Global Threonine Market Size, Share, And Business Benefits By Source (Plant-Based, Animal Based), By Form (Powder, Liquid), By End-Users (Animal Feed, Pharmaceuticals, Food and Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157024

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

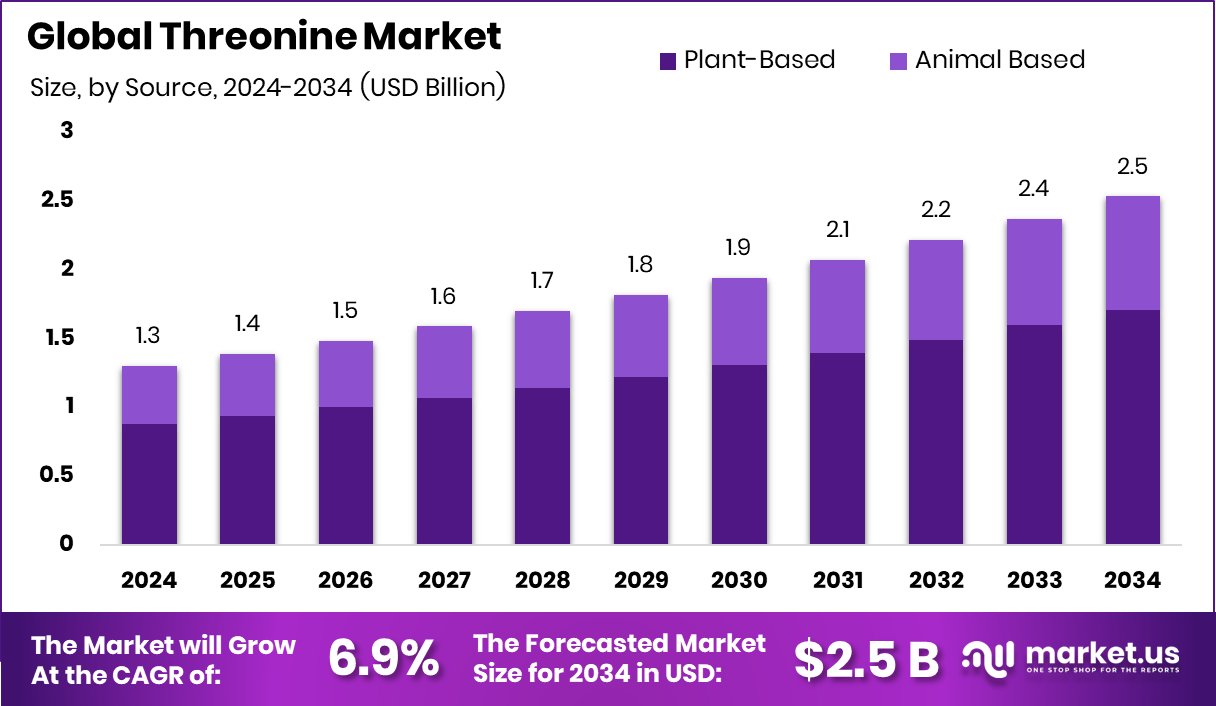

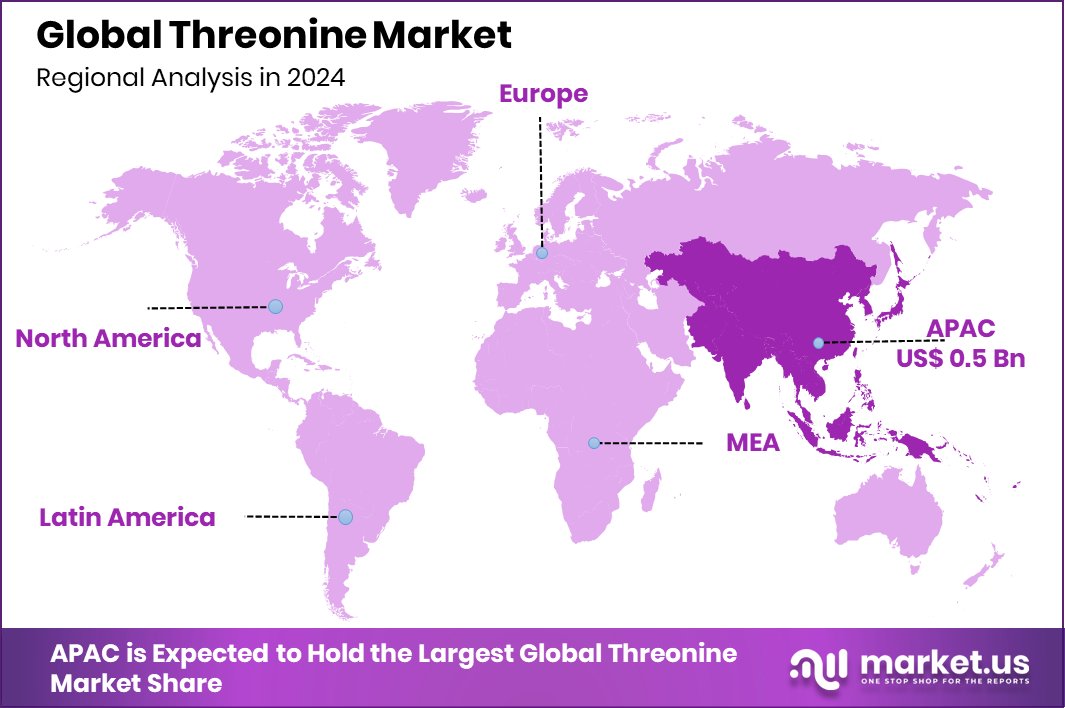

The Global Threonine Market is expected to be worth around USD 2.5 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034. Asia-Pacific 45.80% market, worth USD 0.5 Bn, benefits from expanding feed and nutrition industries.

Threonine is an essential amino acid that plays a vital role in protein synthesis, maintaining proper digestive function, and supporting the immune system. Since the human body cannot produce it naturally, it must be obtained from dietary sources or supplements. It is particularly important for animal nutrition, as it helps optimize growth and metabolism in poultry, swine, and aquaculture species.

The threonine market represents the global trade and production of this amino acid, mainly used in animal feed, pharmaceuticals, and dietary supplements. With livestock industries expanding to meet rising protein demand, threonine has become indispensable in feed formulations to improve feed efficiency, reduce nitrogen excretion, and support sustainable farming practices. According to an industry report, Wastelink secures $3M to boost animal feed supply chain

One major growth factor for the threonine market is the surge in demand for high-quality animal protein. As global meat consumption continues to rise, the need for efficient feed additives like threonine increases, ensuring better growth rates and health outcomes in animals.

The demand is also driven by the growing trend of functional foods and dietary supplements. Consumers seeking better digestive health, improved immunity, and balanced nutrition are turning toward amino acid-based products, making threonine a valued ingredient in human health applications.

Key Takeaways

- The Global Threonine Market is expected to be worth around USD 2.5 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 6.9% from 2025 to 2034.

- In 2024, plant-based sources held a 67.3% share, showing the Threonine Market’s growing reliance on sustainable feedstock.

- Powder form dominated the Threonine Market with a 78.4% share, reflecting convenience and efficiency in feed applications.

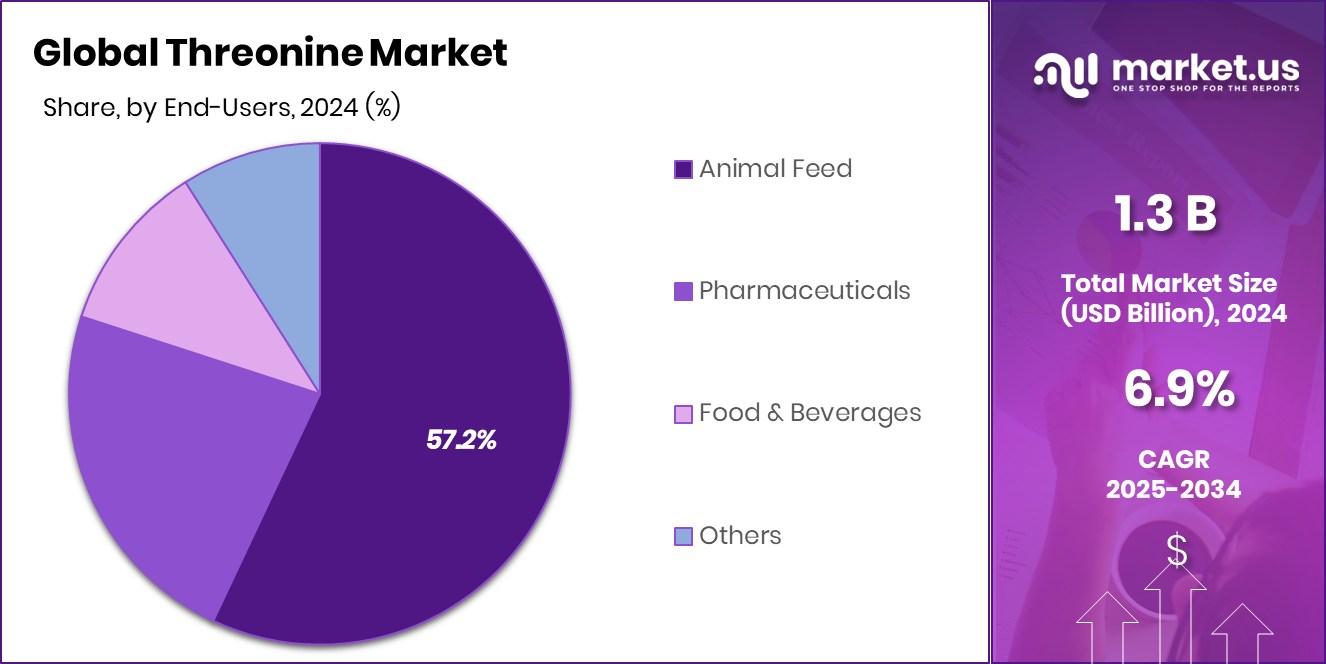

- The animal feed sector captured 57.2% of the threonine market, underlining its critical role in livestock productivity.

- Rising livestock production across the Asia-Pacific 45.80% region strongly drives threonine demand, supporting USD 0.5 Bn growth.

By Source Analysis

The threonine market thrives with a 67.3% share from plant-based production sources.

In 2024, Plant-Based held a dominant market position in the By Source segment of the Threonine Market, with a 67.3% share. This strong presence reflects the rapid adoption of plant-derived sources in amino acid production, driven by both sustainability initiatives and cost-effective fermentation technologies.

The preference for plant-based threonine is also influenced by the global shift toward greener solutions, where industries are actively seeking alternatives that reduce dependency on synthetic chemicals and align with eco-friendly manufacturing practices.

The large share is also supported by the wide application of plant-based threonine in animal feed, where it enhances protein utilization and growth efficiency. As livestock industries expand to meet rising global protein demand, the reliance on plant-derived threonine is becoming even more pronounced.

In addition, regulatory bodies in several regions have been encouraging the use of sustainable raw materials, creating further opportunities for plant-based production to flourish.

Another factor contributing to this segment’s dominance is the rising consumer awareness around clean-label and natural ingredients. As food and nutraceutical companies incorporate amino acids into their formulations, sourcing from plant-based origins adds value to product positioning.

By Form Analysis

Powder dominates the threonine market, holding 78.4% due to easy feed blending.

In 2024, Powder held a dominant market position in the By Form segment of the Threonine Market, with a 78.4% share. The preference for powdered threonine is primarily due to its ease of blending, stability during storage, and cost-effectiveness in large-scale applications.

Powder form is widely adopted in animal feed formulations, where precise dosage and uniform mixing are essential to improve feed efficiency and optimize animal growth. Its ability to disperse evenly ensures that livestock receive consistent nutritional benefits, making it the most practical choice for the feed industry.

The pharmaceutical and nutraceutical sectors also contribute to the prominence of the powder form, as it allows manufacturers to formulate tablets, capsules, and supplements with higher accuracy and longer shelf life. Additionally, powdered threonine is more convenient to transport and store, offering advantages in global supply chain management.

The dominance of the powder form is further reinforced by technological advancements in fermentation and processing, which enable manufacturers to produce high-quality threonine powders at scale. With its 78.4% share, powder continues to set the benchmark for efficiency and versatility, ensuring its role as the preferred form in the threonine market in 2024.

By End-Users Analysis

The animal feed sector leads the threonine market, capturing a 57.2% share worldwide.

In 2024, Animal Feed held a dominant market position in the By End-Users segment of the Threonine Market, with a 57.2% share. This dominance highlights the critical role of threonine as a key amino acid in livestock nutrition, particularly in poultry, swine, and aquaculture.

As global demand for animal protein continues to rise, farmers and feed manufacturers are increasingly incorporating threonine to enhance feed efficiency, support healthy growth, and improve overall productivity. Its inclusion reduces the need for excess crude protein in diets, thereby lowering feed costs and minimizing nitrogen excretion, which also supports environmental sustainability.

The use of threonine in animal feed is further strengthened by regulatory guidelines and government initiatives promoting balanced feed formulations to improve animal health and reduce environmental impact.

With livestock production expanding across Asia-Pacific, Europe, and North America, the demand for threonine in feed applications remains robust. Moreover, rising consumer expectations for high-quality meat and dairy products are pushing producers to optimize animal diets, where threonine plays a central role.

Key Market Segments

By Source

- Plant-Based

- Animal Based

By Form

- Powder

- Liquid

By End-Users

- Animal Feed

- Pharmaceuticals

- Food and Beverages

- Others

Driving Factors

Rising Demand for High-Quality Animal Nutrition

One of the biggest driving factors for the threonine market is the growing demand for high-quality animal nutrition. Threonine is a vital amino acid used in animal feed, especially for poultry, pigs, and aquaculture. Farmers and feed manufacturers rely on it to improve feed efficiency, enhance growth, and support stronger immunity in animals.

As global meat and dairy consumption increases, the pressure on livestock producers to deliver healthier and more efficient production also rises. Threonine helps reduce excess protein in feed, lowering costs and environmental impact by minimizing nitrogen waste.

This makes it not just a nutritional ingredient but also a sustainable solution. Its dual role in improving productivity and promoting eco-friendly practices keeps it central to market growth.

Restraining Factors

Price Volatility of Raw Materials and Production

A key restraining factor for the threonine market is the high price volatility of raw materials and production inputs. Threonine is commonly produced through fermentation processes that depend on agricultural feedstocks like corn and other plant-based sources.

When crop prices rise due to poor harvests, climate change, or global supply chain disruptions, the cost of producing threonine increases sharply. This directly impacts manufacturers and makes it harder to maintain stable pricing for end-users such as feed producers.

Additionally, high energy and operational costs in fermentation facilities add to the challenge. Such fluctuations reduce profitability and can limit wider adoption, particularly in price-sensitive markets. This cost instability remains a major hurdle to the steady expansion of the threonine market.

Growth Opportunity

Expanding Use of Threonine in Human Nutrition

A major growth opportunity for the threonine market lies in its expanding use within human nutrition and healthcare. While animal feed remains the primary application, growing consumer awareness about amino acids and their role in overall wellness is opening new pathways.

Threonine supports liver function, digestive health, and immunity, making it a valuable ingredient in dietary supplements, functional foods, and sports nutrition products. With rising health-conscious lifestyles and demand for clean-label supplements, threonine has strong potential to move beyond livestock applications.

Pharmaceutical industries are also exploring their role in therapeutic formulations. This diversification of end-use applications provides a promising growth avenue, ensuring the threonine market can capture long-term opportunities in both nutrition and wellness sectors.

Latest Trends

Adoption of Sustainable Fermentation for Threonine Production

One of the latest trends in the threonine market is the rapid adoption of sustainable fermentation technologies. Manufacturers are focusing on eco-friendly production methods that reduce reliance on traditional chemical synthesis and cut down energy use.

Using advanced microbial fermentation, companies can achieve higher yields of threonine while lowering greenhouse gas emissions and waste. This shift is strongly supported by global sustainability goals and stricter environmental regulations in the feed and food industries.

Additionally, plant-based fermentation aligns with the growing demand for cleaner, more natural ingredients, which resonates with both feed producers and health-conscious consumers. As sustainability becomes a key competitive edge, the trend of adopting greener fermentation processes is shaping the future of the threonine market.

Regional Analysis

In 2024, Asia-Pacific dominated the Threonine Market with a 45.80% share, valued at USD 0.5 Bn.

The threonine market shows varied regional dynamics across North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America, reflecting differences in livestock production, dietary trends, and industrial development. In 2024, Asia-Pacific emerged as the dominating region, capturing a significant 45.80% share valued at USD 0.5 billion.

The region’s leadership is largely driven by its vast livestock sector, particularly in China and India, where the demand for poultry, swine, and aquaculture products continues to rise with growing populations and urbanization. Government initiatives promoting sustainable farming practices and feed efficiency further support the use of threonine in animal diets, ensuring better growth and reduced environmental impact.

Asia-Pacific’s dominance is also reinforced by its strong manufacturing base, which allows for cost-effective production and large-scale supply to domestic and global markets. While North America and Europe maintain steady adoption supported by advanced feed practices, Asia-Pacific remains at the center of growth due to its scale and expanding consumption patterns.

The combination of rising protein demand, supportive policies, and industrial capacity cements Asia-Pacific’s role as the most influential region in shaping the threonine market outlook in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Evonik Industries AG continues to leverage its expertise in amino acid production, focusing on sustainable feed solutions. The company emphasizes reducing the environmental footprint of livestock farming through advanced threonine formulations that optimize protein utilization and cut nitrogen emissions. Its commitment to eco-friendly production processes positions Evonik as a strong player in addressing both efficiency and sustainability goals.

CJ CheilJedang Corporation, with its robust presence in fermentation-based biotechnology, plays a pivotal role in scaling threonine production. The company’s extensive global footprint, particularly across Asia-Pacific, enables it to meet rising demand efficiently. By investing in advanced microbial fermentation, CJ CheilJedang not only ensures cost-effective production but also aligns with the growing industry trend toward cleaner and greener solutions.

Ajinomoto Co., Inc., recognized for its pioneering role in amino acid technologies, continues to integrate threonine into both feed and health-related applications. The company’s focus on research and innovation allows it to diversify threonine usage beyond animal nutrition, tapping into dietary supplements and wellness markets.

Top Key Players in the Market

- Evonik Industries AG

- CJ CheilJedang Corporation

- Ajinomoto Co., Inc.

- Archer Daniels Midland Company

- Meihua Holdings Group Co., Ltd.

- Bio-Chem Technology Group Company Limited

- NB Group Co., Ltd.

- Prinova Group LLC

Recent Developments

- In April 2025, at the China Feed Industry Expo in April 2025, Evonik showcased its product portfolio’s efficiency and sustainability. Notably, it emphasized MetAMINO®’s 35% lower carbon footprint compared to industry averages. It also introduced a poultry-focused probiotic, Ecobiol®, and showcased analytical services (AMINONIR®) aimed at improving feed efficiency and reducing environmental impact.

- In November 2024, CJ CheilJedang announced it was reaching out to potential buyers for its bio business division, which includes production of amino acids used in microbial-based food and feed, and this covers threonine. The move signals a strategic shift in its biotechnology segment.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.5 Billion CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plant-Based, Animal Based), By Form (Powder, Liquid), By End-Users (Animal Feed, Pharmaceuticals, Food and Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Evonik Industries AG, CJ CheilJedang Corporation, Ajinomoto Co., Inc., Archer Daniels Midland Company, Meihua Holdings Group Co., Ltd., Bio-Chem Technology Group Company Limited, NB Group Co., Ltd., Prinova Group LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Evonik Industries AG

- CJ CheilJedang Corporation

- Ajinomoto Co., Inc.

- Archer Daniels Midland Company

- Meihua Holdings Group Co., Ltd.

- Bio-Chem Technology Group Company Limited

- NB Group Co., Ltd.

- Prinova Group LLC