Global Synthetic Yarn Market Size, Share, And Business Benefits By Fiber Type (Polyester, Nylon, Acrylic, Polypropylene, Others), By Process (Meltdown Spun Yarn, Solution Spun Yarn, Bicomponent Yarn, Others), By Application (Apparels, Home Textiles, Aerospace, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 159283

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

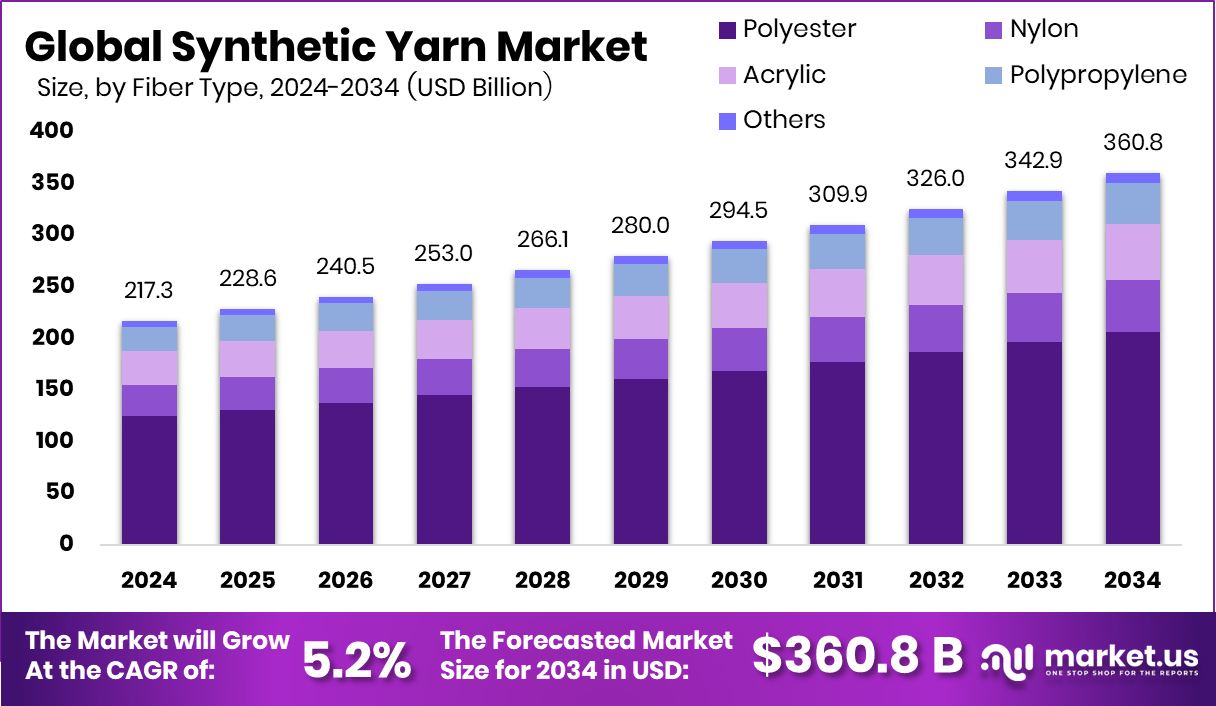

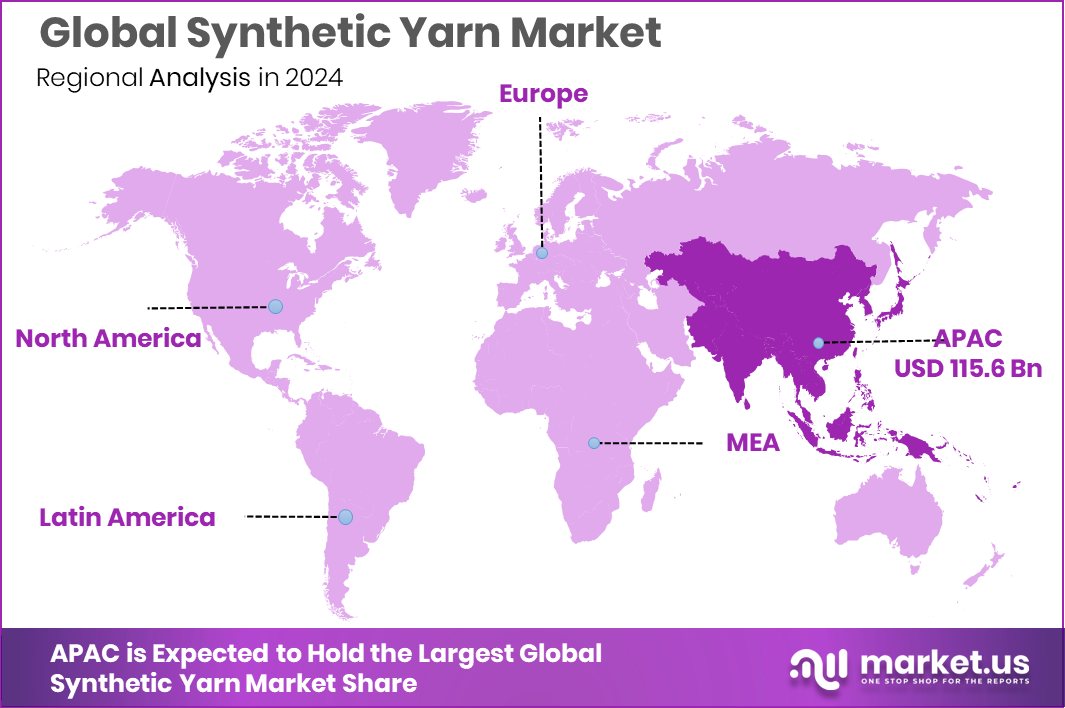

The Global Synthetic Yarn Market is expected to be worth around USD 360.8 billion by 2034, up from USD 217.3 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034. With 53.20% market share, Asia Pacific leads the synthetic yarn sector, worth USD 115.6 Bn.

Synthetic yarn is a type of yarn made from man-made fibers, typically derived from petrochemical sources. Common examples include polyester, nylon, and acrylic. These yarns are engineered to offer specific properties such as durability, moisture resistance, and elasticity, making them suitable for a wide range of applications in textiles, fashion, and industrial products.

The synthetic yarn market encompasses the production, distribution, and consumption of yarns made from synthetic fibers. This market serves various industries, including apparel, automotive, and home furnishings, driven by the demand for cost-effective, durable, and versatile materials. The market’s growth is influenced by factors such as technological advancements, consumer preferences, and economic conditions.

The synthetic yarn market is experiencing significant growth due to several factors. Technological advancements in fiber production have led to the development of high-performance yarns with enhanced properties. Additionally, the increasing demand for affordable and durable textiles in emerging economies is driving market expansion. Government initiatives, such as the establishment of yarn depots with a ₹50 crore corpus fund in Telangana, further support industry growth by improving infrastructure and accessibility.

The demand for synthetic yarn is being propelled by the rising popularity of fast fashion and the need for versatile, low-maintenance fabrics. Synthetic yarns offer benefits like color retention, wrinkle resistance, and ease of care, making them attractive to both manufacturers and consumers. This demand is particularly evident in urban areas where lifestyle changes and disposable income levels are increasing.

Government funding plays a crucial role in the development and expansion of the synthetic yarn industry. Initiatives like the Textile Production-Linked Incentive (PLI) scheme aim to attract significant investments, with a target of ₹95,000 crore over the next four to six years.

Additionally, the establishment of yarn depots in Telangana with a ₹50 crore corpus fund demonstrates the government’s commitment to enhancing infrastructure and supporting the growth of the synthetic yarn sector. Such funding initiatives are instrumental in fostering innovation, improving competitiveness, and ensuring the sustainable development of the industry.

Key Takeaways

- The Global Synthetic Yarn Market is expected to be worth around USD 360.8 billion by 2034, up from USD 217.3 billion in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- In the synthetic yarn market, polyester dominates with a 57.3% share by fiber type.

- Melted spun yarn leads the synthetic yarn market, accounting for 63.8% of total production.

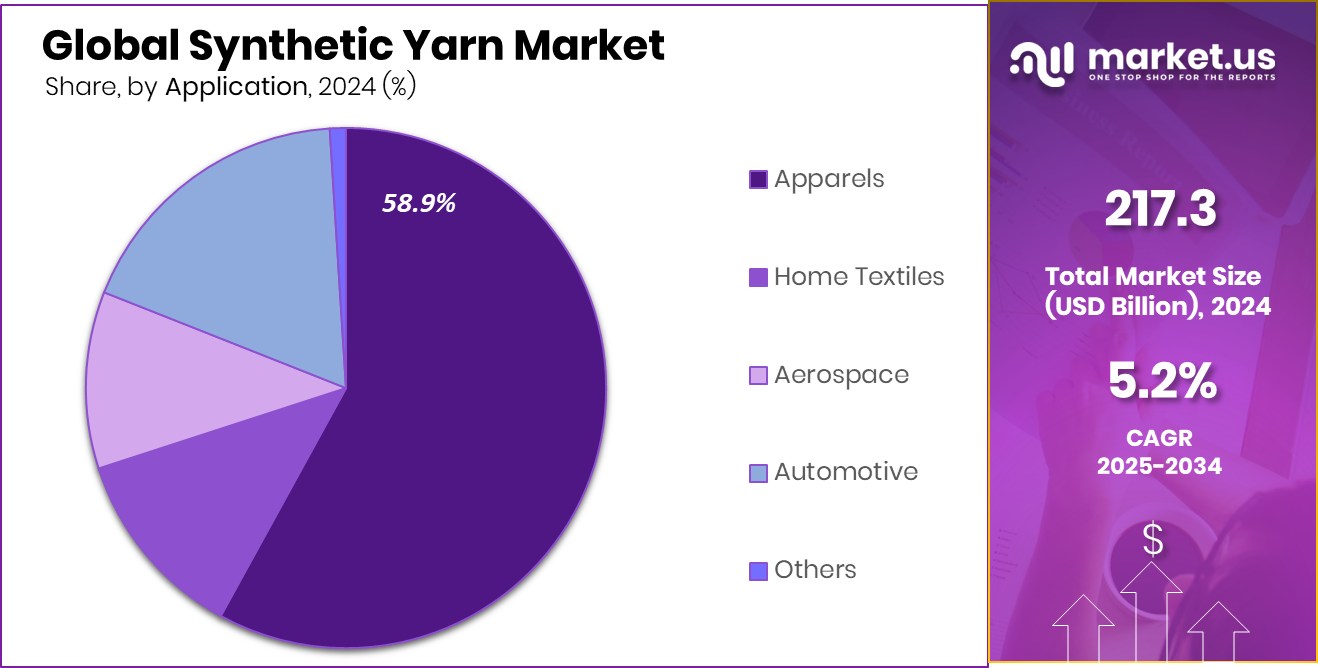

- Apparel applications drive the Synthetic Yarn Market, contributing 58.9% of overall industry demand.

- The Asia Pacific region, holding USD 115.6 Bn, drives synthetic yarn demand with 53.20% growth.

By Fiber Type Analysis

Polyester dominates the synthetic yarn market, holding a 57.3% global share.

In 2024, Polyester held a dominant market position in the By Fiber Type segment of the Synthetic Yarn Market, with a 57.3% share. This strong performance is attributed to polyester’s versatility, durability, and cost-effectiveness, making it a preferred choice across apparel, home textiles, and industrial applications. Manufacturers benefit from its excellent moisture resistance and color retention properties, which meet the growing demand for low-maintenance fabrics.

The segment’s growth is further supported by government initiatives, including infrastructure development and funding programs that enhance production capacity. With rising consumer preference for synthetic fabrics and continuous technological improvements in fiber processing, the polyester segment is expected to maintain its lead, driving overall market expansion in the synthetic yarn industry.

By Process Analysis

Meltdown spun yarn leads the synthetic yarn market with 63.8% usage.

In 2024, Meltdown Spun Yarn held a dominant market position in the By Process segment of the Synthetic Yarn Market, with a 63.8% share. The strong adoption of meltdown spun yarn is driven by its superior strength, uniformity, and smooth texture, which make it highly suitable for textile applications requiring durability and consistent quality. Its efficient production process allows manufacturers to meet large-scale demand while maintaining cost-effectiveness.

Government support, such as infrastructure development initiatives and funding programs, has further facilitated the expansion of this segment. With increasing consumer demand for high-performance fabrics and ongoing technological improvements in spinning processes, the Meltdown Spun Yarn segment is expected to sustain its leading position, contributing significantly to the overall growth of the synthetic yarn market.

By Application Analysis

Apparels drive the synthetic yarn market, accounting for 58.9% of demand.

In 2024, Apparels held a dominant market position in the By Application segment of the Synthetic Yarn Market, with a 58.9% share. The strong demand in this segment is driven by the increasing preference for synthetic fabrics in clothing due to their durability, wrinkle resistance, and low maintenance. Consumers and manufacturers favor synthetic yarn for a wide range of apparel, including casual wear, sportswear, and fashion garments, as it offers cost-effective solutions without compromising on quality.

Government initiatives, such as funding programs and infrastructure support for textile production, have further strengthened this segment by improving accessibility and production capacity. With rising consumer awareness and fashion trends, the apparel segment is expected to continue leading the synthetic yarn market.

Key Market Segments

By Fiber Type

- Polyester

- Nylon

- Acrylic

- Polypropylene

- Others

By Process

- Meltdown Spun Yarn

- Solution Spun Yarn

- Bicomponent Yarn

- Others

By Application

- Apparels

- Home Textiles

- Aerospace

- Automotive

- Others

Driving Factors

Government Support Fuels Synthetic Yarn Market Growth

Government initiatives play a pivotal role in propelling the synthetic yarn market forward. In India, the establishment of the Pradhan Mantri Mega Integrated Textile Region and Apparel (PM MITRA) Park in Dhar, Madhya Pradesh, exemplifies such support. This greenfield textile park, covering 2,158 acres, has attracted investments exceeding ₹20,000 crore from over 80 investors, including prominent firms like Trident Group and Vardhman Textiles. The park aims to create a comprehensive textile ecosystem, enhancing the production and export capabilities of synthetic yarns.

Additionally, the government’s Production-Linked Incentive (PLI) scheme has been instrumental in boosting domestic manufacturing. By offering financial incentives, the PLI scheme encourages companies to invest in advanced technologies and expand production capacities, thereby increasing the availability of synthetic yarns in the market.

These strategic initiatives not only bolster the domestic production of synthetic yarns but also position India as a competitive player in the global textile industry. With continued government support, the synthetic yarn market is poised for sustained growth and innovation.

Restraining Factors

Environmental Impact and Recycling Challenges

Synthetic yarns, predominantly derived from petroleum-based fibers like polyester and nylon, pose significant environmental challenges. Their production is energy-intensive and contributes to greenhouse gas emissions. Additionally, these fibers are non-biodegradable, leading to long-term waste accumulation in landfills and oceans. The shedding of microplastics during washing further exacerbates pollution, contaminating water bodies and harming aquatic life. Recycling synthetic fibers is complex due to their chemical composition, often requiring specialized processes that are not widely available.

While some initiatives aim to address these issues, the scale of the problem remains substantial. The lack of efficient recycling infrastructure and consumer awareness hinders progress toward sustainability in the synthetic yarn sector. Without significant advancements in recycling technologies and increased consumer participation, the environmental impact of synthetic yarns will continue to pose a major challenge to the textile industry.

Growth Opportunity

Government Funding Accelerates Synthetic Yarn Innovation

The Indian government’s strategic funding initiatives are unlocking significant growth opportunities in the synthetic yarn sector. Under the National Technical Textiles Mission (NTTM), the Union Ministry of Textiles is offering grants of up to ₹50 lakh each to 150 startups focused on developing advanced technical textiles, including synthetic yarns. This initiative, with a ₹375 crore allocation for FY25, aims to foster innovation and entrepreneurship in the sector.

Additionally, the government is considering subsidies and tax incentives to establish advanced manufacturing units for synthetic yarns. These measures are designed to enhance domestic production capabilities and reduce dependency on imports, particularly from countries like China.

These funding initiatives not only support the growth of synthetic yarn manufacturing but also position India as a competitive player in the global textile industry. By encouraging innovation and infrastructure development, the government is paving the way for a sustainable and self-reliant synthetic yarn sector.

Latest Trends

Recycling Innovations Transform Synthetic Yarn Production

The synthetic yarn industry is experiencing a significant shift towards sustainability, driven by advancements in recycling technologies. Innovative projects are now converting post-consumer polyester textiles into new yarns, effectively creating a circular economy within the textile sector.

For instance, the collaboration between the Salvation Army and Project Plan B in the UK has led to the establishment of Project Reclaim, which aims to recycle 2,500 tonnes of polyester waste in 2024, with plans to double that amount by 2025. This initiative not only reduces landfill waste but also lowers carbon emissions associated with textile production.

Similarly, in India, the Tirupur region, known for its knitwear exports, is transforming manmade fibres (MMF). The local industry, which currently contributes just 10% to production, aims to increase MMF’s role to 30% by 2030. This shift is supported by government subsidies, R&D funding, and initiatives like the Tamil Nadu Tech Textile Mission, which facilitate industrial growth and innovation in MMF and technical textiles.

Regional Analysis

In 2024, the Asia Pacific dominated the Synthetic Yarn Market with a 53.20% share, valued at USD 115.6 Bn.

In 2024, the Synthetic Yarn Market across regions such as North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America shows diverse growth patterns driven by regional demand and industrial development. Asia Pacific emerges as the dominating region, holding a substantial 53.20% market share, valued at USD 115.6 billion. The region’s dominance is supported by rapid industrialization, increasing textile production, and government initiatives aimed at enhancing infrastructure and manufacturing capabilities. Countries in this region are witnessing rising consumption of synthetic yarn in apparel, home textiles, and industrial applications due to cost-effectiveness, durability, and easy maintenance.

North America and Europe maintain steady demand, driven by technological advancements, premium textile applications, and high consumer awareness regarding fabric performance. The Middle East & Africa and Latin America are gradually expanding their synthetic yarn usage, supported by emerging textile industries and increasing investments in manufacturing facilities.

However, the Asia Pacific region continues to lead, accounting for over half of the global market share, reflecting its strategic position in textile production and export. With sustained government support and growing industrial capacity, the Asia Pacific is expected to maintain its leadership in the synthetic yarn market in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Kuraray Co. Ltd., a Japanese chemical company, has established a strong presence in the synthetic yarn market through its production of specialized fibers such as polyvinyl alcohol (PVA) and polyester. The company’s commitment to innovation is evident in its development of high-performance materials like KURALON™ and VECTRAN™, which are utilized in various applications, including textiles, industrial products, and medical devices. Kuraray’s focus on sustainability and technological advancement positions it as a key player in the global synthetic yarn market.

DuPont, a U.S.-based science and technology company, has been a significant contributor to the synthetic yarn market, particularly through its production of high-performance fibers such as Nomex® and Kevlar®. These fibers are renowned for their heat and flame-resistant properties, making them essential in protective clothing and industrial applications. However, DuPont has recently announced the sale of its Aramids business, which includes Kevlar® and Nomex®, to Arclin for $1.8 billion. This strategic move is part of DuPont’s broader reorganization efforts to streamline operations and focus on core areas.

Reliance Industries Limited, an Indian conglomerate, has made substantial investments in the synthetic yarn sector, particularly in the production of polyester and nylon fibers. The company’s integrated operations, from petrochemical manufacturing to textile production, enable it to maintain a competitive edge in the market. Reliance’s commitment to expanding its synthetic yarn production capacity aligns with the growing demand in both domestic and international markets.

Top Key Players in the Market

- Kuraray Co. Ltd

- DuPont

- Reliance Industries Limited

- Lenzing Group

- Teijin Limited

- Toray Industries Inc.

- Indorama Ventures Public Company Limited

- Eastman Chemical Company

- Mitsubishi Chemical Corporation

- Zhejiang Hengyi Group Ltd.

- Aksa Akrilik Kimya

Recent Developments

- In April 2025, Kuraray acquired Nelumbo Inc., a U.S.-based company specializing in surface modification technologies. This acquisition enhances Kuraray’s capabilities in developing high-performance materials, potentially impacting the synthetic yarn market by introducing advanced functionalities and applications.

- In May 2022, DuPont Biomaterials partnered with JP Modatex India to launch a sustainable spun yarn collection. This collaboration blends DuPont’s Sorona® fibers with natural fibers to create yarns suitable for various applications, including apparel and home textiles. The initiative underscores DuPont’s commitment to sustainability and innovation in the textile industry.

Report Scope

Report Features Description Market Value (2024) USD 217.3 Billion Forecast Revenue (2034) USD 360.8 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fiber Type (Polyester, Nylon, Acrylic, Polypropylene, Others), By Process (Meltdown Spun Yarn, Solution Spun Yarn, Bicomponent Yarn, Others), By Application (Apparel, Home Textiles, Aerospace, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kuraray Co. Ltd, DuPont, Reliance industries Limited, Lenzing Group, Teijin Limited, Toray Industries Inc., Indorama Ventures Public company Limited, Eastman Chemical Company, Mitsubishi Chemical Corporation, Zhejiang Hengyi Group Ltd., Aksa Akrilik Kimya Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Synthetic Yarn MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Synthetic Yarn MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Kuraray Co. Ltd

- DuPont

- Reliance Industries Limited

- Lenzing Group

- Teijin Limited

- Toray Industries Inc.

- Indorama Ventures Public Company Limited

- Eastman Chemical Company

- Mitsubishi Chemical Corporation

- Zhejiang Hengyi Group Ltd.

- Aksa Akrilik Kimya