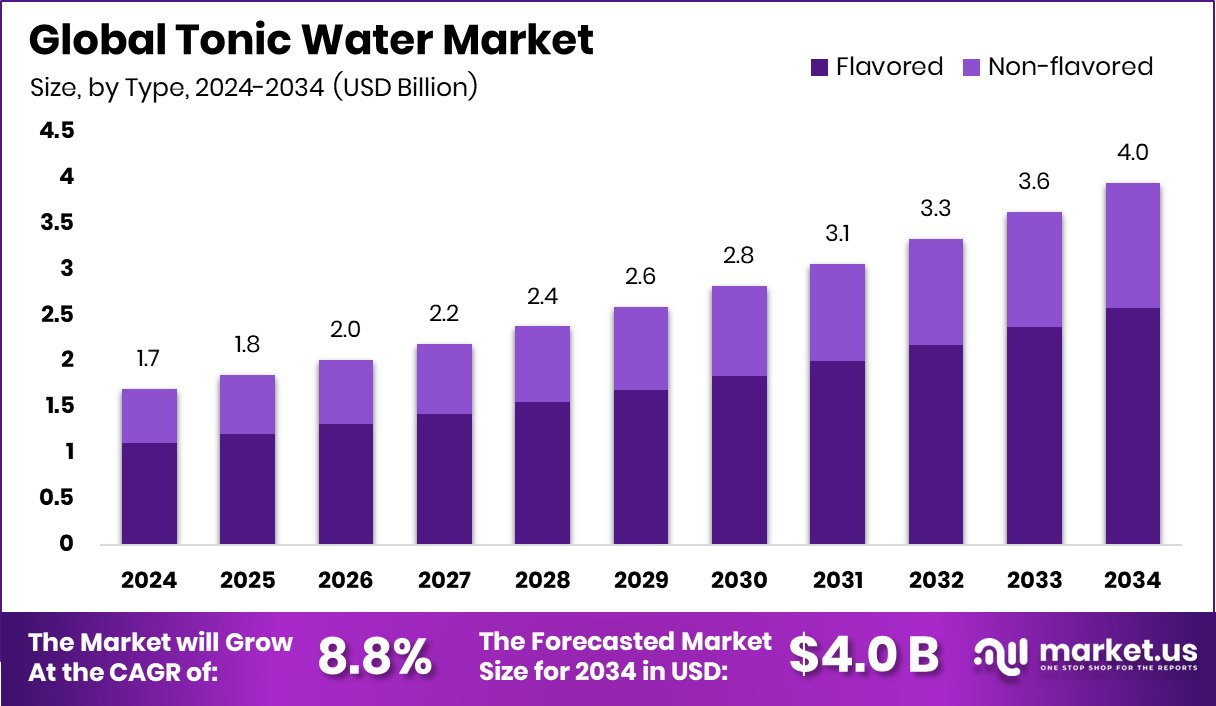

Global Tonic Water Market is expected to be worth around USD 4.0 billion by 2034, up from USD 1.7 billion in 2024, and grow at a CAGR of 8.8% from 2025 to 2034. Strong consumer demand in North America drove tonic water market growth to 39.4%.

Tonic water is a carbonated soft drink that contains quinine, a compound originally used as a remedy for malaria. It has a distinct bitter flavor and is often mixed with gin or other spirits to make cocktails, though it’s also consumed on its own for its refreshing taste. Modern tonic water usually includes added sweeteners and citrus flavoring to balance the bitterness of quinine, making it a versatile beverage enjoyed worldwide.

The tonic water market refers to the industry focused on the production, distribution, and sale of tonic water as a standalone beverage and cocktail mixer. It includes flavored variants, low-calorie options, and premium offerings, catering to both casual consumers and those seeking a more refined drinking experience. The market has evolved beyond traditional bar settings and now sees demand from home consumers, restaurants, and wellness-focused buyers.

A key growth factor in this market is the rise in cocktail culture, especially among younger consumers who enjoy experimenting with drinks at home. This trend is pushing the demand for quality mixers like tonic water that complement premium spirits. Additionally, the desire for sophisticated non-alcoholic alternatives also boosts its popularity. According to an industry report, Malaki recently announced the successful completion of its seed funding round, raising ₹5.7 crore to support its next phase of growth.

Demand is also rising due to growing health consciousness. Many people now prefer tonic water over sugary soft drinks, particularly those that offer low-calorie or natural ingredient options. As more consumers seek refreshing yet healthier choices, tonic water is becoming a go-to beverage. Meanwhile, the brand behind Jimmy’s Cocktails and mixers has secured ₹35 crore in its latest pre-Series A funding round, strengthening its financial position for further expansion and innovation.

Key Takeaways

- Global Tonic Water Market is expected to be worth around USD 4.0 billion by 2034, up from USD 1.7 billion in 2024, and grow at a CAGR of 8.8% from 2025 to 2034.

- Flavored tonic water dominates the market, accounting for 65.3% due to evolving taste preferences.

- Regular tonic water holds a 74.7% share, reflecting continued demand for traditional bitterness and sweetness balance.

- Bottles lead with 68.4% market share, favored for convenience, storage, and premium presentation appeal.

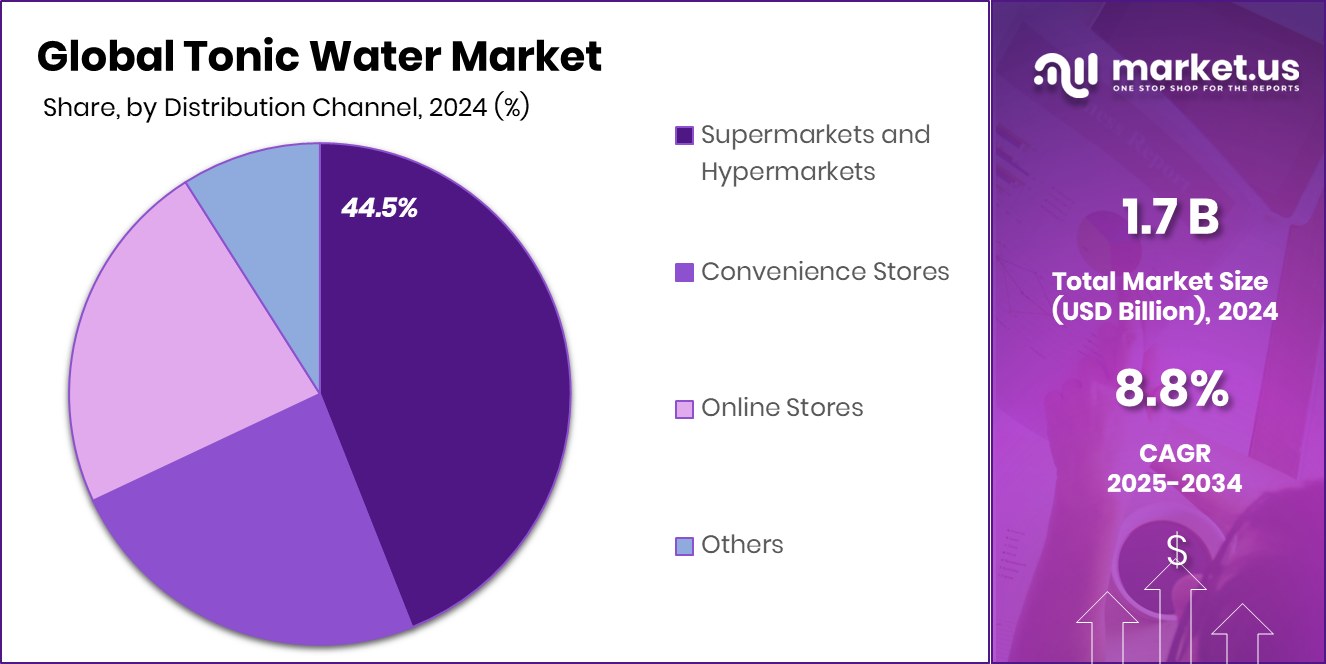

- Supermarkets and hypermarkets drive 44.5% of sales, offering accessibility and a wide product range.

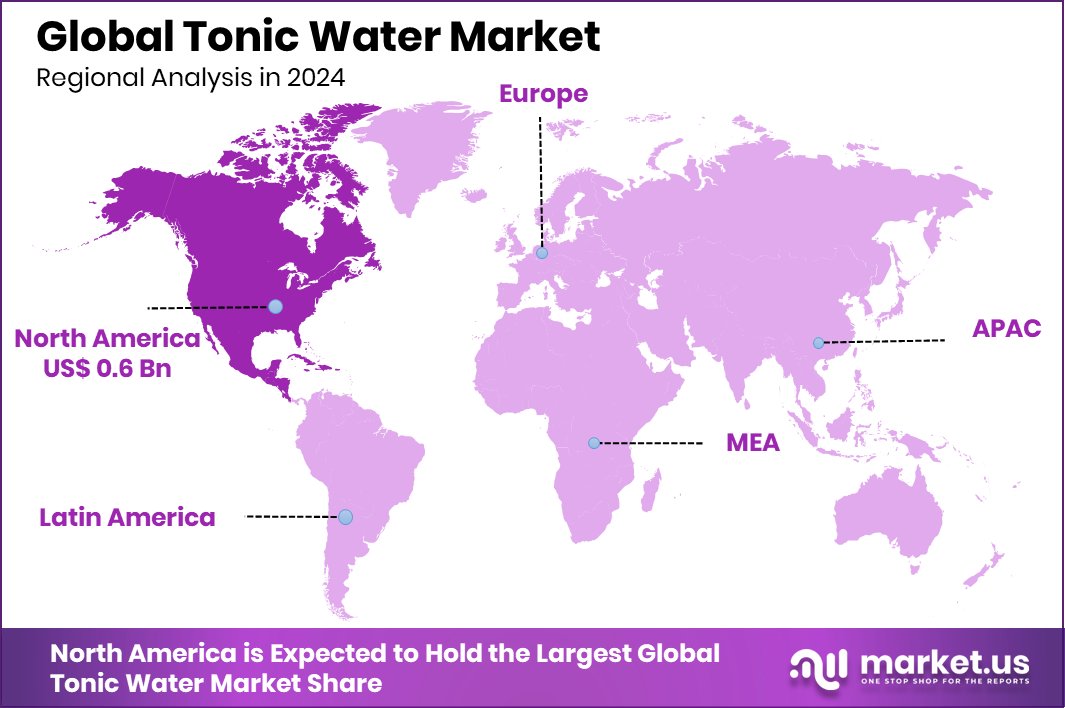

- The regional market size in North America reached USD 0.6 billion.

By Type Analysis

Flavored tonic water dominates the market with a 65.3% share.

In 2024, Flavored held a dominant market position in the By Type segment of the Tonic Water Market, with a 65.3% share. This strong performance reflects shifting consumer preferences toward more diverse and enjoyable taste profiles in their beverages.

Flavored tonic waters, often infused with botanicals, fruits, or herbs, are increasingly favored for their ability to elevate both alcoholic and non-alcoholic drinks. Their versatility makes them a popular choice among consumers looking to experiment with new mixes or seeking a refreshing alternative to traditional soft drinks.

The growth in this segment can also be attributed to the rising interest in premium and craft beverage experiences, where taste and uniqueness play a key role. Flavored tonic waters appeal to a broad demographic, including health-conscious individuals seeking low-sugar or naturally sweetened options with added taste complexity. The market’s expansion is further supported by urban consumers who value quality mixers at home, especially as cocktail culture continues to influence purchase habits.

By Category Analysis

Regular tonic water holds a leading 74.7% market category share.

In 2024, Regular held a dominant market position in the By Category segment of the Tonic Water Market, with a 74.7% share. This commanding presence highlights the strong consumer preference for traditional tonic water formulations that maintain the classic balance of bitterness and carbonation. Regular tonic water continues to be the most familiar and widely accepted choice among both casual drinkers and mixology enthusiasts, often serving as the standard mixer in alcoholic beverages like gin and tonic.

The dominance of the Regular category is also supported by its consistent availability across a wide range of retail and on-trade channels, making it the go-to option for both home consumption and hospitality use. Many consumers appreciate the consistent flavor profile that Regular tonic water provides, making it a reliable base for drinks or a standalone refreshment. Its established market presence and broader appeal have contributed significantly to maintaining its leadership in this segment.

Despite evolving consumer trends, the stronghold of Regular tonic water underscores the sustained demand for classic beverages that offer familiarity, simplicity, and reliable taste. Its position is further reinforced by loyal customer habits and the foundational role it plays in both everyday and social drinking occasions.

By Packaging Type Analysis

Bottled tonic water accounts for 68.4% of total market packaging.

In 2024, Bottles held a dominant market position in the By Packaging Type segment of the Tonic Water Market, with a 68.4% share. This strong preference for bottled packaging reflects both consumer convenience and product presentation value. Bottles are widely perceived as a premium and practical format, suitable for both individual consumption and social settings.

The dominance of bottles is also linked to their strong visibility and shelf appeal in both retail outlets and hospitality environments. Consumers often associate bottled tonic water with freshness and reliability, contributing to its broad acceptance. Additionally, bottles are well-suited for single-serve or multi-pack formats, offering flexibility across different buying preferences and usage occasions.

This packaging format continues to benefit from strong brand recognition and user familiarity, reinforcing its lead in the market. The 68.4% share reflects not only a historical preference but also the continued consumer trust in bottles as a functional and attractive way to enjoy tonic water.

By Distribution Channel Analysis

Supermarkets and hypermarkets contribute 44.5% of tonic water sales.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Tonic Water Market, with a 44.5% share. This leading position reflects consumers’ continued reliance on large-format retail outlets for beverage purchases, including tonic water. Supermarkets and hypermarkets offer wide product visibility, variety, and competitive pricing, making them a preferred shopping destination for regular and occasional buyers alike.

The convenience of one-stop shopping, combined with frequent promotional offers and bulk purchasing options, supports the dominance of this channel. Consumers are able to compare different brands, flavors, and packaging types in a single visit, enhancing their overall shopping experience and influencing purchase decisions. The organized layout and strong presence of beverages in designated sections further reinforce product accessibility and impulse buying behavior.

Additionally, supermarkets and hypermarkets are often the first point of introduction for new products in the category, helping to drive awareness and trial among a broad consumer base. Their ability to serve both urban and suburban markets at scale makes them a crucial distribution point.

Key Market Segments

By Type

- Flavored

- Non-flavored

By Category

- Low/No Sugar

- Regular

By Packaging Type

- Bottles

- Cans

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Driving Factors

Rising Popularity of Home Cocktail Culture

One of the top driving factors of the tonic water market is the growing trend of home-based cocktail making. More people are now experimenting with mixing their drinks at home, especially after spending more time indoors in recent years. This has led to a higher demand for mixers like tonic water, which is a key ingredient in many popular cocktails.

Tonic water is no longer limited to bars or restaurants; consumers now prefer to stock it at home for casual gatherings or personal enjoyment. As people become more interested in trying new flavors and combinations, they are looking for quality tonic waters that enhance the overall taste of their drinks.

Restraining Factors

Health Concerns Over Sugar Content in Beverages

A major restraining factor in the tonic water market is growing concern over the sugar content in beverages. Many traditional tonic waters contain a significant amount of added sugar, which can be a turn-off for health-conscious consumers.

With rising awareness around issues like obesity, diabetes, and heart health, people are becoming more careful about what they drink. This shift in mindset has led some consumers to avoid sugary drinks altogether, including tonic water. Even though low-sugar or sugar-free versions are available, they may not be as widely known or accessible.

Growth Opportunity

Expanding Organic and Botanical Infused Tonic Waters

A top growth opportunity in the tonic water market lies in the development of organic and botanically infused variants. Many consumers today seek natural, high-quality ingredients in their beverages, and organic tonic water fits this demand perfectly. Bottlers can explore infusions with botanical extracts such as elderflower, lavender, or lemongrass to create unique flavor profiles that appeal to discerning customers.

These premium offerings not only cater to health-conscious buyers but also delight cocktail enthusiasts looking for distinctive mixers. Introducing organic and botanical blends can help brands stand out, target niche markets, and justify a slightly higher price point.

Latest Trends

Rise of Premium and Artisanal Flavor Innovations

A major trend in the tonic water market is the growing interest in premium and artisanal flavor innovations. Consumers are becoming more adventurous, seeking tonic waters that offer unique taste experiences beyond the classic quinine bitterness. Brands are responding by introducing small-batch products infused with exotic botanicals, herbs, and fruits—think grapefruit zest, rosemary sprigs, or even cucumber essence.

These high-end offerings are often marketed as craft or boutique variants, appealing to refined palates and social media-savvy drinkers. Not only do these innovations enrich the drinking experience, but they also allow brands to charge a premium price. This trend is gaining momentum as more people treat tonic water as a destination drink, rather than just a mixer, driving both trial and repeat purchases.

Regional Analysis

North America led the Tonic Water Market in 2024 with a 39.4% share.

In 2024, North America emerged as the dominating region in the tonic water market, accounting for 39.4% of the global share and reaching a market value of USD 0.6 billion. This leadership position is driven by a strong cocktail culture, widespread availability of tonic water products, and high consumer awareness regarding premium mixers.

The region also benefits from a mature retail infrastructure and rising demand for both regular and flavored variants among health-conscious and trend-sensitive consumers. Europe follows closely, with steady market demand supported by a deep-rooted tradition of gin and tonic consumption, particularly in Western countries.

Asia Pacific is experiencing notable growth, fueled by urbanization, rising disposable incomes, and the expanding presence of international beverage brands. In the Middle East & Africa, market development is slower but shows potential in premium hospitality sectors. Latin America presents emerging opportunities, especially in urban centers where consumer preferences are shifting toward global beverage trends.

Overall, while all regions are contributing to the global tonic water market’s expansion, North America stands out as the key growth driver due to its dominant share, strong consumption patterns, and value-driven market dynamics, maintaining a leading role in shaping the industry landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global tonic water market reflected a dynamic blend of tradition and innovation, with notable contributions from key players such as Bickford & Sons Ltd, Britvic Plc, and East Imperial Beverage Corp. These companies have played a central role in shaping product trends, consumer expectations, and regional market behaviors.

Bickford & Sons Ltd continued to reinforce its position by emphasizing classic tonic recipes with a refined, heritage-driven brand image. The company’s consistent quality and appeal to traditionalists provided it with a strong foothold in mature markets where authenticity and taste consistency remain important to consumers.

Britvic Plc stood out for its strong distribution capabilities and broad product portfolio, making it a significant force across multiple regions. The company’s ability to cater to both mainstream and premium segments enabled it to maintain steady growth in a competitive environment. Its reach into both retail and hospitality sectors supported visibility and customer engagement.

East Imperial Beverage Corp focused on the premium end of the market, carving a niche with high-quality, small-batch tonic waters infused with exotic botanicals. Its branding, targeting upscale consumers and mixologists, aligned with growing interest in craft and artisanal beverage experiences.

Top Key Players in the Market

- A.S. Watson Group

- Bickford & Sons Ltd

- Britvic Plc

- East Imperial Beverage Corp

- Fentimans Ltd

- Fevertree

- Novonesis Group

- Q Tonic LLC

- SodaStream International Ltd.

- Stirrings

- The Coca-Cola Co

- Thomas Henry GmbH

- Three Cents Co

- White Rock Beverages Ltd

Recent Developments

- In February 2025, liquidators confirmed that a mystery buyer acquired certain East Imperial assets, including finished stock and intellectual property, likely encompassing tonic water recipes and branding, after the company entered liquidation.

- In February 2025, Fentimans announced it had returned to profit following a challenging period. For 2024, it recorded a pre-tax profit of £1.4 million, recovering from a loss of £655,708 in 2023. The turnaround was driven by cost-saving measures, despite slightly lower sales both in the UK and overseas.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Billion Forecast Revenue (2034) USD 4.0 Billion CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Flavored, Non-flavored), By Category (Low/No Sugar, Regular), By Packaging Type (Bottles, Cans), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape A.S. Watson Group, Bickford & Sons Ltd, Britvic Plc, East Imperial Beverage Corp, Fentimans Ltd, Fevertree, Novonesis Group, Q Tonic LLC, SodaStream International Ltd., Stirrings, The Coca-Cola Co, Thomas Henry GmbH, Three Cents Co, White Rock Beverages Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- A.S. Watson Group

- Bickford & Sons Ltd

- Britvic Plc

- East Imperial Beverage Corp

- Fentimans Ltd

- Fevertree

- Novonesis Group

- Q Tonic LLC

- SodaStream International Ltd.

- Stirrings

- The Coca-Cola Co

- Thomas Henry GmbH

- Three Cents Co

- White Rock Beverages Ltd