Global Specialty Sweeteners Market Size, Share Analysis Report By Product Category (Artificial, Natural), By Product Type (Starch Sweeteners and Sugar Alcohols, High Intensity Sweeteners (HIS)), By Application (Food, Beverages), By Distribution Channel (Hypermarket/Supermarket, Specialty Stores, Pharmacies, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152818

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

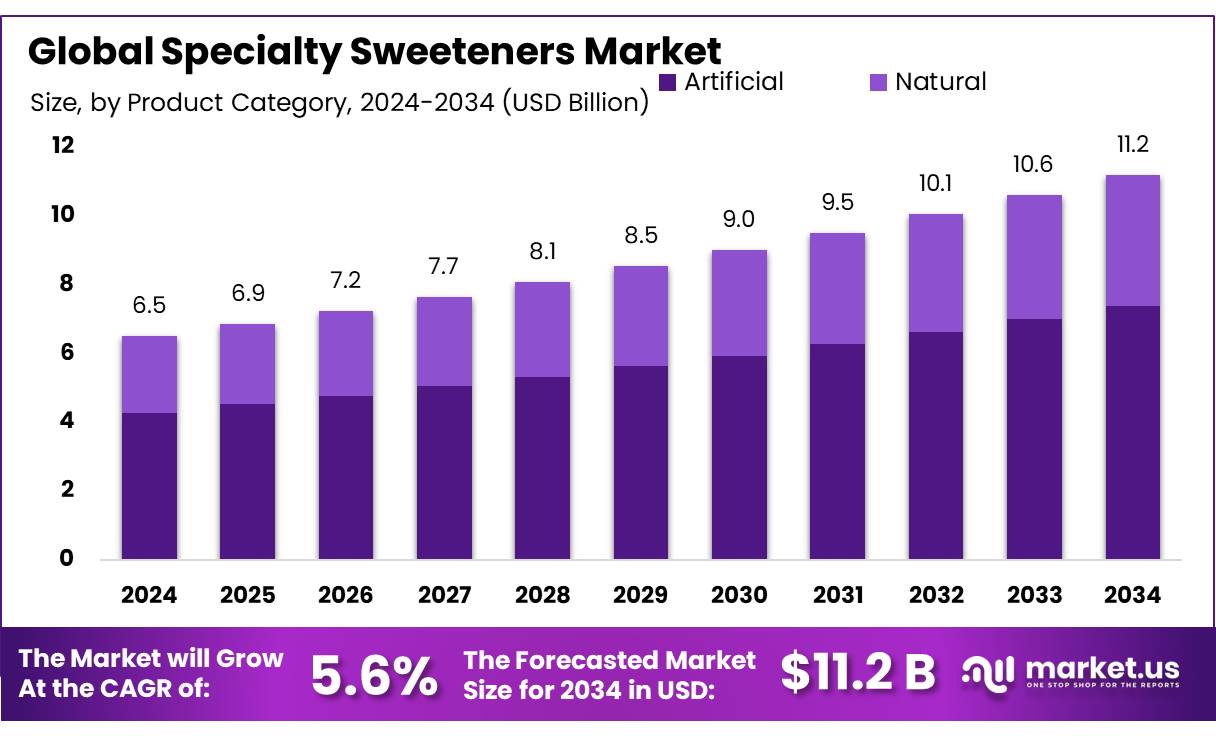

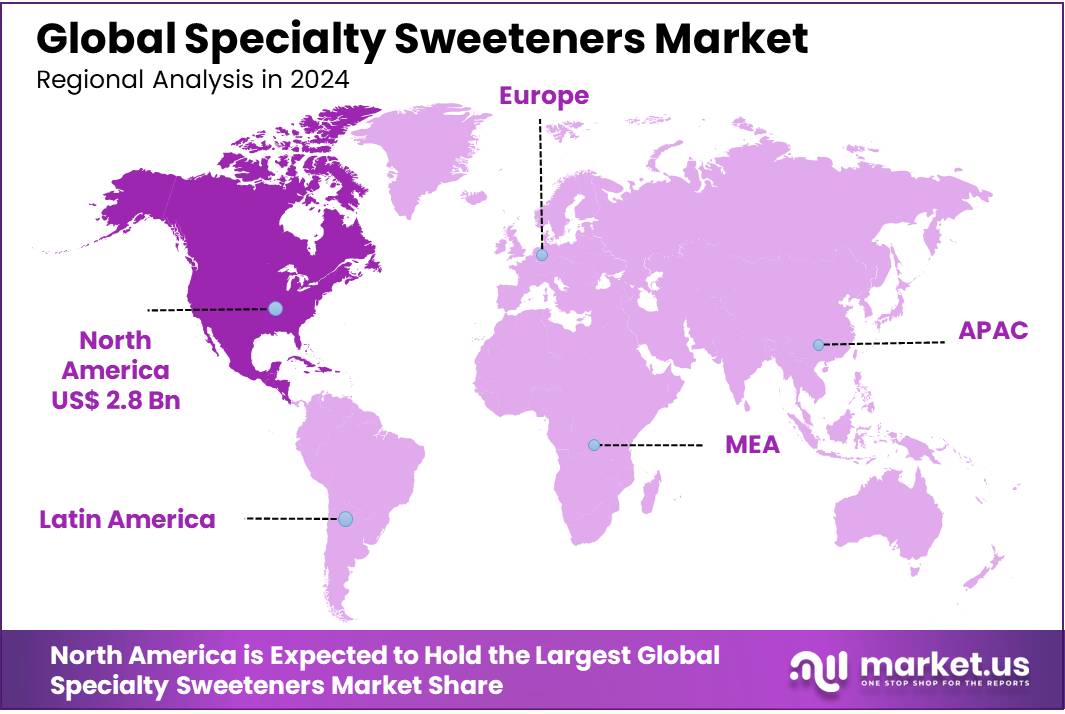

The Global Specialty Sweeteners Market size is expected to be worth around USD 11.2 Billion by 2034, from USD 6.5 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034. In 2024, North American held a dominant market position, capturing more than a 43.7% share, holding USD 2.8 Billion revenue.

The specialty sweetener concentrates industry encompasses high-intensity and natural sugar substitutes such as stevia, erythritol, monk fruit, sucralose, and aspartame. These concentrates provide powerful sweetness at substantially lower caloric values compared to sucrose, supporting the food and beverage industry’s shift toward low-sugar formulations. For instance, aspartame is approximately 200 times sweeter than sugar, while steviol glycosides and sucralose range between 200–600 times sweetness, enabling significant sugar reduction with minimal volume use.

Government data underscores the scale and trend of specialty sweetener usage. The USDA’s Economic Research Service projects U.S. sugar deliveries for food and beverage use at 12.125 million short tons in 2025/26, with total sugar supply forecast at 13.773 million short tons. These statistics reflect rising substitution with non-sucrose sweeteners, as evidenced by the gradual decrease in sugar supply and increase in the stocks-to-use ratio (projected at 11.7%). Moreover, according to global packaged food and beverage data (2007–2019), per-capita non-nutritive sweetener (NNS) consumption increased by 2g globally, with North America experiencing a jump of 31.2g due to policy-driven shifts.

Key driving factors for the industry include heightened public health concerns over obesity and diabetes, which have prompted government initiatives such as SSB taxation, nutrition labeling, and institutional food standards. A notable policy trend is the implementation of more than 22 sugar-sweetened beverage taxes and 15 new labeling regulations globally between 2007–2019. These measures have been correlated with decreased sugar and increased NNS usage, particularly in higher-income countries.

Health and Regulatory Pressures: Incentives such as sugar-sweetened beverage (SSB) taxes, public institution standards, and mandatory front-of-pack labeling have significantly decreased added sugar consumption—by 1.1kg per capita globally between 2007–2019—with contemporaneous increases in non-nutritive sweeteners (NNS) by 31.2g per capita, particularly in North America.

Key Takeaways

- Specialty Sweeteners Market size is expected to be worth around USD 11.2 Billion by 2034, from USD 6.5 Billion in 2024, growing at a CAGR of 5.6%

- Artificial held a dominant market position, capturing more than a 65.9% share of the overall specialty sweeteners market.

- Starch Sweeteners and Sugar Alcohols held a dominant market position, capturing more than a 59.2% share.

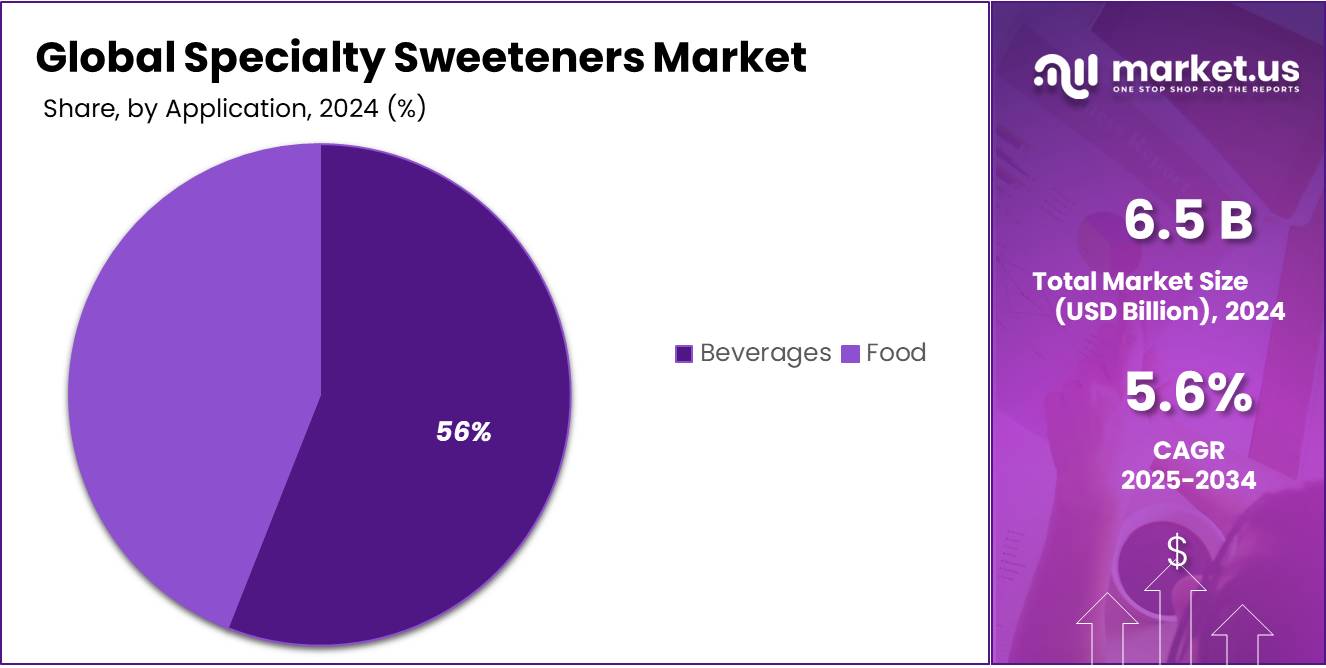

- Beverages held a dominant market position, capturing more than a 56.8% share of the overall specialty sweeteners market.

- Hypermarket/Supermarket held a dominant market position, capturing more than a 48.4% share of the global specialty sweeteners market.

- North America emerged as the leading region in the global specialty sweeteners market, capturing a significant 43.7% share, equivalent to a market value of approximately USD 2.8 billion.

By Product Category Analysis

Artificial Sweeteners lead the market with 65.9% share in 2024, driven by wide application in low-calorie products.

In 2024, Artificial held a dominant market position, capturing more than a 65.9% share of the overall specialty sweeteners market. This significant share was largely supported by the growing use of artificial sweeteners like aspartame, sucralose, acesulfame potassium, and saccharin across a broad range of food and beverage products. These sweeteners are widely used in carbonated drinks, sugar-free gums, desserts, dairy alternatives, and baked goods due to their high sweetness intensity, low cost, and long shelf life.

By Product Type Analysis

Starch Sweeteners and Sugar Alcohols dominate with 59.2% share in 2024, driven by rising demand for reduced-calorie products.

In 2024, Starch Sweeteners and Sugar Alcohols held a dominant market position, capturing more than a 59.2% share of the global specialty sweeteners market. Their widespread use in processed foods, chewing gums, sugar-free candies, and bakery products has been a key factor behind their large market footprint. Sorbitol, xylitol, maltitol, and erythritol are among the most commonly used sugar alcohols, offering moderate sweetness with fewer calories compared to sucrose. At the same time, starch-derived sweeteners such as high fructose corn syrup and glucose syrups continue to find heavy application in beverages, sauces, and snacks due to their functional properties and cost-efficiency.

By Application Analysis

Beverages lead the way with 56.8% share in 2024, supported by strong demand for low-calorie drinks.

In 2024, Beverages held a dominant market position, capturing more than a 56.8% share of the overall specialty sweeteners market. This leadership was driven by the growing use of sweeteners in soft drinks, flavored waters, energy drinks, and ready-to-drink teas and coffees. As consumers continue to shift away from high-sugar beverages, manufacturers are increasingly reformulating products using zero- or low-calorie sweeteners to meet changing dietary preferences. The demand for diet sodas, sugar-free juices, and functional drinks with added health claims has further fueled the growth of specialty sweeteners in the beverage sector.

By Distribution Channel Analysis

Hypermarkets and Supermarkets take the lead with 48.4% share in 2024, thanks to wide shelf space and consumer convenience.

In 2024, Hypermarket/Supermarket held a dominant market position, capturing more than a 48.4% share of the global specialty sweeteners market by distribution channel. This strong performance was largely driven by the accessibility and product visibility these retail formats offer. With their large floor space and high foot traffic, hypermarkets and supermarkets provide a prime platform for both well-known and emerging sweetener brands to reach a broad consumer base. Consumers prefer shopping in these outlets because they can compare multiple options, check nutrition labels, and take advantage of discounts and bulk offers.

Key Market Segments

By Product Category

- Artificial

- Natural

By Product Type

- Starch Sweeteners and Sugar Alcohols

- Dextrose

- High Fructose Corn Syrup (HFCS)

- Maltodextrin

- Sorbitol

- Xylitol

- Others

- High Intensity Sweeteners (HIS)

- Sucralose

- Aspartame

- Saccharin

- Cyclamate

- Ace-K

- Neotame

- Stevia

- Others

By Application

- Beverages

- Food

- Bakery and Confectionery

- Dairy products

- Soups

- Sauces

- Dressings

- Others

By Distribution Channel

- Hypermarket/Supermarket

- Specialty Stores

- Pharmacies

- Others

Emerging Trends

Clean Label Movement Accelerates Specialty Sweeteners Adoption

A significant trend in the specialty sweeteners market is the growing consumer demand for “clean label” products—foods and beverages that are perceived as natural, transparent, and free from artificial additives. This shift is prompting manufacturers to reformulate products using natural sweeteners like stevia, monk fruit, and erythritol, aligning with consumer preferences for healthier options.

In the United States, the Food and Drug Administration (FDA) has updated its “healthy” claim criteria to reflect current nutrition science, allowing more products to qualify for this label if they meet specific limits for added sugars, saturated fat, and sodium. This move supports the clean label trend by encouraging manufacturers to reduce unhealthy ingredients and promote healthier alternatives.

Similarly, the European Union’s Farm to Fork Strategy aims to make food systems fair, healthy, and environmentally-friendly, indirectly promoting the use of natural sweeteners by encouraging sustainable and healthy food practices. This clean label movement is not just a passing trend but a reflection of a broader consumer shift towards transparency and health-conscious choices, presenting a substantial growth opportunity for the specialty sweeteners market.

Drivers

Increasing Health Consciousness Drives the Demand for Specialty Sweeteners

The growing global health consciousness has significantly fueled the demand for specialty sweeteners in the food and beverage industry. Consumers are becoming increasingly aware of the health risks associated with high sugar intake, which has led to a shift towards low-calorie and natural alternatives. This trend is particularly evident in the rising preference for non-caloric sweeteners, as well as those derived from natural sources like stevia, monk fruit, and erythritol.

According to the U.S. Food and Drug Administration (FDA), excessive sugar consumption is a major contributor to various health issues, including obesity, diabetes, and heart disease. As a result, there has been a notable push for healthier sweetening alternatives.

In 2023, the FDA reported that over 50% of consumers were actively seeking products with reduced or no sugar. Additionally, the World Health Organization (WHO) has recommended limiting daily sugar intake to less than 10% of total energy intake, which has accelerated the growth of the sugar substitute market.

This shift towards healthier alternatives is also supported by government initiatives promoting healthier diets. For instance, the U.S. government has introduced policies encouraging the food industry to reduce sugar content in processed foods, which further boosts the demand for specialty sweeteners. In Europe, the European Food Safety Authority (EFSA) has approved a range of low-calorie sweeteners, providing a foundation for their growth in food and beverages.

Organizations like the American Heart Association (AHA) have continuously advocated for reducing sugar consumption in daily diets, emphasizing the benefits of using specialty sweeteners. In fact, data from the AHA suggests that reducing added sugar intake by just 100 calories a day can have significant long-term health benefits.

Restraints

Regulatory Challenges and Consumer Skepticism Restrain Specialty Sweeteners Growth

Despite the growing demand for specialty sweeteners, one of the major restraining factors is the regulatory challenges and consumer skepticism surrounding their safety and long-term health effects. While many specialty sweeteners are considered safe by regulatory bodies like the FDA, there is still a degree of uncertainty in the minds of consumers. This has created a barrier to wider adoption, especially in markets that are more cautious about food additives and artificial ingredients.

For instance, the European Food Safety Authority (EFSA) and the U.S. Food and Drug Administration (FDA) have approved various non-caloric sweeteners, including aspartame, sucralose, and stevia. However, despite these endorsements, some consumers remain concerned about potential side effects, such as gastrointestinal issues or adverse effects on metabolism.

According to a survey by the European Commission, around 28% of European consumers are still wary of using artificial sweeteners in their food due to health concerns. This hesitance is compounded by conflicting media reports on the potential risks associated with these products, which adds to the general confusion among consumers.

Additionally, governments and health authorities are continually re-evaluating the safety of various sweeteners, which creates a level of uncertainty in the market. In 2021, the FDA began reviewing safety data on the artificial sweetener aspartame, which has triggered fresh concerns. While no new risks have been identified, the review has prompted further public discussion about the long-term health implications of sweetener consumption.

Consumer preference for “natural” products has also put additional pressure on synthetic sweeteners. While stevia and monk fruit are perceived as safer and more natural alternatives, they are often more expensive to produce, which limits their widespread use, especially in price-sensitive markets.

Opportunity

Rising Demand for Sugar Alternatives in Clean Label Products

One of the most promising growth opportunities for the specialty sweeteners market is the increasing demand for clean label products. Consumers are becoming more conscious of the ingredients in the food and beverages they consume, and clean label products, which are perceived as natural and free from artificial additives, are gaining traction. This shift is particularly notable in the growing trend toward healthier, more transparent food options, where sugar substitutes are increasingly being seen as a healthier alternative to traditional sugar.

The clean label movement is being driven by both consumer demand and regulatory pressures. According to the Food and Drug Administration (FDA), products labeled with simple, natural ingredients are expected to grow by 10% annually over the next decade. This demand is closely tied to consumers’ desire for products that are free from artificial ingredients, which includes sugar substitutes.

Government initiatives also play a critical role in this trend. In the United States, for example, the FDA’s Nutrition Facts Label changes have encouraged manufacturers to reduce added sugars in packaged foods. This shift aligns with the government’s broader strategy to reduce sugar consumption due to its links to obesity and diabetes. In Europe, the European Commission has also been pushing for healthier food options through various health-focused guidelines, thereby driving the adoption of low-calorie and natural sweeteners in food and beverage products.

Regional Insights

North America dominates specialty sweeteners market with 43.7% share, valued at USD 2.8 billion in 2024.

In 2024, North America emerged as the leading region in the global specialty sweeteners market, capturing a significant 43.7% share, equivalent to a market value of approximately USD 2.8 billion. The region’s dominance can be attributed to widespread consumer awareness regarding sugar-related health issues, high prevalence of lifestyle diseases such as obesity and diabetes, and an established market for functional and reduced-calorie foods.

In addition, government-led nutritional labeling requirements and initiatives to curb sugar consumption have accelerated the use of sugar substitutes in North America. For instance, the U.S. FDA mandates the declaration of added sugars on nutrition labels, which has prompted major food manufacturers to reformulate products using low- and no-calorie sweeteners. The American Heart Association also continues to recommend limiting added sugar intake, further encouraging the shift toward specialty sweeteners.

The rising trend of health and wellness, coupled with growing demand for clean-label and plant-based products, is further boosting the adoption of natural sweeteners such as monk fruit extract and steviol glycosides across the region. As the consumer base continues to prioritize healthier food choices, North America is expected to maintain its leadership in the specialty sweeteners market in 2025 as well, driven by innovation, product diversification, and strong retail penetration across the U.S. and Canada.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Tate & Lyle PLC is a global leader in food ingredients, specializing in the production of sweeteners such as sucralose and stevia. The company is renowned for its commitment to sustainability and innovation, offering a wide range of products aimed at reducing sugar content in food and beverages. With a strong focus on health-conscious consumers, Tate & Lyle’s research-driven approach continues to propel its growth in the specialty sweeteners market.

DuPont is a science and technology company that has made significant inroads in the specialty sweeteners market, particularly through its innovative offerings like sucralose and other low-calorie sweetening solutions. The company focuses on creating healthier alternatives to sugar by leveraging its expertise in biotechnology and food science. DuPont’s commitment to improving food formulations with clean-label solutions has positioned it as a key player in the growing specialty sweeteners market.

Archer Daniels Midland Company (ADM) is a key player in the food and nutrition industry, producing a variety of specialty sweeteners, including glucose syrups and corn-based sweeteners. ADM’s vast distribution network and strong industry presence have allowed it to expand its specialty sweetener offerings. The company’s commitment to research and development ensures that its products meet evolving consumer preferences for healthier and more sustainable ingredients in food and beverages.

Top Key Players Outlook

- Tate & Lyle PLC

- Cargill Incorporated

- Archer Daniels Midland Company

- DuPont

- PureCircle Limited

- Ingredion Incorporated

- Stevia First Corporation

- NutraSweet Company

Recent Industry Developments

In 2024, DuPont’s net sales totaled $12.4 billion, with an operating EBITDA of $3.14 billion, reflecting a 3% increase in net sales and a 1% rise in organic sales compared to the previous year.

In 2024, ADM’s Carbohydrate Solutions segment, encompassing starches and sweeteners, reported an operating profit of $1.34 billion, reflecting a 1% increase from the previous year.

Report Scope

Report Features Description Market Value (2024) USD 6.5 Bn Forecast Revenue (2034) USD 11.2 Bn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Category (Artificial, Natural), By Product Type (Starch Sweeteners and Sugar Alcohols, High Intensity Sweeteners (HIS)), By Application (Food, Beverages), By Distribution Channel (Hypermarket/Supermarket, Specialty Stores, Pharmacies, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tate and Lyle PLC, Cargill Incorporated, Archer Daniels Midland Company, DuPont, PureCircle Limited, Ingredion Incorporated, Stevia First Corporation, NutraSweet Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Specialty Sweeteners MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Specialty Sweeteners MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tate & Lyle PLC

- Cargill Incorporated

- Archer Daniels Midland Company

- DuPont

- PureCircle Limited

- Ingredion Incorporated

- Stevia First Corporation

- NutraSweet Company