Global Solid State Thin Film Batteries Market Size, Share Analysis Report By Battery Type (Lithium-Based, Solid Electrolyte, Others), By Capacity (Below 20 mAh, 20-500 mAh, Above 500 mAh), By End-User (Automotive, Electronics, Healthcare, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168714

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

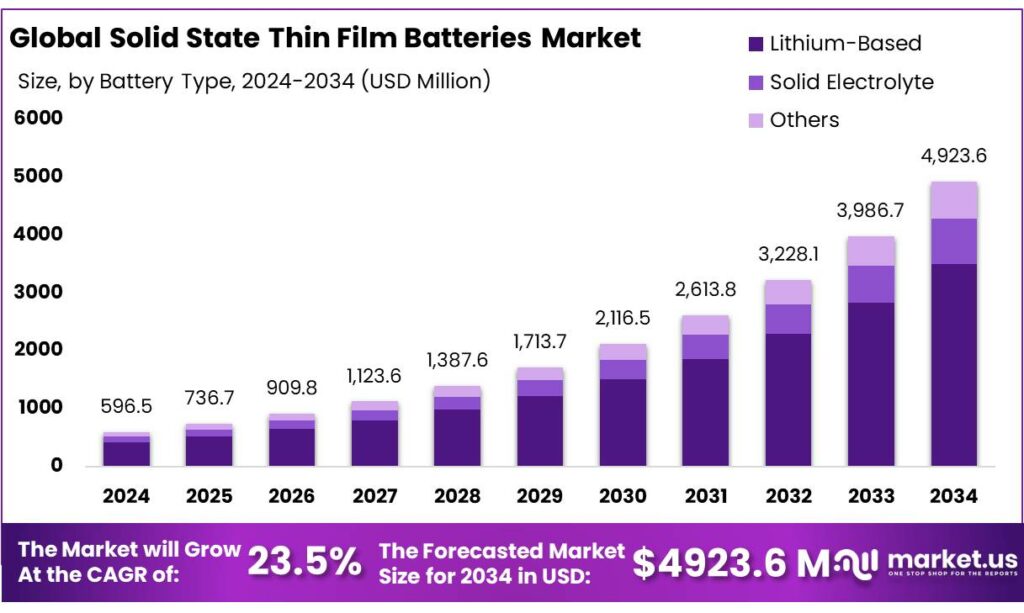

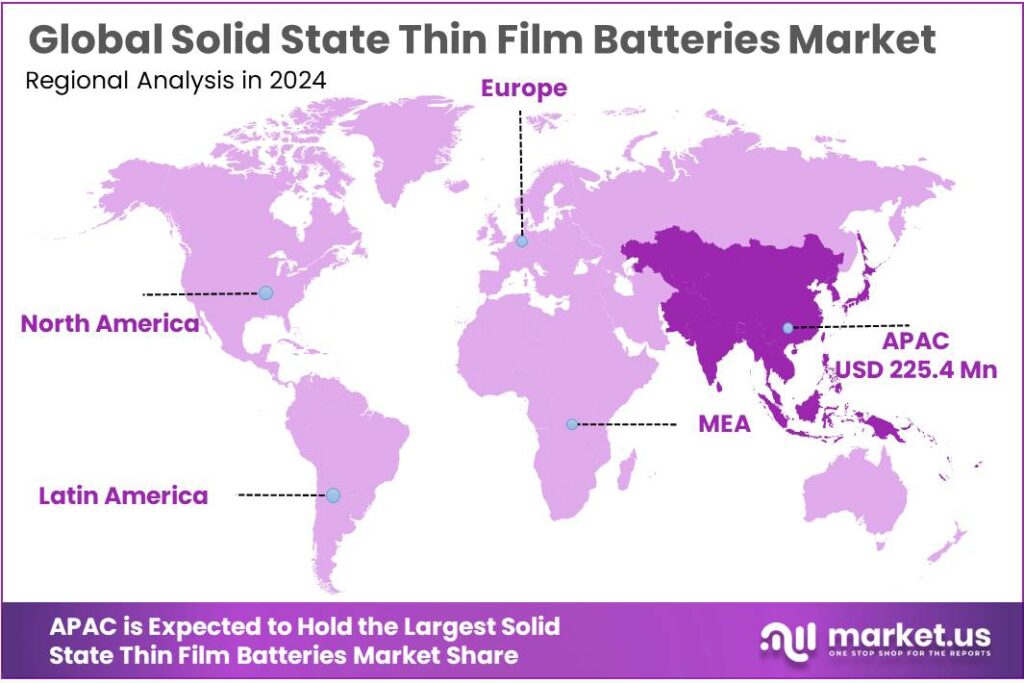

The Global Solid State Thin Film Batteries Market size is expected to be worth around USD 4923.6 Million by 2034, from USD 596.5 Million in 2024, growing at a CAGR of 23.5% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 37.8% share, holding USD 225.4 Million revenue.

Solid-state thin film batteries are ultra-thin solid-state cells deposited on substrates such as silicon, glass or flexible polymers. Their solid electrolytes and micrometre-scale form factors make them well suited for wearables, medical implants, smart cards and edge IoT nodes, where safety, long cycle life and precise voltage delivery matter more than bulk energy capacity. Demand for these niche batteries sits within a much broader electrification wave: almost 14 million new electric cars were registered in 2023, bringing the global stock to 40 million vehicles.

- The International Energy Agency (IEA) estimates that global energy storage must expand six-fold to 1,500 GW by 2030, with batteries providing 1,200 GW—around 90% of this increase. In Europe alone, battery storage capacity is forecast to rise from 10.8 GW today to more than 50 GW by 2030, representing about €80 billion in investment, underscoring strong downstream pull for advanced chemistries and formats. While thin-film solid-state batteries will not address bulk grid storage, they enable ultra-distributed sensing and control that support these larger systems.

Performance advances in solid-state architectures are another key driver. The EU-backed SOLIDBAT programme is targeting high-energy solid-state cells with around 400 Wh/kg and 1,000 Wh/L, levels that illustrate how solid electrolytes can close the gap with, and potentially surpass, conventional lithium-ion systems. In parallel, research on printed and thin-film batteries highlights their suitability for flexible, low-cost wearable and medical electronics, where conformability and safety are critical.

Policy and funding support are accelerating industrialization. In the United States, the Department of Energy has committed about $25 million to eleven next-generation battery manufacturing projects, specifically targeting advanced materials, processes and equipment. An additional $25.54 million under the AMMTO “Platform Technologies for Transformative Battery Manufacturing” programme supports technologies such as nanolayered films that are directly relevant to thin-film solid-state architectures. Separately, DOE has selected Solid Power for award negotiations of up to $50 million to scale sulfide-based solid electrolytes for all-solid-state batteries, reinforcing the broader ecosystem that thin-film players rely on.

- Government initiatives further shape the industrial landscape. In September 2023, the U.S. Department of Energy (DOE) awarded US$16 million across five projects to advance domestic manufacturing of solid-state and flow batteries, explicitly targeting next-generation chemistries.

- In September 2024, DOE selected Solid Power for negotiations on up to US$50 million to scale continuous production of sulfide-based solid electrolytes for advanced all-solid-state batteries, strengthening the ecosystem for solid-state materials and processes. Complementing this, the Biden administration has announced over US$3 billion in grants under the infrastructure law to build out EV battery and critical-materials supply chains, leveraging nearly US$35 billion of federal support that has catalyzed more than US$100 billion in private investment.

Key Takeaways

- Solid State Thin Film Batteries Market size is expected to be worth around USD 4923.6 Million by 2034, from USD 596.5 Million in 2024, growing at a CAGR of 23.5%.

- Lithium-Based solid state thin film batteries held a dominant market position, capturing more than a 71.3% share.

- 20-500 mAh solid state thin film batteries held a dominant market position, capturing more than a 49.9% share.

- Electronics held a dominant market position in the solid state thin film batteries sector, capturing more than a 43.8% share.

- Asia Pacific region accounted for a dominant portion of the global solid‑state thin‑film battery market, capturing 37.8% of total demand, equivalent to roughly USD 225.4 million.

By Battery Type Analysis

Lithium-Based batteries dominate with 71.3% due to their high energy density and widespread adoption

In 2024, Lithium-Based solid state thin film batteries held a dominant market position, capturing more than a 71.3% share. Their high energy density, long cycle life, and compact design make them the preferred choice for applications in wearable electronics, medical devices, and small consumer electronics. The growing demand for reliable, lightweight, and safe power sources has reinforced the dominance of lithium-based technologies over other battery types. Continued R&D and improvements in thin film deposition techniques are expected to further strengthen their market position in 2025 and beyond.

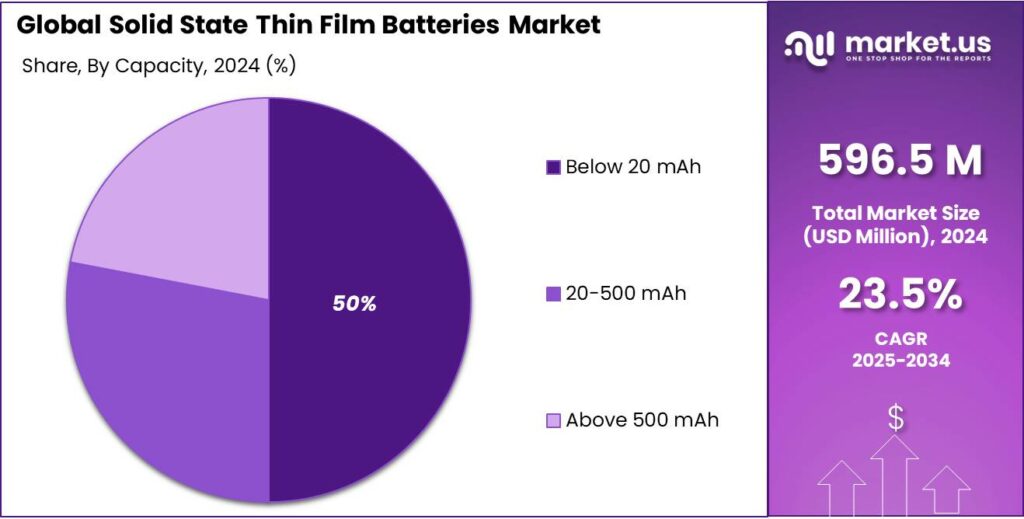

By Capacity Analysis

20-500 mAh capacity leads with 49.9% due to suitability for compact and low-power devices

In 2024, 20-500 mAh solid state thin film batteries held a dominant market position, capturing more than a 49.9% share. This capacity range is widely preferred for small electronic devices, wearable gadgets, and medical sensors, where compact size and reliable power output are critical. The growing demand for miniaturized electronics and IoT applications has reinforced the adoption of these batteries. Technological improvements in energy density and safety continue to support their strong market performance in 2025.

By End-User Analysis

Electronics dominate with 43.8% due to rising demand for compact and high-performance devices

In 2024, Electronics held a dominant market position in the solid state thin film batteries sector, capturing more than a 43.8% share. The growth is driven by increasing adoption of wearable devices, medical electronics, sensors, and compact consumer gadgets that require lightweight, safe, and long-lasting power sources. Rising demand for miniaturized and efficient batteries in IoT and portable electronics has reinforced their prominence. Continued innovation in energy density and durability is expected to sustain this trend into 2025.

Key Market Segments

By Battery Type

- Lithium-Based

- Solid Electrolyte

- Others

By Capacity

- Below 20 mAh

- 20-500 mAh

- Above 500 mAh

By End-User

- Automotive

- Electronics

- Healthcare

- Others

Emerging Trends

Thin-Film Batteries Powering Smart Food Packaging and Cold Chains

One of the most interesting new trends for solid state thin film batteries is their quiet move into smart food packaging and cold-chain monitoring. Food companies and retailers are under pressure to cut waste and emissions, so they are turning to tiny, embedded sensors and data loggers that need ultra-thin, safe power. Solid state thin film cells, which can be laminated into labels or tags, fit this shift almost perfectly.

Global food numbers explain why this trend is gathering speed. Latest UN figures show that about 13.2% of food produced is lost between post-harvest and retail, while another 19% is wasted in households, food service and retail. UNEP also notes that food loss and waste together generate around 8–10% of global greenhouse gas emissions and cost the world economy roughly US$1 trillion every year. For food brands, that is no longer just a sustainability talking point; it is a hard business and climate risk, and it pushes them toward real-time tracking of temperature, shocks and handling.

Cold chains are at the heart of this transformation, and they are energy-intensive. A joint FAO–UNEP report estimates that food cold chains, including refrigeration systems and food lost because of missing or poor refrigeration, account for about 4% of total global greenhouse gas emissions. Another analysis shows that emissions from agrifood cold chains reached around 1.32 Gt CO₂-equivalent in 2022, more than double the level in 2000.

Policy is helping this trend move from pilots to larger roll-outs. The UN’s International Day of Awareness of Food Loss and Waste highlights that around 2.3 billion people – about 28% of the global population – were moderately or severely food insecure in 2024, while one in twelve people faced hunger. At the same time, governments have signed up to Sustainable Development Goal 12.3, which calls for halving per-capita food waste by 2030 and reducing losses along production and supply chains.

Drivers

Food Safety, Waste Reduction and Smart Cold Chains as a Key Driver

A powerful driving force behind solid state thin film batteries is the quiet revolution happening across global food systems. Governments, retailers and logistics firms are under pressure to cut food loss, improve safety and reduce emissions, and that pressure is pushing them toward dense networks of smart sensors, data loggers and intelligent packaging – all of which need tiny, safe and long-lasting power sources.

The scale of the challenge is huge. FAO and UN partners estimate that around 14% of the world’s food, worth about US$400 billion each year, is lost between harvest and retail, while a further 17% is wasted at retail and household level. UNFCCC adds that food loss and waste generate 8–10% of annual global greenhouse gas emissions and cost roughly US$1 trillion every year. For food companies, this is not just a sustainability issue; it is a massive profit drain and a regulatory risk.

- The World Health Organization estimates that unsafe food causes about 600 million cases of foodborne disease and 420,000 deaths each year, with productivity losses and medical costs totalling around US$110 billion in low- and middle-income countries alone. That reality is driving tighter rules on traceability, temperature logging and real-time monitoring from farm to fork. Thin, solid-state batteries that can sit inside a label, a smart tag or a tiny wireless probe become essential enablers.

Cold chains show why energy and electronics matter so much. Research on the food sector finds that cooling and freezing alone account for about 30% of electricity use in food processing and storage. Every refrigerated warehouse, truck and display cabinet is now a candidate for dozens or hundreds of connected sensors watching temperature, humidity and door openings. Each sensor needs a safe, stable power supply that can last for years without maintenance in cold, sometimes wet environments. Solid state thin film batteries, with no liquid electrolytes and very low self-discharge, fit this niche far better than traditional coin cells.

Policy signals are moving in the same direction. The UN General Assembly created the International Day of Awareness of Food Loss and Waste to reinforce Sustainable Development Goal target 12.3 on halving food waste by 2030. Yet UN analysis shows that in 2019 only about US$0.1 billion a year was flowing into food loss and waste reduction and low-carbon diets, leaving large room for new, data-driven solutions. As public and private investment catches up, food producers and retailers will look for robust, low-maintenance power for billions of smart devices.

Restraints

High per-unit cost relative to food-industry margins limits widespread use in food packaging

One of the main restraints limiting adoption of solid state thin film batteries in real-world applications — especially in the food sector — is cost economics. To make a meaningful dent in food loss and waste, smart sensors or monitoring tags powered by these thin-film batteries would need to be embedded across vast numbers of packages and shipments — but food supply chains operate on razor-thin margins, making the required per-unit cost extremely challenging to justify.

Globally the problem is enormous: roughly 14% of all food produced is lost between harvest and retail — a staggering US$ 400 billion worth of food every year. An additional 17% is wasted at retail or by consumers, according to recent estimates. These losses happen across billions of tons of produce, processed goods and packaged foods, running through farms, warehouses, transport, retail, restaurants, and households.

- Moreover, even with the societal value of reducing waste, food companies face tight cost–benefit trade-offs. For example, regulatory pressure and health risks remain enormous: every year about 600 million people fall ill from unsafe food, and 420,000 die. Moreover, even with the societal value of reducing waste, food companies face tight cost–benefit trade-offs. For example, regulatory pressure and health risks remain enormous: every year about 600 million people fall ill from unsafe food, and 420,000 die.

Additionally, regulatory frameworks such as the effort behind Sustainable Development Goal 12.3 encourage waste reduction through better handling, refrigeration, and logistics — but seldom mandate smart-sensor use, especially where costs matter the most. In absence of strong regulation or subsidies, food businesses have limited incentive to absorb the added cost of powering ubiquitous sensors.

Opportunity

Smart, Low-Carbon Food Systems as a Big Opportunity

A major growth opportunity for solid state thin film batteries sits inside the quiet digital upgrade of global food chains. Governments, retailers and logistics firms want to cut food loss, improve safety and lower emissions. That push is creating huge demand for tiny, safe power sources that can sit inside smart labels, sensors and data loggers along the entire cold chain.

- Recent UN figures show the scale of the problem and the size of the opportunity. In 2021, about 13% of food produced worldwide – around 1.25 billion tonnes – was lost after harvest and before reaching retail shelves. In 2022, another 19%, or roughly 1.05 billion tonnes, was wasted in households, food service and retail. Households alone cause 60% of this waste.

At the same time, 2.3 billion people were moderately or severely food insecure in 2024, and one in twelve people faced hunger. Food that is never eaten is also a climate problem. UNEP notes that wasted food is responsible for 8–10% of global greenhouse gas emissions and uses 28% of the world’s agricultural area. These numbers explain why better monitoring and control have become strategic priorities.

Thin film solid state cells are ultra-thin, safe and can operate at low temperatures with very low self-discharge. That makes them ideal for smart temperature loggers that travel inside a box of berries, humidity tags in a cold room, or wireless sensors on doors and compressors. As food companies roll out thousands of such devices to hit SDG 12.3 targets on halving food waste by 2030,

Regional Insights

Asia Pacific leads with 37.8% share, valued at USD 225.4 million in 2024 — a regional powerhouse for solid‑state thin‑film batteries

In 2024, the Asia Pacific region accounted for a dominant portion of the global solid‑state thin‑film battery market, capturing 37.8% of total demand, equivalent to roughly USD 225.4 million. This strong position is rooted in the region’s established electronics manufacturing hubs — particularly in countries such as China, Japan, South Korea, and Taiwan — which supply a large share of global consumer electronics, wearable devices, IoT modules, and medical devices.

The leadership of Asia Pacific in 2024 is supported by broad government backing for battery development, integrated supply chains, and proximity to downstream device manufacturers that demand compact, efficient, and safe power solutions. This structural advantage allows suppliers to serve both domestic and export markets with shorter lead times, lower logistics costs, and regulatory compliance.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Samsung SDI is a leading player in the solid state thin film battery market, leveraging its expertise in lithium-ion and next-generation battery technologies. In 2024, the company reported total revenue of approximately KRW 11.2 trillion (≈ USD 8.3 billion), with a growing focus on thin-film solid-state solutions for electronics and automotive applications. Its R&D investments of KRW 1.3 trillion emphasize improving energy density, safety, and miniaturization, supporting its strategic aim to capture a larger share of high-performance battery markets.

Toyota Motor Corporation is actively developing solid state thin film batteries to enhance electric vehicle performance. In 2024, Toyota invested around JPY 115 billion (≈ USD 870 million) in solid-state battery R&D, targeting higher energy density, faster charging, and long lifespan for automotive applications. The company plans to integrate these batteries into next-generation hybrids and EVs, emphasizing safety, compact design, and improved efficiency. Toyota’s strategy strengthens its position in both domestic and global EV markets.

Panasonic Corporation focuses on solid state thin film batteries for electronics and automotive sectors. In 2024, Panasonic recorded JPY 8.1 trillion (≈ USD 61 billion) in total revenue, with specialized investments of JPY 42 billion in next-generation battery technologies. The company emphasizes high energy density, safety, and long cycle life, aiming to supply batteries for wearables, EVs, and energy storage systems. Panasonic’s global manufacturing and R&D capabilities support its strong market presence and innovation-driven growth.

Top Key Players Outlook

- Samsung SDI

- Toyota Motor Corporation

- Panasonic Corporation

- Solid Power Inc.

- QuantumScape Corporation

- Ilika plc

- ProLogium Technology Co., Ltd.

- STMicroelectronics N.V.

- Cymbet Corporation

- Blue Solutions SA

Recent Industry Developments

In December 2024, Samsung SDI announced that its all-solid-state battery (ASB) technology had achieved an energy density of 900 Wh/L thanks to a new cathode-free design, and said it plans to mass-produce SSB cells by 2027.

In May 2024, Blue Solutions inaugurated a new concerted effort — backed by state and regional support — to build a gigafactory in eastern France, with planned investment of €2.2 billion aimed at producing enough solid-state batteries for as many as 250,000 electric vehicles per year once fully operational.

Report Scope

Report Features Description Market Value (2024) USD 596.5 Mn Forecast Revenue (2034) USD 4923.6 Mn CAGR (2025-2034) 23.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Lithium-Based, Solid Electrolyte, Others), By Capacity (Below 20 mAh, 20-500 mAh, Above 500 mAh), By End-User (Automotive, Electronics, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Samsung SDI, Toyota Motor Corporation, Panasonic Corporation, Solid Power Inc., QuantumScape Corporation, Ilika plc, ProLogium Technology Co., Ltd., STMicroelectronics N.V., Cymbet Corporation, Blue Solutions SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Solid State Thin Film Batteries MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Solid State Thin Film Batteries MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung SDI

- Toyota Motor Corporation

- Panasonic Corporation

- Solid Power Inc.

- QuantumScape Corporation

- Ilika plc

- ProLogium Technology Co., Ltd.

- STMicroelectronics N.V.

- Cymbet Corporation

- Blue Solutions SA