Stereotactic Planning Software Market By Product Type (Integrated and Standalone), By Application (CT Images, PET/CT, and MRI Images), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157278

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

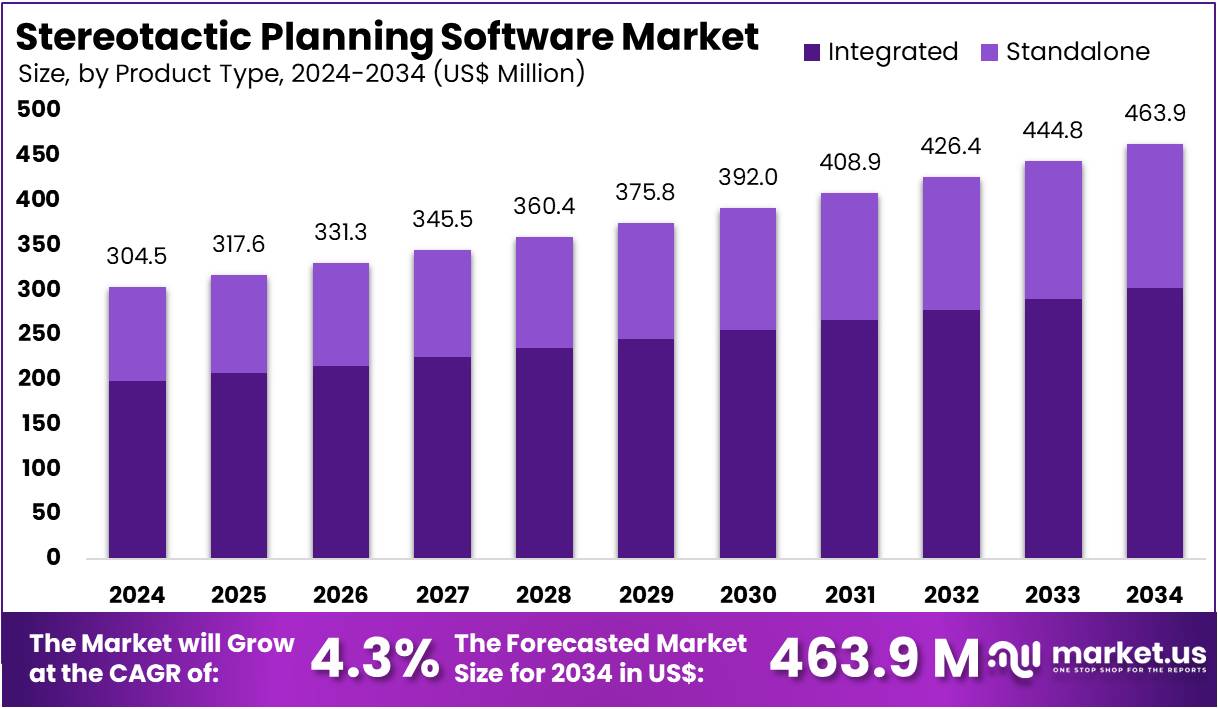

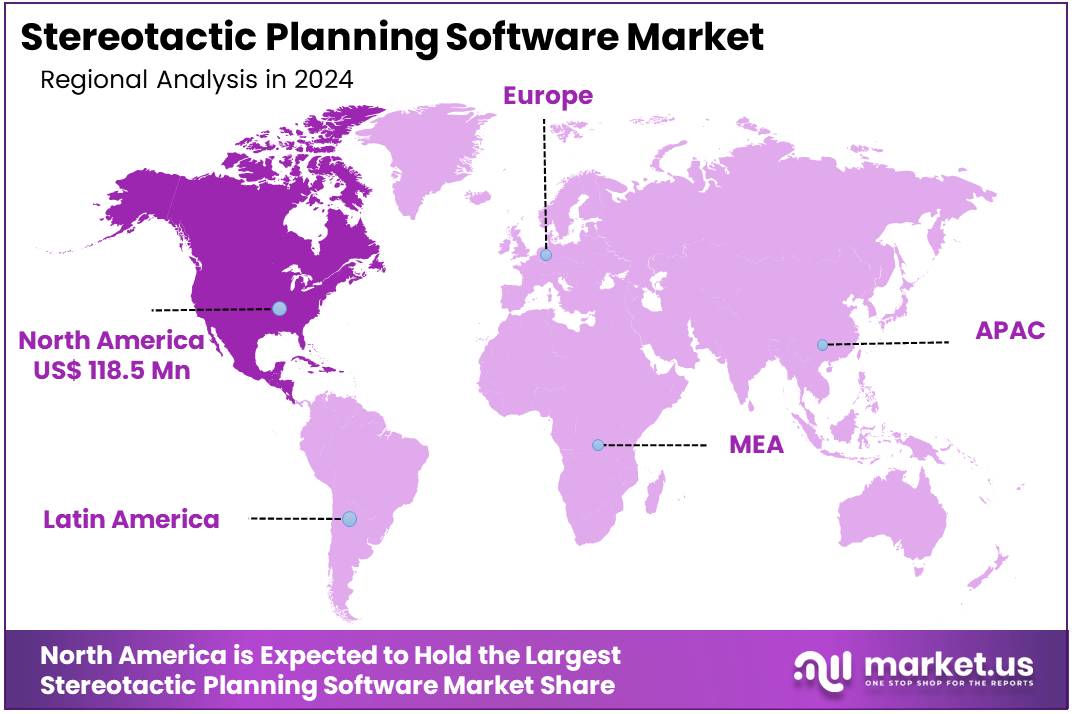

The Stereotactic Planning Software Market Size is expected to be worth around US$ 463.9 Million by 2034 from US$ 304.5 Million in 2024, growing at a CAGR of 4.3% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.9% share and holds US$ 118.5 Million market value for the year.

Rising incidence of complex neurological and oncological conditions is a primary driver of the stereotactic planning software market. This software is a critical component of stereotactic radiosurgery (SRS) and stereotactic radiotherapy, enabling clinicians to precisely target tumors and lesions while minimizing damage to surrounding healthy tissue.

The American Brain Tumor Association estimates that over 90,000 new cases of primary brain and central nervous system tumors are diagnosed annually, with millions of individuals currently living with a diagnosis. This high patient volume, along with a growing focus on less invasive treatment options, fuels the demand for advanced planning software that provides unparalleled precision for delicate procedures.

Growing technological integration and strategic partnerships are key trends shaping the market. Companies are increasingly collaborating to offer comprehensive, end-to-end solutions that combine advanced software with hardware to improve access and efficiency.

For instance, in July 2025, RaySearch Laboratories and Radiology Oncology Systems (ROS) announced a strategic partnership to integrate advanced software solutions with refurbished linear accelerators. This collaboration aims to make high-quality radiation therapy more affordable and accessible to clinics, thereby promoting a wider adoption of RaySearch’s planning software, RayStation, and extending the lifecycle of existing equipment, advancing sustainability in radiation therapy.

Increasing demand for personalized medicine and data-driven treatment planning is creating significant opportunities for market expansion. The shift towards personalized oncology requires software that can analyze complex imaging data and genomic information to create highly customized treatment plans.

The National Cancer Institute (NCI) reports that the five-year relative survival rate for all patients with malignant brain tumors hovers around 36%, highlighting the urgent need for more effective and targeted treatments. Advanced planning software is critical for this effort, as it allows for the precise delivery of high radiation doses to tumors, improving local control rates and patient outcomes. The continuous development of AI-powered algorithms to automate and optimize treatment plans further ensures market growth.

Key Takeaways

- In 2024, the market generated a revenue of US$ 304.5 Million, with a CAGR of 4.3%, and is expected to reach US$ 463.9 Million by the year 2034.

- The product type segment is divided into integrated and standalone, with integrated taking the lead in 2023 with a market share of 65.3%.

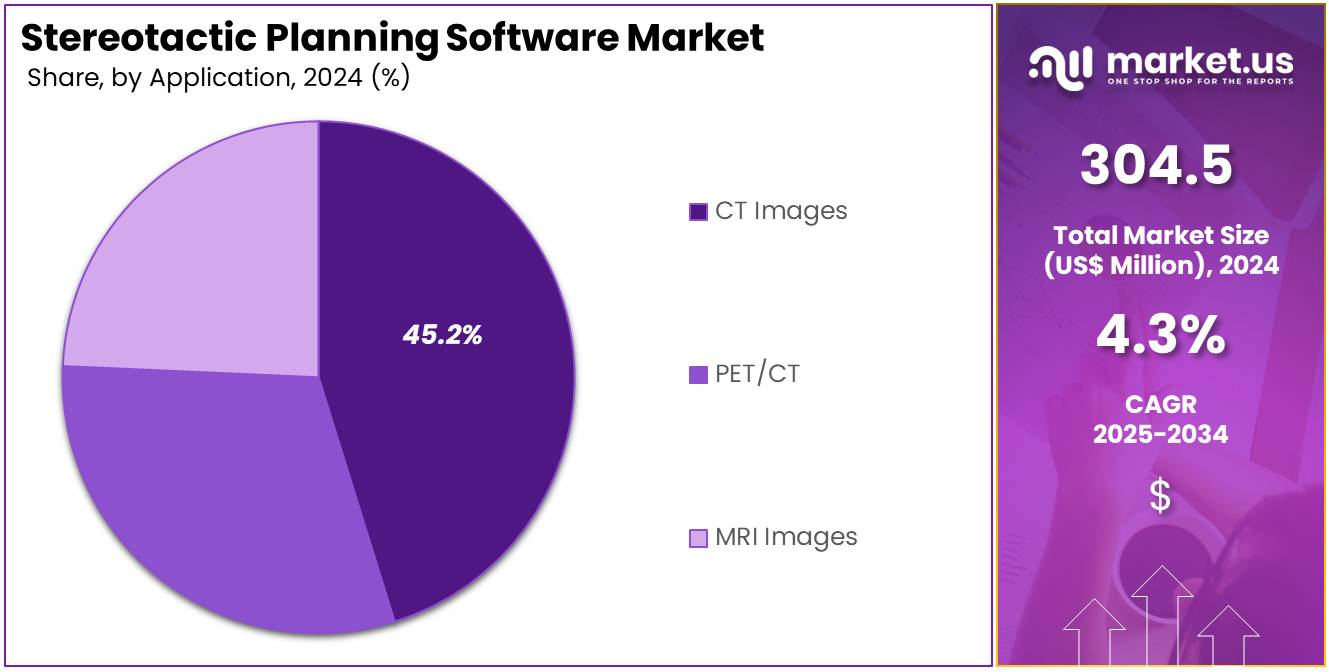

- Considering application, the market is divided into CT images, PET/CT, and MRI images. Among these, CT images held a significant share of 45.2%.

- North America led the market by securing a market share of 38.9% in 2023.

Product Type Analysis

The integrated segment holds a 65.3% share of the stereotactic planning software market. This growth is expected to continue as integrated solutions offer the advantage of a seamless workflow across different imaging modalities and departments. The increasing need for comprehensive and synchronized data management, along with real-time updates across systems, drives the adoption of integrated systems. Healthcare providers favor these solutions as they simplify the planning process and reduce errors, making them an attractive option for hospitals and clinics.

The demand for integrated systems is also rising due to the advancements in artificial intelligence and machine learning, which enhance the capabilities of these systems, offering improved accuracy and decision-making in planning surgical procedures. As the healthcare industry focuses on increasing efficiency, improving patient outcomes, and streamlining operations, integrated systems will continue to see significant growth in the stereotactic planning software market.

Application Analysis

CT images hold a 45.2% share in the stereotactic planning software market. This segment is expected to maintain its dominance due to the wide use of CT imaging in planning for various surgical procedures, particularly in neurosurgery and oncology. The high resolution and cross-sectional images provided by CT scans allow for precise localization of tumors and anatomical structures, making it an essential tool for accurate planning.

As the demand for minimally invasive surgeries rises, the need for precise imaging to guide these procedures is likely to grow, further driving the adoption of CT image-based stereotactic planning software. Additionally, the continuous improvements in CT imaging technology, which allow for faster scans with lower radiation doses, are expected to enhance the utility of CT images in stereotactic planning, ensuring this segment’s continued prominence in the market. As more healthcare providers adopt cutting-edge imaging technologies, CT images will remain a crucial element of surgical planning.

Key Market Segments

By Product Type

- Integrated

- Standalone

By Application

- CT Images

- PET/CT

- MRI Images

Drivers

The rising incidence of neurological disorders and cancer is driving the market

The market for stereotactic planning software is experiencing significant growth, primarily driven by the rising global incidence of neurological disorders and various forms of cancer, particularly brain tumors. Stereotactic radiosurgery is a highly precise and non-invasive treatment option for these conditions, offering an alternative to traditional open surgery. As the global population ages, the prevalence of these diseases is projected to increase, creating a growing demand for advanced and targeted treatment modalities.

The effectiveness of this software in creating highly accurate treatment plans has made it an indispensable tool for neurosurgeons and radiation oncologists. According to the National Brain Tumor Society (NBTS), an estimated 94,000 new primary brain tumor diagnoses were expected in the US in 2023. This substantial and consistent patient population underscores the critical and ongoing need for the precise planning and delivery capabilities that stereotactic software provides.

Restraints

The high cost and specialized training requirements are restraining the market

A significant restraint on the market is the substantial cost associated with both the software itself and the highly specialized training required to use it effectively. Stereotactic planning software is a complex and highly technical tool, and its acquisition often represents a major capital expenditure for hospitals and treatment centers. This high entry barrier can limit its adoption, particularly in smaller clinics or healthcare systems with constrained budgets.

Furthermore, the software’s sophisticated nature necessitates extensive training for medical staff, including neurosurgeons, radiation oncologists, and medical physicists, to ensure proper and safe use. The expertise required for accurate treatment planning is not widely available, and the time and financial investment in professional development can be a deterrent.

A review of cost data from sources tracking medical procedures shows that stereotactic radiosurgery itself can have a high average cost, with many of those costs attributed to the advanced equipment and software required for the treatment, creating a significant barrier to entry for many providers.

Opportunities

The shift toward image-guided and minimally invasive procedures is creating growth opportunities

A key growth opportunity in the stereotactic planning software market lies in the broader industry trend toward image-guided surgery (IGS) and other minimally invasive procedures. These techniques are increasingly favored by both physicians and patients due to their potential to reduce recovery times, minimize scarring, and lower the risk of complications compared to traditional open surgeries. Stereotactic planning software is foundational to these procedures, as it allows for the precise localization and targeting of tumors or other abnormalities without large incisions.

The software merges and analyzes high-resolution medical images from sources like MRI and CT scans to create a detailed 3D model, guiding the surgeon or radiation beam with sub-millimeter accuracy. A 2022 study on a large cohort of functional and stereotactic neurosurgical procedures found no increased risk of complications in overlapping surgeries compared to non-overlapping ones, which underscores the growing trust in these precise techniques. This positive trend toward IGS directly correlates with an increased demand for the advanced planning software that makes such procedures possible.

Impact of Macroeconomic / Geopolitical Factors

The stereotactic planning software market is significantly influenced by macroeconomic and geopolitical factors, particularly given its reliance on sophisticated healthcare IT infrastructure. Rising healthcare expenditure, a key macroeconomic driver, fuels demand for advanced medical technologies, including software that improves the precision and efficiency of complex procedures. However, high inflation and the risk of recession in major economies, such as the US, can lead to budget tightening in healthcare systems and hospitals, potentially slowing down the adoption of new, high-cost software solutions.

Geopolitical tensions and their impact on global supply chains are also a major concern. While software is a digital product, it is often bundled with or dependent on imported hardware like high-performance computing systems and specialized GPUs. The recent US tariffs, which can reach as high as 145% on certain imported electronic components from countries like China, create a ripple effect. This raises the overall cost of a complete system for end-users, compelling software vendors to either absorb the increased costs, pass them on to customers, or explore new sourcing and manufacturing strategies, which can disrupt the market and alter pricing models.

Latest Trends

The integration of AI for predictive treatment planning is a recent trend

A defining trend in 2024 is the accelerated integration of artificial intelligence (AI) and machine learning for enhanced treatment planning and predictive analytics. This innovation is transforming stereotactic planning by enabling software to automate complex tasks, analyze vast datasets, and even predict patient outcomes. AI algorithms can rapidly contour tumors and organs at risk on medical images, significantly reducing the time required for a radiation oncologist to create a treatment plan.

The technology can also suggest optimal treatment strategies based on a patient’s specific characteristics and historical data, leading to more personalized and effective care. This trend is strongly supported by regulatory bodies. According to the US Food and Drug Administration (FDA)’s list of AI-enabled medical devices, there were a total of 950 such devices authorized between 1995 and August 7, 2024. Of these, 24 were specifically for radiation therapy treatment planning, highlighting a clear regulatory path and a strong focus on AI applications that augment the capabilities of stereotactic planning software.

Regional Analysis

North America is leading the Stereotactic Planning Software Market

North America maintains a dominant position in the stereotactic planning software market, holding a 38.9% market share in 2024. This growth is driven by the region’s well-established healthcare infrastructure, a high prevalence of chronic diseases, and a strong emphasis on clinical research. A 2024 report from the National Cancer Institute indicates that cancer incidence in the U.S. has remained steady among men and has slightly increased among women from 2020 to 2021. This trend is fueling the demand for advanced oncology treatments, including stereotactic radiosurgery.

As high-precision radiation therapy becomes more prevalent, the need for sophisticated software solutions to plan and guide these treatments grows. The U.S. Food and Drug Administration (FDA) plays a pivotal role in fostering innovation, having authorized 950 AI-driven medical devices between 1995 and August 2024. Additionally, market leaders are expanding their capabilities.

For example, in April 2024, GE HealthCare acquired MIM Software Inc., a leader in radiation oncology software, further consolidating the industry’s advanced software offerings. The increasing adoption of integrated solutions in hospitals, which streamline workflows across various imaging technologies, is further driving market growth as healthcare providers seek to optimize efficiency and data synchronization.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is poised for significant growth in the stereotactic planning software market, fueled by increased healthcare spending, a rising burden of chronic diseases, and growing interest in adopting advanced medical technologies. Governments across the region are prioritizing healthcare infrastructure upgrades, which are expected to create substantial demand for sophisticated treatment platforms. A 2024 report from the World Health Organization noted that lung cancer remains the most prevalent cancer globally, driven in part by continued tobacco use in Asia, intensifying the need for advanced oncology solutions.

Additionally, a 2022 report highlighted China’s focus on digitalizing its healthcare sector, a move that is expected to boost the adoption of cutting-edge software solutions. The rise of medical tourism in countries like India is also contributing to market expansion. According to a 2024 release from India’s Press Information Bureau, the “Heal in India” initiative led to 644,387 medical tourist arrivals in 2024. This influx of patients seeking advanced care is expected to further fuel the demand for state-of-the-art medical devices and planning software. As a result, a combination of local healthcare demands, strategic government initiatives, and the growth of medical tourism will continue to drive the market’s expansion in the Asia Pacific region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the stereotactic planning software market are driving growth through several key strategies. They are heavily investing in integrating advanced technologies like artificial intelligence and machine learning to automate image analysis and improve treatment plan accuracy. Companies are also pursuing strategic acquisitions and partnerships to expand their portfolios and gain access to new therapeutic areas, such as neurological disorders and oncology.

Furthermore, market leaders are actively developing user-friendly, cloud-based solutions that enhance data sharing and collaboration among healthcare professionals. This combination of innovation and strategic business development is crucial for maintaining a competitive edge.

Brainlab AG, a privately held German medical technology company, has established a dominant position in the sector. The company’s business model is centered on a deep commitment to scientific innovation, providing a comprehensive portfolio of software and hardware for neurosurgery and radiosurgery.

Brainlab’s strategy involves continuously investing in its R&D pipeline to develop high-throughput and multi-parameter systems, such as the Brainlab Elements platform, while also leveraging its global distribution network to ensure widespread product availability. The company’s focus on creating integrated, end-to-end solutions for its customers has solidified its role as a foundational partner in the life sciences and diagnostics sectors.

Top Key Players in the Stereotactic Planning Software Market

- Varian Medical Systems

- Renishaw

- RaySearch Laboratories

- Philips

- MIM Software Inc.

- IBA Worldwide

- GE HealthCare

- Elekta

- Brainlab AG

- Accuray Incorporated

Recent Developments

- In September 2025: RaySearch Laboratories launched RayIntelligence v2025, a cloud-based oncology analytics system. This new version includes enhanced tools for building customized dashboards and deeper integration with other RaySearch products. The company’s press release highlights that this development helps clinics collect, structure, and analyze patient data to improve treatment outcomes. This focus on data-driven, analytical solutions is a key trend in the market.

- In April 2024: GE HealthCare acquired MIM Software Inc. MIM Software is a provider of a variety of software, including radiation oncology treatment planning software. This acquisition, which was confirmed by GE HealthCare’s public announcements, is a significant development as it strengthens GE’s portfolio of precision care technologies. By incorporating MIM’s technologies, GE HealthCare aims to enable more personalized treatment plans and boost clinical workflow efficiency.

Report Scope

Report Features Description Market Value (2024) US$ 304.5 Million Forecast Revenue (2034) US$ 463.9 Million CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Integrated and Standalone), By Application (CT Images, PET/CT, and MRI Images) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Varian Medical Systems, Renishaw, RaySearch Laboratories, Philips, MIM Software Inc., IBA Worldwide, GE HealthCare, Elekta, Brainlab AG, Accuray Incorporated. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Stereotactic Planning Software MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Stereotactic Planning Software MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Varian Medical Systems

- Renishaw

- RaySearch Laboratories

- Philips

- MIM Software Inc.

- IBA Worldwide

- GE HealthCare

- Elekta

- Brainlab AG

- Accuray Incorporated