Global Thioglycolic Acid Market Size, Share, Growth Analysis By Type (High Purity Grade, Low Purity Grade, Technical Grade), By Form (Liquid, Solid), By Application ( Corrosion and Scale Inhibitors, Flow Stimulator, Reducing Agent, Chemical Intermediate, Chain Transfer Agent, Catalyst Recovery Agent, Additives, Others), By End Use (Oil and Gas, Plastics and Polymers, Chemicals and Petrochemicals, Leather, Cosmetics, Metal and Metallurgy, Others) - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157316

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

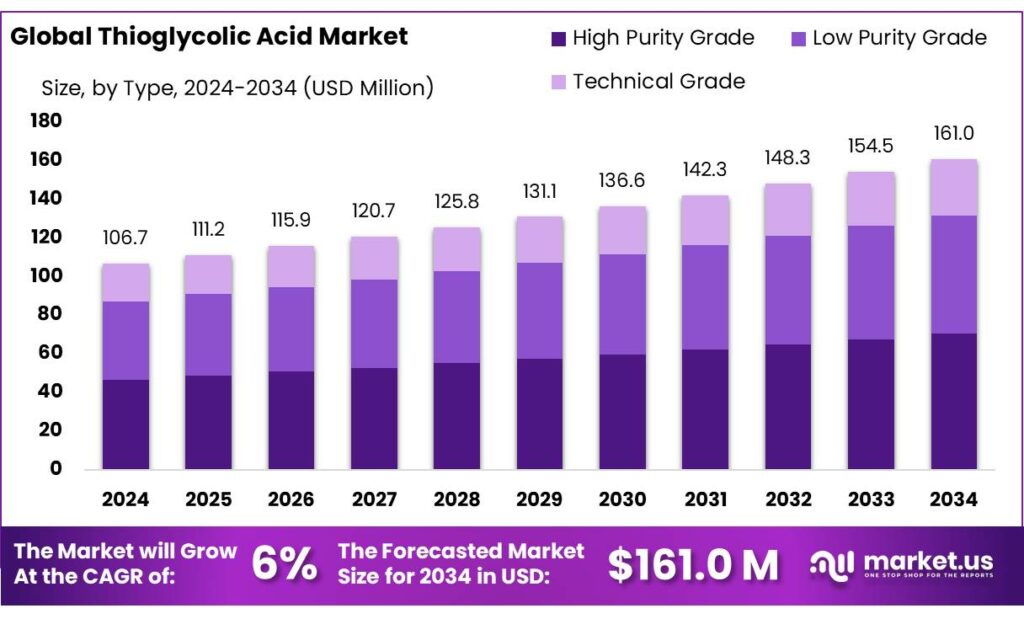

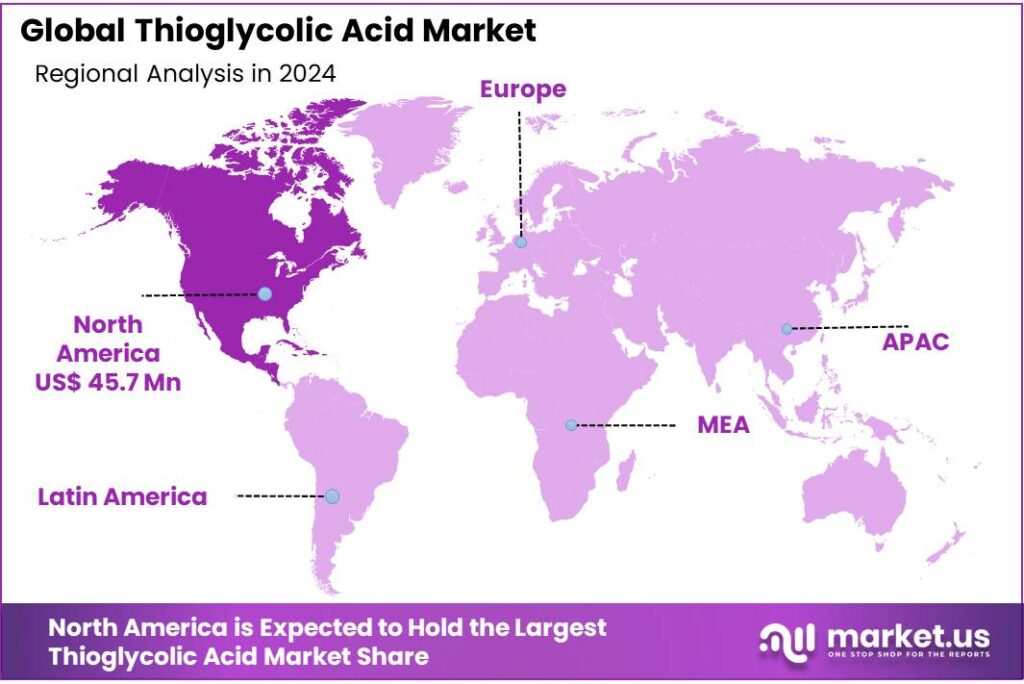

The Global Thioglycolic Acid Market size is expected to be worth around USD 161.0 Million by 2034, from USD 106.7 Million in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 42.9% share, holding USD 45.7 Million in revenue.

Thioglycolic acid (TGA), also known as mercaptoacetic acid, is a versatile sulfur-containing organic compound with the chemical formula C₂H₄O₂S. It is primarily utilized in various industrial applications, including cosmetics, pharmaceuticals, leather processing, and as a chemical intermediate in the production of thioglycolates. In India, the chemical industry is a significant contributor to the economy, accounting for approximately 7% of the country’s Gross Domestic Product (GDP) as of 2022. The sector produces over 80,000 different chemical products and generates employment for around five million people.

Government initiatives such as “Make in India,” “Aatmanirbhar Bharat,” and the Production-Linked Incentive (PLI) Scheme are designed to bolster domestic manufacturing capabilities, including in the chemical sector. These programs aim to reduce dependency on imports, enhance production capacities, and encourage innovation and research in chemical manufacturing. Such policies are expected to positively impact the thioglycolic acid industry by fostering a more self-reliant and competitive domestic market.

The demand for thioglycolic acid is also influenced by advancements in technology and increasing industrial applications. In the oil and gas industry, TGA is used as a corrosion inhibitor and in oilfield chemicals. In the textile industry, it serves as a stabilizer in the production of textile treatment chemicals. Moreover, TGA is utilized in the production of pesticides and as a chain transfer agent in polymerization processes.

Key Takeaways

- Thioglycolic Acid Market size is expected to be worth around USD 161.0 Million by 2034, from USD 106.7 Million in 2024, growing at a CAGR of 6.0%.

- High Purity Grade held a dominant market position, capturing more than a 43.8% share in the global thioglycolic acid market.

- Liquid held a dominant market position, capturing more than a 67.9% share in the global thioglycolic acid market.

- Corrosion & Scale Inhibitors held a dominant market position, capturing more than a 25.1% share in the global thioglycolic acid market.

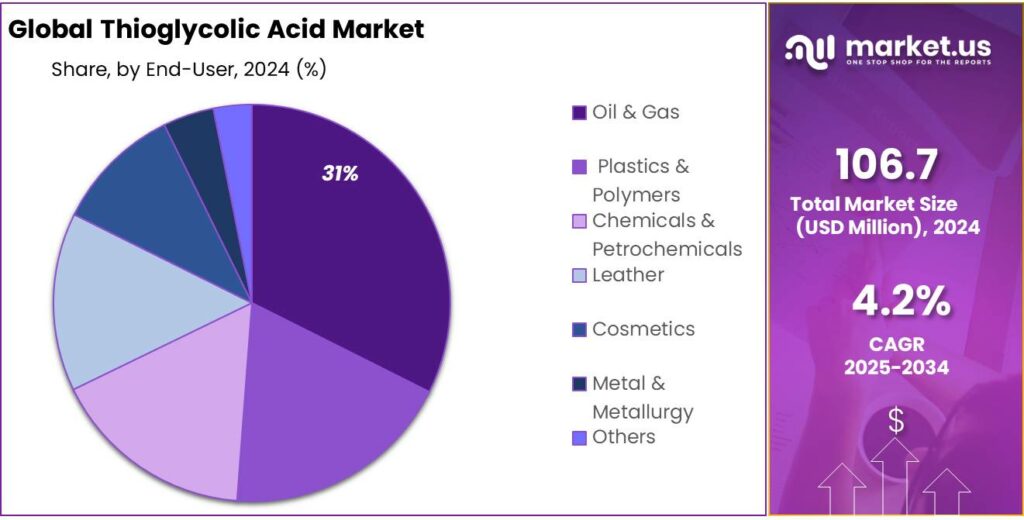

- Oil & Gas held a dominant market position, capturing more than a 31.2% share in the global thioglycolic acid market.

- North America held a dominant market position in the global thioglycolic acid market, capturing more than a 42.9% share, valued at USD 45.7 million.

By Type Analysis

High Purity Grade Leads with 43.8% Share in 2024

In 2024, High Purity Grade held a dominant market position, capturing more than a 43.8% share in the global thioglycolic acid market. This segment has gained traction because of its essential role in industries that require strict quality standards, such as cosmetics, pharmaceuticals, and specialty chemicals. Products like hair care formulations, depilatory creams, and medical applications rely heavily on high-purity thioglycolic acid, as impurities can reduce both effectiveness and safety.

The growing consumer demand for safe personal care solutions in 2024 has particularly strengthened the adoption of this grade. The rise in disposable incomes and awareness about grooming and hygiene in regions like Asia-Pacific and North America continues to push demand for high-purity formulations. Furthermore, regulatory guidelines in both developed and emerging markets increasingly emphasize the use of high-quality raw materials, which has positioned the high-purity grade as the preferred choice across industries.

By Form Analysis

Liquid Form Dominates with 67.9% Share in 2024

In 2024, Liquid held a dominant market position, capturing more than a 67.9% share in the global thioglycolic acid market. This form has become the most widely used because of its easy handling, faster solubility, and compatibility with various industrial processes. Industries such as cosmetics, leather processing, and chemical manufacturing rely heavily on liquid thioglycolic acid, as it can be directly blended into formulations without additional processing steps.

The high adoption in cosmetic and hair care products during 2024 has been a major driver. Liquid thioglycolic acid serves as a key ingredient in depilatory creams and hair treatments, offering both convenience and consistent quality. Its usage also extends into industrial cleaning and metal treatment applications, where the liquid form ensures uniform application and effectiveness. With the rise in demand for both personal care and industrial-grade solutions, the liquid segment has maintained a clear edge over other forms.

By Application Analysis

Corrosion & Scale Inhibitors Lead with 25.1% Share in 2024

In 2024, Corrosion & Scale Inhibitors held a dominant market position, capturing more than a 25.1% share in the global thioglycolic acid market. This strong presence is largely due to the wide application of thioglycolic acid in preventing rust, scaling, and mineral deposits across industries such as oil & gas, water treatment, and power generation. Its ability to act as an effective chelating agent makes it essential for extending equipment life, reducing maintenance costs, and improving operational efficiency.

The rising focus on industrial safety and asset protection in 2024 further pushed demand in this segment. In oilfield operations, where pipelines and drilling equipment are constantly exposed to harsh environments, the use of thioglycolic acid in corrosion inhibitors has become indispensable. Similarly, in water treatment facilities, the compound helps in scale control, ensuring smoother operations and compliance with quality standards. These practical benefits have made corrosion and scale inhibitors one of the most valued application areas for thioglycolic acid.

By End Use Analysis

Oil & Gas Sector Dominates with 31.2% Share in 2024

In 2024, Oil & Gas held a dominant market position, capturing more than a 31.2% share in the global thioglycolic acid market. The segment’s leadership is rooted in the critical role of thioglycolic acid as a corrosion and scale inhibitor within oilfield operations. From drilling fluids to enhanced oil recovery and pipeline maintenance, its chelating properties help prevent mineral buildup and protect equipment exposed to extreme conditions. This ensures not only smoother operations but also longer service life of assets in one of the world’s most capital-intensive industries.

The year 2024 witnessed growing investment in upstream exploration and production, especially in regions such as North America, the Middle East, and parts of Asia. With rising energy demands, companies prioritized cost-effective maintenance solutions, and thioglycolic acid emerged as a reliable choice for controlling corrosion and scaling in complex extraction and transport processes. Its application across both offshore and onshore activities has made it indispensable in safeguarding productivity.

Key Market Segments

By Type

- High Purity Grade

- Low Purity Grade

- Technical Grade

By Form

- Liquid

- Solid

By Application

- Corrosion & Scale Inhibitors

- Flow Stimulator

- Reducing Agent

- Chemical Intermediate

- Chain Transfer Agent

- Catalyst Recovery Agent

- Additives

- Others

By End Use

- Oil & Gas

- Plastics & Polymers

- Chemicals & Petrochemicals

- Leather

- Cosmetics

- Metal & Metallurgy

- Others

Emerging Trends

Shift Toward Biodegradable and Non-Toxic Alternatives

A significant trend in the thioglycolic acid (TGA) market is the growing emphasis on developing biodegradable and non-toxic alternatives. This shift is driven by increasing consumer demand for safer, environmentally friendly products and stricter regulatory standards.

Traditional TGA formulations, while effective, pose environmental and health concerns due to their corrosive nature and potential toxicity. As a result, the industry is exploring greener alternatives to mitigate these issues. For instance, Arkema Inc. has adopted a green chemistry approach in manufacturing TGA by replacing hydrogen sulfide with sodium hydrosulfide, reducing the environmental impact of production.

Furthermore, the European Union Cosmetics Regulation permits the use of TGA and its salts in hair waving or straightening products at concentrations up to 11% for professional use, provided the pH is between 7 and 9.5. In depilatories, the permitted concentration is up to 5% with a pH range of 7 to 12.7.

These regulatory standards aim to balance the efficacy of TGA in cosmetic formulations with consumer safety and environmental considerations. The ongoing research and development in this area are crucial for aligning industry practices with sustainable and health-conscious trends.

Drivers

Rising Demand in Cosmetics and Personal Care

One of the primary driving forces behind the growth of the thioglycolic acid (TGA) market is the increasing demand from the cosmetics and personal care industry. TGA is a key ingredient in various hair care products, including depilatories and perm formulations, due to its unique chemical properties that facilitate hair restructuring. As consumer awareness about personal grooming and aesthetics rises, the demand for effective and reliable hair care solutions has surged.

This trend is particularly evident in regions like Asia-Pacific, where disposable incomes are growing, and consumers are increasingly investing in beauty and personal care products. The expanding middle-class population in countries such as India and China is contributing significantly to this demand, driving the growth of the TGA market in the region.

According to the Indian Brand Equity Foundation (IBEF), the Indian chemical industry contributes approximately 7% to the country’s Gross Domestic Product (GDP) and is the world’s sixth-largest producer of chemicals as of 2022. This robust industrial base provides a conducive environment for the growth of thioglycolic acid production and consumption within the country.

Government initiatives such as “Make in India,” “Aatmanirbhar Bharat,” and the Production-Linked Incentive (PLI) Scheme are designed to bolster domestic manufacturing capabilities, including in the chemical sector. These programs aim to reduce dependency on imports, enhance production capacities, and encourage innovation and research in chemical manufacturing. Such policies are expected to positively impact the thioglycolic acid industry by fostering a more self-reliant and competitive domestic market.

Restraints

Health and Safety Concerns

One significant challenge in the widespread use of thioglycolic acid (TGA) is its potential health and safety risks. While TGA is effective in various applications, including cosmetics and personal care products, its corrosive and toxic nature poses concerns for both consumers and workers handling the substance.

TGA is classified as a hazardous substance due to its corrosive properties. Direct contact with the skin or eyes can result in severe irritation, burns, and potential permanent damage. For instance, exposure to TGA can cause severe skin burns and eye damage, as well as respiratory issues like coughing and shortness of breath. Inhalation of its vapors can irritate the respiratory tract, leading to symptoms such as coughing and wheezing. Repeated exposure may also cause skin rashes and other dermatological issues.

The acute toxicity of TGA is evident in various studies. For example, the lethal dose (LD50) for oral ingestion in rats is approximately 73 mg/kg body weight, indicating a high level of toxicity. Additionally, dermal exposure has shown to cause severe skin irritation and, in some cases, systemic toxicity.

These health hazards necessitate stringent safety measures during the production, handling, and use of TGA. Regulatory agencies have established exposure limits to mitigate risks. For instance, the Occupational Safety and Health Administration (OSHA) has set a permissible exposure limit (PEL) for TGA at 1 ppm (3.8 mg/m³) over an 8-hour workday, with a skin notation indicating potential for significant skin absorption

Opportunity

Government Initiatives Supporting Thioglycolic Acid Growth

One significant growth opportunity for thioglycolic acid (TGA) lies in the support provided by various government initiatives aimed at fostering industrial development and innovation. These initiatives not only promote the growth of industries that utilize TGA but also encourage research and development in chemical manufacturing processes.

In the United States, for instance, the Department of Defense (DoD) awarded $192.5 million through the Defense Production Act Investments (DPAI) Program to establish domestic manufacturing capabilities for critical chemicals. This move underscores the importance of securing a reliable supply chain for essential chemicals, including those like TGA, which are vital in various industrial applications. Such government-backed investments can stimulate innovation and enhance the competitiveness of domestic chemical manufacturers.

Similarly, in India, the government’s “Make in India” initiative aims to encourage domestic manufacturing and reduce dependency on imports. This initiative has led to significant growth in the chemical industry, with the sector contributing approximately 7% to India’s GDP as of 2022. The Indian chemical industry produces over 80,000 different chemical products and employs around five million people. Such a robust industrial base provides a conducive environment for the growth of thioglycolic acid production and consumption within the country.

Regional Insights

North America Leads with 42.9% Share Worth USD 45.7 Million in 2024

In 2024, North America held a dominant market position in the global thioglycolic acid market, capturing more than a 42.9% share, valued at USD 45.7 million. The region’s leadership is strongly tied to its advanced industrial base, high demand from oil & gas, and thriving cosmetics and personal care industries. Thioglycolic acid is widely used in corrosion and scale inhibitors for oilfield operations, and with the United States being one of the largest producers and consumers of oil and gas, the compound continues to see steady uptake across exploration, refining, and pipeline maintenance.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Qingdao LNT Chemical, based in China, is a specialized producer of thioglycolic acid and its derivatives. The company has built expertise in manufacturing high-purity products for applications in leather processing, cosmetics, water treatment, and industrial chemicals. With modern production facilities and a strong supply chain, Qingdao LNT serves both domestic and global markets efficiently. Its focus on product quality, competitive pricing, and international trade partnerships has positioned it as a reliable supplier in the global thioglycolic acid market.

Ruchang Mining, also located in China, operates as a chemical and mining enterprise with expertise in thioglycolic acid production. The company primarily serves the mineral processing and metallurgy industries, where thioglycolic acid is used as a flotation reagent. Ruchang also extends its products to applications in water treatment and industrial cleaning. Known for cost-effective production and stable supply, the company leverages its mining background to secure raw material advantages, reinforcing its role as a competitive player in global markets.

Daicel Corporation, based in Japan, is a diversified chemical company specializing in advanced materials and performance chemicals. In the thioglycolic acid sector, Daicel offers products with high quality and purity standards, catering to industries such as personal care, pharmaceuticals, and polymers. The company emphasizes innovation and sustainability, ensuring its chemical solutions comply with international safety norms. With decades of expertise and strong regional influence in Asia-Pacific, Daicel contributes significantly to the reliable supply of thioglycolic acid globally.

Top Key Players Outlook

- Arkema

- Daicel Corporation

- HiMedia Laboratories

- Qingdao LNT Chemical Co., Ltd.

- Ruchang Mining

- Sasaki Chemical

- Tokyo Chemical Industry Co., Ltd

Recent Industry Developments

In 2024, Ruchang Mining, based in Qingdao, China, quietly held a solid presence in the thioglycolic acid sector by producing 1,000 tonnes per year of thioglycolic acid.

In 2024, Qingdao LNT Chemical Co., Ltd., operating out of Qingdao, China, stood steadily as a specialist in thioglycolic acid—with a registered capital of CNY 9.6 million, a plant covering 36,000 m², and a team of 50–100 people driving production.

Report Scope

Report Features Description Market Value (2024) USD 106.7 Mn Forecast Revenue (2034) USD 161.0 Mn CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (High Purity Grade, Low Purity Grade, Technical Grade), By Form (Liquid, Solid), By Application (Corrosion and Scale Inhibitors, Flow Stimulator, Reducing Agent, Chemical Intermediate, Chain Transfer Agent, Catalyst Recovery Agent, Additives, Others), By End Use (Oil and Gas, Plastics and Polymers, Chemicals and Petrochemicals, Leather, Cosmetics, Metal and Metallurgy, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arkema, Daicel Corporation, HiMedia Laboratories, Qingdao LNT Chemical Co., Ltd., Ruchang Mining, Sasaki Chemical, Tokyo Chemical Industry Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Arkema

- Daicel Corporation

- HiMedia Laboratories

- Qingdao LNT Chemical Co., Ltd.

- Ruchang Mining

- Sasaki Chemical

- Tokyo Chemical Industry Co., Ltd