Global Soy Food Market Size, Share, And Enhanced Productivity By Type (Fermented, Non Fermented, Soy additives/Ingredient, Soy Oils), By Category (Conventional, Organic), By End-User (Bakery and Confectionary, Meat Products, Functional Foods, Dairy Products, Infant Foods, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Online Retail Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169228

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

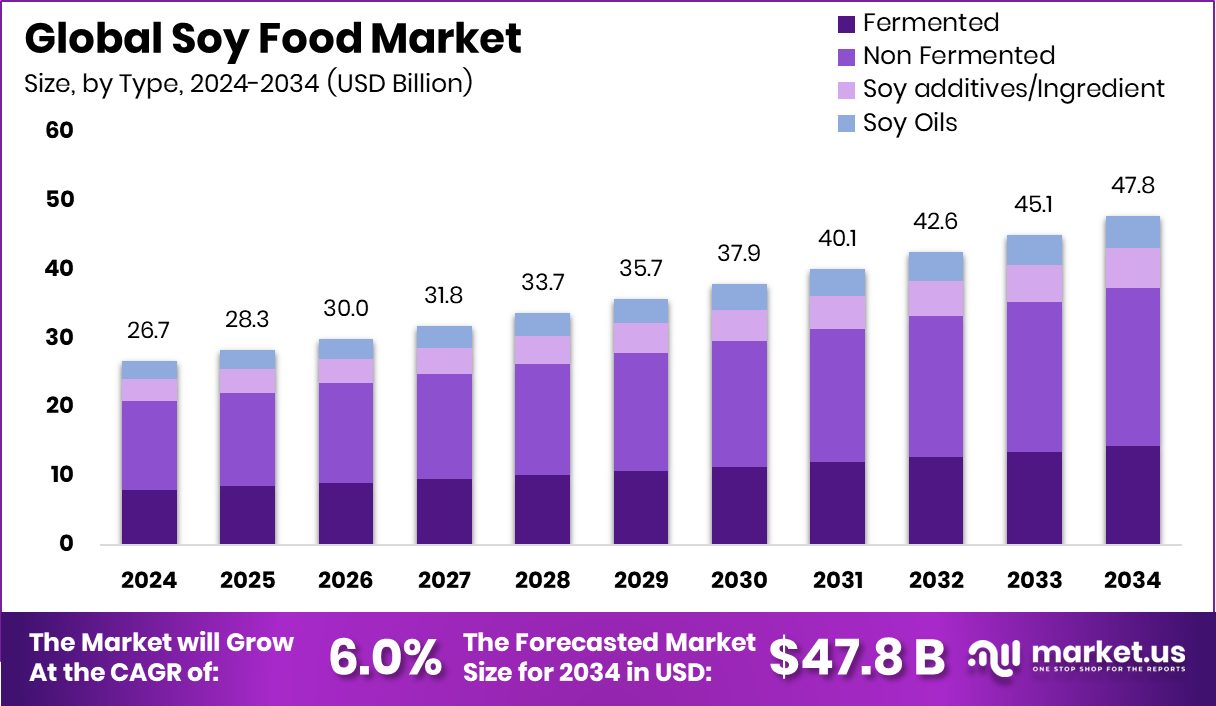

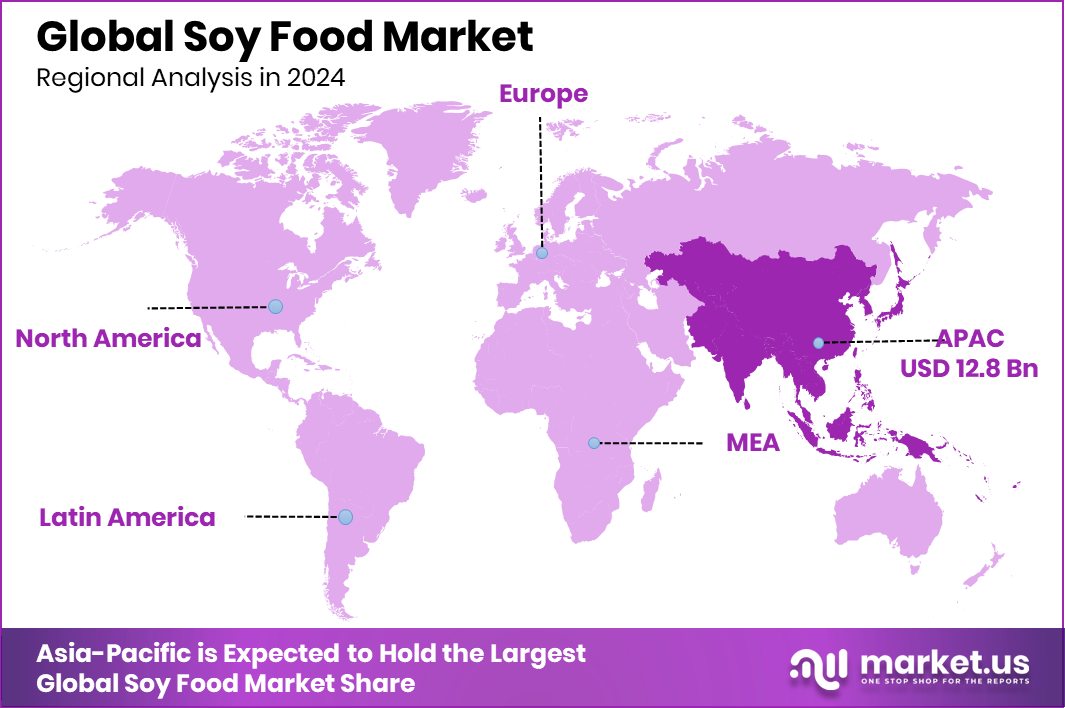

The Global Soy Food Market is expected to be worth around USD 47.8 billion by 2034, up from USD 26.7 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034. The Asia-Pacific soy food market held a 48.10% share worth USD 12.8 Bn globally.

Soy food refers to edible products made from soybeans, such as tofu, soy milk, tempeh, textured soy protein, and fermented soy items. These foods are valued for their high protein content, balanced amino acids, and suitability for vegetarian and plant-forward diets.

The soy food market includes the production, processing, and sale of soy-based foods for household, foodservice, and ingredient use. It is closely linked to agricultural supply, edible oil availability, protein consumption trends, and changes in global trade flows.

Market growth is supported by rising interest in affordable plant protein and improvements in soybean supply, which has increased by about 25 percent. However, volatility persists, with grocery outlets still facing soybean oil shortages and banks facing scrutiny over long-term financing tied to deforestation concerns.

Demand is shaped by food price sensitivity and nutrition awareness. Edible oil imports dropped by 15 percent in March, influencing soy usage patterns. At the same time, farmer sentiment has been affected by policy actions such as the US$20 billion Argentina bailout, impacting global soybean dynamics.

Opportunities lie in value-added soy foods and protein innovation. Foods nearing Rs 100 Cr ARR secured US$3.5 million to scale Protein Chef, while functional food innovation is also attracting capital, highlighted by a functional chocolate brand raising CAD 8 million to accelerate growth.

Key Takeaways

- The Global Soy Food Market is expected to be worth around USD 47.8 billion by 2034, up from USD 26.7 billion in 2024, and is projected to grow at a CAGR of 6.0% from 2025 to 2034.

- In the soy food market, non-fermented products hold 48.2%, driven by wide usage in daily meals.

- The soy food market is led by conventional products with a 79.4% share due to affordability.

- Dairy alternatives dominate the soy food market, accounting for 31.7% of overall consumption.

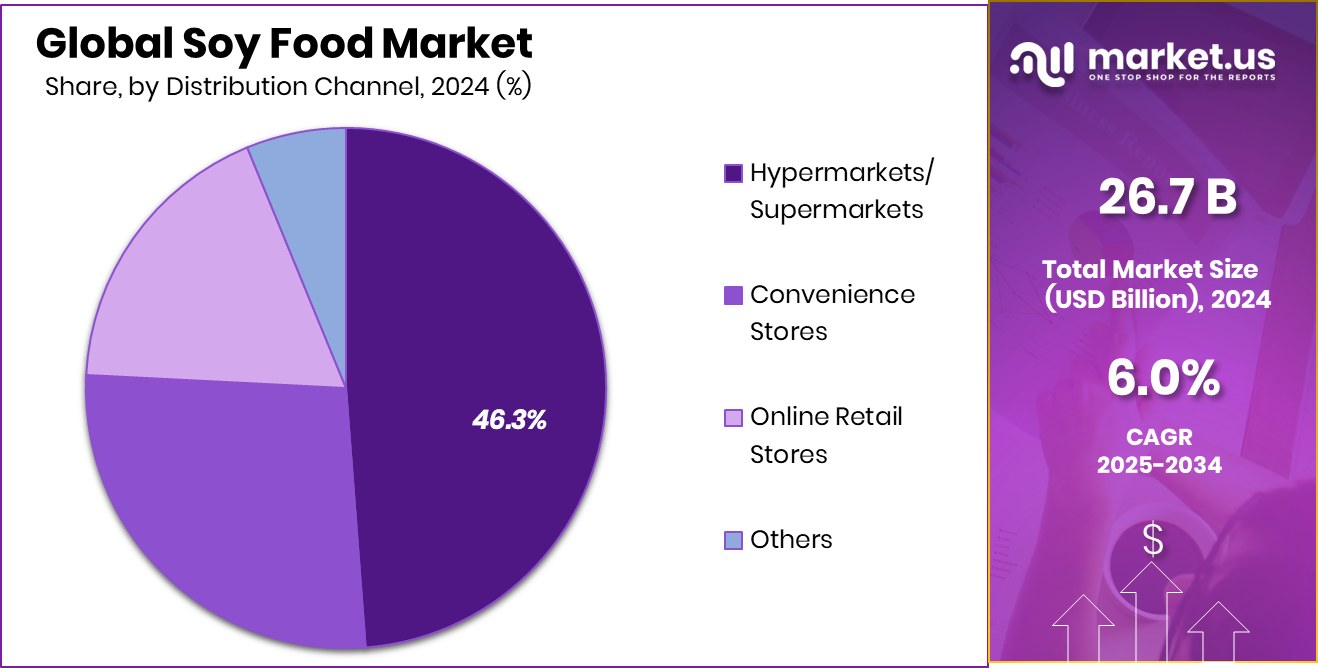

- Hypermarkets and supermarkets lead the soy food market with a 48.8% share, supported by a strong retail presence.

- In the Asia-Pacific, the soy food market reached 48.10% share, generating USD 12.8 Bn revenue.

By Type Analysis

Non-fermented held a 48.2% share in the Soy Food Market.

In 2024, Non-Fermented held a dominant market position in the By Type segment of the Soy Food Market, with a 48.2% share, driven by its wide acceptance across everyday diets and ease of incorporation into common food formats. This segment benefits from simple processing methods and consistent taste profiles, making it suitable for mass consumption and large-scale food applications.

Non-fermented soy foods are commonly used in household cooking, packaged foods, and ready-to-eat products, supporting steady demand across urban and semi-urban consumers. Their longer shelf life and compatibility with industrial food processing further strengthen their market presence.

As soy food consumption continues to align with affordability, familiarity, and convenience, the non-fermented category maintains strong traction, positioning itself as the leading contributor within the soy food product landscape.

By Category Analysis

Conventional products dominated with a 79.4% share in the soy food market.

In 2024, Conventional held a dominant market position in the By Category segment of the Soy Food Market, with a 79.4% share, reflecting its strong availability and established consumer preference. This category benefits from well-developed cultivation practices, stable supply chains, and widespread use across everyday soy food products.

Conventional soy foods remain cost-effective for both producers and consumers, which supports continued adoption in price-sensitive markets. Their consistent quality and reliable yields enable food manufacturers to maintain uninterrupted production and distribution.

In addition, conventional soy sources are easily integrated into large-scale processing systems, making them suitable for meeting high-volume demand. These factors collectively reinforce the leadership of the conventional category, ensuring its continued dominance within the soy food market landscape.

By End-User Analysis

Dairy Products accounted for 31.7% of the soy food market.

In 2024, Conventional held a dominant market position in the By End-User segment of the Soy Food Market, with a 31.7% share, supported by its broad acceptance across regular consumption channels. This segment continues to benefit from steady consumption patterns driven by daily dietary use and familiarity among consumers.

Conventional end users rely on consistent quality, easy availability, and predictable pricing, which helps sustain demand over time. The segment’s dominance is also reinforced by its alignment with large-scale food preparation and routine meal formats.

As consumption habits remain centered on affordability and accessibility, conventional end users maintain a strong presence, allowing this segment to retain its leading role within the end-user landscape of the soy food market.

By Distribution Channel Analysis

Hypermarkets/Supermarkets captured 48.8% share in the Soy Food Market.

In 2024, Conventional held a dominant market position in the By Distribution Channel segment of the Soy Food Market, with a 48.8% share, reflecting its strong presence across established retail and supply networks. This channel benefits from widespread consumer reach, routine purchasing behavior, and easy access to soy food products.

Conventional distribution supports high product visibility and regular stock availability, which helps maintain consistent sales volumes. Its dominance is further supported by streamlined logistics and familiarity among both sellers and buyers, enabling smooth market operations.

As consumers continue to prefer dependable purchasing options for everyday food needs, the conventional distribution channel remains the primary route for soy food sales, reinforcing its leading position within the market structure.

Key Market Segments

By Type

- Fermented

- Non Fermented

- Soy additives/Ingredient

- Soy Oils

By Category

- Conventional

- Organic

By End-User

- Bakery and Confectionery

- Meat Products

- Functional Foods

- Dairy Products

- Infant Foods

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Retail Stores

- Others

Driving Factors

Rising Demand for Plant-Based Nutrition Choices

One of the key driving factors of the soy food market is the growing shift toward plant-based and vegan eating habits. Consumers are increasingly choosing soy foods as they look for affordable, protein-rich, and familiar alternatives to animal-based products. Soy fits well into daily meals and modern food formats, making it easier for people to adopt without major changes to their diets.

Innovation in plant-based foods is also accelerating this trend. Interest from global brands and cultural influencers is strengthening consumer trust and visibility in this space. This momentum is supported by recent funding activity, including an $8 million raise backing functional vegan chocolates, supported by Unilever and Tiësto, which highlights strong investor confidence in plant-based and soy-adjacent food innovation.

Restraining Factors

High Production Costs And Consumer Trust Issues

One major restraining factor in the soy food market is the rising cost of production, combined with growing consumer concerns around processed proteins. Fluctuations in raw soybean prices, energy costs, and transportation expenses increase pressure on soy food producers, often leading to higher retail prices.

At the same time, some consumers remain cautious about alternative proteins, questioning processing methods and nutritional transparency. This hesitation can slow purchase decisions, especially in traditional food markets.

Investment trends also show diversification beyond soy, such as Australia’s Eclipse Ingredients securing $4.6 million for recombinant breast milk protein, indicating that capital is flowing into competing protein technologies. As attention and funding spread across multiple protein alternatives, soy food faces stronger competition for both consumer acceptance and innovation investment.

Growth Opportunity

Expanding Innovation In Alternative Protein Foods

A major growth opportunity in the soy food market lies in the continuous expansion of alternative protein products. Soy remains a key base ingredient for many new food formats because it is versatile, familiar, and easy to scale for mass production. As consumers look for better taste, texture, and nutrition from plant-based foods, soy-based innovation can meet these expectations across snacks, meals, and functional foods.

The strong investment interest in this space highlights its long-term potential, with alternative protein driving $4.8 billion in funding in 2021 for innovative food development. This level of financial support reflects confidence in plant-based protein growth, creating room for new soy food formulations, processing improvements, and wider global adoption.

Latest Trends

Functional Ingredient Integration Driving Soy Food Innovation

One of the latest trends in the soy food market is the blending of soy with functional ingredients to improve health positioning and consumer appeal. Food brands are increasingly combining soy protein with nutrients that support energy, immunity, and overall wellness, helping products move beyond basic nutrition. This trend aligns with rising consumer interest in foods that offer added benefits without changing daily eating habits.

Soy provides a neutral base that works well with functional components, making it suitable for beverages, snacks, and meal replacements. Investor activity reflects this shift, highlighted by Kääpä Biotech securing €9 million in investment to scale functional mushroom ingredients. Such funding signals growing demand for functional foods, opening new pathways for soy-based products enhanced with wellness-focused ingredients.

Regional Analysis

Asia-Pacific soy food market dominates with 48.10% share valued at USD 12.8 Bn.

North America represents a developed soy food market with steady consumption, supported by strong awareness of plant-based diets and high penetration of soy foods in packaged and ready-to-eat formats. The region benefits from established distribution networks and consistent consumer demand for protein-rich food options, helping maintain stable market performance.

Europe demonstrates growing acceptance of soy foods, largely driven by changing dietary preferences and rising interest in sustainable and alternative protein sources. Soy foods are increasingly used in everyday meals, supported by food manufacturers focusing on clean-label and plant-based offerings.

Asia-Pacific is the dominating region, holding a 48.10% share valued at USD 12.8 Bn, making it the largest contributor to the global soy food market. The region benefits from long-standing soy consumption traditions, widespread use of soy in daily diets, and strong regional production capabilities.

Middle East & Africa remains an emerging market, with soy food consumption gradually increasing due to dietary diversification and improving food supply chains. Awareness of plant-based nutrition is still developing but shows steady progress.

Latin America shows moderate growth, supported by expanding soy cultivation and the gradual inclusion of soy foods in local diets, positioning the region as a developing yet promising market outlet.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Danone S.A. continues to hold a strategically important position in the soy food market through its long-standing focus on plant-based nutrition. The company leverages strong capabilities in dairy alternatives, nutrition science, and product formulation to integrate soy-based foods into mainstream consumption. Its emphasis on health-focused offerings and everyday nutrition supports steady consumer trust and repeat demand across multiple regions.

Vitasoy International Holdings remains closely associated with soy-based consumption culture, particularly in liquid and ready-to-drink formats. The company benefits from deep-rooted expertise in soy processing and a clear brand identity centered on soy nutrition. Its ability to align traditional soy usage with modern packaging and convenience-driven consumption supports continued relevance in changing dietary patterns.

Nestlé S.A. approaches the soy food market as part of its broader plant-based and nutrition portfolio. The company’s strength lies in scale, product innovation, and global distribution reach, allowing soy-based foods to be integrated into diverse consumer lifestyles. Its focus on accessibility, taste improvement, and nutrition balance positions soy foods as practical options rather than niche alternatives.

Top Key Players in the Market

- Danone S.A.

- Vitasoy International Holdings

- Nestlé S.A.

- Unilever PLC

- Conagra Brands Inc.

- Archer Daniels Midland Co.

- Wilmar International Ltd.

- Bunge Ltd.

- Cargill Inc.

- Impossible Foods Inc.

Recent Developments

- In July 2025, Danone completed the acquisition of a majority stake in Kate Farms, a U.S.-based brand offering plant-based and organic nutritional formulas for both everyday use and medical nutrition. This move aims to expand Danone’s specialized nutrition and plant-based portfolio.

- In November 2024, Vitasoy’s leadership commented publicly on being open to potential business collaborations, indicating strategic flexibility in expanding or restructuring its operations.

Report Scope

Report Features Description Market Value (2024) USD 26.7 Billion Forecast Revenue (2034) USD 47.8 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Fermented, Non-Fermented, Soy additives/Ingredient, Soy Oils), By Category (Conventional, Organic), By End-User (Bakery and Confectionery, Meat Products, Functional Foods, Dairy Products, Infant Foods, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Danone S.A., Vitasoy International Holdings, Nestlé S.A., Unilever PLC, Conagra Brands Inc., Archer Daniels Midland Co., Wilmar International Ltd., Bunge Ltd., Cargill Inc., Impossible Foods Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Danone S.A.

- Vitasoy International Holdings

- Nestlé S.A.

- Unilever PLC

- Conagra Brands Inc.

- Archer Daniels Midland Co.

- Wilmar International Ltd.

- Bunge Ltd.

- Cargill Inc.

- Impossible Foods Inc.