Global Specialty Fibers Market Size, Share Analysis Report By Product (Carbon Fiber, Polybenzimidazole (PBI), Aramid Fiber, M5/PIPD, Polybenzoxazole (PBO), Glass Fiber, Others), By Application (Electronics and Telecommunication, Textile, Aerospace and Defense, Construction and Building, Automotive, Sporting Goods, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161569

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

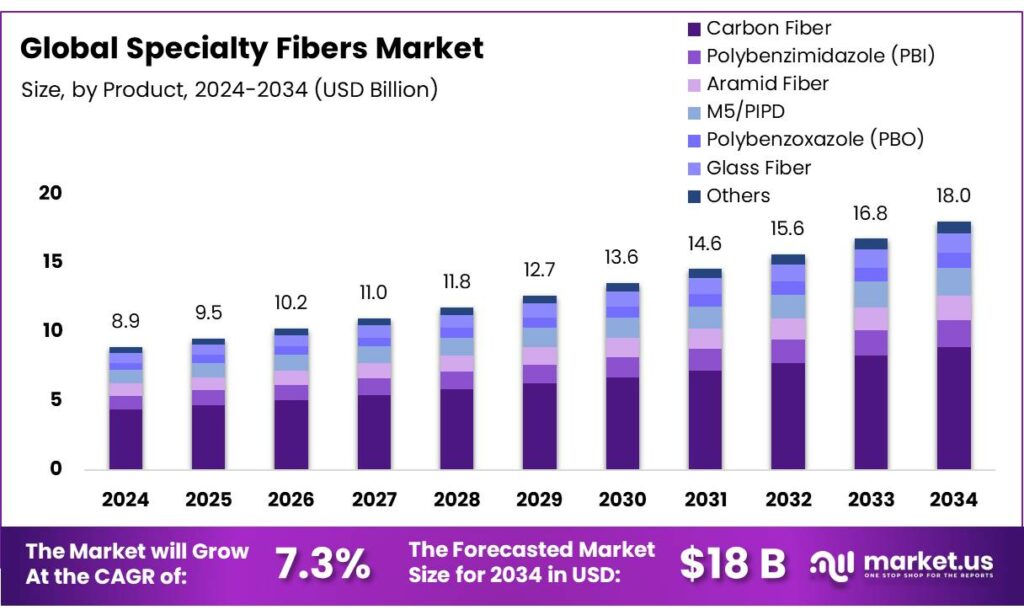

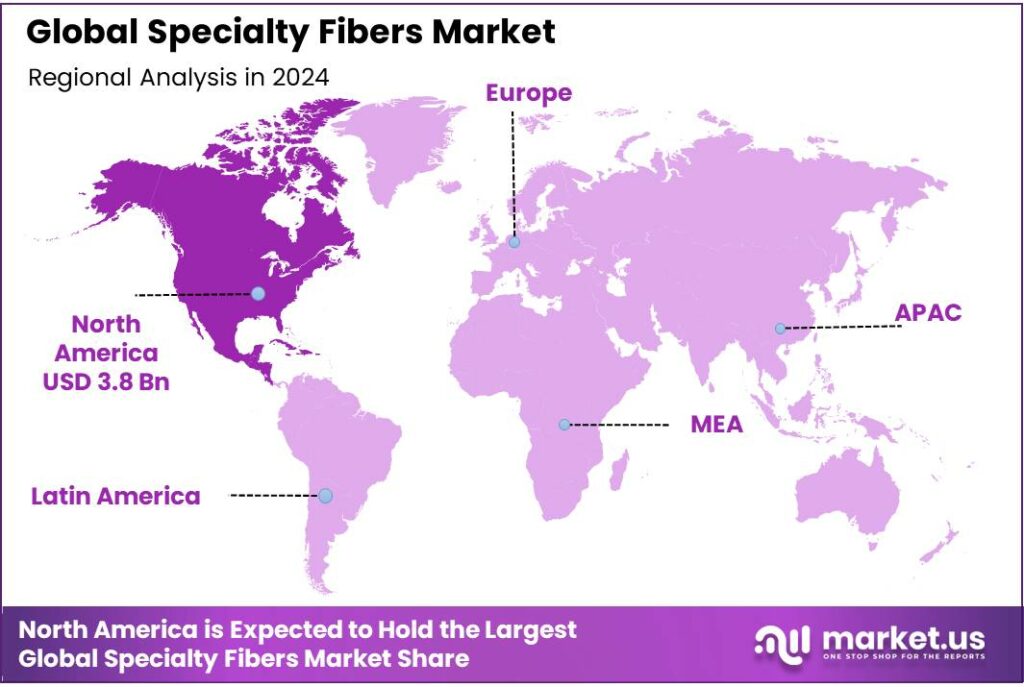

The Global Specialty Fibers Market size is expected to be worth around USD 18.0 Billion by 2034, from USD 8.9 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 43.8% share, holding USD 3.8 Billion in revenue.

Specialty fibers—carbon, aramid, ultra-high-molecular-weight polyethylene (UHMWPE), high-modulus glass, and advanced bio-based fibers—are increasingly embedded in the energy transition’s hard assets: wind turbine blades, hydrogen tanks, battery enclosures, grid hardware, and lightweight structures in EVs and aerospace.

Global renewable deployment sets the demand backdrop: in 2024, the world added ~585 GW of new renewable power capacity, a 15.1% jump year-on-year, according to IRENA, marking another record year for installations that are fiber-intensive in balance-of-plant and rotor systems. The IEA projects the electricity share from renewables will climb from 30% in 2023 to 46% by 2030, with solar and wind supplying almost all of the increase—sustaining multi-year pull for high-performance fibers in blades, nacelle covers, cables, and composite housings.

Industrial activity is also broadening. In the United States, the Department of Energy notes 500+ domestic factories make wind components—blades, towers, generators, and assemblies—supporting localized demand for fiber reinforcements, resins, and fabrics as turbine sizes scale. Reaching the national 30 GW offshore wind goal by 2030 is estimated to require 12,300–49,000 average annual full-time equivalent jobs in fabrication and assembly, contingent on domestic content—a signal of the manufacturing throughput and composite consumption implied.

Government initiatives now explicitly target fiber circularity and domestic capability, opening new demand pockets. The U.S. Department of Energy announced $20 million in December 2024 to improve recycling of fiber-reinforced composites and critical magnets in wind systems, catalyzing end-of-life blade solutions and secondary fiber markets. Complementing that, DOE’s Wind Turbine Materials Recycling Prize awarded $3.6 million in September 2024 to six teams, accelerating scalable recovery of glass- and carbon-fiber components—an early signal that recyclate streams will increasingly compete with virgin fibers in selected applications.

Policy and public funding are catalyzing upstream materials innovation and scale-up. In January 2024, the U.S. DOE Industrial Efficiency and Decarbonization Office announced an $83 million funding opportunity to cut emissions in energy- and emissions-intensive industries—relevant to fiber precursors, resins, and high-temperature processing.

- In December 2024, the DOE’s Advanced Materials and Manufacturing Technologies Office selected projects under the Critical Materials Accelerator totaling $16.93 million, targeted at validation and commercialization acceleration—helpful for next-gen carbon fiber, aramid intermediates, and recycling technologies.

Key Takeaways

- Specialty Fibers Market size is expected to be worth around USD 18.0 Billion by 2034, from USD 8.9 Billion in 2024, growing at a CAGR of 7.3%.

- Carbon Fiber held a dominant market position, capturing more than a 49.4% share of the global specialty fibers market.

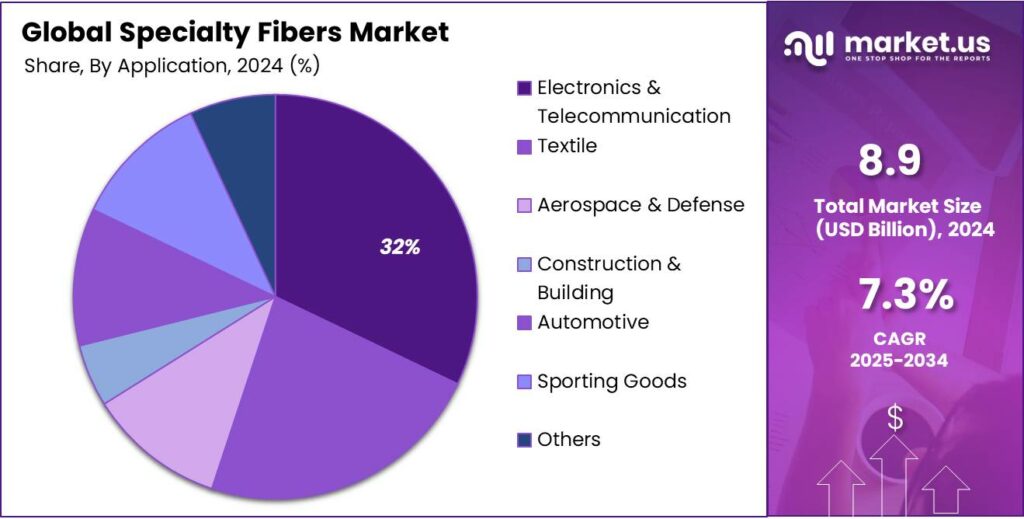

- Electronics & Telecommunication held a dominant market position, capturing more than a 32.1% share of the specialty fibers market.

- North America held a dominant position in the global specialty fibers market, capturing more than 43.8% of the market share, equating to approximately USD 3.8 billion.

By Product Analysis

Carbon Fiber dominates Specialty Fibers Market with 49.4% share in 2024

In 2024, Carbon Fiber held a dominant market position, capturing more than a 49.4% share of the global specialty fibers market. This leadership can be attributed to its exceptional strength-to-weight ratio, high durability, and versatility across key industries such as aerospace, automotive, and defense. The adoption of carbon fiber has increased steadily, driven by the growing need for lightweight materials that enhance fuel efficiency in vehicles and aircraft, while also maintaining structural integrity under extreme conditions. In the automotive sector, carbon fiber is increasingly used in high-performance and electric vehicles to reduce weight and improve overall efficiency.

This trend continues as manufacturers expand their production capabilities, investing in advanced carbon fiber composites that offer improved thermal stability and fatigue resistance. The continued integration of carbon fiber into infrastructure, renewable energy, and sports equipment sectors further reinforces its dominant market position. Overall, the superior properties and growing application scope of carbon fiber ensure its sustained leadership in the specialty fibers market, making it the material of choice for industries seeking high-performance solutions.

By Application Analysis

Electronics & Telecommunication leads Specialty Fibers Market with 32.1% share in 2024

In 2024, Electronics & Telecommunication held a dominant market position, capturing more than a 32.1% share of the specialty fibers market. This strong performance is driven by the increasing demand for high-speed data transmission, miniaturized devices, and advanced communication networks that rely on specialty fibers such as optical fibers and high-performance polymers. The growing deployment of 5G networks and the expansion of data centers have accelerated the adoption of these fibers, as they provide superior signal quality, reliability, and durability compared to traditional materials.

The trend continues with manufacturers focusing on enhancing fiber efficiency and reducing signal losses to support next-generation communication technologies. Additionally, the rising integration of specialty fibers in consumer electronics, wearable devices, and smart home systems further strengthens their role in this sector. The combination of technological advancements, growing digital connectivity, and the need for high-performance communication solutions ensures that Electronics & Telecommunication remains a leading application segment in the specialty fibers market.

Key Market Segments

By Product

- Carbon Fiber

- Polybenzimidazole (PBI)

- Aramid Fiber

- M5/PIPD

- Polybenzoxazole (PBO)

- Glass Fiber

- Others

By Application

- Electronics & Telecommunication

- Textile

- Aerospace & Defense

- Construction & Building

- Automotive

- Sporting Goods

- Others

Emerging Trends

Agro-fiber hybrids and biobased composites moving into high-performance use

A clear, fast-moving trend in specialty fibers is the shift from “all-synthetic” lay-ups to hybrid composites that blend high-performance fibers (carbon, aramid, UHMWPE) with agro-based natural fibers (jute, kenaf, sisal, abaca, coir). This is happening for two practical reasons: engineered sustainability targets are getting stricter, and manufacturers need lower-cost, lower-emission reinforcement options that still meet stiffness, fatigue, and impact requirements.

The Food and Agriculture Organization (FAO) provides the scale context for this pivot: its Jute, Kenaf, Sisal, Abaca, Coir and Allied Fibres Statistical Bulletin 2022 documents sizeable, organized supply chains for these crops—giving composite designers reliable volumes of agricultural fibers to work with and to blend into performance parts where full carbon content isn’t essential.

Two numbers illustrate why this matters now. First, global fibre production reached ~124 million tonnes in 2023, up from ~116 million tonnes in 2022—growth still dominated by synthetics, which raises embedded-emissions concerns and keeps procurement teams searching for credible bio-content pathways.

Second, the U.S. biobased products industry contributed $489 billion of value added to GDP in 2021 (downstream demand signal), supporting 3.94 million jobs—a policy-anchored pull that rewards materials with verified bio-based content, labeling, and traceability. Together, these figures show both the pressure to decarbonize high-volume materials and the economic incentive to scale bio-content in advanced applications.

Policy is accelerating the trend from “good idea” to plant-floor reality. In the U.S., the USDA BioPreferred Program’s latest economic impact update underscores a national framework that rewards verified bio-based materials via procurement and labeling—translating directly into specification pull for hybrid laminates that can document bio-content at the part level. The program’s $489 billion GDP contribution number is not just macro context; it signals that buyers tied to public procurement and corporate sustainability targets will privilege certified bio-based inputs, including specialty-fiber hybrids that balance performance with renewable content.

Drivers

Growing Demand for Renewable Energy & Lightweight Structures

One of the strongest and most visible drivers fueling growth in the specialty fibers sector is the rising demand for renewable energy systems—especially wind turbines—and lightweight structures in transportation. As the global energy transition accelerates, there is a surging need to build large wind blades, lighter vehicle components, and high-performance structures that push the limits of conventional materials. Specialty fibers—such as carbon fiber, aramid, and high-modulus glass fibers—are uniquely positioned to meet that demand because they offer high strength-to-weight ratio, fatigue resistance, and long-term durability.

Wind energy is a clear example. Modern wind turbines keep getting larger, with longer blades, higher tip speeds, and more demanding structural loading. Conventional glass fiber composites are often augmented or replaced by carbon or hybrid fibers to reduce weight while maintaining stiffness and fatigue life. In fact, advanced materials like carbon-fiber composites can deliver 5–13% lower embodied energy and faster carbon-payback cycles for wind blades when compared to conventional materials, improving the environmental and economic performance of wind farms.

This demand is rooted in hard numbers. The International Renewable Energy Agency (IRENA) reported that renewables added 585 GW of capacity in 2024, accounting for 92.5% of total annual capacity growth and bringing total global renewable capacity to 4,448 GW. Such a pace of deployment implies large volumes of composite blade materials, nacelle components, and structural supports—many of which increasingly rely on specialty fibers to meet performance and weight targets.

What makes this driver even more powerful is its alignment with government and public policy goals. Many countries have set aggressive renewable energy installation targets, emissions reduction mandates, and subsidies for clean manufacturing. In the United States, for instance, the National Strategy for Advanced Manufacturing (published in March 2024) emphasizes development of innovative materials and processing technologies as one of its core pillars. This sort of policy backing helps reduce the investment risk for advanced materials supply chains, encouraging fiber manufacturers to scale up, invest in R&D, and move upstream.

Restraints

High Cost and Capital Intensity

Even as specialty fibers hold exciting promise, one of their most stubborn brakes is the high cost and capital intensity required to produce them reliably at scale. The journey from precursor chemical to finished fiber involves complex, energy-intensive steps—large reactors, high-temperature treatment, precision handling, and tight quality control. Those steps demand heavy investment in equipment, facilities, and process development, all of which raise the minimum viable scale and pose a steep entry barrier. Research in materials processing notes that such fiber-reinforced systems often have high fixed costs but lower marginal costs, meaning that unless production is large enough, the per-unit cost remains too high to compete.

To bring in some perspective from the agriculture / natural fiber side the world natural fiber production in 2023 was about 31.4 million metric tons, slightly down from the previous year. That scale shows how entrenched natural fiber systems are and how difficult it is to grow supply substantially. On the synthetic side, virgin fiber production globally was 107 million tonnes in 2022, up from 102 million tonnes in 2021. These large scales of fiber production underline that unless specialty fiber makers can approach competitive volume or niche premium margins, the cost burden remains heavy.

Government or public initiative can ease these burdens, but so far those interventions are uneven. In many regions, support for advanced materials and manufacturing comes through grants, tax credits, or clean-technology programs—but those often focus on incremental innovation or pilot scale projects, not always full commercial deployment. The cost gap between existing fibers and specialty fibers remains wide.

Opportunity

Biocomposite & Natural Fiber Integration

One of the most promising growth avenues for specialty fibers lies in biocomposites and the integration of natural/hybrid fibers. In a world that’s increasingly conscious of sustainability, climate impact, and circularity, combining advanced specialty fibers with bio-derived or natural fibers offers both performance and environmental appeal. This hybrid route allows industries to reduce reliance on fully synthetic fibers, lower carbon footprint, and tap into agricultural value chains that are already supported by food and fiber institutions.

The Food and Agriculture Organization (FAO) about natural fibers to anchor this argument. For example, global coir fiber production in 2019 was about 1.26 million tonnes, with India alone accounting for 518,000 tonnes of it. This indicates that there is already a relatively large, under-utilized supply of a natural fiber that could be valorized in composites. If specialty fiber manufacturers partner with agricultural or fiber cooperatives, they can turn what is often treated as agricultural waste into value streams, blending coir or other natural fibers into composite materials.

Brands and OEMs increasingly care about life-cycle emissions, material traceability, and “bio-based” or “green” labels. A manufacturer that can present a composite structure with 20–40% natural fiber content, validated lifecycle emissions reduction versus pure synthetic alternatives, or rate of biodegradability for some constituents may attract premium contracts or partnerships in automotive, consumer goods, or building materials.

Regional Insights

North America leads Specialty Fibers Market with 43.8% share in 2024

In 2024, North America held a dominant position in the global specialty fibers market, capturing more than 43.8% of the market share, equating to approximately USD 3.8 billion in market value. This leadership is primarily attributed to the region’s advanced industrial infrastructure, substantial investments in research and development, and the presence of key end-use industries such as aerospace, automotive, defense, and electronics.

The United States, in particular, is a significant contributor to this market share, driven by its robust manufacturing base and increasing demand for high-performance materials. The aerospace and defense sectors are notable consumers of specialty fibers, utilizing materials like carbon fiber and aramids to produce lightweight, durable components essential for modern aircraft and defense systems. Additionally, the automotive industry is increasingly adopting specialty fibers to manufacture lightweight vehicles that meet stringent fuel efficiency and emission standards.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

DuPont de Nemours, Inc. is a prominent player in the specialty fibers market, renowned for its high-performance materials such as Kevlar® and Nomex®. These fibers are widely utilized in applications requiring exceptional strength, heat resistance, and durability, including personal protective equipment, automotive components, and aerospace structures. DuPont’s commitment to innovation and sustainability has solidified its position as a leading supplier of specialty fibers globally.

Kolon Industries, Inc. is a South Korean company recognized for its production of high-performance materials, including aramid fibers and tire cords. The company holds a significant market share in specialized materials, with an estimated 11% share of the global para-aramid market. Kolon’s commitment to research and development and its robust manufacturing capabilities position it as a key player in the specialty fibers industry.

Toyobo Co., Ltd. is a Japanese manufacturer specializing in fibers and textiles, including synthetic and functional fibers. The company produces high-performance materials used in various sectors, such as automotive, healthcare, and industrial applications. Toyobo’s focus on innovation and quality has established it as a reputable supplier of specialty fibers, contributing to advancements in material science and technology.

Top Key Players Outlook

- DuPont de Nemours, Inc.

- Teijin Limited

- Mitsubishi Chemical Holdings Corporation

- Kolon Industries, Inc.

- Toyobo Co., Ltd.

- Honeywell International Inc.

- Toray Industries, Inc.

- Bally Ribbon Mills

- SGL Carbon SE

- W. L. Gore & Associates, Inc.

Recent Industry Developments

In 2024, DuPont reported annual revenues of approximately $12.39 billion, marking a 2.64% increase from $12.07 billion in 2023.

In 2024, Toyobo reported consolidated net sales of ¥414.3 billion, reflecting a 3.6% increase from the previous year. The Environmental and Functional Materials segment, encompassing high-performance fibers, achieved sales of ¥115.3 billion, marking a 4.1% growth year-over-year.

Report Scope

Report Features Description Market Value (2024) USD 8.9 Bn Forecast Revenue (2034) USD 18.0 Bn CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Carbon Fiber, Polybenzimidazole (PBI), Aramid Fiber, M5/PIPD, Polybenzoxazole (PBO), Glass Fiber, Others), By Application (Electronics and Telecommunication, Textile, Aerospace and Defense, Construction and Building, Automotive, Sporting Goods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape DuPont de Nemours, Inc., Teijin Limited, Mitsubishi Chemical Holdings Corporation, Kolon Industries, Inc., Toyobo Co., Ltd., Honeywell International Inc., Toray Industries, Inc., Bally Ribbon Mills, SGL Carbon SE, W. L. Gore & Associates, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DuPont de Nemours, Inc.

- Teijin Limited

- Mitsubishi Chemical Holdings Corporation

- Kolon Industries, Inc.

- Toyobo Co., Ltd.

- Honeywell International Inc.

- Toray Industries, Inc.

- Bally Ribbon Mills

- SGL Carbon SE

- W. L. Gore & Associates, Inc.